Solid foundations for future growth

Civitas Social Housing (CSH) is one of only a small handful of REITs that have had a positive year in the face of the COVID-19 pandemic. Due to the nature of its income – which is government-backed through housing benefit – rent collection rates have not been affected and, to reflect its growing earnings, the board has increased the dividend target for 2021 to 5.4p per share (from 5.3p).

CSH’s cash reserves are fully allocated (including around £25m held as a cash contingency), so new debt facilities are being lined up and an equity raise could be on the cards later this year or early next year.

Income and capital growth from social housing

CSH aims to provide its shareholders with an attractive level of income, together with the potential for capital growth from investing in a portfolio of social homes. The company expects that these will benefit from inflation-adjusted long-term leases and that they will deliver a targeted dividend yield of 5% per annum on the issue price, with further growth expected. CSH intends to increase the dividend broadly in line with inflation.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | EPRA earnings per share (pence) | Dividend per share (pence) |

|---|---|---|---|---|---|

| 1 | 31 Mar 2018 | -0.60 | 10.70 | 1.44 | 4.25 |

| 2 | 31 Mar 2019 | 4.20 | 6.20 | 3.63 | 5.00 |

| 3 | 31 Mar 2020 | 6.60 | 5.40 | 4.63 | 5.30 |

| 4 | 5.40 |

Fund profile

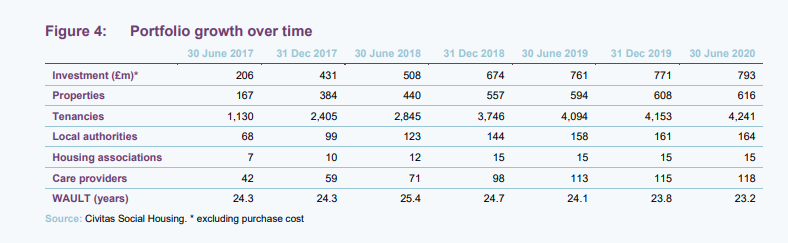

CSH has invested £793m to amass a portfolio of diversified supported social housing assets since it launched on 18 November 2016. It raised £350m at IPO and expanded in November 2017, raising an additional £302m through a C share issue (whereby C share investors own a separate class of shares which has its own portfolio). These two pools were merged together in December 2018.

CSH aims to provide an attractive yield, with stable income growing in line with inflation and the potential for capital growth. Its diversified portfolio is let to housing associations and local authorities (referred to as registered providers) on long-term lease agreements, typically 25 years. It buys only completed homes, which includes acquiring new developments on completion, but it does not get involved with forward funding deals (putting up money to finance the construction of new social homes), or the management of social homes directly.

CSH’s portfolio has a low correlation to the general residential and commercial real estate sectors, as the supply and demand demographics driving the social home sector do not move in line with that of the wider real estate market. It is a real estate investment trust (REIT), giving it certain tax advantages. As a REIT, it must distribute at least 90% of its income profits for each accounting period.

The adviser – Civitas Investment Management

CSH is advised by Civitas Investment Management (CIM), previously named Civitas Housing Advisors, a business established in 2016. Many of the 25-strong team have long experience of working in the sector and in specialist healthcare, and collectively, they have been involved in the acquisition, sale and management of more than 80,000 social homes in the UK.

Market update

Supported social housing, in which CSH is the leading UK investor, is an integral part of the healthcare sector in the UK and a key component in facilitating the delivery of care for individuals with significant long-term care needs. It enables such people to live fulfilling lives within the community and close to their families, rather than in a hospital or institutional setting.

Individuals in supported housing properties require some form of care, and mainly include people with learning disabilities, autism, mental health issues and physical disabilities, although demand for supported housing is growing and expanding to cover a wide range of underlying needs faced by people who are battling homelessness, addiction or who are stepping down from the NHS into a more appropriate supportive care environment.

Local authorities are responsible for providing accommodation and funding care for individuals within its jurisdiction. Supported living provides local authorities with a cost-effective solution to housing people in need, with rents being cheaper than residential care placements and inpatient facilities. According to the monetisation calculations completed by the Social Profit Calculator in 2019, CSH’s portfolio generated £64.7m of direct fiscal savings to local and national government per year. The setting also increases quality of life and life outcomes for the residents.

There is a severe shortage of properties that are capable of hosting mid-to-higher-acuity care within local community settings, while demand for such properties is high due to long-standing government policy to seek closure of remote hospitals in favour of community provision.

The trend for community provision has become established in the UK over the past 25 years and reflects much broader societal change in the manner that care is delivered for people of working age with lifelong care needs. What has developed more recently has been the emergence of specialist housing associations that deliver the augmented property services and who, in turn, enter into leases to secure available properties for their underlying tenants.

The Care Quality Commission has commented that there are “too many people with a learning disability or autism in hospital because of a lack of local, intensive community services”. It is exactly this gap that CSH and similar companies are seeking to fill.

How it works

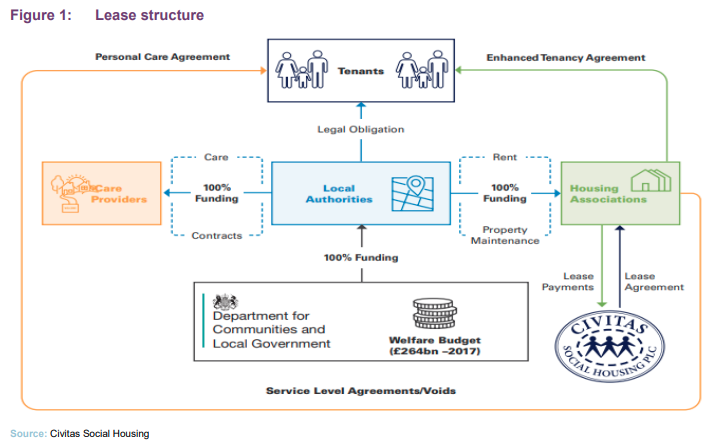

Housing benefit typically provides 100% of the funding of rent and service charge for all supported housing, as shown in Figure 1.

Local authorities enter into care contracts with care providers, who are responsible for the personal care of each individual tenant, and pay them from funding provided by the Ministry of Housing, Communities and Local Government.

The care provider in turn enters into a service level agreement with a registered provider, usually a housing association, which has ultimate responsibility for housing provision. Housing benefit is paid by the local authority to the registered provider to cover each individual tenant’s rent and service charge.

CSH owns the property and rents it under a long-term lease, or an occupancy agreement, to the registered provider. The registered provider uses the housing benefit that it receives to cover the rent due and the costs of managing and maintaining the property, as well as seeking to generate a modest surplus.

Of the £264bn spent by the UK government on welfare in 2017, around 10% (£25bn) covered housing benefit, according to the Office for National Statistics. Of the £25bn, supported social housing accounted for roughly 3.5% or £1.4bn. CSH’s annualised rent roll represents roughly 6% of housing benefit spent on supported social housing, highlighting the significant growth opportunity for the company.

Social impact

Investment in supported living has an obvious positive social impact. Investments are designed with the intention of enhancing the lives of people who, as a result of the homes, are able to benefit from the availability of secure, long-term, high-quality housing, whether of a general nature or as a base for the provision of more specialist housing and care.

Every year, social advisory firm The Good Economy publishes a report examining the social impact of CSH’s investments. Due to COVID-19, it has not been able to publish one this year, but the 2019 report found CSH to be an “authentic impact investor” in accordance with the International Finance Corporation Principles for Impact Management. As part of the report, the Social Profit Calculator (SPC) – a social value consultancy that specialises in calculating the additional value of social, economic, and environmental impact – calculated the social value of CSH’s portfolio in monetary terms and found the portfolio to have produced £114m of social value per year. This equates to £3.50 of social value being created for every £1 of annualised investment.

Sector resilient in face of COVID-19

CSH has reported that the number of incidences of COVID-19 among tenants and staff remains low, reflective of the wider supported social housing sector. This may be in part accounted for by the age profiles of the tenants – the average age in CSH’s portfolio is 32 – and by the configuration of the properties (self-contained apartments and small housing clusters), which enables a greater degree of control over movement.

Various changes have been made to the working practices of both housing associations and care providers, including the implementation of adapted procedures relating to staff and tenant engagement, enhanced hygiene, social distancing with communal areas closed, and restricting access to properties to essential visits.

From a financial perspective, CSH has not seen any impact, with normal levels of rent collection for the second and third quarters of 2020, owing to the government-backed income.

Inflation

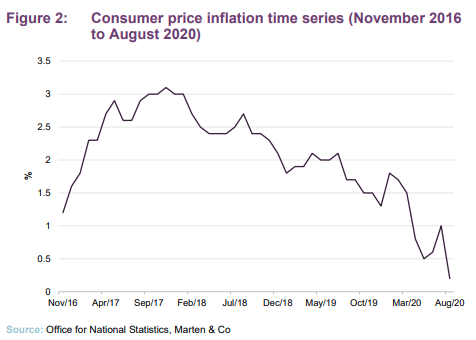

Annual rental increases in the terms of the leases signed by housing associations on properties in CSH’s portfolio are linked to the consumer prices index (CPI), with the majority having a 0% floor and a 4% ceiling.

Current low CPI inflation growth means that in the short term, rental growth in CSH’s portfolio is going to be marginal. Figure 2 shows the CPI time series since CSH’s inception.

Inflation has fallen markedly since the onset of COVID-19 and the enforced lockdown in March 2020. CPI fell to a five-year low of 0.2% in August, from 1% in July, in part due to government schemes to boost spending, including ‘Eat Out to Help Out’ and a cut in VAT in the hospitality sector. Longer-term forecasts for CPI are for it to return to the Bank of England’s target of 2% by the end of 2021.

Investment process

CSH has invested £793m to build a portfolio of 616 properties, as at 30 June 2020. The company’s investment portfolio offers dual exposure to both the social housing and healthcare sectors in the UK. It provides purpose-built and bespoke properties that support the delivery of mid-to-higher-acuity care for working-age adults with long-term care needs. It delivers this in local community settings supported by government-funded care providers and housing associations.

The bulk of the properties have been acquired from housing associations, care providers, developers and private owners, at yields of between 5.5% and 6.5%; the majority of the time on an off-market basis. As the first and largest fund in the sector, CSH has established extensive relationships with developers, care providers and registered providers, which it uses to put in place acquisition agreements. All of the properties that it acquires already have a lease agreement with a registered provider in place, and so are income-producing from day one. It may, from time to time, require the seller to review and upgrade the contracts that it has with various parties before acquisition.

In May 2020, CSH received overwhelming approval from shareholders to expand its investment policy to allow transactions to be undertaken directly with other not-for-profit organisations, including the NHS as well as other entities in receipt of government funding.

CSH makes a detailed assessment of each property to ensure it is fit for purpose before acquisition. It only invests in completed buildings and does not engage in development or forward funding risk.

Due diligence

CSH has followed a detailed due diligence programme with its lease counterparties since launch, which encompasses:

• completion of diligence forms for KPIs, health and safety and finances;

• discussions with the CEO and finance director of the registered provider;

• site visits to meet management and visit properties;

• standard investigation reports on key individuals for standards of conduct;

• regulatory checks;

• review of available management accounts and business plans;

• physical inspections of properties;

• independent, third-party benchmarking of rent;

• references from all significant care providers; and

• requests for ring-fencing, with segregated accounts or charges for protection of rent and deposits due to CSH.

Promoting best practice

CSH works closely with housing associations to support them and help recruit experienced and knowledgeable non-executive directors onto boards in order to strengthen corporate governance and improve standards of disclosure and asset management.

It has taken its responsibility as the leading player in supported living further with the formation of a not-for-profit community interest company (CIC). The Social Housing Family CIC’s aim is to offer additional support, guidance and management skills to its member housing associations.

The CIC is operationally and financially independent from CSH, is supported by financial contributions from within the social housing sector and has a skills commitment from CSH.

Members of the CIC transfer ownership of the housing association to the social housing family, thereby giving CSH enhanced certainty of future rental income as well as further protecting the interests of end users.

Auckland Home Solutions is the first housing association to join The Social Housing Family CIC, and recruitment of additional senior personnel for Auckland is already under way as a means of providing further resource and expertise.

CSH has also developed a best-practice protocol to ensure that housing associations are structured for long-term stability.

The protocol contains 10 core principles relating to matters such as financial prudence, conflicts of interest, management and interaction with regulators. In addition, it contains detailed requirements for the on-boarding of new properties. These include:

• independent verification of rent to confirm this is appropriate within the local authority area and represents value for money;

• a minimum ‘on-boarding fee’ paid to the Registered Provider from the proceeds of the sale of the property to CSH, to cover the setup costs of getting the property ready for occupation by a tenant;

• the Registered Provider maintaining segregated accounts/charges for rent and service charges for properties leased from CSH;

• the establishment of a rental protection fund for each tenant, to cover three-to-six months’ rent on every property;

• a sinking fund for each property to cover certain capital and maintenance costs and over-runs; and

• an indexation reserve fund to be set up at the outset of a lease and topped up over its lifetime, with indexation being set with reference to CPI.

Investment restrictions

CSH operates within the following investment restrictions:

• It may only invest in social homes located in the UK.

• It may only invest in social homes where the counterparty to the lease is an approved provider.

• The minimum unexpired term for a lease or occupancy agreement at the time of acquisition will be 10 years (although leases with shorter lengths can be included in an acquisition of a portfolio that has a weighted average unexpired lease term (WAULT) of more than 15 years).

• The maximum exposure to any single approved provider is 25% of gross asset value (once the capital of the group is fully invested).

• The maximum exposure to a group of houses/apartment blocks in a single geographic location is 20% of gross asset value (once the capital of the group is fully invested).

• Only completed social homes will be acquired – forward finance of social homes under construction is not permitted.

• No investment in other investment companies or alternate finance funds.

• No short selling.

Asset allocation

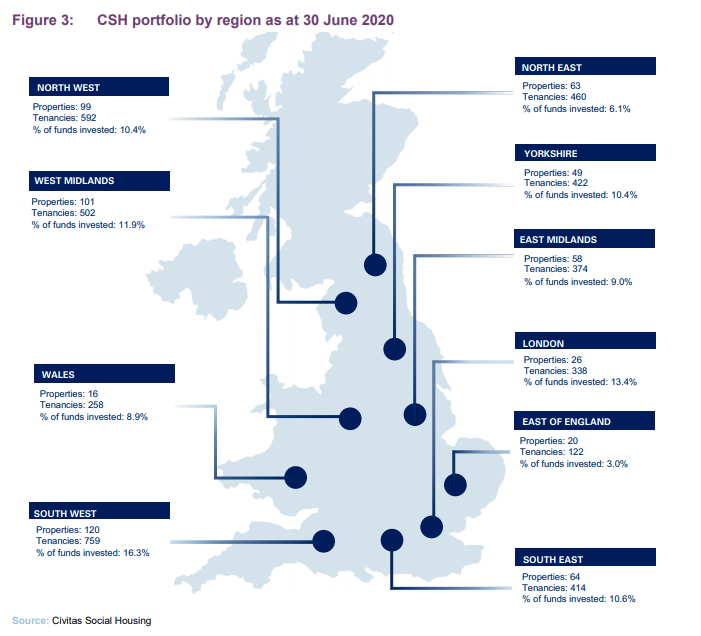

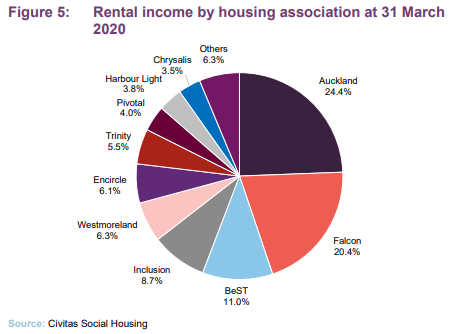

CSH’s portfolio is valued at £885.4m and comprises 616 properties, let to 15 housing associations, with 4,241 individual tenants. The weighted average unexpired lease term (WAULT) on the portfolio is more than 23 years.

Pipeline

CSH’s pipeline of investment opportunities is in excess of £200m, and primarily comes from extensive relationships with housing associations, care providers and local authorities. As well as continued demand for specialist supported housing from local authorities in England and Wales, including for homeless housing, the manager says that the company is increasingly seeing opportunities in Scotland and Northern Ireland. It is also seeing opportunities from healthcare providers, whereby CSH would buy the real estate in a sale and leaseback deal.

The company is also looking at new avenues of investment to diversify its lease counterparty base to include entities such as the NHS and other care providers that are in receipt of government funding as well as leading charities and other not-for-profit entities.

Before it can look to make acquisitions, CSH needs to raise money either through debt or an equity raise. It currently has around £35m (net of operating and finance amounts due) on its balance sheet, with around £10m allocated to a capital payment (contingent on certain financial obligations being met) at its new state-of-the-art healthcare facilities in Wales. Around £25m is kept on the balance sheet as a cash contingency, meaning that it has largely exhausted the cash it has available to expand the portfolio.

Debt and equity raise

The group has been in negotiations to secure a loan of between £80m and £120m for some time now, with the COVID-19 pandemic slowing down the process due to banks’ focusing on clients that need emergency funding and reviewing new loans. The manager said that it was confident that the group will get the loan amount, which would take its loan to value ratio to its target 35%, in more than one tranche and is hopeful of securing it by the end of 2020 or shortly after.

CSH will look to deploy the debt into the new pipeline and to augment that in due course with a modest equity issuance later this year or early next year.

The manager said that next year it would look at a placing programme to give it flexibility and the ability to raise money on a rolling basis.

Performance

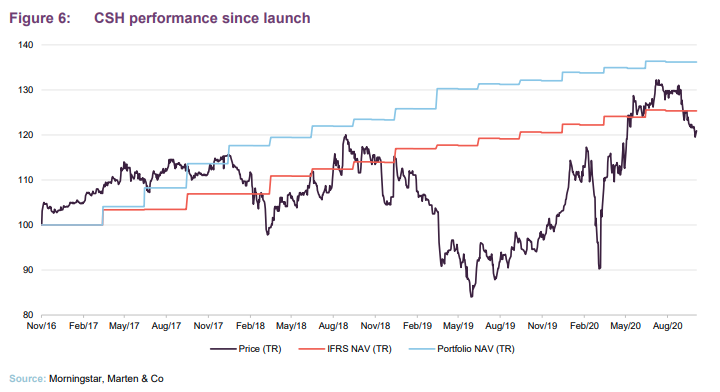

CSH publishes two NAVs – an International Financial Reporting Standards (IFRS) NAV, which reflects the value of the portfolio if it was sold off on a piecemeal basis, and a portfolio NAV, which is based on the value if it were to be sold as a single portfolio. This reflects the fact that the properties are held in special purpose vehicles and attract a lower tax charge than selling properties individually.

At 30 June 2020, the IFRS NAV was £670.9m or 107.92p per share. On a portfolio basis, the NAV was £736.1m or 118.40p per share.

The second half of 2019 saw CSH’s share price start to recover from an all-time low in June 2019. The share price trended upwards in the second half of 2019 and into 2020 as the market became more comfortable with the fundamentals of the business. CSH’s share price dropped off in March 2020 as part of a wider sell-off due to fears over the spread of COVID-19, but regained all its losses as investors recognised the critical role it plays in the care of individual tenants and the strength of its government-backed income. Unlike most other REITs, CSH has not seen a drop-off in its rent collection rates throughout the COVID-19 pandemic.

Earlier this year, CSH reached a major milestone in its life by achieving 100% dividend cover by earnings, on a run-rate basis.

Peer group comparison

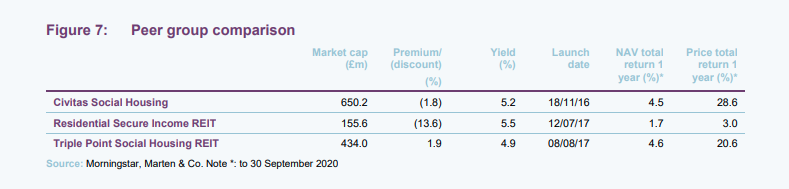

CSH sits within a small group of listed peers comprised of Triple Point Social Housing REIT (SOHO) and Residential Secure Income REIT (RESI). CSH is by far the largest fund in this peer group. RESI’s focus is more on retirement properties and shared ownership housing (without leases), and therefore SOHO may provide a better comparison. CSH is larger and has a longer track record than SOHO, yet has an inferior rating. This seems perverse, given its higher yield and comparable performance over one year.

Dividend

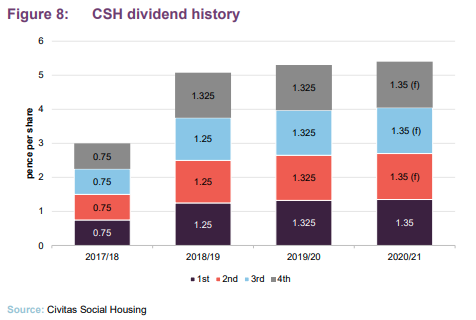

CSH paid 5.3p per share in the financial year to 31 March 2020, in line with its target. It has declared its first dividend for the year to 31 March 2021 of 1.35p per share and has a target dividend for the year of 5.4p. CSH paid 3p per share in its first year, and 5.075p per share in its second accounting year.

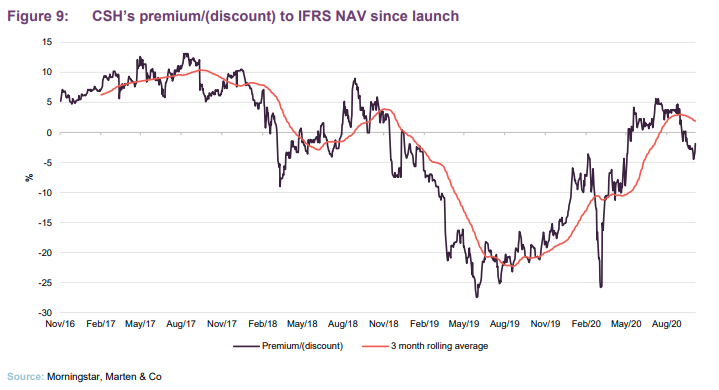

Premium/(discount)

CSH’s shares initially traded at a premium to its IFRS NAV, but moved to trade at a discount due to the concerns that the regulator highlighted regarding some of the housing associations in its portfolio. As the company demonstrated the underlying fundamentals supporting growth in the supported living sector and its leading position in it, the discount narrowed from July 2019. The discount widened dramatically as COVID-19 was declared a global pandemic but quickly narrowed again as the company and the sector proved resilient, helped by secure government-backed income. CSH’s shares traded at a small premium from June and at 20 October 2020 were at a slight discount of 1.8%.

CSH is authorised to repurchase up to 14.99% of the issued share capital (renewal of this authority is sought annually at the company’s AGM). Any shares repurchased may be cancelled or held in treasury and later resold. Shares will not be resold from treasury at a discount to NAV unless as part of an offer that is being made to all shareholders on a pro-rata basis.

CSH repurchased 815,000 shares to be held in treasury in the final three months of 2019 at a cost of £699,000. This represented 0.13% of the issued share capital. The share purchases were made with a view to reducing discount volatility and maintaining the middle market price at which the shares traded close to NAV.

Fees and costs

CIM is entitled to an annual advisory fee based on a percentage of CSH’s IFRS NAV. This is calculated as 1% on the first £250m, 0.9% on the next £250m, 0.8% on the next £500m and 0.7% on amounts above £1bn. The fee is calculated and paid quarterly in advance. There is no performance fee.

CIM’s contract cannot be terminated before 30 May 2024 and thereafter 12 months’ written notice is required.

Other service providers

G10 Capital Limited is CSH’s AIFM and is entitled to an annual management fee of 0.03% of NAV, subject to a minimum of £96,000 (this contract is terminable with three months’ notice).

The administrator is Link Alternative Fund Administration Limited, which receives a fixed fee as well as additional variable fees for duties relating to corporate activities. The secretary, which has been in place since 28 March 2018, is Link Company Matters Limited. It also receives a fixed fee.

Indos Financial Limited is CSH’s depositary and receives an annual fee of £59,000, plus 0.006% of the first £350m of any new equity capital raised and 0.003% of further equity thereafter, subject to a maximum of £150,000. The agreement is terminable on six months’ notice.

The company’s auditor is PricewaterhouseCoopers LLP. It received £246,000 for its auditing services relating to the period ended 31 March 2020 (March 2019: £221,000).

Capital structure and life

As at 20 October 2020, CSH had 621,646,380 ordinary shares in issue, with 815,000 shares held in treasury. Gearing may be used up to an absolute maximum of 40% of gross asset value (i.e. net gearing of 66.7%). Debt has to be secured at an asset level (a property or collection of properties held within a special purpose vehicle) without recourse to CSH. The board has stated that it intends that CSH should have an average leverage of 35% on a gross asset basis. CSH has total bank borrowings of £272.5m, equating to 26.9% of gross assets.

Debt facilities

The existing facilities comprise a £52.5m loan note from Scottish Widows with a 10-year maturity and an all-in fixed cost of 2.99%, two revolving credit facilities – a £60m, three-year floating rate facility (plus a one-year extension) with Lloyds and a £100m, three-year floating rate facility (plus two one-year extensions) with HSBC, and a £60m five-year fixed-rate debt facility with NatWest.

As previously mentioned, CSH says that it is looking to secure a further £120m that will help it push borrowings towards its target 35% loan to value ratio.

Life

CSH’s year end is 31 March. CSH will hold its first continuation vote at the AGM in 2022 and every five years thereafter.

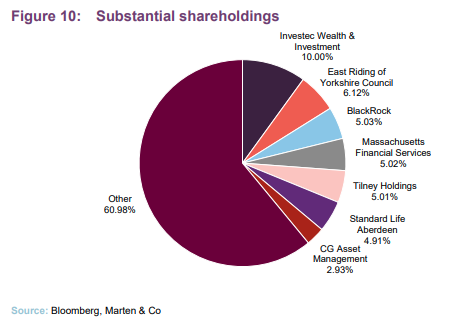

Major shareholders

Investment team

CSH’s investment advisor, CIM, has a proven track record in the social housing sector, combined with many years of experience in the investment industry and financial sector.

Paul Bridge is CIM’s chief executive (social housing) and joined the company at formation. He has over 20 years’ experience of working at a senior level in the social housing sector. He was chief executive of Homes for Haringey, a registered provider, where he was responsible for 800 staff and 21,000 homes. He has also held a variety of non-executive roles including the chairman of Thames Valley Charitable Housing Association and director at Hyde Group.

Andrew Dawber is a director and co-founder of CIM. He has been active in the social housing sector since 2012 and was part of the team that founded the private investment company Funding Affordable Homes. He also founded PFI Infrastructure, the first publicly traded social infrastructure fund.

Tom Pridmore is group director and co-founder of CIM. He is a specialist in real estate and residential development finance and was part of the team that founded the private investment company, Funding Affordable Homes. He is a qualified lawyer with over 19 years’ experience in real estate investment and development, and is responsible for sanctioning all property investment advice and portfolio monitoring.

Subbash Thammanna is the chief financial officer at CIM. He has 20 years of experience in finance roles in the real estate sector, having worked across a variety of private and public structures covering all aspects of financial reporting, control and operations. He has held senior finance positions at AEW Europe, Harbert Management Corporation, and most recently as finance director at Henderson Park. He is a fellow of the Institute of Chartered Accountants in England & Wales.

Eleanor Corey is transactions director at CIM. She has extensive experience in all aspects of real estate management, investment, development and finance from stints at the in-house corporate real estate team at Lloyds Banking Group and a national housebuilder. She previously spent more than 12 years at international law firm CMS Cameron McKenna Nabarro Olswang, where she practised in their real estate team.

Board

The board is comprised of five non-executive directors, four of whom were appointed on the company’s incorporation in November 2016. All members are non-executive and independent of the investment adviser.

All directors automatically stand for election at the first AGM following their appointment. Thereafter, they are required to stand for re-election at three-yearly intervals, unless they have served for nine or more years, after which they stand for re-election annually. Excluding newly-appointed directors and directors who have served more than nine years, one-third of the remaining directors must retire and stand for re-election by rotation at each AGM.

Michael Wrobel has over 30 years’ experience in the investment industry. He is the non-executive chairman of Diverse Income Trust. He serves as a trustee director of the BAT UK Pension Fund and chair of its investment and funding committee. He is also the chairman of trustees of the Thornton’s Pensions Scheme and Deutsche Bank UK Pension Schemes, a trustee of the Cooper Gay (Holdings) Ltd Retirement Benefits Scheme and acts as an investment adviser to a number of Rio Tinto pension schemes. Formerly, he was a non-executive director of JPMorgan European Smaller Companies Trust and NatWest Smaller Companies. He has served as a director of the Association of Investment Companies, the Investment Management Association and CoFunds. Michael has previously worked at Morgan Grenfell, Fidelity International, Gartmore Investment Management and F&C Management. He has an MA in Economics from Cambridge University.

Caroline Gulliver is a chartered accountant with over 25 years’ experience at Ernst & Young, latterly as an executive director. During that time, she specialised in the asset management sector and developed extensive experience of investment trusts. She was a member of various technical committees of the Association of Investment Companies and a member of the AIC SORP working party for the revision to the 2009 investment trust SORP (which set out how investment companies should lay out their accounts). Caroline is a non-executive director and audit committee chair for JP Morgan Global Emerging Markets Income Trust, International Biotechnology Trust and Aberdeen Standard European Logistics Income.

Peter Baxter has 30 years’ experience in the investment management industry. He is a managing director of Project Snowball, a social impact investment organisation, and a trustee of Trust for London, a charitable foundation. He is also a non-executive director of BlackRock Greater European Investment Trust. Previously he served as chief executive of Old Mutual Asset Managers (UK), and has worked for Schroders and Hill Samuel in a variety of investment roles. Peter holds an MBA from London Business School and is an associate of the Society of Investment Professionals.

Alastair Moss is a property development lawyer with over 20 years’ experience and is co-head of real estate at Memery Crystal. He has been a non-executive director of Notting Hill Housing Group (now Notting Hill Genesis) and a member of the audit and treasury committees. He is a former chairman of the investment committee of the City of London Corporation and chaired its property investment board. Alastair is currently chairman of the City’s planning and transportation committee. He is a trustee of Marshall’s Charity and a mentor to commercial directors in government departments, and has also been a board member of Soho Housing Association and was a member of the area board of CityWest Homes. He was a councillor at Westminster City Council for 12 years, including his tenure as chairman of the planning & city development committee.

Alison Hadden has over 25 years’ experience in the housing industry. She started her career at Dudley Metropolitan Borough Council and Birmingham City Council, and went on to hold chief executive positions at several major housing associations, including Paradigm Housing, a 13,000-home housing association based in Buckinghamshire. She has also been an executive director at Circle Housing, one of the largest housing associations in the UK. In these roles, she has worked with many of the stakeholders in the industry, including the Regulator of Social Housing. Alison was previously the chair of Housing Plus Group and is currently a non-executive director and member of the audit and risk committee of Yorkshire Housing and a non-executive director and member of the governance committee of Peaks and Plains Housing.

Previous publications

QuotedData has published four previous notes on CSH. You can read them by clicking the links below.

Socially beneficial investing, initiation note, published June 2018

Regulatory action is positive, update note, published February 2019

Targeting full dividend cover, annual overview, published September 2019

Proved its mettle, update note, published April 2020

The legal bit

This marketing communication has been prepared for Civitas Social Housing by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.