Focused on returns

Focused on returns

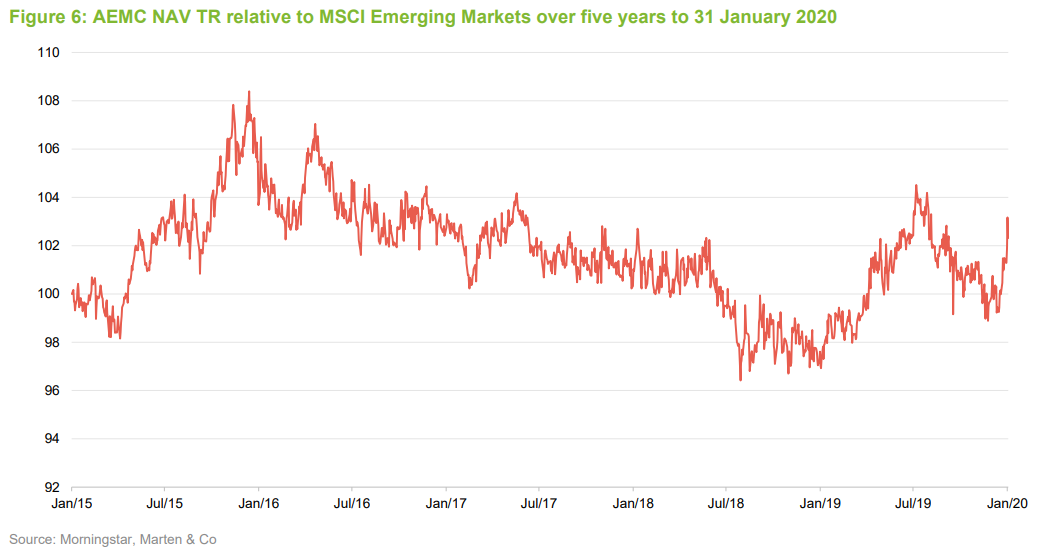

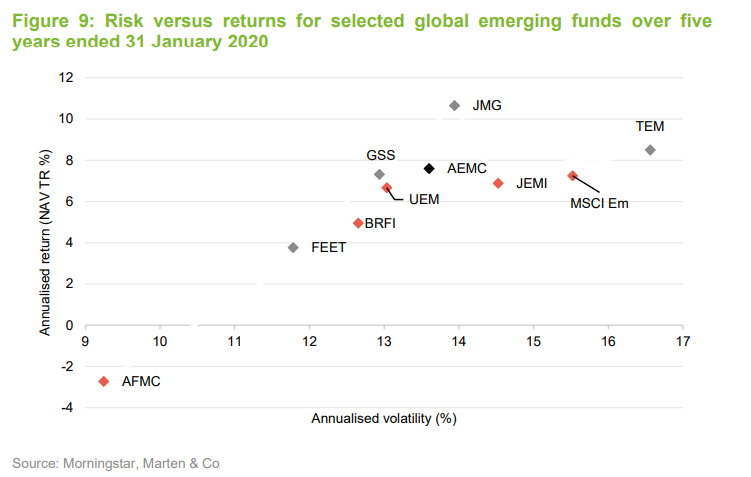

The managers of Aberdeen Emerging Markets (AEMC) are optimistic about the prospects for the company. Strong performance last year has not yet translated into a reduction in the discount that the share price trades at relative to the asset value, but if outperformance can be maintained, this should follow in time. Investors might also be comforted by AEMC’s much lower volatility of returns compared to its peers and its benchmark.

The managers feel that AEMC offers investors a ‘one-stop shop’ for those looking for emerging markets exposure. AEMC’s portfolio would be hard for most investors to replicate without considerable effort. It also benefits from an experienced and well-resourced team, backed by the resources of Aberdeen Standard Investments.

Before the emergence of COVID-19 (the coronavirus), the managers felt that 2020 could be the year in which emerging market earnings turned a corner. Investors’ expectations and valuations are more realistic now and recent market falls could be a buying opportunity.

Aims for consistent outperformance of MSCI Emerging Markets Index

Aims for consistent outperformance of MSCI Emerging Markets Index

AEMC invests in a carefully-selected portfolio of both closed- and open-ended funds, providing a diversified exposure to emerging economies. It aims to achieve consistent returns for its shareholders in excess of the MSCI Emerging Markets Net Total Return Index in sterling terms.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI Emerging Markets TR. (%) | MSCI World total return (%) |

|---|---|---|---|---|---|

| 1 | 31 Jan 2016 | -13.00 | -13.20 | -16.30 | 0.50 |

| 2 | 31 Jan 2017 | 37.30 | 40.90 | 41.40 | 32.00 |

| 3 | 31 Jan 2018 | 25.10 | 21.90 | 24.80 | 11.30 |

| 4 | 31 Jan 2019 | -13.80 | -11.00 | -7.30 | 1.00 |

| 5 | 31 Jan 2020 | 12.40 | 9.40 | 3.60 | 17.50 |

Fund profile

Fund profile

Aberdeen Emerging Markets Investment Company (AEMC) offers its shareholders access to a range of ‘best-of-breed’ investment managers, many of whom are inaccessible for most UK-based investors. These managers are investing in some of the most dynamic and fast-growing countries in the world. Investments are made through both closed- and open-ended funds, combining liquidity and access to a wider range of managers with the opportunity to add value through reduction in discounts.

Whilst benchmarked against the MSCI Emerging Markets Index, AEMC’s asset allocation may differ markedly from the benchmark, and is one source of alpha generation. Manager selection is also key to the success of the fund, and AEMC is fortunate to have investments in a number of funds that the average investor might struggle to access. The ability to add value from narrowing discounts and corporate actions in the closed-end fund holdings is another source of alpha. The fund also offers a dividend yield of 3.7% (at the time of publication), which is paid quarterly from a combination of income and capital.

Management team

Management team

AEMC’s Alternative Investment Fund Manager (AIFM) is Aberdeen Standard Fund Managers Limited (Aberdeen Standard) and it has delegated the investment management of the company to Aberdeen Asset Managers limited (AAML). Both companies are wholly-owned subsidiaries of Standard Life Aberdeen Plc.

Andrew Lister and Bernard Moody (the managers) have been the lead managers of the fund since 30 June 2014. They have been involved with the management of the fund since October 2000 and August 2006, respectively. They are assisted by Samir Shah and Omar Ene (collectively, the team). All of the senior members of the team have personal investments in the fund. Aberdeen Standard has considerable depth of investment management and analytical resource, in both emerging market equity and debt.

The team is now working closely with members of Aberdeen Standard’s multi-asset investing team, including Alistair Veitch, Margaret Ismond and Chris Paine. They provide inputs into the asset allocation decisions.

A good 2019

A good 2019

2019 was a good year for emerging markets and for AEMC in particular. The company’s results, covering the 12 months ended 31 October 2019, published on 13 February 2020, showed a net asset value (NAV) return of 14.1% against 10.3% for the MSCI Emerging Markets Index. The share price total return was 13.2%.

The managers note that these returns were achieved in an environment where they might have expected that it would be hard for AEMC to match the index. Size and sector allocation biases within the portfolio acted as headwinds. For example, small and mid-cap stocks underperformed, large technology stocks outperformed (although not in the final quarter of 2019), and growth is still outperforming value. There is scope for further outperformance if any of these trends reverse.

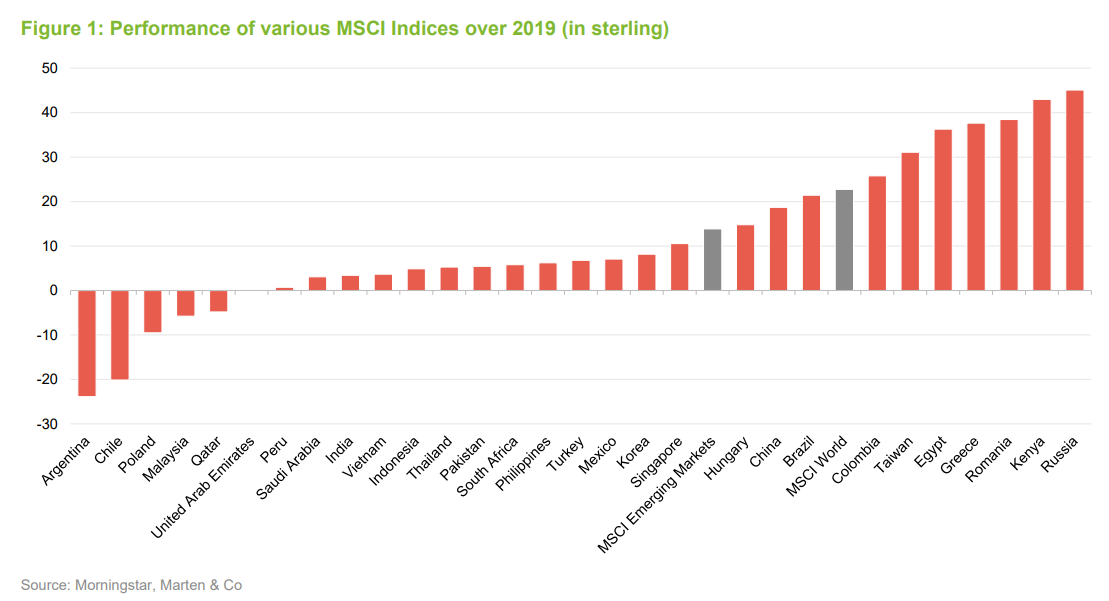

Figure 1 shows the performance of a range of MSCI Indices covering markets that AEMC is exposed to. At the lower end, a new Peronist government in Argentina derailed that market, and unrest in Chile held back its stock market. It is notable that Russia and Romania (a frontier market) – countries to which AEMC has a big overweight exposure relative to its benchmark – both did very well last year.

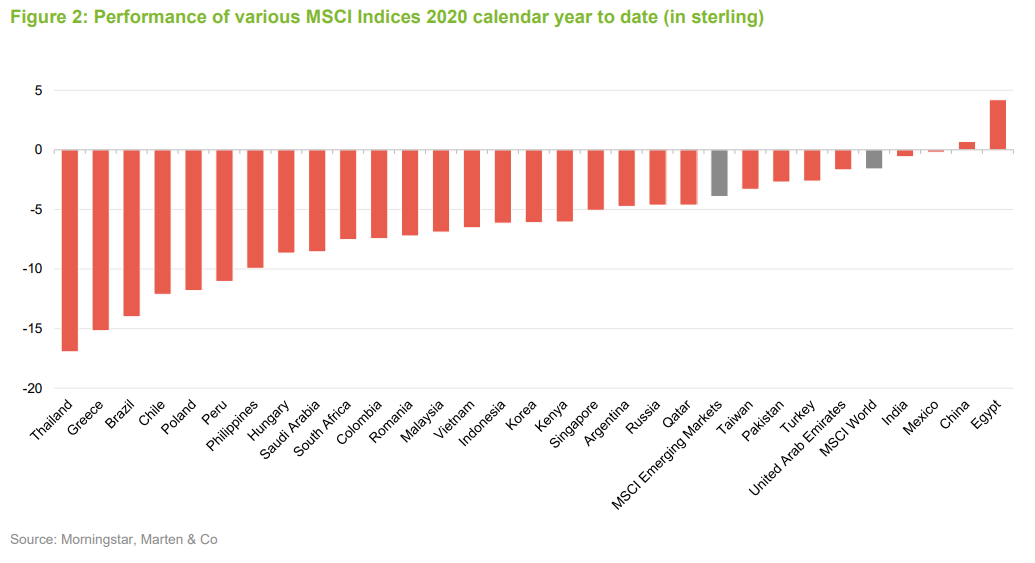

The managers highlight that investors, especially US investors, have an underweight exposure to emerging markets. Going into 2020, the managers were optimistic, believing that earnings growth expectations and valuations were realistic and that there was a reasonable prospect of an earnings recovery in 2020. Signs of improvement in US/China trade relations were also encouraging. However, in the short term, markets – particularly Asian markets – have been overshadowed by COVID-19, the coronavirus. A core manufacturing province in China has come to a standstill and consumer spending has slowed. The managers’ experience of the SARS outbreak in 2002/2003 was that new cases declined rapidly in the spring and there was rapid recovery in economic activity and stock markets.

The Chinese response has been to cut interest rates and inject liquidity into the system. China’s stock market is actually up this year in sterling terms. It is too early to tell whether there will be a significant long-term effect on its economy.

More focused portfolio

More focused portfolio

AEMC’s portfolio is becoming increasingly concentrated. The aim is to have fewer than 30 positions, increasing the active risk within the portfolio, although it should be noted that, on a look-through basis, the fund will be still be quite diversified (with exposure to around 1,300 companies at the last estimate). A couple of the existing positions are in wind-up mode (Komodo Fund and a side-pocket investment that is a legacy from an earlier liquidation of a trust portfolio) and should soon be fully realised.

As a fund of funds, the managers are very aware of the need to minimise the running costs that can arise when investing in other funds. One way that they can achieve this is by allocating a part of the portfolio to in-house funds when it makes sense to do so. The managers bought both a frontier markets bond fund and a China A share fund (a fund investing in China’s domestic stock market) – both open-ended. The latter has done particularly well; this is now the largest standalone fund in the ASI stable and, at least until the coronavirus emerged, was seeing sizeable inflows. The ASI focus on quality companies is working well in the A share market, which is still plagued by many companies of dubious quality treated like gambling chips by domestic investors.

AEMC also owns three ASI closed-end funds, Asia Dragon, Aberdeen Asian Income and Aberdeen New India. The managers point out that there is no pressure on them to hold back when seeking discount-narrowing opportunities in ASI trusts. For example, the managers tendered AEMC’s position in Asia Dragon in that trust’s most recent tender offer (an invitation by the trust for investors to sell all or part of their holding).

Investment process

Investment process

AEMC’s managers seek to construct a portfolio of both closed- and open-ended funds that give a diversified exposure to emerging markets. Outperformance of the benchmark can come from asset allocation decisions, fund selection and, in the closed-ended fund part of the portfolio, value can be added through discount contraction and corporate activity.

The managers believe that value-based, active investing can deliver outperformance of market indices over the long term. They say that closed-ended structures have some structural advantages over open-ended structures. However, the inclusion of open-ended funds within the portfolio gives access to talented management teams that might not be available via closed-ended funds, allows for improved liquidity and offers protection against the possibility of discount widening (prices for open-ended funds are set once a day based on their NAV).

Asset allocation – a contrarian approach

Asset allocation – a contrarian approach

In what can be quite volatile and unpredictable markets, the managers stress that it makes sense to prioritise caution over greed. Therefore, they tried to avoid taking excessive investment style and factor risk within the portfolio. However, asset allocation is seen as an important potential source of alpha generation and therefore the distribution of the portfolio may differ markedly from the benchmark.

Asset allocation decisions are based on a detailed assessment of prospects for different regions and the opportunities available. The underlying managers, experts in their fields, are a valuable source of information. The managers leverage the expertise of Aberdeen Standard’s multi-asset team as well as the portfolio managers for the various regional and country-specific portfolios. In addition, the managers use a multi-factor quantitative model to help check their assumptions. Essentially, the approach is a contrarian one, favouring markets that are undervalued relative to their peers and cheap relative to history. The board has not imposed any prescriptive limits on the geographic breakdown of the portfolio.

Fund selection – looking for best-of-breed

Fund selection – looking for best-of-breed

The managers conduct extensive due diligence on prospective investments, including a comprehensive assessment of operational issues by the eight-strong operational due diligence team at Aberdeen Standard Investments. When selecting the underlying funds, the managers’ focus is on the ‘four Ps’ – people, process, portfolio and performance. The team conducts between 400 and 500 meetings with managers each year. They want to identify underlying managers with strong stock-picking skills and relevant experience, who are prepared to engage in an ongoing dialogue with the team, and whose interests are aligned with those of investors, often through significant personal investments in their own funds.

The investment process should be understandable, repeatable and consistently applied. The team is looking for evidence that the underlying managers are carrying out extensive research on their investments. The team will analyse the underlying portfolios and determine their risk and return characteristics. They will interpret the portfolio’s performance track record in the light of this analysis.

Fees charged on the underlying funds must be competitive. The managers are often able to secure terms not available to other investors.

Discount narrowing

Discount narrowing

The managers can switch the balance of the fund from open- to closed-ended and vice versa depending on the availability of discount narrowing opportunities. The inclusion of listed closed-ended funds within the portfolio allows the manager to seek to add value through discount narrowing. In these situations, the preference is for funds where they can identify a catalyst for a reduction in the discount. They will engage actively with boards, managers, shareholders and brokers.

Diversification

Diversification

The principle that asset allocation should make a meaningful contribution to returns ensures that the portfolio differs significantly from the make-up of the benchmark. The only formal constraint imposed on portfolio construction is that no holding will exceed more than 15% by value of net assets at the time of investment. The managers believe the portfolio should demonstrate the conviction that they have in their manager selection and aim to have fewer than 30 holdings in the fund. The managers take the degree of diversification within investee funds into account when selecting funds, so that AEMC’s exposure to any one underlying company should never be excessive. In practice, the look-through portfolio will be much more diversified than that of most other funds in the peer group, which should help reduce the volatility of AEMC’s returns.

Asset allocation

Asset allocation

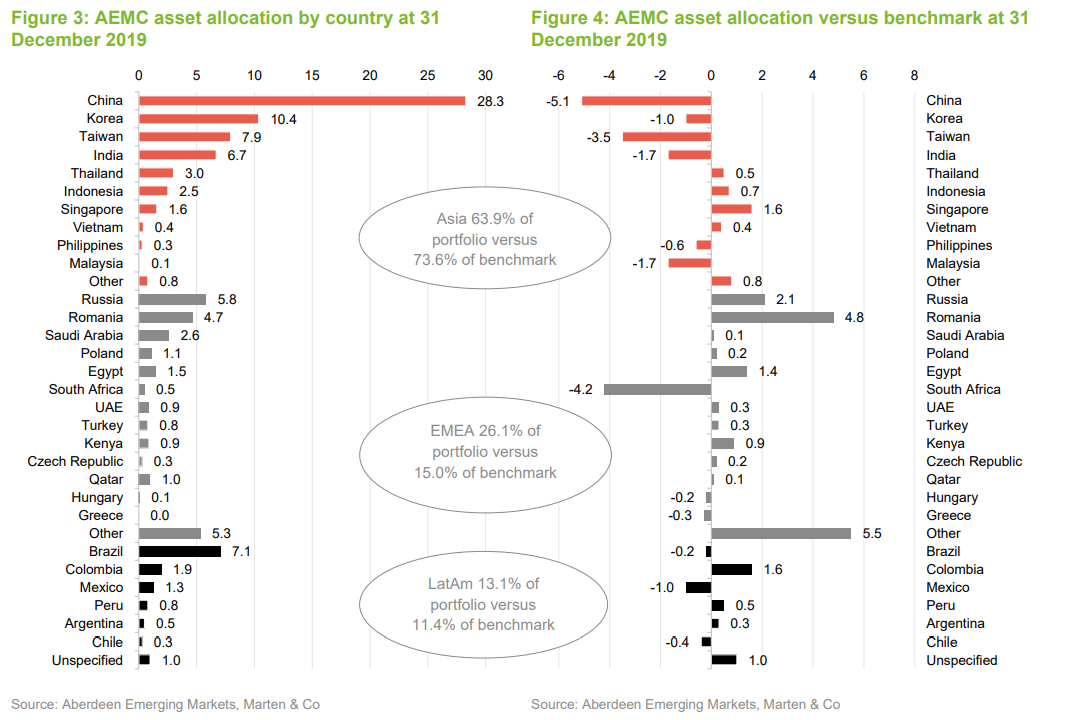

AEMC remains less exposed to Asia than its MSCI Emerging Markets Index benchmark. AEMC has a larger underweight exposure to China than it did six months ago, despite the investment in Aberdeen’s open-ended China A share fund.

In EMEA, where AEMC’s managers favour Russia and Romania, the managers believe that Russia still looks inexpensive even after its strong run in 2019. They note that the market’s rise was driven by domestic investors and international investors are still sitting on the sidelines.

Around 12% of the portfolio is invested in frontier markets, including Romania. The overweight exposure to Romania has increased on the back of the strong performance of that market and the investment in Fondul Proprietatea, in particular. Its NAV was written up at the end of December. The majority of this fund is invested in private equity positions. Its largest holding, a hydroelectric firm, might soon be privatised, triggering a further uplift in the NAV. Fondul is trading on a 30% discount to NAV and offers a 7% yield. It also holds regular tender offers.

The trust still has a relatively small amount invested in South Africa, on asset allocation grounds. Any slowdown in Chinese growth would weigh on commodity exporters such as South Africa.

In Brazil, AEMC’s exposure matches that of the index but the managers highlight that, like Russia, this is another market that foreigners have a low exposure to. The managers also say that Brazilian pension funds, which have been focused on bonds, may be tempted into equity markets as rates fall and bond yields look less attractive. There is a problem, though, as many pure-play Brazilian funds have disappeared over the years and this makes it hard to find opportunities to exploit the opportunity. The same is true of sub-Saharan Africa funds, where AEMC holds Laurium Limpopo.

Largest holdings

Largest holdings

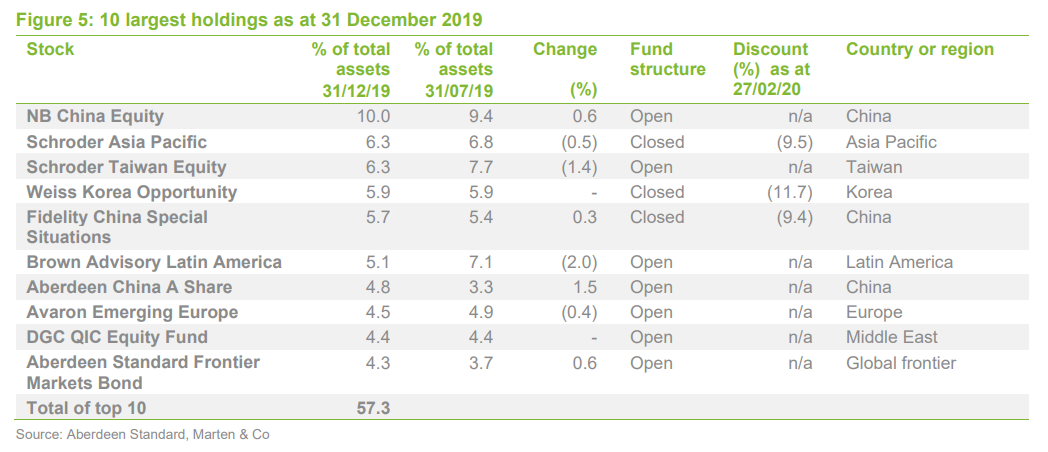

Since we last published, Genesis Emerging Markets and JPMorgan Emerging have dropped out of the list of the 10 largest positions. The managers say that exposure to generalist emerging markets investment trusts will be lower in future unless a compelling discount-narrowing opportunity exists as they seek to make the portfolio more differentiated.

The company has been running with a reasonable level of gearing (7.6% at the end of December 2019). Some money was invested into Aberdeen’s frontier markets bond fund. This has performed well, and when we met, the manager had already added about 1% to returns. Part of the attraction was the 8.2% yield on offer on this fund. The managers are looking for funds that might be complementary to this investment.

The China A share fund was discussed on page 5 in the enclosed PDF version, but elsewhere in China, the trust retains positions in Fidelity China and Neuberger Berman China.

The investment in Weiss Korea has not yet worked out as intended. The managers say that reforming South Korean corporate governance is slow going. The premise was that the fund could buy preference shares trading on big discounts to equivalent ordinary shares and profit as those discounts narrowed. Unfortunately, preference shares and the Korean market remain cheap. One comfort is that this investment company does facilitate exits at prices close to NAV.

Brown Advisory Latin America had a poor 2019, largely because it called Argentina wrong, as did BlackRock Latin American, which AEMC also holds. There could be a 25% tender in the latter fund within 18 months, which might provide a discount narrowing opportunity.

Performance

Performance

A relatively strong start to 2020 has helped AEMC recoup some of the ground it lost over the second half of 2019.

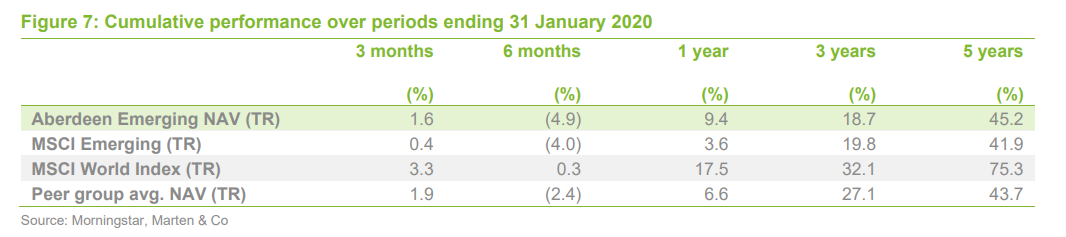

The peer-group used in Figure 7 comprises the average performance of Fundsmith Emerging Equities, Genesis Emerging Markets, JPMorgan Emerging Markets, Mobius Investment Trust and Templeton Emerging Markets. These funds’ investment objectives closely resemble those of AEMC.

Notwithstanding a more difficult second half of 2019, good performance over the past year has allowed AEMC to maintain its record of outperformance of its benchmark and peer group over the long term. Emerging markets continue to lag developed markets, extending the valuation gap between the two.

Drivers of performance

Drivers of performance

The managers have broken down the drivers of the company’s outperformance of its benchmark over its financial year ended 31 October 2019. All three routes to added value worked for the fund over this period as fund (manager) selection added 0.8%, asset allocation 1.6% and discount narrowing 2.4%.

On fund selection, individual positions highlighted by the managers include Aberdeen Standard China A Share Equity Fund and Neuberger Berman China Equity Fund. On asset allocation, while the Russia overweight proved useful, the funds exposed to the market lagged the index. Discount narrowing on BlackRock Latin American and JPMorgan Emerging was augmented by the exit achieved from BlackRock Emerging Europe when that trust opted to liquidate (with a choice of cash or a rollover into BlackRock Frontier Markets).

Peer group comparison

Peer group comparison

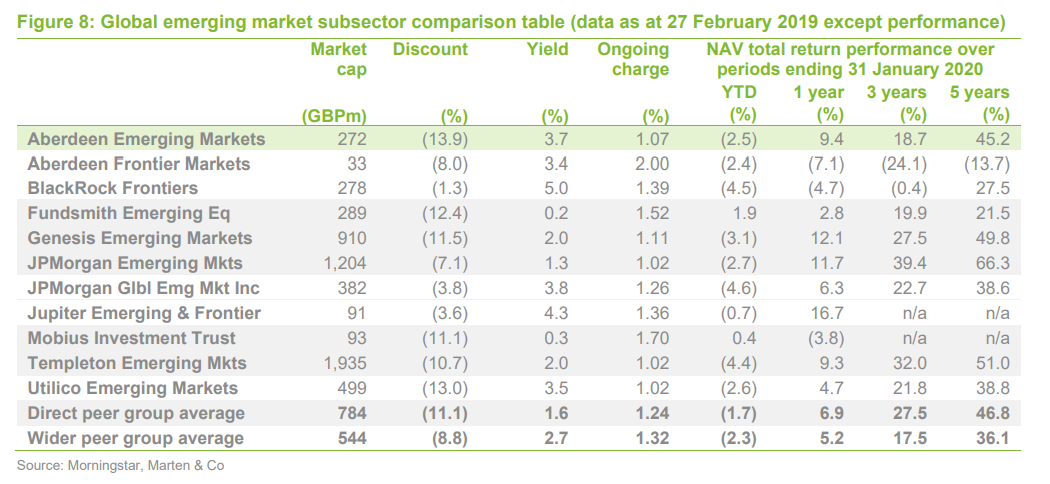

The constituents of the peer group identified above are highlighted in grey in Figure 8. The wider peer group comprises all the funds in the AIC’s global emerging markets sector, excluding Africa Opportunity, Gulf Investment Fund and Qannas, which are not global funds; and Ashmore Global Opportunities, which is in the process of liquidating its portfolio.

AEMC’s discount remains anomalously wide, especially given its attractive yield and low ongoing charges ratio.

Over five years, AEMC’s returns are ahead of the peer group average. We also note that the volatility incurred in generating the returns was above the average of selected global emerging market funds, shown in Figure 9.

Dividend

Dividend

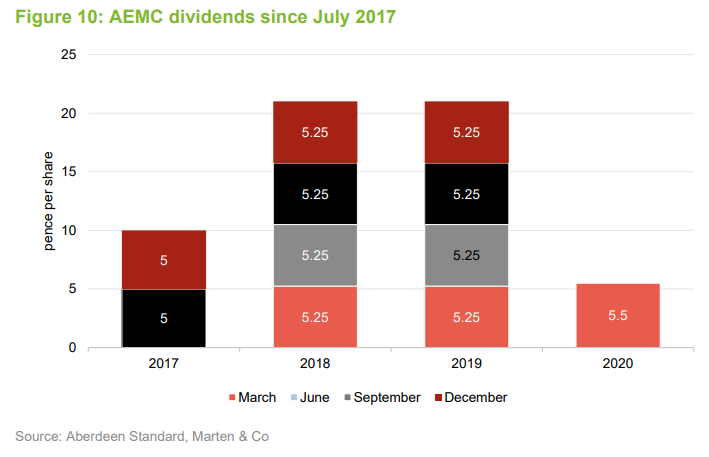

In July 2017, AEMC’s board decided to implement a new dividend policy, paying dividends topped up from distributable capital reserves. The board believed that investors were placing an increased emphasis on the income available from investing in emerging markets; yet, having built up substantial revenue losses, AEMC had not declared a dividend since 2009.

Over the company’s financial year ended 31 October 2019, dividends totalled 21p. The board has indicated that the total dividend for the current financial year will be not less than 22p and has declared a first quarterly dividend of 5.5p.

By contrast, AEMC’s revenue per share for the year ended 31 October 2019 was 2.41p (2018: 2.03p).

Discount

Discount

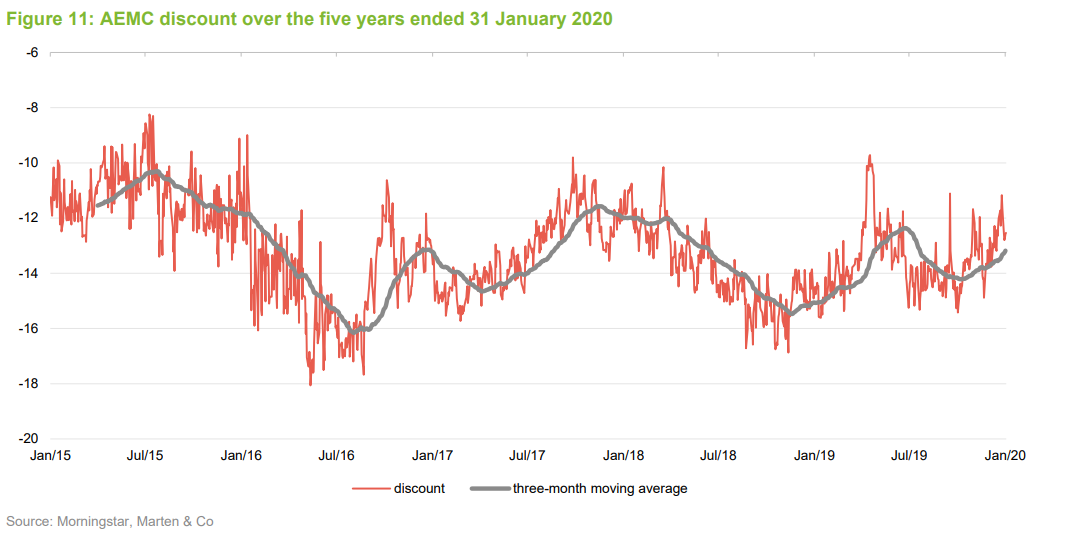

Over the year ended 31 January 2020, AEMC’s discount moved within a range of 15.6% and 9.7% and, at 25 February 2020 the discount was (13.9%).

The company takes powers at each AGM to buy back up to 14.99% of its then-issued shares. The company bought back 81,937 shares over the year ended 31 October 2019 and has not made any repurchases since.

The trust’s discount seems to be on a narrowing trend, but there is scope for it to narrow further.

Fees and costs

Fees and costs

AEMC’s management fee is charged at an annualised rate of 0.8% of net assets. There is no performance fee. For the purposes of the calculation of the management fee, any investments in funds managed by Aberdeen Standard are excluded from net assets. The investment management agreement can be terminated on six months’ written notice by either party.

Vistra Fund Services (Guernsey) Limited is the administrator and secretary to the company. It receives a fee of £40,000 a year plus certain additional fees. PraxisIFM Fund Services (UK) Limited acts as administration agent in the UK. It receives a monthly fee equal to one-twelfth of 0.1% of NAV, but this was capped at £148,653 for the year ended 31 October 2019 and the cap is increased annually in line with the UK Retail Price Index.

Northern Trust (Guernsey) Limited, receives fees for depositary services calculated at the rate of 2.95 basis points (0.0295%) a year, subject to a minimum annual fee of £20,000 plus fees for custody services.

AEMC’s ongoing charges ratio for the year-ended 31 October 2019 was 1.07% (2018: 1.02%). The small uplift in the ratio was the result of a year-on-year decline in the average NAV over the trust’s financial year ended in 2019 (£300.9m versus £331.8m for the 2018 financial year), with total non-management expenses remaining largely unchanged.

Capital structure and life

Capital structure and life

There are 45,965,159 ordinary shares in issue as at the date of the publication of this note and no other classes of shares. There are also 8,653,348 ordinary shares held in treasury, which can only be reissued at a premium to NAV.

The company is permitted to borrow, at the point of drawdown, up to 15% of its net assets. In March 2017, the company entered into an unsecured multi-currency revolving loan facility with The Royal Bank of Scotland, for an amount of £25m and termination date of 29 March 2019, this was renewed for a further year and the board has stated that it is in discussions with its bankers and expects to renew the facility on similar terms in March of this year. Gearing (borrowing) was 7.6% at 31 December 2019.

The company’s year-end is 31 October and, typically, AGMs are held in April. AEMC does not have a fixed life, but does hold regular continuation votes. At the 2018 AGM, shareholders approved the continuation of the company. Another vote will be put to shareholders at the AGM to be held in 2023 and every fifth annual general meeting thereafter.

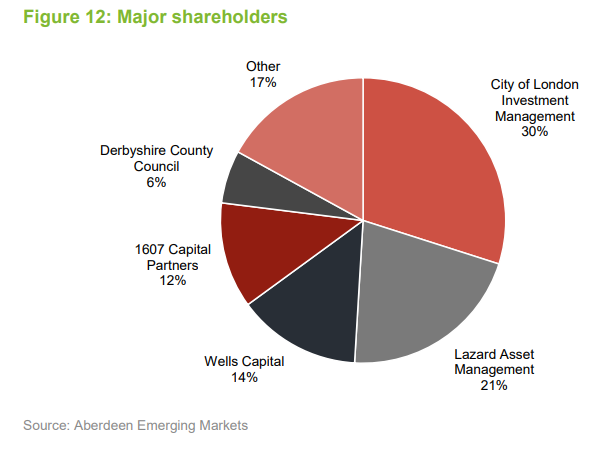

Major shareholders

Major shareholders

There is a need for AEMC to diversify its relatively concentrated shareholder base. During the year, the board announced that the number of ordinary shares held in public hands was below the minimum 25% threshold stipulated by the listing rules. The FCA says that 17% of AEMC’s shares are held in public hands versus the 25% minimum it mandates. It has agreed to modify temporarily the relevant listing rule to permit this decreased level of shares in public hands for a period up until 21 August 2020, during which time the company and investment manager will work towards restoring the number of shares in public hands. Failing this, AEMC might have to move to another market – AIM or SFM, for example.

Board

Board

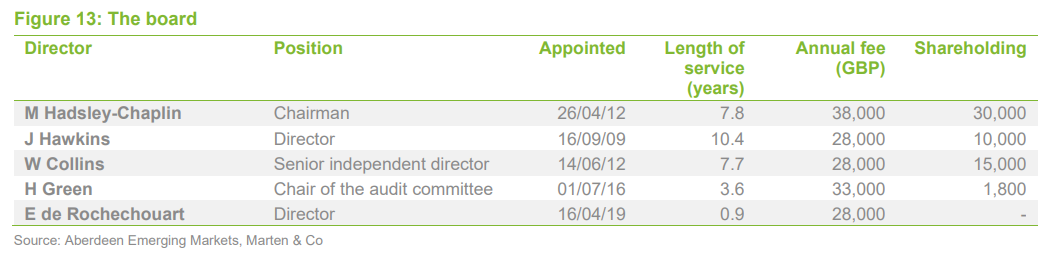

The board comprises five non-executive directors, all of whom are considered to be independent of the manager. Whilst mindful of his length of service, the board has asked John Hawkins to stay on as a director until the AGM in 2021.

The most recent addition to the board is Eleonore de Rochechouart. She is a partner of ResFamiliaris LLP, a wealth management advisory boutique designed for families looking for a dedicated and independent service covering all aspects of their global wealth including financial and non-financial assets. Prior to joining ResFamiliaris in 2010, Ms de Rochechouart spent 20 years in the financial services industry as an economist, researcher and asset allocator in both the traditional and alternative investment arena.

Previous publications

Previous publications

Marten & Co has published two notes on AEMC. You can read this by clicking on the links:

- Access to a wealth of talent – Initiation – 28 September 2017

- 10.6% a year for ten years – Update – 11 June 2018

- A reversal of fortune – Annual overview – 21 January 2019

- The stars may be aligning – Update – 15 August 2019

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Aberdeen Emerging Markets Investment Company.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.