QuotedData’s Real Estate Annual Review – 2020

Real Estate Annual Review

Kindly sponsored by Aberdeen Standard Investments

Riding out the COVID rollercoaster

The 2020 rollercoaster saw more downs than ups and at times felt like a pandemic induced freefall. Lockdowns, tiers and plenty of U-turns meant investing in property was not for the faint hearted. Positivity returned at the end of the year, though, with a vaccine breakthrough.

Retail, leisure and hospitality sectors were forced to close for large parts of the year, and when they did open it was at reduced capacity. Inevitably some businesses were unable to pay rent, while others collapsed into administration. The impact on property companies was stark and rent collection, for so long a certainty, became the all-important metric. Waivers, deferments, and re-negotiations followed. Dividend suspensions swept the listed property sector as income dived.

It wasn’t all bad, though. The industrial and logistics sector flourished as the stay-at-home mantra forced a whole new cohort into online retailing. Companies focused on logistics assets thrived as the fundamentals of the sector played out.

The eagerly awaited vaccine breakthrough and the subsequent rollout fuelled an 11.8% jump in property company share prices in the final quarter of the year, as hope of a return to some form of normality rose. However, there remain many unknowns for property born out of trends that were formed and accelerated during the pandemic – not least for the office sector. QuotedData’s annual real estate review rounds-up the events of 2020 and looks at the prospects for 2021.

The property sector in 2020

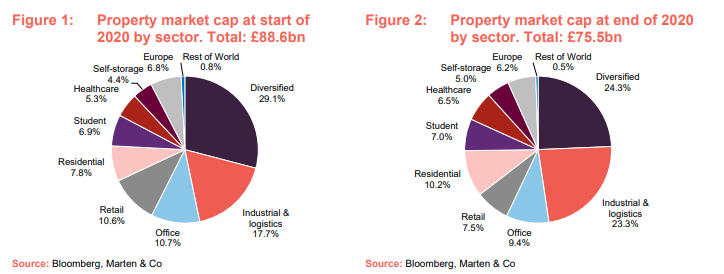

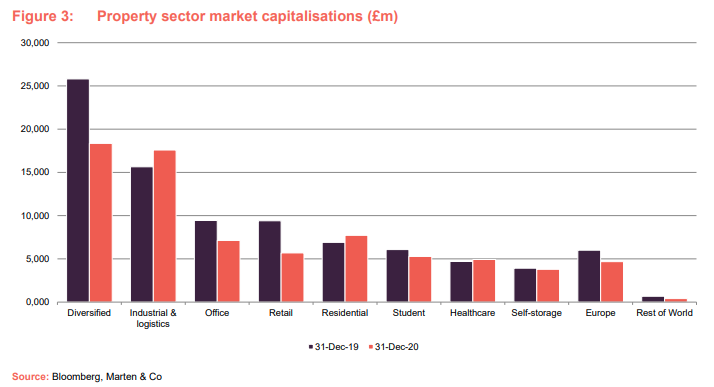

The impact of the COVID-19 pandemic on property has been reflected in the total market capitalisation of listed property companies and real estate investment trusts (REITs) during 2020. Overall, the sector shrank by 15%, or £13.1bn, to £75.5bn.

A breakdown of the property sub-sectors, illustrated in Figures 1 and 2, show that companies focused on the industrial & logistics sector have grown in popularity during the year, having benefited from an increase in online retailing.

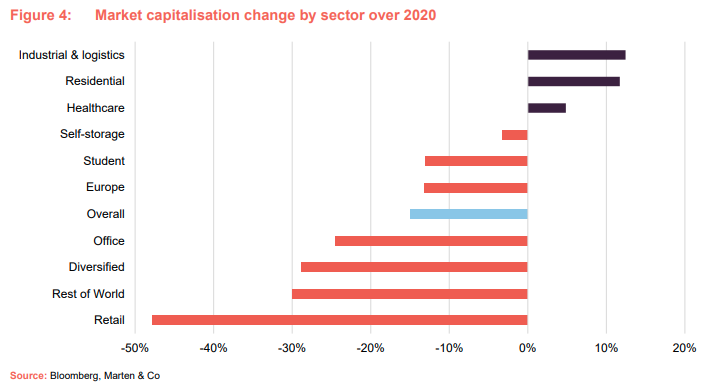

This is also shown in Figure 4, where the market cap of the seven companies focused on the industrial & logistics sector increased by 12.5%. There were just two other sub-sectors that increased market capitalisation during the year – residential and healthcare. Both of these sectors have seen strong rent collection figures during the year, which can’t be said for other sectors that were badly affected by lockdowns.

The most severely affected has been the retail sector. Having been in decline for a number of years, the sector lost a further 48% of its market capitalisation in the year as lockdown hampered rent collection rates. The pandemic was the final nail in the coffin of shopping centre owner Intu Properties, which went into administration in June. Generalist (diversified) property companies, which own property in various sectors, also had a tough year, with market capitalisations falling by 28%. With most people working from home during the pandemic, the future of the office has been much debated and office-focused companies lost 24% of their value in the year.

Fund performance data

Best performing companies

The top performing property companies in price terms during the year were generally industrial & logistics landlords, for reasons mentioned earlier, and social housing specialists. It is a fund from the latter category that topped the price moves during 2020. Triple Point Social Housing REIT saw its share price increase 24.2% over the year.

The social housing sector has performed strongly during the crisis, with government-backed income proving resilient. Fellow social housing REIT Civitas Social Housing also made the top 10 with a 14.8% rise.

A total of five industrial & logistics focused companies made the top 10 price movers, with Aberdeen Standard European Logistics Income (ASLI) recording a 20.3% gain. The company has benefitted from strong net asset value (NAV) growth during the year as it looks to expand its European portfolio.

Tritax Big Box REIT’s share price increased 12.8%, with its development capabilities shining through and complementing its established investment portfolio. Warehouse REIT also had a year of strong growth, recording the largest NAV move among property companies, of 12.5%.

Cuban real estate investor CEIBA Investments saw a 19% jump in its share price, mainly off the back of Joe Biden’s win in the US presidential election. The Trump administration had implemented strong sanctions against Cuba, including banning US residents from travelling to the country. It is expected that President Biden will reverse these measures.

German business park owner Sirius Real Estate also had a strong year, with share price growth of 5.5% and NAV growth of 6.5%. The German economy has performed better than most other European countries during the pandemic and the office sector has been a beneficiary.

Private rented sector and residential development specialist Sigma Capital Group’s share price was boosted by news in September that it had launched a £1bn joint venture with EQT Real Estate, the real estate platform of global investment firm EQT, which will see it deliver 3,000 private rental homes in Greater London.

Worst performing companies

It is no surprise that it was retail landlords that topped the chart of worst performing property companies, in both price and NAV terms. It is, however, quite shocking at just how much their share price has fallen. Shopping centre owners Hammerson and Capital & Regional were especially bad. Hammerson had a very busy year treading water, completing a rights issue and share consolidation plan during September, as well as announcing a new chief executive. It hopes work to shore up its balance sheet, including several chunky asset sales, will prevent it from following the same fate as rival Intu.

Meanwhile, NewRiver REIT, which owns shopping centres, retail parks and pubs, has been hit hard during the pandemic and lost 57.8% in value.

U and I Group’s share price reached an all-time low during the year as it continues to battle against declining land and development values across its portfolio. Its NAV has plummeted 26.3% in the year and its share price by 65%.

African-focused company Grit Real Estate was another victim of the pandemic as its retail and hospitality exposure weighed on its NAV and a wide discount opened up.

The lockdown took its toll on the giants of London’s West End, Capital & Counties and Shaftesbury, which have been hit hard by muted tourist numbers.

Significant rating changes

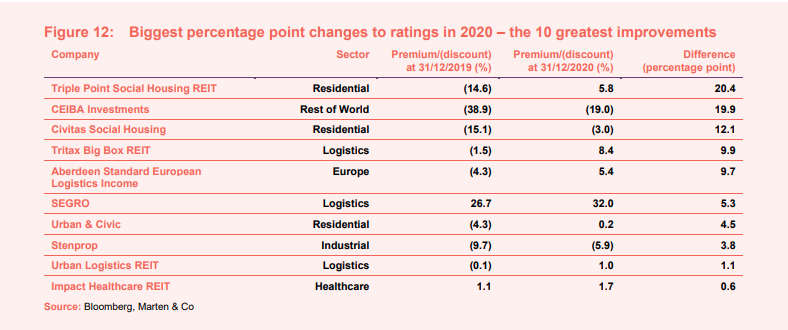

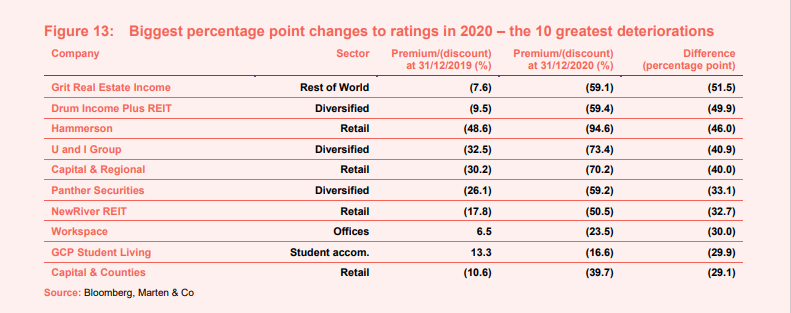

Figures 12 and 13 show how premiums and discounts have moved over the course of the year.

The boost in Triple Point Social Housing REIT’s share price saw it move from a pretty sizeable discount at the start of the year to finish the year on a premium to NAV of 5.8%. Meanwhile, Civitas Social Housing’s discount narrowed, but it is still trading at a discount.

Likewise, CEIBA Investments’ share price gains saw its discount narrow during the year by almost 20 percentage points, ending the year on a discount of 19%.

Industrial & logistics specialists feature heavily in the greatest rating improvements in 2020, with Tritax Big Box REIT, ASLI and Urban Logistics REIT moving from slight discounts to premium ratings. SEGRO saw its substantial premium increase over the year to 32%.

Urban & Civic, the residential master developer, saw its rating move to a slight premium after a £506m takeover bid by the Wellcome Trust boosted its share price.

Most of the companies to feature in Figure 13 have been covered off earlier in the worst performing companies’ section. Additional entrants include Workspace, which owns a portfolio of flexible office space in London – a sector that has an uncertain future given the changes to working practices during the pandemic.

Student accommodation specialist GCP Student Living lost its premium rating during the year following a chaotic return to university and the threat of rent boycotts by students that have been forced to study off-campus.

Major corporate activity

Fundraises

Despite the impact of COVID-19 on the real estate sector, property companies raised more than £3bn during the course of the year – eclipsing the £1.7bn raised in 2019. That included the launch of Home REIT, which is focused on providing a portfolio of homeless accommodation. It launched in October, raising £240.5m in an initial public offering.

The biggest fundraise was by industrial and logistics giant SEGRO, which raised £680m in in June in a share placing “to take advantage of ecommerce trends that are accelerating as a result of the covid-19 pandemic”. Logistics companies dominated fund raising activity in the year, with Urban Logistics REIT raising more than £220m in two separate placings during the year, Warehouse REIT securing £153m and LondonMetric Property raising £120m in an oversubscribed placing.

Also busy in the fundraising department was Supermarket Income REIT, which raised £339.8m across two hugely oversubscribed placings in the year. Healthcare property specialists Assura Group and Primary Health Properties both completed significant raises during the year of £185m and £140m respectively.

Student accommodation specialist Unite raised £300m in a placing in June to “accelerate growth opportunities” in London and prime provincial markets, while private-rented residential specialist Grainger raised £186.7m through a placing to fund acquisitions and developments.

West End landlord Shaftesbury tapped the market for completely different reasons, raising £307m in October to shore up its balance sheet having been particularly badly impacted by COVID-19 enforced lockdowns on its retail and leisure portfolio.

Buybacks

A number of property companies that saw their rating swing to significant discounts to NAV bought back shares to narrow the discount.

Schroder REIT commenced a share buyback programme during the year, taking advantage of its wide discount (of around 50%).

Meanwhile, Phoenix Spree Deutschland, Stenprop, Standard Life Investments Property Income Trust, Real Estate Investors and Conygar Investment Company also returned money to shareholders through smaller share buybacks.

Hibernia REIT, which owns commercial and residential properties in Dublin, commenced a €25m share buyback programme that it said would return to shareholders the proceeds from the sale of 77 Sir John Rogerson’s Quay.

Major appointments

There were a number of major appointments in the property sector during the year.

Unite Group, the student accommodation specialist, announced Richard Huntingford as its new chairman. Huntingford, who is chairman of Future Plc, will take over from Phil White on 1 April 2021.

Standard Life Investments Property Income Trust’s chairman Robert Peto stepped down from the board. He was replaced as chairman by James Clifton-Brown.

Schroder REIT’s fund manager Duncan Owen stepped down as global head of real estate at Schroders at the end of the year. He has become a special advisor to the company.

Meanwhile, Land Securities, British Land, Hammerson, St Modwen, Empiric Student Property and Harworth Group appointed new chief executives.

Land Securities appointed St Modwen’s Mark Allan as chief executive, replacing Robert Noel. St Modwen replaced Allan with Centrica Consumer chief executive Sarwjit Sambhi, effective from 2 November 2020.

British Land’s chief financial officer Simon Carter succeeded Chris Grigg as chief executive on 18 November 2020. Retail landlord Hammerson appointed Rita-Rose Gagné as new chief executive replacing David Atkins.

Meanwhile, Duncan Garrood took up the position of chief executive at Empiric Student Property on 28 September and Lynda Shillaw took the hot seat at Harworth Group.

Mergers and acquisitions and major trades

In February, Hansteen Holdings was acquired and taken private by Blackstone for £500m. Hansteen shareholders received 116.5p per share – an 18.1% premium to its three-month average price at the time of the bid in December 2019.

In November, master developer Urban and Civic agreed terms on a recommended £506m cash offer for the company by the Wellcome Trust. The price was a huge premium to its prevailing share price and just above its NAV.

Capital & Counties acquired a 26.3% shareholding in rival West End landlord Shaftesbury for £436m in May, buying the shares owned by Hong Kong billionaire Samuel Tak Lee. Capital & Counties also participated in Shaftesbury’s £307m fundraise in October and now owns 25.24% of the company.

Redefine Properties sold its 29.42% stake in RDI REIT to affiliates controlled by Starwood Capital Group.

Glenstone Property acquired 11,855,461 shares in Alternative Income REIT through a tender offer, equivalent to 14.73% of the company.

Liquidations, de-listings and trading cancellations

In one of the biggest property company casualties in recent history, shopping centre owner Intu Properties collapsed into administration in June. The company was in dire straits even before the COVID-19 pandemic having built up £4.5bn of debt. It was also facing rent reduction demands from dozens of struggling retailers during the coronavirus crisis.

Summit Properties cancelled the trading of its shares on AIM in March 2020 and following a recommended final cash offer, Daejan Holdings also announced plans to de-list.

Other major corporate activity

Hammerson completed a rights issue (and 1 for 5 share consolidation programme) in September raising £552m that it used, along with proceeds of the sale of its 50% stake in VIA Outlets, to pay down debt.

SEGRO listed its shares on Euronext Paris in a secondary listing. It said the listing would ensure it could maintain an efficient holding structure for its continental European assets following the Brexit transition period. Hammerson now also has a secondary listing, on the Euronext Dublin stock exchange, guaranteeing it an EU equivalent trading venue.

Grit Real Estate completed its delisting from the Johannesburg Stock Exchange, making London its primary listing and Mauritius its secondary. It also converted to a sterling quotation on the London Stock Exchange.

Primary Health Properties internalised its management with the acquisition of its manager Nexus Tradeco for £33.1m. It said it would save £4m a year in fees.

Gresham House bought the manager of Residential Secure Income REIT, TradeRisks Limited. Gresham paid £7m upfront and up to £4m more, subject to the achievement of certain performance targets.

Alternative Income REIT appointed M7 Real Estate as its new investment adviser. The company made the appointment after the previous manager, AEW, departed in February. The company tweaked its investment policy following a review by M7, which is a leading specialist in the pan-European, regional, multi-let real estate market.

Major news stories

- Aberdeen Standard Investments (ASI) announced it was acquiring a 60% interest in Tritax Management, the fund manager behind Tritax Big Box REIT and Tritax EuroBox. The move comes as it looks to strengthen its offering in the growing logistics real estate market, where it already has a listed fund in Aberdeen Standard European Logistics Income.

- Urban & Civic agreed terms on a recommended £506m cash offer for the company by the Wellcome Trust. The price was a huge premium to its prevailing share price and just above its NAV.

- Capital & Counties acquired a 26% shareholding in rival West End landlord Shaftesbury, in what could be the first steps in a long-mooted merger of the two groups.

- Tritax EuroBox refined its acquisition strategy to a more value-add approach, acquiring assets earlier in the development process or with leasing events and vacant land.

- Regional REIT announced it would sell all non-office assets – mainly industrial and retail worth £146m – after a strategic review. It said it would recycle the proceeds into acquiring office assets as well as potentially undertaking a share buyback programme.

- Secure Income REIT decided to stick with Travelodge at its 123 sites (it could have evicted them as part of the hotel group’s CVA) after sales and re-letting exercises came up short. Under the terms of the CVA, Secure Income REIT will receive 70% of normal rents from Travelodge in 2021.

- British Land sold a 75% stake in a portfolio of three offices in London’s West End (10 Portman Square, Marble Arch House and York House) for £401m, reflecting a blended net initial yield of 4.32%.

- Land Securities sold 1 & 2 New Ludgate, located next to the Old Bailey, for £552m, ahead of valuation, and bought an office development opportunity at 55 Old Broad Street for £87m.

- Schroder European REIT forward sold Boulogne-Billancourt office in Paris for €104m. The deal delivered a net profit of 35% and increased the company’s NAV by 15%.

- Tritax Big Box REIT pre-let a 2.3m sq ft of logistics space at its Littlebrook development in Dartford, east London, to Amazon.

Selected QuotedData views

The solution to filling the vast amount of vacant space in shopping centres could come from an unlikely source in logistics. Mall owners in the US have reportedly been in talks with Amazon to convert vacant department store space into distribution hubs. The idea makes perfect sense for both parties.

The debate around the future of the office continues to rage with the government on a campaign to get people back to the office. But is there an appetite among employees and even employers to get back to the office?

After two more former high street stalwarts crashed into administration, exposed property companies were left with a conundrum of what to do with the space.

Valuers of property assets were accused of being in denial about office values during the pandemic, when rent and demand for space has fallen. A review of the valuation process is underway.

Outlook for 2020

Here are a few recent comments from managers and directors on how events may unfold in 2021, drawn from our latest real estate roundup.

Richard Shepherd-Cross, investment manager, Custodian REIT:

“As we see increasing confidence in the collection of contractually deferred rents and once landlords can formally pursue non-payers, positive sentiment towards the income credentials of commercial real estate investment is likely to return. In a low return environment, where dividends are under pressure across all investment markets, we believe that property returns will look attractive and the search for income and long-term capital security will bring many investors back to real estate. We expect further tenant failures as government support packages are withdrawn, the lockdown and subsequent restrictions bite and while CVAs remain legal, if questionable, practice, but this is likely to be heavily weighted towards the retail sector and should not diminish the overall appeal of real estate.”

Sir Julian Berney Bt., chairman of Schroder European REIT:

“Faced with a global pandemic such as COVID-19 and ongoing political risk such as Brexit, it is impossible to accurately forecast with any degree of confidence how European economies and real estate markets will perform this year. In the face of uncertainty, we believe there will continue to be caution amongst occupiers, investors and banks, which will put downward pressure on rents and values in the short-term, particularly in certain sectors such as retail. We expect the consequences of COVID-19 to continue to present a challenging market backdrop for the foreseeable future and lead to long-term and permanent structural changes affecting how we live, work and play, particularly for leisure and shopping centres.”

Brian Bickell, chief executive of Shaftesbury:

“In the year ahead, the widespread distribution of effective vaccines will bring a gradual return of confidence and activity across the West End and, a recovery in domestic footfall and spending. At the present time, it is not possible to predict at what point conditions will improve but it is likely social distancing and other restrictions, with the risk of further lockdowns, will continue into the spring and possibly early summer, putting further financial strain on occupiers. The overhang of unusually high vacancy across the West End will take time to be absorbed.”

William Hill, chairman of Ediston Property:

“Irrespective of whether the economy gets back to where it was, we will be using real estate in a different way to that pre-crisis. Some of the change was already in the pipeline. Mega trends relating to the climate crisis, demographics, digitalisation, disruption from new technologies (such as robotics), the emphasis on health and well-being and the circular economy were all there before. The post COVID-19 ‘reset’ will accelerate the pace of many of these changes. Other changes will be new and reflect risk management against future pandemics. Retail warehouses have a high proportion of essential retail tenants, a defensive convenience led bias, rents at affordable levels and it fits well into the new retail economy, including retailers’ omnichannel strategies.”

Recent real estate research notes

Aberdeen Standard European Logistics Income – Expansion on the radar

Lar Espana Real Estate – Built to last

Tritax EuroBox – Boxing clever

Civitas Social Housing – Solid foundations for future growth

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.