What Is A Quoted Investment Company?

What Is A Quoted Investment Company?

Click here to go forward to the What Makes Investment Companies DIfference Section

Click here to return to Investment Companies – Part One

Click here to return to Investment Companies – Part Two

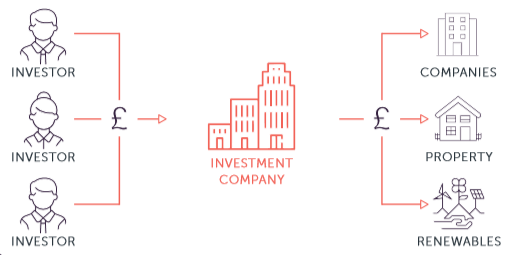

Quoted investment companies are set up to make investments on behalf of their shareholders. They are traded on a stock exchange and have a fixed share base. In other words, they are closed-ended funds. Investment trusts and real estate investment trusts (REITs) make up a majority of UK-listed investment companies.

Investing in an investment company (or any other type of pooled/collective fund such as a unit trust) is a useful way of passing the job of managing some of your investments to an expert – the investment manager.

Investment companies let you invest in a spread of different types of investment in an easier and more efficient way than buying a collection of individual investments, saving you money in dealing charges and letting you invest relatively small amounts of money. All things being equal, buying a spread of different types of investments (diversification) reduces your risk. It lessens the chance that one specific problem will have a major impact on your entire wealth.

There is a huge range of choice. There are around four hundred investment companies available to buy on a UK stock exchange. This guide aims to give you the tools to help navigate your way around them all.

Click here to go forward to the What Makes Investment Companies DIfference Section

Click here to return to Investment Companies – Part One

Click here to return to Investment Companies – Part Two