The conflicts in Ukraine and the Middle East continued throughout April, with oil volatile on fears of an escalation to the conflict between Israel and Iran. Meanwhile, moderately improving figures have fuelled hopes for economic recovery in several markets. In a rather unexpected turn of events, US growth declined to its weakest rate in nearly two years, with GDP growing at an annualised rate of only 1.6% in Q1, versus expectations of 2.4%. Although, chief economist of Pantheon Macroeconomics, Ian Shepherdson, advised to ‘ignore’ concerns of stagflation. He outlined that a drop in GDP can be partly attributed to a rise in imports, meaning that US consumers have still maintained their strong purchasing power. Despite this, updated figures from the US Department of Commerce, indicated a jump in inflation of 3.4% in the first three months of the year, with such increases likely to push back the Fed’s plans for cutting rates.

“As sure as the spring will follow the winter, prosperity and economic growth will follow recession.” – Bo Bennet

As a result of the Eurozone’s gradual deceleration of consumer price inflation, the ECB may cut its rates as early as June, which would place it three months ahead of the Fed’s schedule. This would be a U-turn from last month’s position, as policymaker Fabio Panetta called for ‘progressive steps’, consisting of small cuts that the central bank could halt, should inflationary hikes occur. Despite the ECB’s encouraging change of tune, the Eurozone’s economic sentiment indicator fell to 95.6 from 96.2 in March, indicating that the European economy is yet to fully recover.

The UK economy has demonstrated some resilience, with Oxford Economics forecasting expansion of 0.3% on a quarter-on-quarter basis in Q2. Moreover, a S&P global survey revealed a rise to 54.0 in composite PMIs, an eleven-month high, signalling a potential rebound from the recent recession. In the equity market, strong commodity prices helped drive the UK large cap index to a record high.

| Click to read our guide to investment companies |

|---|

At a glance

MSCI Indices (rebased to 100)

The UK was the best performing of the indices that we follow. As US growth stalled and new inflation data was released, indices such as the S&P 500 and the Nasdaq Composite ended down in April. Bond yields also rose on the news and the gold price continued to climb.

European stocks ended the month down 1.49%, the first negative closing month since October 2023.

As the Bank of Japan kept interest rates on hold, the Japanese yen hit its lowest rate against the US dollar since 1990, closing at 160 on Monday 29th April.

| Indicator | 30 April 2024 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 87.86 | 0.4 |

| Gold (US$ per Troy ounce) | 2286.25 | 2.5 |

| US Treasuries 10-year yield | 4.68 | 11.4 |

| UK Gilts 10-year yield | 4.35 | 10.5 |

| German government bonds (Bunds) 10-year yield | 2.58 | 12.5 |

Global

(compare global investment funds here, here, here and here)

Zehrid Osmani, portfolio manager, Martin Currie Global Portfolio Trust – 24 April 2024

We continue to see opportunities in the eight mid-term thematic opportunities that we have described in recent years and which are listed below:

Green and alternative energy

Energy efficient infrastructure

Electric transportation – both EV and high speed railways

Healthcare infrastructure

Technological and geopolitical fragmentation

Cloud computing and cyber security

AI, robotics and automation

Metaverse and quantum computing

All of these themes benefit from significant investment support, from the private and/or public sectors, with some of these investments being very long duration, making them attractive over the long-term time horizon that we focus on.

Three particular themes that we believe are important for investors to focus on currently, amongst the eight listed above, are energy transition, AI, and ageing population.

Energy transition captures the first three themes on our list, namely green and alternative energy, energy efficient infrastructure, and electric transportation.

AI received a significant boost in 2023, both from the excitement triggered by ChatGPT, an app that reached 100m users at the fastest pace ever achieved by any app, and from the outsized earnings achieved by Nvidia in the first quarter of 2023. Nvidia then continued to beat analysts’ consensus expectations in each of its subsequent quarterly reports, leading the market to realise that the demand for AI has been significantly under-appreciated. We believe that the focus on AI will remain significant going forward. We also believe that the potential for AI remains under-appreciated by the market fundamentally, but are also cognisant that themes such as this can generate outsized excitement, which can lead to valuations becoming disconnected from fundamentals. It is therefore critical, as always, to ensure that investors maintain valuation discipline, based on detailed fundamental assessments.

The AI mega-theme captures the last four themes that we highlight above, namely technological and geopolitical fragmentation, cloud computing and cyber security, robotics, automation and AI, and metaverse and quantum computing.

The final mega-theme, ageing population, encompasses and highlights the need for increased healthcare infrastructure, as the need for more healthcare grows.

These three mega-themes are bringing seismic changes to the economy, and have the potential to bring more innovation and disruption. They are captured in our mega-trends framework, which is illustrated in the annual report and accounts, along with the themes that run through the portfolio.

. . . . . . . . . . .

Ben Lofthouse, fund manager, Henderson International Income Trust – 25 April 2024

The global economy has weathered increased interest rates better than expected and falling inflation might allow central banks to cut rates without a significant increase in unemployment. Falling interest rates with improving growth has historically been a relatively rare combination but one that can be positive for equity markets.

. . . . . . . . . . .

David Seligman, British & American Investment Trust – 30 April 2024

Equity markets in the UK and USA performed with a determined firmness in 2023, maintaining their close to all time high levels throughout the first three quarters. Then in the fourth quarter, equity prices broke out strongly, by over 20 percent in the USA, as inflation levels started to decline from their 2022 highs and the prospect of reductions in interest rates began to be foreseen, with the first in a series of rate reductions expected from the Federal Reserve in the USA in March 2023.

Further strong impetus was given to markets at this time from significantly improved results from technology companies in the USA with particular exposure to activities connected with Artificial Intelligence. These movements had the effect of lifting markets strongly as a whole, although equity price rises have since become more broadly-based as other leading companies have been able to show growing levels of profitability for 2023, recovering from the depredations of the Covid pandemic in 2021 and 2022.

Market strength over the last year seems, however, to have ignored the many and substantial challenges and uncertainties developed economies are facing politically, strategically, militarily and socially around the world. These include the continuing war in Ukraine, now into its third year; new instability in the Middle East with renewed and intensified Israeli and Palestinian conflict; a revanchist Russia threatening the post-WW2 settlement in Europe, political gridlock in the US Congress impeding the effective conduct of government business together with divisive and acrimonious elections due there at the end of the year, as well as in many major European countries including the UK; battles over the implementation of climate change policies while weather records are continuously being broken and damage to infrastructure, production and habitats is being experienced throughout the world; and the dangerous distortion of truth and real news through social media misinformation or AI- generated fakery to further malign political and social programmes or criminal enterprises to the detriment of free and open discourse. While markets seem to have so far ignored these important and future-defining issues, definite reaction is now being seen politically and socially, as societies have become increasingly polarised, populist politicians have been gaining traction and long held social norms have begun to be eroded.

Voters now show a high level of distrust in their politician’s ability to address their basic concerns – uncontrolled levels of immigration, lack of economic growth, high rates of tax, stagnation in middle class incomes, lack of investment and trust in government – precipitating movements towards political extremes and a hollowing out of the liberal political middle.

It goes without saying that these unfortunate and regressive developments will inevitably have a fundamental and destabilising effect on future economic outcomes, democratic freedoms and continued social development in those countries where governments fail to provide real leadership rather than gesture politics and fail to respond to their citizens’ basic needs and expectations.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Guy Anderson and Anthony Lynch, portfolio managers, Mercantile Investment Trust – 11 April 2024

Financial markets continue to be heavily influenced by the inter-connected forces of inflation, monetary policy, and the impact of these upon economic growth expectations. While the domestic economy through the end of last year was undoubtedly lacklustre, and the UK may have experienced a recession, evidence thus far would suggest that this is more likely behind than ahead of us, and if so, it will have proven to have been far briefer and shallower than most were anticipating. Indeed, employment levels have remained resilient and following 13 consecutive months of real wage declines, the average consumer has now experienced over ten months of real wage growth. Coincident with this, consumer and business confidence indicators are pointing to an improving picture, which could lay the foundations for greater consumer demand, more business investment, and thus lead to a better environment for corporate earnings growth.

Any improvement in such prospects could yield healthy market gains, as the prevailing negative sentiment and uncertainty over the outlook is evidently reflected in valuations, with the UK market trading at a steep discount to both its own history and relative to other developed markets. Within the UK, given their greater economic cyclicality and sensitivity to interest rates, mid-and small-caps are trading at a discount relative to their usual level versus large caps.

. . . . . . . . . . .

Laurence Hulse, investment director and founder, Onward Opportunities, 10 April 2024

2023 was a different year than most investors expected. Investors began 2023 fearing inflation and the consequences of higher, for longer, interest rates. While the demise of Silicon Valley Bank (“SVB”) and the life support given to other regional banks seemed to justify their fears, the vital signs of US economic health persisted, and policy rates continued to rise until August. This drove increasing levels of pain and discounting in equities, especially at the most economically sensitive smaller company end of the spectrum, which became particularly pronounced in the UK around Halloween in October. Perhaps not by coincidence just a few weeks later, following some Federal Reserve smoke signals, investors began believing rates had peaked. Bond yields tumbled, risk assets rose as short positions were closed, and the bond rush subsided. Financial conditions and liquidity eased, the dollar weakened, and investors rolled out the red carpet to greet the improbable soft landing. The ‘immaculate disinflation’ became investors’ base case scenario.

In the coming year, circa 40% of the world’s population will vote in national elections, including both its wealthiest and most populous nations. The UK’s election, likely in FY24Q4, will be of little consequence for global investors, most of whom wrote off the UK as a home for proactive investment long ago. Having won last year’s Most Improved Player Award for Political Stability, this year, a smooth UK political transition could be all that is required for both direct and portfolio investors to tie a bow on the UK as a place to increase their position sizes. In stock market terms last year, the UK remained a laggard by global standards.

The S&P 500 was pipped by Tokyo’s Nikkei 225 (+28% to +25%) in the major country indices stakes. The real story of the year, however, was the continued power of US Big Tech, with the NASDAQ 100 up over 50%. Within it, the newly crowned Magnificent Seven AI wonder stocks (the FAANGS minus Netflix, plus Nvidia, Microsoft and Tesla) were ahead by more than 100%, and ended the year accounting for nearly 30% of the market cap of the S&P 500 and 19% of the MSCI Developed World All Share Index – an index which comprises the largest 12,500 listed-companies across 23 countries. As a result, just seven stocks now account for almost US$12 trillion of market value (more than six times the size of the FTSE100), a degree of market concentration greater than the Dotcom Boom of 25 years ago and the Nifty Fifty of 50 years ago.

When these previous periods of excessive market concentration were unwound, the result was the multiyear outperformance of smaller companies and the value style. We remain vigilant for early signs that might suggest the coming years might follow such a pattern.

The UK’s AIM 100 index ended the year down a disappointing 8% but also rallied from its post-COVID low in October 2023 by 8%. The more value-laden FTSE Smaller Companies Index, broadly unchanged over 2023, rose by 13% from its October 2023 low point. These moves have yet to constitute a new trend. They offer signs of hope that normalised rates will establish a divergence of equity returns that reward active stock picking over trend following and indexation, a trend, if established, that could significantly re-rate the UK small and mid-markets.

As we enter a year of elections, the issue of fiscal dominance and bond yields remain essential drivers of financial market performance. 2023 ended with US and UK 10-year yields broadly unchanged. However, this masked a roller coaster ride. Capital poured into sovereign debt during the year, offering the prospect of a real return for the first time in many years and crowding out investment for other assets. The lesson from 2023 is that bond markets influence equity valuations, but quality equities can adapt and survive, as we saw in a number of our investments.

. . . . . . . . . . .

Colin Clark, chair, Merchants Trust, 3 April 2024

As ever it is difficult to predict the ‘macro’ direction for economies and markets. There are many factors which may influence short term sentiment and consequential market movements and returns. However, fortunately, that is of less consequence to the Merchants’ investment strategy which is predicated on good stock picking with a long-term time horizon – finding individual companies which have good prospects, but which are trading below our manager’s estimation of their intrinsic worth.

The negative sentiment which has overshadowed the UK market in recent years has led to a market which is lowly-rated by international comparison and by extension, to a lowly-rated Merchants portfolio. With the manager’s value ’tilt’ in terms of share selection this has been a drag on recent performance as noted earlier. Our investment managers, however have a strongly held ‘glass half full’ attitude to the current UK market outlook. They remain optimistic for the long-term for the UK market and believe that there is considerable pent-up value in the market. That value, they believe, is both evident in the aggregate valuation of the market compared to global peers, but also between the more lowly-priced and the higher rated segments of the UK market.

. . . . . . . . . . .

Asia Pacific

(compare Asia Pacific funds here, here and here)

Pruksa Iamthongthong and James Thom, abrdn Asia Dragon Trust – 22 April 2024

After a challenging 2023, we are turning incrementally more positive in our outlook for Asian equities this year.

In China, sentiment has been far weaker than we would like, given that the fundamentals of our holdings are intact. There are still headwinds, especially in the property sector, while geopolitical risks linger. It is a positive that Beijing signalled its intent to support the economy at the recent key policymaking session in March, announcing a reasonably ambitious growth target of around 5% for 2024. We view China as oversold and we are seeing value in some quality stocks that have been indiscriminately sold off despite delivering on growth and earnings.

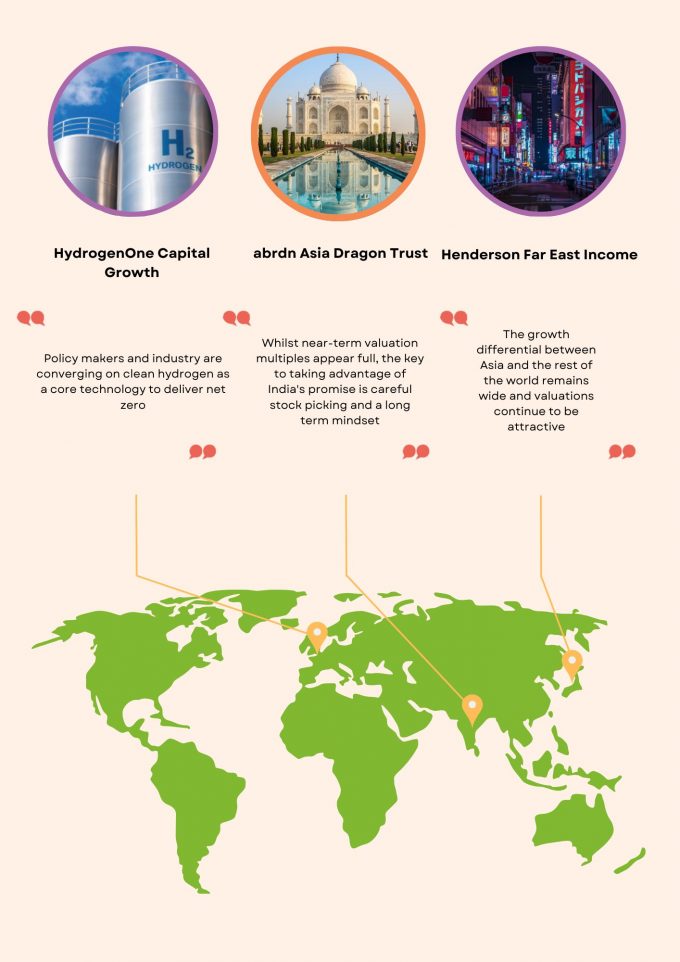

Meanwhile, we expect a lot more from India. Earnings growth is running at solid double digits. The direction of policy and reform looks set to continue with Prime Minister Narendra Modi likely to be re-elected for a third term in the upcoming national polls. India, too, is a market of 1.4 billion people, most of whom are below 35 years old. Such a rich demographic dividend will see an emerging middle class with rising affluence, alongside economic growth. Whilst near-term valuation multiples appear full, the key to taking advantage of India’s promise is careful stock picking and a long term mindset, which aligns well with how we invest.

Elsewhere, Southeast Asia is often overlooked as a rich source of quality companies. We continue to regard these countries as beneficiaries of shifting global supply chains with supportive government policies and favourable cost structures, and they also represent a large consumer market of about 700 million people.

In the Asian technology sector, our stock picks have been strong. As AI-related apps and chips start to proliferate, rising demand in terms of usage and complexity will boost the semiconductor and consumer electronics segments.

. . . . . . . . . . .

Sat Duhra, fund manager, Henderson Far East Income – 25 April 2024

Whilst the challenges faced by China dominate headlines, there are numerous bright spots which we expect to be positive for performance. We expect this to continue as the likes of India, Indonesia, Taiwan and South Korea provide compelling exposure to growth themes in our region. There is also evidence of dividend growth in areas such as Indonesian banks, Korean corporate reform names and Taiwanese technology companies. If the recent stabilisation in China macro-economic data develops into a more positive trend, then this, along with potential interest rate cuts, in the second half of 2024, could provide a further boost to our markets.

The growth differential between Asia and the rest of the world remains wide and valuations continue to be attractive. We are observing significant opportunities to accumulate quality companies which are growing their earnings and increasing their dividends across many of our markets. The outlook for dividends in the region remains robust. Positive free cash flow generation alongside the strength of balance sheets, with record cash held by corporates, provides a strong backdrop across several sectors and markets across our region.

. . . . . . . . . . .

Japan

(Compare Japanese funds here and here)

Masaki Taketsume, portfolio manager, Schroder Japan Trust – 16 April 2024

The Japanese equity market has shown encouraging strength this year, with the Nikkei 225 Index finally exceeding the bubble-era high seen in December 1989. The conditions are now in place for a bold new era of prosperity for the Japanese stock market.

Importantly, the market’s rise has been supported by strong and improving corporate fundamentals. Profits from Japanese companies are generally heading in the right direction, with the most recent quarterly earnings season seeing plenty of upwards revisions of profit estimates. The performance of domestically-oriented companies has been particularly impressive, with many companies demonstrating strong demand and displaying signs of regained pricing power. After years of entrenched deflation, the importance of this last point should not be underestimated.

Meanwhile, thanks to the ongoing efforts of the Tokyo Stock Exchange, corporate governance reforms have continued. After a long period of overseas apathy towards Japanese equities, these reforms are now resulting in growing interest from the global investment community. The unwinding of cross-shareholdings is progressing and there has been an increasing number of Japanese companies involved in corporate actions. According to the Nikkei newspaper, the number of take-over bids in Japan was 65 in 2023, up by 35% year on year and the highest figure since 2000. Notably, share buy-backs have continued to increase, and by the end of February 2024, the share buy-back plans announced by Japanese companies for the fiscal year to March 2024 had already exceeded the level of the full preceding fiscal year to March 2023. We would expect these trends in corporate activity to continue as more and more companies are compelled to take steps to improve their returns and address persistent under-valuations.

There has also been an increase in the level of Japanese retail participation in the equity market as a result of the revised tax-exempt scheme for individual investors, known as NISA. The revised NISA scheme now allows individual investors to invest more assets with tax exemptions for an unlimited period of time. The changes in the NISA scheme came at an ideal time, just as retail investors started to recognise a shift towards a more inflationary environment in Japan and thus the need for the retail investor to move money out of their bank deposits and to rotate it towards investment in the equity market.

. . . . . . . . . . .

North America

(compare North American funds here)

Dame Susan Rice, chair, North American Income Trust – 2 April 2024

At the time of writing, investors expect the Fed to end its rate-hiking cycle and begin monetary easing in 2024. This is despite the Fed’s somewhat conservative tone as its favoured measure of annual inflation, the core Personal Consumption Expenditures Price Index, remained above 2%. Additionally, conflict in the Middle East has increased the risk of a resurgence in inflation, due to possible oil supply disruptions and rising shipping costs. While a robust US economy helped the country to avoid a recession in 2023, the risk has not completely gone. The Board and Investment Manager believe that a mild recession or soft landing remain in the balance. Meanwhile, the upcoming US election may add to market volatility, as investors remain focused on potential changes to government policies. Added to this, geopolitical issues elsewhere in the world could affect the global economy and financial markets in general.

. . . . . . . . . . .

Global Emerging Markets

(compare global emerging markets funds here)

Omar Negyal and Isaac Thong, portfolio managers, JPMorgan Global Emerging Markets Income Trust – 3 April 2024

Emerging markets were generally weak over the six months ended 31st January 2024. The Company’s Benchmark declined by 5.0% over this period, due mainly to the poor performance of the Chinese equity market, where investor sentiment was undermined by concerns about the economy. The widely anticipated post-pandemic rebound failed to materialise as consumer confidence, and hence consumption, were adversely impacted by ongoing problems in the property sector, after a prolonged period of overbuilding and excessive leverage. The Chinese government’s apparent reluctance to take decisive steps to solve these problems is exacerbating consumer caution.

We recognise that China faces fundamental challenges, including not only weak consumer demand, and a stricken property market, but also an increasingly fractious relationship with the US, but nonetheless we still see value and opportunities in some areas of the Chinese market. Valuations are low following persistent declines over the past three years, and, in addition, some corporates are returning more cash to shareholders via higher dividend payments and share buybacks – something which is of particular interest to income investors like us.

Elsewhere, Taiwan performed well, supported by the popularity of its technology stocks. The fundamentals of this industry generally look favourable, and some Taiwanese tech companies are also seeing stronger demand due to exposure to the artificial intelligence (‘AI’) revolution. Mexico also did well. The economy is performing strongly, helped by its proximity to the US, as companies look to diversify and strengthen their global supply chains by moving production closer to their principal markets.

Overall, we have held a cautious view around the potential risk of a slowdown in the US economy, which would dampen global demand. However, we saw little sign of this during the six-month review period. The US Federal Reserve held interest rates steady as inflation pressures eased, and many investors are now expecting rates to begin falling this year.

. . . . . . . . . . .

Vietnam

(Compare country specialist funds here)

Le Anh Tuan, lead portfolio manager, Vietnam Enterprise Investments Limited – 29 April 2024

After a tough 18 month period, investors should be able to look forward to a much brighter outlook in 2024. In terms of the macroeconomic outlook, Vietnam’s stability remains a strong point for the economy with inflation remaining manageable, averaging 3.3% in 2023, and the foreign exchange rate relatively benign. Much of the Government’s focus is now on growing the economy. From a monetary perspective, Vietnam is now in full-easing mode with the interest rate falling back to 2022 level. The SBV has also granted full credit growth quota to the banks from the start of the year instead of on a quarterly basis, ensuring there is no shortage of capital for the local economy. After fiscal spending hit a record high in 2023 of US$27.8 billion, the Government once again put forward an ambitious plan of fiscal spending of over US$28 billion. At the same time, various task forces of top-ranking Government officials, some of whom were set up in 2023, were asked to directly work with local corporates to resolve the legal issues that have historically hamstrung private investments. For 2024, the Government has set a GDP growth target of 6.0%. Whilst there might be some remnants of challenging times earlier on in the year, VEIL believes investors can look forward to an accelerating growth outlook for Vietnam in 2024

. . . . . . . . . . .

Commodities and natural resources

(compare commodities and natural resources funds here)

Howard Myles, chair, Baker Steel Resources – 26 April 2024

The outlook for raising mining development finance is expected to remain challenging in 2024 albeit with some improvement beginning to emerge. Whilst investors have been firmly in “risk off” mode in recent years, now that interest rates appear to have peaked and as monetary policy starts to ease we are hopeful that the picture will improve in the second half of this year. High real interest rates in the fight against inflation have been a significant headwind for most if not all financial assets and the prospect of lower rates ahead is encouraging for our sector, which as we know tends to be particularly cyclical.

However some risk remains that central bankers may be overly hawkish and that a soft landing for the world’s leading economies is not achieved. Higher energy costs in Europe following the Ukraine war do seem to be taking their toll on the German economy in particular, traditionally the powerhouse of the Eurozone. Nevertheless, the structural case for those metals and commodities essential for the electrification and decarbonisation transition continues to strengthen. Heightened geopolitical tensions will likely increase trends towards de-globalisation and the security of supply of critical minerals as well as potentially significant re-armament programmes, should underpin commodity prices in the longer term.

. . . . . . . . . . .

Environmental

(compare environmental funds here)

Jon Forster, Fotis Chatzimichalakis, and Bruce Jenkyn-Jones, managers, Impax Environmental Markets – 10 April 2024

Electrification

Some of the lowest-hanging fruit to reduce greenhouse gas (“GHG”) emissions can be delivered through electrification. Powering processes with electricity can deliver dramatic efficiency gains, with some estimates concluding that electrifying global energy systems could reduce total energy demand by around 40%.

Yet many “non-power” sectors still rely on fossil fuels as a source of energy. Even in a developed market like the US, electricity accounts for only slightly more than one-third of primary energy consumption.

The decarbonisation opportunity therefore lies in broadening electricity’s use cases across sectors. According to the IEA, emissions from transport, buildings, and industry account for 56% of all CO2 globally. While Electric Vehicles (“EVs”) are now commonplace, global penetration remains low. By contrast, the electrification of heating and cooling, through heat pumps, and the electrification of industrial processes, is in its infancy.

Electrification also has the potential to transform the energy used in buildings. Russia’s invasion of Ukraine in 2022 exposed the geopolitical and economic vulnerabilities of fossil fuel dependence, boosting uptake for alternative solutions. According to the IEA, global sales of heat pumps grew by 11% in 2022. In the near-term, normalisation of subsidies and increased competition may present some headwinds, but long-term growth potential remains strong.

The pace of electrification has increased most rapidly in areas where technological advances have made it most compelling. In transport, the battery packs that power EVs now cost about one-tenth of what they did 15 years ago. As a result, almost one-fifth of new cars sold globally in 2023 are expected to be EVs. While concerns about the cost of living have slowed EVs’ growth of late, with continuing cost reductions enabled by technological innovation and wider adoption, EVs could hit price parity with internal combustion engine models in Europe over the course of 2024.

As these sectors electrify, demand for sustainable electricity will increase. The EU Commission expects European power demand to rise 60% between now and 2030,5 with renewables contributing much of the supply.

At the same time, a range of ‘midstream’ technologies will play an important role in storing, transforming and delivering clean power to end users. Electricity grids originally designed to connect consumers to local power stations will need to become larger and more flexible. They will also need to connect across greater distances, with greater penetration of renewables increasing the need to move power from where it is generated to where it is consumed. Energy storage facilities and smart demand-side management will likewise need to increase to deal with renewable power’s intermittency.

This additional investment is required over and above increasingly vital maintenance spend. By way of example, the U.S. Department of Energy found that 70% of U.S. transmission lines are more than 25 years old in its last network-infrastructure review in 2015. Lines typically have a 50-year lifespan, after which efficiency drops off and operating costs rise. In this vein, November 2023 saw the EU announce its “Grid Action Plan”, which seeks to ease permitting for transmission and distribution networks, improve financing and reduce grid interconnection queues.

Solar

Within the Company’s portfolio, the solar energy sector faced some of the strongest headwinds in 2023. A combination of higher interest rates, new US regulation, and inventory destocking interacted with a sharp drop in European power prices. As a result, many stocks which had reached all-time highs in the wake of Russia’s invasion of Ukraine fell sharply.

Higher interest rates reduce demand for residential solar by raising the cost of financing. In the US in particular, most domestic solar installations are paid for with a long-term loan. Higher upfront prices have been lifted further by soaring wage costs for installation. In Europe, the price of electricity has plummeted from recent peaks – see chart below. This dynamic creates an increasingly long and unappealing payback period – how long it takes the system to pay itself off.

This payback period drew particular focus in the US state of California. New state regulations known as Net Energy Metering (“NEM”) 3.0 became effective in April 2023, and cut the export price for new systems by 75%, while also requiring the installation of a battery as storage. California matters because it represents almost two-fifths of the US residential solar installed base and has historically set the trend for US solar regulation.

Companies with European solar exposure were insulated from this regulatory headwind, and saw less impact from higher rates given lower levels of financing. However, unlike the US, Europe’s market can fall victim to Chinese oversupply. In 2023, Chinese manufacturers dumped an estimated 40GW of excess inventory (equivalent to a year’s worth of installations) into Europe. This effectively crushed pricing power even while underlying demand remained robust.

However, after a difficult year, the fundamental drivers for long-term growth in solar energy remain in place. These include incentives to decarbonise, higher household electricity consumption and a drive for self-sufficiency. In 2023, Bloomberg New Energy Finance (“BNEF”) estimates that new global solar PV installations will total 413GW – four-fifths more than in 2022 and far exceeding recent expectations.

Historically, investing in solar stocks has required a distinctly contrarian mindset. Market participants are flighty, with the type of short term focus usually reserved for hedge funds and speculators. The extent of the recent sell-off therefore occasions another look at the space. Companies with market-leading technology have quality business models and barriers to entry high enough to benefit from the industry’s long-term growth.

Policy

Recent macroeconomic and geopolitical changes have put an increased focus on energy security and the cost of living. As a result, policy measures which seek to create a more sustainable economy but involve upfront costs have been the victim of political pushback. In the UK, the most notable example came in September 2023, when Prime Minister Rishi Sunak rolled back the deadline for selling new petrol and diesel cars, as well as the phasing out of gas boilers.

This trend has been seen across geographies and partly reflects the vaulting ambition of targets set during COVID-19 – a time of lower economic activity and more stable geopolitics. However, it also reflects politicians’ willingness to use sustainability policy as a wedge issue on the campaign trail, even if the impact is limited in practice.

Across the board, incidences of real and direct policy change have thus far been limited with few long-term strategic shifts. Such developments ultimately amount to an understandable delay but do not change the destination. Existing regulations, consumer demand and corporate strategy also continue to be effective drivers of growth for environmental markets. Indeed, business leaders remain focused on competing long-term and some of the most vocal opponents of the UK Government’s measures were the car manufacturers.

Broad public support for environmental solutions also remains high, particularly when the financial and geopolitical benefits are made clear. This continued level of policy support for environmental markets was evident at COP 28, November’s UN conference on climate change held in Dubai. The meeting produced an historic agreement on the need to “transition away from fossil fuels in energy systems”. Over 130 countries also endorsed the Global Renewables and Energy Pledge to triple renewable energy capacity and double the rate of energy efficiency improvements to 2030, specifically calling attention to permitting and ensuring cross-border grid interconnections.3

The event was also a testament to the power of collective engagement. As part of the Farm Animal Investment Risk and Return Initiative (“FAIRR”), Impax is one of several stakeholders that has campaigned for a greater focus on the role food systems play in climate change. Historically absent from COP agreements, this year saw a whole day devoted to food and agriculture.

At COP 28, the UN’s Food and Agriculture Organisation launched a road map to bring the world’s food production in line with global climate goals. A corresponding declaration on sustainable agriculture also demonstrated that governments are increasingly willing to co-opt entire sectors into their national plans for decarbonisation.

Looking forward, one of the biggest determinants of environmental policy is likely to be the US Presidential Election. At the time of writing, Donald Trump is the presumed Republican candidate, and has made his opposition to the Inflation Reduction Act – which provides funding, as well as broader legislative support for renewable energy – well known.

Impax views Donald Trump’s chances of frustrating the legislation as limited. Doing so would require a comprehensive victory in the Senate and Congress, while also reversing significant spending and job creation in many Republican states. Since passage of the Inflation Reduction Act in 2022, more than US$160bn has been committed by the private sector to new clean energy manufacturing facilities in states that often or sometimes have Republican congressional majorities.4 State-level political dynamics will matter too. Today, 17 US states have legally binding 100% clean energy targets. These cannot be undone at the federal level. Nevertheless, the prospect will continue to hang over relevant sectors until November 2024 at least, affecting valuations accordingly.

. . . . . . . . . . .

Debt – loans and bonds

(compare debt – loans and bonds funds here)

NB Global Monthly Income Fund – 16 April 2024

Non-investment grade credit markets finished the reporting period with strong returns despite some volatility earlier in the year from a relatively short-lived mini-banking crisis and uncertainty around economic growth and the path of interest rates. The strong 2023 returns were boosted by risk-on sentiment late in the year as markets priced in rate cuts for 2024 despite resilient economic data. For calendar year 2023, high yield bond and loan market returns were among the highest since 2019 and the Great Financial Crisis, respectively. Yields declined across fixed income during the final quarter of the year, primarily driven by a fall in 10-year U.S. Treasury yields. The yield on U.S. 10-Year Treasuries ended December at 3.87%, declining 71 basis points since the end of the third quarter and roughly flat compared to the start of the start of the year. Yields on 10-year U.K. Gilts and German Bunds also declined over the fourth quarter and were also down compared to the beginning of 2023. Broadly, non-investment grade issuer aggregate fundamentals of EBITDA growth, free cash flow, interest coverage and leverage remain in somewhat favorable ranges and earnings generally came in better-than-feared, but some lower-quality issuers have been experiencing earnings pressure more recently.

The loan market saw very strong results over the reporting period driven by higher base rates, resilient economic growth, lessening inflation pressures and a late-year risk-on rally which propelled weighted average bid prices to move up 379 basis points in the year to close at $96.23. Over the reporting period, the Morningstar LSTA U.S. Leveraged Loan Index (“the LLI”) returned 13.32% (in USD terms) and the Morningstar European Leveraged Loan Index (“the ELLI”) returned 13.42% (excluding currency). Lower quality loans in the LLI outperformed the highest quality as securities rated BB, B and CCC and below returned 10.18%, 14.82% and 17.54%, respectively. The Morningstar U.S. Leveraged Loan 100 Index-a measure of the largest and most liquid loan issuers-returned 13.20%, slightly underperforming the overall index. The Second Lien Loans index returned 22.74% over the period.

The global high yield bond market also had strong returns in 2023 as credit spreads tightened materially over the year. The ICE BofA Global High Yield Constrained Index (Total Return, Hedged, USD) returned 12.97% for the full year 2023. In global high yield, lower quality securities, such as those rated CCC & below and B in the ICE BofA Global High Yield Index, outperformed with returns of 17.70% and 14.18%, respectively, whereas BB securities were up 11.36%.

CLO debt spreads were meaningfully tighter in the final quarter of the year, as economic data and statements from the Federal Reserve later in the year indicated that there would be no further rate hikes, with the market increasingly gravitating toward a “soft landing” economic scenario and the potential for future rate cuts later in 2024. Secondary non-investment grade CLO trading volumes declined 13% quarter-over-quarter. The CLO BB index gained 7.33% during the fourth quarter and was up 24.52% for the full year 2023. Returns have been driven approximately two thirds by coupon income and one third by price appreciation. As of the end of December, higher quality CLO BBs were trading around S+675 in secondary markets. Despite macro and geopolitical concerns through the year, we continue to be fundamentally confident in the significant structural protection provided against credit losses in the underlying loan portfolios. CLO structures in general, and CLO BBs in particular, have showed themselves once again to be very robust.

. . . . . . . . . . .

Tim Scholefield, chair, Invesco Bond Income Plus, 2 April 2024

I have little doubt that inflation statistics will remain a key focus of attention over the next six months or so. Optimists will hope that inflation is on track to meet central bank targets and hence that the upward march of interest rates is reversed. An outcome where inflation is tamed without a substantial contraction in economic activity would provide a favourable backdrop for high yield markets in 2024.

The potential for a ‘soft landing’ to be derailed cannot be dismissed. Military conflict now seems to be the norm with fighting in the Middle East escalating and no resolution in sight to the war between Ukraine and Russia; the humanitarian cost of conflict is appalling. The economic impact includes a threat to global supply chains and hence the danger of fresh inflation setbacks. Elections in the US and probably the UK add to the uncertainty clouding the outlook for high yield markets in 2024.

Economists have long argued that the full impact of changes in interest rates might only become apparent after the elapse of ‘long and variable lags’. This notion may well go someway to explain why the UK has thus far avoided a sharper slowdown despite the jump in interest rates over the past eighteen months. Consumer confidence remains fragile and there are signs that the labour market is softening. We expect corporate failures to increase over the next twelve months and global economic growth to be modest at best. Having flatlined for much of 2023 the UK economy is vulnerable to further setbacks.

. . . . . . . . . . .

Hedge funds

(compare hedge funds here)

Portfolio analysts, Third Point Investors – 22 April 2024

On a fundamental basis, the impact of higher rates has the potential to create widespread credit stress in high yield. According to a recent Bank of America study, 40% of all B/CCC issuers (roughly half the market) will be free cash flow negative as they refinance maturing debt with more expensive debt due to higher interest rates. It is also worth noting that this analysis, done at the beginning of 2024, assumed that the U.S. Federal Reserve would cut interest rates by 250 basis points as was being projected by the market at the time. It is becoming more probable that that the Fed cuts do not match those expectations or, if they do, they are accompanied by economic weakness which would hamper corporate cash generation. This may or may not lead to large increases in defaults, but it is difficult to see how there will not be increasing credit stress.

. . . . . . . . . . .

Insurance and reinsurance

(compare insurance and reinsurance funds here)

Life Settlement Assets – 29 April 2024

The economic landscape of 2023 has been characterised by higher interest rates, increased inflation, and elevated uncertainty, casting the shadow of a potential recession. Despite this turbulent environment, the outlook for continued growth in life settlements remains promising, propelled by several positive factors.

One significant driver is the surge in the U.S. inflation rate, leading to a corresponding increase in insurance premiums This rise has rendered some policies financially burdensome to maintain. Even for those who can afford to uphold coverage, the diminishing purchasing power of the death benefit due to inflation has become a concern Consequently, policyholders may opt to sell their policies and reinvest the proceeds elsewhere.

The escalating long-term care costs, which have witnessed a notable 68.79% increase since 2004, present another catalyst for the growth of life settlements. This financial strain has prompted many seniors, who typically bear the highest life insurance premiums, to sell their policies to cover the escalating costs of care. This trend is anticipated to intensify, given the impending surge in long-term care expenses resulting from the aging Baby Boomer population, commonly referred to as the “silver wave,” requiring increased care amid a labour shortage in nursing homes. The ensuing interest in care services may lead to a surge in care costs, further augmenting the demand for life settlements among seniors.

Indeed, the demographic shift is set to play a crucial role, as the U S senior population is projected to grow by 38% between 2015 and 2025. A considerable portion of this demographic lacks sufficient retirement savings to replace their working income. Approximately 50% of seniors, estimated to have life insurance, can leverage these assets by liquidating life insurance policies to generate essential funding for retirement. This confluence of factors suggests a positive trajectory for the life settlement market in the midst of broader economic uncertainties.

. . . . . . . . . . .

Renewable energy infrastructure

(compare renewable energy infrastructure funds here)

Manager, Gresham House Energy Storage – 26 April 2024

National Grid ESO and the Balancing Mechanism

The trading and revenue environment remains challenging for BESS in Great Britain as skip rates have not significantly improved since the launch of the Open Balancing Platform (OBP) in December 2023. They remain, in our view, at high levels of over 80%, with Modo Energy estimating it to be over 90% in March 2024, i.e., ESO is not using BESS when offering capacity at competitive prices, at least 80% of the time. According to the Energy Storage Network, this cost the consumer £150mn in 2023 alone.

We understand that the reason BESS are still being skipped, despite the launch of OBP, is because there are other improvements in the control room required to unlock lower skips. We continue to actively engage with ESO to facilitate solutions to these issues.

We have seen the launch of OBP, the launch of Balancing Reserve (BR) and expect to see Fast Dispatch launched in Spring 2024. In addition, to try and lower skip rates, ESO has decided to change the ’15-minute’ rule which limits BESS trades to a maximum of 15 minutes to a maximum of 30 minutes effective from 12 March 2024. As a majority of BM instructions are for more than 15 minutes, this is a very positive development as it encourages more despatch of BESS.

BR gives BESS the opportunity to pre-contract their capacity in the day ahead market, in a competitive forum for BESS and gas-fired generation (for the first time since the Reserve from Storage trials in 2020). This means BESS can be “seen” and used by the Control Room ahead of real time. This represents a new revenue stream for BESS and also ensures less gas-fired power hits the market, leading to lower skip rates in real time. BR is intended to replace Regulating Reserve, through which gas-fired generation is currently reserved.

The first 10 days of Balancing Reserve saw batteries win 45% of all volume in the service. Modo’s Great Britain BESS index showed revenues increased by 48% compared with the 21 days prior to the launch of the service, with Balancing Reserve accounting for 12% of revenues post launch. Currently only 400MW is being procured through the service but National Grid ESO have indicated that they aim to procure up to 2.5GW during peak periods next winter through BR.

Quick Reserve will replace the existing STOR, Fast Reserve, and Operational Downward Flexibility Management Services sourced from gas and diesel peakers today. It is primarily for restoring grid frequency to 50Hz after a large deviation and will complement the Dynamic frequency response services which BESS already participate in. Unlike the previous frequency restoration services, Quick Reserve will be open to all assets including batteries and it will operate as a single service, providing greater market transparency. Due to the quick response required, BESS are expected to be the primary technology for this reserve product when it launches in Summer 2024. Reserve markets are expected to be a significant driver for improved utilisation of BESS assets and removes one of the major barriers today being the ability to contract BESS ahead of real time.

We have seen a significant volume of coal used over Winter 2023/24, further adding to oversupply pressures and flattening volatility. A dispensation was provided for coal fired plant to run for a further period due to the cost-of-living crisis and concerns over energy scarcity in 2022. This dispensation expires in September 2024 and will never repeat. This will mark a significant milestone for the transition to clean energy: having driven the industrial revolution since its beginning and forming the majority source of electrical generation throughout the 20th century up until the “dash for gas” in the 1990s, in the next few months coal will be gone from the Great Britain grid.

Finally, the overuse of gas assets by ESO in the BM, exacerbated by current low gas prices, is reducing day ahead wholesale price opportunities. Improvements in the BM will therefore also see greater imbalance price volatility and a return to higher volatility in the wholesale markets.

Electricity demand

Following a period of demand reduction, we have seen demand stabilise in 2023.

Since 2005 annual electricity demand in the UK has been decreasing as energy intensive heavy industry has decreased and electrical goods such as lighting have become more energy efficient (especially due to LED lighting). This gradual decline in demand has led to an increasing oversupply in the market as older fossil fuel assets are slow to retire (and seek to extract as much revenue at the end of their lives) and the rate of build out of renewable energy increases. The spike in gas prices following Russia’s invasion of Ukraine extended this downtrend.

Oversupply flattens volatility in power prices as energy scarcity occurs less frequently. The growth in electric vehicles and domestic heat pumps electrifies energy consumption and replaces oil and gas consumption.

This will see demand rise; the UK’s millionth battery EV was sold in January 2024, and the highest volume of monthly EV sales [was] in February 2024.

In National Grid’s 2023 Future Energy Scenarios publication, in the three scenarios which achieve net zero by 2050 (Customer Transformation, System Transformation, and Leading the Way) demand increases by at least 40% by 2035 and 137% by 2050 from the stated 2022 levels. Even under the Falling Short scenario, where Net Zero is not reached, demand increases by 30% by 2035 and 99% by 2050. This large-scale increase in demand will rebalance supply and demand and (a direct consequence of the increased renewable generation in the power mix) increase volatility to market power prices, thus improving battery revenues.

Electricity supply

Since Summer 2023 we have seen the reintroduction, albeit temporary, of sustained use of coal for power generation on the UK grid. This has come despite wind curtailment and ever cheaper, cleaner technologies being available to generate electricity at all times. The reason the Great Britain grid has continually used c1.8GW of coal from the Ratcliffe-on-Soar plant, the last coal plant in the UK, is because National Grid scheduled it, regardless of cost merit or carbon emissions, to use up remaining coal stocks before Ratcliffe is permanently taken off the system by September 2024. The effect of this has been to distort markets as coal has been used to provide flexibility by turning up and down generators as needed. This has both crowded batteries out of the flexibility market and flattened volatility in general.

Natural gas also continues to be used in large quantities in both the wholesale market and, more importantly for batteries, in the Balancing Mechanism (BM). Much of the time gas is taken out of merit (i.e. it is selected even though it is more expensive than other market participants such as batteries) in the BM to fulfil National Grid’s Regulating Reserve requirements.

Regulating Reserve gives National Grid reserve capacity (both headroom and ‘footroom’) as actual supply and demand almost always differ from their forecasts even a few hours ahead of real time. Through Regulating Reserve, gas-fired generation is “warmed up” when required and dialled up to a partial output level so that, for example, when it comes to the evening peak in demand, it can be turned up or down. The limitation of gas-fired generation is that it takes time and is costly to warm up in order to generate the required response. This means the market is oversupplied in the afternoon and evening due to this out-of-merit power being run for long warm up periods meaning that cheaper batteries are skipped, blocking them from generating revenue in the BM. The new Balancing Reserve (BR) service, which reserves capacity in the day ahead, will help resolve this challenge as BESS start to outbid gas assets in BR.

At the end of 2023 there was 3.5GW of operational BESS capacity (source: Modo Energy). ESO predicts that 32GW / 55GWh will be needed by 2050 in their Consumer Transformation Future Energy Scenario demonstrating the value that they believe BESS offers and the substantial requirements for storage in future. Third party forecasters model the future capacity in the electricity system as one that is built on and dispatched in merit. As the market heads towards this, in the short term through improvements in the BM, battery revenues will see improvement as they are the most cost-effective solution. A more efficient market will see increased use of BESS and prove more cost effective (and lower carbon) for the consumer.

. . . . . . . . . . .

Ian Nolan, chair, Aquila European Renewables – 24 April 2024

We expect the macro-economic environment for 2024 to benefit from several positive cyclical catalysts, with the core assumption being that inflation in the European Union will continue to recede in the coming months. The easing of significant price increases across the board witnessed in 2022 and 2023 should lead to a further fall in inflation towards the European Central Bank’s inflation target of 2.0%. However, many trends including ageing demographics in the labour market, de-globalisation, energy shortages, disrupted supply chains, and higher defence spending as a result of the continued conflict in Ukraine, will ensure that inflation remains elevated compared to the last decade. Against this backdrop, in the absence of any exogenous events that could derail assumptions on inflation or the global economic situation, the market consensus is that central banks should begin to cut interest rates this year, reversing the steepest tightening cycle in over 40 years. Lower interest rates have the effect of reducing the discount rate applied to the DCF valuation of assets, thus increasing value – all other things being equal.

The past year also saw accelerated European and national deployment plans for renewables across most countries the Company is invested in, as governments recognise the urgency of renewable energy developments as a source of energy security and environmental progress, while also signalling increased stability and visibility over the regulatory landscape. Combined with a more favourable interest rate outlook, we expect this to bode well for the renewable energy sector.

. . . . . . . . . . .

HydrogenOne Capital Growth – 18 April 2024

Some 1.2GW of green hydrogen production was on line globally at the end of 2023, a 50% increase year-on-year. This includes the start-up of the 260MW Xinjiang Solar Hydrogen Project in China and new liquefied hydrogen facilities in the USA. In addition, there are some 35GW of further projects in development world-wide, an increase of 20% from 2022, which could result in over 40 million tonnes per annum of avoided greenhouse gas emissions.

Policy makers and industry are converging on clean hydrogen as a core technology to deliver net zero, improved air quality and enhanced energy security.

The Paris Agreement in 2015 has led at least 40 countries to set out hydrogen policies and US$70 billion of funding as part of net zero targets to deliver the energy transition.

In response to the Russian invasion of Ukraine, the EU has reshaped its energy policy to the REPowerEU 2030 plan, which calls for over 300GW of clean hydrogen by 2030, compared to 80GW in previous plans. Some €5.4 billion in hydrogen subsidies have recently been approved under Important Projects of Common European Interest (“IPCEI”), which are expected to unlock a further €8.8 billion of private investment. The Hy2Tech links 41 projects and 35 companies building out the hydrogen sector, and has qualified for IPCEI funding. The EU’s Hydrogen Bank began the auction of €800 million of opex subsidy to green hydrogen in 2023. There are additional sources of grant funding at a country level in multiple EU countries.

. . . . . . . . . . .

Hugh W M Little, chair, Downing Renewables and Infrastructure – 11 April 2024

The war in Ukraine will continue to have a major impact on power prices in Europe and the UK where gas supply is dominated by Russia. Consequently, the UK gas and UK power markets are likely to stay volatile as long as the uncertainty about the Russian gas supply continues.

Nordic Power Market

The Nordic power market was dominated by the falling gas and power prices on the continent, a cold spell resulting in demand increase and a delayed spring flood. Prolonged outages with Swedish and Finnish nuclear facilities also contributed. Consequently, the market remained volatile, albeit less volatile than for the last quarter of 2022. The variability in wind generation added to the volatility on the spot market. The news about the cracks in some the French nuclear facilities also resulted in some bullish news for the Nordic power markets at the end of March. The latter part of Q1 and the beginning of Q2 saw a cold snap in the Nordic regions. The weather then became warmer than is seasonally typical by the end of May, which resulted in the delayed spring flood and sudden hydro inflows at approximately twice the seasonal average. The high hydro levels combined with high wind and PV solar generation lead to very low (sometimes negative) spot prices across the Nordics and Europe. In June, prices increased due to high continental temperatures and lower precipitation, combined with reduced French nuclear availability and low renewable generation. However, prices decreased again in Q3 due to high precipitation. The spot market occasionally traded at negative prices because of low demand and high wind generation.

UK power market

Weather and LNG supply dominated the evolution of forward power prices in the UK throughout the year. Prices gradually came down from the previously reported extreme highs in September 2022. Power prices are now trading below the levels of just before the Ukraine war but still higher than the longer historical price range. The market witnessed a number of mini rallies due to industrial action in France, news about potential new cracks in French nuclear power plants, extreme temperature spikes on the continent in the Summer and news about potential supply issues in the gas markets. As cold weather combined with signs of tightness in physical supply, National Grid ESO ordered three coal-fired units to be readied for production. Potential gas supply issues included North Sea gas outages, threats to global gas supply due to potential industrial actions from Australian LNG workers and rising maintenance restrictions. These mini rallies were short lived, however, as overall gas reserves have been high due to a relatively mild winter and relatively wet summer, pushing prices down.

. . . . . . . . . . .

Property

(compare UK property funds here, here, here, here, here, here and here)

Lawrence Hutchings, chief executive, Capital & Regional

We have continued to see the impact of rising inflation and debt costs on business and consumer confidence. This is being mitigated by high employment, salary growth and higher levels of household savings. We have seen the early signs of respite in inflation and the cost of debt, along with some erosion in consumer savings. In previous economic cycles, these times of reduced consumer confidence have typically favoured sales of grocery and non-discretionary retail and services. Based on feedback from our retailers and our own footfall data we are seeing an increase in retail sales across much of our anchor store and speciality tenant base. Many have been able to pass on the full impact of inflation into prices and this will, over time, assist us in unlocking rental growth for our locations. The improvement in non-discretionary retailer performance is driving occupier demand.

Another feature of last year was the continued evolution in distribution of goods and services in the UK. The UK has one of the most mature online retail markets, with a share of just under 30% according to ONS data. Online sales as a percentage of total retail sales have been on a downward trend for the last two years, which is a sharp reversal from the Covid era which naturally accelerated channel shift in retail spending.

The store remains an important part of the majority of retailers’ distribution strategies as customers support store-based retailing and retailers benefit from lower costs per transaction. The new model prioritises the seamless integration of both channels.

Whilst the overall market share is high, non-discretionary and grocery sectors have online penetration of around 10%, despite the length of time this has been part of the retail landscape. Pharmacy and value retailers are often lower still, as these categories have lower margins and consumers have indicated a preference to use the proliferation of convenience store formats at transport interchanges and in town and city centres locally, especially in highly urbanised areas. These retailers are amongst the most expansionary and we continue to work closely with an increasingly wide cross section of non-discretionary and value based retailers wishing to locate or expand in our centres.

Inflation has had a significant impact on the cost of doing business as a retailer. Increases in staff costs and petrol, and therefore distribution, together with a higher percentage of product returns, has disproportionately impacted online retailers with several high profile business failures during the year. The lower unit cost store based retailing model still accounts for the majority of retail sales and informs or prompts purchasing decisions. In addition, consumers are increasingly drawn to the convenience of store based collection and returns which, in turn, are a lower cost last mile logistics solution for a retailer. This also provides retailers with the added benefit of a guest potentially buying something, or seeing something they then buy online later, whilst they are in store.

Several of the larger pure play online retailers are now seeking to create bricks & mortar store networks to better compete with those traditionally physical retailers who are successfully embracing both retailing channels. This benefits us as retailers take new, or reconfigure and right size existing, stores to ensure they are able to meet the demands of consumers in a competitive retailing landscape.

After 10 years of structural change, these are exciting times for physical retail with significant opportunities for retail platforms such as ours that understand and can capitalise on the operational intensity needed to evolve existing centres to reflect this new seamless commerce retailing dynamic.

. . . . . . . . . . .

Property advisor, Phoenix Spree Deutschland

The long-term outlook for Berlin residential property remains well underpinned. The current landscape of the residential construction industry across Germany suggests a significant decrease in new construction activity in the coming years which will exacerbate the existing market dynamics. Despite a longstanding shortage of housing, there has been a notable reduction in the initiation of new residential projects, with many existing projects facing postponement or cancellation. The ifo Institute estimate the number of residential construction companies operating in Germany, and building residential units, experiencing the termination of development projects in 2023 to be the highest since records began in 1991. As a result, the ifo Institute projects a decrease in apartments completed in Germany to 175,000 per annum by 2025, versus a Federal Government target of 400,000.

The economics of new construction are being challenged, following a 25% increase in construction costs over the past three years. This contrasts with sales prices for new-build residential, which have risen by an average of only 7% over the same period. These dynamics have resulted in a situation where, in many parts of Germany, tenanted multi-family properties are trading at values which are up to 40% lower than the cost of new construction. To the extent that new build is occurring, it is highly polarised, with a focus on high-end buildings commanding rental values that are out of reach for most tenants, or on social housing initiatives. The larger “middle-market” in central Berlin continues to be poorly served by new construction activity.

Absent a significant shift in German government policy to incentivise new build for the mid-market PRS sector, the supply-demand imbalance which currently exists will only grow wider. In a constrained Berlin rental market, characterised by positive net inward migration and vacancy which is currently near record lows, investors can be confident of the enduring stability of their rental income.

By contrast, a combination of “higher-for-longer” interest rates and a weakening German economy have presented significant headwinds for real estate values and transaction volumes. The Covid pandemic and the war in Ukraine heralded the onset of monetary tightening across the globe and prime residential yields have risen, from a starting point of below 2% in 2021, to 3.7% currently. Rental yields during the era of low interest rates had fallen to a lower level in Germany than in most European countries, and the adjustment in pricing as interest rates have risen has consequently been more pronounced. Notwithstanding the health of the rental market, growth in rental income has been insufficient to offset a broad-based decline in asset values.

Whilst consensus expert opinion now predicts that monetary tightening has come to an end, soon to be replaced by interest rate cuts, current transaction volumes and observed transaction values across the residential market have yet to recover. Real estate owners generally remain “net sellers” of assets as they seek to deleverage following asset value declines and refinance at rates which are likely to remain at more elevated levels than before the onset of the current real estate downturn. At the same time, uncertainty about the extent and duration of the interest rate cycle and associated correction in property values continues to weigh on capital deployment decisions for most potential institutional buyers.

The disequilibrium between investor sentiment on the one hand, and the robust health of the rental market on the other, will inevitably come to an end at some point. However, whilst declining interest and risk-free rates will be helpful, the precise timing of this remains difficult to predict.

. . . . . . . . . . .

Tony Roper, chairman, abrdn European Logistics Income

December 2023 saw the end of seven consecutive months of falling Eurozone inflation figures, resulting in the money markets adjusting their expectations. However with the deposit rate held at 4%, valuations continue to come under pressure. Looking forward, our Investment Manager believes that the most significant value correction is behind us and the negative pressure on yields, which has lagged the UK, will plateau later this year.

Future occupational demand looks set to be determined by two key trends: stabilising growth amongst eCommerce operators and a continued trend towards onshoring amongst manufacturers. The logistics market is characterised by rising occupier demand, limited supply in core markets and high barriers to developing new assets in prime locations.

The onshoring of operations should be a long-term trend over the next decade. While it could lead to a tangible boost in take-up in the near term, we do not believe it will result in the same explosive growth that the increase in online shopping led to over the last decade. Data from a European Central Bank survey points to an increasing number of firms expecting to increase their sourcing of production inputs from within the EU, compared to a declining number of firms sourcing their inputs externally.

The prime logistics markets in Germany, Netherlands, France, and Spain, where the majority of the portfolio is focused, continue to witness near-historically low vacancy rates. With speculative development expected to remain low due to increased costs and regulation, we expect vacancy rates to remain tight, which will keep upward pressure on indexed rents.

. . . . . . . . . . .

Jason Baggaley, fund manager, abrdn Property Income Trust

We expect the UK real estate market to bottom out in 2024 and start to improve in the latter part of the year and into 2025. A catalyst for an improvement in the fortunes for UK real estate will be the start of the interest rate cutting cycle, matched with lower prices, and the prospect of a far more positive real estate yield margin.

While the macro environment will continue to dominate in 2024, sector allocation will remain crucial. Polarisation in performance from both a sector and asset-quality perspective will remain a key differentiator for performance. Real estate refinancing poses a risk to our outlook in 2024, but we believe that the risk is more heavily skewed towards the office sector, given the amount of outstanding debt and lack of appetite for lending to this sector.

Sectors that benefit from longer-term growth drivers, such as the industrial and logistics sector, will continue to garner the most interest from investors. It is unlikely that there will be a material change in investor sentiment towards the office sector, but more attractively priced re-positioning opportunities will emerge over the course of 2024, with debt re-capitalisation and funds working through redemptions the most likely source of value. However, underwriting assumptions, particularly around capital expenditure, are crucial. Long income assets now look more attractively priced, and we anticipate there will be some good buying opportunities in this area of the market in 2024.

. . . . . . . . . . .

Richard Kirby, fund manager, Balanced Commercial Property Trust

2023 was a challenging year for UK real estate due to the macro-economic environment and a 15 year high in interest rates. Volatility in financial markets, uncertainty as to the interest rate outlook and persistently high inflation dampened investor appetite and the relative attractiveness of real estate.

UK real estate investment volumes totalled circa £40bn in 2023, a fall of 40% year on year. Despite the negative headlines around offices, they were the second most traded sector in 2023, accounting for approximately 24% of deal volume. The tentative emergence of counter-cyclical and opportunistic strategies has been supported by an occupational market that continues to display resilience and even growth, albeit this is increasingly nuanced by micro-location and asset fundamentals.

As income has driven returns, we have seen an increasing divergence in performance across the sub-sectors due to differing rental growth prospects. As a result, weaker office segments have lost market share to ‘beds, sheds, and meds’, being the sectors delivering rental growth founded on structural undersupply and positive thematic support. Industrials generated the highest rental growth over the year at 7.1% and were unsurprisingly the most traded sector. Retail warehousing, underpinned by low vacancy and a negligible development pipeline, supported positive rental growth over the year of 1.8% and is expected to gain further momentum in 2024.

All this is to say that delivering relative outperformance has become a more nuanced pursuit founded on disciplined management of both portfolio composition and the standing asset base. The notable absence of the distressed (or even motivated) selling of real estate assets has put the onus on returns being generated through proactive asset management and diversification of income streams. Crystallising rental growth through leasing initiatives, driving capital growth through refurbishments, enhancing occupational and investment prospects through asset repositioning relies heavily on expertise to leverage strong underlying asset and portfolio fundamentals.

. . . . . . . . . . .

Peter Pereira Gray, chairman, UK Commercial Property REIT

The improvement in property returns recorded in 2023 (whilst still overall negative) was led by the industrial and living sectors, both of which posted positive total returns for the year, counterbalancing the office sector which continued its decline as thematic headwinds remained. The lack of uniformity across the sectors has been notable and offered opportunities for diversified portfolio managers to orientate toward those sectors which would prospectively perform well.

The industrial market rebounded from a bruising second half of 2022, posting a positive annual total return of 4.1% by the end of the year according to the MSCI Quarterly Index. Yields stabilised so that capital value growth levelled out on an annual basis at the All Industrial level at –0.4%. London and the Southeast posted total returns of 3.2% and 4.0% respectively, and all regions posted positive capital value changes on an annual basis. Market rental growth has decelerated from the positive growth seen in 2022 as levels of supply and demand became more balanced.

The retail sector posted an annual total return of –0.1% to December 2023 according to the MSCI Quarterly Index. The sector enjoyed something of a year of two halves, with a relatively robust total return of 2.2% in the first half but reducing again in the second half as the cost-of-living pressures cemented themselves in consumer psychology. Consequential consumer spending habits and structural changes in the market continue to influence performance. Typically, value-conscious consumers have propelled discount retailers to the forefront of UK retail sales and much of the recovery was influenced by strong performance within the high-yielding shopping centres and resilient retail warehousing sub-sectors, with the latter posting consistent month-on-month rental growth over the year.

The office sector continued to underperform, delivering an annual total return of –10.2% to December 2023 according to the MSCI Quarterly Index. Weakening capital values led this decline, with the deterioration accelerating over 2023 as the Bank of England raised interest rates. An uneven performance across the sector was experienced as London West End offices were substantially stronger at –2.4% total annual return than the –13.9% and –15.4% for the City of London and wider South East respectively. Market rental value growth was also uneven with Midtown and West End offices leading the pack with an annual 4.8% and 4.4% respectively, compared to 2.4% for the year for all offices.

The alternatives sector, or ‘Other’ as categorised by MSCI, saw an annual total return of –0.3% over 2023. Notable within these returns were a resilient living sector, benefitting from a supply demand imbalance. Purpose Built Student Accommodation (PBSA) delivered strong total returns of 2.7%, with a return of 1.4% delivered solely in the fourth quarter. Elsewhere, the hotel market reversed its recent fortunes in the face of sustained cost of living pressures and delivered above All Property total returns at 0.8% to December 2023.