Seneca Global Income & Growth – Holding steady as cycle turns

Seneca Global Income & Growth – Holding steady as cycle turns

Seneca Global Income & Growth Trust’s (SIGT’s) manager, Seneca Investment Managers (Seneca IM), has continued to reduce the trust’s equity weighting, in advance of a global recession it expects in late 2020/ early 2021. Consistent with its view, the yield curve has all but inverted (as at 22 March, the gap between three-month and 10-year US treasuries was just 3bp) and the manager says that in the past, on average, an economic recession has commenced 311 days later (see page 3).

SIGT has recently outperformed its benchmark and global equity markets (see page 9). Its manager expects its multi-asset strategy to strongly outperform equities in the downturn, though during such a period the trust would struggle against its absolute-orientated benchmark.

Multi-asset, low volatility, with yield focus

Multi-asset, low volatility, with yield focus

Over a typical investment cycle, SIGT seeks to achieve a total return of at least the Consumer Price Index (CPI) plus 6% per annum, after costs, with low volatility and with the aim of growing aggregate annual dividends at least in line with inflation. To achieve this, SIGT invests in a multi-asset portfolio that includes both direct investments (mainly UK equities) and commitments to open-and-closed-end funds (overseas equities, fixed income and specialist assets). SIGT’s manager uses yield as the principal determinant of value when deciding on its tactical asset allocation and holding selection.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Benchmark (%) | MSCI World total return (%) | MSCI UK total return (%) |

|---|---|---|---|---|---|---|

| 1 | 31/03/15 | 9.8 | 9.6 | 3.5 | 19.7 | 6.2 |

| 2 | 31/03/16 | 4.4 | 1.7 | 3.6 | 0.3 | (5.8) |

| 3 | 31/03/17 | 26.3 | 18.2 | 3.5 | 32.7 | 23.6 |

| 4 | 31/03/18 | 4.0 | 4.2 | 7.3 | 1.8 | (0.2) |

| 5 | 31/03/19 | 6.7 | 7.0 | 8.3 | 12.6 | 7.6 |

Manager’s view

Manager’s view

Reducing equity exposure in anticipation of a global recession in 2021

Reducing equity exposure in anticipation of a global recession in 2021

As discussed in all of our notes since June 2017, Seneca Investment Managers (Seneca IM) has set out a clear ‘road map’ for SIGT’s equity weighting and how this will be reduced in advance of a global recession that Peter Elston (the research specialist for asset allocation) currently anticipates in late 2020/early 2021. He expects to see a global equity bear market commencing in advance of this, starting at some point in late 2019/early 2020, and aims for SIGT to be meaningfully underweight in equities at this time, as it is during the peak phase of the cycle that equities provide the worst performance.

Reflecting this, SIGT’s equity exposure has been on a decreasing trend since mid-2017 (initially this fell by 1% every couple of months, give or take, depending on market conditions, and more recently it has been decreased by 1% a quarter). As discussed in the asset allocation section (see page 5), since setting out its intentions, Seneca IM has been sticking to its plan.

For professional investors, a detailed discussion is provided in Peter Elston’s investment letters of July 2017 (Issue 26: Preparing for the next downturn), November 2017 (Issue 30: Keeping it simple – how to add value effectively through tactical asset allocation) and August 2018 (Issue 39: Inflation). We recommend reading them.

Recent economic data reinforces the manager’s view

Recent economic data reinforces the manager’s view

Peter Elston tells us that, since we last published in June 2018, Seneca IM’s asset allocation roadmap remains unchanged. Furthermore, his analysis of macroeconomic developments since then has served to reinforce his view that the global economy is approaching the end of its expansionary phase.

The ‘mechanics’ underlying Peter’s approach have been covered in detail in our previous notes (for example, please see pages 5 and 6 of our June 2018 note for a more in-depth discussion) but, to summarise, developed markets and economies are approaching the end of their expansion phase. Inflation is picking up, which will lead to monetary tightening and economic contraction.

In developed markets, unemployment is very low and showing signs of bottoming (in both the UK and the US but less so in Japan). SIGT’s manager expects that the next move will be up, which will be a sign of an economic contraction. Peter acknowledges that across developed markets inflation has been down a little recently, but he thinks that this is a one-off effect that relates to a fall in the oil price and other commodity prices late last year. Hereafter, he expects wage growth in the developed world to continue to accelerate, and that this will drive an increase in core inflation. Peter also makes the case that “shrink-flation” is alive and well. That is, to remain competitive, suppliers maintain a headline price but reduce the size to compensate.

The Federal Reserve’s behaviour suggests it is concerned about the progression of the economic cycle

The Federal Reserve’s behaviour suggests it is concerned about the progression of the economic cycle

Having been very “hawkish” in 2018, the Federal Reserve has become markedly more “doveish” this year. Specifically, it has said that there will be no interest rate rises in 2019 and quantitative tightening will now slow from May and cease in September. Peter says that it is very rare to see interest rates increase, then pause for a year, and then increase again. Usually, if rate rises are paused, the next move is down, typically on the back of a recession.

The yield curve is close to, or possibly at, inversion

The yield curve is close to, or possibly at, inversion

In the US, long-term bond yields have fallen while short-term rates have been edging up. Irrespective of how you look at it (two-year versus 10-year, or three-month versus 10-year), the yield curve is almost inverted. For example, the 10-year/three-month US spread was as low as three basis points on 22 March 2019. SIGT’s manager says that on the six occasions over the past 50 years when the three-month yield has exceeded that of the 10-year, an economic recession has commenced 311 days later, on average.

There’s no safe haven to be found in government bonds!

There’s no safe haven to be found in government bonds!

Seneca IM says that there are periods where good returns can be made in government bonds, particularly during the recession stage of the cycle. That said, the yield on 10- year treasuries has moved from 3.2% to 2.6% in recent months, and whilst this has provided a good return in terms of capital appreciation, the coupon that bondholders are receiving is very low. Inflation risk aside (something that we have discussed in our previous notes in detail), the manager’s major concern is that with bond yields so low, they are extremely overvalued. Therefore, to make a return, the pricing of these bonds needs to move from being very expensive to even more expensive, in its view. Whilst not impossible, the danger is that both inflation and bond yields rise, and holders see negative total real returns.

From a portfolio management perspective, Peter says that investing in government bonds can be considered as a form of insurance. However, with any form of insurance, there is a price where it is simply not worth it and the Seneca IM team can find other ways to protect the portfolio. For example, the team is looking at gold, and SIGT’s portfolio already has specialist assets that offer decent yields.

Infrastructure assets are another example; such assets tend to have durable income streams, with a high degree of inflation protection for both income and capital. These will have greater price volatility than bonds (for example, the discount can widen) but Peter thinks that investors can accept this risk, as long as the income streams are safe and any price reduction, due to discount widening, is a temporary loss of capital.

Asia and emerging market equity

Asia and emerging market equity

SIGT’s Asia and emerging market equity exposure is now high relative to total equity exposure (at the time of writing, it accounts for 60-70% of SIGT’s overseas equities exposure) whilst, in contrast, the trust has zero allocation in the US, and little in Europe and Japan. There are two key reasons:

- Seneca IM likes the long-term structural growth that is available in Asia and emerging markets. It sees this as a tail wind for companies, economies and corporate profits.

- Equity markets in these regions are less efficient, allowing more scope to identify outperforming funds. SIGT’s manager says that if you are able to select the correct managers, who have the skills and resources to take advantage of pricing inefficiencies, investors can earn a superior return over and above the extra benefit derived from the structural growth.

Fixed income

Fixed income

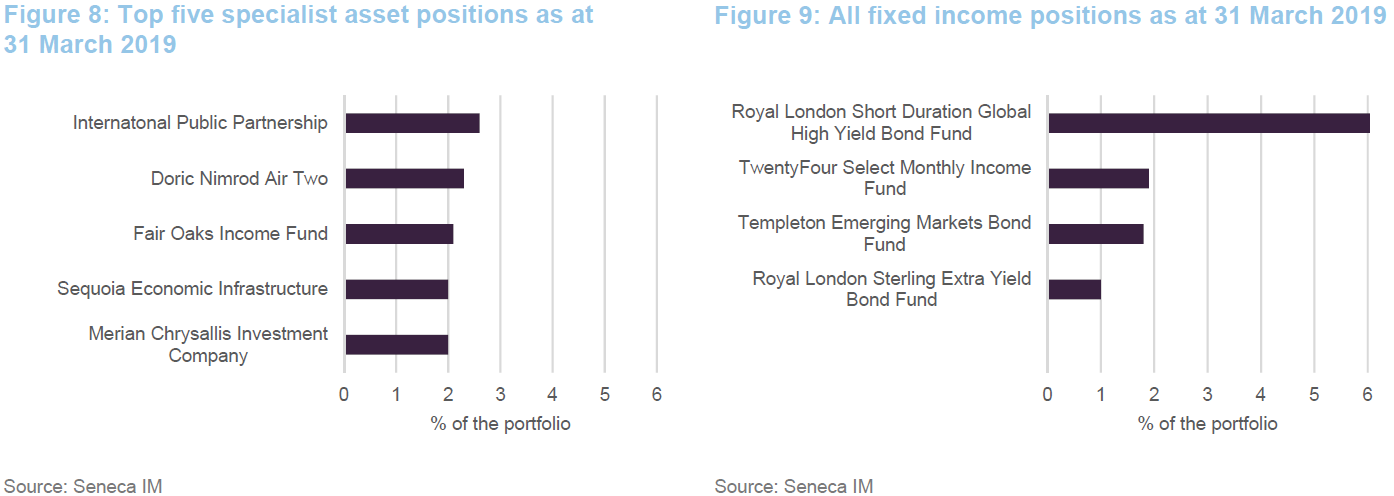

SIGT’s manager says that there continue to be opportunities in this space. Specifically, there can be a big mismatch between spreads and defaults, particularly in non-investment grade bonds, which creates an opportunity for the skilled manager. Peter says that the Seneca IM team is very comfortable with the holding in the Templeton Emerging Market Bond Fund. It is providing a yield in the region of 10% and, whilst its price fell as markets came off at the end of 2018, the managers believe that, like emerging market equities, it benefits from a positive tailwind of strong structural growth.

SIGT’s manager continues to favour credit risk; it says that the key is to choose the right manager, that can avoid the default risk. However, it continues to dislike duration risk (this is a consistent theme from our past notes). The look-through duration on SIGT’s fixed income portfolio is one-to-two years. This is mostly due to the Royal London Short Duration Global High Yield Bond Fund, which has a noticeably shorter duration than its peers.

UK equities

UK equities

The UK equity market has been impacted by Brexit during the last three years. SIGT is focused on the mid-cap area, which is less well-researched than large caps and therefore offers better opportunities (and have better liquidity than smaller companies). Mid caps have had a particularly difficult period over the last three years. The manager highlights that UK mid-cap equities have had two major legs down during this period:

- after the referendum; and

- towards the end of 2018, both as a consequence of Brexit-related political turmoil

and with global equity markets suffering more generally during this period amid concerns of faltering global growth. In relation to the second point, mid and small caps are generally higher beta and so suffer more heavily in down markets, which is apparent in their valuations. SIGT’s manager considers that UK equities are cheap and that now is not the time to be reducing the trust’s UK equity exposure. Furthermore, the manager says that the yield on the UK equities portfolio is around 5%, and this is well covered (an average of two times covered by earnings). The manager acknowledges that UK equities would get even cheaper on a negative Brexit outcome, but says that they have no competitive advantage in terms of forecasting the outcome of Brexit, and so remain focused on buying good companies. SIGT’s exposure is weighted towards domestics and cyclical companies, as these look particularly cheap. Furthermore, should the market have a big leg down, SIGT has cash available that can be put to work.

Asset allocation

Asset allocation

One per cent. reduction in equity exposure every three months

One per cent. reduction in equity exposure every three months

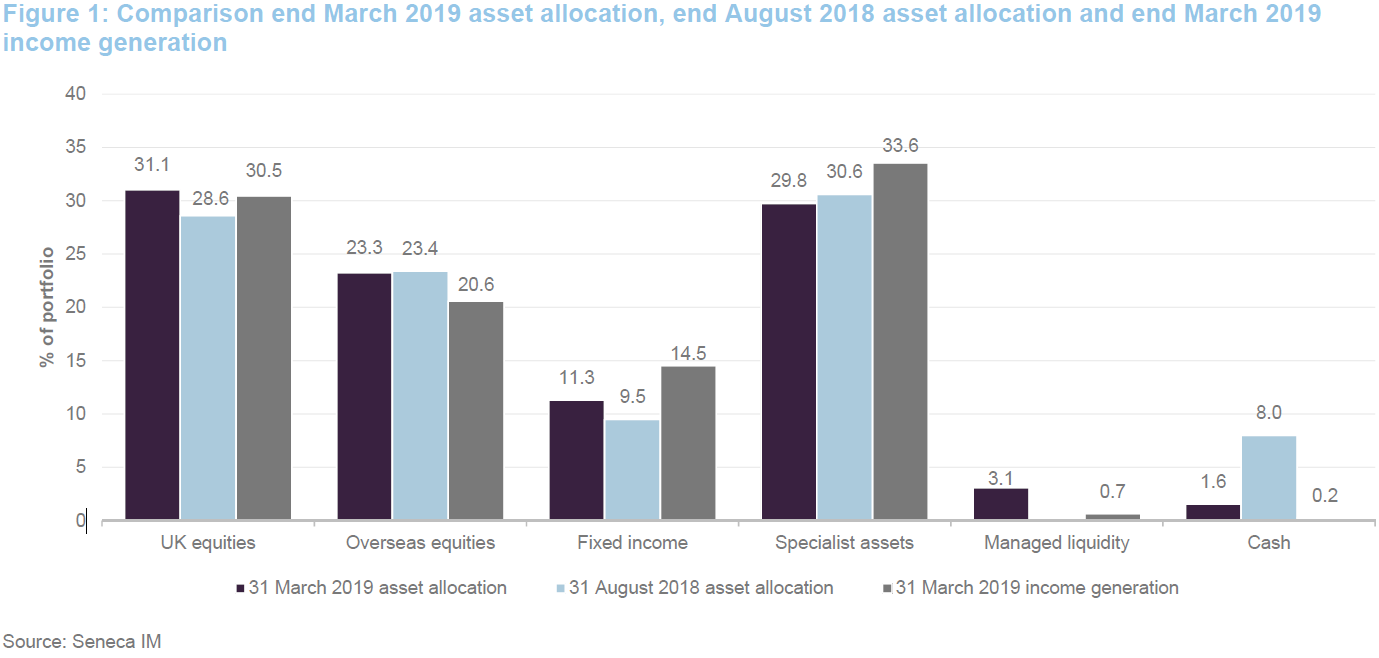

The team at Seneca IM set out its intention in mid-2017 to reduce SIGT’s allocation to equities during the next few years, with the aim of being significantly underweight by the time markets peak. This process has continued since we published our update note in September 2018. The key changes, since we last published, are as follows:

- A 1% reduction in SIGT’s equity weighting at the end of September 2018. This comprised a 0.5% reduction in SIGT’s allocation to Europe ex UK equities, and a 0.5% reduction in the allocation to Japanese equities (both being reductions from SIGT’s overseas equities portfolio). This funded a 1% increase in the allocation to corporate bonds.

- A 1% reduction in SIGT’s equity weighting in the middle of January 2019. This comprised a 1% reduction in SIGT’s allocation to Europe ex UK equities, and a 1% increase in the allocation to corporate bonds. This reduction had been scheduled for end of December 2018 but this was delayed as market liquidity was poor at that time (the manager felt it would be sub-optimal for the pricing of the trades).

- Separate to the above tactical asset allocation changes, the manager sold out of the 2% holding that SIGT had in the Insight Equity Income Booster fund (see page 10 of our June 2018 annual overview note for more detailed discussion of this fund). The rationale is discussed overleaf.

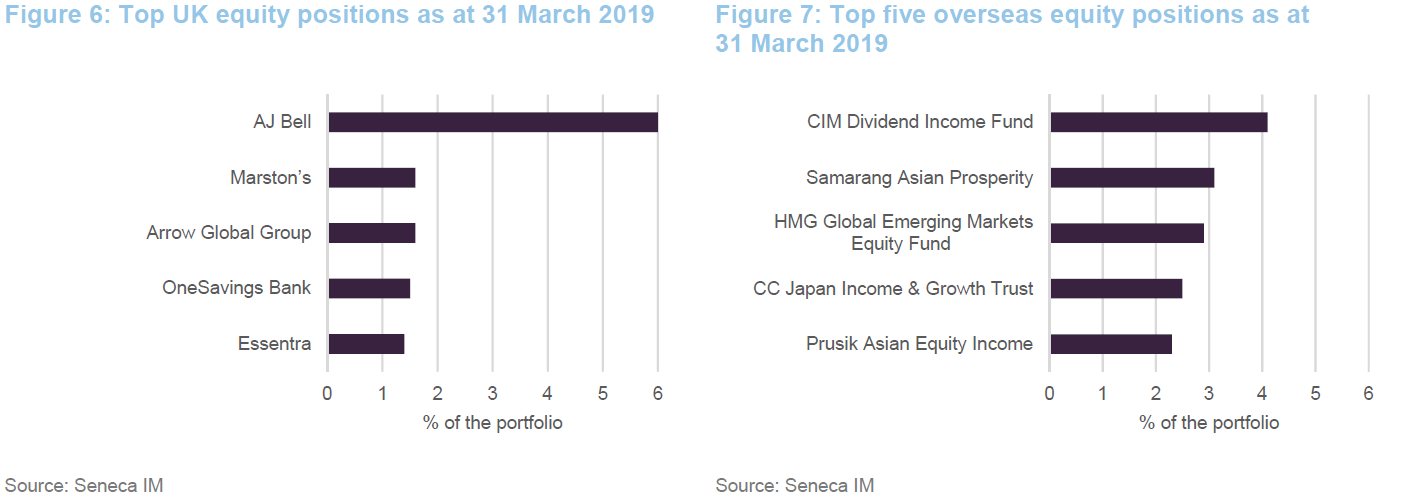

It is noteworthy that the allocation to UK equities has remained unchanged. This reflects the manager’s view that the UK is structurally cheap at the moment. With AJ Bell moving out of specialist assets (see overleaf), new positions have been initiated in Merian Chrysalis and Woodford Patient Capital Trust. These are discussed on the next two pages.

Insight Equity Income Booster fund sold in its entirety

Insight Equity Income Booster fund sold in its entirety

The Insight fund was added in 2018 to boost SIGT’s income and counter the effect of the reduction in UK equities (this sat within the UK equities allocation), which is a relatively higher yielding market. However, the manager noted that:

- SIGT had continued to produce a strong level of income; and

- When AJ Bell completed its IPO and listed on the LSE, it moved from being a specialist asset to a UK equity holding (thereby greatly increasing the weighting in UK equities).

Taking the above two considerations together, the manager felt that it was appropriate to sell out of the Insight fund.

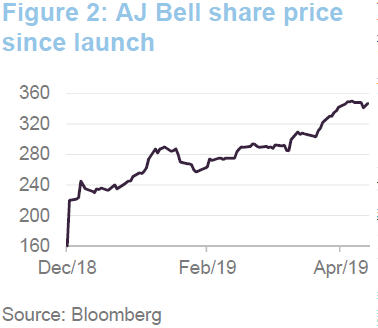

AJ Bell (6.0%) – SIGT sold 50% of its holding as part of the IPO

AJ Bell (6.0%) – SIGT sold 50% of its holding as part of the IPO

As we have discussed in our previous notes, SIGT has held a position in AJ Bell (www.ajbell.co.uk) for many years and, as an unquoted holding, it was treated as a specialist asset within SIGT’s portfolio. AJ Bell listed on the London Stock Exchange on 7 December 2018 (Ticker: AJB) and SIGT sold 50% of its position as part of the IPO. However, as illustrated in Figure 2, the share price doubled on the first day of trading and has risen further. The effect is that it continues to have around 6% of its portfolio in AJ Bell, despite having sold half of its shares.

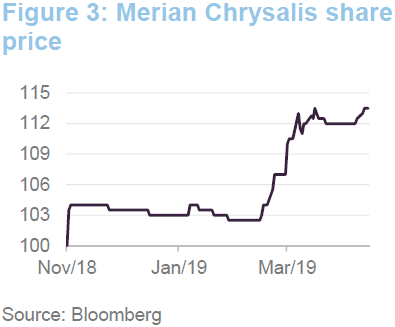

Merian Chrysalis (2.0%) – SIGT invested at IPO

Merian Chrysalis (2.0%) – SIGT invested at IPO

Merian Chrysalis (www.merian.com/chrysalis) is a new investment company that listed on the LSE on 6 November 2018 (Ticker: MERI). It invests in late-stage private companies and maintains a concentrated portfolio of these. Seneca IM says that it is very familiar with the management team (the fund is managed by Richard Watts and Nick Williamson, who are ex Old Mutual), whom it has followed for some time and who have an enviable track record.

In addition, the team is well-resourced (as at 31 July 2018, the manager, Merian Global Investors, had some £7bn of AUM) and SIGT’s manager likes the trust’s differentiated approach. The trust is exposed to more mature private companies, with business models that are generally more proven than earlier-stage companies and financing needs that are also generally more modest. It is a holding that SIGT’s manager believes will continue to perform as the cycle turns (there is a technology focus within the fund and these holdings should be able to make progress regardless of the stage of the economic cycle). SIGT’s manager also considers that it offers access to high quality businesses that are otherwise difficult to gain exposure to.

Woodford Patient Capital Trust – position initiated

Woodford Patient Capital Trust – position initiated

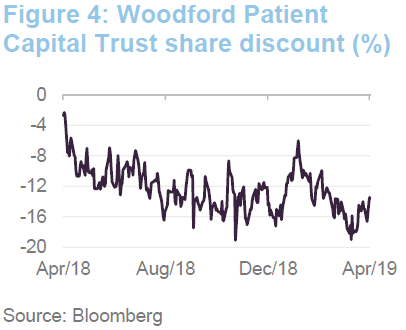

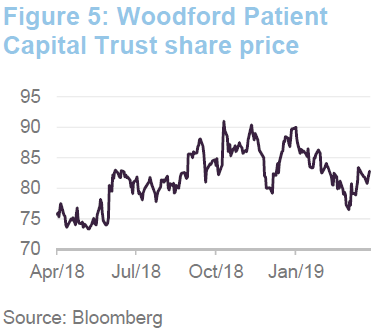

The manager has established a position in Woodford Patient Capital Trust (WPCT – woodfordfunds.com/funds/wpct). It is not the first time that SIGT has held WPCT; it was held some years ago and the position was sold at a premium. However, in recent years, WPCT has been getting a lot of negative press, and it has drifted out to a circa 20% discount (See Figure 4). The manager felt that it could be an attractive proposition, and this prompted it to take a closer look. However, it took a number of weeks for the Seneca IM team to get comfortable with WPCT and add it to the portfolio (this included a five-hour site visit to the investment manager in Oxford, with two hours spent with Neil Woodford).

WPCT has invested in lots of early stage businesses that needed cash. These take time to develop but many of these are now closer to IPO and their cash requirements are considerably less. SIGT’s manager feels that the market does not fully appreciate this and that the current high discount offers an excellent entry point.

In Seneca IM’s view, the portfolio holds companies with some quite promising ideas, and the market has become fixated with just a few of the larger holdings in the portfolio and is failing to appreciate the variety of opportunities that are present in the portfolio. The trust has also suffered from negative press surrounding a transaction with the LF Woodford Equity Income Fund. Falling capital values in this OEIC increased the values of its unquoted holdings to a level for which it was not authorised. It effectively became a forced seller, with WPCT purchasing a number of holdings by issuing shares at NAV.

SIGT’s manager says that there are many issues for Woodford Investment Management with the OEIC, but these problems do not apply to the trust. (However, we note that these problems may have just been amplified with the Guernsey stock exchange suspending listings for a number of unquoted companies held in the OEICs portfolio: Benevolent AI, Industrial Heat and Ombu; it has been reported that Woodford Investment Management had listed these stakes in the Channel Islands as a means of remaining within the City regulator’s rules on the amount of unquoted company stocks a fund can hold. It may be that the OEIC becomes a forced seller of these or other unlisted positions held within WPCT.)

As CIO, Peter Elston says that they have subjected the Woodford investment to an extensive and rigorous appraisal process. Furthermore, while the discount gives comfort, it is not central to Seneca IM’s investment thesis. SIGT has invested in WPCT on the expectation of how the NAV will perform (the manager believes that there will be a j-curve effect) and WPCT is investing alongside expert co-investors with the resources and expertise to assess and value these investments. SIGT’s manager has also spoken to WPCT’s chairman. Seneca IM considers that the board were very careful when selecting which holdings to buy from the OEIC (typically existing holdings within WPCT that the board liked and that were not considered likely to present WPCT with a cash call).

Largest investments

Largest investments

Figures 6, 7, 8 and 9 show the largest positions in each part of the portfolio as at 31 March 2019. Details of the rationale underlying some of these and other positions can be found in our previous notes (see page 11 of this note). For example, readers who would like more detail on the CIM Dividend Income Fund, Samarang Asian Prosperity Fund, Hipgnosis Songs Fund, Diploma, Victrex or Custodian REIT should see pages 6 to 9 of our September 2018 update note. As discussed in that note, the positions in Diploma, Victrex and Custodian REIT have all been sold in their entirety.

Many of the names in Figures 6, 7, 8 and 9 will be familiar to readers of our previous notes on SIGT, particularly for the overseas equities, specialist asset and fixed income positions. AJ Bell has moved to the top holdings in UK equities (as well as the fund) for the reasons discussed above. Essentra has also moved into the top five UK equities. Merian Chrysalis (discussed on page 6) is a new name within specialist assets. Otherwise, the same stocks have continued to feature in the top positions in their respective baskets, as you would expect from a lower-turnover portfolio such as SIGT’s.

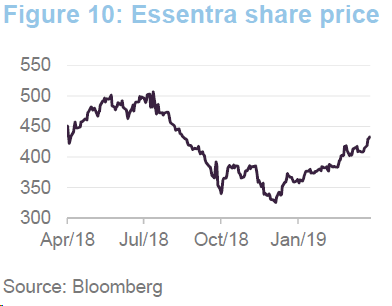

Essentra (1.4%) – topped up on weakness

Essentra (1.4%) – topped up on weakness

Essentra (www.essentraplc.com) has been a constituent in SIGT’s portfolio for some time (the holding was discussed in detail in our September 2016 update note (see pages 6, 8 and 9 of that note). Equity markets suffered from a significant sell-off in Q4 2018. Seneca IM felt that some segments of the market – for example, financials and industrials – were particularly good value, and took the opportunity to top up selective holdings.

SIGT’s managers consider that Essentra is a good quality company, with a strong balance sheet that generates a high return on equity. It makes a range of simple, cheap and essential products and, reflecting this, generates fairly stable cash flows. SIGT’s managers say that Essentra generates 85% of its revenues outside of the UK and, while this means that its profits are sensitive to sterling (it is a beneficiary of sterling depreciation), its business is otherwise insensitive to the gyrations of Brexit.

Performance

Performance

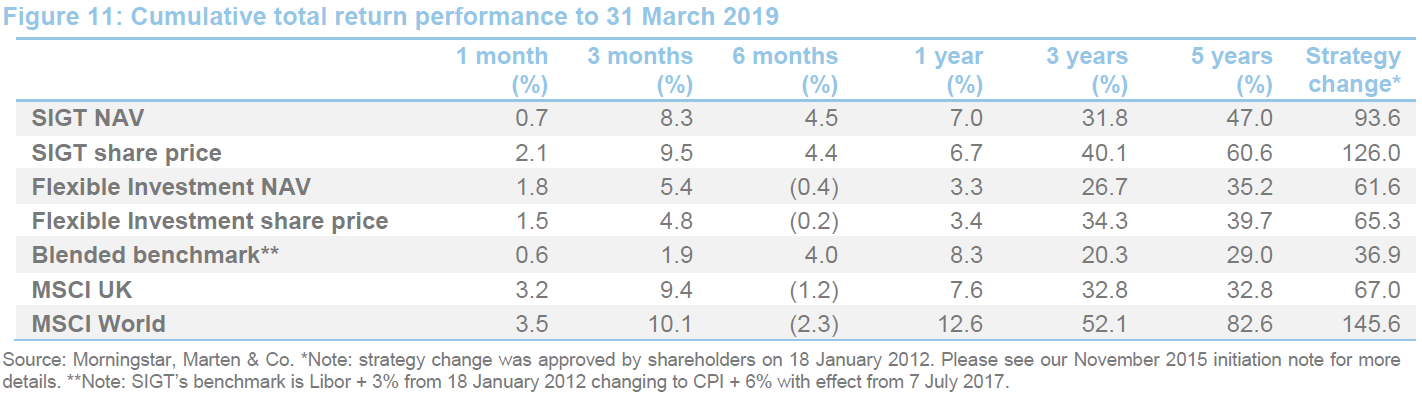

Looking at Figure 11, it can be seen that SIGT’s NAV total return performance has been particularly strong during the last three months, in absolute terms and when compared to its flexible investment sector peer group and its benchmark.

Despite this, it remains our view that, for a strategy such as SIGT’s, it is the longer-term horizons over which performance is best assessed, and we observe that over the longer-term periods provided in Figure 11 (three years, five years and since the strategy change in 2012), SIGT’s NAV and share price have markedly outperformed those of the peer group and of its benchmark. With regards to the long-term performance record, Seneca IM considers poor short-term performance to be inevitable from time to time, and it should be regarded simply as a cost of good long-term performance.

We would also add that we are increasingly late-cycle, and SIGT’s manager is shifting away from equities as they peak. This strategy is designed to cushion SIGT’s NAV as markets roll over, but it is likely to act as a drag on relative performance as equities tend to make good progress in the final phase.

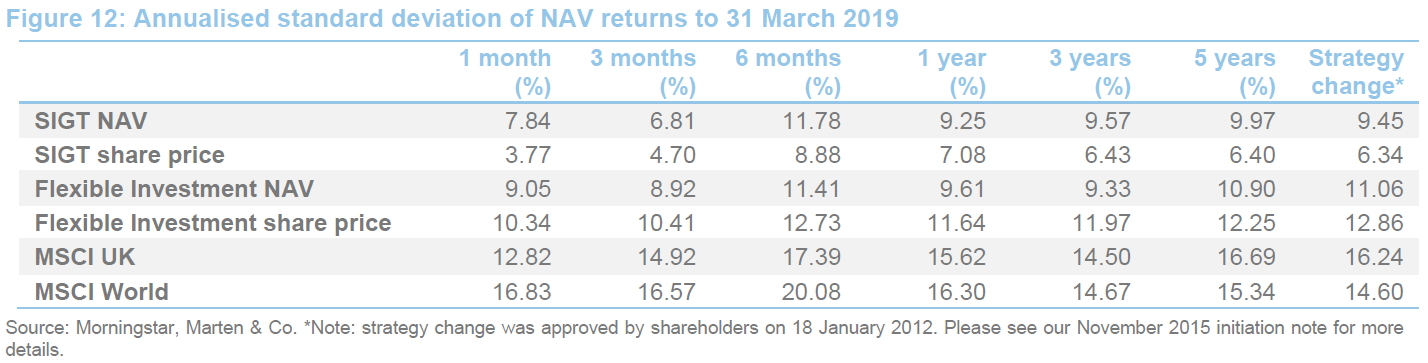

It should also be noted that SIGT has achieved these returns in the shorter term with lower volatility than the average of its peer group (for both share price and NAV), over all of the time periods provided. Its return volatility has also been markedly lower than that of both the MSCI UK and MSCI World indices (see Figure 12).

SIGT’s DCM keeps it trading close to asset value

SIGT’s DCM keeps it trading close to asset value

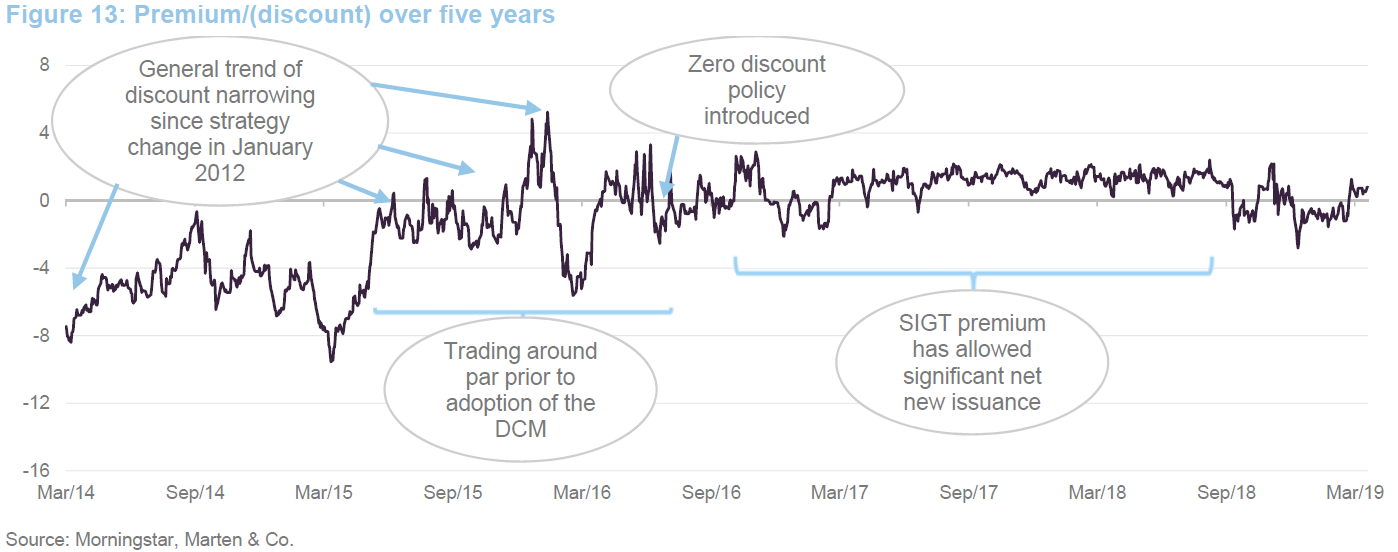

As illustrated in Figure 13, SIGT’s discount control mechanism (DCM), which went live on 1 August 2016, continues to keep the trust trading close to asset value (SIGT has traded at an average premium of 0.5% during the last 12 months).

By giving investors confidence that they can enter and exit SIGT at close to NAV, the DCM is designed to allow SIGT to attract new shareholders and grow its asset base over time. This will be helped if it continues to provide low-volatility returns that are attractive to investors.

The DCM has now been in place for over two and a half years. As highlighted in our previous notes, the overwhelming trend has been one of share issuance since the DCM was introduced. There were some modest share repurchases between October 2018 and January 2019, but recently SIGT has been issuing stock again (readers should note that the DCM is proven for both issuance and repurchases).

The significant net issuance that has taken place since the DCM was introduced illustrates that there is demand for SIGT’s strategy. We like the certainty that the DCM offers investors, and believe that the asset growth that it has facilitated is positive as, all things being equal, it serves to lower SIGT’s ongoing charges ratio and should support liquidity in SIGT’s shares. These should benefit all of SIGT’s shareholders.

Fund profile

Fund profile

SIGT’s aim is to grow both income and capital through investment in a multi-asset portfolio and to have low volatility of returns. Its portfolio includes allocations to UK equities, overseas equities, fixed income and specialist assets.

SIGT is designed for investors who are looking for income, want that income to grow and the capital of the investment to grow, and are seeking consistency or lower volatility in total returns. A pure bond fund could meet the first of those needs and a pure equity fund could meet the first three. SIGT invests across a number of different asset classes with the aim of achieving all four objectives.

Seneca Investment Managers – a multi-asset value investor

Seneca Investment Managers – a multi-asset value investor

SIGT’s portfolio has been managed by Seneca Investment Managers (Seneca IM), and its forerunners, since 2005. Seneca IM describes itself as a multi-asset value investor. We think the combination of multi-asset investing with an explicit value-oriented approach may be unique to Seneca IM. The idea is that Seneca IM can allocate between different asset classes and investments, emphasising those that offer the most attractive opportunities and yields, making asset allocation, direct UK equity and fund selection (for access to other overseas equities and other asset classes) follow a value-based approach.

Previous publications

Previous publications

Readers interested in further information about SIGT, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note Cutting back on equities, published on 21 June 2018, as well as our previous update notes and our initiation note (details are provided in Figure 14 below). You can read the notes by clicking on them in Figure 14 or by visiting our website.

(graphic removed – available in pdf version)

The legal bit

This marketing communication has been prepared for Seneca Global Income & Growth Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing

communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.