Able to commit to the dividend

Able to commit to the dividend

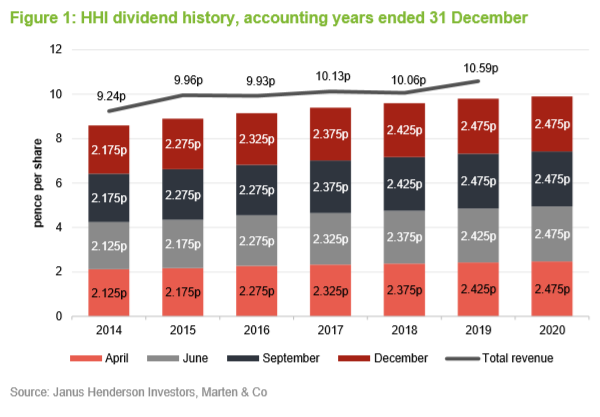

Recent market falls have left Henderson High Income Trust (HHI) trading on a 7.3% dividend yield. This is a significant premium to the yield on the UK market, which has been hit by a swathe of dividend cuts. The board are well aware of the reliance that many investors have on the income paid by the trust. Fortunately, HHI’s sources of revenue are diversified and it had revenue reserves of 8.3p per share at the beginning of the year. Given this, the board felt confident enough to announce their intention to maintain the quarterly dividend at 2.475p for the remainder of the trust’s financial year ended 31 December 2020.

High income from a diverse UK equity income portfolio

High income from a diverse UK equity income portfolio

HHI invests in a prudently diversified selection of both well-known and smaller companies to provide investors with a high income stream while also maintaining the prospect of capital growth. Gearing (borrowing) is used to enhance income returns, and also to achieve capital growth over time. A portion of gearing is usually invested in fixed interest securities, which helps dampen the overall volatility of the trust’s returns.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Benchmark TR (%) | MSCI UK total return (%) | ICE BofAMI SN-G (%) |

|---|---|---|---|---|---|---|

| 1 | 30 Apr 2016 | 0.60 | -3.00 | -5.50 | -7.50 | 2.60 |

| 2 | 30 Apr 2017 | 14.50 | 15.50 | 17.80 | 20.00 | 9.60 |

| 3 | 30 Apr 2018 | 1.00 | 4.80 | 6.50 | 8.00 | 0.70 |

| 4 | 30 Apr 2019 | 2.00 | 3.80 | 3.10 | 3.00 | 3.60 |

| 5 | 30 Apr 2020 | -15.70 | -14.90 | -13.40 | -18.10 | 6.60 |

Fund profile

Fund profile

Henderson High Income Trust (HHI) invests in a prudently diversified selection of both well-known and smaller companies, to provide investors with a high-income stream, while also maintaining the prospect of capital growth.

A majority of assets will be invested in ordinary shares of listed companies with the balance in listed fixed interest stocks (i.e. the trust will not hold unquoted investments). Investee companies should have strong balance sheets that are capable of paying dividends. There is a focus on well-managed companies whose qualities may have been temporarily overlooked and which offer the potential for capital appreciation over the medium term. A maximum of 20% of gross assets may be invested outside the UK.

Gearing is used to enhance income returns, and also to achieve capital growth over time. A portion of gearing is usually invested in fixed interest securities.

Henderson Investment Funds Limited is the company’s AIFM and it delegates investment management services to Henderson Global Investors (both are subsidiaries of Janus Henderson Group Plc). The lead fund manager assigned to the trust is David Smith. He was made co-manager of the trust in 2014 and has been sole manager since 2015.

Blended benchmark

Blended benchmark

HHI benchmarks itself, for performance measurement purposes, against a blend of 80% of the FTSE All-Share Index return and 20% of the ICE Bank of America Merrill Lynch Sterling Non-Gilts Index. For the purposes of this note, we have replaced the AllShare with the MSCI UK Index.

Weathering the storm

Weathering the storm

Our initiation note on HHI was published a couple of weeks ahead of the UK general election. The decisive victory by the Conservative party gave a short-term boost to UK equity markets. Those sectors of the economy that were threatened with nationalisation by a Corbyn government rallied on the election result. However, the subsequent decision to impose a new arbitrary deadline on Brexit trade negotiations unnerved some investors.

This issue has faded into the background, however, in the face of the pandemic. The COVID-19 outbreak has caused immense disruption to the global economy and has generated considerable volatility in stock markets. Markets were relatively sanguine about the news coming out of China until the third week of February. Panic set in thereafter. Interest rates were slashed, quantitative easing stepped up (to unprecedented levels) and various initiatives adopted by governments and banks around the globe in an attempt to shore up economies. Markets have recovered much of the ground that they had lost. Most commentators seem convinced that the economic recovery will be a slow one, and David agrees. He anticipates that markets will remain volatile for some time.

The UK market has fared relatively poorly over this period. In part, this reflects the composition of the UK stock market, which is heavily exposed to oil, gas and basic materials and has an underweight exposure to technology relative to global indices. Brexit uncertainties may also be playing on investors’ minds.

The benefits of diversification

The benefits of diversification

For a UK equity income investor, the pandemic has been particularly bad news. UK banks have, in common with many others around the globe, been ordered to suspend dividend payments and focus on lending to cash-strapped companies. Many other companies have reduced or suspended dividends but it was Shell’s decision to slash its dividend payments that had the greatest effect. David Smith, HHI’s manager, cites estimates that between a third and half of the UK’s dividend income for 2020 could disappear. The Q1 2020 UK dividend monitor published by Link Asset Services reported that 45% of UK companies had already scrapped payouts to shareholders.

HHI is fortunate, however, in that it has a range of sources available to it to maintain its dividend:

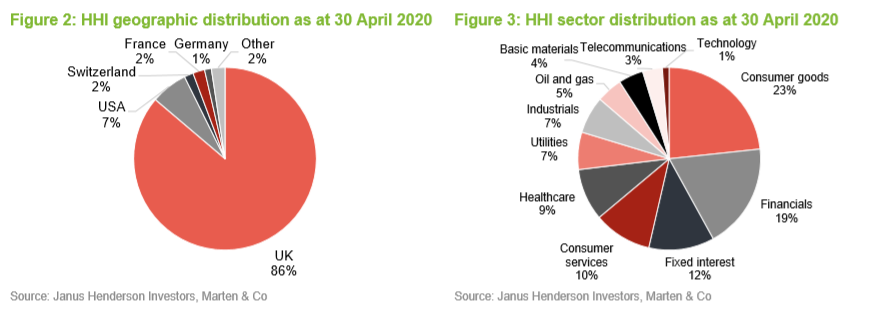

• Fixed interest positions, which accounted for 12% of the portfolio at the end of April 2020, make a valuable contribution to HHI’s revenue account.

• The portfolio’s overseas exposure (14% of the portfolio at the end of April) has allowed David to diversify the portfolio into some reliable dividend payers such as the European pharmaceutical stocks, Roche and Sanofi.

• A small exposure to alternative income investment companies (about 3% of the portfolio) gives access to returns that have a low correlation with equity markets. (HHI holds Greencoat UK Wind and Tufton Oceanic Assets.)

• HHI can draw on its revenue reserves; it has the equivalent of 10 months’ dividend held in reserve.

• David can also write call options on existing portfolio positions as a way of generating additional income. This was a power that had not been used much in recent times but is potentially much more lucrative now that market volatility has increased. The first calls were written in April.

• Lastly, but perhaps most importantly, David says that just shy of 50% of the portfolio is invested in defensive companies. Over the last 18 months, as we described in our initiation note, he has followed a policy of reducing the trust’s exposure to companies that are more sensitive to the economic cycle in favour of more defensive companies. This was done in anticipation of slowing economic growth. The portfolio has an overweight exposure to pharmaceuticals, consumer staples and utilities and this has proved beneficial in recent weeks.

In oil and gas, HHI retains an underweight exposure to Shell and BP. David told us that he was anticipating Shell’s dividend cut (although perhaps not of the magnitude that we saw). He thinks that the decision to reduce the dividend was the right one for Shell’s long-term future as it seeks to reposition itself towards renewable energy. He stresses that it is important for companies to invest in their businesses as well as paying an appropriate level of dividends to shareholders. The investment approach that we outlined in our initiation note emphasises the sustainability of dividends.

Dividend

Dividend

On 7 May 2020, HHI’s board announced that its second interim dividend (available to holders on the register in June and payable in July) would be 2.475p. It also said that “…it is the board’s current intention to use its revenue reserves where necessary to maintain the quarterly dividend at the existing level of 2.475p for the remainder of this financial year”.

This is clearly very good news for shareholders. At the current share price, it leaves HHI trading on a prospective yield of 7.3%, at the top end of the range for yields on investment companies in the UK equity and bond income and UK equity income sectors.

At the end of December 2019, HHI had revenue reserves of £10,674,000, equivalent to 8.3 pence per share. In addition, as we explained earlier, there are other reasons why HHI’s revenue account should be more resilient in this crisis when compared to a pure UK equity income fund.

Investment companies’ ability to salt income away for a rainy day is one of the key strengths of the closed-end structure and HHI is demonstrating the value of that in 2020.

Asset allocation

Asset allocation

HHI’s geographic asset allocation is not much changed from when we last published on the company using data as at the end of October 2019.

The most significant change to HHI’s industry sector allocation has been an increase in its exposure to consumer goods, in line with the increased emphasis on defensive stocks, and a reduction to HHI’s fixed interest exposure.

Within the consumer goods sector, David has added to HHI’s investment in the tobacco sector – see comment on British American Tobacco.

In the ‘flight to safety’ that accompanied the COVID-19 related panic in February and March, HHI’s US investment grade bond holdings performed particularly well. These were acquired in 2018 at yields of 4% to 4.5%, when markets were nervous that rates were rising. The average yield on these holdings has almost halved since then, reflecting the change in sentiment and the accompanying fall in interest rates. Given the strong capital performance and now low yields on offer, David decided to reduce these holdings.

The sale proceeds (about £12m) were used to reduce HHI’s overall gearing to more appropriate levels in early March, given the uncertain outlook for markets. Gearing on the equity portfolio was maintained at about 8%.

The remainder of HHI’s bond portfolio is in high yield bonds, which have experienced rising yields/falling prices in recent weeks as credit spreads widened. However, John Pattullo and Jenna Barnard, managers of HHI’s bond portfolio, have a strong emphasis on credit quality when selecting investments for the portfolio and HHI’s high yield bonds have proved relatively resilient. No defaults are expected.

Top 10 Holdings

Top 10 Holdings

The composition of HHI’s list of 10 largest holdings is not much changed from when we last published on the trust. Rio Tinto and Unilever have entered the top 10, but both were just outside the list in October 2019, and Astra Zeneca and HSBC have dropped out.

Some notable recent portfolio changes are outlined below.

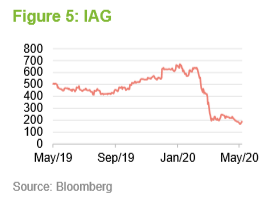

International Consolidated Airlines Group (IAG)

International Consolidated Airlines Group (IAG)

Ahead of the COVID-19 outbreak, HHI had a position in IAG (www.iairgroup.com), the parent company of British Airways and Iberia. This had been acquired in the summer of 2019 and provided a yield of more than 12% over the short time that HHI held it. The stock performed quite well over the following six months. However, David recognised the threat posed by the virus to the airline industry early on and sold the stock at 550p. This crystallised a capital profit for HHI and avoided the precipitous fall in IAG’s stock over subsequent weeks.

Vistry Group (formerly Bovis Homes)

Vistry Group (formerly Bovis Homes)

Vistry (www.bovishomes.co.uk) was one of the stocks that did well in 2019 on the back of efforts to increase the number of houses being built in the UK. David reduced the position early in 2020 close to the highs. David has maintained exposure to the sector via holdings in Bellway and Persimmon. Despite both suspending dividends in the short term, he believes that both offer potential strong capital performance over the long term once a recovery emerges.

Vistry started to reopen its construction sites from 27 April 2020. Over the first four weeks of lockdown, Vistry completed 193 home sales and saw 132 new homes reserved by potential buyers. The executive directors took a voluntary 20% pay cut with effect from 1 April 2020. Net debt at 21 April was £440m. This compares to £770m of borrowing facilities.

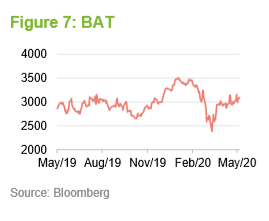

British American Tobacco

British American Tobacco

HHI’s exposure to British American Tobacco (www.bat.com) has doubled since last October. In part, that reflects the stock’s relative performance over this period, but David has also been adding to the position, attracted by the sector’s defensive qualities. The shares sold off along with the UK market in February/March but have recovered strongly since.

BAT reported 5.7% revenue growth for 2019 and increased its dividend by 3.6%. It says the COVID-19 impact on its business has been limited, with only outlets at major travel centres adversely affected. It thinks revenue growth for the 2020 financial year will be towards the bottom end of a 3% to 5% range.

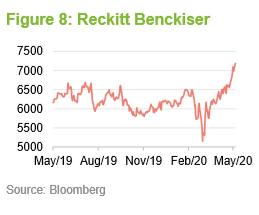

Reckitt Benckiser

Reckitt Benckiser

David was attracted by Reckitt Benckiser’s (www.rb.com) defensive qualities, but it is one of a few stocks that are trading at a higher price than before the pandemic panic set in. Its results for the first quarter of 2020 were strong. Like-for-like revenue growth was 13.3% over the quarter. The outbreak has spurred demand for its hygiene and health products (the likes of Dettol, Lysol and Nurofen). Increasingly, consumers bought these products online – ecommerce revenues were 50% higher. The company expects that revenues for 2020 will exceed pre-outbreak expectations.

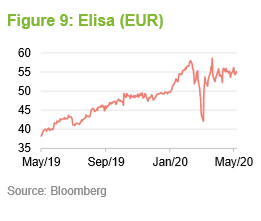

Elisa Oyj

Elisa Oyj

Elisa (www.elisa.com) is a Finnish telecommunications company. It operates in an oligopoly (there are three key players in its market). The company has been investing in its infrastructure, improving data speeds. First quarter results were encouraging, showing like-for-like earnings per share growth of 10.1%. David was also encouraged by Elisa’s 7.3% growth in free cash flow.

Telecoms revenue is not much affected by COVID-19. Its customers want reliable and high-quality connections for home-working, gaming and streaming entertainment. The company cautions that an economic slowdown may have an impact but its guidance for 2020 was unchanged.

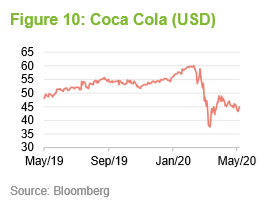

Coca Cola

Coca Cola

Coca Cola’s (www.investors.coca-colacompany.com) strong global franchise should make it relatively defensive in any economic slowdown. It has been diversifying its business into low sugar and non-carbonated drinks (it bought Costa Coffee a couple of years ago, for example).

However, COVID-19 has affected demand for its products in some areas as restaurants and some retail outlets have been shuttered. The company said that in April, it experienced a 25% decline in volumes. It has been working to increase online sales. Coca Cola has also been cutting back on its advertising expenditure and reducing other costs where it can. Volumes should recover as lockdowns are eased, hence David used the pull back in the share price to purchase the stock on an attractive 3.8% dividend yield.

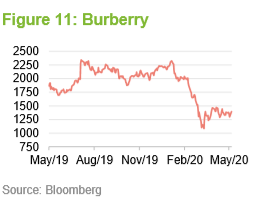

Burberry

Burberry

One of the other stocks that David has been able to add to HHI’s portfolio in recent weeks is Burberry (www.burberryplc.com). He points out that UK investors have few opportunities to invest in global luxury brands within the domestic stock market. Trading has been affected by COVID-19 and this has depressed the share price. Ahead of the outbreak, the company was benefitting from changes made by a management team that was refreshed three years ago and a new designer. Burberry’s long-term prospects, like those of other luxury goods companies, are underpinned by the growth of the middle class globally, but particularly in Asia. The effects of the pandemic may delay that process, but not indefinitely.

Others – maintaining some cyclical positions

Others – maintaining some cyclical positions

In line with the decision to maintain some exposure to UK housebuilders that we mentioned in connection with Vistry above, the manager is also happy to own other quality cyclicals, such as Bodycote, Vesuvius, and Whitbread, despite the lack of dividend in the short term. The first two should be benefitting as Chinese manufacturing ramps back up again, buoyed by considerable stimulus from the Chinese government. With Whitbread, David thinks its Premier Inn business may prove more resilient than some of its competitors, emerging from this crisis with a stronger market position.

Performance

Performance

Good results for 2019

Good results for 2019

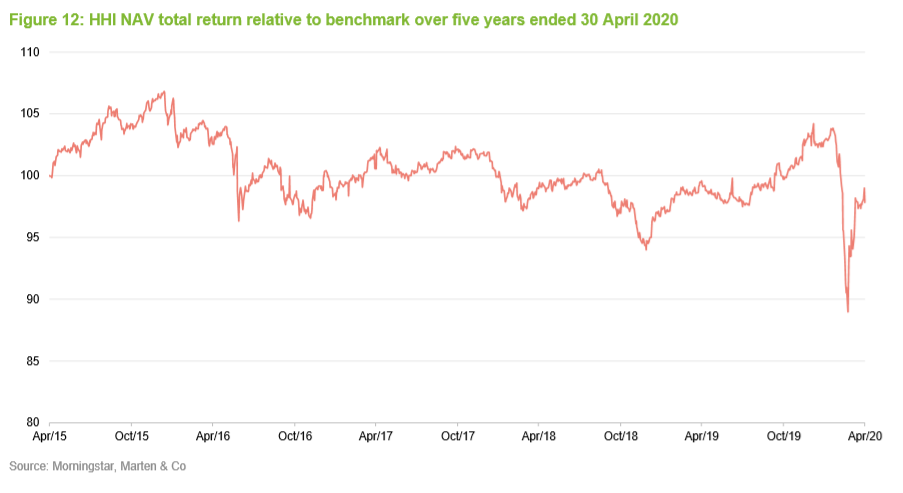

HHI recently published its results for the year ended 31 December 2019. The period was a good one for the trust: the dividend was increased by 2.1%, ahead of the rate of inflation; the NAV total return was 25.6%, well-ahead of the 17.2% return generated by its benchmark; and a narrowing of the discount meant shareholders earned a 27.0% total return for 2019. The outperformance was driven mainly by stock selection and being geared into a rising market.

The gearing worked in reverse as markets fell and this was a major factor in HHI’s recent underperformance. This has unfortunately dragged down its long-term record, which was still looking good at the beginning of March. As discussed earlier, HHI was able to reduce its gearing in March through the sale of its US investment grade bonds.

Stocks that made a positive contribution to returns in 2019 included Next (up 80%); Intermediate Capital (up 78%); brick company, Ibstock (up 67%, benefitting from the upturn in housebuilding); automotive fluid systems company, TI Fluids Systems (up 64%); and Greene King (up 61% following a takeover bid). By contrast, there were only two detractors from performance of note – Ted Baker (down 69%) and Connect Group (down 31%).

Ahead of the pandemic, David had expected to see more takeover bids within the portfolio. In addition to Greene King, HHI also benefitted when entertainment One was bid for. HHI held the company’s bonds and was able to realise a profit as the bidder was perceived to be a better-quality credit, and so its bonds trade on lower yields.

The position in Ted Baker was sold in October after David realised that there was a chance that the headlines surrounding the company’s CEO were likely damaging a brand that was already challenged by the difficult retail environment. After David sold HHI’s position, the shares fell by around 50% following a profit warning.

Connect Group’s acquisition of Tuffnells Parcels Express was ill-judged in David’s view. He sold HHI’s position ahead of a 50% decline in Connect’s share price over February and March.

Bond exposure proved defensive in Q1 2020

Bond exposure proved defensive in Q1 2020

Over the first three months of 2020, the HHI’s bond portfolio fell in value by 4.2%, much less than falls in equity markets.

Peer group

Peer group

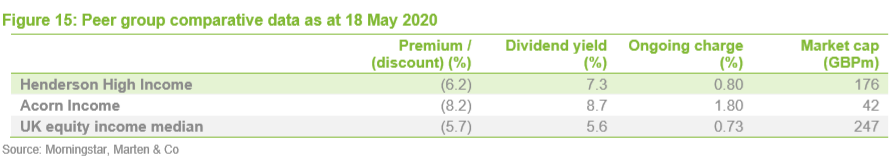

HHI sits within the AIC’s UK equity income and bond sector. There is just one other constituent, Acorn Income, and that is a split capital trust with a small-cap focus. Acorn’s capital structure amplifies NAV moves, both positive and negative. In this section, we have also compared HHI to the UK equity income sector, which has 26 constituents.

Within that group are a few investment companies with unusual structures or asset exposures including British & American (highly geared and significant biotech exposure), Value & Income (large property weighting) and Law Debenture (subsidiary engaged in commercial activity). The closest comparator to HHI is probably Shires Income, which is a smaller trust and whose fixed interest investments are largely represented by preference shares.

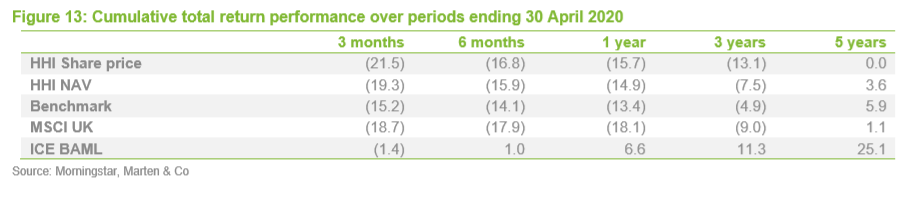

HHI’s returns are ahead of both Acorn Income and the median of the UK equity income sector over all time periods.

After sharp falls in the share prices of many competing investment companies, HHI no longer has the highest yield in this extended peer group. Some of these funds may be forced to reduce their dividends, however.

Premium/discount

Premium/discount

Over the 12 months ended 30 April 2020, HHI ranged between trading at a discount of 13.3% and a premium of 7.2%. The average discount over this period was 3.1%. At 18 May 2020, HHI was trading at a discount of 6.2%.

We would expect that HHI’s discount will narrow from here, and it seems reasonable that HHI’s attractive yield will help keep its discount narrow in the months to come.

The board considers the issuance and buy-back of the company’s shares where prudent, subject always to the overall impact on the portfolio, the pricing of other comparable investment companies and overall market conditions. The board believes that flexibility is important and that it is not in shareholders’ interests to set specific levels of premium and discount for its issuance and buy-back policy.

Previous publications

Previous publications

Readers may wish to read our initiation note on HHI – The trust that delivers – which was published on 26 November 2019. Please click the link to read the note.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Henderson High Income Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.