Potential strategy in COVID-19

Potential strategy in COVID-19

The pandemic presents Sareum with an unexpected opportunity to test its lead TYK2 inhibitor, SDC-1801, in COVID-19. Such a move would require external funding, but this could accelerate clinical development timelines and catalyse a substantial increase in value for the company. Meanwhile, the recent £1m fundraising allows Sareum to advance SDC-1801 towards trials for mainstream autoimmune conditions.

Sareum intends to make grant applications to explore the activity of SDC-1801 in COVID-19, where the aim would be to reduce the immune system over-reaction that has been seen in the later phase of the infection. If such grant applications are awarded, SDC-1801 could join a group of drugs – including a number of JAK inhibitors – that have been fast-tracked into trials for COVID-19 As a dual TYK2/JAK1 inhibitor, SDC-1801 could be more effective and/or better tolerated than these similar compounds in treating COVID-19.

Meanwhile, Sareum has raised £1m via an equity issue that allows it to advance SDC-1801 into clinical trials for autoimmune disease, consistent with its original business plan.

While QuotedData’s model does not ascribe a value to the COVID19 opportunity at present, the estimate of the TYK2 assets’ current value has been increased to $30-50m. After modest assumptions for research and development (R&D) spending, QuotedData has assigned a fair value for Sareum in the £25–45m range (0.76– 1.38p/share), with the interest in SRA-737 representing upside to the investment case that may be realised in a deal involving the licensee Sierra Oncology.

| wdt_ID | Year ended | Revenue (£m) | Profit before tax (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|---|

| 1 | 30 Jun 2018 | 0.00 | -1.70 | -0.05 | 0.00 |

| 2 | 30 Jun 2019 | 0.00 | -1.70 | -0.05 | 0.00 |

| 3 | 30 Jun 2020 | 0.10 | -1.30 | -0.04 | 0.00 |

| 4 | 30 Jun 2021 | 0.00 | -1.40 | -0.04 | 0.00 |

Data summary

Data summary

Investment summary

Investment summary

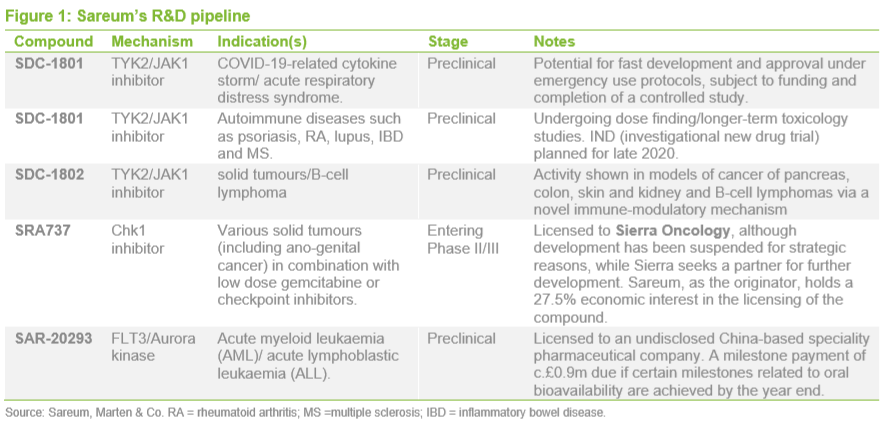

• Sareum’s investment case centres on the development and out-licensing of two preclinical-stage TYK2/JAK1 inhibitors for autoimmune disease and cancer. Sareum is also one of a small number of companies with a licensable TYK2 inhibitor programme.

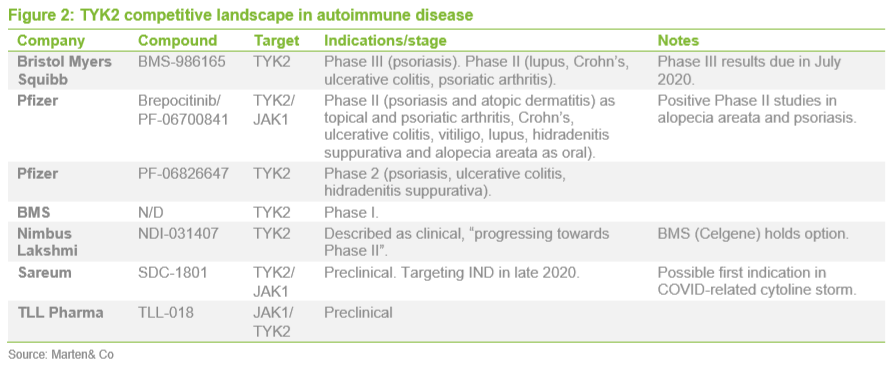

• Although Sareum’s candidate, SDC-1801, is behind the class leaders, it has the potential to be attractive as a licensing opportunity, as the main autoimmune disorder markets it addresses are large and have historically supported multiple agents with similar mechanisms. Meanwhile, SDC-1802 could potentially be the first TYK2 inhibitor to enter clinical development for a cancer indication.

• Bristol Myers Squibb’s class leader BMS-986165 has been ranked as the pharma industry’s second most valuable research and development-stage asset. The compound has been calculated to have a (non-risk adjusted) net present value of $6.7bn, based on consensus sell-side analyst projections. Readouts from currently ongoing Phase III trials in psoriasis should further highlight both its own commercial potential and the opportunity for competitors with follow-on products.

• The global pandemic has become a major healthcare priority and has led to a huge industry effort to develop a vaccine, anti-virals and other therapeutic interventions. Suppressing the immune system over-reaction or “cytokine storm” that occurs in some patients is a key target for drug intervention, as this appears to cause the lung damage that is responsible for much of the mortality.

• A large, randomised study of dexamethasone in COVID-19-related cytokine storm has shown the corticosteroid to reduce mortality in ventilated COVID-19 patients and those receiving oxygen. This supports the hypothesis that suppressing this undesirable inflammatory response can improve patient outcomes.

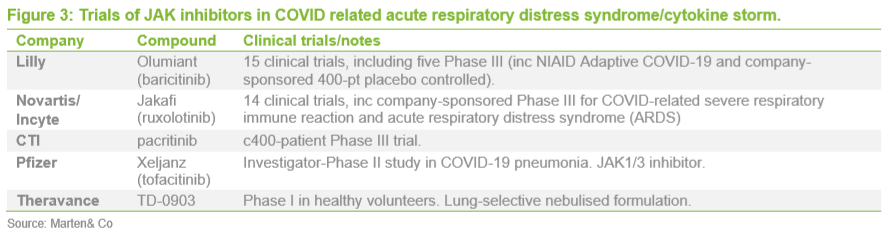

• JAK inhibitors are an obvious candidate for addressing this aspect of the COVID-19 infection as they target the signalling that causes the hyper-immune response. Two approved JAK inhibitors – Oluminant (bariticinib, Lilly) and Jakafi (ruxolotinib, Incyte/Novartis), as well as a developmental agent, pacritinib (CTI BioPharma), have been fast-tracked into Phase III trials for COVID-19 cytokine storm. In addition, Xeljanz (tofacitinib, Pfizer) is in Phase II studies and Theravance’s developmental pan-JAK inhibitor, TD-0903, is in early human safety studies and expected to move into COVID-19 patients in due course.

• As a dual TYK2/JAK1 inhibitor, SDC-1801 may be more effective if TYK2 is a better target. However, as SDC-1801 is at an earlier stage of development, it would have to offer advantages over the competing molecules for the programme to be commercially viable. SDC-1801 could nevertheless be the first TYK2 inhibitor to enter trials for this indication as neither Bristol Myers Squibb nor Pfizer have disclosed any plans yet to trial their TYK2 inhibitors in COVID-19.

• Sareum is looking for government or other funding to test its TYK2 assets in COVID-19. The UK government is, for example, providing funding to test both approved products and novel agents in COVID-19.

• Assuming such funding can be obtained, it is possible that a clinical development programme for SDC-1801 in COVID-19 could be started in patients quickly, perhaps within months of first-in-person studies (single and multiple ascending dose in healthy volunteers). This would mirror the approach Theravance has taken with TD-0903.

• If successful, a programme in COVID-19 could accelerate development timelines for the compounds more generally without compromising their commercial potential in mainstream autoimmune disease, which remains the focus of the commercial value.

• Disruption caused to healthcare systems generally by the pandemic has made it difficult to conduct clinical trials (outside of COVID-19). Hence, the key competitors, Bristol Myers Squibb and Pfizer, may have or are likely to experience some slippage in the development timelines of their respective TYK2 compounds. This means that these agents’ relative lead over SDC-1801 may be reduced, compared with the pre-pandemic situation.

• Sareum has separately secured a licensing deal for its previously de-prioritised FLT-3/aurora kinase compound with an undisclosed Chinese speciality pharmaceutical company. The deal provided a modest upfront payment (~£50k), with a larger payment (£0.9m) due if certain formulation challenges can be overcome this year. If this is successful, this could contribute to Sareum’s longterm value.

• Development of the Sareum/ICR-originated Chk1 inhibitor, SRA-737, by Sierra Oncology is effectively suspended, while a new partnership or sub-licensing arrangement is sought. Sierra’s decision to terminate development reflected competing strategic priorities and was not a reflection on the compound per se.

• Sareum holds a 27.5% economic interest in the licensing deal covering SRA-737. If Sierra is unsuccessful in sub-licensing or otherwise partnering the compound, the rights revert to the licensor (CRT Pioneer Fund), possibly allowing it to be relicensed, on different terms. The uncertainty over SRA-737’s future means that it cannot be considered to contribute to Marten & Co’s indicative valuation of Sarem, but represents upside to the investment case that may arise if there is a partnership. QuotedData’s model has previously ascribed a value of c£20m to the interest in the compound.

• Sareum is exposed to risks normally associated with biotech company drug development, including the uncertain outcome of clinical trials, a reliance on partners and the success or failure of competing molecules. The ability to exploit the COVID-19 opportunity will be determined by whether sufficient grant funding can be sourced, as it does not have the resources to pursue this independently.

• Following its recent £1m equity issue, Sareum is relatively well financed, with funding to mid-2021. The company has not yet taken advantage of UK government funding schemes for small businesses related to the pandemic but may also be able to.

• QuotedData’s model does not assign any value to Sareum for the COVID-19 opportunity, despite the potential attractiveness of the TYK/JAK1 assets. However, it has reviewed its estimate of the economic return that could be realised in a future partnership and consequently has raised its estimate of their notional value to $30-50m. It is important to recognise that a feature of the riskadjusted valuations is that they can rise very rapidly as product(s) advance through clinical trials.

• After normal assumptions for R&D spending and overheads, QuotedData’s model suggests a fair value of Sareum lies in the £25–45m range (0.76–1.38p/share). This is up to 160% above the current share price, with potential for further upside arising from any progress towards development in COVID-19 or from a resumption of development of SRA-737.

Update: Possible strategy in COVID-19

Update: Possible strategy in COVID-19

The global pandemic presents Sareum with an unexpected opportunity to examine whether its candidate, SDC-1801, can reduce the undesirable hyper-inflammatory response or “cytokine storm” that sometimes occurs in patients with COVID-19. This would depend entirely on Sareum securing grant funding, as it does not have sufficient resources to pursue the opportunity independently. Nevertheless, if funding can be obtained, such a move could accelerate the clinical development timeline of SDC-1801 and could catalyse a substantial increase in value.

One of the main targets for therapeutic intervention in COVID-19 has been the immune system reaction that can occur in some patients late in the course of the infection. This can give rise to the pneumonia-like symptoms that progress to acute respiratory distress syndrome (ARDS), a key cause of mortality. The recent success in a large, randomised study of the corticosteroid dexamethasone, in treating patients on supplementary oxygen or mechanical ventilation, suggests that suppressing this inflammatory response can improve patient outcomes.

JAK inhibitors are an obvious candidate for this, as the JAK-dependent signalling is one way to restrain the excessive cytokine signalling. Several JAK inhibitors have already been advanced into trials by cooperative or academic groups and three – Olumiant (bariticinib, Lilly), Jakafi (ruxolotinib, Incyte/Novartis) and pacritinib (CTI Biopharma) – are in company-sponsored Phase III studies for COVID-19:

Lilly is conducting a 400-patient Phase III trial of Olumiant that is expected to have results in September, the outcome of which is being closely watched as the drug has been hypothesised to have a separate direct anti-viral effect based on artificial intelligence modelling. Novartis has a similar study underway with Jakafi that is due to render results in October. Two other JAK inhibitors are, or are expected to enter, studies for COVID-19: Xeljanz (tofacitinib, Pfizer) and Theravance’s TD-0903.

Sareum’s SDC-1801, as a dual TYK2/JAK1 inhibitor, may be more effective and/or be better tolerated than the JAK1 or pan-JAK inhibitors. TYK2 (tyrosine kinase 2) is the fourth member of the Janus family (which also includes JAK1, 2 & 3), all of which transduce cytokine-mediated signals via the JAK-STAT pathway.

Focus should remain on autoimmune disease

Focus should remain on autoimmune disease

While COVID-19 has understandable attention at the moment, it remains autoimmune indications where the commercial value primarily lies. Sareum is one of five companies developing a TYK2 inhibitor in autoimmune disease and one of perhaps just two that have compounds available for licensing.

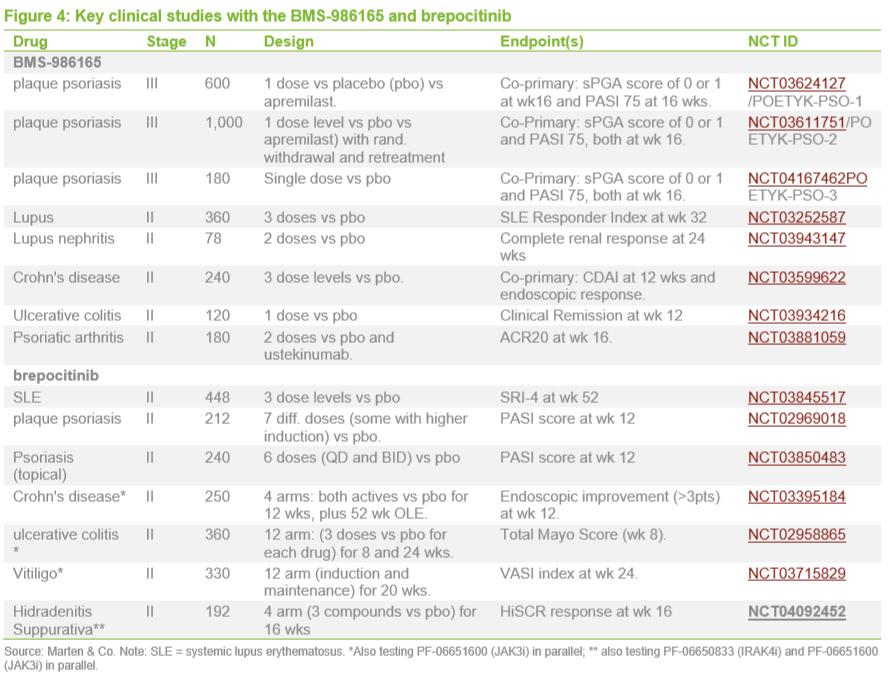

The class leaders– Bristol Myers Squibb’s BMS-986165 and Pfizer’s brepocitinib (PF06700841) – are in mid/late clinical stage trials (details shown in Figure 4). The key Phase III trials of BMS-986165 in psoriasis are due to provide results this year. Multiple mid-stage studies are also underway in other indications including lupus, Crohn’s and ulcerative colitis (UC).

Both brepocitinib and Sareum’s SDC-1801 have activity on JAK1, which is also a validated target in autoimmune disease, with four JAK1 products approved for rheumatoid arthritis and other autoimmune indications. Sareum continues to evaluate a potential lead indication for SDC-1801, with the choice depending on competitive and other factors. One indication known to be under consideration is lupus or lupus nephritis, the kidney damage associated with later stages of this disease.

SRA-737 licensee still being sought

SRA-737 licensee still being sought

Sierra Oncology, the license holder for the Sareum-originated SRA-737 is seeking a sub-licensee for the Chk1 inhibitor, having decided last year to discontinue active development and focus resources exclusively on another agent. Sareum holds a 27.5% interest in the licensing deal that covers the compound, as a result of an earlier arrangement with the Institute of Cancer Research and Cancer Research UK. The licensing deal, which was executed by CRT Pioneer Fund (CPF), the investment arm of CR UK, has a headline value of $328.5m plus royalties.

SRA-737 has now effectively completed two Phase I/II trials, one as a monotherapy (as a single drug by itself) and the other in combination with low-dose gemcitabine (LDG). Initial findings showed anti-tumour activity, with the combination study highlighting an attractive fast-to-market development opportunity in ano-genital cancer.

There is, however, little visibility on when or whether Sierra may be able to secure a licensing deal or other arrangement to allow development of SRA-737 to continue. If there is a protracted delay in finding a partner, CRT Pioneer Fund should be able to recover the rights allowing it to potentially re-license it itself. As a result of Sierra Oncology’s decision and the uncertainty over the sub-licensing deal, QuotedData’s model assumes that the asset’s value is temporarily impaired.

Investment thesis

Investment thesis

Sareum’s investment proposition centres on the development and out-licensing of the two TYK2/JAK1 inhibitors for autoimmune disease (SDC-1801) and cancer (SDC1802). Licensing R&D stage programmes such as these to larger biotech or pharmaceutical companies is a well-established business model that would be expected to generate an economic return for Sareum in the form of an upfront payment, milestones (payments triggered by future events) and royalties on sales.

Sareum also holds an economic interest in SRA-737, which is currently licensed to Sierra Oncology pending a new licensing arrangement or other partnership. Sareum has also recently option/licensed its FLT-3/aurora kinase assets to an undisclosed Chinese partner that may generate a further payment of £0.9m if certain reformulation challenges can be overcome.

QuotedData’s model assumes that the TYK2/JAK1 compounds to form the core of the investment case, with upside possible from any positive development involving SRA737 and aurora/FLT-3. Furthermore, the model does not assign any value to the COVID-19 opportunity, given this is currently at the conceptual stage.

Nevertheless, SDC-1801 has the potential to be an attractive licensing opportunity, given the scarcity of such assets and the fact that it addresses large markets that have historically supported multiple agents with similar mechanisms. We note that the value attached to the later stage competitor, BMS-986165, which has been ranked as the pharma industry’s second most valuable R&D-stage asset with a non-risk adjusted net present value of $6.7bn. This was based on a review of the main pharma industry R&D programmes, based on consensus sell-side analyst projections.

QuotedData’s model includes a conservative estimate of the TYK2 assets’ current value, based on common industry benchmarks. It is not realistic to calculate an explicit value (based on a risk-adjusted NPV, for example), as these are highly sensitive to unknowns (such as targeted indications, timelines, probabilities of success etc). Preclinical compounds of this type typically have values in the industry upwards of $25m, based on the upfront values licensing/M&A transactions, and often much more if there are exceptional circumstances.

QuotedData’s model’s estimate of the assets’ notional value has increased to $3050m. This could rise rapidly if the product(s) advance through clinical trials and the assumed probability of success improves.

After modest assumptions for R&D spending, the model suggests a fair value for Sareum in the £25–45m range (0.76–1.38p/share). This suggests there is the potential for up to 160% upside at the current share price with further possible upside should there be development in COVID-19 or from a resumption of development of SRA-737 or FLT-3 aurora.

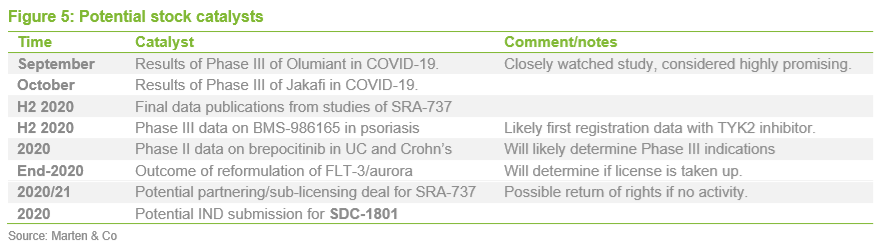

Stock catalysts

Stock catalysts

Investment sensitivities

Investment sensitivities

Sareum is exposed to the risks typically associated with biotech company drug development, including the uncertain outcome of clinical trials and reliance on third parties to advance the development of licensed assets and own internal compounds. At present, a key sensitivity is the outcome of Sierra Oncology’s efforts to license SRA-737 and of Sareum’s grant applications for development of SDC-1801 in COVID-19.

We note that for commercial reasons a potential partner(s) for the TYK2 compounds may insist on rights to both autoimmune and cancer indications and thus it may not be possible to license the two compounds separately.

While Sareum may have strong licensing candidates, it may not be possible to license them separately. Instead, potential partner(s) may seek to license both compounds at the same time in order to maintain greater control.

The value of the TYK2 assets that may be realised in a licensing deal may be affected by the success or failure of competitors, both within the TYK2/JAK class and, to a lesser extent, for other oral molecules addressing autoimmune/inflammatory indications. In order to be commercially successful, new oral agents will likely have to show levels of efficacy that approach or match those of biological agents while offering side-effect advantages.

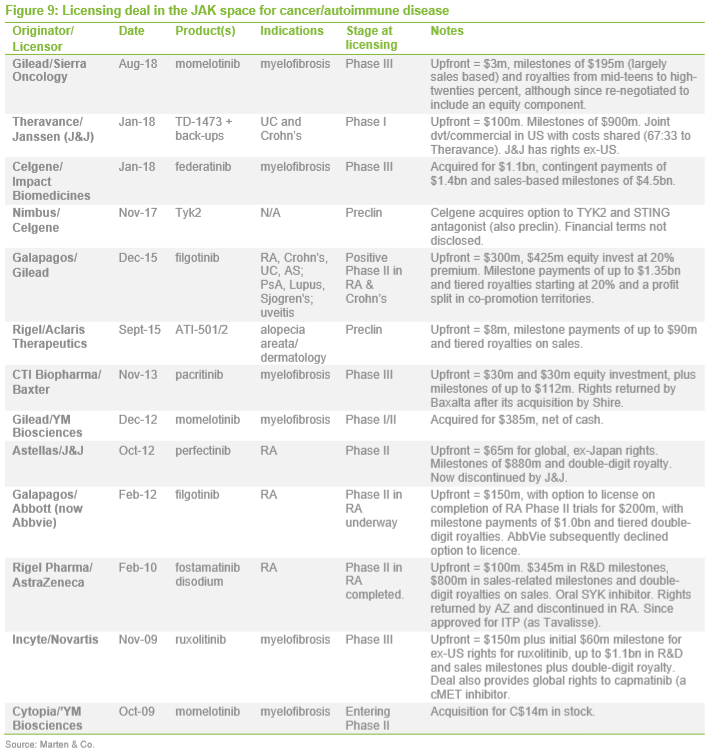

It is difficult to assess the level of interest on the part of potential licensees as well as the timing and outcome of licensing negotiation (disclosed terms of licensing deals in the TYK2/JAK space are summarised in the Appendix later).

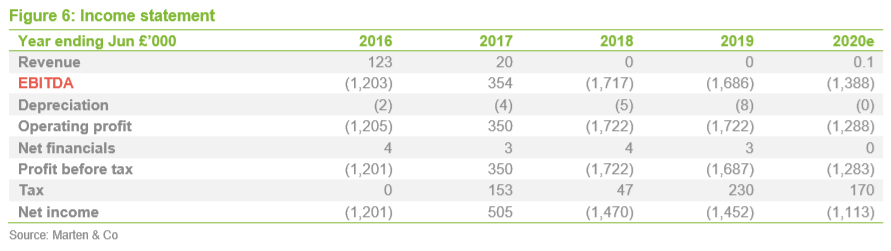

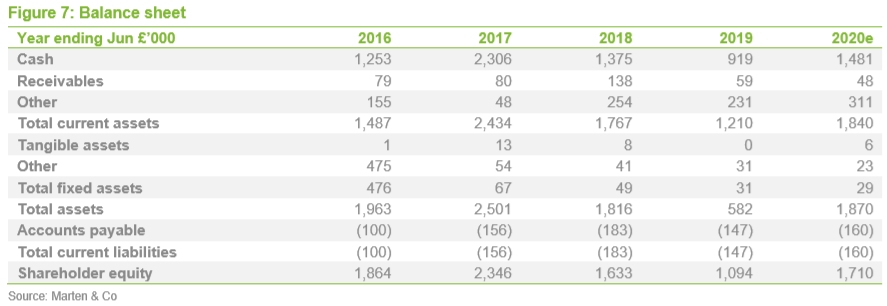

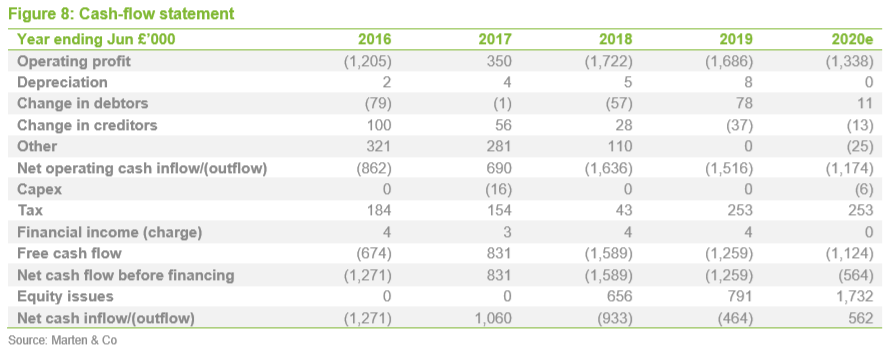

Financials

Financials

Sareum reported cash at the half year end (30 December) of £1.0m, and with expenditure running at about £1.4k per year, QuotedData’s model estimates Sareum’s cash position at the financial year-end will be approximately £1.5m, which should provide funding to mid-2021. QuotedData’s analysis of Sareum does not consider the financial results to be a major factor in the investment thesis, except in relation to the ability to fund planned future development activities. Sareum has 3.27bn shares in issue and there are no substantial or disclosable (>3%) shareholdings.

Appendix – JAK licensing deals

Appendix – JAK licensing deals

Previous publications

Previous publications

Readers interested in further information about Sareum may wish to read QuotedData’s previous notes. You can read the notes by clicking on the links.

Tyking the boxes, initiation note, published November 2018

Key ‘737 data coming up, update note, published March 2019

Tyking over…nicely, annual overview, published December 2019

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Sareum Holdings Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.