BlackRock Throgmorton Trust – Impressive run continues

Impressive run continues

Impressive run continues

Since QuotedData last published on BlackRock Throgmorton Trust (THRG), it has continued to beat both its benchmark and the average of its peer group by some margin. In a period where the market has been rising, the trust’s short positions managed to break even on average, whilst the long positions outperformed (see pages 6-7 for explanation of the shorting strategy).

Many investors are wary of the UK, looking nervously at Brexit and the possible impact of a wider global growth slowdown. However, THRG appears to be thriving in this environment. The manager, Dan Whitestone, attributes this to his policy of focusing on companies with good management, strong market positions and those that are beneficiaries of industry change. It helps, too, that he can add value by shorting (selling short) companies that don’t fit that description.

Both long and short positions in UK small-and-mid-cap companies

Both long and short positions in UK small-and-mid-cap companies

THRG aims to provide shareholders with capital growth and an attractive total return by investing primarily in UK smaller companies and mid‑capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction. Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Peer group average NAV total return (%) | Numis Smaller Co.s plus AIM, ex IC (%) | MSCI UK total return (%) |

|---|---|---|---|---|---|---|

| 1 | 30 Jun 2015 | 18.5 | 17.0 | 15.0 | 10.4 | (0.2) |

| 2 | 30 Jun 2016 | (7.3) | (5.0) | (3.6) | (6.6) | 3.4 |

| 3 | 30 Jun 2017 | 46.8 | 45.2 | 33.9 | 29.1 | 16.7 |

| 4 | 30 Jun 2018 | 34.3 | 23.9 | 14.5 | 7.6 | 8.2 |

| 5 | 30 Jun 2019 | 3.1 | (3.8) | (1.5) | (7.2) | 1.6 |

Uncertain times

Uncertain times

We live in uncertain times. We will soon know who our next Prime Minister will be, but we will be no closer to resolving the big questions around Brexit. The US/China trade war rumbles on and is having a clear dampening effect on both Chinese and US growth. Currently, hopes of a reconciliation are buoying markets, but a conclusive deal may be some way off. Slowing growth means that the US Federal Reserve is widely expected to cut interest rates when it meets in a few days’ time. Tensions between the US and Iran are high and this is keeping the oil price higher than it might otherwise be. In addition, Italy’s rising debt burden threatens an already-weak EU economy.

In the face of this uncertainty, businesses are reluctant to invest. Investors, too, seem to be sitting on their hands or favouring perceived safe havens. Overseas investors are shunning the UK and consequently, UK stocks are relatively lowly valued.

Fund profile

Fund profile

BlackRock Throgmorton Trust (THRG) aims to generate capital growth and an attractive total return, by investing primarily in UK smaller companies and mid‑capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence which stocks are selected or how big a position they are within the portfolio.

For the period between 1 December 2013 and 22 March 2018, the benchmark was Numis Smaller Companies Index, excluding both AIM stocks and investment companies. There used to be a restriction on the trust’s exposure to AIM companies, but this was removed in March 2018 and, at the same time, the manager was given permission to invest up to 15% of the portfolio in stocks listed on exchanges outside the UK.

Both long and short positions

Both long and short positions

Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks. Up to 30% of the portfolio may be invested in contracts for difference (CFDs), both long and short. Under normal market conditions, the net exposure will account for 100 – 110% of net assets. A separate section on pages 6 and 7 of this note goes into Dan’s approach to shorting stocks.

Both long and short positions

Both long and short positions

BlackRock Investment Management (UK) Limited was appointed manager of the trust in July 2008. Dan Whitestone, head of the emerging companies team at BlackRock, has been sole manager of the trust since 12 February 2018 (he had been co-manager, alongside Mike Prentis, since March 2015). Dan heads a team of four. All members of the team manage portfolios, and between them manage or advise on about £4.3bn across a variety of different funds. This includes the £154m UK Emerging Companies Hedge Fund and the £232m UCITS vehicle (BSF Emerging Companies Absolute Return Fund). The emerging companies hedge fund, which most closely resembles THRG’s mandate, can hold up to 40% in international stocks and the UCITS fund up to 30%. The team shares research responsibilities between them.

Investment process – identifying differentiated quality and change

Investment process – identifying differentiated quality and change

When selecting long investments for THRG, Dan focuses on two types of opportunity: quality, differentiated companies and companies leading industry change.

High-quality differentiated companies

High-quality differentiated companies

Dan believes that high-quality companies have certain characteristics for long-term success, based on:

- Management team

- Product

- Industry

- Balance sheet/cash flow

In Dan’s view, the most important factor in driving value creation or destruction is the quality of the management team. Its ability to have a vision, execute on strategy and adapt to a changing environment is crucial. Dan and the team make a point of meeting not only the top layer of management, but also other key people within a business. He believes that a common reason for growing companies experiencing “growing pains” is if they fail to build the infrastructure and depth of team beneath the top management layer.

Meeting management is a core part of the BlackRock smaller companies team’s approach, and between them they probably have around 750 meetings a year. Usually, they try to have as many of the team in a meeting as possible, to get a diversity of viewpoint.

Dan looks for companies whose products are not purely competing on price but instead offer solutions to customers’ problems – this gives the company pricing power and persistent demand for its products. It is also important that a company maintains its product’s relevance through research and development.

The industry that a desirable company operates in should have structural growth drivers. It should not be capital-intensive, nor cyclical. It should be free from regulatory interference and should not be facing competitors with strong financial support.

Dan avoids heavily indebted companies. He points out that the finance director/chief financial officer of a heavily indebted company often ends up managing it for the benefit of the bank rather than investors. Dan focuses on cash-flow measures of value as these are less easy to manipulate than profits. He looks for indicators of quality such as the conversion of sales made into cash collected – such companies can establish a virtuous circle whereby excess cash can be recycled into sales efforts. A company trading on 25x cash earnings is preferable in his eyes to one on 10x earnings but with no cash flow. The latter are the types of companies that he tends to short (see page 6).

An analysis of THRG’s long investments (its positive positions in companies) would suggest that, on average, it trades on higher multiples than the short investments (its negative positions in companies). This reflects a focus on quality and a desire to avoid value traps – companies that look superficially attractive on valuation grounds but are cheap for a good reason.

Industry change

Industry change

Industry change can provide both long and short ideas. Previously in his career, Dan was a strategy consultant. The experience highlighted the impact of disruptive change on industries and has influenced his thinking since. Small and medium-sized companies can be a good source of industry disruptors as they need to do something special, or otherwise innovate, if they are to compete effectively.

There are many ways that disruptive change can manifest itself. These include new products, changes to manufacturing that allow products to be sourced more cheaply, vertical integration to improve and extract cost from supply chains, and changes in distribution.

Portfolio construction

Portfolio construction

Position sizes are driven by liquidity, risk considerations and conviction. Liquidity is important; Dan wants to be able to trade out of a position in the event that something is going against it. He also says that he is ruthless about selling positions when the investment thesis is not working. As an aside, he says that historical average daily volume is a misleading indicator of future liquidity for small cap stocks.

Dan does not consider the benchmark when constructing the portfolio; consequently, the portfolio will tend to have a high active share (a high degree of difference to the weightings of each stock in the benchmark index).

Dan is targeting a portfolio with 120 positions – about 80 long positions and 40 shorts. The number of shorts may seem large, but it is important that the short book is diversified. Dan points out that it is perfectly possible to accurately predict that an industry will suffer long-term decline. Then select a stock to represent this which is then subject to a bid, quite possibly from a competitor. This is because companies in declining industries frequently see consolidation as a remedy, although this may not work as a strategy in the long term. Nevertheless, being short a stock that becomes subject to a bid can be costly. It is therefore better to own a spread of stocks to represent a theme.

The largest position size that Dan would be comfortable with is 5% – there is nothing in the portfolio that is as big as that now. At the low end, he wants to avoid having a long tail of small positions in the portfolio.

Essentially, Dan is a growth investor. He therefore believes that the portfolio may underperform in an environment where investors are favouring value stocks. Valuation is secondary to the investment thesis, in Dan’s opinion, but part of the assessment of the merits of a stock is an attempt to identify whether the market appreciates, and is therefore pricing in, the story.

Dan does not believe that mean reversion (a tendency for a stock’s price to move back to its average over time) applies to the types of stocks he is focused on; winners win big and losers go bust. Therefore, he does not trade stocks based on valuation differentials.

Shorting

Shorting

About half of the short positions represent themes – for example, industries under pressure. Dan cites the examples of pubs and restaurants, and out-of-town retail. These themes are expressed through several stocks in accordance with the approach outlined above. It is not as simple as shorting a basket of stocks in any given industry, however. Even within a struggling sector, there may be companies whose strategy allows them to survive or even thrive.

The rest of the book represents idiosyncratic shorts selected for stock-specific reasons. Companies with questionable accounting are a fertile hunting ground for shorts, although Dan says that sometimes these can take a while to come to fruition.

BlackRock has a blanket ban on disclosing short positions and so it is not possible to identify which stocks have been shorted, even if they have a significant impact on performance (positive or negative). We appreciate that some investors will find this frustrating.

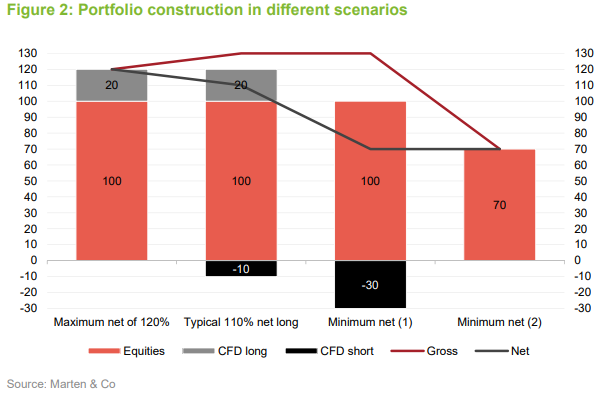

The board has set a maximum limit of net gearing of 20% and, in practice, gearing is provided by the CFD portfolio. The fund operates with an upper limit of 130% gross exposure to equities. Typically, this might comprise 100% in equities, 20% in long positions and 10% in short positions, i.e. a net exposure of 110%.

Cash balances are generally kept low and gearing is flexed by adjusting the size of the CFD book; Dan expects to operate within a range of 100% to 110% net long. The manager has the flexibility to reduce net exposure to a minimum of 70%. This is more likely to be achieved by using shorts rather than holding cash (as illustrated by minimum net (1) rather than minimum net (2) in Figure 2).

Up to 15% of the portfolio may be invested in overseas stocks. Dan does not want to have exposure to unquoted investments within the portfolio (for liquidity reasons).

Asset allocation

Asset allocation

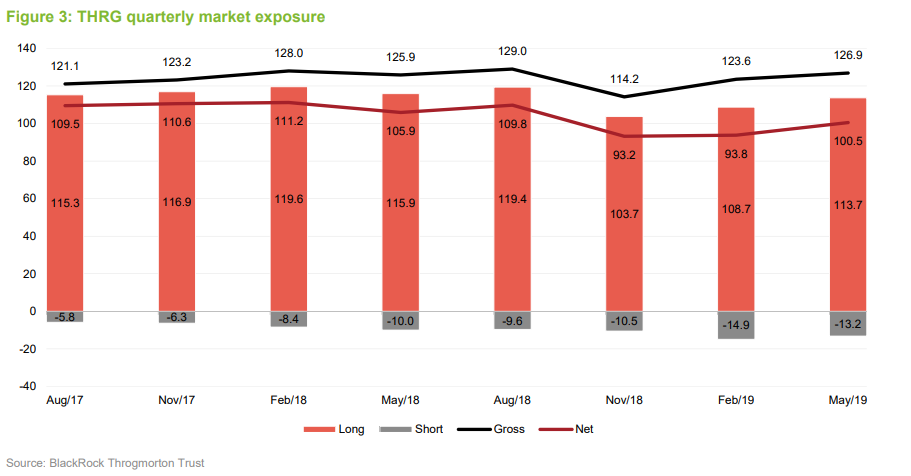

Dan cut the portfolio’s net exposure quite aggressively in the run up to the end of 2018, but has been gradually increasing it since. THRG’s portfolio still has less market exposure than long-term averages, however. The gross exposure has been maintained with additional short positions. Dan acknowledges that he is excited about the prospects for these.

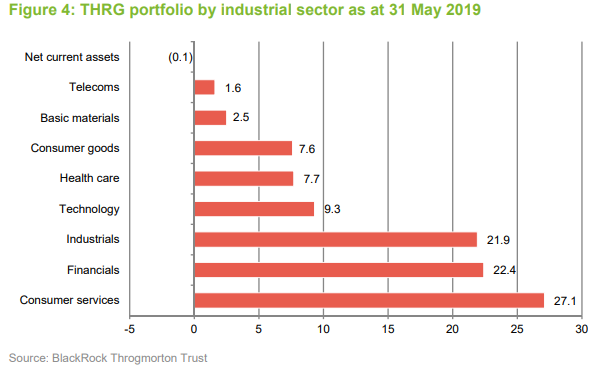

The portfolio’s exposure to consumer services has risen since QuotedData last published, and this is discussed on the next page.

Top 10 holdings

Top 10 holdings

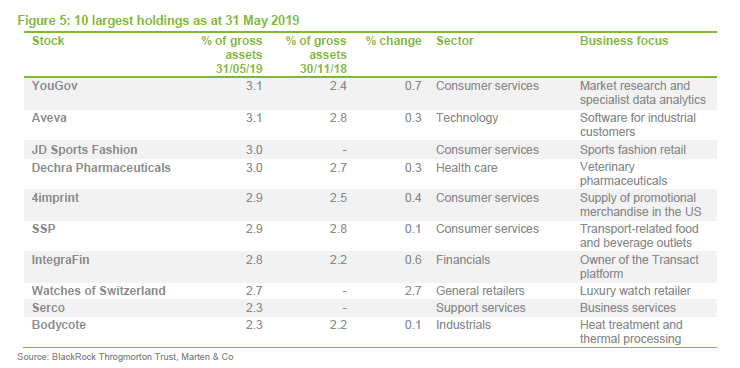

Figure 5 shows the top 10 holdings in the portfolio as at the end of May 2019.

Three new names have appeared in THRG’s top ten holdings since 30 November 2018 (the most recently available data when QuotedData last published). They are watches of Switzerland, JD Sports Fashion and Serco. All three are new positions that are discussed below. The stocks that have moved out are Hiscox, Ascential and Craneware.

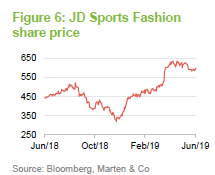

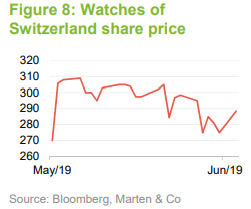

One change QuotedData spotted ahead of meeting Dan is that THRG’s exposure to the retail sector has risen substantially in recent months. This contrarian stance attracted our attention. This change is a good example of how the trust works, however. Rather than making any call on the retail sector as a whole, Dan identified three stocks which he felt were bucking the general trend: JD Sports Fashion, WH Smith and Watches of Switzerland.

JD Sports Fashion

JD Sports Fashion

A position in JD Sports Fashion was established in December 2018. This is a stock that Dan has held before – the stock had fallen sharply in the fourth quarter of 2018. The BlackRock team met the chief executive officer and came away enthused about the prospects for the business. There is an opportunity to expand in the US. The company has a strong balance sheet and was trading on a price/earnings ratio (P/E) of just over 13x. Dan likes the fact that the company has a strong relationship with the brands that it stocks, which gives it preferential access to new products. He says that there is much less emphasis on discounting than is the case with some of its competitors. The company also offers next-day delivery for online shoppers. The company beat expectations in January (Dan increased the position at this point) and estimates were upgraded in April.

WH Smith

WH Smith

THRG has held WH Smith for a while but Dan has increased the position since QuotedData last published on the trust. Many investors and commentators have written off the company (it was recently rated as the UK’s least favourite shop). However, Dan likes the management team. He also admires the way that the company’s high street shops have been repositioned, costs have been taken out, unprofitable business lines have been shed and so has space. The company has been strengthening its presence at major travel hubs (airports and stations). The attraction here is that footfall is increasing and airports in countries such as the USA are devoting more attention to building their retail revenues. THRG also has a position in SSP, a growing operator of restaurants within airports (it just bought the Jamie’s Italian airport franchises from administration). Operating within these restricted locations helps improve pricing power. WH Smith does pay a dividend, but this is well covered by cash flow and is not restricting investment in the business.

Watches of Switzerland

Watches of Switzerland

Dan likes Watches of Switzerland, which THRG bought during the company’s initial public offering (IPO), as it faces little competitive pressure, sells high-value items from small stores and is achieving decent revenue growth. Dan thinks it unlikely that consumers would make a meaningful shift to buying such high-end items online. The BlackRock team carried out extensive due diligence on the company before committing to participate in the IPO. The company has considerable opportunity to grow within the US market, which is highly fragmented (the US is almost a quarter of revenue). The company raised £155m from the IPO, enabling it to pay down debt.

SERCO

SERCO

One other new position in the trust is SERCO. The management team (ex-Aggreko) is well-known to the BlackRock team. Dan trusts that they can turn the business around. The focus is on generating cash flow and improving earnings quality. THRG first invested last year and the holding was topped up when SERCO raised money in May 2019 to fund the acquisition of a US naval defence business (an area that Dan sees as recession-resistant). That deal helps diversify revenue away from the UK. A trading statement published in late June says that the company expects 20% growth in its underlying trading profit over the first half of 2019 and believes revenues will be towards the top end of expectations for the year as a whole.

Sales

Sales

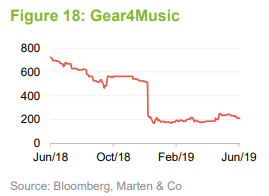

A few stocks were sold when the business case changed detrimentally. Gear4Music was a small position (around 0.5% – see page 14 for more discussion). The shares dropped precipitously on a profit warning and Dan sold the position immediately thereafter. Similarly, he sold out of Accesso Technology, which released a disappointing trading statement in February, and Restore, which saw a change in its management team.

Performance

Performance

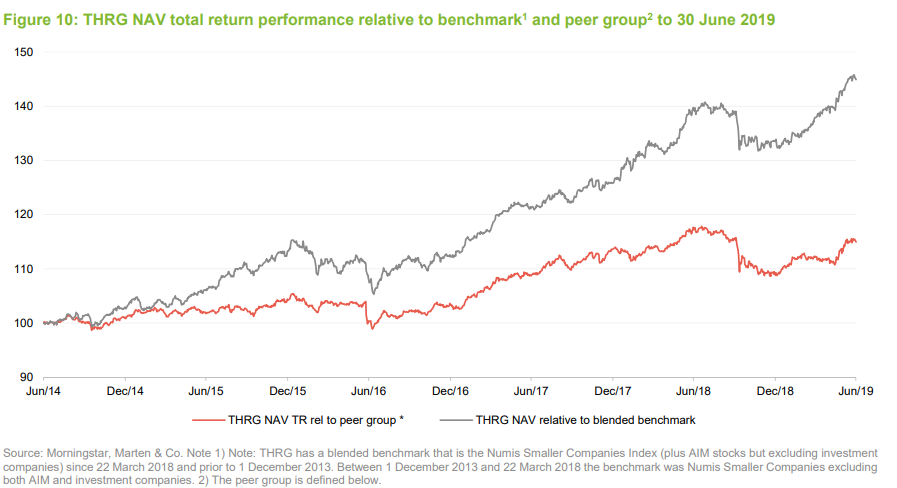

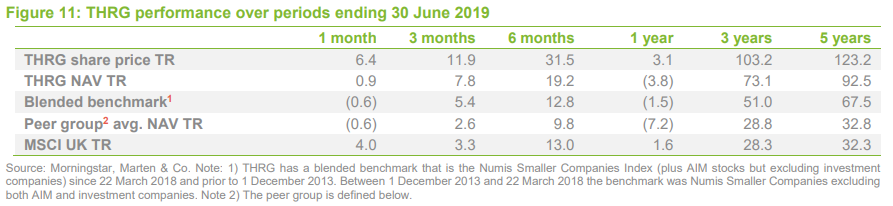

THRG has outperformed both its benchmark and the average of the peer group over every time period in Figure 11. Figure 10 shows the modest setback that the trust experienced in Q4 2018, as growth stocks sold off. However, THRG has recouped all of this and more and its share price is trading close to the all-time high achieved in August 2018.

Peer group

Peer group

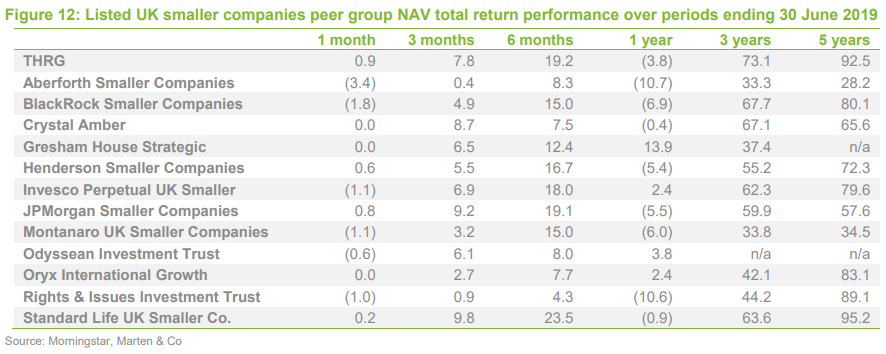

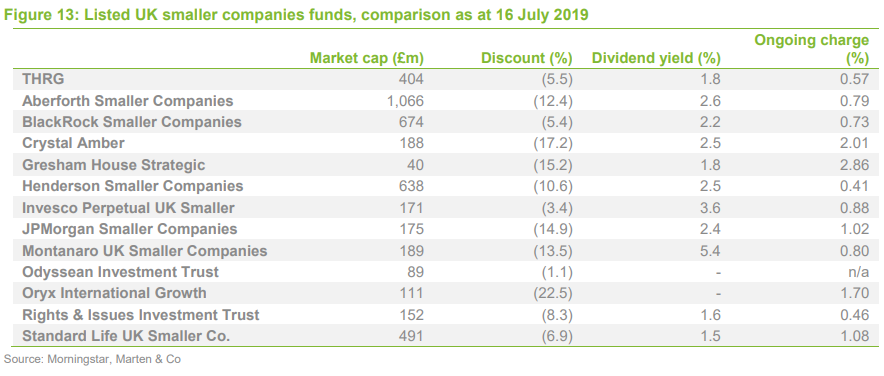

For comparison purposes, a subset of funds in the AIC’s UK smaller companies sector has been used. For this comparison, split-capital companies, trusts with a small market capitalisation, and those that focus exclusively on micro-cap companies have all been excluded. A complete list is provided in Figures 12 and 13.

THRG vies with Standard Life UK Smaller Companies for the position of top-performing UK smaller companies trust over most time periods, topping the table over three years.

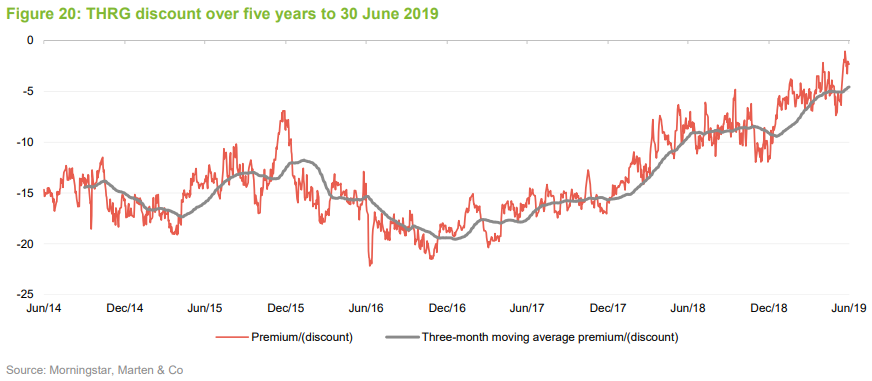

As discussed on page 14, THRG’s discount has been on a narrowing trend in recent months and is now one of the tightest in its peer group. Notably, THRG’s ongoing charges ratio is one of the lowest of this group of funds.

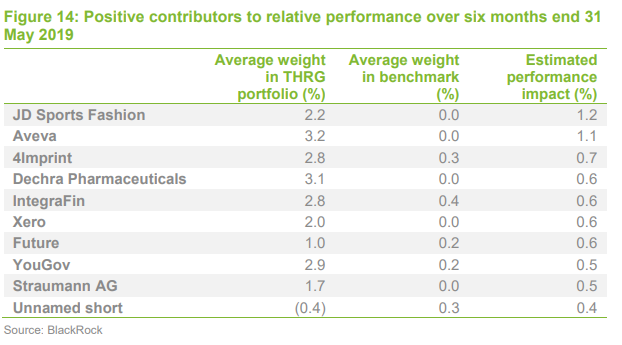

Performance attribution

Performance attribution

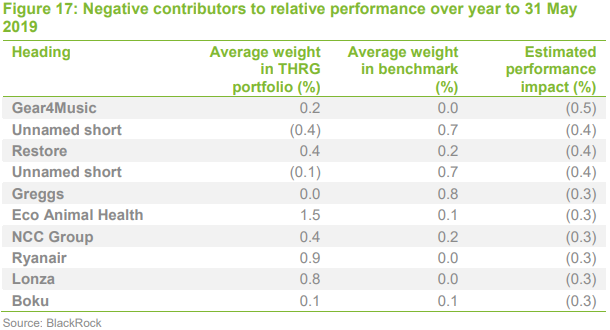

BlackRock has provided us with some attribution analysis, covering the six months to the end of May 2019. Generally, the short positions have done well over the past six months, especially against a backdrop of a rising market, when it might have been expected to lose money. In line with its policy, the manager does not name the stocks that it has shorted. However, one that made a significant contribution in May was described, in THRG’s factsheet, as a UK contractor which fell heavily in the month on renewed concerns over its balance sheet and cash generating abilities. The manager also revealed that this short position had been increased in May and the company published a profit warning in June, further benefitting the trust.

Aveva

Aveva

Industrial software business Aveva was discussed in QuotedDatas’ January 2019 update note (see page 5 of that note). It released its results for the year to the end of March 2019 at the end of May. Revenue was up 11.9% year-on-year. The statement was upbeat about the prospects for market growth and the opportunity for Aveva to capture a larger market share. The company is targeting a higher proportion of its earnings coming from recurring revenue and higher margins. It is making progress towards both those goals.

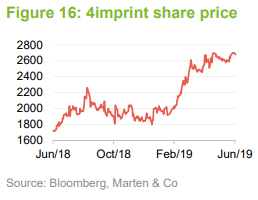

4imprint

4imprint

Promotional products company, 4imprint, released a trading statement at its AGM in May that said: “The first four months of 2019 have shown encouraging further progress, with total order intake up 14% and revenue up 16% over the same period in 2018.”

Half-year results are due at the end of the month, but the board is confident that full-year results will be in line with market forecasts.

Gear4Music

Gear4Music

Gear4Music is a retailer of musical instruments. The shares fell sharply on the publication of its interim results in October 2018. Although revenue growth was strong, this came at the expense of lower margins – the position was sold immediately afterwards. Full-year figures released in June show EBITDA falling in 2018 and 2019 and an earnings per share loss for the period to the end of March 2019.

Dividend

Dividend

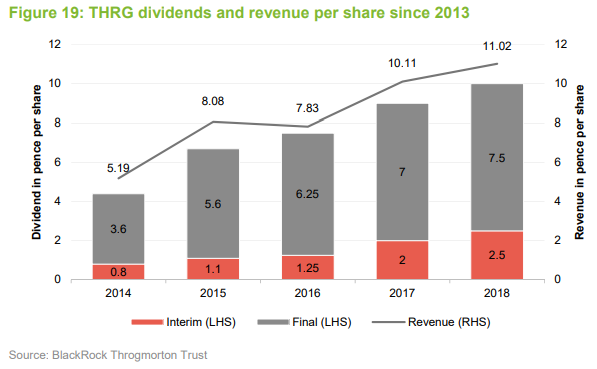

Dividends are a by-product of the investment process and THRG’s portfolio is not managed with any income generation objective in mind. Nevertheless, the portfolio may generate reasonable levels of income. The base management fee is charged 25% and 75% to the revenue and capital accounts respectively, while 100% of any performance fee is charged to capital.

THRG has also built up a substantial revenue reserve (£12.8m as at 30 November 2018, equivalent to 17.4p per share) and this is available to supplement current year revenue if the board feels that would be desirable.

Discount

Discount

As illustrated in Figure 20, THRG’s discount has been on a narrowing trend. Over the year to the end of June 2019, the discount moved within a range of 12.0% to 1.1%, averaging 7.2% over this period. As at 16 July 2019, the discount was 5.5%. If the trust’s strong performance record is maintained, it is possible we may see THRG trading around asset value, perhaps even issuing shares.

Fees and costs

Fees and costs

BlackRock Investment Management (UK) Limited provides THRG with portfolio and risk management services under a contract that THRG has with BlackRock Fund Managers Limited. That contract is terminable on six months’ notice by either side. BlackRock Fund Managers’ base fee is calculated as 0.35% of gross assets (calculated monthly and paid in arrears). In addition, it can earn a performance fee of 15% of the outperformance of the benchmark index over a two-year rolling period with an effective cap of 0.9% of average gross assets, resulting from a cap on total management fees of 1.25% over a two-year period.

For the year ended 30 November 2018, a performance fee of £3,018,000 (2017: £4,659,000) was payable.

The ongoing charges ratio for the year ended 30 November 2018 was 0.57%, considerably lower than the equivalent period for the prior year (0.87%), reflecting a revised management fee introduced in 2017.

Capital structure and life

Capital structure and life

THRG has 73,130,326 ordinary shares in issue and no other classes of share capital. An additional 7.4m shares are held in treasury. THRG’s board takes powers each year to repurchase up to 14.99% of the trust’s issued share capital (excluding treasury shares) and to issue up to 10%. Shares repurchased may be held in treasury or cancelled, at the discretion of the board. No treasury shares will be reissued other than at prices that represent a premium to the prevailing NAV, thereby ensuring that this action does not have any adverse effect on ongoing shareholders.

The board has set a maximum limit of net gearing of 20%. In practice, gearing is provided by the CFD portfolio. The mechanics of this are described on pages 6 and 7.

The company’s year end is 30 November and AGMs are normally held in March.

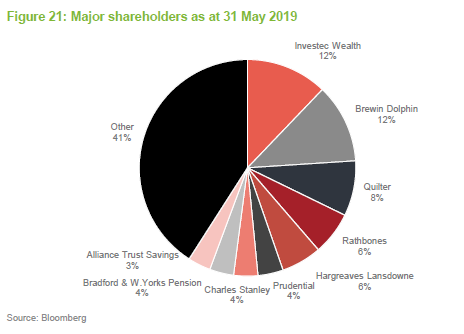

Major shareholders

Major shareholders

The most significant change to the register since last year is that, discount-driven investor Wells Capital no longer holds a notifiable position and Brewin Dolphin’s clients have increased their interest in the company.

Board

Board

THRG has four non-executive directors, all of whom are independent of the manager and who do not sit together on other boards. Louise Nash replaced Simon Beart who resigned as a director at this year’s AGM having served on the board for nine years. Andrew Pegge also decided to step down at the AGM, reducing the board from five directors from four.

Chris Samuel was chief executive of Ignis Asset Management from 2009 until its sale to Standard Life Investments in 2014. He was previously chief operating officer at Gartmore and Hill Samuel Asset Management and was a partner at Cambridge Place Investment Management. He is also chairman of JPMorgan Japanese Trust and is a non-executive director of the Alliance Trust Plc, UIL Limited and its subsidiary UIL Finance Limited, and Sarasin Partners LLP. He graduated from Oxford with an MA in Philosophy, Politics and Economics. He qualified as a chartered accountant with KPMG.

Loudon Greenlees was chief financial officer and chief operating officer of Thames River Capital from 1999 until 2007 and then commercial director until May 2013. Prior to this, he had been group finance director and chief operating officer of Rothschild Asset Management and group finance director of Baring Asset Management. He is a chartered accountant.

Jean Matterson is a partner of Rossie House Investment Management, which specialises in private client portfolio management with particular emphasis on investment trusts. She was previously with Stewart Ivory & Co for 20 years – as an investment manager and a director. She is chairman of Pacific Horizon Investment Trust Plc and a director of Capital Gearing Trust Plc, Herald Investment Management Limited and HIML Holdings Limited.

Louise Nash was a UK small and mid-cap fund manager, firstly at Cazenove Capital and latterly at M&G Investments, which she left in 2015. She now works for family wine business Höpler. She also acts as a consultant to JLC Investor Relations. Louise holds an MA in German and Politics from the University of Edinburgh and the IMRO Investment Management Certificate.

Previous publications

Previous publications

Readers may be interested in our previous publications on THRG, which are listed below:

- Vision, execution and adaptability – Initiation – 11 September 2018

- Throg’s shorts shine – Update – 16 January 2019

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on BlackRock Throgmorton Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.