Henderson Diversified Income Trust – Soft landing likely…

Soft landing likely…

Soft landing likely…

…but caution is required. The managers of Henderson Diversified Income (HDIV) stuck to their guns in the face of a consensus view of rising rates and inflation. This stance, and their focus on high-quality credits, has been rewarded in 2019, as central banks around the world have cut rates to tackle a slowing economy and investors fear a global recession. HDIV is the top-performing fund in its peer group, but perversely, is trading at a smaller premium than some of its peers.

HDIV’s managers think that the bond market may not have peaked yet. However, they are concerned about the loan market (an area that they have been deliberately avoiding), and the market for securitised loans in particular (an area that HDIV has never had exposure to). The allocation to investment grade bonds has been increased.

High income from a flexible fixed income portfolio

High income from a flexible fixed income portfolio

HDIV’s objective is to seek income and capital growth such that, on a rolling annual basis, the total return on the NAV exceeds three-month sterling LIBOR plus 2%. It invests in a diversified portfolio of global assets including secured loans, government bonds, high yield (sub-investment grade) corporate bonds, unrated corporate bonds, investment grade corporate bonds and asset-backed securities. The trust may also invest in high-yielding equities and derivatives. The managers use gearing to enhance returns.

Dividends, which make up the bulk of returns for investors, are paid quarterly.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Three-month LIBOR plus 2% (%) |

|---|---|---|---|---|

| 1 | 31 Oct 2015 | 4.80 | 5.30 | 2.60 |

| 2 | 31 Oct 2016 | 7.60 | 7.60 | 2.60 |

| 3 | 31 Oct 2017 | 9.40 | 7.70 | 2.30 |

| 4 | 31 Oct 2018 | -9.40 | -3.10 | 2.60 |

| 5 | 31 Oct 2019 | 10.10 | 12.60 | 2.90 |

Fund profile

Fund profile

Henderson Diversified Income Trust (HDIV) invests selectively across the full spectrum of fixed-income asset classes, including – but not limited to – secured loans; government bonds; asset-backed securities; investment-grade corporate bonds; high-yield corporate bonds; unrated bonds; preference and selective high-yield equity shares; hybrid securities; convertible bonds; and floating-rate notes.

Its objective is to seek income and capital growth such that, on a rolling annual basis, the total return on the NAV exceeds three-month sterling LIBOR plus 2%. It has a global mandate and the managers use gearing to enhance returns. The company was redomiciled to the UK from Jersey with effect from 27 April 2017.

The managers

The managers

Henderson Investment Funds Limited is HDIV’s AIFM and Henderson Global Investors Limited (Henderson) is the delegated investment manager. Parent company, Janus Henderson Investors had around £289bn of AUM at the end of September 2019. The named fund managers for HDIV are John Pattullo and Jenna Barnard. They have been managing the fund since it was launched in 2007 and have been working together at Henderson since 2002. They are part of a six-strong Strategic Fixed Income team, including Nicholas Ware, who has been working closely with John and Jenna on HDIV since he joined the team in 2012. They are supported by Janus Henderson’s wider fixed-income team and its seven-strong specialist secured-loan team. Responsibility for the selection of suitable secured loans is delegated to the specialist secured-loan team, led by David Millward.

The right call on duration

The right call on duration

HDIV’s managers observe that analysts consistently misforecast the direction of rates. The consensus is almost always for rates to rise, but bond yields have almost always undershot analysts’ targets. Readers of our last couple of notes on HDIV will recall that the managers took a strong contrarian stance on the direction of US rates, extending the duration of the portfolio. That stance paid off handsomely when the Fed changed tack at the start of 2019 and has been rewarded further as rate cuts materialised.

The managers remain convinced of their ‘lower for longer’ stance on inflation and rates – the ‘Japanification’ of economies. There is a range of long-term factors weighing on economic growth including stagnant and ageing populations, technology replacing jobs and driving down manufacturing costs, increasing political uncertainty strangling investment, and the overwhelming debt burden (which might be hard to sustain at higher rates and which borrowers are seeking to reduce in preference to spending).

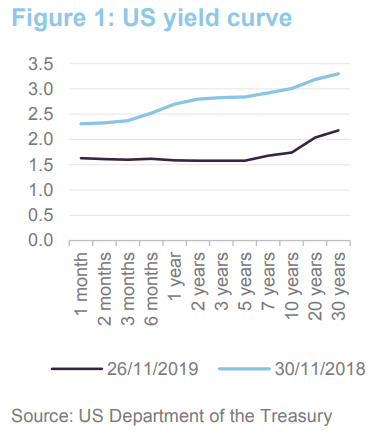

Over the course of 2019, many investors have begun to realise that a return to ‘normal’ levels of rates looks increasingly unlikely. The Fed’s 2018 ambition of an end to and a reversal of QE is a pipe dream. The managers compare QE and low rates to a lobster pot that is hard to escape from. The effect has been to drive down long-term rates and flatten, even invert, the yield curve (although this looks more normal now).

US long-term rates are still a lot higher than those of other developed economies (this is one reason why the dollar does not weaken when Trump tries to talk it down).

Despite the exuberance shown by equity market investors, the economic slowdown that we flagged in our last HDIV note appears to be underway. The question is, are we facing a hard or soft landing? The managers lean towards the latter; they think we may be experiencing a typical global manufacturing inventory slowdown, led by Asia (and not necessarily driven by the US/China tariff war). Based on a range of leading indicators, Janus Henderson’s in-house economist thinks that we may have just seen the trough of this slowdown, particularly in the inventory cycle.

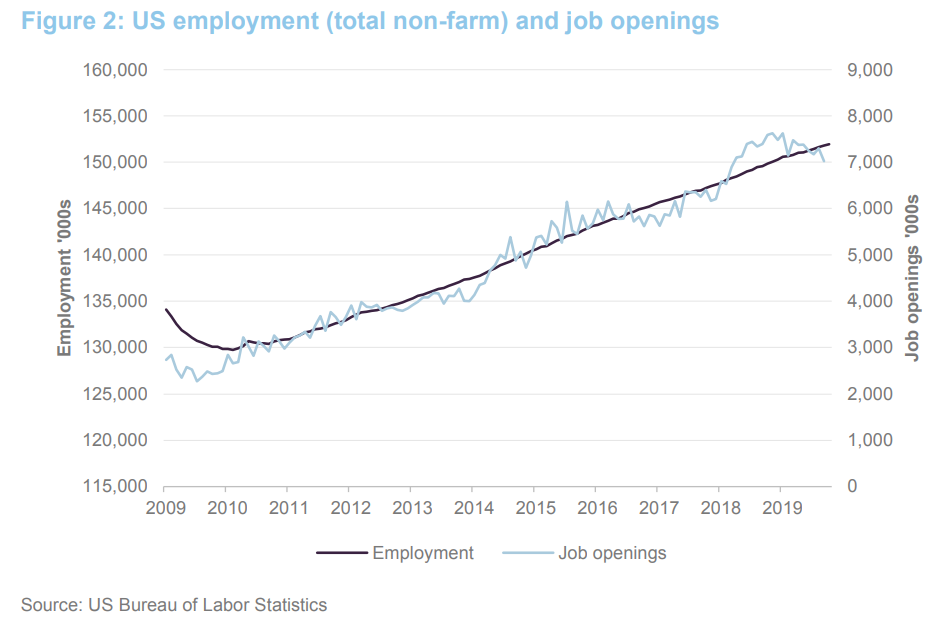

However, whether we have a hard or a soft landing depends on whether the manufacturing slowdown spills over into the services sector. The managers use job vacancies as a leading indicator for employment and, perhaps, we are seeing this roll over. In addition, a survey of CEO confidence in the US has turned sharply negative (almost as low as it was in Q1 2009). If we do get a hard landing, rates will be cut even more aggressively, to HDIV’s benefit. If it is a soft landing, it might be better to reduce the fund’s duration, although by no means are the managers expecting a strong recovery, business investment looks set to remain depressed for some time yet, for example.

The managers are watching the situation carefully and are ready to respond as required. At the same time, they are conscious that a slowing economy will be piling pressure on weaker credits. HDIV’s emphasis on higher-quality credit exposure should stand it in good stead in this environment.

High yield – dispersion of returns in 2019, quality has been rewarded

High yield – dispersion of returns in 2019, quality has been rewarded

Overall, the high-yield market has had a good year, but within this, there has been a wide dispersion of returns. Funds, such as HDIV, that have avoided riskier credits (based on the managers’ ‘sensible income’ approach to managing the portfolio), have benefited as these have trailed higher-rated bonds. Given the strength in equity markets, it might have been reasonable to assume that CCC-rated bonds (US BB-rated credit has returned 13.7% versus 5.6% for US CCC-rated credit) would have performed better than they have. It might be that bond market investors are positioning for a hard landing and equity market investors are positioning for a soft landing.

However, the relative lack of issuance within the high-yield sector (discussed in previous notes) means that there is excess demand for high-yield paper, and so higher-rated high yield has been a crowded trade. It may be that, if investors’ fears of a hard landing ease, lower-rated bonds will do well in the run-up to the year end.

On balance, rating agencies have been upgrading more high-yield bonds than downgrading them. Analysis of ‘fallen angels’ versus ‘rising stars’, carried out by Citigroup and JPMorgan, backs this up. HDIV’s managers have been targeting issues that they think might be upgraded, and have had a few successes in this area.

CLO market facing problems?

CLO market facing problems?

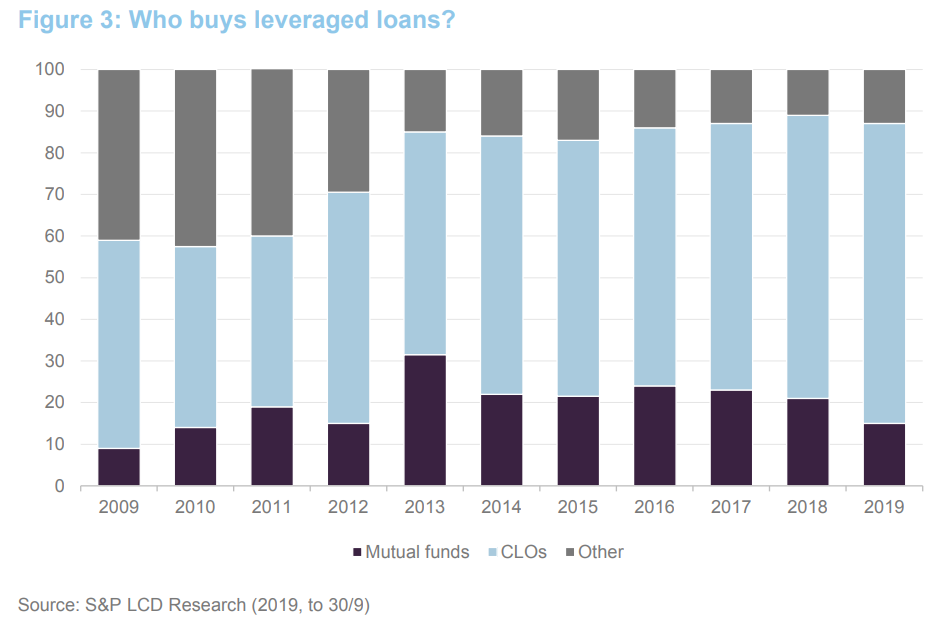

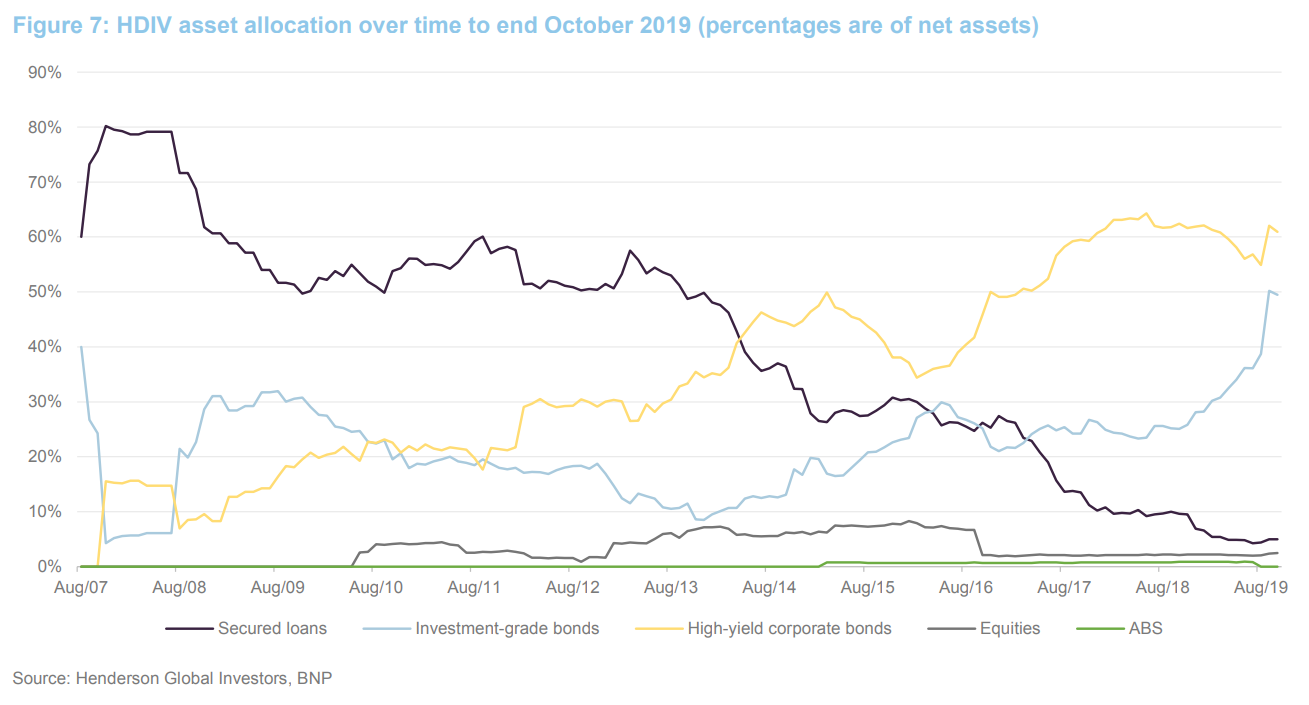

HDIV still has a very low exposure to loans (see Figure 7) and has no exposure to securitised loans. In part, the managers’ long duration stance is one reason for this. Given that floating rate loans have no duration, investors tend to pull money out of loans in periods when rates are falling. When interest rates bottom out, loans will become more attractive and, when they judge the time is right, the managers may raise exposure to loans in anticipation of this.

However, another reason why the managers have been reducing HDIV’s exposure to the loan market, in recent years, has been their concern about the quality of loans available. Excess and indiscriminate demand for loans has allowed over-leveraged companies and those with challenged business models to obtain finance. HDIV’s managers have not been afraid to sit on the sidelines, awaiting the inevitable fallout. Low interest rates and a lack of covenants help prolong the day of reckoning but CLO market investors have started to wake up to the problem.

A burgeoning CLO market created considerable demand for loans that private equity firms and corporates have been happy to tap into (S&P LCD estimates that CLOs hold between 55% and 60% of all outstanding leveraged loans and have been buying three-quarters of all new loans). In a race to the bottom, covenant-lite loans (which do not offer call protection, for example) have proliferated (we are late in both the economic and lending cycles).

Rating agencies have given loans reasonable ratings, but as profit growth stalls, they are starting to look at over-levered businesses again, putting pressure on loan prices. In contrast to the high yield market, more loans are being downgraded than upgraded. LCD reports the ratio of downgrades to upgrades is as high as it was in November 2009. It says that 13% of outstanding loans were rated B- at the end of September 2019.

CLOs get into difficulties if the amount they hold in CCCs breaches agreed limits (typically 7.5%). In a breach situation, interest payments on lower ranking tranches may be suspended until the problem is rectified. While it is unlikely that there will be a mass failure of CLOs (on average, CLOs have 4.1% of their assets in CCC-rated loans according to LCD), Citi thinks that half of CLO managers may exceed the 7.5% limit. CLO prices are weakening and new CLO issuance is slowing. If the CLO new issue market turns off, loan prices will weaken further, as they are the largest buyers of loans, and borrowers will be forced to issue into the high-yield bond market.

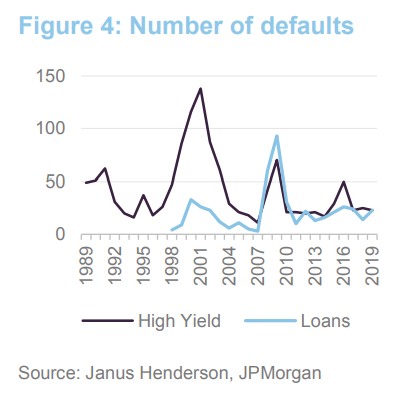

Defaults are still low by historical standards. They are held there by quantitative easing, which has depressed rates and so eased the debt service burden for distressed companies. The managers do expect default rates to rise next year, but to about 3%-3.5% for leveraged loans and high yield bonds – still low by historical standards. The defaults that have happened this year are in the sectors that HDIV avoids. The managers say that there is nothing in the portfolio that they are particularly worried about.

When defaults do happen, recovery rates tend to be around 70bps. However, in a covenant-lite scenario, defaults occur long after a covenanted loan would have defaulted. The result is that recovery rates are expected to be lower, in the order of 50bps, driven by loans being covenant-lite (a lack of covenants means that these credits do not have any triggers to restructure the assets) and also a lack of subordinated loans in the capital structure. Investors need to be compensated for this through the spread. Anticipation of an uptick in defaults is also putting pressure on loan prices.

Investment process – sensible income

Investment process – sensible income

The managers are responsible for the portfolio’s asset allocation and have the freedom to invest across the whole spectrum of debt markets. Theoretically, the portfolio will be biased to fixed income at the top of the interest-rate cycle and secured loans towards the bottom of the interest-rate cycle. In practice, rates fell sharply early in the fund’s life and have not recovered. This has had an impact on portfolio construction ever since.

Emphasis on capital preservation

Emphasis on capital preservation

The emphasis of the team is on preserving capital as well as generating attractive income returns. That means focusing on the quality of credit, security and collateral. Chasing yield by investing in poor-quality credits may appear to be an attractive strategy in the good times, but these can be difficult to trade out of when the market turns – sometimes there is no bid. The portfolio is weighted towards defensive businesses that can cope with low economic growth rates and away from investments that might be described as ‘value traps’ – companies with declining business models, no pricing power and excessive leverage. The managers will look to exploit mispricing opportunities when they arise, switching between junior and senior tranches of debt in the same issuer, for instance.

Proprietary, fundamental credit analysis

Proprietary, fundamental credit analysis

The management team carries out proprietary fundamental credit analysis with the aim of preserving capital by minimising default losses.

The managers’ focus is on identifying good-quality credit and exploiting opportunities for carry, given the spreads available over HDIV’s borrowing costs.

Indices play no part in informing portfolio construction. The US offers the deepest markets, but this is not a factor in determining HDIV’s asset allocation. The managers are firmly of the view that bond markets need stock pickers. Passive investment in bond markets, through bond ETFs, for example, results in having your largest exposures to the biggest borrowers and this is not a recipe for success.

Risk management

Risk management

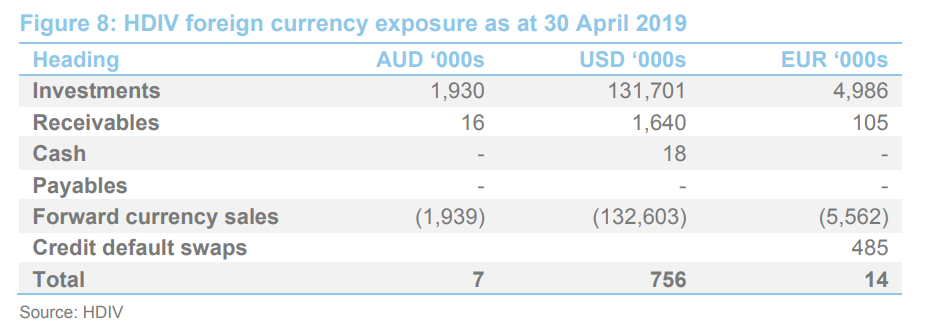

Non-sterling assets are hedged back to sterling using rolling, forward foreign currency contracts.

The managers emphasise the importance of a strong sell discipline, saying that avoiding the worst-performing bonds is key to performance. They also point out that towards the end of the cycle in bonds, rates are squeezed and covenants eased; debt is issued to fund M&A at the top of the market; and balance sheets are stretched thin through buybacks and special dividends. The managers try to avoid ‘investing with the crowd’ in these situations. Areas that they consider to be riskier include emerging market debt and the energy, mining, materials, automotive and shipping sectors. Wherever possible, they like to keep the portfolio invested in ‘vanilla’, lower-risk and liquid debt.

ESG

ESG

Increasingly, the managers are incorporating ESG criteria into their decision-making. The conscious bias away from highly cyclical sectors helps avoid some of the worst offenders on the environmental front but the managers also have a list of companies that they will not invest in on social and governance grounds.

Investment restrictions

Investment restrictions

HDIV invests in unlimited amounts of secured loans; government bonds; and investment- grade and high-yield bonds. Up to 10% may be invested in unrated corporate bonds, up to 40% may be invested in asset-backed securities and up to 10% may be invested in high-yielding equities. No more than 10% of the fund will be invested in any one issuer.

Derivatives

Derivatives

Gearing is used to arbitrage between the cost of debt and the yields available from investments. HDIV can also boost its income in exchange for taking on some default risk. In addition to gearing provided through a borrowing facility (see page 14 in the enclosed PDF version), credit default swaps (CDS) are used to provide gearing to the portfolio. The managers can use derivatives (CDS, interest-rate futures and swaps) in the management of the portfolio – it lets them manage exposures without buying or selling the underlying securities. Exposure to credit derivatives (synthetic gearing) is capped at 40% of net assets and the combination of synthetic gearing and more traditional gearing is also capped at 40% of net assets. Forward currency contracts are used to hedge foreign currency exposures.

Asset allocation

Asset allocation

HDIV maintains its bias towards US credits, reflecting the managers’ ability to access a deeper, more liquid market and the availability of better quality credits. As discussed below, currencies exposures are always hedged back into sterling.

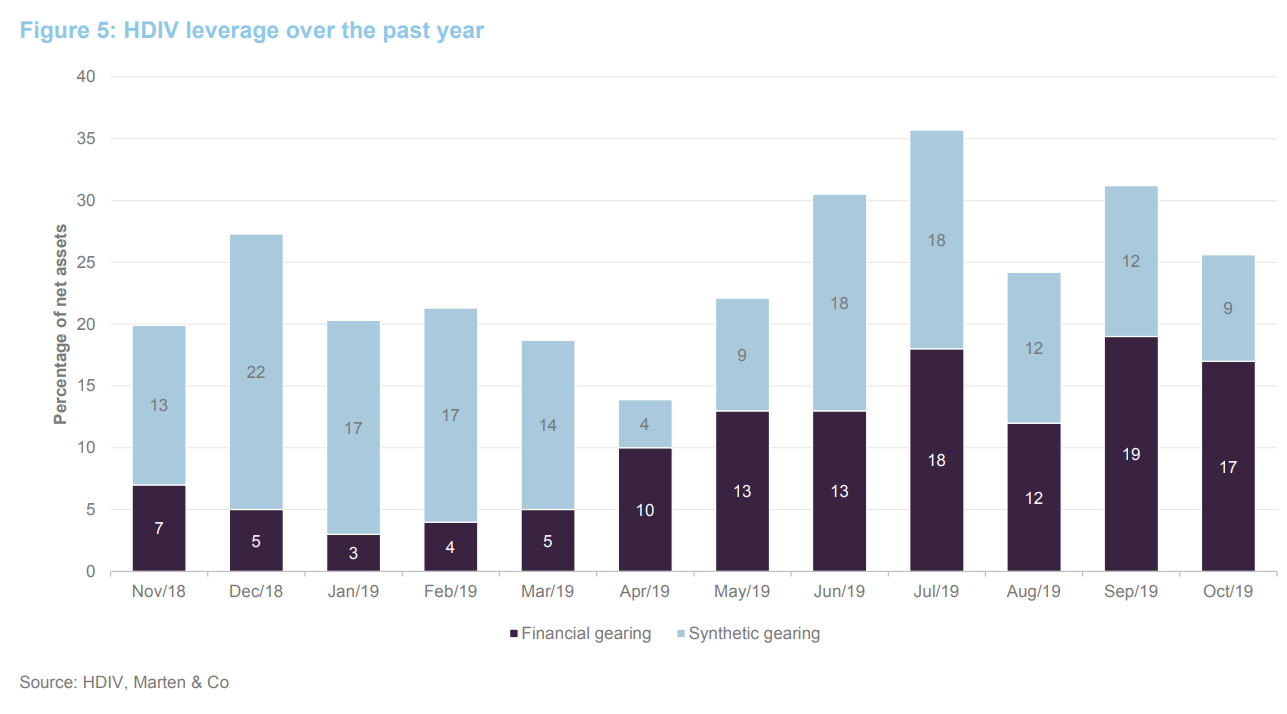

Fluctuations in the level of synthetic gearing over the past 12 months are, in part, attributable to the managers’ use of interest rate futures. The exposure to this area was particularly high (13.5% at the end of June 2019) in the run up to the first of the Fed’s rate cuts. At the end of October 2019, total net gearing (bank borrowings and synthetic gearing less cash) was 25.6%.

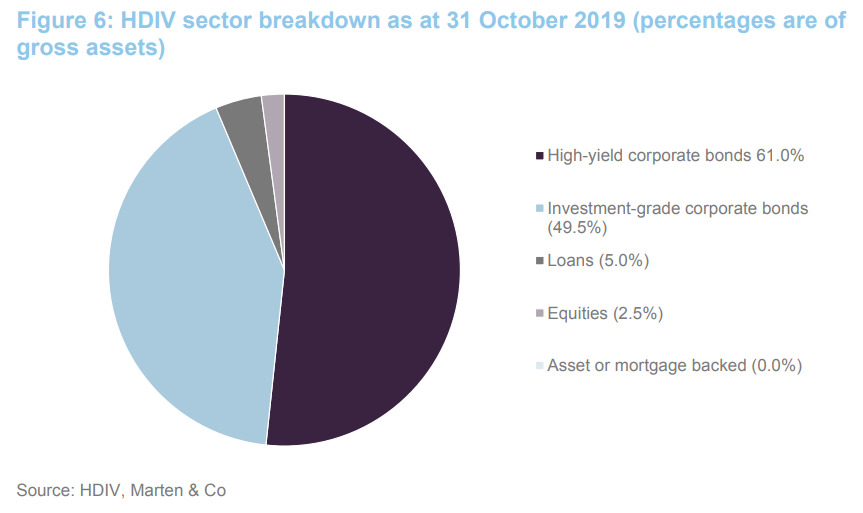

There were 135 holdings in the portfolio at the end of October 2019. Figure 6 shows how the portfolio was split between various types of credit and Figure 7 shows how this has varied through time.

Exposure to loans has continued to fall, initially to the benefit of the allocation to high-yield but recently the exposure to investment grade debt has risen sharply and is close to all-time highs. The managers are keeping an eye on the loan market to see whether opportunities may arise with the sell-off that is taking place.

The managers acknowledge that both investment-grade and high-yield may be slightly expensive. In the latter case, prices are well supported because of a lack of supply. Increasing the weighting to investment grade bonds puts a little pressure on the income account, but the managers believe that it is the prudent thing to do in this environment.

The majority of the high-yield bonds that HDIV holds tend to be in the BB-BBB range – they are avoiding the riskier issues. In addition to avoiding issuers exposed to the automotive, shipping and airline sectors, and emerging market debt. The managers also warn about the hidden risks in illiquid assets, which tend to be valued at par, distorting Sharpe ratios.

As at 30 April 2019, in-line with its standard practice, HDIV’s foreign currency exposure is hedged back into sterling, as Figure 8 shows.

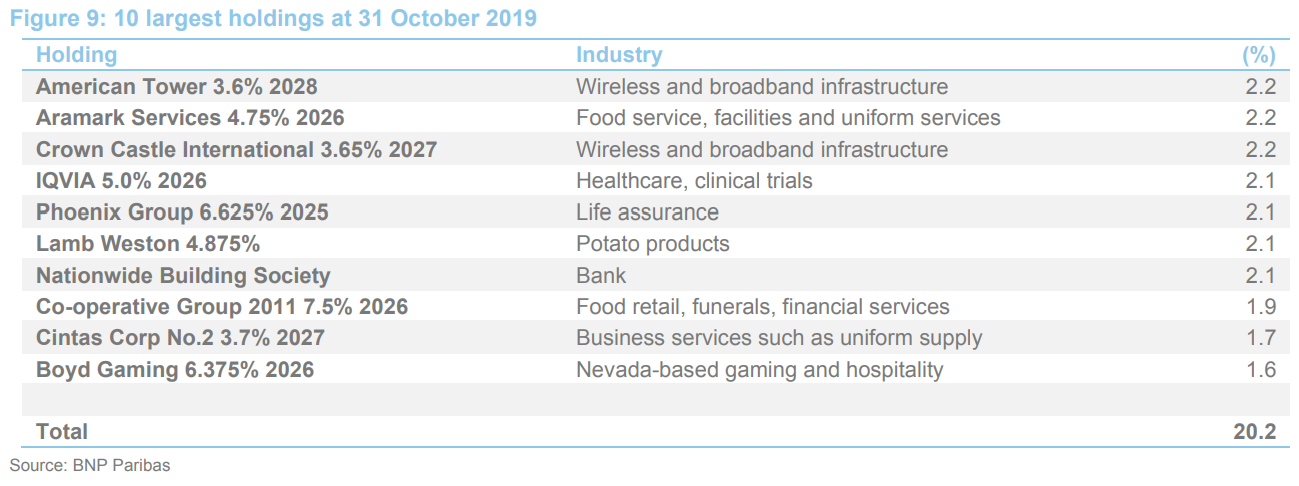

10 largest exposures to individual issuers

10 largest exposures to individual issuers

Six of 10 issues in the list of largest holdings were present in the top 10 at the end of February 2019 (the data we used in our last note). There is not much variation in portfolio weightings, however, and so small changes in allocation and valuation have an impact on the line-up.

Performance

Performance

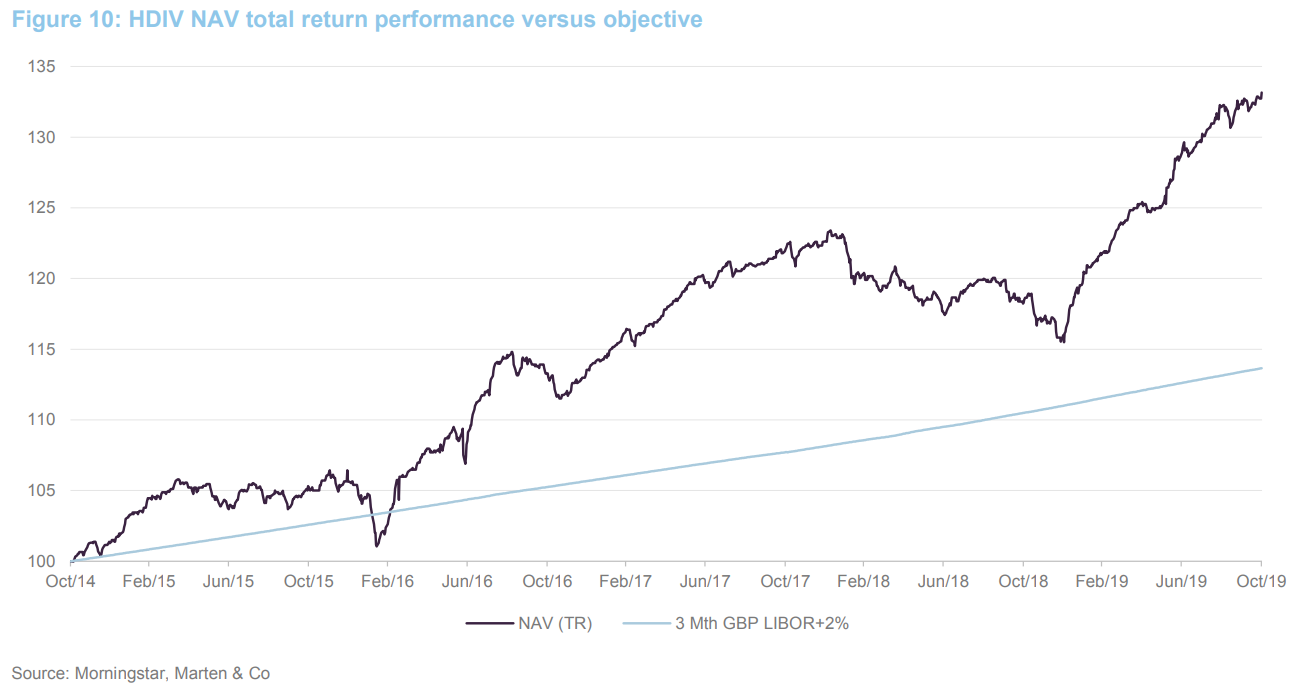

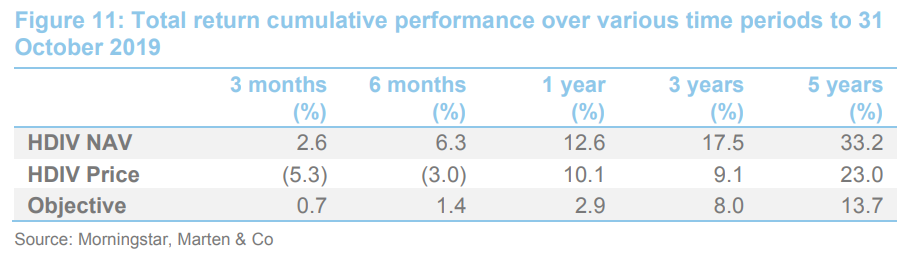

HDIV continues to outstrip its benchmark by some margin.

As Figure 12 shows, HDIV’s returns over the past 12 months have been particularly strong. Primarily, this has been driven by the managers’ long duration stance ahead of rate cuts in the US and elsewhere. Another source of returns in 2019 has been rating upgrades within the high-yield portfolio. The managers highlight Tesco 5.2% 2057, Equinix 5.875% 2026, HCA 5.875% 2026 and HIS Markit 4.75% 2025 as examples of bonds which are trading on much narrower spreads following rating upgrades.

The allocation to interest futures has worked out well. This has added 78bp to returns over the eight months to the end of August 2019.

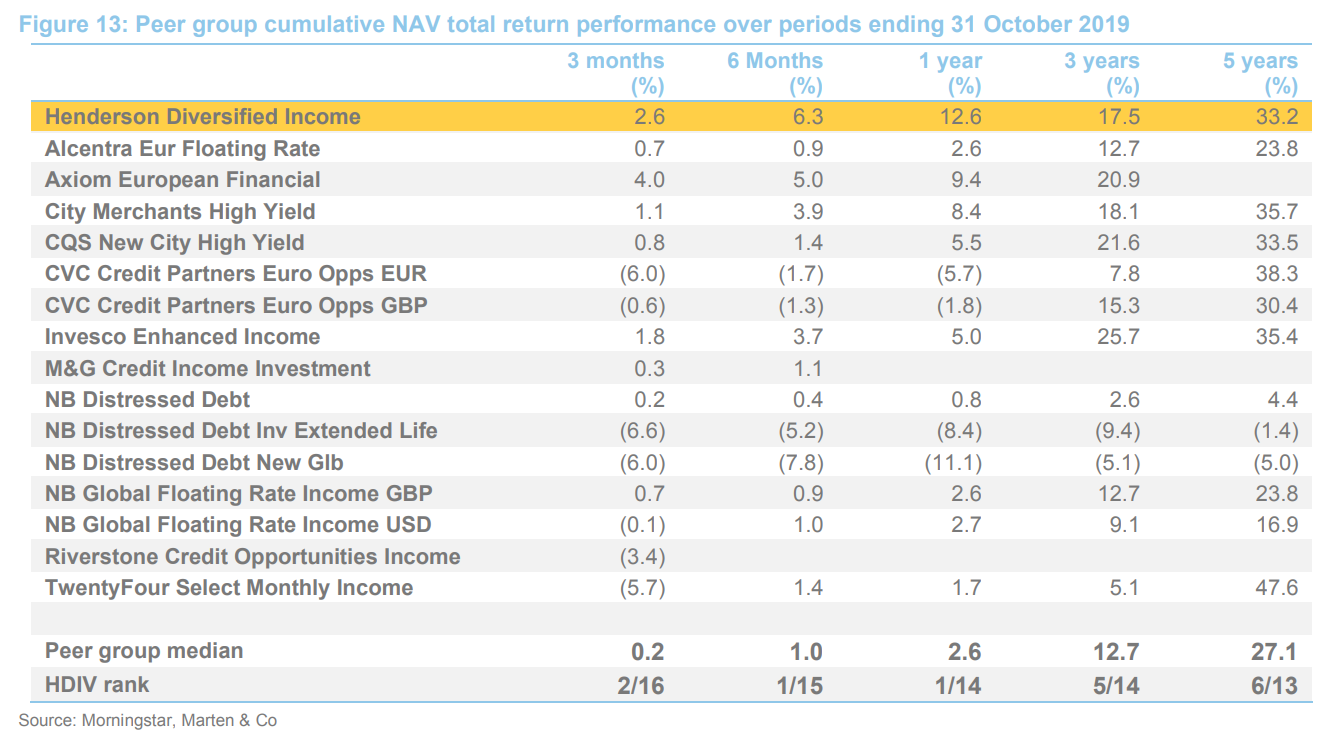

Peer group

Peer group

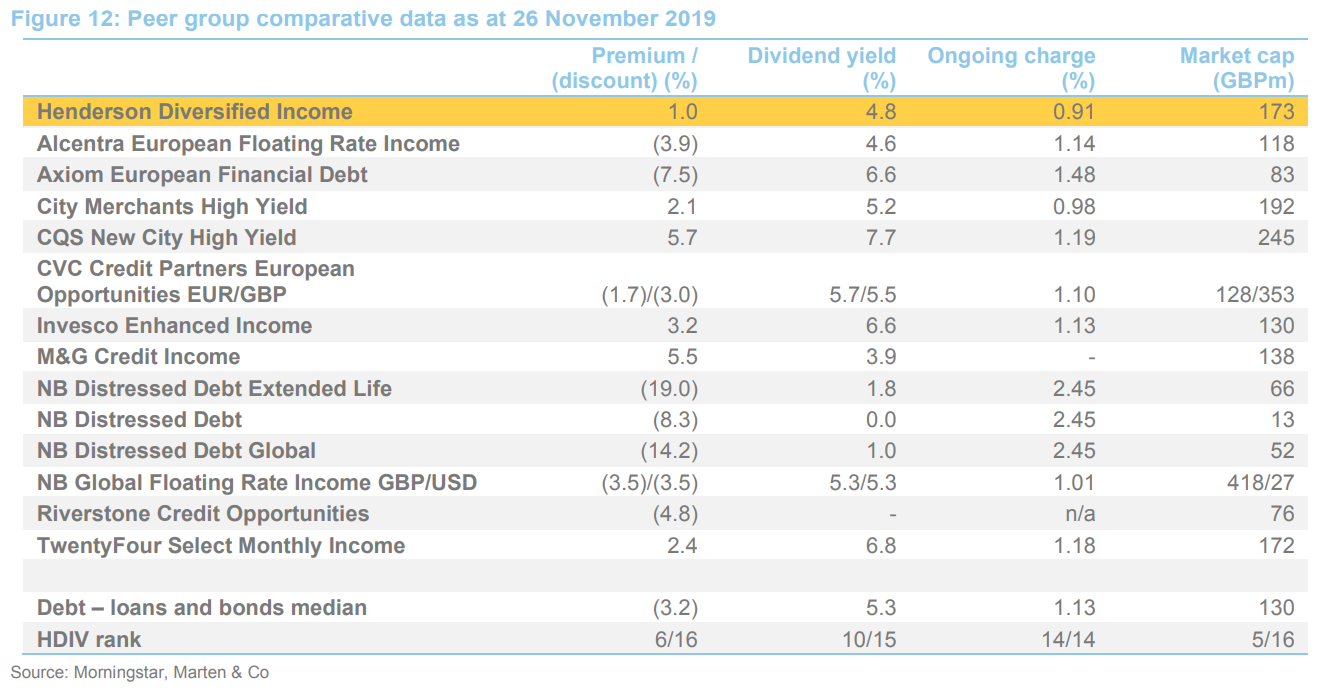

Since we last published a note on HDIV, it has been reclassified by the AIC from the global high-income sector to a new debt – loans and bonds sector. The new peer group provides a wider set of comparators. There are some differences in approach that should be borne in mind when comparing the companies, however.

HDIV’s managers believe that their focus on debt owed by high quality, growing companies helps separate them from the herd.

The new peer group has 14 constituents (12 if we treat the three NB Distressed Debt portfolios as one fund, 16 if we count the additional currency share classes for CVC and NB Global Floating Rate).

The three NB distressed debt portfolios operate in a distinct sector of the loans and bond market. Alcentra, Axiom and CVC restrict themselves to European debt, while HDIV takes advantage of what its managers see as a wider choice of higher-quality credits offered by the US market.

Riverstone is focused on funding energy companies (an area that HDIV actively avoids). TwentyFour Select Monthly Income targets illiquid securities and has a high exposure to asset-backed securities, an area that HDIV has largely avoided (it did hold a bond backed by properties occupied by Tesco until recently, which met HDIV’s quality criteria).

HDIV has moved to trading on a small premium in recent days having spent a few weeks trading at a discount. The discount seemed anomalous to us, especially given HDIV’s strong performance over the past year and focus on quality, and the current rating looks more reasonable. In an environment where investors are increasingly fixated on fees, HDIV offers the lowest ongoing charges ratio of any fund in this peer group. HDIV is the sixth-largest fund in this group but it has ample scope to expand.

HDIV’s long-term performance is respectable against this peer group, but particularly impressive over the past year.

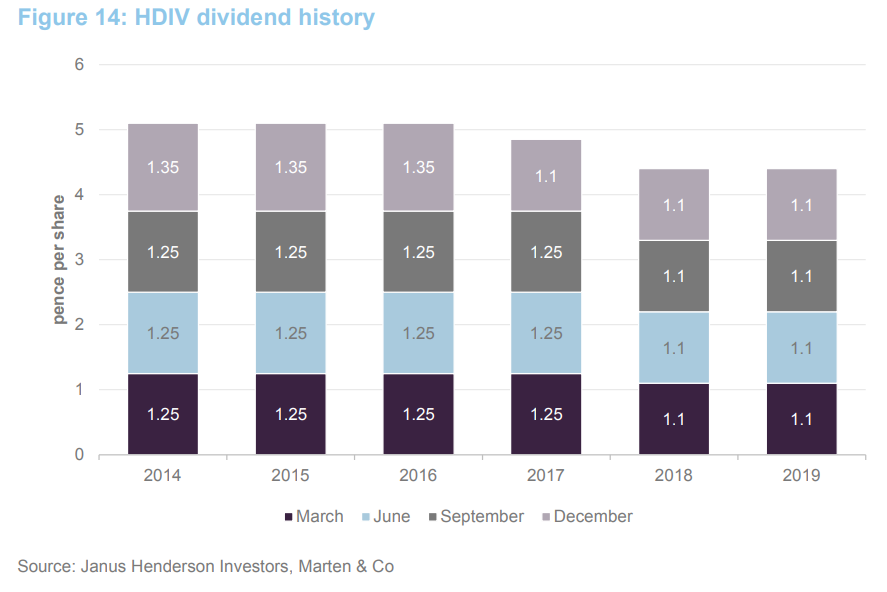

Dividend

Dividend

HDIV pays quarterly dividends in March, June, September and December. The rebasing of HDIV’s dividend to 1.1 pence per quarter was the main topic of our November 2017 note. The low yields available in the market left the managers with a stark choice between cutting the dividend or raising the risk profile of the fund (at an increased risk of a permanent loss of capital). They chose the former route.

Following the reduction, HDIV’s dividend is now covered by earnings. Against dividends totalling 4.4p, the revenue per share for the accounting year ended 30 April 2019 was 4.47p (up from 4.19p for the prior year). The revenue reserve stood at £2.3m at the end of April 2019 – enough to cover one quarter’s dividend.

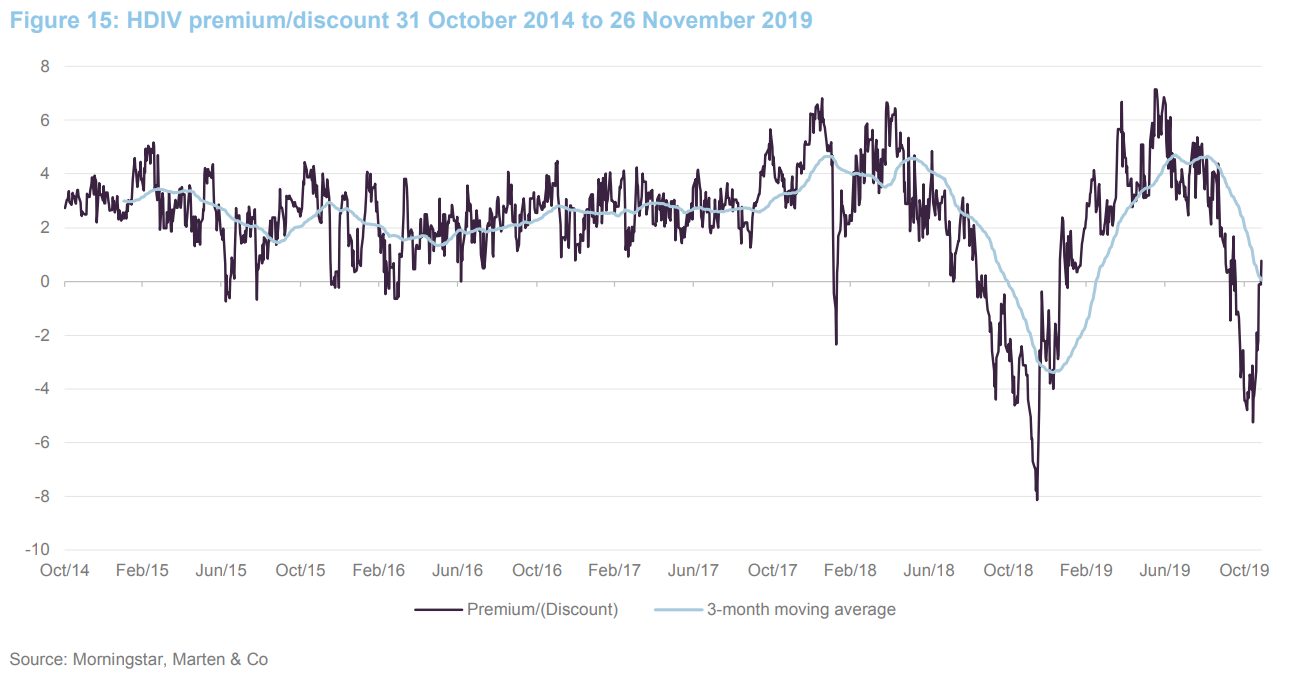

Premium

Premium

Despite its strong recent performance and attractive yield, HDIV has traded at a discount in recent months. Over the year ended 31 October 2019, the shares ranged between an 8.1% discount and a 7.1% premium and averaged a 1.6% premium. However, on 26 November 2019, the trust was trading at a premium of 1.0%, which seems more reasonable given its track record and quality focus.

Each year, the directors ask shareholders for permission to allot new shares and buyback existing ones. At the AGM on 3 September 2019, shareholders approved the issuance of up to 10% of HDIV’s then issued share capital (18,961,824 shares) and the repurchase of up to 14.99% of its then-issued share capital (28,423,774 shares). No shares have been issued or repurchased in 2019.

Should it repurchase shares, HDIV may hold these in treasury and re-issue them at a later date. Shares will only be issued at a premium to asset value.

Fees and costs

Fees and costs

Janus Henderson provides HDIV with investment management, accounting, administrative and company secretarial services. BNP has been subcontracted by Janus Henderson to provide the accounting and administration services. HDIV pays Janus Henderson a fee of 0.65% of net assets (calculated and paid quarterly in arrears). There is no performance fee. The trust also makes a contribution to the manager’s marketing expenses. For the year to the end of 30 April 2019, this amounted to £55,000. The contract with the managers can be terminated on six months’ notice.

The only other expenses of note in the year ended 30 April 2019 were the directors’ fees (see below), the auditor’s remuneration of £36,000, and £35,000 to cover the depositary’s fees. The ongoing charges ratio for the year ended 30 April 2019 was 0.89%. As noted on page 12 (in the enclosed PDF version), this is the lowest of any fund in HDIV’s peer group.

The trust’s management expenses are charged 50% against capital and 50% against revenue. All other expenses are charged against revenue.

Capital structure and life

Capital structure and life

HDIV has 189,618,240 shares in issue and no other classes of security. Gearing is provided through a multicurrency loan facility of £45.5m provided by Scotiabank Europe, which expires on 14 August 2020, and through the use of derivatives (synthetic gearing, as described on page 7 in the enclosed PDF version). Total gearing (synthetic and financial) is capped at 40% of net assets. At the end of April 2019, the interest rate on the Scotiabank facility was 87.5bp over LIBOR.

HDIV’s year end is 30 April and its AGMs are held in September. It has an unlimited life.

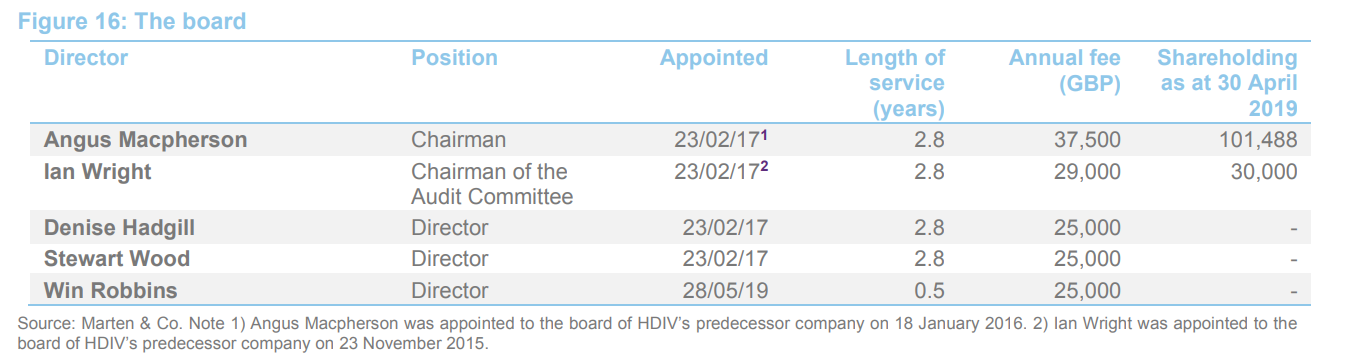

Board

Board

HDIV has five directors, all of whom are non-executive, independent of the manager and who do not sit together on other boards. The board was refreshed when the company moved onshore in 2017, and only two pre-existing directors (the chairman and Ian Wright) were appointed to the new board. The most recent recruit, Win Robbins, joined in May 2019.

Angus Macpherson

Angus Macpherson

Angus is chief executive of Noble & Company (UK) Limited. He is also a director of Pacific Horizon Investment Trust Plc, a director of Southern Pentland Shooting Club Limited and trustee of The Scottish Policy Foundation. Previously he worked for Merrill Lynch in London, New York, Singapore and Hong Kong, latterly as head of Capital Markets and Financing in Asia. He was also chairman of JP Morgan Elect Plc until January 2018, chairman of the Belhaven Hill School Trust Limited, and a member of the Scottish Government’s Financial Services Advisory Board.

Ian Wright

Ian Wright

Ian is deputy chairman of the Jersey Financial Services Commission, a director of the Jersey Heritable Property Company Limited and a policeman in the Parish of St. Brélade. He is a Chartered Accountant. Previously he was an audit partner in Price Waterhouse and then PricewaterhouseCoopers, including serving as the senior partner of the firm’s international accounting consulting group. A founder member of the IFRS Interpretations Committee, he has also served on professional committees of the ICAEW and FEE. He was also a panel member of the Financial Reporting Review Panel, which is part of the UK Financial Reporting Council. He is resident in Jersey, having previously worked in the Channel Islands, London and Bahrain.

Denise Hadgill

Denise Hadgill

Denise was managing director and head of the UK Product Strategy Group at BlackRock until 2015, and was responsible for delivering the firm’s investment message and economic outlook to an extensive range of UK pension fund and charity trustee boards. Prior to this, she spent 14 years at Schroder Investment Management Limited where she was UK equity fund manager and director responsible for the firm’s relationship with 21 UK pension fund and charity clients with multi asset portfolios valued at £2 billion.

Stewart Wood

Stewart Wood

Stewart Wood has been a Labour member of the House of Lords since 2011 and is a member of its Committee on International Affairs. He was Shadow Minister without Portfolio and a strategic adviser to Ed Miliband (he led Ed Miliband’s Labour leadership campaign). Prior to that, he was a special advisor to the Chancellor of the Exchequer and led the assessment of the UK’s entry to the euro. In 2016, he became the chair of the United Nations Association (UK). He is Professor of Practice at the Blavatnik School of Government at the University of Oxford.

Win Robbins

Win Robbins

Win has extensive investment management experience, having held various senior positions including eight years as director of Credit Suisse Asset Management Limited from 1996 until 2004 and managing director and head of Non-US Fixed Income at Citigroup Asset Management from 2004 to 2006. Win is a non-executive director of Polar Capital Holdings Plc, a position she has held since 2017. She is also a non-executive member of the Investment Committee of St. James Place Partnership Plc and an independent trustee of the Institute of Cancer Research Pension Fund. Win holds a Diploma in Investment Management from the London Business School, and was formerly a non-executive director of City Merchants High Yield Trust Limited.

Previous publications

Previous publications

Readers interested in further information about HDIV, may wish to read our last update note, Death rattle for bull market, published on 3 April 2019, as well as our previous notes:

- Onshore, on-message, on-form – Initiation – May 2017

- Dear Prudence – Update – November 2017

- Winter is coming – Annual overview – 4 October 2018

- Death rattle for bull market – Update – 3 April 2019

The legal bit

The legal bit

This marketing communication has been prepared for Henderson Diversified Income Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.