Underappreciated emerging and frontier income access

Jupiter Emerging & Frontier Income (JEFI) offers unique access to well-positioned emerging and frontier market companies in many countries where economic activity has largely returned to normal. Perhaps for the first time, companies based in the likes of Taiwan, South Korea, and even Kenya can arguably have greater confidence in their ability to deliver dividend payments at pre-pandemic levels than those based in developed markets. Promising recent news on the vaccine front could see market sentiment improve in some of JEFI’s hardest-hit markets, like Brazil, India, and Mexico.

JEFI provides less exposure to China than some of its peers, as its manager, Ross Teverson, felt that valuations were more attractive in the likes of Hong Kong, Taiwan, and Mexico. As we explain on page 16, this, and the withdrawal of funds from many emerging and frontier (EM and FM) markets, has held back returns in recent months and the discount to net asset value (NAV) has widened. Still, JEFI’s shares are currently yielding 5.4% and, with around a third of the portfolio sitting on net cash and debt levels typically lower than those of the developed world, equity income investors do still have good options in JEFI’s chosen markets.

Long-term capital and income growth

JEFI aims to generate capital growth and income over the long term, through investment predominantly in companies exposed directly or indirectly to emerging markets and frontier markets worldwide

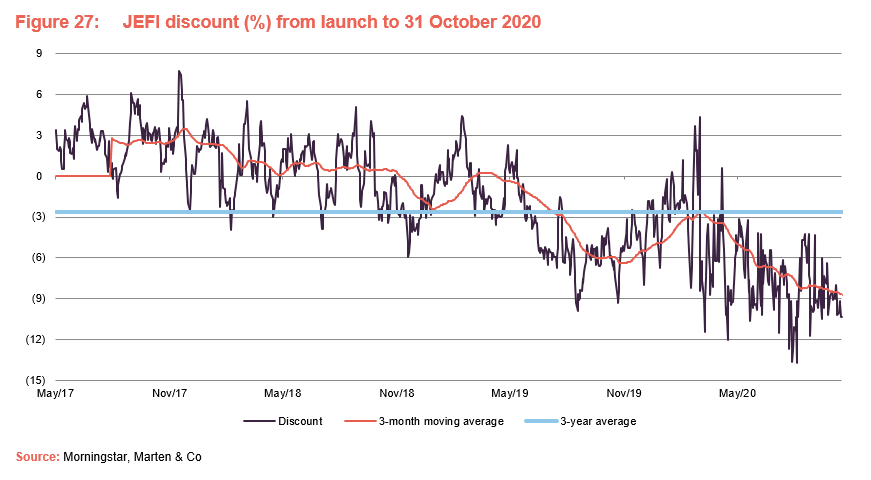

Share price and discount

JEFI’s discount has widened since September, suggesting that the market has yet to embrace the view that many firms based in emerging and frontier markets can arguably have greater confidence in their ability to deliver dividend payments at or close to pre-pandemic levels.

Performance since launch

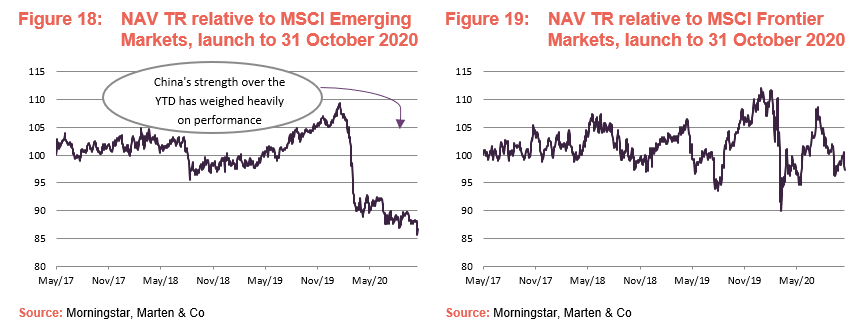

Since March, JEFI’s relative performance has suffered against the MSCI Emerging Markets Index as a result of the emphatic rebound in Chinese economic activity and its stock market. Going forward, a greater appreciation among equity income investors of the robust state of balance sheets across the banking sector in particular could potentially benefit JEFI disproportionately compared to many of its peers.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI Emerging Markets TR (%) | MSCI Frontier Markets TR (%) | MSCI World TR (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Oct 2018 | -16.70 | -12.10 | -8.70 | -8.40 | 5.70 |

| 2 | 31 Oct 2019 | 14.10 | 18.50 | 10.90 | 9.60 | 11.90 |

| 3 | 31 Oct 2020 | -13.90 | -10.20 | 8.70 | -2.20 | 5.00 |

Signs of further green shoots across emerging and frontier markets

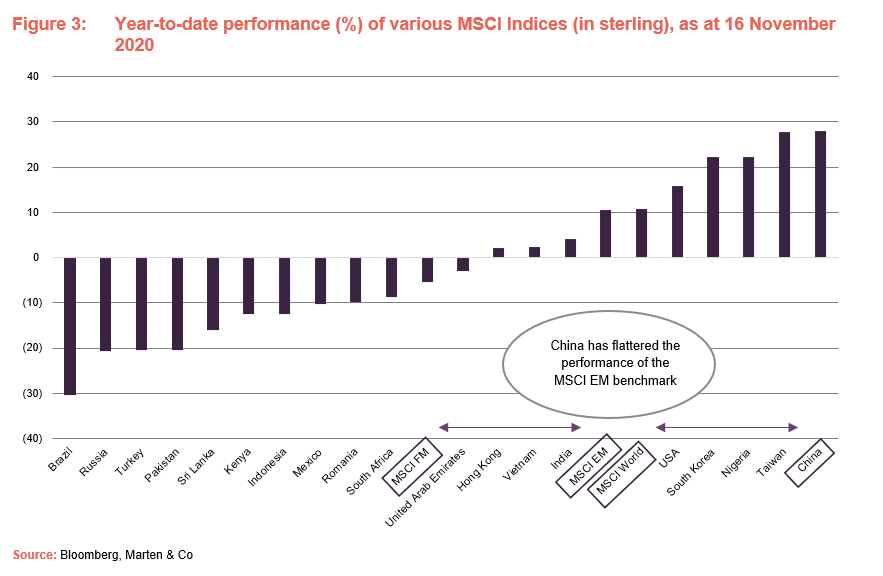

China has undergone a remarkable turnaround since February, with economic activity returning to near-normal levels in just a few months. Led by its technology behemoths and pushed on by resurgent domestic retail investors, China is the best performing major global equity market so far this year, as Figure 3 illustrates. The fact that China accounts for over 40% of the MSCI Emerging Markets Index (JEFI’s benchmark) largely explains that index’s performance.

The stock-picking style favoured by Ross means that JEFI’s portfolio only loosely resembles the benchmark. Much more emphasis is placed on the fundamentals of the businesses that it invests in. As discussed in the asset allocation section, the manager believes that greater value can currently be found in the likes of Hong Kong, where many companies trade at more attractive valuations than their Chinese-mainland peers.

While the performance of China, and to a lesser extent Taiwan and South Korea, has generated a lot of interest, many countries across the emerging and frontier landscape have been quietly returning to near-normal levels of movement and economic activity. With more than one promising vaccine now on the horizon, activity and confidence could accelerate further, particularly in countries that have been most acutely affected by the pandemic.

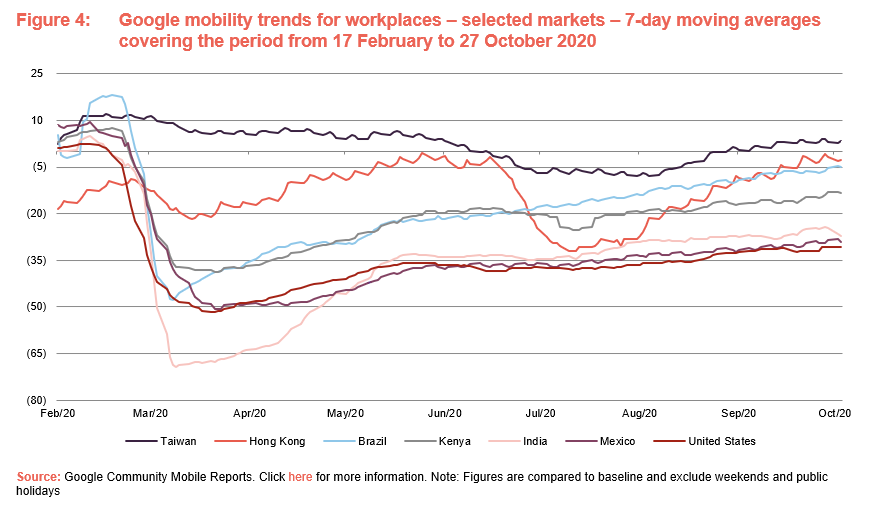

India has been one of the main exceptions, having been hit particularly hard. Ross notes that while some countries have seen active cases peak over recent weeks, the trough in economic activity was reached in May. Whilst economic stimulus measures implemented in developed markets have dwarfed those in emerging and frontier markets, demographics have certainly worked in the emerging world’s favour. As Figure 4 illustrates, using data captured by Google’s weekly community mobile reports using anonymised location history data, Taiwan and Hong Kong’s all-in early response efforts allowed disruptions to workplace attendance to be minimised. Kenya represents a good example of a frontier market that has also returned to normal activity. In Figure 4, the US is used as a broad control group for developed markets. Disruption has been more severe across Western Europe.

Investment process

The manager’s investment approach for JEFI is different from that of its peer group, and can be summed up as ‘change-based investing’. It involves identifying a change or an improvement in a business that is not already reflected in its share price, but where the manager can pinpoint a catalyst for a re-rating.

The manager acknowledges that the approach, which combines both value and growth elements and is style agnostic, makes the fund hard to pigeonhole. That means, though, that the performance of the portfolio should not be dependent on where we are in the economic cycle.

The process revolves around stock selection. The manager does not formulate macroeconomic views or incorporate them into portfolio construction. The only top-down element to portfolio construction is in ensuring adequate risk diversification.

Types of change

- Company-specific change: the most common type of change that the manager identifies is that which is within the power of company management. Examples would include the launch of new products and services or changes to capital structure.

- Industry change: typically about improving competitive structure within an industry. The manager cites the example of the IT hardware sector, where a fragmented industry has become an oligopoly, with greater pricing discipline.

- Structural change: which tends to be very long-term.

The manager has no target in mind for allocations to each ‘bucket,’ but wants a reasonable spread of the different types of change within the portfolio.

There are many catalysts for a rerating but the manager cites examples such as the publication of sales data; earnings announcements; investor roadshows; and announcements of returns of capital.

Take advantage of biases

Mispricing of companies’ shares is more prevalent in EM and FM, presenting opportunities to invest in robust companies with attractive secular growth potential (note: secular growth occurs when something fundamentally changes within an industry or sector, thereby creating new demand). The manager highlights some of the emotional and cognitive (systematic) biases that create opportunities to profit from underappreciated change.

- Anchoring – the tendency of markets to be preoccupied with past performance and perceptions of a company;

- Institutional inertia – the tendency for investors to overlook attractive opportunities in favour of familiar widely owned companies; and

Short-termism – the overemphasising of short-term news, which can come at the expense of grasping long-term structural change.

Selecting stocks

A proprietary quantitative model, which scores stocks on factors such as earnings growth and valuation metrics, is used to highlight potential opportunities. The model helps to provide ideas on a universe of 6,000 stocks, which compares with around 1,100 within the universe of the MSCI Emerging Markets Index. This provides approximately a quarter of ideas for the portfolio. The model includes a liquidity threshold of turnover of $1m, but the manager says that JEFI’s

closed-end structure allows it to hold stocks that are less liquid than those in the equivalent open-ended funds, and that stocks that do not meet the threshold can be included in the JEFI portfolio.

Other ideas come from a variety of sources, notably from the breadth of investment management and analytical support offered by the rest of Jupiter’s team (each manager specialises in research into specific sectors). For example, Jupiter’s UK small-cap manager has some holdings in common with the fund by virtue of companies operating within emerging or frontier markets but having a listing in London.

The manager ensures that talks can be held with company management before JEFI invests. They will meet them when they can – they travel extensively. The team has around 1,000 face-to-face or telephone meetings with companies in a typical year.

The manager also tries to find independent evidence that supports the investment thesis for each stock. For example, interviewing both local and international competitors and customers before investing.

Income

The manager says that the companies that the fund owns will often have strong balance sheets (about a third of the portfolio has net cash – i.e. after deducting their total liabilities). Companies will also tend to have high-income visibility and above-average levels of dividend growth. Notionally, the manager allocates stocks to one of three ‘dividend buckets’.

About 10% of the fund will be in stocks with future income potential. Typically, these will have dividend yields between 0% and 2%. The manager feels that it is important not to have a minimum yield threshold for the inclusion of stocks within the portfolio. They do not mind buying some low-yielding companies with the prospect of above-average dividend growth.

About 50% of the fund can be classified as income growth stocks. These have a yield between 2% and 6%, have an established track record of paying dividends, and demonstrate positive change that supports dividend growth.

The balance of the portfolio, about 40% of the fund, is classified by the manager as ‘high-income visibility’ stocks. These will typically have yields above 6%, predictable dividend streams and may have some associated dividend growth from gradual structural change.

Portfolio construction

Position sizes in the portfolio will vary between 1% and 5%. The manager wants each stock to make a meaningful contribution to performance; this helps set the minimum position size. The maximum position size helps avoid a situation where an individual stock becomes the main driver of portfolio performance and a concentration risk.

New position sizes depend largely on the strength of the manager’s conviction but are also influenced by liquidity and the extent that the position will diversify fund factor risk (systematic risk related to specific macroeconomic factors such as interest rates, currencies, oil price, etc). The portfolio should comprise, therefore, about 40–45 stocks and the manager aims to operate a ‘one in, one out’ policy.

There are no explicit risk limits, apart from having a maximum 25% exposure to frontier markets.

Sell discipline

For each holding, there is a review price, and if that is reached, the manager will revisit the investment case. A stock reaching its review price is not an automatic trigger to sell, but it does prompt a re-evaluation of what is changing for the company and whether that change has now been priced in by the market.

If a position drops below 1% of the trust, it is automatically put up for review, and the covering analyst is expected to conclude if the investment case is still attractive and the position should be added to, or if the investment case is broken and it should be removed from the trust. This discipline avoids having a long tail of ‘hope stocks’ which the manager might hope will turnaround but has no supporting evidence that this will happen.

Risk controls

The manager operates with the following risk controls, which were outlined within the prospectus:

- up to 30% of the fund can be invested in developed markets;

- the maximum exposure to frontier markets is 25%;

- up to 5% of the fund can be invested in unquoted companies;

- no more than 10% can be invested in any single holding at the time of investment;

- no limits on geographic exposures;

- hedging, using index futures, options and forward currency contracts is permitted; and

- contracts for difference are permitted as is the use of bonds, warrants and equity-related securities including participation notes.

In addition, the manager works within the following parameters:

- maximum and minimum position sizes of 5% and 1%;

- while hedging is permitted, they are very unlikely to hedge currencies in practice, preferring instead to maintain diversified currency exposures;

- derivatives may only be used if direct market access is an issue; and

- whilst the portfolio may include a number of less liquid companies (benefitting from its closed-end structure), the manager will not buy illiquid companies (i.e. no stocks that can go for multi-day periods without trading).

- JEFI does not intend to use derivatives or other financial instruments to take short positions, nor to increase gearing over the limit set out in the company’s borrowing policy. Currency exposures will not be hedged routinely.

ESG and change-based investing

Stewardship forms a core component of JEFI’s change-based investment process and the manager aims to understand environmental, social and governance (ESG) risks and opportunities for every investment considered, paying particular attention to management alignment and capital management, as well as environmental and social risk mitigation. In some instances, the underappreciated change that they seek to invest in relates to corporate governance – for example, JEFI may decide to invest in a company where improving governance practices and shareholder returns are yet to be reflected in the share price.

The manager highlights Norilsk Nickel (discussed in the performance attribution sector on page 17) as a good example of an investment where ESG factors are central to the decision-making process. Governance improvements have increased the size and visibility of the company’s dividend payouts and nickel is a key component in the electric vehicle batteries that will make a significant contribution to decarbonising transport over the coming decade. Set against these positive dynamics are the environmental risks that inevitably result from mining and smelting operations, and it is important for the manager to see that the company (it is investing billions of dollars into projects to cut sulphur dioxide emissions) is responding appropriately to these challenges.

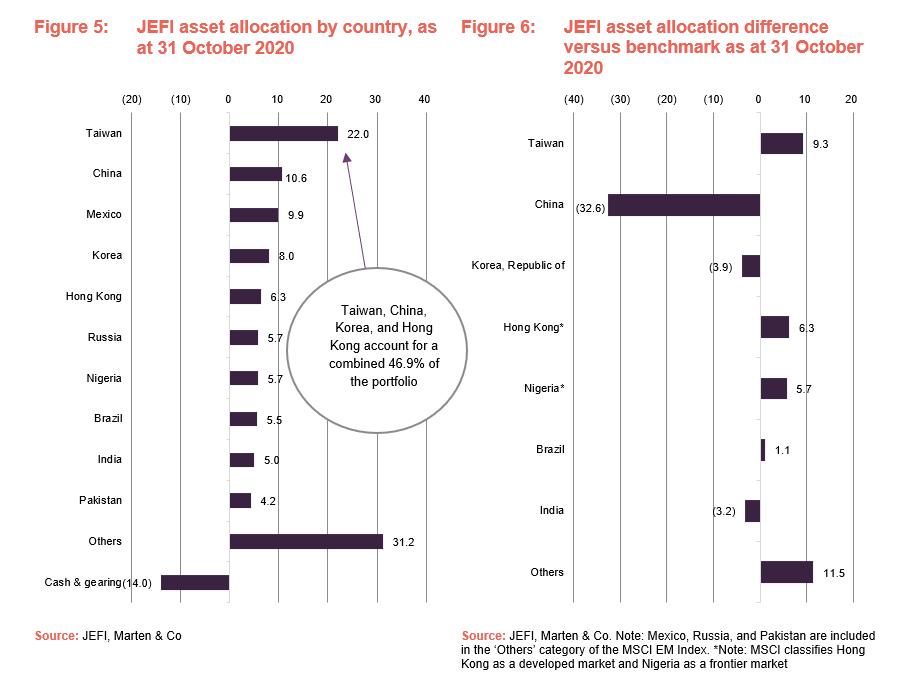

Asset allocation

The stock-picking style favoured by JEFI’s manager means that the portfolio only loosely resembles the benchmark. As illustrated by Figure 6, this is most clearly represented by JEFI’s much lower allocation to China. As at 31 October 2020, the relative difference between JEFI’s exposure and that of the benchmark was (32.6%). This represents a marked increase from the (21.0%), as at the 31 July 2019 figures used in our last note. This change is primarily a result of the strong performance delivered by Chinese assets over the year to date.

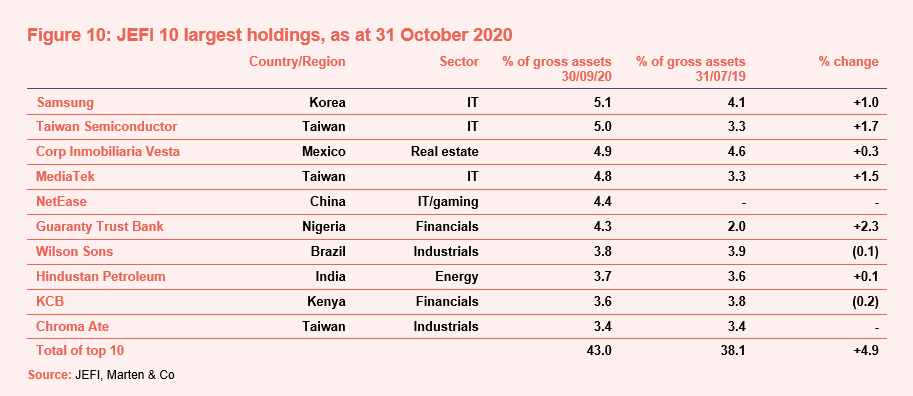

Taiwan continues to provide a particularly fertile ground for JEFI’s bottom-up approach, with three of the top 10 holdings based there. The bottom-up investment process naturally steers JEFI to a lower allocation to China than many of its peers. Ross believes that greater value can be found in the likes of Hong Kong, where many smaller companies trade at cheaper valuations to their peers on the mainland.

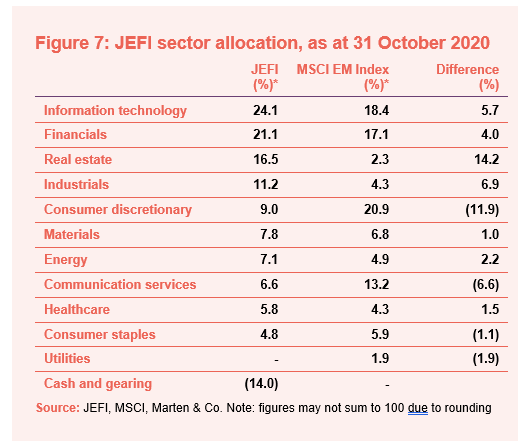

At 24.1% of the portfolio, technology is JEFI’s largest sector allocation – it was 20% when QuotedData last published. As discussed in the top 10 holdings section, Taiwan Semiconductor, NetEase, and MediaTek have performed particularly well over the calendar year-to-date. Financials are also well represented, in large part reflecting Ross’s view that the long-term financial inclusion catalyst behind holding sub-Saharan African banking stocks is currently greatly under-appreciated by the market.

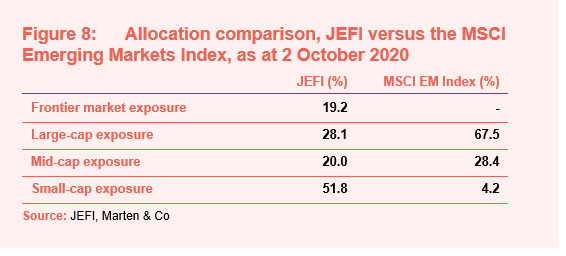

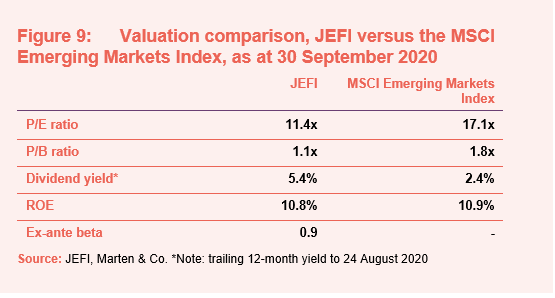

Figures 8 and 9 add some layers to the earlier point on how JEFI’s approach leads to a portfolio that only loosely resembles the benchmark.

Top 10 holdings

Ross did not significantly increase trading in the portfolio over the initial pandemic period, with changes to the portfolio remaining within similarly modest levels to previous years. The manager felt comfortable in the ability of balance sheets of companies across the portfolio to withstand the early impact of lockdowns, where, in some cases such as India, policy was on a par if not more stringent than in many Western countries.

As a result, the pandemic’s effect on the composition of the top 10 holdings, compared to when we last published, has been somewhat modest. New entrants to this list include NetEase and MediaTek, both of which are having excellent years and were held in the portfolio last year. They are discussed in the performance attribution sector on page 17.

Ross also notes that none of the holdings have had to raise equity, while income distributions have held up far more vigorously than has been the case across much of the developed world, where dividend payout ratios tend to be higher. Having been stung by the ripple effects of the global financial crisis of 2008, many of the largest banks held within JEFI’s portfolio, as well as more broadly within EM and FM, entered the pandemic with healthy levels of capitalisation. In some cases, banks have felt comfortable enough to reinstate dividends. Ross cited the example of Russia’s Sberbank, which reinstated its dividend at a record level in October.

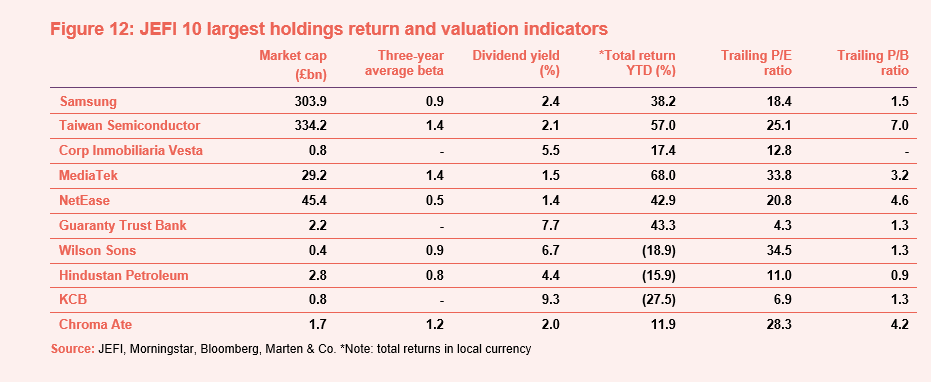

Within the portfolio, the market appears to be valuing Kenya’s KCB bank (whose shares were yielding 9.3% as at 17 November 2020) with same broad-brush stroke applied to banks based in countries where the economic impact has been more severe. In October, the IMF raised its GDP growth forecast for the country from -1% to +1%. It is one of a handful of Sub-Saharan African countries that are expected to grow this year, reflective of an economy that is amongst Africa’s most diverse.

Nigeria’s Guaranty Trust Bank is another top 10 holding selected for its exposure to the long-term financial inclusion theme, with some 60m Nigerians not having their own bank accounts. This and a return on equity of nearly 30% help highlight the long-term potential of Guaranty Trust Bank. A recent decision by the ratings agency Fitch to remove the company from its watch list, after pressure on its loan book was judged to have reduced significantly since March, could tempt foreign capital back in.

We have discussed many of the rest of the top 10 holdings in earlier notes, readers may wish to review the previous publications section on page 25.

Outside of the top 10 holdings, Ross highlights United Arab Emirates-based Emaar Malls and Pakistan’s Indus Motors as two holdings with attractive fundamentals that are underappreciated by the market. Ross believes that Emaar Malls, which owns Dubai Mall (the largest global mall by land area) is not being valued as a tier-one mall and that Namshi, its e-commerce business, (relied on by many of its tenants) is being overlooked. Rents have held up resiliently.

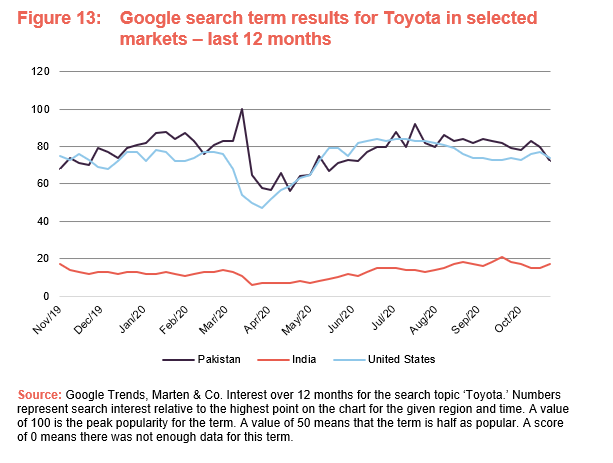

Indus Motors is a joint venture with Toyota in Pakistan. The company has strong pricing power in a country where car ownership has a lot of room for growth and the Toyota brand is popular. Google trend search results can provide a useful approximation for popularity. Figure 13 compares the popularity of the ‘Toyota’ search term in Pakistan with that of India and the US. Ross says the market is overly concerned with short-term car sales data and government policy in Pakistan, which has led to the market’s valuation of Indus Motors incorrectly implying that the company is ex-growth (low prospects for growth in earnings or value).

Portfolio activity over the past 12 months

Over the past 12 months, JEFI’s manager has brought four new companies into the portfolio. They are AvivaSa (Turkish insurance company), Kunlun (Chinese gas distributor), Greatview (Chinese consumer staples packaging company), and Crédit Agricole Egypt (Egyptian retail and commercial bank).

AvivaSa

Based in Turkey, AvivaSa (www.avivasa.com.tr/en/) provides private pension and life insurance products. AvivaSa operates as a joint venture with UK-based Aviva. Ross believes the life insurance industry in Turkey is primed for growth and was able to bring the company into the portfolio at an attractive valuation – the shares trade at a trailing P/E ratio of 9.1x. It has consistently grown its net income over the past few years.

Kunlun

An integrated energy company, Kunlun (www.kunlun.com.hk/s/index) primarily operates as a seller of natural gas, with core operations in China, Kazakhstan, Peru, and Thailand. The company generates annual sales volume of 16bn cubic metres of natural gas and 6m tons of liquefied petroleum gas, making it one of the largest players in mainland China. Ross notes that Kunlun is a recent addition to the portfolio, with its dividend yield, currently at 5.6%, adding to the investment case.

Greatview

Ross draws similarities between Hong Kong-listed Greatview’s (www,greatviewpack.com) business and that of Tetra Pak. Greatview’s packaging footprint is particularly strong in dairy and non-carbonated soft drinks, where it is an established player on the mainland, giving it good pricing power. There continue to be strong opportunities for growth in both per capita consumption levels of beverages, as well as higher up the value-chain through premiumisation (buying more expensive or premium brands as income increases). Picking companies within supply chains that are well-positioned to take advantage of wider industry growth is an approach that is well represented across JEFI’s portfolio. Ross adds that Greatview is an attractive payer of dividends and that it represents another example of a Hong Kong-listed company valued at an attractive discount to its peers on the mainland.

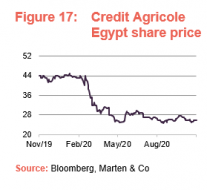

Crédit Agricole Egypt

France’s Crédit Agricole is the majority shareholder in Crédit Agricole Egypt (www.ca-egypt.com/en/personal-banking/). Ross draws a parallel with AvivaSa, where local governance and management quality benefit from having a large, established developed market parent group/joint venture partner. Crédit Agricole Egypt operates as a retail and commercial bank, while it also has asset management and investment banking arms. As with Guaranty Trust Bank and KCB, Crédit Agricole Egypt is a play on long-term financial inclusion in Egypt, where about one-third of its 100m population have access to a bank. With the shares yielding more than 10% and still far off their pre-pandemic level, Ross took the opportunity to initiate the position.

Performance

Over the period from JEFI’s launch in May 2017 until early February 2020, leading up to the pandemic’s initial impact on Asian markets, JEFI’s total NAV returns were about 10% ahead of the benchmark MSCI Emerging Index, as illustrated by Figure 19. JEFI’s outperformance of the MSCI Frontier Markets Index was slightly better, at about 12%.

Since March, JEFI’s relative performance has suffered against the MSCI Emerging Markets Index as a result of the emphatic rebound in Chinese economic activity and its stock market. If valuations in some of the other well-performing neighbouring Asian markets (like Hong Kong and Taiwan) were to move closer into line with China, JEFI would be likely to benefit on a relative performance basis.

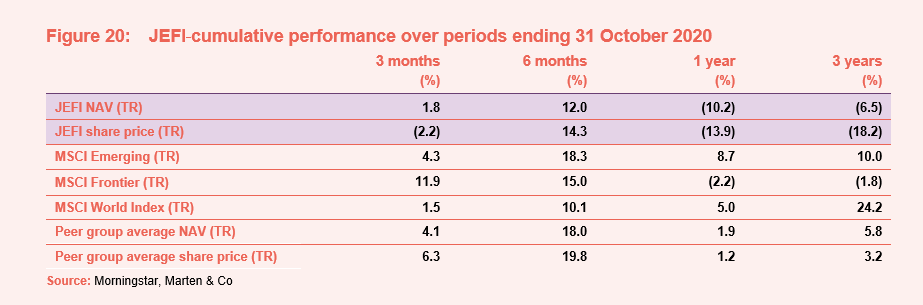

The peer group used in Figure 20 includes all the funds in the AIC’s global emerging markets sector, with the exceptions of Africa Opportunity, Gulf Investment Fund and Qannas, which are not global funds; and Ashmore Global Opportunities, which is in the process of liquidating its portfolio.

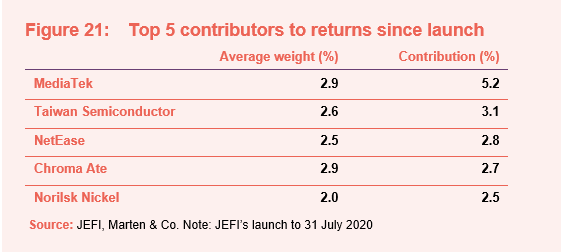

Performance drivers – positive contributions led by Taiwan tech

JEFI’s manager have provided a performance attribution breakdown since launching on 15 May 2017, with the positive contributors illustrated by Figure 21.

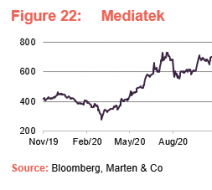

MediaTek

MediaTek, held by JEFI since launch, has been going from strength to strength. In addition to cementing its position as the second-largest manufacturer of chipsets for mobile phones behind Qualcomm, the progress it has made in narrowing the technological gap has been eye-catching. Ross says that MediaTek used to be one or two years behind Qualcomm – it is now neck and neck. MediaTek is well entrenched in the 5G cycle, which should support the ongoing growth of the business, and it has also been expanding into building smart chips for Amazon and Google’s range of smart speakers. The manager adds that MediaTek benefits from having the pick of Taiwan’s engineering talent, while its proximity to customers in mainland China is a strategic advantage.

Taiwan Semiconductor

Taiwan Semiconductor is a key supplier to Apple, Intel, and Nvidia. The company is the world’s largest contract chipmaker, and it recently recorded its highest quarterly profit to date. The company has benefited from a trend that has seen its customers increase their inventory levels, as insurance against potential supply-chain disruptions. Taiwan Semiconductor would also be in a position to capitalise were there to be a sustained reduction in sourcing chips from China by Western buyers.

Others

NetEase, China’s largest online video game developer, has gone from strength to strength, building a globally competitive business. The company added to what was previously an exclusive listing on the New York Stock Exchange with a $2.7bn secondary offering in Hong Kong in June 2020.

Chroma Ate, another Taiwanese hardware enabler, manufactures precision electronics testing components. The company was once JEFI’s largest holding, propelled by a doubling in the shares over the second half of 2017.

The fifth-largest driver of returns since inception has been Russia’s Norilsk Nickel, the largest global producer of palladium and nickel. This holding was sold since we published our last note, where after a strong run of performance the manager saw better opportunities elsewhere.

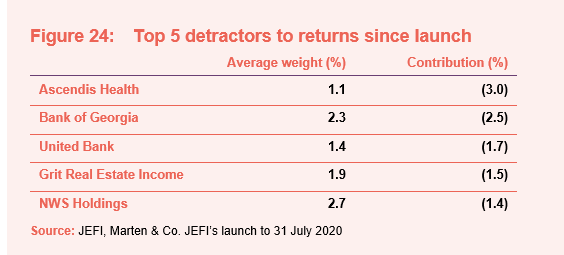

Detractors

The largest detractors are illustrated by Figure 24 below. Other than Ascendis Health, all of these companies remain in the portfolio, with the manager believing that the investment cases remain intact.

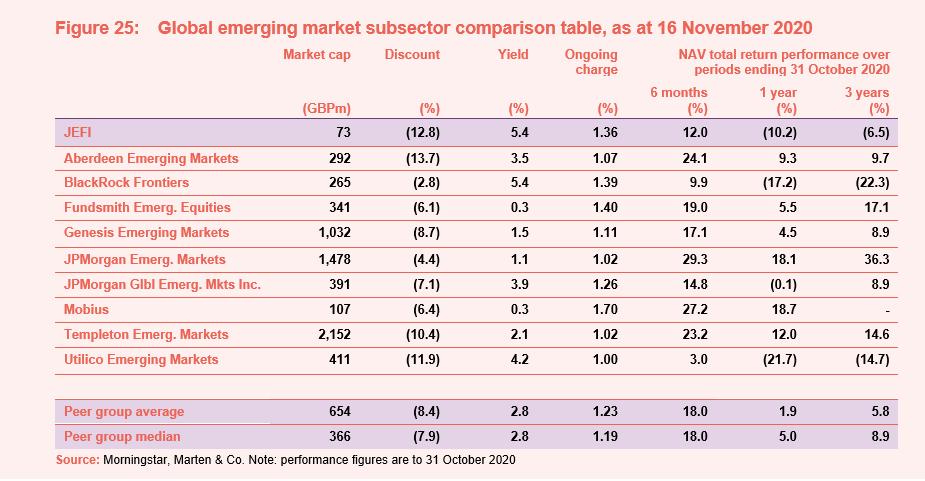

Peer group comparison

JEFI has some unique traits when compared to the peer group shown in

Figure 25. Among the subset of the AIC’s global emerging markets funds shown, Mobius is the only other fund that invests across both emerging and frontier markets. The similarities largely end there. Around a quarter of the Mobius fund is invested in healthcare and, with respect to geography, India and Brazil account for over a third of its portfolio. Mobius is also almost entirely growth-focused.

JPMorgan Global Emerging Markets Income (JEMI) is the only other company to invest in a portfolio of predominantly above-average yielding equities. There is some overlap with JEMI with Taiwan Semiconductor and Samsung also representing its two largest holdings. JEMI does not invest in frontier markets, which – as we discussed in the asset allocation section in the section looking at the banking sector in some of Sub Saharan Africa’s largest economies – are providing some deeply discounted opportunities, with yields of close to 10% in some cases.

JEFI and BlackRock Frontiers are the sector’s two highest-yielding funds, though the latter is capital growth-focused and its frontier-only approach means it cannot hold companies in China, Hong Kong, South Korea, and Taiwan – three of the best performing global markets so far this year (see page 4).

JEFI’s ongoing charges are higher than the peer group average, but not overly so when you factor in its smaller size. JEFI’s board and manager remain keen for the trust to expand, which might help improve liquidity in the shares and lower the ongoing charges ratio further.

JEFI’s discount appears excessive when taking into account the access it provides to fundamentally sound companies in economies that are performing well, its

5.4% yield, and the fact that it provides an annual redemption facility (ARF) at NAV (see page 21).

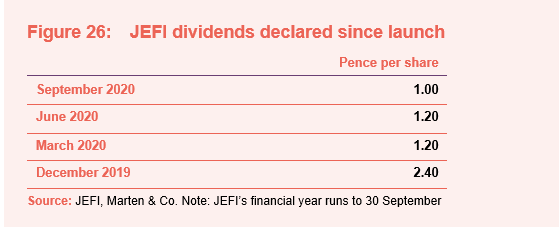

Dividend

JEFI’s manager targets a dividend yield that is at least 20% higher than that of its benchmark. Four payments are made per year, in April, July, October, and January. At launch, JEFI said it would target a minimum annualised dividend of 4%. As of

13 November 2020, JEFI’s shares had a dividend yield of 5.4%.

For the financial year-end to 30 September 2020, the first interim dividend of 1.2p was paid on 17 April 2020. On 3 June 2020, JEFI declared a further interim dividend of 1.2p which was paid on 3 July 2020 – both distributions were fully covered by earnings.

The pandemic’s initial impact led to JEFI reducing its expectations for dividend income growth for the financial year, though as Ross points out, the early suspension of dividend payments by banks was the result of regulatory intervention. As discussed in the asset allocation section, some banks have been reinstating dividends. For the majority of JEFI’s portfolio, the outlook for dividends remains unchanged, in part due to the relative balance sheet strength of many companies – around a third of JEFI’s portfolio companies hold net cash (after deduction of their total liabilities) on their balance sheets.

Premium/(discount)

Over the year to 31 October 2020, JEFI’s shares moved within a range of a 13.7% discount to a 4.4% premium and an average discount of 6.1%. At 16 November 2020, JEFI was trading on a discount of 12.8%. Discounts across AIC’s global emerging market sector widened sharply in the early phase of the pandemic, magnifying the impact of the wider sell-off in stocks.

JEFI operates a discount control mechanism using share buybacks and new issues of shares with the aim of ensuring that, in normal market conditions, the price of its shares will closely track the underlying NAV. Since its formation in 2017, JEFI has issued 4m additional shares at a premium to NAV. For JEFI to start to grow the fund again, the shares would need to return to trading at a premium to NAV. With total assets of £86m as at 31 October, JEFI’s asset base remains close to the lower end of the minimum size preferred by many institutional and wealth management investors.

Catalysts for a narrowing in the discount could come from an improvement in sentiment towards emerging and frontier market stocks, potentially helped by the fact that many EM and FM markets have been able to return to more normal levels of economic activity over recent months. What is more, a greater appreciation among equity income investors of the more robust state of balance sheets across banks in many growth markets, in addition to greater momentum towards sustained resumptions of closer to normal levels of activity, could potentially benefit JEFI disproportionately compared to many of its peers.

Annual redemption facility

JEFI has an annual redemption facility (ARF) that allows shareholders to request that the company redeems all or part of their shareholding. The operation of the ARF and the number of shares that will be redeemed are at the discretion of the board.

JEFI’s interim results announcement on 22 June noted that for the 30 June 2020 redemption, it had received requests to redeem 4,607,803 ordinary shares, representing 5.1% of the issued share capital at the time. In the preceding year, JEFI repurchased 3,971,266 ordinary shares, as part of the ARF.

Fees and costs

Jupiter Unit Trust Managers Limited (JUTM), a subsidiary of Jupiter Investment Group Limited, is JEFI’s alternative investment fund manager (AIFM). It is entitled to a management fee of 0.75% of NAV, payable quarterly in arrears. Any investment by JEFI in other funds managed or advised by any part of Jupiter Investment Group Limited would be excluded from the calculation of the NAV for the purposes of calculating the management fee. The management fee payable to JUTM for the interim period to 31 March 2020 was £302k. There is no performance fee. The investment management agreement can be terminated on 12 months’ written notice from either party.

Investment management fees, as well as finance costs, are charged 75% to capital and 25% to revenue.

For the six months to 31 March 2020, JEFI’s ongoing charges ratio was 1.36%. The ratio is calculated as a proportion of the total ongoing charges to JEFI’s average NAV over the period.

Capital structure

As at 31 October 2020, there are 85.5m ordinary shares in issue and no other classes of share capital. JEFI has repurchased 4.6m shares since we last wrote on the trust, as part of its discount management policy. The policy aims to prevent a material imbalance between the trust’s shares and NAV, in normal market conditions. Shares that are repurchased may be held in treasury.

At the last AGM held in February 2020, shareholders granted JEFI permission to repurchase of up to 14.99% of the issued share capital.

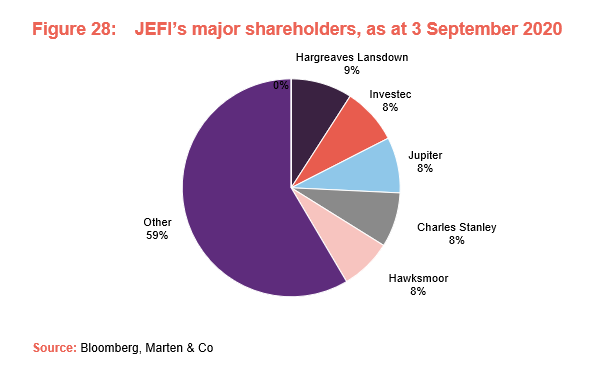

Major shareholders

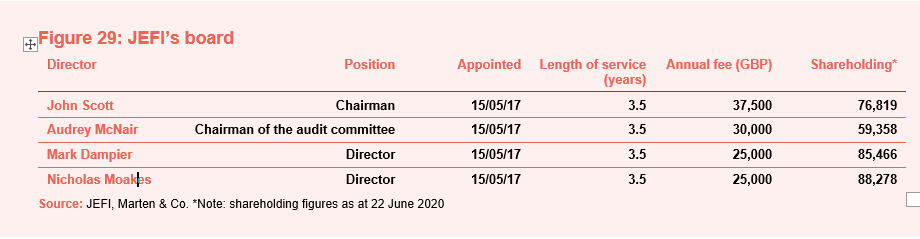

Board

JEFI has four directors, all of whom are non-executive and independent of the manager. All the directors acquired shares at launch and have topped up their holdings since. The directors committed to investing all of their first two years’ net earnings in JEFI shares and have exceeded that commitment. It is JEFI’s policy for all directors to stand for re-election annually.

John Scott (Chairman)

John is a former international investment banker. He was appointed a director of Scottish Mortgage Trust in 2001 and became chairman at the end of 2009. John is a former executive director of Lazard Brothers & Co. During his 20 years with Lazard, he was involved with the merchant bank’s corporate advisory activities and its Asian businesses. He is currently chairman of Impax Environmental Markets and Alpha Insurance Analysts, as well as being a director of various companies, including Bluefield Solar Income Fund, and CC Japan Income & Growth Trust.

Audrey McNair (Chairman of the audit committee)

Audrey has been a non-executive director of Earl Shilton Building Society since February 2015 (and is currently chair of its audit, compliance and risk committee) and a non-executive director of British Friendly Society since April 2016 (and is currently chair of its risk committee). In her executive career across the buy and sell-side in the City of London, she has gained extensive knowledge of regulatory governance and investment management processes and products. Audrey’s experience includes having worked at Aberdeen Asset Management from May 2008 to March 2016, starting as head of internal audit (EMEA) and becoming global head of Business Risk (including Operational, IT and strategic risk) and responsible for the group’s risk management framework and internal adequacy capital assessment.

Mark Dampier (Director)

Mark is head of investment research at Hargreaves Lansdown, a position he has held since 1998; a director of Hargreaves Lansdown Asset Management; and a member of Hargreaves Lansdown’s executive management committee. He has over 30 years’ experience in the fund management industry, including managing and marketing investment trusts and unit trusts, has published a book on effective investing, and is a leading commentator on the investment sector. He was appointed to the board of Invesco Income Growth Trust in March 2016.

Nicholas Moakes (Director)

Nick is chief investment officer of The Wellcome Trust, one of the world’s largest charitable foundations. He is on the board of the Investor Forum, an investor-led organisation established to improve long-term investment returns through collective shareholder engagement. He also chairs the Imperial College Endowment Fund and was appointed to the board of Foreign & Colonial Investment Trust Plc in March 2011. Nick has nearly 30 years’ experience in Asia and 25 years’ experience in global equity markets. He started his career in the diplomatic service, where he specialised in Hong Kong and China. Before joining Wellcome in 2007, he was head of the Asia Pacific investment team and co-head of emerging markets at BlackRock Investment Management.

Fund profile

Launched in May 2017, JEFI invests in stocks that provide exposure to emerging and frontier markets (any country that is not classified as developed or emerging). The aim is to generate both capital growth and income over the long term, using an investment approach that is benchmark agnostic, unconstrained and focused on identifying positive change.

Investment manager

JEFI’s portfolio is managed by Ross Teverson, of Jupiter Asset Management (Jupiter), who subcontract the job of managing the portfolio from the AIFM, Jupiter Unit Trust Managers Limited. Ross is now the sole manager of JEFI with the departure of Charles Sunnucks in June following Jupiter’s merger with Merian. The emerging markets team has approximately £1.4bn under management. The manager can also draw on the expertise of Jupiter’s wider pool of asset managers and analysts.

Ross Teverson

Ross has been managing an unconstrained emerging markets portfolio since 2012. He joined Jupiter in 2014 as head of strategy, Global Emerging Markets. Before joining Jupiter, Ross worked for 15 years at Standard Life Investments, where he managed a global emerging markets equity fund. Ross spent seven years in Standard Life Investments’ Hong Kong office, where he managed an Asian equity fund and was a director of the business. He is a graduate of Oxford University and is a CFA Charterholder.

Previous publications

Readers interested in further information about JEFI may wish to read our earlier notes. You can read the notes by clicking on the links below:

A very successful fundraise – Initiation – 28 November 2017

Off to a great start – Update – 29 August 2018

Income objective exceeded – Annual overview – 15 April 2019

Unjustified discount? – Update – 23 September 2019

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Jupiter Emerging & Frontier Income Trust.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.