Lar España Real Estate – Built to last

Built to last

Unlike most of its retail property-focused European peers, Spanish-listed Lar España Real Estate can look to the future with some confidence that it is on the path to recovery, despite the impact of the COVID-19 pandemic. The majority of the group’s €1.5bn portfolio of Spanish retail assets are ‘dominant’ shopping malls and retail parks, with little or no competition and large catchment areas.

Customer visits and sale volumes across its portfolio were back up to 96% of 2019 levels following the first lockdown in Spain in March – underlining the strength of the assets’ locations and their dominant nature. Redevelopments and refurbishments across its portfolio have all but been completed in recent years, bringing the malls in line with a changing retail world that incorporates online retailing with bricks-and-mortar retail and integrates big data technology.

The company has a strong balance sheet to help it see out any further COVID-related turbulence. It has €140m of cash reserves – enough, its manager says, to cover all expenses for the next four years.

Considerable annual dividend

Lar España aims to grow its EPRA net asset value (NAV) through active asset management initiatives, such as refurbishments and leasing transactions, and deliver high returns primarily through the payment of considerable annual dividends.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Peer group NAV total return (%) | Morningstar Eur REIT TR (%) |

|---|---|---|---|---|---|

| 1 | 30 Nov 2016 | -10.50 | -6.60 | 17.00 | 11.10 |

| 2 | 30 Nov 2017 | 26.20 | 17.40 | 11.90 | 17.70 |

| 3 | 30 Nov 2018 | 1.40 | 18.70 | 8.20 | -2.00 |

| 4 | 30 Nov 2019 | 1.80 | 14.00 | 3.30 | 23.90 |

| 5 | 30 Nov 2020 | -22.10 | 0.00 | -4.80 | -11.20 |

Fund profile

Lar España Real Estate is a SOCIMI (the Spanish equivalent of a listed Real Estate Investment Trust (REIT)) that has been listed on the Madrid Stock Exchange since 5 March 2014.

Lar España was the very first Spanish SOCIMI to be floated. It was also the first listing on the Madrid Stock Exchange for three years, and the first listing of a real estate company in seven years. It was founded at the bottom of the Spanish property cycle when real estate prices were at record lows and the real estate market was entering a new cycle.

The company is focused on investment in real estate assets throughout Spain, mainly in the retail sector. It aims to deliver high returns for its shareholders through the payment of considerable annual dividends and create value by increasing the company’s EPRA NAV through active asset management initiatives, such as refurbishments and leasing transactions.

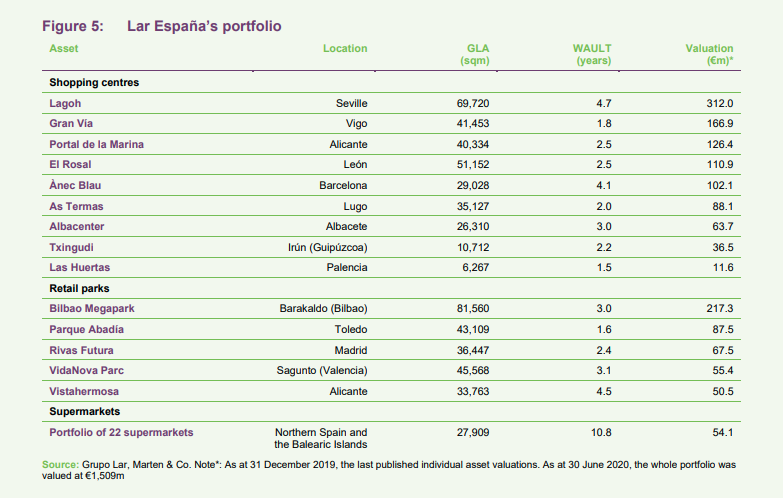

The group’s portfolio comprises nine shopping centres, five retail parks and a portfolio of 22 supermarkets. It was valued at just over €1.5bn on 30 June 2020.

Lar España is exclusively managed by Grupo Lar, a real estate company that has extensive experience in the sector. It boasts a large team of professionals that actively manage the portfolio, aiming to maximise its operational efficiency.

A differentiated offering

The COVID-19 pandemic has been particularly hard on the retail sector in 2020. In Spain, all but essential retail was closed during the first wave of infections in March, as part of the government’s state of alarm restrictions to curb the spread of the disease. The lockdown was lifted in June, but a new wave in the autumn has seen infection and death rates rise again.

A second state of alarm was declared on 26 October, but this time restrictions were less severe. A national curfew between the hours of 11pm and 6am was implemented and regional governments were given the power to limit the mobility of people in and out of their jurisdictions.

Recent breakthroughs in the race to develop an effective vaccine have been positive and hopes that some form of economic normality will return in 2021 have grown. It is not known, however, whether consumer behavioural trends that developed during lockdown – specifically increased online retailing – will endure.

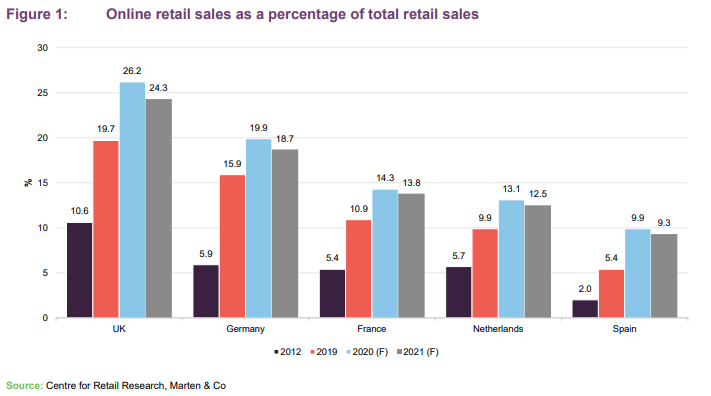

Structural change in the retail sector has been evident for a number of years and has been accelerated during the pandemic. The e-commerce penetration rate in Spain is forecast to almost double in 2020 compared to 2019. As Figure 1 shows, it had been steadily growing over a number of years, albeit far lower than most other European countries. The saturation of retail space in Spain is far less than in the UK, and therefore the impact of increased online retailing is expected to have less of an impact than has been witnessed in the UK.

There are a number of factors that differentiate Lar España and its portfolio relative to other retail-focused property companies in Europe.

Dominant centres

A lot of the work to futureproof Lar Espana’s shopping centres has already been done. It has carried out refurbishments across a significant portion of its malls, boosted leisure provisions to drive footfall and dwell time, and increased omnichannel activities (an omnichannel strategy is one that combines in-store and online retail into one experience).

The retail landscape is evolving, and store footprints are changing to be focused on the highest footfall locations, where retailers can engage with consumers to showcase their brand. Dominant shopping centres, located in a large catchment area, are important for retailers as they move to an omnichannel strategy. Seven of the nine shopping centres in Lar España’s portfolio are classified as dominant, with catchment areas around 350,000 to 400,000 people and no significant competing retail schemes.

To be considered as dominant, the assets must have a gross leasable area above 40,000 sqm, at least 4m visitors per year (footfall), above 90% occupancy levels, and have at least five critical retail operators. All of Lar España’s retail parks are also classified as dominant (here, the definition of dominant is at least 20,000 sqm, 3m visitors per year, above 90% occupancy levels).

More information on Lar España’s portfolio is detailed later.

Resilient performance during COVID

The government’s response to the COVID-19 pandemic meant that all but essential retail was closed across Spain. This meant more than 75% of Lar España’s portfolio by gross lettable area (GLA) was closed. After its centres reopened in June, visitor numbers (footfall) and sales rates across the portfolio have been encouraging.

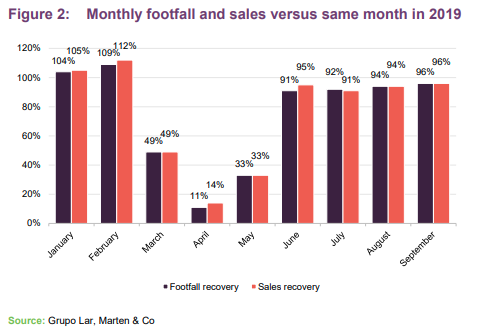

By September, 98% of Lar España’s portfolio was open and trading, with footfall and sales at 96% of the level recorded in September 2019. The footfall figure of 96% is well ahead of the ShopperTrak index (the retail analytics firm that collates data across European retail assets) figure of 80%, proving the strength of the assets’ locations and their dominant nature.

Following the new restriction brought in on 26 October, 85.4% of Lar España’s portfolio is open and in operation by GLA. Three of its shopping centres (El Rosal, Anec Blau, and Las Huertas) were closed for a two-week period in November, for all but essential retail. In other centres, restaurants were forced to close and operate a take-away service only.

The level of footfall and sales bounce-back experienced after the first lockdown gives the manager confidence in a similar response this time.

The company has worked closely with its tenants to reach an agreement on rent payments under conditions that the manager says represent a great commitment on both sides. The manager’s main priority was to keep occupancy high. As part of negotiations, rent-free periods were given in return for extension to the lease term.

It has reached agreements on rental concessions on 95% of its portfolio by GLA, with the agreements adapted for each tenant. Lar España expects the total cumulative impact on rental income due to COVID-19 to amount to between €19m and €20m. In line with applicable accounting legislation, the impact on revenue will be apportioned on a straight-line basis over the term of each lease agreement of between six and seven years. The negative impact on 2020 revenues is estimated at just under €2m.

Retailer relationships

The manager says Lar España puts a big emphasis on its relationship with tenants. This close relationship helped it negotiate rental concessions early in the pandemic and give it a clear line of sight over the impact on income. It says these negotiations will strengthen its relationship with its tenants and pay dividends over the long-term. This position is in stark contrast to other shopping centre landlords in Europe. Unibail-Rodamco-Westfield, the owner of malls across Europe and the US, for example, has reportedly threatened some of its tenants with legal action over the non-payment of rent.

An example of the impact of its strong tenant relationship, and the dominant nature of its portfolio, is Lar España’s relative insulation from a big store closure plan by its largest tenant Inditex. One of the biggest fashion retailers in Europe, Inditex (the huge fashion retailer behind Zara) announced in June 2020 that it would close between 1,000 and 1,200 stores across Europe to focus on larger concept stores. Just one store in Lar España’s portfolio is on the at-risk list out of a total of 57 units that it lets to the retailer.

Leasing activity across Lar España’s portfolio has continued during the pandemic. During the third quarter of the year, brands including Hugo Boss and New Balance opened new stores at the group’s Megapark scheme. So far in 2020, Lar España has completed 81 leasing deals including renewals, relocations, re-lettings and new lettings, covering €4.4m of rent and resulting in a 4% uplift in rent.

Strong balance sheet

The group’s main priority through the COVID pandemic is cash preservation. All non-essential capital expenditure has been put on hold (most refurbishment projects were completed ahead of the pandemic) along with potential acquisitions. In addition to this, management fees have been reduced during the crisis.

Lar España has €140m in cash and undrawn debt facilities – enough, it says, to cover all expenses for the next four years. Its debt totals €729.3m at an average interest rate of 2.2% and an average debt maturity of 3.3 years. The group’s loan to value (net debt divided by gross asset value) is 41%. It has no major debt maturities until 2022 when a €140m bond (issued in 2015) and €114.5m of bank debt becomes payable. The manager says that it will most likely replace its bond through a new green loan financing or through the issuance of a new bond, depending on the market conditions prevailing at the time.

The company has completed two share buyback programmes, totalling 2.9 million shares, and has a third (for a maximum of 5% of share capital or €45m) ongoing.

Non-core asset disposals

Lar España has around €102m of assets held for sale, with the proceeds to be used to increase cash reserves and reduce leverage. It is looking to sell its supermarkets portfolio, which was valued at €57m in June 2020.

It will also sell the Txingudi and Las Huertas shopping centres. The manager says the company has executed its business plans for both assets and they no longer fit the investment strategy of the company as they are too small.

Asset allocation

Lar España’s portfolio was valued on 30 June 2020 at just over €1.5bn. It comprises nine shopping centres, five retail parks and a portfolio of 22 supermarkets. By value and income, the portfolio is split as 65% shopping centre, 31% retail park and 4% supermarket.

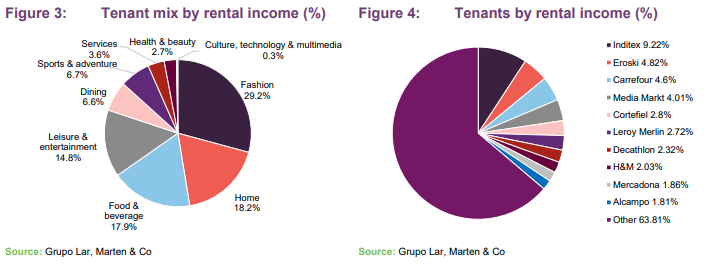

It has a diverse range of tenants, as shown in Figures 3 and 4, with an occupancy rate across the portfolio of 95.2%. Its 10 main tenants account for 36% of the company’s rental income, while at 30 September 2020 more than 60% of leases had expiries beyond 2024.

Lagoh shopping centre

The largest asset in Lar España’s portfolio, the company bought the site of the Lagoh shopping centre in March 2016 for €38.5m and completed the development of the 69,720 sqm mall in 2019. It opened its doors in September 2019 and is home to a range of retailer and leisure brands. The centre comprises 148 stores and produces an annual rent of €17.8m, with an occupancy rate that stands at 99.2%.

It is located in the centre of Seville, the fourth-largest city in Spain, which has a population of 676,000 and 1.5m in the Greater Seville metropolitan area. Despite the demographics, the Lagoh shopping centre is the first dominant shopping centre in the Greater Seville area.

The brand-new shopping centre was designed with technology and sustainability at its core. Technology initiatives at the mall include a sensor system that monitors visitors’ flow around the centre and use of space, which can inform prime footfall areas and marketing decisions.

Sustainability features include solar panels providing low-carbon electricity and geothermal technology. Energy provided to the whole complex is 100% renewable and the scheme has been awarded the BREEAM Sustainability Building Certification.

Bilbao Megapark retail park

Megapark is the largest retail complex in the Basque Country and the fourth largest in Spain, covering a total area of 128,000 sqm, of which Lar España owns 81,560 sqm. It is the only retail park within a radius of 400 kilometres and is the leading scheme in the Bilbao area, with a catchment area of more than 1m people.

Developed in 2007, Lar España bought its holdings in two separate deals in 2015 and 2017 for a combined €178.7m. It was last valued at €217.3m.

Comprised of 81 retail units and 8,200 car parking spaces, Megapark is home to leading international retailers, such as Ikea, Mediamarkt and Leroy Merlin, and hosts the cinema with the highest box-office turnover in the Basque Country.

Gran Via shopping centre

Located in the largest city in the Pontevedra province, Vigo, the Gran Vía shopping centre has 41,453 sqm of lettable space and is the main shopping centre serving 482,100 people in the catchment area. The mall opened in 2006 and was acquired by Lar España in September 2016 for €141m. The scheme was last valued at €166.9m.

It comprises 121 retail units that are let to a mix of international brands and Spanish companies, with an occupancy rate of 98.6%. Tenants include Zara, H&M, Massimo Dutti and Carrefour. It produces an annual rental income of €10.5m.

During the quarter to the end of September 2020, Lar España completed five leasing deals at the scheme, including letting a 500 sqm unit to fashion retailer Mango and renewing the leases of Misako (90 sqm) and Lotería Post (24 sqm). In total more than €276,000 of annual rent was negotiated.

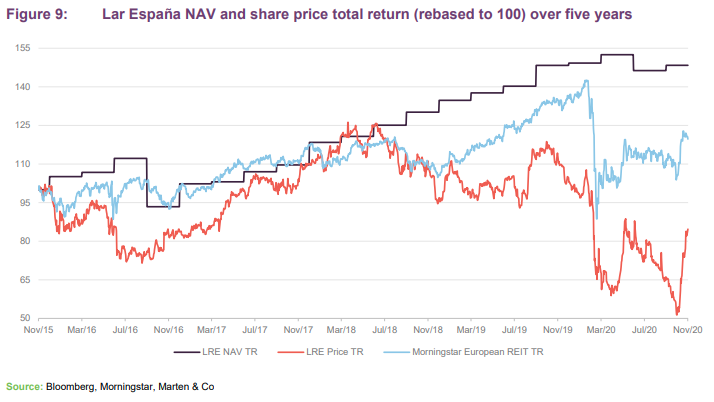

Performance

Lar España’s NAV has grown strongly since 2016 and over five years has returned 48.4%. The growth in NAV total return has been down to acquisitions and value accretive asset management initiatives, such as refurbishments and redevelopments, as well as a strong dividend policy. The value of its portfolio has held up relatively well due to the dominant nature of the assets and consistently high occupancy rates, as well as the strong value uplift at its Lagoh shopping centre asset.

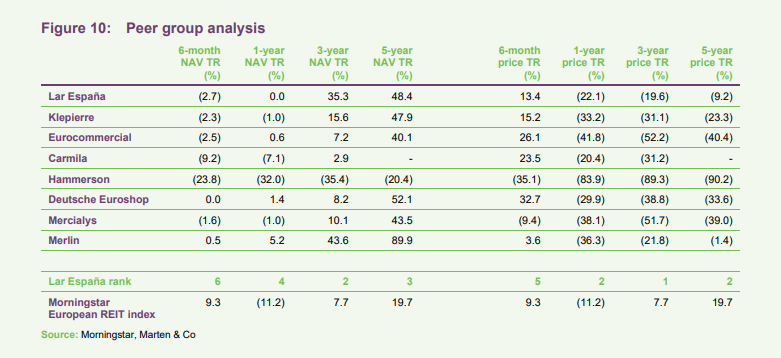

Peer group analysis

We have put together a comparison of Lar España’s listed peers in Europe, including pan-European and country-specific retail landlords and a Spanish peer. The peer group we have assembled consists of: Klepierre, Eurocommercial and Camila – which are pan-European; Hammerson (UK), Deutsche Euroshop (Germany) and Mercialys (France) – which are country-specific; and Merlin – which owns Spanish real estate predominantly in the office sector. We have also used the Morningstar European REIT Index as a comparator.

Figure 10 shows Lar España’s short- and long-term performance versus its peers. It has significantly outperformed most over a three-year and five-year period, in NAV terms. In share price total return terms, it has performed markedly better than all its European retail peers for all periods over one year.

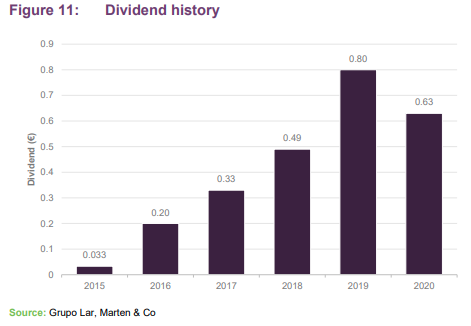

Dividend

Lar España pays a dividend once a year in accordance with the SOCIMI rules. It has consistently distributed a high level of dividend to shareholders since its launch and declared and paid a dividend of €0.63 per share in April this year, despite the impact of COVID-19. The manager says the dividend for 2021 will be less than in previous years and will depend on the final results and cash levels.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Lar Espana Real Estate.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.