Preference shares paying dividends

Preference shares paying dividends

Shires Income (SHRS) has been weathering the storm of dividend cuts better than many of its peers. Holding a portfolio of preference shares, which contribute over 30% to income generation – and, crucially, have not been affected by regulatory restrictions on dividends – has proved to be a major competitive advantage.

SHRS’s manager, Iain Pyle, expects to take a slightly more active approach to managing the portfolio going forward, with the pandemic likely to re-shape a number of industries. SHRS has been recovering ahead of most of its peer-group, with its high dividend yield and exposure to growth companies proving compelling enough for it to be in a position to issue shares over July. As a closed end fund, SHRS can draw on its revenues to maintain the dividend when there is a shortfall in revenue income (a distinct advantage over open-ended funds). In this regard, SHRS dividend remains well protected with revenue reserves of 1.1x the most recent annual dividend.

High level of income with potential for growth

High level of income with potential for growth

SHRS aims to provide its shareholders with a high level of income, together with the potential for growth of both income and capital from a diversified portfolio substantially invested in UK equities but also in preference shares, convertibles, and other fixed income securities.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI UK total return (%) | MSCI World total return (%) |

|---|---|---|---|---|---|

| 1 | 30 Jun 2016 | -7.70 | 0.90 | 3.40 | -3.80 |

| 2 | 30 Jun 2017 | 27.60 | 23.30 | 16.70 | 23.50 |

| 3 | 30 Jun 2018 | 18.50 | 5.70 | 8.30 | 14.80 |

| 4 | 30 Jun 2019 | 2.90 | 1.30 | 1.70 | -5.80 |

| 5 | 30 Jun 2020 | -7.10 | -8.00 | -15.20 | -11.30 |

Preference shares providing timely protection

Preference shares providing timely protection

COVID-19 has acutely affected several companies that had been stalwarts of UK equity income funds for decades. Whether brought upon by regulators, as has been the case in banking, or in response to the collapse in global trade, the likes of Barclays, HSBC, Lloyds Bank, and Royal Dutch Shell have either slashed or suspended dividends.

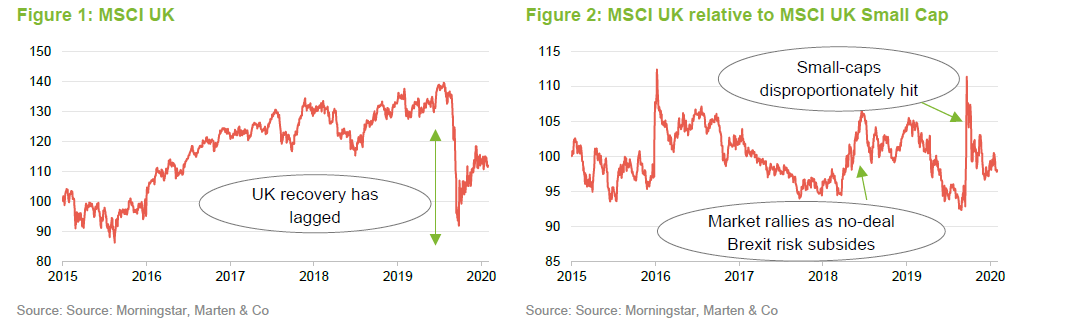

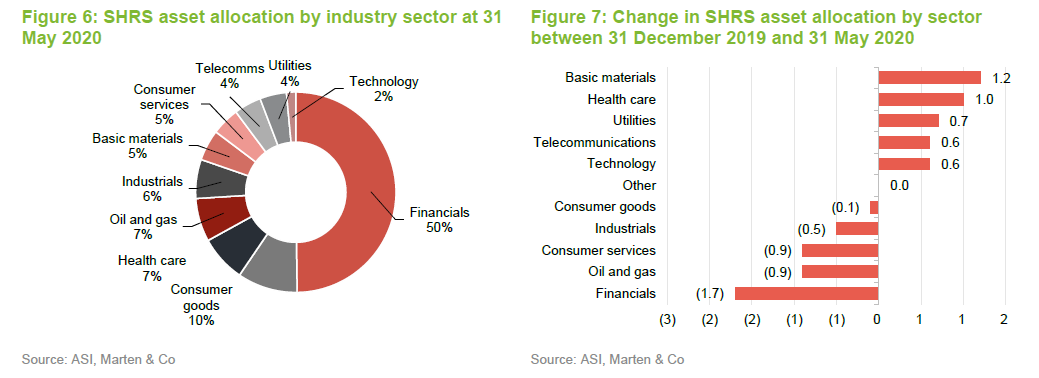

In order to deliver on their income mandates, fund managers have been looking to more defensive sectors, such as healthcare and tobacco. More broadly, UK equities, as represented by the MSCI UK indices illustrated by Figures 1 and 2, have lagged behind the recovery in global stock markets since April.

Iain believes we have likely moved past the worst phase of the pandemic. Provided the UK is able to escape a second-wave of infections over the coming months, there should be signs of green shoots as the economy gradually re-opens. This would particularly benefit SHRS’s largest holding, the growth-focused Aberdeen Smaller Companies Income Trust, at about 9% of the portfolio.

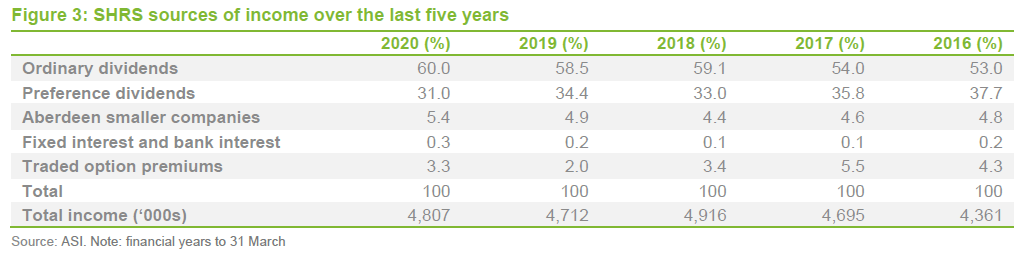

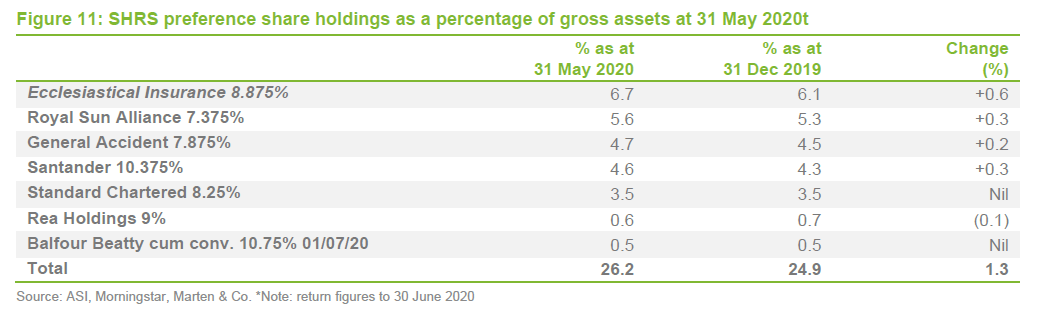

Holding growth-focused exposure is made possible by the fact that over 30% of SHRS’s income generation is delivered by a preference shares portfolio, which is financed by a combination of debt and equity. The income that this generates allows the manager to invest in a number of low to non-income-paying growth stocks, without compromising the trust’s attractive dividend yield. Figure 3 lists SHRS’s income sources.

Despite the fact that SHRS’s preference shares are predominantly in financials, where regulators have mandated suspensions to ordinary dividends, the regulators have allowed these companies to continue to pay their preference share dividends and so this source of income has continued unabated. This has contributed to SHRS’s outperformance of its peer group since April. The manager also has the ability to increase option writing to supplement income.

Asset allocation

Asset allocation

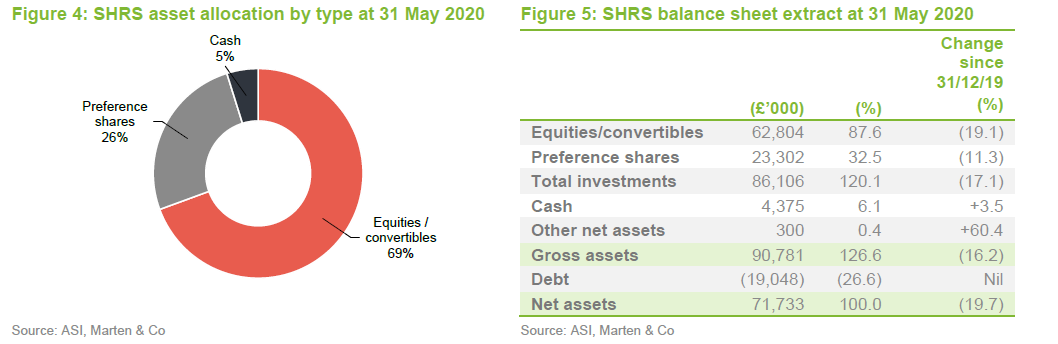

As at 31 May 2020, SHRS’s portfolio consisted of 56 investments, split between seven fixed-income and 49 equity positions. As illustrated by Figure 5, at 31 May the value of the preference share portfolio was 1.6x greater than the fund’s debt, net of cash.

As illustrated by Figure 5, between 31 December 2019 (the balance sheet information used in our most recent annual note) and 31 May 2020 net assets declined by 19.7%, driven by COVID-19-related market moves. As might be expected, the value of the preference share portfolio has been more resilient than the equities/convertibles assets. Most of the preference share positions are in financials, where Iain notes that the withholding of ordinary dividend payments is primarily the result of regulatory intervention by the Bank of England. The banking sector is benefitted from having been well capitalised going into the pandemic.

Top 10 holdings

Top 10 holdings

The aforementioned benefit of holding high yield preference shares allows SHRS to allot 9–10% of gross assets to the relatively low-yielding (and more growth focused) Aberdeen Smaller Companies Income Trust (ASCIT). Inevitably, ASCIT suffered over the first half of 2020, reflecting the greater vulnerability of smaller companies to the strain inflicted by the pandemic. ASCIT recovered well over the quarter to 30 June 2020 as equity markets rallied sharply, delivering total NAV and share price returns of 19.0% and 37.0%. By comparison, the AIC UK Smaller Companies sector generated median returns of 16.4% and 18.0%, respectively.

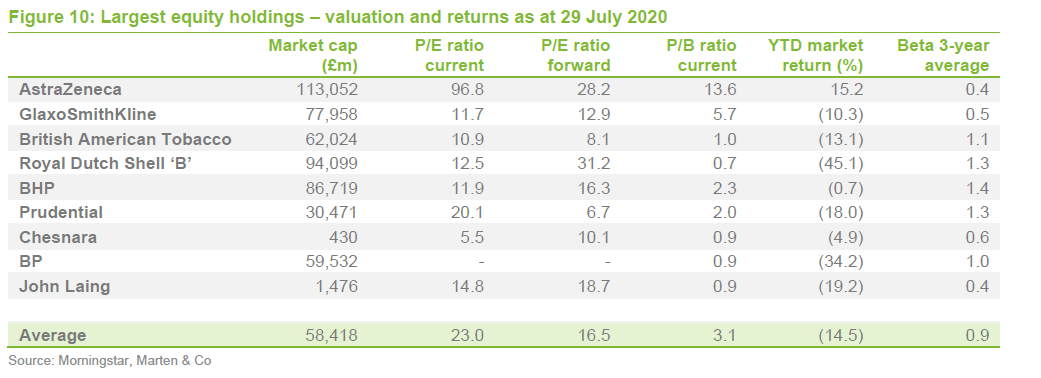

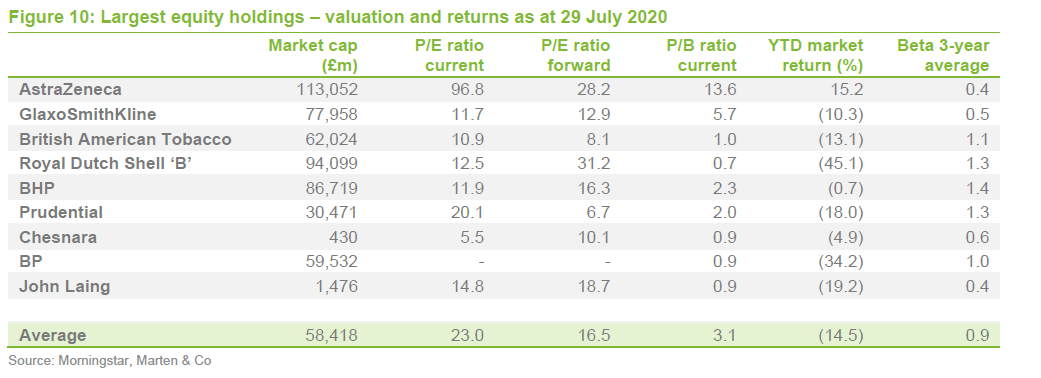

The manager’s long-term buy and hold strategy usually results in modest changes to the top 10 holdings. In these exceptional times, changes are inevitably more pronounced. Royal Dutch Shell ‘B’ (Shell) and BP’s relative positions have slipped down, mirroring the performance of the energy sector. Iain reduced the holding in Shell by about 40%. In April, Shell slashed its dividend by two-thirds, in what was its first cut since the Second World War. BP has so far not followed Shell in cutting its dividend, though there is a good chance this will happen as the oil price remains depressed reflecting the contraction in the global economy. The company reported a 66% drop in first quarter earnings.

AstraZeneca and GlaxoSmithKline have replaced the oil majors, as the second and third largest equity holdings. The pharmaceutical sector has been resilient. Purchases by Iain and market moves have increased the fund’s exposure to both companies by about 5%, over the past few months. AstraZeneca has performed very well recently, boosted by the apparent success of the COVID-19 vaccine that it is developing and manufacturing in conjunction with Oxford University’s vaccinology centre. Moreover, over recent years, AstraZeneca has launched a number of very successful cancer drugs.

Elsewhere, the global mining company, BHP, is a new entry in the top 10. Iain increased the trust’s exposure to the company by around 61%, as part of his strategy over recent months, to increase the portfolio’s international focus. Dividend payments by global mining companies like BHP are not thought to be under threat. The holding in British American Tobacco was also topped up. It offers a secure dividend and Iain believed it to be attractively priced. We also note that Chesnara, the life insurance company, increased its dividend in late March.

The composition of the preference share portfolio remains unchanged from when QuotedData last published on SHRS in February 2020. Other than the Balfour Beatty convertible, none of the securities listed in Figure 11 has a fixed redemption date.

Portfolio activity

Portfolio activity

New holdings added by the manager since our last note include Total SE, Direct Line Insurance Group, LondonMetric, and Coca-Cola HBC (these are discussed in more detail below).

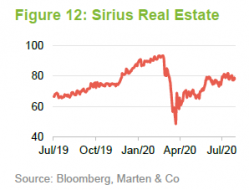

Elsewhere, the manager increased the fund’s exposure to Sirius Real Estate (SRE), M&G, and IWG by more than 50%.

Germany-based SRE invests and operates flexible workspaces with a portfolio of around 60 business parks. Germany appears to have managed the spread of COVID-19 and the process of re-opening its economy more effectively than the other major Western European countries.

Asset management company M&G was topped up over June, at what the manager considers to be an attractive valuation. We note that as at 20 July 2020, M&G’s shares are trading at 4.4x trailing earnings. The company is making a concerted effort to make further inroads into the retail market after agreeing to acquire Ascentric, an advisory platform, for £14bn from Royal London. Ascentric’s wide user base will provide a greater reach for M&G’s core fund and insurance products.

IWG provides workspace real-estate solutions globally. The company is the world’s largest in its space. Compared to other companies in this industry, like WeWork, IWG has expanded more cautiously. A recent equity raise provides the means to take advantage of distressed opportunities. IWG suspended its dividend and share buybacks in April. The flexible solutions it provides could prove popular with small and medium-sized businesses in particular, as economies gradually re-open.

Total SE – 1.4% portfolio weight as at 30 June 2020

Total SE – 1.4% portfolio weight as at 30 June 2020

Over June, Iain added the France-based integrated oil and gas company, Total SE (Total) (www.total.com), to the portfolio. Total is the world’s second biggest producer of liquefied natural gas (LNG). It recently secured financing of $15bn that will be deployed in developing LNG in Mozambique. The project will be the largest foreign direct investment into Africa, to date. Total is among the major European oil and gas companies that consider green energy to be a major commercial opportunity.

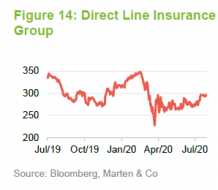

Direct Line Insurance Group – 0.7% portfolio weight as at 30 June 2020

Direct Line Insurance Group – 0.7% portfolio weight as at 30 June 2020

UK-based Direct Line Insurance Group (Direct Line) (www.directlinegroup.co.uk) was added to the portfolio over April. The company is a personal and small business general insurer. Personal insurance operating segments include motor, home, and rescue.

The commercial business provides insurance to small and medium-sized companies. Direct Line was built through a direct-to-customer telephone model. It is investing in digitalising its business, having recently completed the acquisition of Brolly, the digital insurance app.

LondonMetric 0.6% portfolio weight as at 30 June 2020

LondonMetric 0.6% portfolio weight as at 30 June 2020

LondonMetric (www.londonmetric.com) managed to raise £120m in a placing of new shares at a premium to NAV over May, a remarkable figure at the height of the pandemic. The money will be invested in a pipeline of urban logistics assets. LondonMetric has performed resiliently through a pandemic that has severely affected so many commercial property funds. The logistics sector, and urban logistics in particular, is playing an important role for many businesses that are still in operation during the lockdown – e.g. parcel delivery firms. LondonMetric is taking advantage of the current turmoil in property and the majority of the acquisition pipelines it has identified are sale-and-leaseback deals with operators that want to release some capital from the real estate they own.

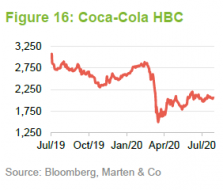

Coca-Cola HBC – 0.5% portfolio weight as at 30 June 2020

Coca-Cola HBC – 0.5% portfolio weight as at 30 June 2020

With revenues in excess of £6bn, Coca-Cola HBC (www.coca-colahellenic.com) is one of The Coca-Cola Company’s leading franchise bottling companies. Coca-Cola HBC serves established markets such as Italy and Switzerland and developing markets across Central and Eastern Europe, including Russia. It also has a sizeable presence in Nigeria. In addition to the core Coca-Cola carbonated line-up, the company also manufactures bottled water, energy drinks and juices.

Disposals and sales

Disposals and sales

Since our last note, the manager has exited positions in HSBC, London Stock Exchange (LSE) Group, and Unibail-Rodamco-Westfield. HSBC will not pay a dividend this year and is exposed to the ongoing fallout between Hong Kong and the Chinese mainland. Hong Kong is the hub of its strong Asia business. Iain noted that whilst the Standard Chartered holding is similarly exposed to Hong Kong, he has retained it in the portfolio on valuation grounds.

LSE was sold over April. The manager’s decision was likely influenced by the holding’s relatively-low yield (below 1%) and the prevailing sentiment at the time. Shares in LSE have since rebounded in line with the wider rally in the equity market.

Shares in Unibail-Rodamco-Westfield, the parent company behind the Westfield shopping centres, are down by nearly 70% over the year to 30 July 2020, reflecting the general malaise in the retail property sector as lockdowns forced store closures and encouraged online shopping.

Elsewhere, the manager has reduced the holding in Associated British Foods. The company owns Primark, the discount clothes retailer. Primark does not have an online presence of its own, which potentially places it at a major disadvantage in this new era. Primark’s reliance on dense footfall drove the manager’s decision.

Performance

Performance

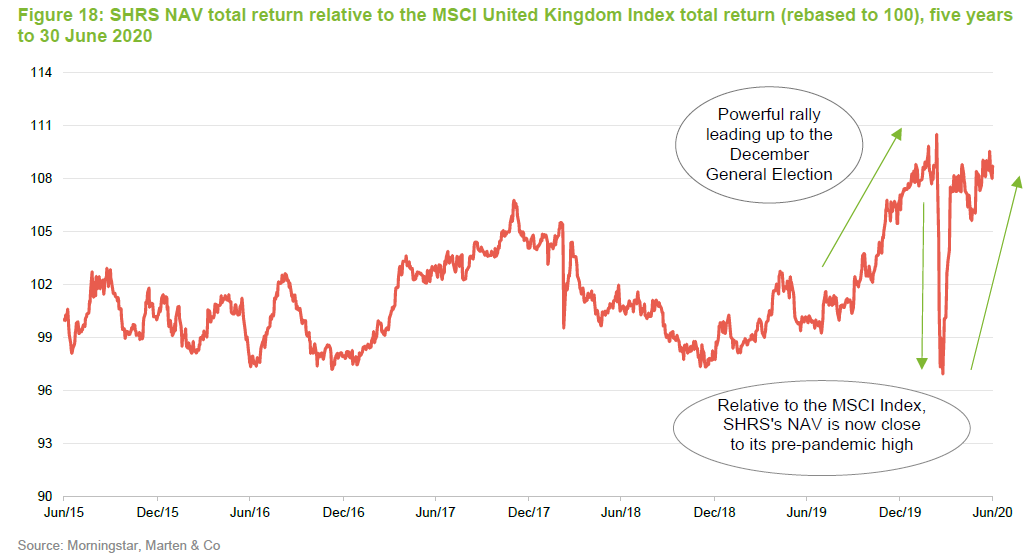

The past year has provided some extraordinary market moves. The period leading up to the UK’s general election last December saw SHRS reach new heights against the broader UK market, represented by the MSCI UK Index. As at 30 June 2020, SHRS NAV is approaching its pre-pandemic high, against the Index, on a normalised five-year basis.

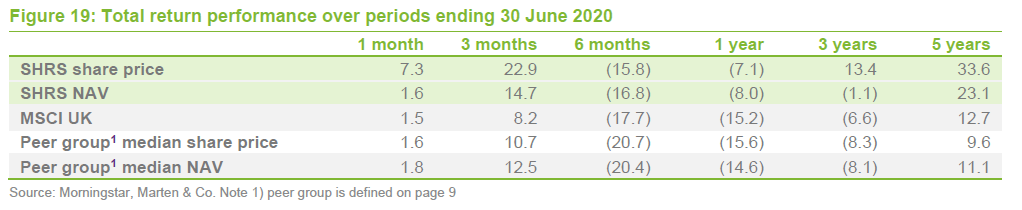

As Figure 19 illustrates, in total return NAV and share price terms, SHRS has outperformed median returns delivered by its peer group (defined in the next section) across most cumulative time periods to 30 June 2020.

Significant underweights to large index constituents delivering value

Significant underweights to large index constituents delivering value

SHRS’s most recent full-year results period to 31 March unfortunately reflected the most severe impact of the pandemic on financial markets, without factoring in the subsequent recovery. Relative to its benchmark and to many peers, SHRS benefitted from either underweight exposures or not holding a number of large constituents of its benchmark, such as Royal Dutch Shell, HSBC, Lloyds Bank, Barclays, and Glencore. Lower exposure to this group of companies has continued to deliver relative outperformance since the end of SHRS’s financial year. Only Glencore has outperformed the fund’s NAV over the period.

Peer group

Peer group

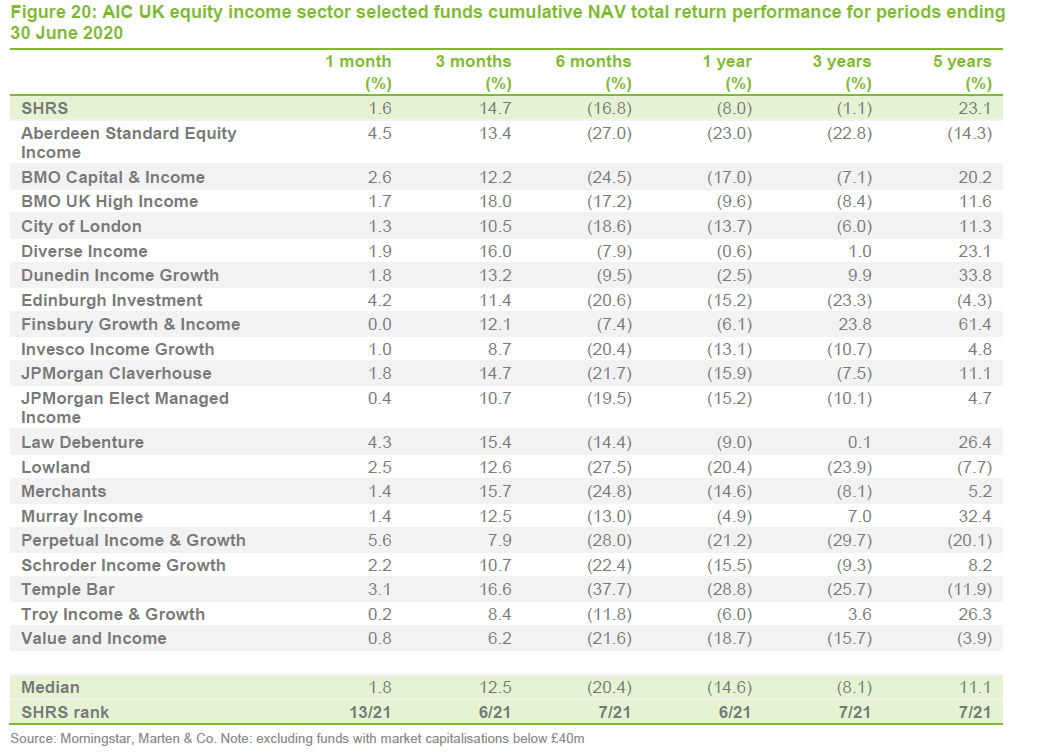

SHRS sits within the AIC’s UK equity income sector. For the purposes of this note, we have excluded investment companies with a market cap of less than £40m. A full list of the investment companies in our peer group is provided in Figure 20.

As discussed in the asset allocation section, SHRS’s policy of enhancing its income through its preference share portfolio allows it to hold more growth companies than most of its peers. The combination of growth and high-income has been powerful over several years, in an environment where investors have favoured growth over value.

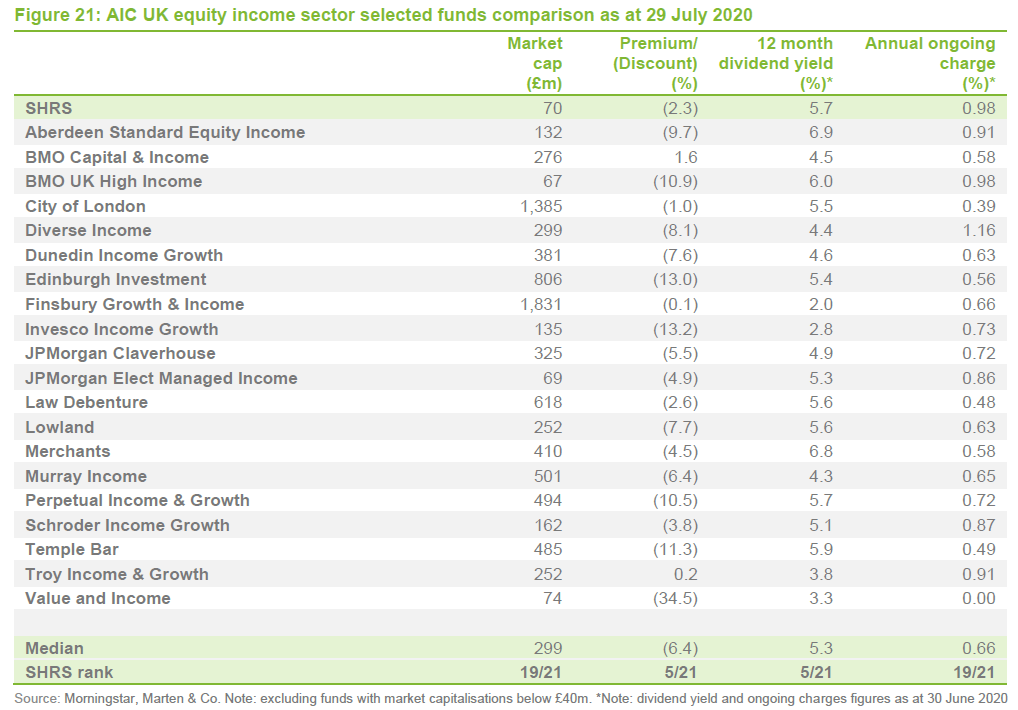

SHRS’s relative performance has been remarkably consistent over the time periods shown in Figure 21, with total returns consistently well ahead of the sector median. The fund’s relatively high ongoing charges ratio reflects its small size, with a market capitalisation of £69.8m, as at 29 July 2020. However, its attractive dividend yield and the growth exposure built into its strategy have allowed its shares to trade close to or above asset value for most of the past 18 months. Readers interested in more detail on SHRS’s fees can refer to page 15 of our most recent annual overview note.

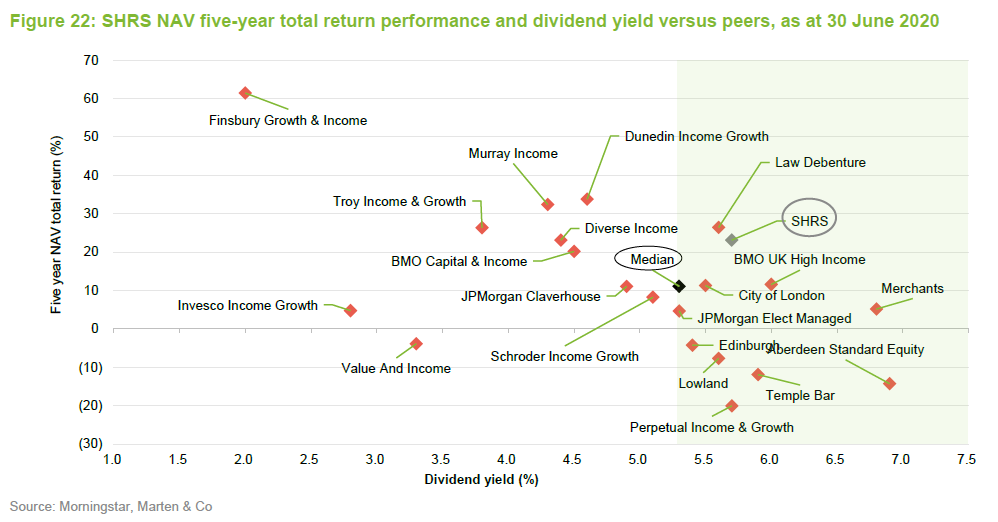

Figure 22 illustrates how SHRS’s dividend yield and NAV return over five years compare against the wider sector. Out of all the funds with a yield greater than the sector median of 5.3% (the shaded area in Figure 22), only Law Debenture delivered a greater five-year total NAV return. Law Debenture, formerly classified under the AIC’s global sector, is a more esoteric fund with its combination of equity investments and the operation of an independent professional services business.

Dividend

Dividend

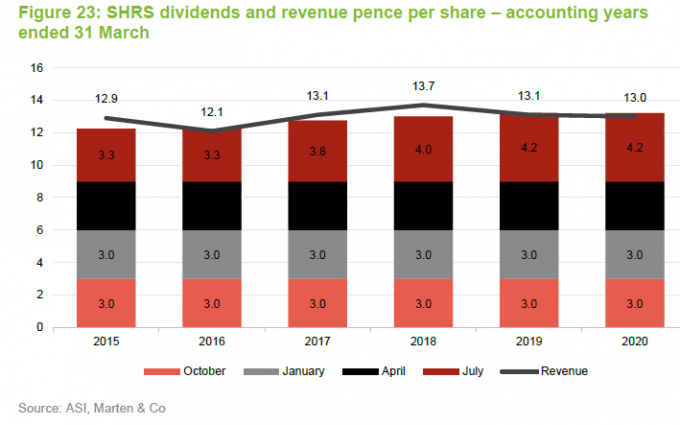

SHRS pays quarterly dividends in October, January, April, and July. For the financial year ending 31 March 2020, the dividend was maintained at 13.2p. As with recent years, it comprises of three quarterly interim dividends of 3p each, with a final dividend determined following a review of the year-end results. As at 28 July 2020, SHRS’s shares were yielding 5.9%.

Whilst many financial companies were forced to suspend dividend payments on their ordinary shares, this has not been the case for SHRS’s preference shares, which is helping to protect a large part of its dividend revenue.

Prior to the payment of the third interim and final dividend, SHRS’s revenue reserves at the end of March 2020 amounted to £6,770,000, equivalent to 22.0p per share. The 2019/2020 dividend was narrowly uncovered by current year earnings, though following the payment of a final dividend of 4.2p, in July, revenue reserves will represent 1.1x the current annual cost of the dividend.

Premium/(discount)

Premium/(discount)

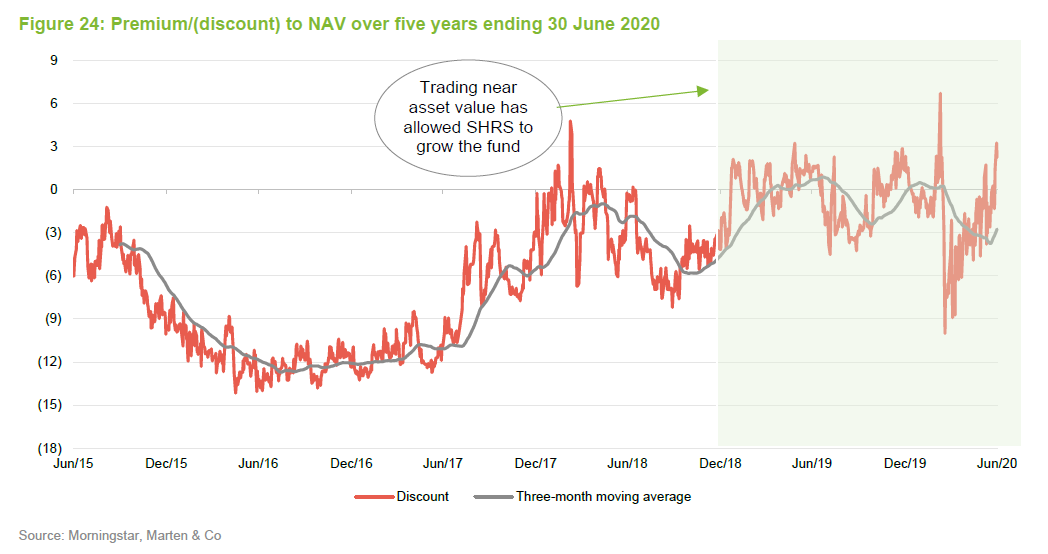

Over the 12 months ended 30 June 2020, SHRS traded within a range of a (10.0%) discount to a 6.7% premium and an average discount of (1.4%). At 28 July 2020, the shares were trading at a discount of (2.7%).

Before the outbreak of COVID-19, SHRS had traded close to asset value for over a year. This provided an opportunity to grow the fund, with 615,000 shares issued, at a premium to NAV, over the year to 31 March 2020. We note that SHRS also issued 25,000 new shares over July 2020.

Fund profile

Fund profile

SHRS aims to provide its shareholders with a high level of income, together with the potential for growth of both income and capital from a diversified portfolio substantially invested in UK equities but also in preference shares, convertibles, and other fixed income securities. The company is benchmarked against the FTSE All-Share Index. We have substituted this with the MSCI UK Index for the purposes of this report.

SHRS generates income primarily from its investments in ordinary shares, convertibles, and a geared portfolio of preference shares. It may supplement this by writing call and put options on shares owned by the trust or shares that the manager would like to buy.

SHRS’s preference share portfolio is funded, in part, by lower cost debt (effectively, the equity portfolio is ungeared). The income that this arrangement contributes to SHRS’s returns allows the manager to hold some lower-yielding equities that offer better prospects for both dividend and capital growth. The pool of income available for distribution is augmented further by writing calls and options. In the past, when interest rates were higher, fixed interest investments and interest on cash deposits would also have made a meaningful contribution to SHRS’s revenue account. This may be the case again if interest rates rise.

SHRS’s manager is Aberdeen Standard Fund Managers Limited, which has delegated the day-to-day management of the company to Aberdeen Asset Managers Limited. Both companies are wholly-owned subsidiaries of Standard Life Aberdeen Plc. The manager emphasises a team approach to managing money. The lead manager for SHRS is Iain Pyle, who is also lead portfolio manager for the Standard Life Investments UK Equity High Income Fund and the Bothwell UK Equity Income Fund.

Iain Pyle

Iain Pyle

Iain is an investment director on the UK equities team, having joined Standard Life Investments in 2015. Previously, he was an analyst on the top-ranked oil and gas research team at Sanford Bernstein. Iain graduated with a MEng degree in Chemical Engineering from Imperial College and an MSc (Hons) in Operational Research from Warwick Business School. He is a chartered accountant and a CFA charterholder.

Previous publications

Previous publications

Readers interested in further information about SHRS may wish to read our previous notes, which are listed below.

- Sustainable high yield – Initiation – 19 October 2018

- Growing again – Update – 30 May 2019

- Building on a great 2019 – Annual overview – 5 February 2020

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Shires Income Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.