High yield without compromising on returns

2020 showed off Shires Income’s (SHRS’s) ability to deliver on its objective. By sourcing income from a wider pool than most of its peers, SHRS’s revenue account held up well relative to the wider UK market, and it managed to produce returns ahead of the average of its peers and the UK market.

Iain Pyle, SHRS’s manager, is cautiously optimistic about the outlook for 2021. The pace of economic recovery, supported by considerable injections of government money, will be influenced by the success of vaccination programmes. Iain’s focus has been on securing SHRS’s revenue income. He is wary of the valuations being applied to some stocks and stresses the need to be selective, which SHRS’s investment approach gives him the freedom to do.

High level of income with potential for growth

SHRS aims to provide its shareholders with a high level of income, together with the potential for growth of both income and capital from a portfolio substantially invested in large-cap UK equities. The portfolio may be further diversified with exposure to smaller UK companies and overseas equities. SHRS augments its income with a portfolio of irredeemable preference shares and convertibles (and, when the manager believes appropriate, fixed income securities), financed, in part by lower cost gearing (borrowing).

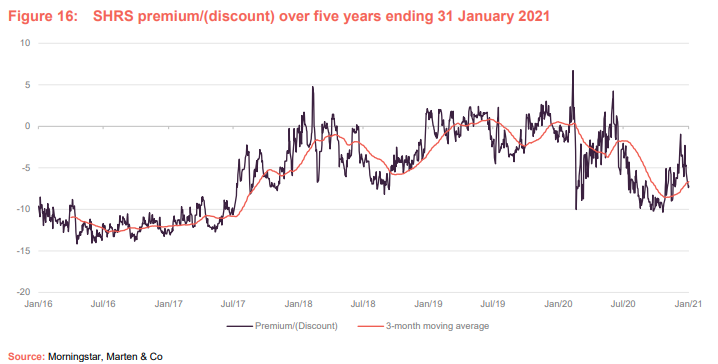

We were disappointed to see the discount widening over the latter half of 2020, especially given the relative solidity of SHRS’s income (see above), and feel that this is unjustified.

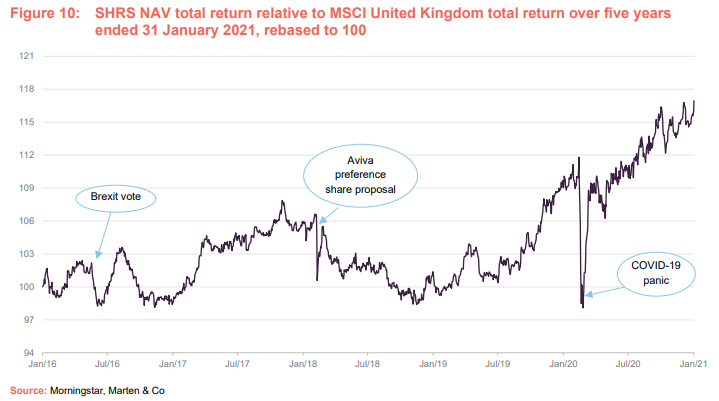

Apart from a brief wobble in March 2020, when markets were panicky and volatile, SHRS has been delivering fairly steady outperformance of the MSCI Index since the end of 2018. It has also been outperforming the median fund in its peer group.

|

|

Fund profile

SHRS aims to provide its shareholders with a high level of income, together with the potential for growth of both income and capital, from a diversified portfolio which is substantially invested in UK equities but also in preference shares, convertibles, and other fixed income securities. The company is benchmarked against the FTSE All-Share Index. We have substituted this with the MSCI UK Index for the purposes of this report.

SHRS’s preference share portfolio is funded, in part, by lower-cost debt (effectively, the equity portfolio is ungeared). The income that this arrangement contributes to SHRS’s returns gives the manager the ability to hold some lower-yielding equities that offer better prospects for both dividend and capital growth without compromising on SHRS’s dividend. The pool of income available for distribution is augmented further by writing calls and options on shares owned by the trust or shares that the manager would like to buy. In the past, when interest rates were higher, fixed interest investments and interest on cash deposits would also have made a meaningful contribution to SHRS’s revenue account.

SHRS’s manager is Aberdeen Standard Fund Managers Limited, which has delegated the day-to-day management of the company to Aberdeen Asset Managers Limited. Both companies are wholly-owned subsidiaries of Standard Life Aberdeen Plc, whose investment management activities are branded as Aberdeen Standard Investments (ASI). The manager emphasises a team approach to managing money. The lead manager for SHRS is Iain Pyle, and he is supported by Charles Luke.

Iain Pyle

Iain is an investment director on the UK equities team. He joined Standard Life Investments in 2015. Previously, he was an analyst on the top-ranked oil and gas research team at Sanford Bernstein. Iain graduated with a MEng degree in Chemical Engineering from Imperial College and an MSc (Hons) in Operational Research from Warwick Business School. He is a chartered accountant and a CFA charterholder. In addition to his role as lead manager for SHRS, Iain is also lead portfolio manager for the Standard Life Investments UK Equity High Income Fund.

Capturing the bounce

When we last published on SHRS, in July 2020, it was already clear that SHRS’s preference share portfolio was proving beneficial to the trust. SHRS’s revenue generation was relatively resilient and the trust was outperforming peer group averages. Broadly, not much changed in markets over the late summer of 2020. Investors’ preference remained for ‘growth’ stocks, momentum plays (investors chasing stocks that are already rising in price) and a general cautious ‘risk-off’ approach. However, we passed the low-point for dividends and started to see some being reinstated.

Iain says that November’s vaccine trial results generated one of the most singular events, in terms of the balance of markets, leading to a massive rotation in investment style from ‘growth’ to ‘value’. Investors could finally look through to 2022 and have some certainty about numbers. This gave them some comfort about valuations and allowed the market to re-engage with the fundamental value within stocks.

There was a strong rally in the sorts of companies that had been struggling with COVID-19-related lockdowns, and this has carried through into 2021. Investors are anticipating economic recovery and there is also some expectation of an uptick in consumer demand as a cohort of consumers which found itself saving money during the lockdowns gains the confidence and the ability to spend that.

The prospect of economic recovery is supported by expansionary monetary policy. The scale of stimulus planned, augmented now by President Biden’s $1.9trn relief package, is extraordinary. We may see a synchronised global recovery.

The caveat to this is around timing and the pace of improvement. There is some disappointment currently, given resurgent case numbers and the emergence of more transmissible variants of the virus. It may be that investors need to see proof that vaccines are working before the final leg of the uptick in markets.

Iain stresses that it is important to look at companies’ balance sheets and their ability to make it through to more normal times. A lot of potential recovery is already in the price for many stocks, but on a case-by-case basis there are still opportunities. For example, Iain feels that some of the pub companies still look cheap; by contrast, travel stocks such as Tui may be quite expensive.

Iain also notes that it is important to look at valuations based on enterprise values rather than market caps, given the high numbers of companies that took on additional debt last year. Some market caps look much lower than pre-pandemic levels, but as companies have taken on additional debt the enterprise value shows a return to normality is already being priced in in some cases.

Portfolio activity is constrained while Iain waits for further clarity on the timing of dividend reinstatements for a number of stocks. Not everything will come roaring back – oil majors, for example, are re-assessing their priorities. Some stocks will look to share buybacks as a more flexible way of handing back capital.

As he looks ahead to the rest of 2021, Iain is cautiously optimistic. He anticipates that sentiment will be buoyed by signs of a cyclical recovery and thinks that rising inflation and a restocking cycle will reinforce demand for companies in sectors such as industrials and commodities.

It is important to note that if the mood shifts to a more gung ho ‘risk on’ approach, SHRS’s preference share exposure might hold back its relative performance, but the high level of income offered by these positions means they remain valuable holdings in the portfolio. Furthermore, the use of gearing to fund these positions negates much of the drag on performance in a rising market.

Investment process

Iain is a member of ASI’s 16-strong UK equity team, 11 of whom are based in Edinburgh and five in London. It is complemented by the small-cap team, headed up by Andrew Paisley, and can draw on the considerable resources of the wider global research team.

Each member of the team has been assigned research responsibilities on a sector-by-sector basis. Investment ideas are put forward by analysts and peer-reviewed, with the aim of building consensus. A list of 20 high-conviction ideas is generated. The UK team meets daily and analysts’ recommendations are presented at UK team sector reviews. Individual portfolio managers are responsible for deciding what goes into their portfolios. They may hold stocks that the analyst has recommended for sale, but have to write and circulate a ‘dissent note’, putting the case for why the stock should remain in the portfolio.

With the aim of building a portfolio that can deliver a high level of income and the prospect of capital growth, the manager incorporates high-yielding preference shares, high-yielding equities and growth equities into the mix. Diversified exposure to smaller companies is achieved through a holding in Aberdeen Smaller Companies Income Trust (ASCIT).

The manager believes that SHRS’s objective could be achieved solely through investment in high-yielding equities. However, investing only in the highest-yielding equities would compromise the emphasis on quality that is a key criterion in the selection of potential investments.

The preference share portfolio

SHRS invests in a number of irredeemable preference shares. These are mainly issued by companies in the financials sector, carry fairly high, fixed coupons and tend to trade at a premium to par. This part of the portfolio tends to be very stable.

SHRS’s preference share portfolio is funded, in part, by lower-cost debt. The income that this arrangement contributes to SHRS’s returns allows the manager to hold some lower-yielding equities that offer better prospects for both dividend and capital growth. The pool of income available for distribution is augmented further by writing calls and options. In the past, when interest rates were higher, fixed-interest investments and interest on cash deposits would also have made a meaningful contribution to SHRS’s revenue account.

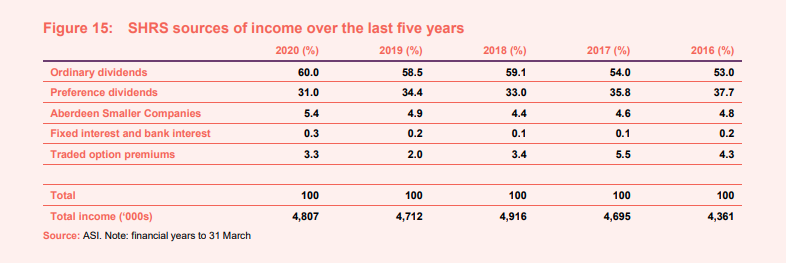

The upshot is that SHRS’s sources of income are much more diverse than would be the case for many equity income funds, especially given that a handful of stocks account for a significant proportion of the income available in the UK equity market.

Equity investment

When selecting equities for inclusion within the portfolio, the manager adopts a buy and hold strategy. It looks for good-quality companies that are trading cheaply, defined in terms of the fundamentals that, in their opinion, drive share prices over the long term. Particular emphasis is placed on meeting the management of these companies, at least twice a year – although, of course, physical meetings have been impossible for much of the past 10 months. The long-term approach helps limit portfolio turnover, although the manager does take advantage of gyrations in markets to top-slice and add to existing positions, where appropriate.

Portfolio construction is driven by stock selection and benchmark weights are not taken into account when determining position sizes. Care is taken to ensure that the portfolio is adequately diversified with respect to a range of metrics. At the end of December, SHRS had an active share of 65.2%.

Environmental, social and governance (ESG)

An assessment of ESG aspects is embedded within the investment process. In particular, ASI seeks to understand how ESG risks might affect returns on an investment and factors this into its decision-making. A central ESG team of more than 50 specialists supports the investment team in this regard.

Through engagement and exercising voting rights, the manager actively works with companies to improve corporate standards, transparency and accountability. The manager encourages investee companies to adhere to best practice in the areas of ESG stewardship. The manager believes that this can best be achieved by entering into a dialogue with company management to encourage them, where necessary, to improve their policies.

Voting decisions have been delegated by the board to the manager and the manager reports on its stewardship activities on a quarterly basis.

Investment restrictions

The board has set some absolute limits on maximum holdings and exposures (these apply at the time of the acquisition of the investment):

- a maximum 10% of total assets invested in the equity securities of overseas companies;

- a maximum 7.5% of total assets invested in the securities of one company (excluding ASCIT);

- a maximum 5% of quoted investee company’s ordinary shares (excluding ASCIT);

- a maximum of 10% of total assets invested directly in AIM holdings;

- a maximum of 7.5% of total assets may be invested in the preference shares of any one company; and

- exposure to an investee company’s preference shares is capped at 10%.

In addition, with respect to the trust’s investments in options:

- call options written must be covered by stock;

- put options written to be covered by net current assets/borrowing facilities;

- call options not to be written on more than 100% of a holding of stock;

- call options not to be written on more than 30% of the equity portfolio; and

- put options not to be written on more than 30% of the equity portfolio.

Option writing

The decision whether to write call or put options is entirely at the discretion of the manager. The manager may write calls on stocks that it wants to sell and puts on stocks that it wants to buy, but only where stock volatility makes that an attractive prospect in terms of the premium available. The manager does not write uncovered calls. Typically, options are short-dated (one-to-three months) and 5–10% out of the money.

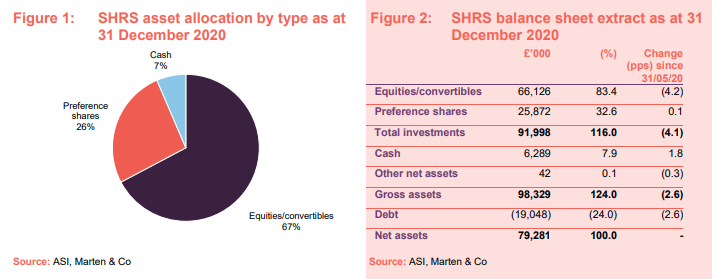

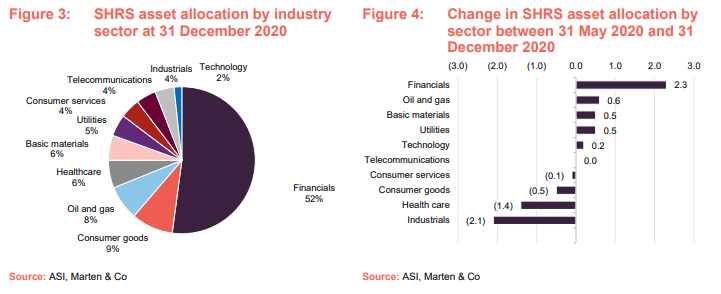

Asset allocation

Since we published our last note, which used data as at the end of May 2020, SHRS’s cash position has increased as a proportion of the portfolio and the proportion financed by debt has fallen (although the absolute level of the debt is unchanged).

The portfolio’s distribution by industrial sector is not much changed. The exposure to financials has fallen, but this is distorted by the exposure to preference shares, which have been relatively stable compared to the volatility in equity markets.

Outside of the preference shares, the portfolio has exposure to life insurance and banks. In the latter sector, SHRS holds Close Brothers and Standard Chartered. Iain says the latter offers the prospect of growth from its emerging markets exposure. Of the other UK banks, Iain is perhaps most interested in HSBC, which he feels may be past the worst of its political problems. He thought it was overdistributing ahead of its COVID-19-related dividend suspension, and does not expect the dividend to return to previous levels in the near future.

Top 10 holdings

At the end of 2020, the top 10 holdings were much as they were at the end of May 2020. Two stocks had fallen out of the list: Royal Dutch Shell and BP. They have been replaced by SSE and Rio Tinto.

Portfolio changes

There was some modest recycling of holdings in the middle of 2020, with the aim of bolstering the income account. Iain added to positions in Direct Line (which we discussed in our last note) and Telenor (discussed in our February 2020 note), for example. Iain says that both stocks have solid yields and cash flows and were not constrained from making dividend payments.

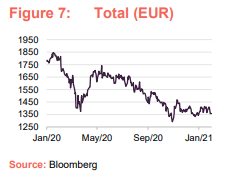

Iain tried to keep hold of exposure to stocks in sectors such as mining and energy, which he anticipated would benefit from an economic recovery, when it materialised. These stocks had the added attraction of still paying some dividends. A purchase was made of Total (funded, in part, by a reduction in the holding in Royal Dutch Shell).

Total

In 2020, the oil sector was hit hard by the collapse of the oil price in the face of COVID-19-related falls in demand and a price war sparked by Russia and Saudi Arabia. Total (www.total.com) was bought on a yield over 8%; the stock has rallied since as the oil price has recovered. At around $55, the oil price is fairly close to its average for 2019.

Like many oil majors, Total is looking to shift the balance of its business towards areas such as liquefied natural gas (LNG) and renewables. Its target is for oil products to make up just 30% of its sales by 2030. In the meantime, it is aiming to get its breakeven price for oil down to $25. It says that the current dividend is supported with oil prices above $40.

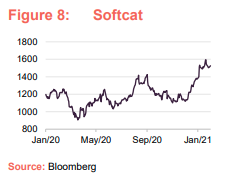

Softcat

A new purchase was Softcat (www.softcat.com) a mid-cap, IT infrastructure provider serving both commercial and public sector clients. Softcat has a strong record of growing sales and profits but it cautioned in October that COVID might have an impact on sales to corporate customers. The stock was bought in December 2020 on a yield of about 2.5% and has risen in value since.

Iain says that consensus forecasts show Softcat’s profit growth slowing, but he feels that this is overly conservative. He says that Softcat has the potential to capture more of its customers spend on IT (currently about 15% but could be substantially higher, in Iain’s opinion). Its customers rate it highly (97% customer satisfaction rate).

Others

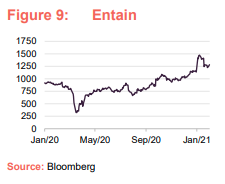

Sales were made of Entain (formerly GVC) and Novo Nordisk as yields compressed to levels where the stocks were less attractive. Iain decided to hold onto the trust’s position in WH Smith, which he sees as a play on a post-COVID recovery. The stock is highly reliant on travel. He added to SHRS’s position in United Utilities, which yields about 4.6%. The company says that under the new five-year asset management plan agreed with the regulator, it can support dividend growth in line with inflation (based on CPIH – which includes the cost of owning, maintaining and living in one’s own home) through to 2025.

Performance

In March 2018, Aviva announced that it planned to redeem its preference shares at par. This triggered sharp falls in the prices of preference shares and impacted on SHRS’s NAV. Investors cried foul and Aviva withdrew its plans, saying that it would revisit the decision in 2026 (when the European regulator, ESMA’s rule changes about the makeup of insurers’ regulatory capital come into effect). Aviva said it would then take into account the fair market value of the preference shares in setting the redemption price, rather than the par value. The manager believes that the market reaction to Aviva’s actions makes any future attempt to redeem preference shares at par less likely.

Apart from a brief wobble in March 2020, when markets were panicky and volatile, SHRS has been delivering fairly steady outperformance of the MSCI Index since the end of 2018. It has also been outperforming the median fund in its peer group.

SHRS’s defensive/quality tilt was beneficial last year and helped the portfolio outperform as markets fell. Nevertheless, the need to generate income from the portfolio meant that it was not exposed to the high-growth stories that were really driving markets higher.

The best news was that the portfolio also kept pace with markets as they rose in the final few months of 2020. Where the need to generate income permitted, Iain hung onto some stocks that were challenged in anticipation of just such a bounce in markets.

Preference shares were less volatile than equities and returned 5% over 2020. This was a factor in SHRS’s outperformance. Nevertheless, the trust’s gearing (used to finance the preference share portfolio) acted as a drag on returns.

Peer group

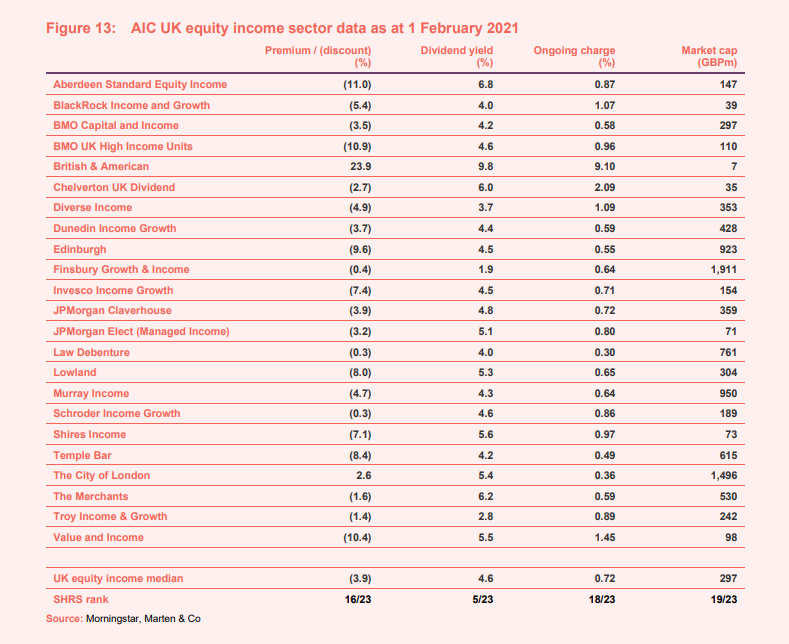

SHRS is a constituent of the AIC’s UK equity income sector and this is the peer group that we have used for the purposes of this report. A full list of the investment companies in its peer group is provided in Figure 13.

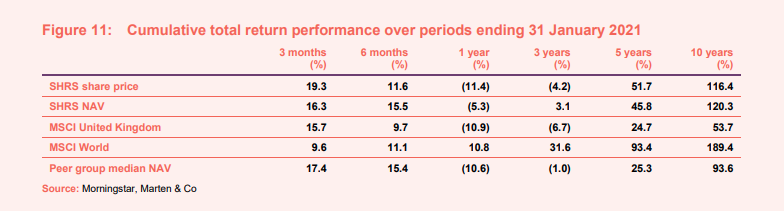

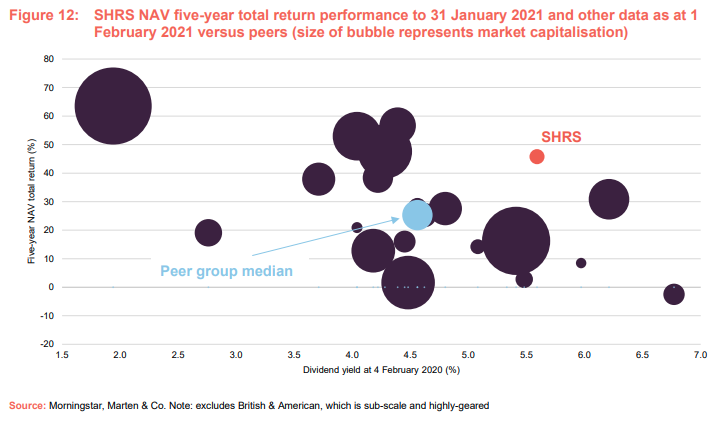

SHRS’s policy of augmenting its income through its preference share portfolio, funded in part by low-cost gearing, enables the manager to hold a higher proportion of higher-growth companies than many of its peers.

SHRS offers a relatively high yield when compared with the median trust in its peer group. However, this does not mean that investors need to compromise on performance. SHRS’s returns over five years are towards the upper end of its peer group league table.

SHRS is one of the smaller funds within the peer group. Its relatively small size has a direct impact on its ongoing charges ratio (we believe its management charges are competitive).

Dividend

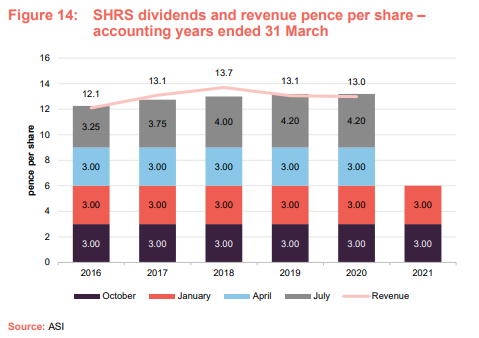

SHRS pays quarterly dividends in October, January, April and July. The board has indicated that it intends to continue to pay three quarterly interim dividends of 3p each and will decide on the level of the final dividend having reviewed the full-year results. Assuming that the final dividend is at least maintained, the current annual rate of dividends is 13.2p, representing a yield of 5.6%.

As Figure 14 demonstrates, this portfolio has produced a modestly growing revenue stream and, historically, has allowed SHRS to grow its dividend while maintaining its revenue reserves. COVID-19 triggered dividend cuts, suspensions and postponements for a number of stocks. Link Group estimated that around 40% of the UK’s dividend income had been lost for 2020. However, SHRS’s income seemed to hold up relatively well. For the six months ended 30 September 2020, its revenue per share was 6.18p, which compares to 7.15p for the equivalent period in 2019, a fall of just 13.6%. SHRS’s preference share income was a major factor in this. Figure 15 illustrates the diversity of SHRS’s revenue sources.

When deciding to maintain the quarterly interim dividends at 3.0p per share, the board factored in SHRS’s brought-forward revenue reserves of £6.77m, enough to cover the annual dividend 1.1 times. It will consider the outlook for SHRS’s income and the economy when assessing the size of the final dividend, payable in July 2021. We think there is a good chance that it will maintain this at 4.2p.

Premium/discount

Over the 12 months ended 31 January 2021, SHRS traded within a range of a 10.4% discount (in March, when markets were panicky and volatile) to a 6.7% premium and an average discount of 4.6%. We were disappointed to see the discount widening over the latter half of 2020, especially given the relative solidity of SHRS’s income (see above), and feel that this is unjustified. At 1 February 2021, the discount was 7.1%.

At the last annual general meeting (AGM), shareholders granted the board permission to issue up to 3,076,958 shares, equivalent to 10% of the then-issued share capital. No shares will be issued at a price less than NAV. Correspondingly, shareholders also approved share repurchases up to 14.99% of SHRS’s then-issued share capital. These permissions expire on 30 September 2021 or at the next AGM, whichever is earlier.

No shares have been issued since the last AGM, but SHRS did issue 25,000 shares at a premium to asset value in July 2020 and a further 615,000 shares over its financial year ended 31 March 2020.

Fees and costs

We believe that SHRS’s management fee is competitive for a fund of its size. The management fee is 0.45% per annum on amounts up to £100m and 0.40% over £100m. It is calculated monthly and paid quarterly. The calculation of the fee is based on the company’s net assets, plus any borrowings up to a maximum of £30m, less any amount invested in ‘commonly managed funds’ (i.e. Aberdeen Smaller Companies Income Trust Plc). There is no performance fee.

The management contract covers the cost of company secretarial and administration services, and is terminable on six months’ notice by either side. The management fee is allocated 50% against the revenue of the company and 50% against its capital. The same treatment is applied to the interest on SHRS’s borrowings. All other expenses are charged against revenue.

Other expenses include an amount paid to the manager for the provision of promotional activities. This was £49,000 for the year ended 31 March 2020, down from £58,000 for the prior year (including VAT). SHRS’s ongoing charges ratio for the year ended 31 March 2019 was 0.96%, down from 0.98% for the prior accounting year. We think that the key to getting SHRS’s ongoing charges ratio down is to grow the size of the trust.

Capital structure and life

As at 1 February 2021, SHRS had 30,794,580 ordinary shares and 50,000 3.5% cumulative preference shares in issue. Each of the ordinary shares and cumulative preference shares has a vote at general meetings of the company. In the event of a winding-up of the company, the cumulative preference shareholders are entitled to any cumulative preference share dividends accrued but not yet paid to them, plus a return of their capital (£1 per share). Ordinary shareholders are entitled to the balance.

SHRS’s accounting year end is 31 March. Its annual results are usually released in May and interims published in November. Its AGMs are held in July. It has an unlimited life and no scheduled continuation votes.

Gearing

The maximum level of gearing on the equity portfolio has been set at 35% of net assets (at the time the funds are drawn down).

SHRS has a £20m loan facility with Scotiabank Europe Plc which matures on 20 September 2022. Under the terms of the facility, the trust has drawn down £10m at a fixed-rate of 1.706%. In addition, £9m has been drawn down on a revolving basis.

The gearing is used to finance the preference share portfolio. At the end of December 2020, the net gearing on the portfolio was 16.1%, but the equity portfolio was ungeared.

Board

SHRS has four directors, all of whom are non-executive, do not sit together on other boards and are independent of the manager. Each of the board members stands for re-election annually.

Robert Talbut (chairman)

Robert Talbut was formerly chief investment officer of Royal London Asset Management and has over 30 years of financial services experience. He has represented the asset management industry through the chairmanship of both the ABI Investment Committee and the Asset Management Committee of the Investment Association. He has also been a member of the Audit & Assurance Council of the FRC and the Financial Conduct Authority’s Listing Authority Advisory Panel. Robert is a member of the M&G With Profits Committee and a non-executive director of Pacific Assets Trust Plc, Schroder UK Mid Cap Fund Plc and JPMorgan American Investment Trust Plc.

Marian Glen (director and chair of the remuneration committee)

Marian Glen was formerly the general counsel of AEGON UK and, prior to that, was a corporate partner and head of funds and financial services at Shepherd+ Wedderburn. She is a non-executive director of Martin Currie Global Portfolio Trust Plc and The Medical and Dental Defence Union of Scotland. Marian was formerly a non-executive director of Murray Income Trust Plc, Friends Life Group Limited and other companies in the Friends Life group of companies.

Robin Archibald (director and chair of the audit committee)

Robin Archibald has a wide range of experience in advising and managing transactions in the UK closed-ended funds sector over his 35-year career as a corporate financier, including with Samuel Montagu, SG Warburg and NatWest Markets. He retired from Winterflood Investment Trusts in May 2014, where he was formerly head of corporate finance and broking. He is currently a non-executive director of Albion Technology & General VCT Plc, Ediston Property Investment Company Plc, Capital Gearing Trust Plc and Henderson European Focus Trust Plc, and serves as audit chair on three of these other investment companies. He is a chartered accountant.

Jane Pearce (director)

Jane Pearce is a co-opted external member of the Audit and Risk Committee of the University of St Andrews. She had an executive career as an equity analyst at leading investment banks and latterly was an equity strategist at Lehman Brothers and Nomura International. Jane is a chartered accountant and was a member of the Governing Council of the Institute of Chartered Accountants of Scotland from

1999–2000.

Previous publications

Readers interested in further information about SHRS may wish to read our previous notes by clicking on the links below.

Sustainable high yield, initiation note, published October 2018

Growing again, update note, published May 2019

Building on a great 2019, annual overview, published February 2020

Preference shares paying dividends, update note, published July 2020

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Shires Income Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.