Double discount on quality-focused portfolio

AVI Global Trust (AGT) offers a genuinely different investment approach to those of competing trusts in the AIC’s global sector. It also has a good track record of beating its performance benchmark, the MSCI All Countries World ex the United States Index, with dividends reinvested and translated back into pounds.

Some well-timed trades and a willingness to look through the current COVID-19 disruption affecting some businesses have helped drive strong performance from AGT over the past few months. The trust’s shares are on an attractive discount, 10.3% at close of business on 22 January 2021, and it is itself invested in a portfolio of high-quality family holding companies, closed-end funds and cash/asset-rich Japanese securities, which collectively trade at a weighted average discount of 30.1% (as at 18 January 2021) to the value of their underlying assets. The manager sees numerous catalysts to unlock value from AGT’s portfolio over 2021.

Extracting value from discounted opportunities

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to their estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include holding companies, closed-end funds, and cash-rich Japanese operating companies.

|

|

Fund profile

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to their estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include family-controlled holding companies, closed-end funds, and cash-rich Japanese operating companies.

For performance measurement purposes, the company compares itself to the MSCI All Country World ex-US Total Return Index, expressed in sterling terms. Whilst it has some exposure, relative to an unconstrained global index, the trust has a sizeable underweight exposure to the US, primarily because there are fewer opportunities to invest in family-controlled holding companies.

AGT’s AIFM is Asset Value Investors (AVI). AVI was established in 1985, when the trust’s current approach to investment was adopted. At that time, AGT had assets of just £6m and was known as the British Empire Securities and General Trust, later shortened to British Empire Trust. The trust adopted its current name on 24 May 2019.

The manager

The lead manager on the trust is Joe Bauernfreund, the chief executive and chief investment officer of AVI. He joined AVI in July 2002 as an investment analyst, working with the then-lead manager, John Walton, and focusing on European investment companies. Later, he became joint manager with John Walton’s successor, John Pennink, and took on the lead role in October 2015.

AVI’s head of research is Tom Treanor, who joined the company in February 2011. His previous role was in closed-end fund analysis for Fundamental Data/Morningstar.

An investment consultant, Jason Bellamy, leads on AVI’s engagement efforts in Japan. He has just been joined by Makiko Shimada, who will work as an investment analyst on Japanese investments. Shimada is currently based in Tokyo, where she had been working for Goldman Sachs.

Other members of the team include Scott Beveridge (an investment analyst focused on real estate-backed opportunities and Asian holding companies), Daniel Lee (the lead investment analyst for Japan and also researches global holding companies and asset-backed special situations), Darren Gillen (an investment analyst working on closed-end funds), Wilfrid Craigie (an investment analyst researching global holding companies and asset-backed special situations) and Ross McGarry (a junior investment analyst researching global holding companies and providing support to the investment team).

As at 30 September 2020, AVI’s investment team owned 223,534 shares in AGT.

AVI has about £1.2bn of assets under management. In addition to AGT, AVI Japan Opportunity Trust was launched in 2018 and a family holding companies fund was launched in December 2019. Goodhart Partners, a London-based independent “multi boutique” asset manager, has been a minority investor in AVI since 2016, having offered an exit for legacy shareholders in the company. Goodhart helps support AVI with its business development and sales and marketing strategy.

Good quality assets at a discount

AGT seeks to buy assets for less that their fundamental value and then profit as the discount between market value and intrinsic value narrows. AVI will engage with boards and underlying managers to unlock value. Usually, AGT will be a significant investor in the closed-end funds that it holds.

The availability of value opportunities shapes the portfolio. For example, at one point, AGT had significant exposure to companies investing in German residential property, but, as discounts narrowed in this area, AVI realised profits and shifted its attention elsewhere.

AVI believes that the underlying assets must also represent an attractive investment opportunity in their own right. When it is considering whether to add a potential investment to the portfolio, AVI is looking for a catalyst that will unlock the discount. However, this can take time to come to fruition. AGT should be able to benefit from uplifts in the underlying asset value as well as discount narrowing.

This is especially true of family controlled holding companies, where AGT tends to have less sway. This is why it is important to align the trust with high quality, long-term management and businesses/assets.

Market backdrop

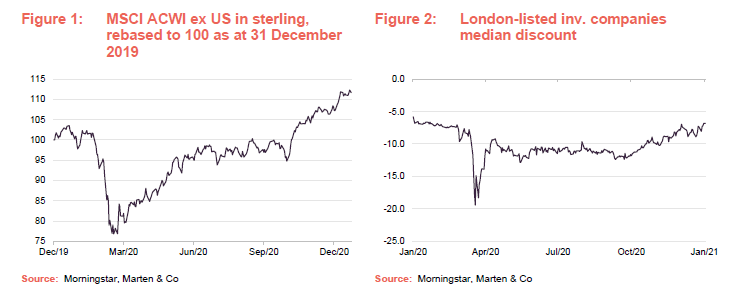

While the UK market has lagged, most other markets recovered their poise fairly quickly after the COVID-19-related panic of February/March 2020 and then moved onto new highs.

The recovery was led by ‘growth’ stocks, and technology, digital commerce and healthcare companies, in particular. AGT has meaningful exposure to these areas through a number of its investments.

In recent weeks, ‘value’ style investment strategies have been more in vogue. The trigger for this was November’s news of success in developing vaccines to ward off the virus.

Figure 2 shows how the median discount for all investment companies listed in London moved over 2020. Even adjusting for the spike in discounts during March, it is clear that discounts were on a widening trend for most of the year. A meaningful reversion to this trend occurred in the final quarter of 2020, spurred by better news on the COVID-19 front, as a number of vaccines passed their clinical trials.

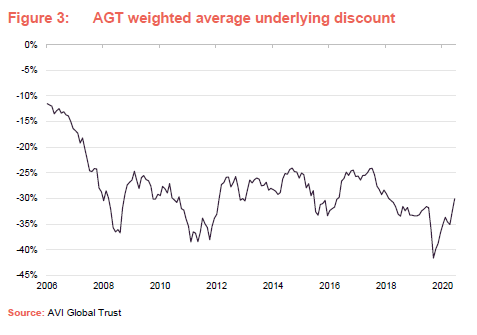

Looking longer term, Figure 3 shows how the underlying weighted average discount on AGT’s portfolio has changed since 2006. In Spring 2020, discounts widened sharply to historic highs. They have narrowed since but remain wider than their long-term averages.

Investment process

The universe of AGT’s potential investments amounts to well over 1,000 stocks: over 100 each of European and Asian family holding companies, over 650 closed-end funds, more than 100 heavily over-capitalised Japanese operating companies with significant cash and/or securities holdings, and over 100 other asset-backed situations.

AVI keeps about 400 of these potential holdings under close scrutiny. When selecting stocks for AGT’s portfolio, AVI’s initial screen is for value, based on the size of the discount that a company is trading on. Listed assets are valued on a mark-to-market basis. Most listed closed-end funds tend to publish regular NAVs, but the team may maintain its own models for funds that publish less frequently. The team also maintains its own models for valuing unlisted assets.

The portfolio is constructed on a bottom-up basis – selecting stocks for their individual attractions rather than seeking to asset allocate to particular regions or sectors – and without any reference to benchmark weights. Potential investments will be subjected to an intensive due diligence process.

AVI have operated with a fairly concentrated portfolio since 2015, with about 25–35 core positions. In practice, this means about a 3% target position in core holdings. Whilst there is no hard limit, the largest position in the portfolio is unlikely to exceed 10% of net assets.

The team has strong relationships with some brokers and AVI is sometimes offered large lines of stock. With the Japanese part of the portfolio, the manager keeps an eye on trading by insiders (as family members faced with inheritance tax bills have to sell stock, for example), which can give an indication that there is stock available.

Family-controlled holding companies

The holding companies that AGT invests in should have high-quality portfolios of listed and/or unlisted businesses with the potential for sustained, above-average, long-term NAV growth. The controlling family or shareholder should have a strong track record of capital allocation and have demonstrated that it is capable of generating returns in excess of broader equity markets.

Part of the attraction of investing in these companies is that they operate with a long-term strategic vision; investing for the benefit of future generations, rather than to beat analysts’ short-term estimates.

The manager’s preference is for investment in holding companies where there is a catalyst in place to narrow the discount. By the manager’s own estimate, historically about three-quarters of AGT’s returns from holding company investments have come from NAV growth and one-quarter from discount tightening.

Closed-end funds

AGT invests in closed-end funds globally, but the majority of its investments in this area are listed in London. There are many reasons for this; for example, the manager says that closed-end funds in the US tend to focus on fixed income and yield and, given that investors are keen to find reliable sources of income at the moment, this means that their discounts are tight. In the manager’s experience, corporate governance in the US is also relatively poor; directors are often conflicted, for example.

Again, the focus is on the quality and growth potential of the underlying assets. When investing in closed-end funds, the manager places a greater emphasis on an ability to close the discount. Consequently, AGT’s stakes in closed-end funds are usually larger, to give it greater influence. The manager will engage with management, boards and other shareholders. Historically, half of AGT’s returns on closed-end fund investments have come from discount narrowing.

Japanese cash-rich operating companies

AGT’s Japanese investments benefit from a tailwind of a revolution in Japanese corporate governance. The manager has been investing in Japan for over 20 years. In 2012, then-Prime Minister Shinzo Abe proposed a stewardship code, which was adopted in 2013. This was aimed at getting investors to fulfil their fiduciary responsibilities and encouraging engagement with company management.

A corporate governance code was introduced in 2015 and strengthened in 2018. This included measures aimed at minimising cross-shareholdings, stressing the importance of companies earning more than their cost of capital, bringing in more independent directors, establishing independent nomination committees for new directors, improving disclosure and greater dialogue with shareholders, and maintaining a level playing field in the treatment of shareholders. AVI describes this as a scorecard with which it could hold Japanese businesses to account.

The number of activist investors in Japanese securities has increased and the manager sees evidence of rising dividend payout ratios (the percentage of earnings paid to shareholders in dividends), share buybacks, and more independent directors. The managers engage with the boards and management of AGT’s holdings, promoting policies for the benefit of all stakeholders.

With all its engagement activities, AVI much prefers that these take place in private, although it is willing to put proposals to shareholders if necessary. The vast majority of engagement activity will never come to light, therefore.

A typical stock in this part of the portfolio will be cash-generative, trade on low valuation multiples, and the underlying business will be of sufficient quality such that the manager can afford to take a long-term view.

Hedging

The manager has the ability to hedge positions (by shorting stocks or indices, for example) should it choose, although this is used infrequently, and the manager would not take a net short exposure.

Currency exposures have been hedged in the past. Now, as we discuss on page 20, AGT has a multicurrency debt facility, which allows the manager to limit exposure to certain currencies.

Asset allocation

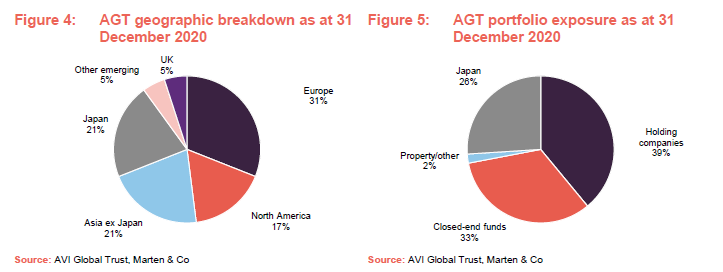

Reflecting the manager’s long-term approach, AGT’s portfolio exposures were not much changed between June 2020 and December 2020.

The portfolio embraces a number of underlying investment themes including digitally-enabled growth (with exposure to companies such as Alibaba, Babylon and Zalando), quality category leaders (LVMH, Disney and Ferrari), improving Japanese corporate governance and cyclical recovery from the slowdown associated with COVID-19.

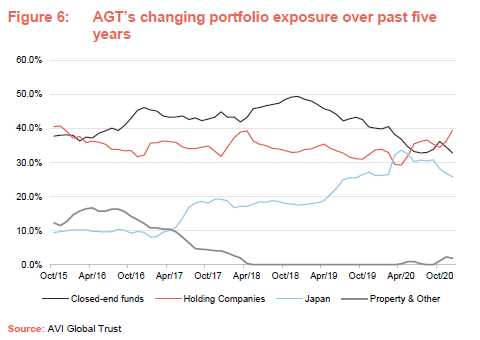

The notable change in the distribution of AGT’s portfolio in recent years has been a shift away from property-focused companies (which has proved timely given the impact of COVID-19 on many stocks in that sector) and an increase in the exposure to Japanese asset/cash-rich companies.

Top 10 holdings

At the end of December 2020, the Japan special situations position represented a basket of 13 stocks: Daiwa Industries, Fujitec, Kato Sangyo, Konishi, NS Solutions, Pasona Group, Sekisui Jushi, SK Kaken, Teikoku Sen-I, Toagosei, Digital Garage, DTS Corp and Bank of Kyoto. Some of these are discussed below, as are some of the other large positions.

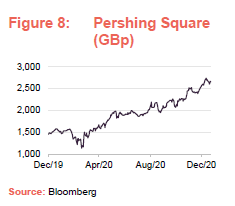

Pershing Square Holdings

Pershing Square Holdings (PSH) – pershingsquareholdings.com – is a £7bn market cap hedge fund run by a team led by Bill Ackman, who owns a substantial stake in the fund. PSH’s portfolio includes stakes in Restaurant Brands (which owns Burger King, Tim Hortons and Popeyes), Agilent Technologies (life science services), Chipotle, Lowes (DIY stores), Starbucks, Hilton, Howard Hughes (a real estate development company), and the US mortgage finance business – Fannie Mae and Freddie Mac. Some of these businesses have been impacted by measures taken to control COVID-19 and might reasonably recover if vaccination programmes succeed in controlling the virus.

PSH has traded on a significant discount for some time, despite the introduction of a modest dividend in 2019 and buybacks. Strong performance in 2019 (sterling returns close to 50%) was not really rewarded with a tighter discount. In March 2020, the fund’s fortunes were transformed when it realised a multi-billion dollar profit on a hedge that the manager had taken out to protect it from market falls. This helped it become one of the best-performing London-listed closed-end funds of 2020.

Nevertheless, the discount has not been eliminated. This seems particularly strange given that PSH recently established a special purpose acquisition company (SPAC) – which we in the UK would call a cash shell – Pershing Square Tontine Holdings, which is trading at a 46% premium to its $20 issue price. The SPAC launched with $4bn and a further $900m has been committed by PSH. The rumoured target was AirBnB, but that private company has since ruled out listing by way of a reversal into the SPAC.

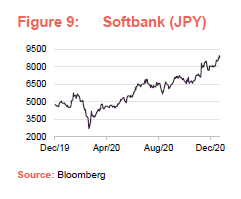

SoftBank

SoftBank (group.softbank/en) has attracted some very negative press commentary in recent times – problems within its venture cap Vision Fund, the pulled initial public offering (IPO) of WeWork and blowing $300m on a dog-walking app, for example. This helped open up a substantial discount between SoftBank’s enterprise value and the value of its underlying stakes, exceeding 70% at one point. US activist fund Elliott has taken a stake in the business. The AGT team felt that this might help spur some remedial action. Two new independent directors have been appointed, a $41bn asset disposal programme initiated and plans have been announced to cut debt and buy back shares in equal measure. The AGT team is pleased with the progress to date.

The planned sale of the UK-based chip-design company ARM to Nvidia (which is subject to regulatory approval) could leave SoftBank with a net cash position. However, offsetting this good news has been a fall in the price of Alibaba, the group’s largest asset, which is more than 25% below its October peak. Jack Ma’s political problems and the cancellation of the Ant Financial IPO are weighing on sentiment.

The manager notes that Masayoshi Son’s percentage stake in SoftBank is rising – might he find a way to take the business private?

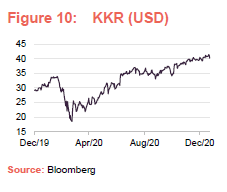

KKR

Today, KKR (kkr.com) is a more diversified business than it was ahead of the crisis of 2008. From a private equity firm, the business has evolved to become a diversified alternative asset manager, with exposure to credit, infrastructure, hedge funds and real estate, as well as private equity.

The manager notes that KKR’s fees should not have been much affected by the sell-off in listed markets. For an asset manager, KKR has a big balance sheet, with around $15bn invested in its own funds. This can be used to seed new funds.

KKR used to be structured as a limited liability partnership and, as such, it did not qualify for inclusion in stock market indices. The structure was designed to minimise the partners’ tax bill on carried interests. In 2018, it adopted a more conventional corporate structure. KKR’s partners may pay more tax, but the idea was that the stock should trade on a higher valuation multiple and qualify for indices (attracting buyers from index-tracking funds). The share price did make strong progress in 2019, rising by around 50%.

KKR recently acquired Global Atlantic, the life assurance arm of Goldman Sachs, in a deal that valued that business at $4.4bn. This added around $70bn to its assets under management.

Underlying exposures

Highlighting some of these:

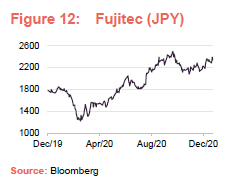

Fujitec

Fujitec (fujitec.com) makes and services elevators, competing with Kone, Schindler and Otis. The company is valued at a big discount to those peers but has had much lower margins, partly, AVI believed, because the business was more focused on installations than servicing. It was also subscale in many of its regional operations.

AVI published detailed research, making specific recommendations, which focused on the scope for operational improvements.

Fujitec agreed to carry out a strategic review and this was published in December 2020. The company pledged to focus on improving returns on equity, its opportunities in the Chinese market and on its aftersales business. It will scrap its ‘poison pill’ arrangements at its 2022 annual general meeting (AGM) (these would have diluted any large shareholder displaying hostile intentions). AVI feels that there is scope for consolidation in the sector, but Fujitec now has a couple of years to demonstrate why it should go it alone or even acquire its competitors.

Fondul Proprietatea

Hidroelectrica (hidroelectrica.ro) is the largest investment in Fondul Proprietatea’s portfolio, accounting for close to half of its NAV. The plan is to IPO the company, allowing Fondul to monetise some or all of its 19.9% stake in due course. An earlier attempt failed after the Romanian parliament blocked the sale of state-owned shares (the Ministry of Energy owns the balance of the company). However, recent elections in the country left a business-friendly party in the ruling coalition and the manager’s expectation is that the IPO will be approved.

Recent trades – realisations

AGT’s turnover picked up last year, reflecting market volatility. In the sell-off of Spring 2020, the manager reduced the portfolio’s exposure to cyclical stocks and added to higher-liquidity, higher-quality positions.

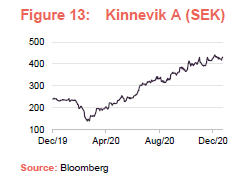

Kinnevik

Kinnevik (kinnevik.com) was a success story for AGT in 2020. The manager was buying stock in March and April when it was trading on around a 30% discount. It was a top 10 holding at the end of September, but given that it is now trading at a premium to the value of its underlying investments, the manager has been taking profits. Kinnevik has a portfolio of technology, internet and digital ecommerce businesses. These include online fashion business Zolando, which accounts for around half of its NAV; Teladoc, which operates in the field of health care technology and came via a merger of Livongo – a company that Kinnevik had backed; and Babylon, another company in the same field.

TBS Holdings

Another large disposal was of the trust’s stake in TBS Holdings (tbsholdings.co.jp/en/) – formerly Tokyo Broadcasting System. This stock, the Japanese equivalent of ITV, was AGT’s first high-profile campaign of activism in Japan. Whilst this was not successful, the publicity that this action garnered has helped with later investments.

AGT first invested in the stock in 2017, when the manager believed it was trading at a 36% discount to NAV. Over half of the company’s balance sheet was in investment securities and cash. This was depressing the stock’s return on equity. AVI proposed an in-specie distribution of surplus assets (handing out the assets to shareholders rather than turning them into cash and handing out the cash). Its proposal, put to TBS’s 2018 AGM, was rejected by shareholders. TBS undertook some modest reduction of its securities portfolio but, ultimately shareholders were disappointed with the company’s progress.

Others

AGT also realised its stake in Pargesa, a Swiss holding company controlled by the Frère family. The holding company had a 50% stake in Groupe Bruxelles Lambert, which in turned owns stakes in diverse businesses from Pernod Ricard to the specialist minerals business Imerys and adidas. Parjointco Switzerland, a holding company owned by the Frère and Desmarais families bought out the minorities in Pargesa in November 2020.

AGT’s holding in Riverstone Energy was sold in May. The manager felt that it would be hard to exert change and overturn the stock’s corporate governance flaws. In addition, looking at the values that that the fund was attributing to its investments versus public comparators, the manager could see further downside in the NAV.

Other recent disposals include French holding company Wendel, Brazilian holding company Cosan and a reduction in the holding in Jardine Strategic. The latter is a long-term core holding for AGT.

Recent trades – investments

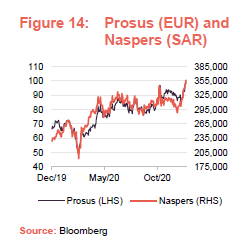

Prosus/Naspers

A significant investment was made in Prosus last year, but this was later switched into Naspers. South African business, Naspers (via Prosus) has a significant (around 30%) stake in Chinese gaming, social media and fintech giant Tencent. AVI is optimistic about the outlook for Tencent based on increased monetisation of its WeChat service and increased penetration of customers in rural China.

The Tencent investment came to dominate Naspers portfolio. Naspers spun its Tencent stake and other international investments (including positions in Delivery Hero, PayU and AutoTrader) into Prosus and listed that on Euronext in mid-2019, retaining a meaningful stake in Prosus (currently 72.5%). AGT’s trades were driven by discount moves. The manager thinks that it is possible that Naspers might distribute a portion of the Prosus holding to its shareholders in-specie, eliminating the Naspers level discount on that portion of the stake.

Christian Dior

Another purchase was of Christian Dior, whose main asset is a stake in the luxury goods business LVMH (lvmh.com). The vast majority of Christian Dior’s shares are owned by the Arnault family. The free float is just 2.45% and voting rights represent less than this. From AVI’s point of view, there is no reason for the Christian Dior holding company to exist.

LVMH comprises around 75 well-known luxury brands in wine & spirits, fashion & leather goods, perfumes & cosmetics, watches & jewellery, retailing, media, yachts and hotels. The manager makes the point that, for the most part, these businesses should not suffer any long-term effects from disruption associated with COVID-19.

Others

AGT also bought a COVID recovery basket of stocks last year. This included UK property companies such as Secure Income REIT (owner of hotels and leisure properties), Shaftesbury (owner of property in London’s West End, which is highly sensitive to tourism), Associated British Foods (owner of Primark), and British Land and Derwent London, owners of London offices. The latter two have since been sold at a profit.

Performance

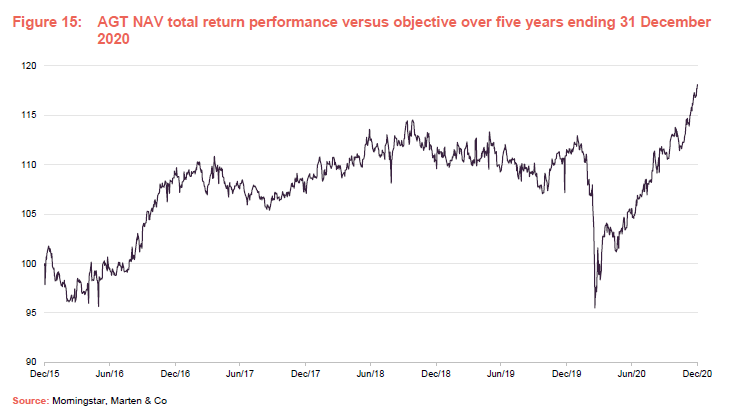

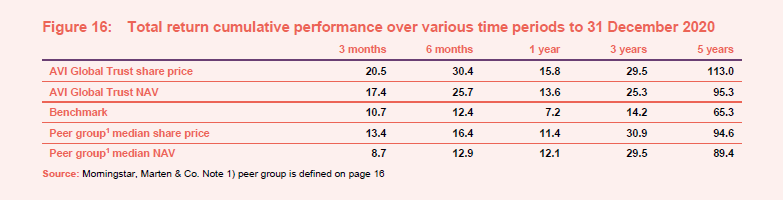

Over 2020, AGT underperformed as markets fell but outperformed as this reversed. The manager says that this is a typical pattern of performance. When investor sentiment worsens, discounts widen. In addition, the trust’s gearing magnifies the effects of the falls. However, this also works in reverse as markets rise.

AGT has delivered decent outperformance of its MSCI AC World Index ex US benchmark over the past five years. March 2020’s COVID-19-related market panic led to some temporary underperformance as investors favoured US stocks and high growth stocks in particular. Nevertheless, AGT swiftly recovered this over the summer of 2020 and has continued to deliver good relative performance since.

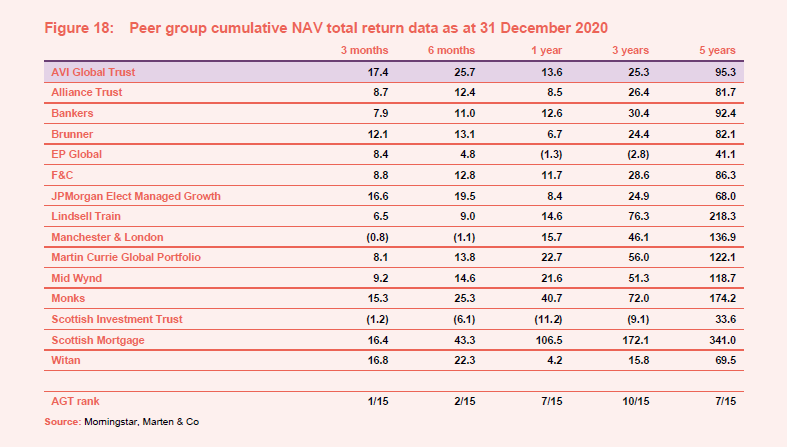

Relative to its peers, AGT has outperformed the average global trust over five years and has done particularly well in the short term.

Peer group

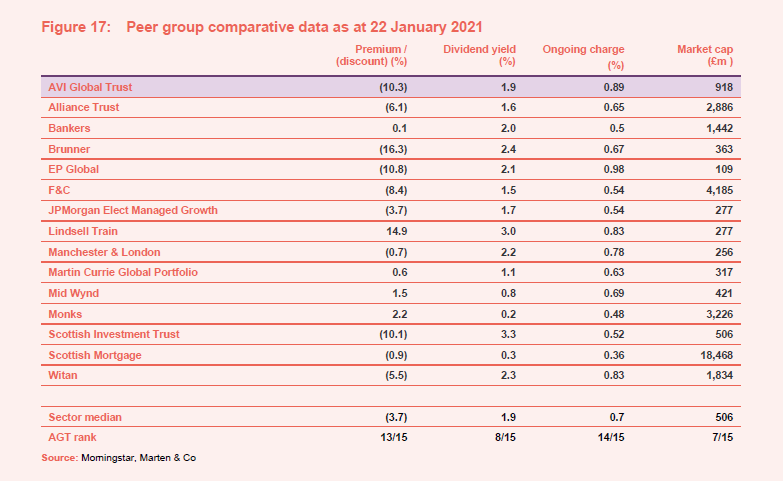

AGT is a constituent of the AIC’s Global sector. For the purposes of this note, we have compared AGT with the other members of this sector. The members of this peer group invest predominantly in listed equities.

AGT’s discount is relatively wide within this peer group. Its dividend yield is about middle of the pack – none of these trusts invests with the primary intention of generating a high dividend yield. AGT’s ongoing charges ratio is towards the higher end of these trusts, but we would argue that none of these figures is particularly high.

AGT’s strong recent run of performance has propelled it close to the top of the peer group performance tables over shorter time periods. Longer-term, its returns are closer to the middle of the pack. A handful of the trusts that compete with AGT are heavily biased towards growth stocks and the US, both of which have performed relatively well in recent years.

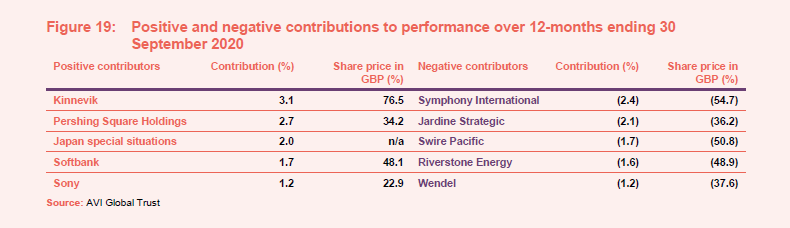

AVI has published some information on the stocks that contributed to AGT’s returns over the 12-month period ending 30 September 2020 which we reproduce in Figure 19.

Many of these companies have been discussed above. Symphony International is an Asian private equity fund which has substantial interests in restaurants and hotels, which have been hit hard by measures to contain COVID-19. The fund is trading on a discount of more than 40%. Jardine Strategic has fallen as COVID-19 has affected many of its investments, including the hotel group Mandarin Oriental. In addition, the political disruption in Hong Kong has affected its Hong Kong Land investment. Swire Pacific has been similarly affected.

Dividend

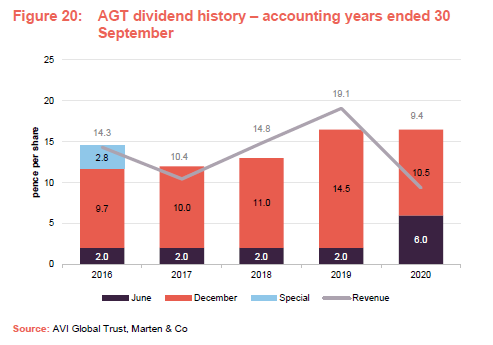

AGT normally declares two dividends per year, an interim in June and a final in December. In 2020, the board rebalanced the dividend payments by increasing the interim dividend and reducing the final.

The board monitors the revenue account but does not set a revenue target for the investment manager. In light of the cancellation, reduction and postponement of a number of dividends, in connection with COVID-19, the board has said that its current intention is to use revenue reserves, and if necessary capital reserves, to maintain the annual dividend at current levels. Nevertheless, the dividend remains under careful and regular review.

At the end of September 2020, AGT’s revenue reserve stood at £30.9m, equivalent to 29.4p per share. In addition, AGT’s articles permit the distribution of realised capital gains. These stood at £676m at the end of September 2020.

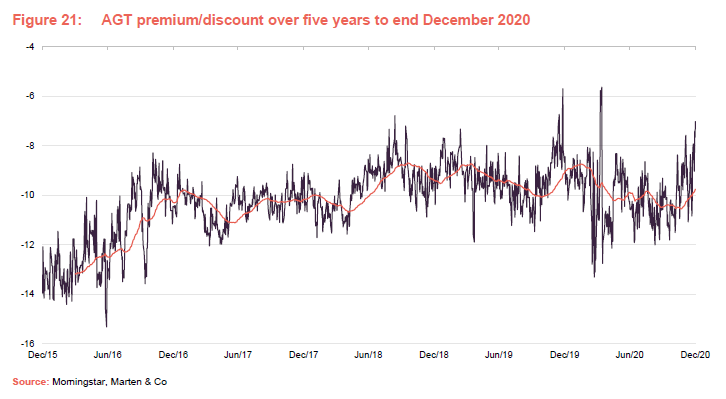

Discount

Over the year ended 31 December 2020, AGT’s discount moved within a range of 13.3% to 5.6% and averaged 9.9%. At 22 January 2021, AGT’s discount was 10.3%.

At the AGM in December 2020, shareholders approved resolutions empowering the board to buy back up to 14.99% of its then issued share capital (equivalent to 15,761,742 shares) and issue up to a third of its then issued share capital (equivalent to 35,049,460 shares). A separate resolution granted permission for 5% of the then-issued share capital to be issued without pre-emption (pre-emptive rights give shareholders the right to buy additional shares in an issue before the shares are made available to the general public).

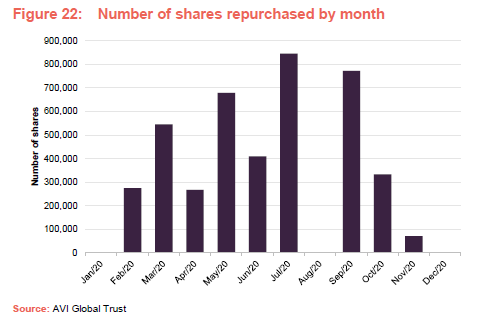

AGT’s board uses share buybacks with the intention of limiting volatility in AGT’s discount. Over the year ended 31 December 2020, around 4.2m shares were repurchased. Buying back shares at a discount enhances the NAV per share.

The board also employs a marketing budget (administered by the investment manager) with the aim of stimulating demand for the trust’s shares.

Fees and costs

The investment manager is entitled to an annual management fee of 0.70% of the first £1bn of AGT’s net assets and 0.60% of any net assets above £1bn. The fee is calculated quarterly by reference to the net assets at the preceding quarter end and paid monthly.

The tiered fee structure was adopted from 1 October 2020. Before that date, the manager’s fee was a flat 0.70% of net assets. At the same time, the notice period for termination of the investment management agreement was reduced from 12 months to six months.

For accounting purposes, 30% of the management fee is charged against revenue and the balance against capital.

For the year ended 30 September 2020, the only other expenses of note were marketing expenses of £459,000 (2019 financial year – FY19: £310,000), advisory and professional fees of £249,000 (FY19: £274,000), custodian fees of £185,000 (FY19: £144,000) and depositary fees of £120,000 (FY19: £121,000).

The ongoing charges ratio for the year ended 30 September 2020 was 0.89%, up from 0.85% for the prior year.

Capital structure and life

At 24 January 2021, AGT had 116,003,133 ordinary shares in issue, of which 10,854,751 shares were held in treasury. The number of total voting rights on that date was 105,148,382. There are no other classes of share capital.

AGT does not have a fixed life. Its financial year end is 30 September 2020 and its AGMs are usually held in December.

Gearing

AGT has an unsecured multicurrency revolving currency facility provided by Scotiabank Europe Plc. The total facility is JPY9.0bn and may be drawn down in Japanese Yen, Pounds Sterling, US Dollars and Euros. The interest rate on amounts borrowed is 0.75% over LIBOR. Undrawn balances below JPY2.0bn are charged at 0.35% and any undrawn portion above this is charged at 0.30%.

AGT has issued three loan notes. At 30 September 2020, the following were still outstanding:

- £29.9m of 4.184% series A unsecured loan notes 15 January 2036

- £27.1m of 3.249% series B unsecured loan notes 15 January 2036

- £18.0m of 2.93% Euro senior unsecured loan notes 1 November 2037

At 21 January 2021, the effect of valuing the loans at fair value was to reduce the NAV by 20.13p per share.

A covenant on the loan notes requires that AGT’s net assets must not be less than £300m and total indebtedness must not exceed 40% of net assets. AGT is well within these limits at the time of publication.

At 31 December 2020, JPY4bn was drawn down on the revolving currency facility and AGT’s gearing was 6.0%.

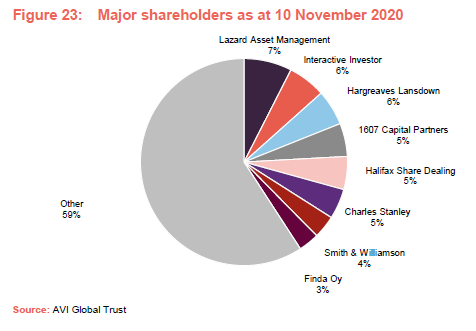

Major shareholders

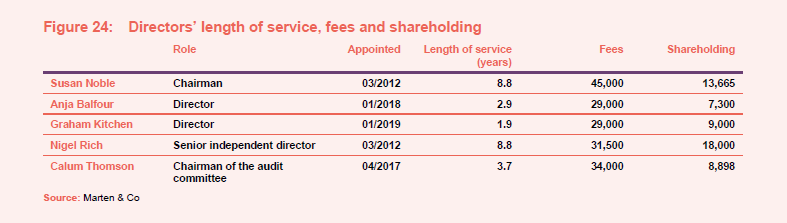

Board

AGT has five directors, all of whom are non-executive, independent of the manager and who do not sit together on other boards.

The chairman, Susan Noble, and senior independent director, Nigel Rich, both joined the board in March 2012. The AGT board has agreed that it would be advisable not to have two directors retire in the same year and that it would be appropriate to have an orderly succession plan. Therefore, Nigel Rich will retire from the board at the AGM in 2021 and Susan will retire from the board at the AGM in 2022. Work is underway to find suitable replacements.

Susan Noble

Susan Noble was appointed as chairman of AGT in December 2017. She is a former chairman of Alliance Trust Investments, a director of Alliance Trust Plc, and a managing director of Goldman Sachs Asset Management, where she was head of European equities and head of global equities. Susan was also a director and senior European portfolio manager at Robert Fleming Asset Management.

Currently, Susan is chairman of Newton Investment Management Limited and an associate director of Manchester Square Partners.

Anja Balfour

Anja Balfour has over 20 years’ experience in managing Japanese and international equity portfolios for Stewart Ivory, Baillie Gifford and Axa Framlington.

She is chairman of Schroder Japan Growth Fund Plc and BMO Global Smaller Companies Plc, and a non-executive director of Scottish Friendly Assurance Society. Previously Anja was a trustee of Venture Scotland and a non-executive director of Martin Currie Asia Unconstrained Trust Plc.

Graham Kitchen

Graham Kitchen has over 25 years’ experience as an investment manager at Invesco, Threadneedle and, until March 2018, Janus Henderson, where he was global head of equities. He was previously chair of the investment committee for the Cancer Research Pension Fund.

Graham is chairman of Invesco Perpetual Select Trust Plc and a non-executive director of The Mercantile Investment Trust Plc and Places for People. He is also a member of the investment committee of the charity Independent Age.

Nigel Rich

Nigel Rich was managing director of Jardine Matheson Holdings and group chief executive of Trafalgar House Plc. Consequently, he has experience as a senior executive and chairman of companies in Asia and the UK. He is also a chartered accountant.

Nigel is a non-executive director of Matheson & Co Ltd, chairman of Urban Logistics REIT Plc, former chairman of SEGRO Plc, Xchanging Plc, Ocean Group/Exel Plc, CP Ships Limited and Hamptons Group Limited. He has also been a director of Pacific Assets Trust Plc, Granada Plc and ITV Plc.

Calum Thomson

Calum Thomson is a qualified accountant with over 25 years’ experience in the financial services industry, including 21 years as audit partner at Deloitte LLP, specialising in the asset management sector. He has wide-ranging experience in auditing companies in the asset management sector and latterly as a non-executive director and audit committee chairman.

Calum is non-executive director and audit chairman of The Diverse Income Trust Plc, The Bank of London and The Middle East Plc, BLME Holdings Plc, Standard Life Private Equity Trust, and Baring Emerging EMEA Opportunities Plc. He is also a non-executive director of Schroder Unit Trusts Limited and Schroder Pension Management Limited, and chairman of two charities: The Tarbat Discovery Centre and La Serenissima.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on AVI Global Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.