Infectious enthusiasm

BlackRock Throgmorton Trust (THRG) has shrugged off the effects of COVID-19, which triggered sharp falls in markets in March, and delivered decent returns over 2020. Dan Whitestone, its manager, remains genuinely excited about THRG’s prospects. He has been banging the drum for the trust, encouraging investors to set aside any doubts over the outlook for the UK, and back THRG’s portfolio of growing companies.

Many commentators have highlighted the extreme undervaluation of the UK relative to other markets, a consequence of the uncertainty around Brexit and our somewhat haphazard handling of the pandemic. Dan points out that moments of maximum uncertainty can present incredible opportunity for the long-term investor.

Both long and short positions in UK small- and mid-cap companies

THRG aims to provide shareholders with capital growth and an attractive total return by investing primarily in UK smaller companies and mid capitalisation companies traded on the London Stock Exchange.

It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction.

Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks.

THRG’s good performance (see below) and an extra marketing effort have helped drive down THRG’s discount to the point where it has been able to issue shares at a premium to asset value. The COVID-19 panic that set into markets in March was soon shrugged off and the share price is back to the levels of February 2020.

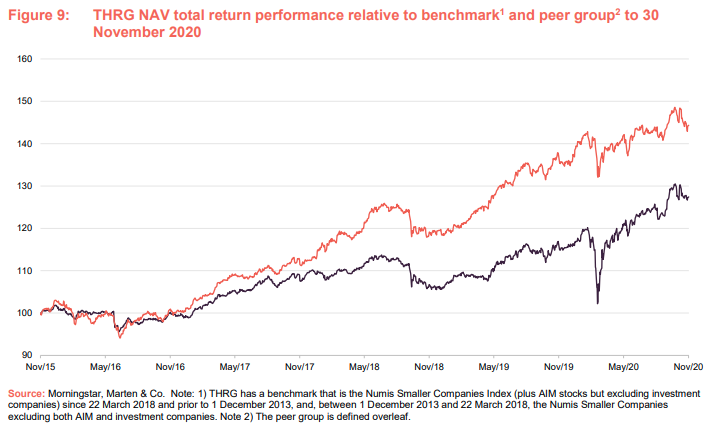

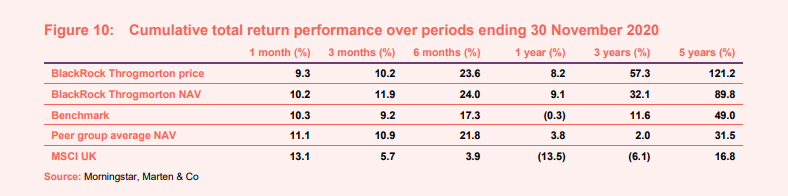

THRG has beaten its benchmark by a considerable margin over the past five years. Investors have also benefited from the narrowing of the discount that we referred to above – pushing the price returns well above the NAV return.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Peer group average NAV TR (%) | Numis Smaller Co.s plus AIM, ex IC (%) | MSCI UK total return (%) |

|---|---|---|---|---|---|---|

| 1 | 30 Nov 2016 | -2.10 | 7.30 | 7.10 | 6.30 | 11.00 |

| 2 | 30 Nov 2017 | 43.80 | 33.90 | 24.60 | 21.30 | 12.00 |

| 3 | 30 Nov 2018 | 1.80 | -2.70 | -1.90 | -9.00 | -0.60 |

| 4 | 30 Nov 2019 | 42.80 | 24.40 | 14.00 | 8.00 | 9.30 |

| 5 | 30 Nov 2020 | 8.20 | 9.10 | -0.30 | 3.80 | -13.50 |

Manager’s view

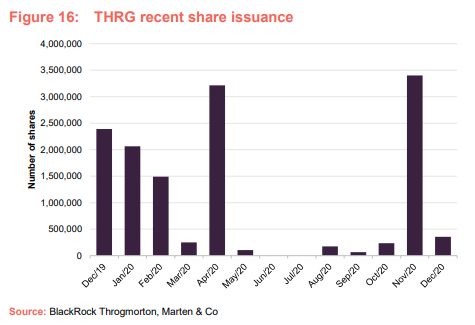

Dan Whitestone, THRG’s manager is excited about the outlook for his portfolio and he pushed for the recent stock issuance (THRG recently placed £18m worth of shares with investors at a small premium to asset value), believing that now is the time to back the trust. THRG has issued almost 7.8m shares since its AGM on 25 March. The board is asking shareholders to approve further issuance at an EGM on 18 December 2020. We believe that shareholders will support the proposal enthusiastically.

Dan believes that incredible opportunities exist for long-term investors at times of maximum uncertainty for markets. However, he feels that he can be certain about the outlook for many companies both positive and negative.

Two major themes

Dan sets out two major themes that he is convinced will set the scene for markets for years to come.

The first of these is secular growth in sectors undergoing structural change. We have seen an acceleration of many of these trends through the pandemic. Generally, in his view, the growth that companies associated with these trends have experienced this year, does not represent a pull-forward of growth – rather he believes that long-term growth rates have increased.

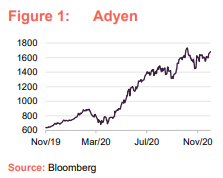

One example of this is digital payments. In the UK, the use of cash is dwindling fast. Online purchasing and mobile payments are driving adoption rates of digital payments higher. Within the portfolio, this theme is represented by the likes of Adyen and Boku. Adyen is a good example of the benefit of THRG’s ability to invest up to 20% of its portfolio overseas. It is a fast-growing, profitable and cash-generative Dutch payments processing company. Its customers include the likes of McDonalds, Uber, eBay and Spotify. It is targeting compound annual revenue growth in the mid-20s to low-30s per cent. over the medium term. Boku is headquartered in San Francisco. It specialises in payments made using mobile phone numbers, whereby customers’ purchases are added to their mobile phone bill.

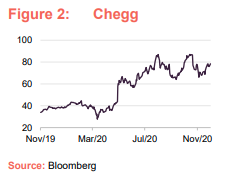

The need for social distancing accelerated the growth of the educational software market. THRG holds Chegg, a US online educational software service offering a range of study aids, online tutoring, Q&As etc. It is particularly popular for university students taking remedial maths classes. The business grew strongly through the pandemic, hitting 3.7m subscribers by the end of September 2020 (up 69% on the previous year). This in turn is driving impressive revenue and profit growth. Students are signed up to an entry-level subscription service and upsold additional services. The company has high recurring revenues and high visibility of its future income.

The video gaming market saw a considerable boost during the lockdowns. Many factors are combining to drive growth in the profitability of the industry, including more content, better monetisation, a larger addressable market and higher revenue per user. Distributing video games digitally rather than as physical cartridges or discs also provides a significant boost to profitability. The industry has good customer retention rates, which should bode well as things hopefully return to normal next year. In THRG’s portfolio are stocks such as Team 17 (discussed in our last note – see page 11 of that note), Sumo Digital and Codemasters.

Accelerated corporate Darwinism

Dan describes his second major theme as ‘accelerated corporate Darwinism’. Those companies that went into the crisis with strong balance sheets are at an advantage – they should emerge with better prospects. Other companies were forced to shore up their finances with share issues at dilutive prices.

Dan anticipates a repeat of the pattern of past winners such as fitted kitchen company Howden Joinery and equipment leasing business Ashtead, which did relatively well following the financial crisis in 2008. Howden had the financial strength and leaner business model to enable it to take market share from retailers. Ashtead was able to invest in the newest equipment, which enabled it to take market share organically. It also had the balance sheet to fund the acquisition of small, independent, usually family-owned businesses. The resulting profit growth was reinforced by a recovering economy.

This time around, Dan is looking for businesses that might benefit as the cost of retail space falls. As the likes of GAP, Debenhams and Arcadia shed stores, those companies with strong bricks and mortar franchises should benefit.

He cites Pets at Home as one potential winner. The market for pets is growing, helped by more of us working from home. So, too, is the spend per animal. Dan has been following the stock for some time and became more enthusiastic about it when the management team was refreshed in 2018. He invested in the stock about 12 months ago and it has just about doubled in value since. Pets at Home is more than just a retailer, offering advice and support to pet owners. The company feels confident enough in its outlook to have repaid the £28.9m business rates relief it received during the pandemic.

Pets at Home is just one way that Dan is exploiting this theme within THRG’s portfolio. He also holds Dechra Pharmaceuticals (veterinary pharmaceuticals and related products) and CVS (the largest integrated veterinary services provider in the UK).

Watches of Switzerland is another retailer that Dan believes can thrive in the current environment. It has a leading position in the sale of Rolex watches. These are not available to buy online. The closure of travel-related outlets has constrained the business, but it has responded by providing online consultations to prospective purchasers. The result is that about 40% of sales are pre-sold before the customer walks into the store. The product will never be commoditised and therefore they will always have pricing power.

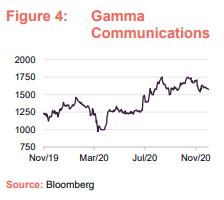

The shift to working from home accelerated the take-up of cloud-based software, and forced companies to upgrade their communications systems. Gamma Communications, which was THRG’s third-largest holding at the end of October has a leading position in the UK’s audio-visual telephony market and is expanding its operations into Europe with a series of bolt-on acquisitions. At 30 June, its cash generation was running at 18% ahead of the prior year and the management were guiding analysts towards figures for 2020 as a whole at the top end of expectations.

Investors taking profits

The good news on the vaccine front has presented THRG with a short-term headwind. Dan observed sharp sell-offs in some positions as other investors took profits and tried to switch into value stocks. We saw sharp upwards moves in the share prices of many of these value stocks over just three weeks (Dan notes that a similar recovery in 2009 took nine months).

Dan thinks this will be a short-lived phenomenon. He expects that many of these stocks will disappoint, as the corporate Darwinism we discussed above shrinks their business. Investors will then return to growth stocks. Dan notes that THRG’s recent influx of cash has been timed well, to capture this temporary dip in prices.

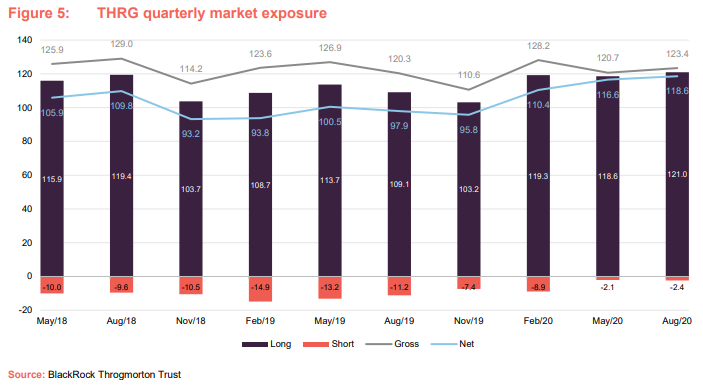

If you are not familiar with THRG’s investment process, it might be best to refer to pages 6–8 of our annual overview note. Figure 5 shows how THRG’s exposure to markets has changed over the past couple of years.

Dan has been expecting a value recovery at some point ever since the market fell in March. He reduced THRG’s short positions in April (as you can gauge from the reduction in the pink bar between February and May). In the event, whilst over the summer the market recovered, the stocks he was shorting only rose in value recently. He believes that it was impossible to know the timing of this, and better to err on the side of caution. He sees a multi-year opportunity to continue to outperform his benchmarks.

The UK remains deeply out of favour with international investors. Dan does not anticipate that Brexit will have much impact on most of the companies in the portfolio either way. However, a final decision on Brexit will at least remove some of the uncertainty that has been weighing on the UK stock market.

Dan has genuine and infectious optimism on the outlook for THRG. Faced, he says, with an abundance of opportunities, the portfolio is fully deployed and the gross and net exposures are high. At the end of September, the net exposure was 117.4%.

Asset allocation

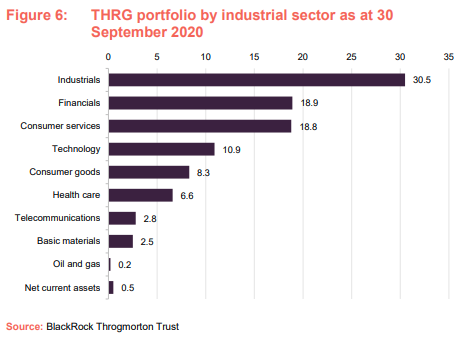

THRG’s sector exposures are driven by stock selection and the themes of structural change that Dan is looking to exploit. Relative to the benchmark, THRG’s has significant overweight exposure to software and computer services, leisure goods, general retailers (but only those select retailers that Dan feels will be the winners in the current environment, such as Pets at Home and Watches of Switzerland, discussed above), support services and media.

By contrast, the portfolio has significant underweight exposure to commoditised sectors such as mining and oil & gas; and sectors battling major headwinds such as travel and leisure, real estate and food producers.

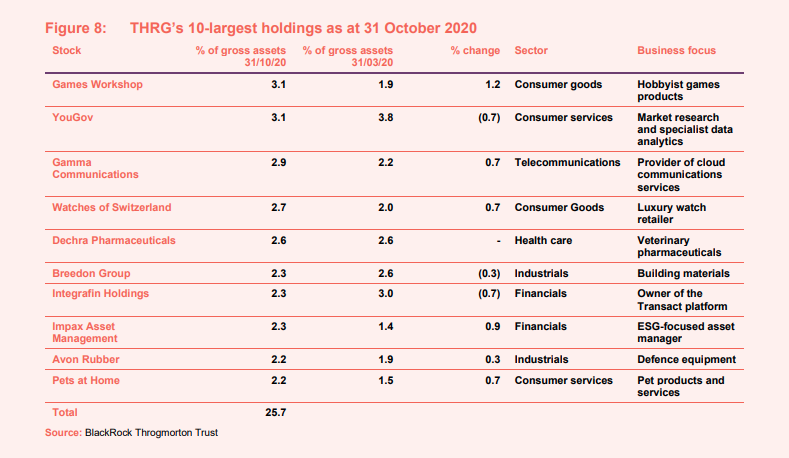

Top 10 holdings

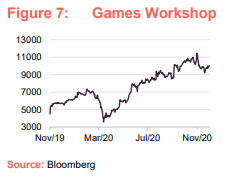

As at the end of October 2020, the largest position in THRG’s portfolio was Games Workshop. It didn’t feature in the list of the 10-largest holdings when we last published, but has been a long-standing position in THRG’s portfolio. Dan points out that the company, which makes figures used in wargaming, is relatively immune to economic shocks as its customer base are hobbyists. He says that Games Workshop is a well-run company, with good management, strong cash flow generation, control of its own destiny and no meaningful competition.

When it was forced to close its high-street shops, the company acted swiftly to shift its business online. This was executed well, in Dan’s opinion. It also provides the company with a cheaper route to market, which is feeding through into revenue and profit upgrades.

Three other companies have moved up into this list since we last published. Pets at Home we discussed. Impax Asset Management, which has been in the portfolio for a number of years, is riding a wave of investors embracing environmental, social and governance (ESG) based investment approaches. Dan describes it as the doyenne of this sector. Its business has experienced strong inflows, helped by good performance.

Avon Rubber has been repositioning its business away from the dairy industry, where it made milking machines, towards the defence/first responder industry, where it makes helmets, body armour and respiratory equipment. It has a strong balance sheet and was not much impacted by COVID-19.

Of the stocks that have fallen out of the list, only SERCO has been sold down materially. Dan felt that its share price had run up too far. The company was sounding a note of caution in its outlook and some analysts were cutting estimates. He decided to lock in profits on the position.

Performance

THRG’s NAV returns continue to outpace those of the benchmark and its peer group. The short-term setback associated with the recent value rally has made only a minor dent in its long-term record.

Peer group

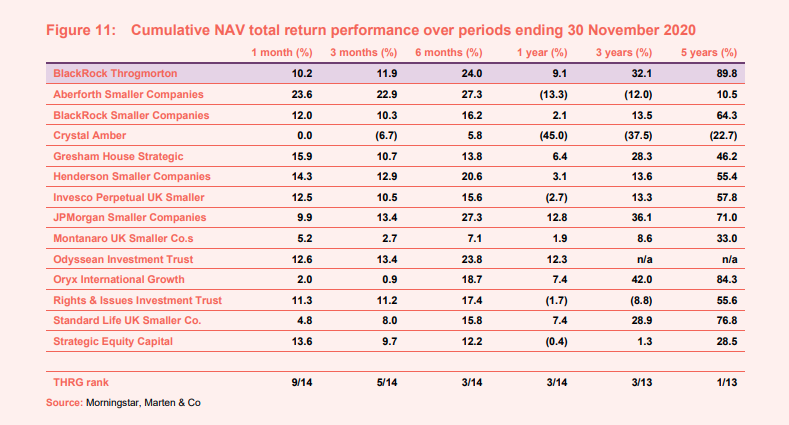

For comparison purposes, we have used a subset of funds in the AIC’s UK smaller companies sector. We have excluded recently-launched companies, split-capital companies, trusts with a small market capitalisation, and those that focus exclusively on micro-cap companies. A complete list is provided in Figure 11.

As Figure 11 shows, THRG ranks close to the top of the table over most time periods except for the very short-term, where it has been held back by the rally in value stocks.

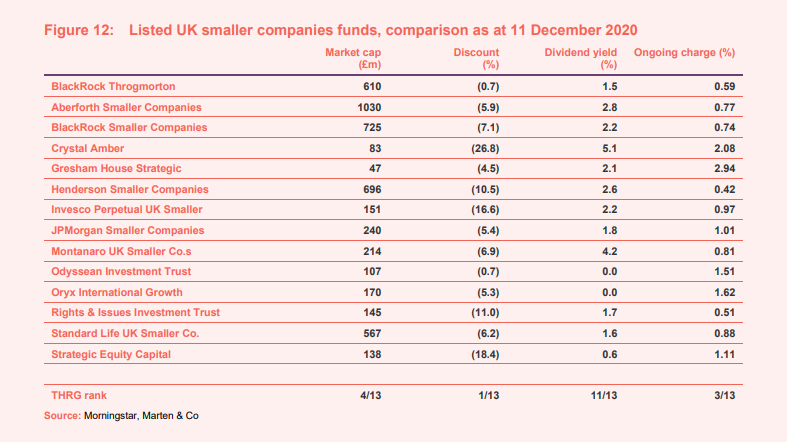

THRG is a decent size but there is scope for it to continue to expand. Investors appear to be attracted by its long-term track record and belief in the prospects of continued outperformance. This has enabled THRG to trade at a small premium to asset value and issue shares to satisfy demand (thereby enhancing the NAV per share for existing shareholders).

THRG is not managed to produce an income, and this is reflected in its relatively low dividend yield.

Its ongoing charges ratio is competitive, especially for a trust of its size.

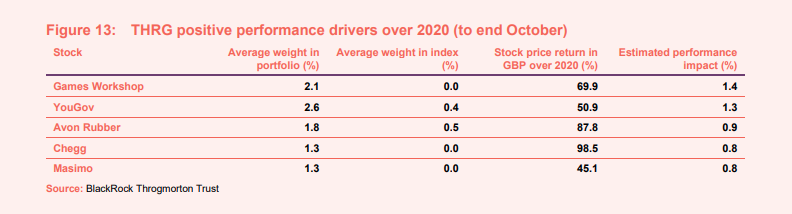

Performance drivers

Figure 13 shows the five stocks that have provided the greatest contribution to THRG’s performance this year relative to its benchmark. We discussed Games Workshop, Avon Rubber and Chegg. YouGov’s data analytics and data mining offering is attracting the attention of new customers in the US and this is helping the growth of its business. Masimo is a US medtech company specialising in non-invasive monitoring technologies. This includes instruments that monitor pulse rates and blood oxygenation, and COVID-19 encouraged the growth of the business.

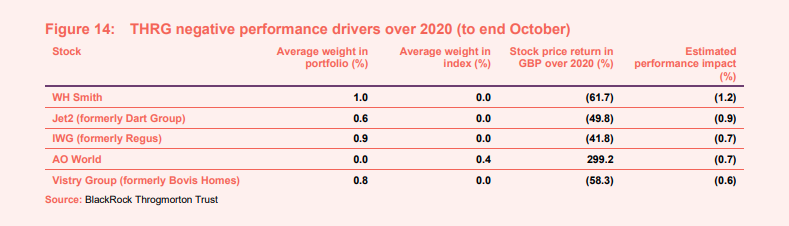

The list of negative contributors is heavily influenced by the COVID-19 outbreak and is dominated by WH Smith, which we discussed in our last note. It was hit hard by the shutdown in its travel-related business, as was Jet2’s package holidays business. Regus’s serviced office business was also affected by lockdowns. Online electrical goods retailer AO World wasn’t held in THRG’s portfolio. Vistry Group’s share price slumped when its building sites were forced to close and its share price is yet to recover.

Discount

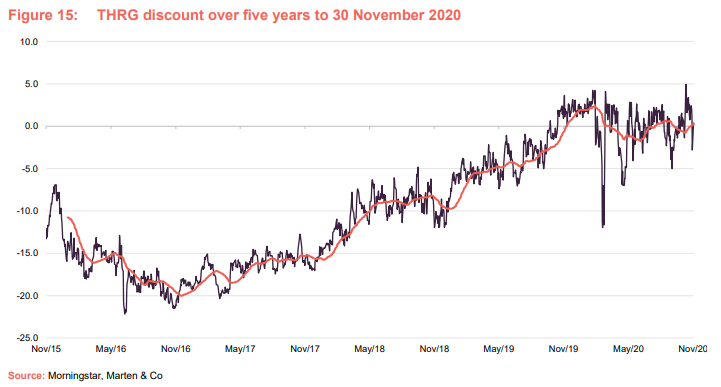

Over the year ended 30 November 2020, THRG’s shares moved between trading at a 12.0% discount and a 4.9% premium and, on average, traded at a premium of 0.2%. On 11 December 2020, THRG was trading at a discount of 0.7%.

THRG’s premium rating has allowed it to issue shares, 11.4m over 2020 to date. As discussed, the board has convened a meeting on 18 December to ask shareholders for the authority to issue further shares. Share issuance at a premium enhances the NAV for existing shareholders, increases liquidity in the trust’s shares and helps to lower the ongoing charges ratio as fixed costs are spread over a wider base. We believe that shareholders will back the proposal enthusiastically.

Fund profile

BlackRock Throgmorton Trust (THRG) aims to generate capital growth and an attractive total return by investing primarily in UK smaller companies and mid capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction.

For the period between 1 December 2013 and 22 March 2018, the benchmark was Numis Smaller Companies Index, excluding both AIM stocks and investment companies. There used to be a restriction on the trust’s exposure to AIM companies, but this was removed in March 2018 and, at the same time, the manager was given permission to invest up to 15% of the portfolio in stocks listed on exchanges outside the UK.

Both long and short positions

Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks. Up to 30% of the portfolio may be invested in contracts for difference (CFDs), both long and short. Under normal market conditions, the net exposure will account for 100–110% of net assets.

The manager

BlackRock Investment Management (UK) Limited was appointed manager of the trust in July 2008. Dan Whitestone, head of the emerging companies team at BlackRock, has been sole manager of the trust since 12 February 2018 (he had been co-manager, alongside Mike Prentis, since March 2015). Dan heads a team of five. All members of the team manage portfolios, and between them manage or advise on about £5.0bn across a variety of different funds. The team shares research responsibilities between them.

Previous publications

Readers may be interested in our previous publications on THRG.

Vision, execution and adaptability, initiation, published September 2018

Throg’s shorts shine, update note, published January 2019

Impressive run continues, annual overview, published July 2019

Look past the short-term noise, update note, published December 2019

Separating the wheat from the chaff, annual overview, published June 2020

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on BlackRock Throgmorton Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.