Unjustified discount?

Unjustified discount?

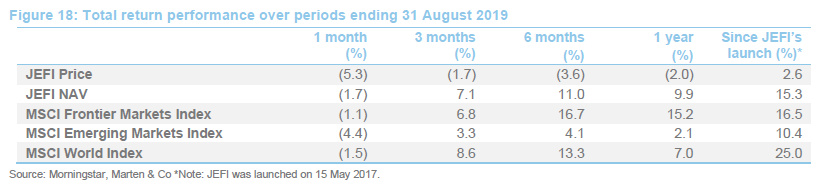

In recent months, Jupiter Emerging and Frontier Income (JEFI)’s discount has widened. This seems at odds with JEFI’s good relative performance over this period and since launch (a 14.7% return on NAV for the period to 19 September 2019 versus 11.4% for the MSCI Emerging Markets Index, 10.4% for the MSCI Frontier Markets Index and 8.2% for the average of JEFI’s peer group – see page 9). It also seems strange given JEFI’s sector-leading dividend yield.

The world is an uncertain place at present, but emerging markets, which have been battling a headwind provided by a strong US dollar, now see a period where the US President is determined to weaken the currency and US interest rates are falling. JEFI’s managers have confidence in their portfolio and the long-term structural trends that underpin growth in their markets. They say that the portfolio has very limited direct exposure that is sensitive to trade tensions, however trade concerns are a significant source of broader investor anxiety.

The managers would like to see the discount eliminated and the trust expanding, to the benefit of all shareholders.

Long-term capital and income growth

Long-term capital and income growth

JEFI aims to generate capital growth and income over the long term, through investment predominantly in companies exposed directly or indirectly to emerging markets and frontier markets worldwide.

Market roundup – frontier’s time to shine

Market roundup – frontier’s time to shine

Whilst we have provided some background on the macroeconomic environment in this section, it is worth remembering that JEFI’s managers place much more emphasis on the fundamentals of the businesses in which they invest than in gyrations in currencies and politics. The managers’ investment approach is described in our annual overview note, which was published in April this year.

While, over the three years to the end of August 2019, frontier markets have outperformed emerging markets (on average), much of frontier’s outperformance can be attributed to Kuwait (which made up 31.5% of the MSCI Frontier Markets Index at the end of August 2019) and Vietnam (18.5% of the index). Collectively these two geographies alone account for half the frontier universe, and rose by 112%/51% respectively, during a period that the broader frontier index was up about 38% (all in sterling terms).

The managers say that Kuwait has been a particular frustration for investors in frontier markets, as its inclusion in the frontier index is not really in the spirit of ‘frontier’ markets, (GDP per capita for instance is over double the equivalent level in China).

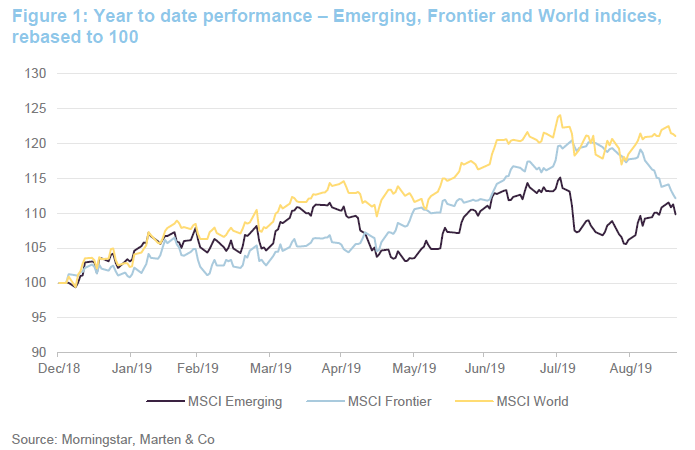

In aggregate, frontier markets have been outperforming emerging and developed markets over 2019 year to date. Sterling weakness flatters returns across almost all markets.

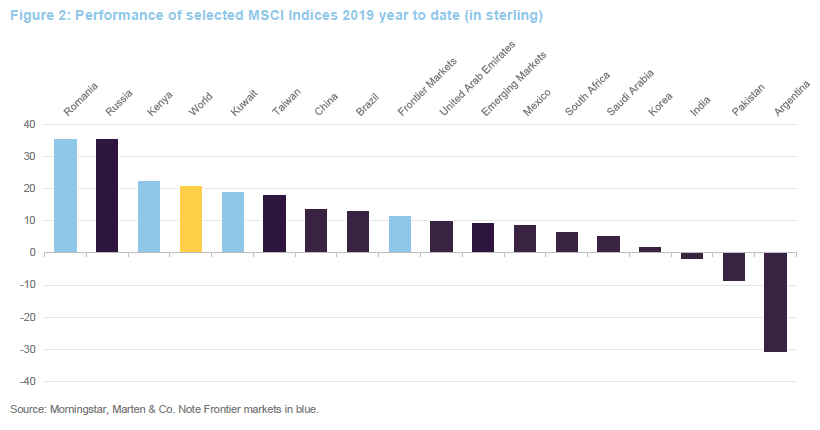

There is a fairly wide dispersion of returns, however, as is evident in Figure 2.

Looking at some of these moves:

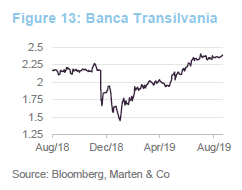

- At the positive end of the scale, Romania has been benefitting from a watering-down of proposed taxes on the financial assets of credit institutions (see our comment on Bank of Transylvania on page 7).

- Kuwait, Saudi Arabia and China’s domestic market are all beneficiaries of changes to the composition of the MSCI Emerging Markets Index (EM Index). China’s A shares were included within the EM Index at a 5% weighting last year. That is being quadrupled to 20% over the course of 2019 (in May, August and November). The MSCI China A share index has outperformed the MSCI China Index by some margin, returning 27.8% in 2019 to end August. Saudi Arabian stocks are entering the EM Index in two equal tranches (in June and September) and Kuwaiti stocks will enter the EM Index in June next year. EM Index inclusion tends to trigger inflows of ‘hot money’, frontrunning ETFs and other index-tracking funds. In recent days, the Saudi market has fallen following the attacks on its oil installations.

- China’s economy has been held back by the tariff war with the US. Some manufacturers have been switching production to outside the country, to the benefit of countries such as Vietnam and Cambodia. The stand-off between the government and protestors in Hong Kong is also weighing on regional markets.

- Brazil had been one of the best performing markets this year, but has retrenched over the summer as controversy raged over the fires in the Amazon basin.

- The managers say that Mexico is still very competitive, with wages one-fifth of those in the US. Mexico is also still perceived as a less risky place from which to be exporting to the US than China. The supply chain is very integrated across the two countries, and they think it would be hard to unravel and damaging to US businesses. The managers are seeing more opportunities in Mexico than Brazil.

- Corruption allegations continue to dog South Africa’s government.

- Tensions between Japan and South Korea related to WWII compensation have resulted in restrictions being imposed on exports to Korea. This was compounded by a renewed investigation into corruption charges against an heir to the Samsung Electronics business.

- India’s GDP growth rate has slumped, as liquidity pressure has weakened economic activity. Its government is, belatedly, taking action, but it has an uphill battle to restore sentiment.

- Argentina has defaulted on its debt and faces the realistic prospect of another Peronist President in October this year.

Might we see US dollar weakness?

Might we see US dollar weakness?

One headwind that emerging and frontier markets have faced for some time is the strength of the US dollar and the prospect of rising US interest rates. The Fed’s policy change in January reversed the position on rates, but to date, dollar strength has persisted. President Trump is adamant that he wants the dollar to weaken, and is likely to pursue policies that try to bring this about.

Emerging and frontier balance sheets are in reasonable shape

Emerging and frontier balance sheets are in reasonable shape

One other factor that the managers feel investors should bear in mind, when looking at emerging and frontier markets, is that the companies within the region have not been buying back shares and paying out dividends in the way that many US companies have. They note that many US companies have been borrowing to fund these returns of capital.

By contrast, EM/FM dividends tend to be covered by cash flow. Emerging and frontier markets have a multi-year opportunity to deliver higher dividend and earnings growth relative to developed markets, aided by adding debt to balance sheets. Alternatively, they may attract more of a safe haven status, as debt-laden businesses in developed markets struggle.

Small caps continue to underperform

Small caps continue to underperform

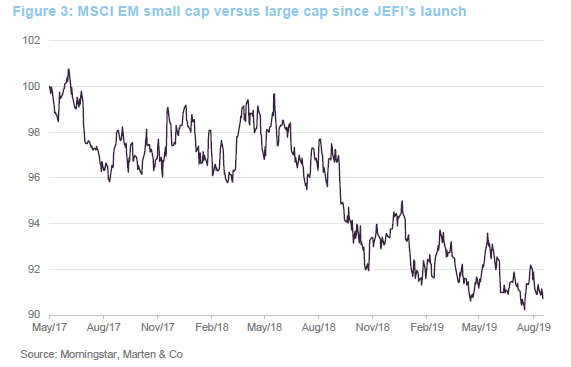

As Figure 3 shows, smaller companies continue to underperform larger ones in emerging markets.

Asset allocation

Asset allocation

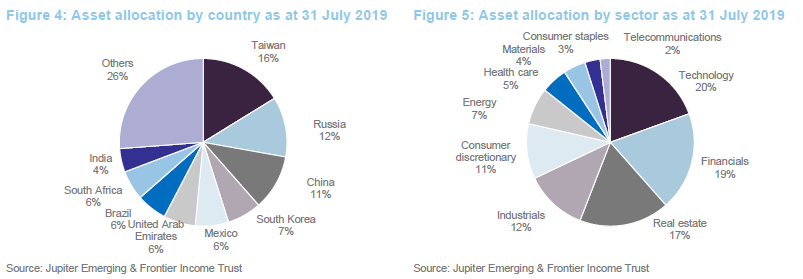

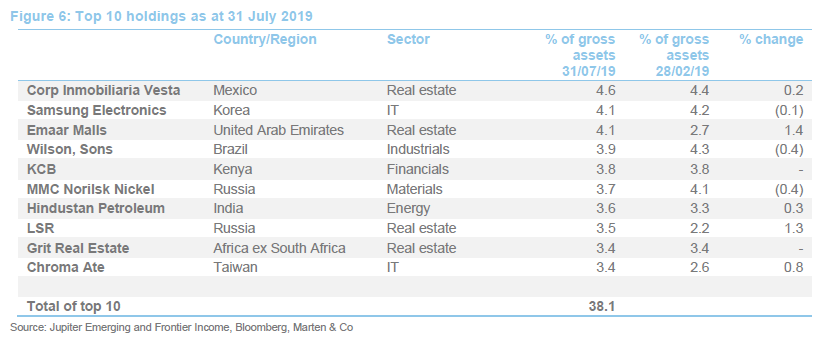

JEFI’s geographic and industry weightings are the product of the managers’ stock selection decisions, and the weightings within the MSCI Indices do not influence this. The result is that JEFI’s portfolio is quite dissimilar to those indices and its peers. Notably, China accounted for 32% of the MSCI EM Index at the end of July 2019 while making up just 11% of JEFI’s portfolio. The trust also has a significant overweight exposure to real estate relative to the MSCI EM Index.

The main changes since the end of February (the latest available data when we published our previous note on JEFI) are a reduction in the Chinese and consumer discretionary exposure and increases in the technology and real estate weightings.

Top 10 holdings

Top 10 holdings

We have discussed many of these stocks in earlier notes, readers may wish to refer to these, see page 12 for details of earlier publications.

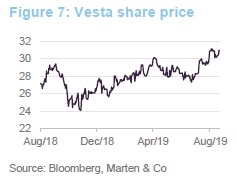

Corp Inmobiliaria Vesta (www.vesta.com.mx)

Corp Inmobiliaria Vesta (www.vesta.com.mx)

The managers feel that there was a perception among some investors that, because Vesta invests in Mexican industrial property, it is sensitive to trade tensions between Mexico and the US. This appeared to be particularly acute while the NAFTA negotiations were underway. However, year-on-year, Vesta has been able to achieve rent increases across its portfolio, helped by a lack of suitable alternative property within Mexico. This may be giving investors the comfort that the excess demand makes the business more defensive. The managers say that it was notable that when President Trump threatened new tariffs against Mexico over the immigrant issue, Vesta’s share price was not much affected.

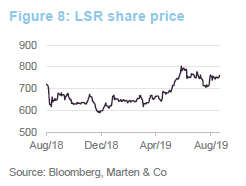

LSR (www.lsrgroup.ru)

LSR (www.lsrgroup.ru)

LSR is a new entrant to the list of top 10 holdings, but is a stock that JEFI has held for a while. It is benefitting from changes to Russia’s housebuilding market (in relation to the rules governing the use of deposits on new build properties), which are helping to regularise the market, and LSR is helping to consolidate the industry. There is still strong demand for housing in Moscow and St Petersburg. The largest shareholder has reduced his stake, but the managers say that he is still very involved with the company.

LSR yields over 10% and this is well-covered by earnings. The very low rating may reflect the antipathy that investors have for the Russian market. The managers say that LSR and MMC Norilsk Nickel (which JEFI also holds) are good examples of stocks where there is a good alignment of interest between controlling and minority shareholders. Within the portfolio, LSR and Sberbank offer exposure to the domestic Russian economy, but MMC Norilsk Nickel (which is benefiting from rising nickel prices, helped in turn by an Indonesian export ban) and NLMK, which is one of the cheapest producers of steel globally, are more export-orientated.

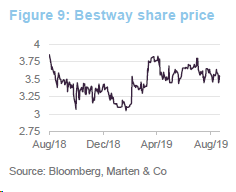

Bestway (www.bestwaycorp.com)

Bestway (www.bestwaycorp.com)

In China, the managers have been looking to take advantage of low valuations. For example, they bought Bestway, a manufacturer of a range of inflatable products from kayaks to paddling pools to tents and including Lazy Spa (inflatable hot tubs). Almost all supply for these types of products comes from China. With nowhere else for consumers to turn, US tariffs are just a tax on the US’s own consumers. The managers say that the company’s sales and earnings are growing in double digits and Bestway is committed to increasing its dividend pay-out ratio.

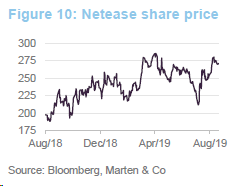

Netease (www.ir.netease.com)

Netease (www.ir.netease.com)

Another stock JEFI has bought in China is Netease, the online gaming company. Whilst it has a strong position in China, it is increasingly globally competitive, with development studios in Europe and Canada. It has been working with Activision/Blizzard on its Diablo franchise (eu.diablo3.com), helping it to adapt the game for mobile phones. Netease also has an education side, building on its successful dictionary app, and is in second place behind Tencent Music in music streaming in China.

Recently, Netease sold its ecommerce business. The managers see this as evidence that it is focused on maximising shareholder value rather than empire-building. It was, for a time, affected by a freeze on game approvals, which was imposed by the Chinese government. Even now, getting new games past the censors takes longer than it used to, although it helps if the gameplay is seen as patriotic. Netease has been shifting its focus from multiplayer to more casual games, broadening their appeal.

The managers like the corporate structure; 70% of the board is independent, it does not have multiple share classes, and it is committed to a dividend pay-out of 20%-30% and a share buyback programme. The businesses are structured as separate entities, allowing them to bring in joint venture partners and outside funding without diluting the core company. This is not a stock with a high yield, but it is one that offers strong dividend growth potential, illustrating the flexibility offered by the investment approach.

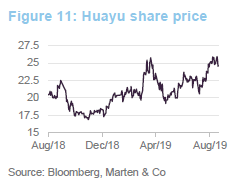

Huayu (www.huayu-auto.com)

Huayu (www.huayu-auto.com)

One Chinese stock that has been sold is Huayu, China’s largest auto-components business and a subsidiary of China’s largest auto OEM (SAIC). The stock was acquired in 2018 on the premise that it was diversifying its client base and developing new product lines, such as intelligent braking systems. The dividend pay-out ratio is around 50% and it has a strong net cash position. However, even though Huayu was making positive returns, against a backdrop of a weak sector, the managers thought there were better opportunities elsewhere. The sales proceeds have been recycled into higher-conviction positions.

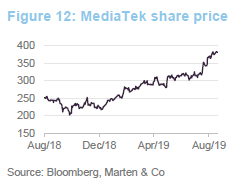

MediaTek (www.mediatek.com)

MediaTek (www.mediatek.com)

MediaTek Is a Taiwanese-based IT designer, competing with firms such as Qualcomm. It manufactures chips for mobile handsets across 3G, 4G and 5G. It is also a major producer of chips for other consumer products, such as TVs and smart speakers, and an emerging player in the automotive-related chips that enable driver assistance. MediaTek’s business is approximately half mobile and half non-mobile. The managers see the prospect of good growth and margin improvement in handset chips as they migrate to 5G. The managers believe that MediaTek has narrowed the gap with market-leader, Qualcomm.

MediaTek has been held in the trust since launch and the position has been added to. The managers highlight that this is a company based in Taiwan, but with a global customer base. They add that this is true of most of the Taiwanese companies held within JEFI. MediaTek is trading on a yield of about 2.6% (it has been as high as 4.2% while owned by JEFI). The managers say that MediaTek has a strong dividend-paying culture and growth opportunities. In addition, it has net cash on its balance sheet. In their view, the dividend could be higher still and there is the possibility for share buy backs.

Banca Transilvania (www.bancatransilvania.ro)

Banca Transilvania (www.bancatransilvania.ro)

We discussed the opportunity to increase the penetration of financial products in emerging and frontier markets in our last note. One new addition to the portfolio is Banca Transilvania, which JEFI acquired in May. The managers like the company’s pay structure (executive remuneration is deferred over five years and discretionary salary for employees is equivalent to about two months’ wages). This is a stock that has been held at points by other funds managed by Jupiter Asset Management. When Romania announced an asset-based tax on banks and other financial institutions, share prices fell steeply, providing an opportunity to buy stock at an attractive valuation. The banks argued successfully that the proposed tax was excessive, and the proposals were watered down. The managers foresee ongoing consolidation within the Romanian banking market. They also think the market is attractive in that the level of corporate debt to GDP has reduced and the structure of that debt has improved. Banca Transilvania’s ROE looks good versus its cost of equity. It has contributed to JEFI’s positive performance since it was acquired.

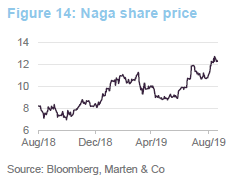

Naga (www.nagacorp.com)

Naga (www.nagacorp.com)

Cambodian gaming company Naga has dropped out of the list of the 10 largest holdings, but is still held within the portfolio. It announced expansion plans (Naga 3) and this unnerved some investors. JEFI voted to approve the expansion plans, based on the managers’ assessment of the long-term growth prospects for the business. Naga has been working with a leading gaming company in Macau. This has been generating more business for Naga. Increased Chinese tourism is also beneficial. The managers’ ESG assessment noted that local Cambodians are not permitted to gamble and the business has tight money laundering controls.

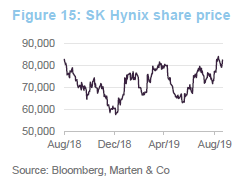

SK Hynix (www.skhynix.com)

SK Hynix (www.skhynix.com)

SK Hynix is one member of an oligopoly of high-speed DRAM chip producers. This market has exhibited good supply-side discipline, which is helping margins. The managers think that the market still values this company as a cyclical investment, yet believe this view is flawed, given the growing range of applications for these chips. The company has been paying a dividend for a number of years now, and there is scope for the pay out to rise further. The managers also note that SK Hynix is a tech-enabling business; it is not consumer-facing but its products are critical to the end product.

Performance

Performance

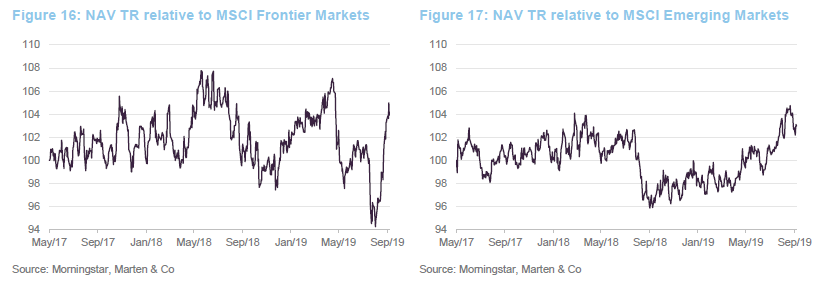

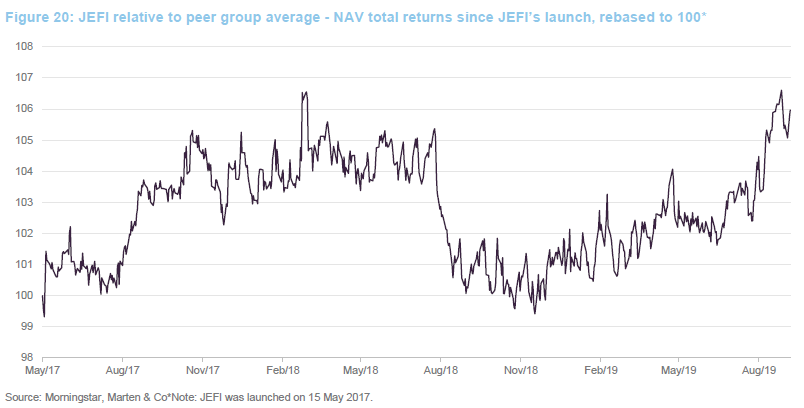

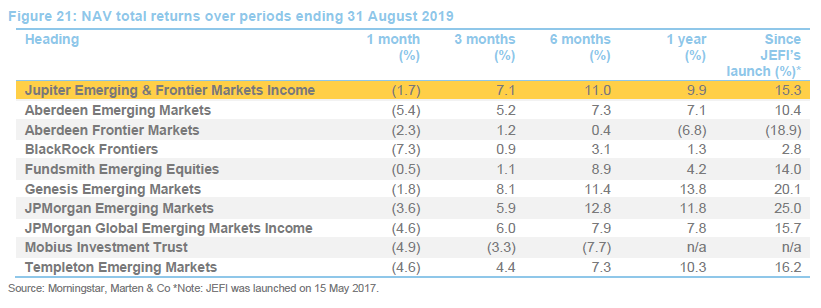

JEFI has held its own against the MSCI Frontier Markets Index and outperformed the MSCI Emerging Markets Index since launch. The performance of the MSCI Frontier Markets Index is heavily skewed by countries being promoted or demoted to and from the MSCI Emerging Markets Index. In recent months, the decision to elevate the Kuwaiti and Saudi markets to emerging markets status has helped push the MSCI Frontier Market Index higher but the recent attacks on Saudi oil installations have led to falls in that market.

As Figure 18 shows, both emerging and frontier markets have lagged developed markets (as represented by the MSCI World Index) since JEFI’s launch.

JEFI’s performance has been achieved despite the trust’s overweight exposure to small cap stocks (we noted the underperformance of smaller companies on page 4) and underweight exposure to China, relative to the benchmark. The manager’s stock selection decisions have more than compensated for this.

Peer group

Peer group

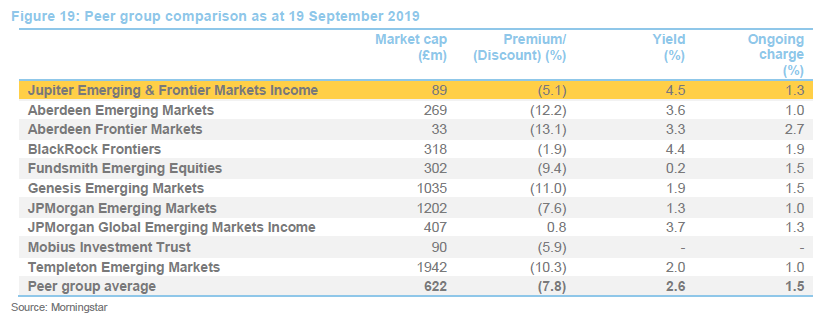

JEFI sits within the AIC’s global emerging market sector. Only one other London-listed investment company has a policy of investing across both emerging and frontier markets (Mobius Investment Trust) and only one other company (JPMorgan Global Emerging Markets Income Trust) invests in a portfolio of predominantly above-average yielding equities. Other trusts in the sector that pay a high dividend yield manufacture a significant part of this by distributing capital.

For the purposes of this note, we have excluded trusts that do not have a truly global remit, those in the throes of liquidation and those with a split capital structure from the peer group. A full list is provided in Figure 19.

JEFI offers the highest yield in the sector and an ongoing charges ratio below the average of the peer group. The managers are keen to expand the trust, which might help improve liquidity and lower the ongoing charges ratio further. The discount is narrower than the average, but this is justified given the trust’s performance record and yield.

JEFI has outperformed the average of the peer group since launch and is well ahead of close competitor Mobius Investment Trust.

Premium/(Discount)

Premium/(Discount)

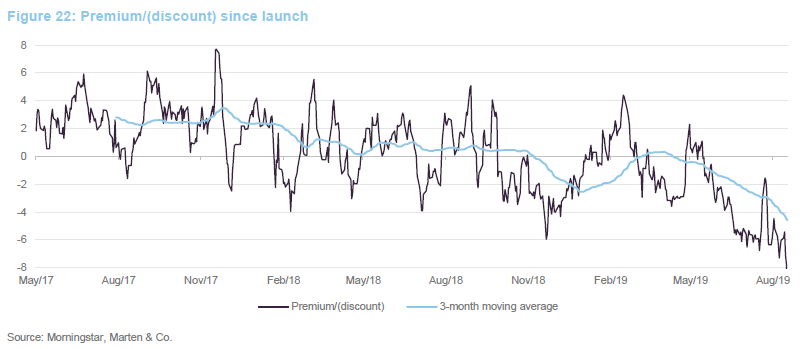

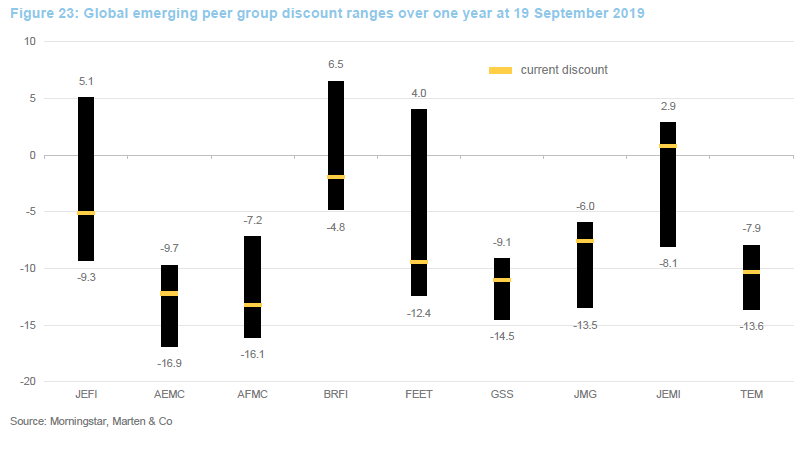

Over the year to the end of August 2019, JEFI traded within a range of -9.3% to +5.1% and an average of -1.7%. At 19 September 2019, JEFI was trading on a discount of 5.1%.

JEFI’s discount has been widening in recent months and at the end of August was at its widest level since launch. In recent weeks the discount has narrowed again, however. As Figure 23 shows, most global emerging trusts are trading wider than their average over the past year. However, JEFI’s rating seems at odds with its decent relative performance and, in an environment where income is hard to come by, JEFI also boasts the highest yield in its sector. It seems reasonable to think that its discount should narrow.

Fund profile

Fund profile

Jupiter Emerging & Frontier Income Trust (JEFI) launched in May 2017. It invests globally in stocks that provide exposure to emerging and frontier markets (any country that is not classified as developed or emerging). The aim is to generate both capital growth and income over the long term, using an investment approach that is benchmark agnostic, unconstrained and focused on identifying positive change.

Investment managers

Investment managers

JEFI’s portfolio is managed by Ross Teverson and Charles Sunnucks (together, the managers), both of Jupiter Asset Management (Jupiter), who subcontract the job of managing the portfolio from the AIFM, Jupiter Unit Trust Managers Limited. The emerging markets team had £1.8bn under management at the end of August 2019. The managers can also draw on the expertise of Jupiter’s wider pool of asset managers and analysts.

Previous publications

Previous publications

Readers interested in further information about JEFI may wish to read our previous notes (A very successful fundraise, 28 November 2017; Off to a great start, 29 August 2018; Income objective exceeded, 15 April 2019) by clicking on the links.

The legal bit

The legal bit

This marketing communication has been prepared for Jupiter Emerging & Frontier Income by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.