This week we managed to catch up with John Pattullo and Nicholas Ware, two of the managers of Henderson Diversified Income Trust.

The trust is the best-performing in the AIC’s debt – loans and bonds sector over one and three years. It offers a yield of 5.1% and has the lowest ongoing charges ratio (a measure of annual running costs) of any of these funds. However, it is trading on a 4.7% discount, which seems a bit strange to us.

Through the crisis of the past few months, two things have stood Henderson Diversified Income in good stead. First, its managers were already wary of the length of the bull market in bonds and so were cautious ahead of the crisis. Second, the managers make a point of only buying debt issued by large companies operating in industries with sustainable earnings. For them, 45% of the global high yield market and 33% of the investment grade market is uninvestable.

That means no cyclical companies – such as airlines. No commoditised companies – such as oil companies. No companies in strategically challenged industries – such as high street shops and restaurants. In fact, the only area of the economy hit badly by COVID that they did have exposure to was travel and leisure.

Bargain hunting when others were selling

Comforted by their conviction in the portfolio and Henderson Diversified’s closed-end structure, the managers had cool heads in March when other investors were panicking. They took on gearing which they used to ramp up the trust’s exposure to the market, picking up some bargains.

One easy way of getting exposure was to buy a derivative instrument – the Itraxx Crossover Index (a liquid European high yield credit derivatives index). They preferred this to an index of US bonds because they foresaw that European governments would be more interventionist when it came to supporting ailing companies. This was evident in the case of two major car hire companies. US-based Hertz went bust, while Europcar was propped up by state-backed loans (not that it is out of the woods yet – it isn’t held by Henderson Diversified).

The trust was rewarded handsomely when central banks around the world took dramatic action to shore up markets. The managers say the decisive move was the US Federal Reserve’s announcement on 23 March that it would buy corporate bonds for the first time.

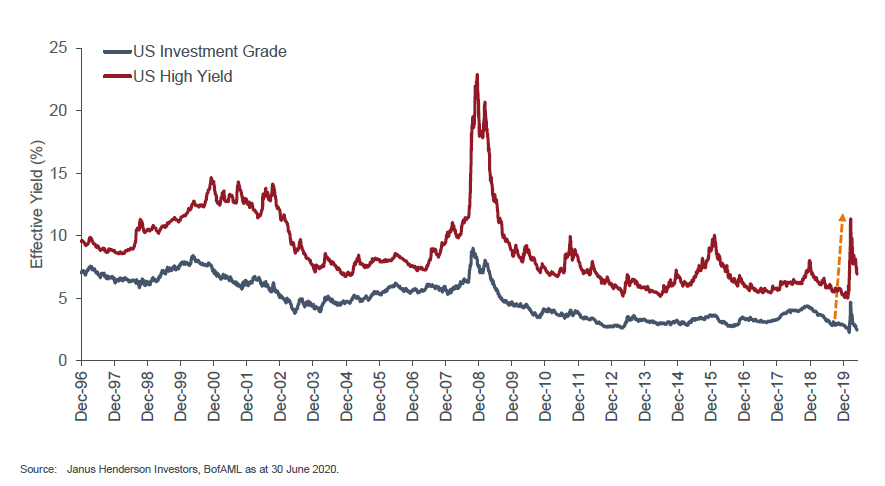

The effect was that, after a brief spike, US investment grade debt returned to trading close to record low yields and high yield debt rallied hard too. Default rates moved sharply higher but the defaults were concentrated in the sectors that Henderson Diversified was already avoiding.

The gearing that the managers took on in March and April was deployed in investment grade bonds – such as HSBC and Disney – and companies that were hit by the crisis but were expected to recover – such as Yum Brands (KFC, Pizza Hut and Taco Bell). They invested in new issues from the likes of T Mobile, Sysco and ThermoFisher Scientific and are sitting on good profits on these.

Recent purchases boost the income account

The spread between the cost of the trust’s borrowing and the yields on the bonds that they are buying flows straight through into the income account. This should help underpin the dividend for the next couple of years.

It seems likely that returns on ‘safe’ investments such as cash deposits will be depressed for some years to come. The managers say that just about everyone is convinced now of the ‘lower for longer’ view on interest rates and growth. That ought to make Henderson Diversified’s 5%+ yield pretty appealing.