Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Performance

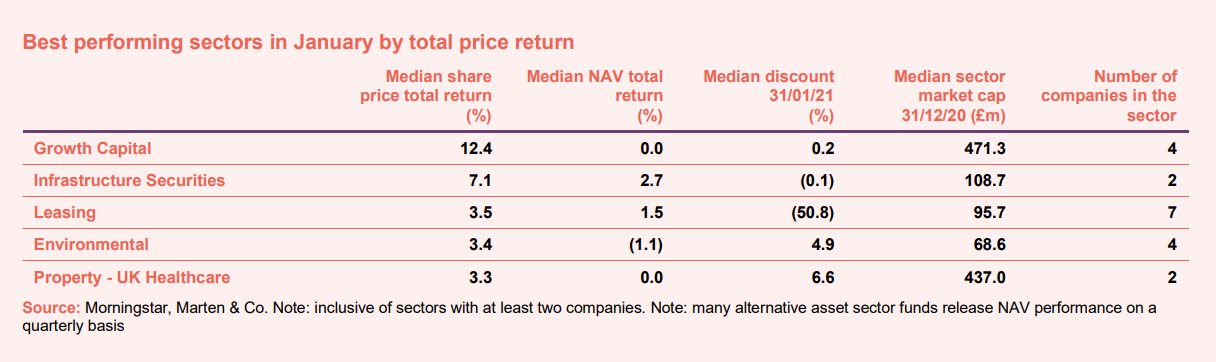

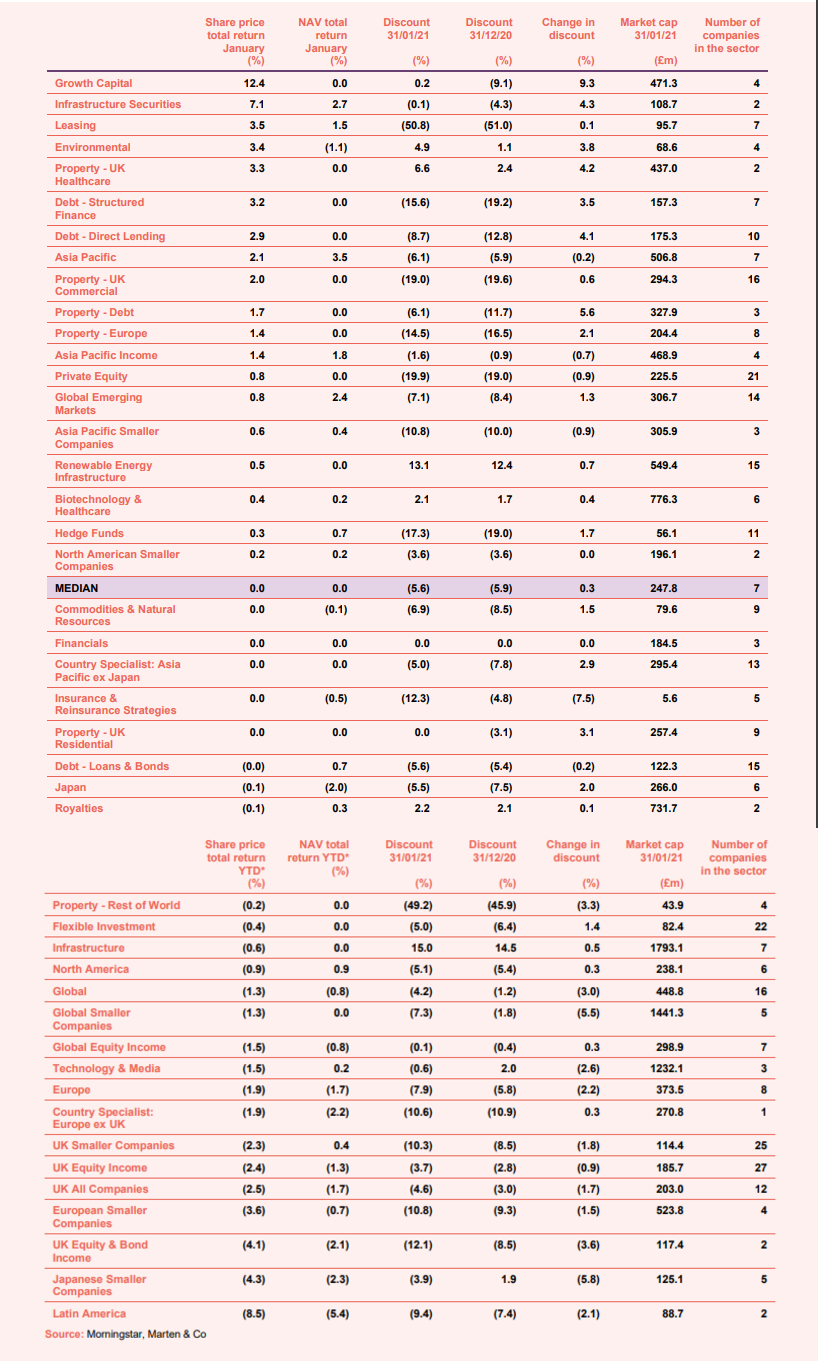

January’s median total share price return from investment companies was (0.2%) (the average was 0.6%), which compares with 4.4% in December 2020. The continued allure of the private companies accessible via the growth capital sector was evident as the year began for that sector where it had left it off, on the front foot. The UK’s speedy rollout of vaccines, to-date, and a final decision on Brexit, brought flows into several UK-focused sectors.

Best performing sectors over January

Please refer to the ‘appendix’ section for a comprehensive list of sector-specific performance. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

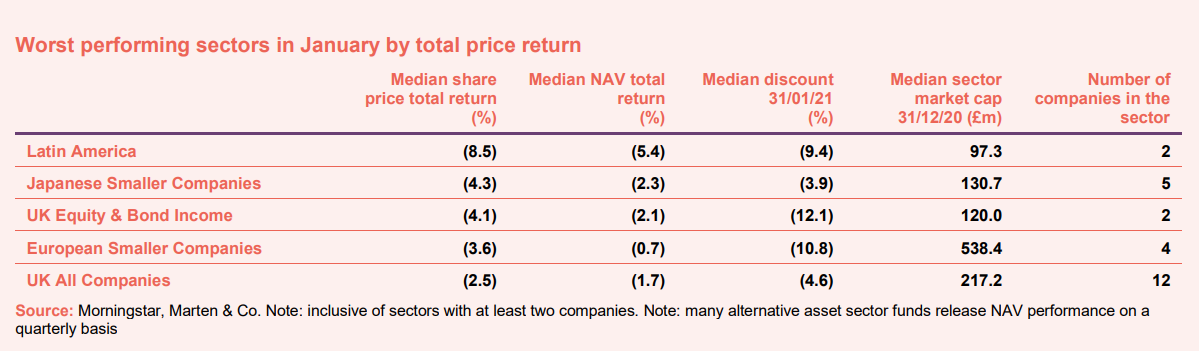

Worst performing sectors over January

On the positive side:

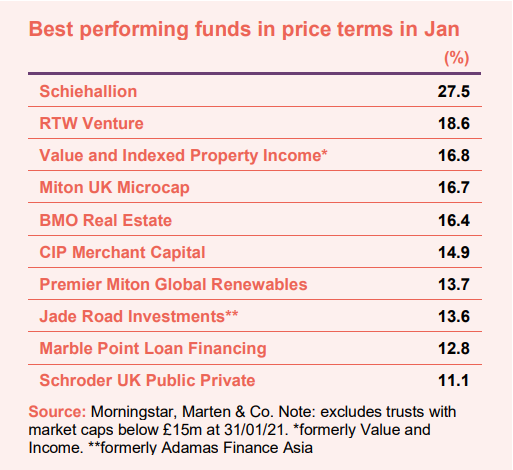

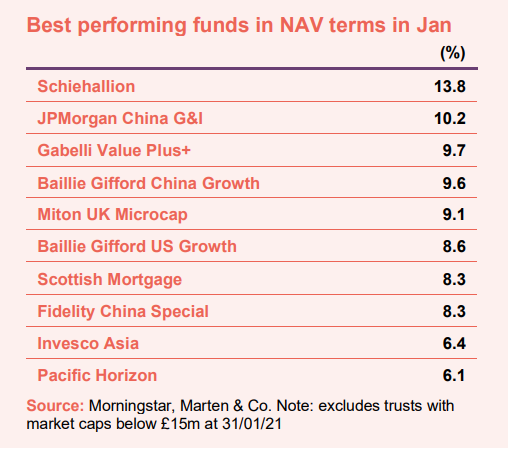

The year started where it left off, with growth in the ascendency, and China-focused strategies continuing their ascent. Baillie Gifford’s private company-focused Schiehallion fund, which is listed on the Specialist Funds Segment, topped performance. China is coming out of the pandemic in a stronger position and its domestic equity market has been flourishing. The three country-specialist funds (Baillie Gifford China Growth, Fidelity China Special Situations, JPMorgan China Growth and Income) all benefitted while Pacific Horizon made its now customary appearance in the ‘winners’ section. UK small caps started the year well, with investors riding-off the sentiment-shaping Brexit resolution and impressive vaccine rollout themes to find value in Miton UK Microcap and Schroder UK Public Private. Sectors that were heavily discounted in 2020, like debt and commercial property, participated too, with price rises helping to narrow discounts. BMO Real Estate rose after an uplift in NAV calmed nerves.

RTW Venture had a busy month, participating in a funding round held by Biomea Fusion, a US-based privately held precision oncology company. It also increased its investment in Immunocore, which was good news given that company’s recent IPO announcement.

On the negative side:

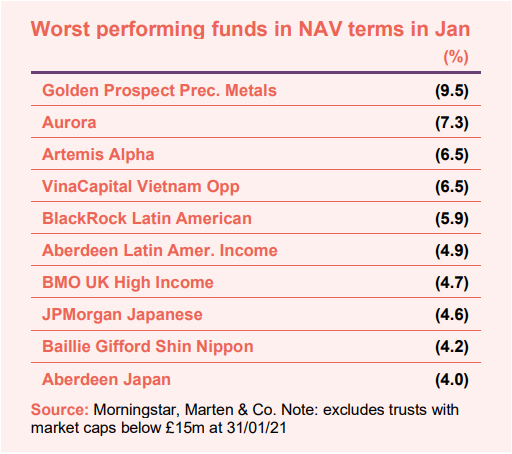

Golden Prospect Precious Metals led NAV declines, as the wider gold price declined by 2.7%, though this had little impact on the fund’s price and this squeezed its discount. Precious metals-linked investments remain popular vehicles for those concerned over the threat of inflation and those looking to hedge against a downward turn in markets.

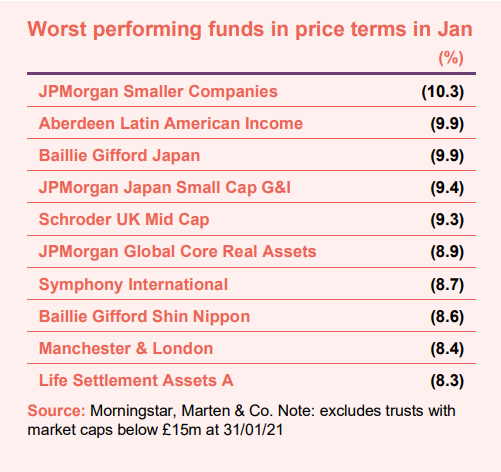

Vietnam-focused funds gave up some of their gains from the previous year. Likewise, Japanese strategies sold off (Japanese smaller company-focused trusts had a particularly good 2020).

Discounts and premiums

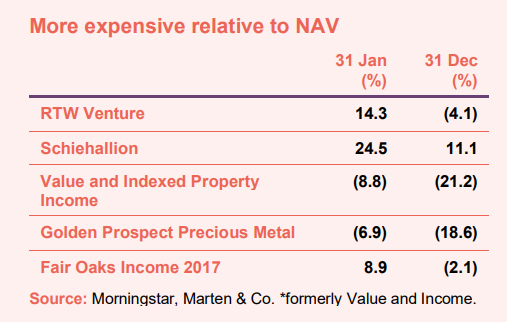

More expensive relative to NAV:

RTW Venture, Schiehallion, and Golden Prospect Precious Metals were discussed in the ‘winners and losers’ section. Value and Indexed Property Income is a new property-focused incarnation of what was previously Value and Income.

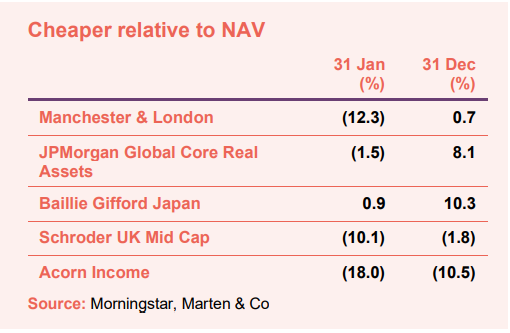

Cheaper relative to NAV:

Profit-taking appears to have weighed on Manchester & London’s shares despite a significant injection of capital from the manager. While JPMorgan Global Core Real Assets moved to a discount over January, the shares were up sharply in early February after it called a further $35.5m of its committed capital, earmarked for investment into industrial/logistics assets. It also announced that its C share will be progressed before the summer.

Money in and out

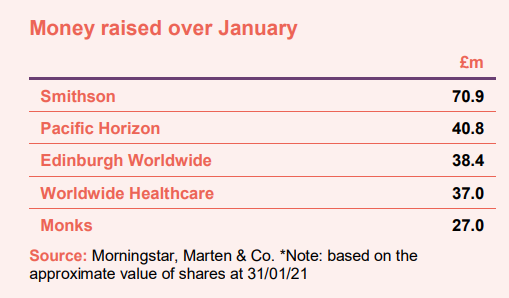

Money coming in:

Fundraising was predictably quiet (VH Global Sustainable Energy Opportunities didn’t start trading until February). More funds are trying to launch, but amongst the existing cohort, Smithson led the way.

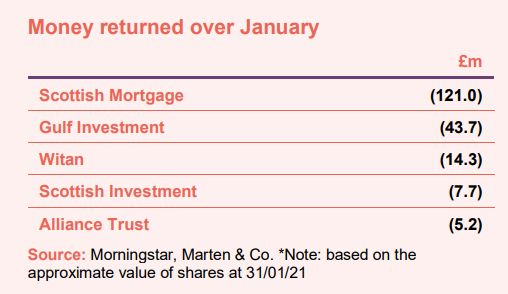

Money going out:

Scottish Mortgage ‘s buyback activity contributed to a narrowing of its premium from 5.3% to 0.5% over January. Gulf Investments shrank as 44% of shareholders opted for the exit in a tender held in December.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Foresight Solar EGM 2021, 15 February

- BMO Capital and Income AGM 2021, 16 February

- QuotedData’s Round the World Webinar series – Asia, 17 February

- JPMorgan Asia Growth & Income AGM 2021, 21 February

- Aberdeen Diversified Income & Growth AGM 2021,23 February

- PRS REIT EGM 2021, 23 February

- Bankers AGM 2021, 24 February

- Ecofin Global Utilities and Infrastructure AGM 2021,

9 March - Standard Life Private Equity AGM 2021, 23 March

- The London Investor Show, 23 AprilSustainable & Social Investing Conference, 21 May

QuotedData’s Round the World Webinar series – Asia – 17 February 2021

Interviews

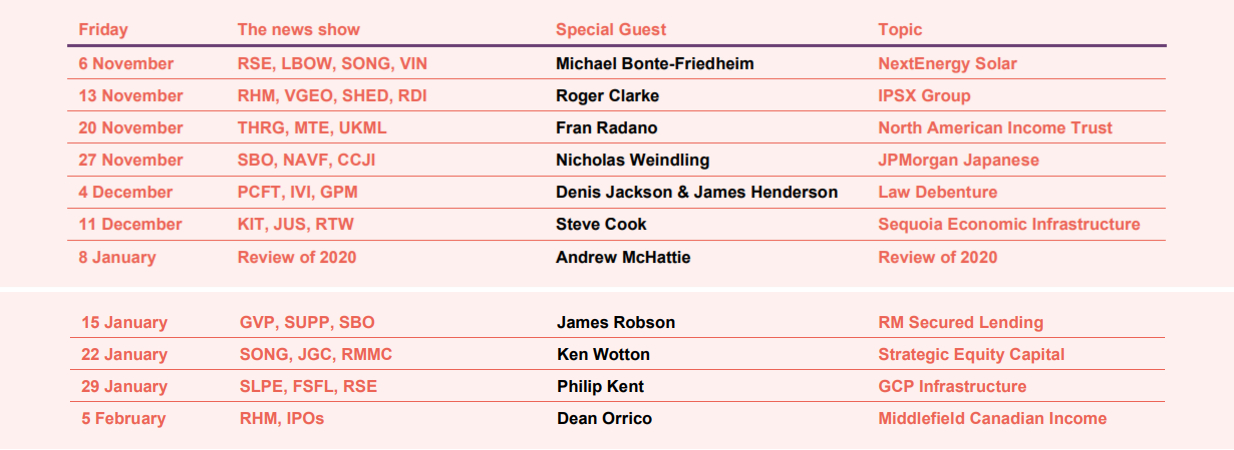

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

And here is what is coming up:

:

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – January median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.