JPMorgan Japanese Investment Trust – Number one over three years

Number one over three years

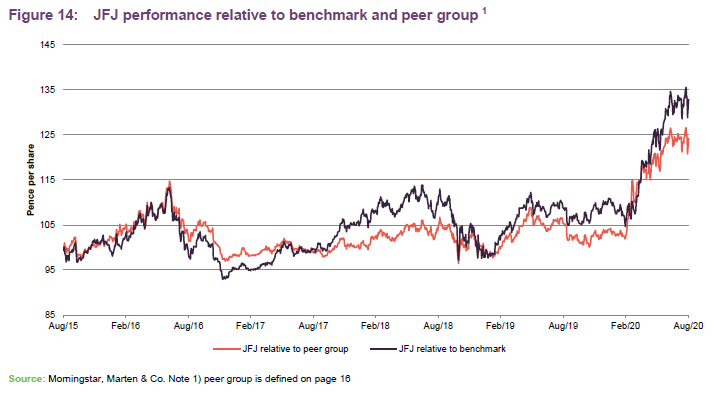

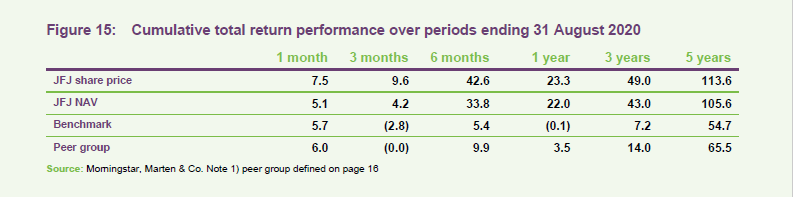

JPMorgan Japanese Investment Trust (JFJ) is the best-performing trust in its peer group over three years by some margin (see page 14). The trust’s performance record has been achieved by following a conviction-driven stock-picking approach that focuses on quality and growth, two aspects that have been in demand in a world tackling COVID-19.

There are large parts of the trust’s benchmark index that JFJ’s managers actively avoid. They believe that these companies and sectors represent the ‘old Japan’. Instead, the portfolio is designed to represent the best opportunities within areas of growth such as the internet, automation and healthcare. Consequently, JFJ’s portfolio has a high active share. It also has returns well-ahead of any index-tracking ETF.

Capital growth from Japanese equities

JFJ aims to produce capital growth from a portfolio of Japanese equities and can use borrowing to gear the portfolio within the range of 5% net cash to 20% geared in normal market conditions.

|

|

Fund profile

JPMorgan Japanese Investment Trust (JFJ or the trust) aims to achieve capital growth from investments in Japanese companies. For performance monitoring purposes, the trust is benchmarked against the returns of the Tokyo Stock Exchange First Section Index (commonly known as TOPIX) in sterling.

The trust makes use of both long and short-term borrowings with the aim of increasing returns.

Day-to-day investment management activity is the responsibility of JPMorgan Asset Management (Japan) Limited in Tokyo. The co-investment managers are Nicholas Weindling, who has had responsibility for JFJ’s portfolio for more than a decade, and Miyako Urabe, who was appointed co-manager in May 2019 (see page 20). They are supported by a well-resourced team.

The investment emphasis is on identifying high-quality companies that are capable of compounding their earnings sustainably over the long term. That means investing in companies in growing industries that have strong balance sheets and are resilient in the face of macro-economic issues.

The managers recognise that JFJ’s performance may lag its benchmark in periods of market exuberance, triggered by an uptick in growth prospects, for example. Q4 2018 and H2 2016 were periods of underperformance for this reason. However, the managers prefer to focus on identifying attractive stocks rather than attempting to time markets. Similarly, the trust’s gearing level is driven by the availability of attractively priced stocks, not by macroeconomic considerations.

Benefitting from local knowledge

The investment team is based in Tokyo, where JPMorgan has had an office since 1969. Nicholas says that it is now relatively unusual for non-domestic asset managers to have a physical presence in Japan. In normal circumstances, visiting companies is an integral part of the team’s investment process. They feel that other managers based outside the country may be at a disadvantage, especially given that COVID-19 has effectively shut Japan’s borders to non-nationals.

The team is 25-strong and is a mix of fund managers and analysts – roughly half and half. In addition, one of the strengths of the business is that the managers can also draw on the expertise of JPMorgan’s analytical teams around the world. This can help with competitive analysis for example – it can also help identify trends on which Japan is behind the curve.

COVID-19 impacted an economy that was already in recession

The managers acknowledge the Japanese economy faces some significant headwinds. Nevertheless, they believe that Japan can boast some great companies. This is why their focus is on stock selection.

For many years, Japan has been associated with deflation and a stagnant economy. This is partly the consequence of the collapse of an asset bubble in the early 1990s and an ageing and shrinking population. Fortunately, as the workforce shrinks, unemployment is negligible. In an attempt to encourage economic growth, the government has been encouraging greater female participation in the workforce, and bringing back retirees.

Poor corporate governance had also been weighing on share prices. However, significant advances have been made in this area, helped by 2014’s stewardship code and 2015’s corporate governance code. Increasingly, companies are appointing independent non-executive directors, relaxing ‘poison pill’ rules that prevented takeovers and unwinding cross-shareholdings. Dividend pay-out ratios, while still low by international standards, have been rising.

Prime Minister Shinzo Abe’s three-fold reforms (fiscal expansion, monetary easing and structural reforms), dubbed Abenomics, began to be implemented in 2013. They have had some modest success, but it has often felt like two steps forward, one step back. For example, last year’s hike in consumption taxes impacted consumer spending and had tipped Japan into a recession even before COVID-19 hit. The Prime Minister’s resignation, for health reasons, knocked market confidence briefly. However, the managers do not expect any major shift in government policy.

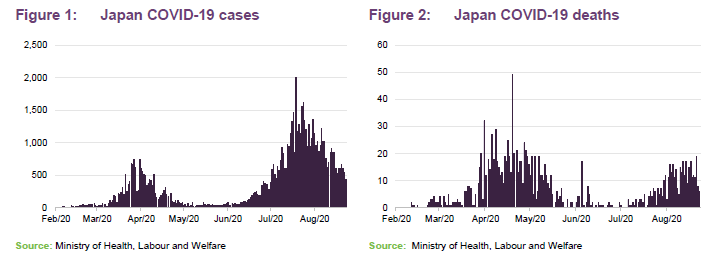

Japan’s early experience of COVID-19 was relatively benign, but the second wave appears to have had more of an impact.

The Government acted swiftly to close schools and encouraged people to stay at home and avoid closed spaces, crowded conditions and close-quarters conversations. The effect was similar to lockdown measures imposed elsewhere. Reluctantly, the Government postponed the Tokyo Olympics until 2021. A nationwide state of emergency was imposed on 16 April and lifted everywhere on 25 May.

The second-quarter hit to Japan’s GDP was (7.8%) (which is significantly better than the equivalent figures for the US and UK). The Bank of Japan (BoJ) is forecasting a 4.7% fall in GDP for the year ended 31 March 2021 with a 0.5% rate of deflation. Overnight interest rates are negative and the BoJ has extended its quantitative easing measures to include purchases of index-tracking ETFs – to the tune of ¥12trn (£86bn) a year.

Japanese companies tend to have considerable reserves of cash on their balance sheets and this should have contributed to their resilience in the face of lockdown measures.

Investing in the new Japan

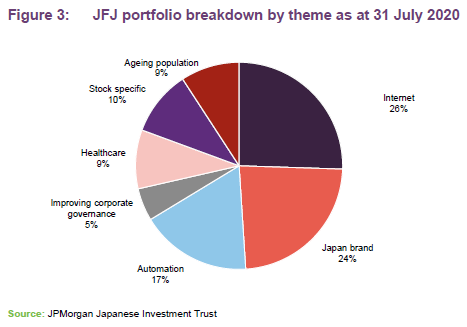

The managers break down the portfolio into a number of investment themes as shown in Figure 3 (which illustrates the spread of investments on that basis, as at 31 July 2020).

Some of these themes are universal – the growth of the internet, online shopping and cloud computing, for example – while others are more specific to or more acute in Japan. One reaction to labour constraints (and relatively high wages) has been to spur investment in automation – an area where Japan is now a world leader. Similarly, the country is being forced to adapt in the face of an ageing population, which is also encouraging investment in healthcare.

The Japan brand theme encompasses the growth of tourism (which was a fast-growing area of the economy before the COVID-19 outbreak), as well as luxury goods and products known for their quality and reliability.

Stock-specific improvements in corporate governance have the potential to drive returns, as a company boosts its dividend pay-out ratio and/or pace of share repurchases, for example.

COVID-19 has provided fresh impetus to many of these trends. It may accelerate the growth of online retail, for example (an area where Japan lags other OECD countries). This would also necessitate a shift towards electronic payments – ahead of the outbreak, 80% of all transactions were in cash, but this is seen as a potential path for the transmission of the virus.

Home-working and online gaming are other areas that have been boosted by lockdown measures. The managers point out that downloading games is far more profitable for gaming companies than selling physical games. They also think that the shift to home-working has highlighted the underinvestment in IT systems by many Japanese companies and this could trigger substantial investment in new systems.

Investment process

The investment process emphasises the long-term sustainability of returns, and there is a clear bias in favour of quality businesses and growth. The approach is unconstrained – they look at the whole market, including a number of smaller companies. The closed-end structure helps in that regard.

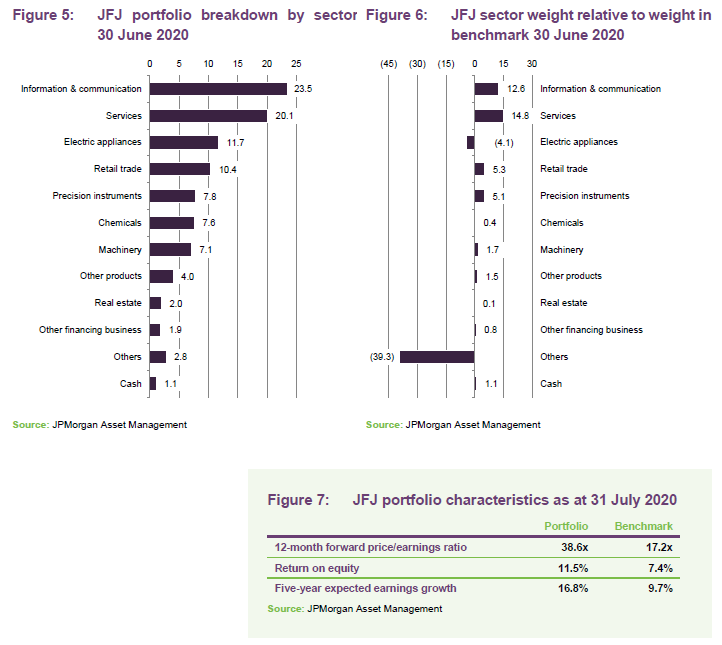

Stock selection drives sector exposure and those sectors that do not fit well within their quality and growth style are not included in the portfolio. The active share approaches 100%, 98.3% at 31 July 2020.

The Japanese market is highly inefficient and therefore conducive to a stock picking approach. The universe comprises around 4,000 stocks. Based on data from September 2019, over 70% of companies with a market cap in excess of $10m are covered by three or fewer analysts, and about half the market is covered either by one analyst or has no coverage at all.

The team meets as many companies as possible, with more than 4,000 meetings in a typical year, including quite a few with pre-IPO companies (although the managers will not invest in unlisted companies).

Japan’s structural transformation

In the managers’ view the benchmark index is dominated by ‘old Japan’, companies operating in stagnant or declining industries. These are not just obviously outdated industries such as steel, but also companies like the automakers who are facing big challenges in adapting to the shift to electric vehicles and self-driving cars. They also cite the example of Canon, where not only is its core camera business being wiped out by smartphones but it also faces a new headwind as people working from home have adjusted to not printing and copying, thereby impacting on another key division within the company. The managers note that many formerly-successful consumer electronics companies are being displaced by other Asian competitors.

Japan is also well-behind the curve when it comes to the displacement of bricks-and-mortar retailers by online competitors, which implies much pain to come but also highlights opportunities in logistics and online payment processing.

Given all of this, it is easy to see why a stock picking fund such as JFJ can offer considerable advantages over an investment in an index-tracking ETF.

Practical approach

When assessing stocks for inclusion in the portfolio, the first questions are: is this a business that they want to own? Does it have competitive strengths that will allow it to thrive? And is it operating in an attractive industry demonstrating secular growth? Valuation considerations are secondary to this.

Indications of quality include returns on equity, free cash flow generation and balance sheet strength. The company should have competitive strengths that give it pricing power.

Governance and other aspects of ESG

One long-running theme within Japan has been improvements to corporate governance. Assessing governance aspects is therefore a key part of the investment process. Social and environmental factors are evaluated as well.

Companies being considered for inclusion within the portfolio are judged on the basis of a 98-question analysis, that covers a wide range of ESG aspects, with simple yes/no answers. This analysis should pick up anomalies such as a substantial divergence between accounting profits and cash generation.

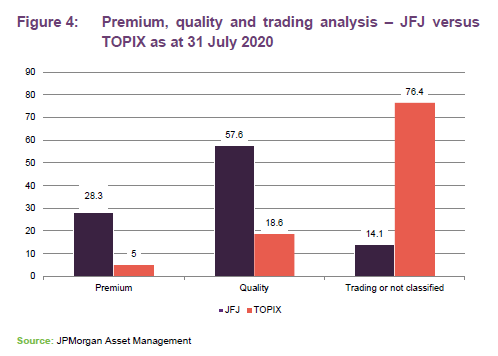

The worst companies have scores in the high 20s. Within JFJ’s portfolio, on average premium companies score 7, quality companies score 9 and trading companies score 14.

Tokyo Electric Power, the company associated with the Fukushima nuclear disaster, is the worst-rated. Oil and mining companies fall at these hurdles, and the managers say that Nissan would not have made the grade even before the Carlos Ghosn scandal broke.

Informed by this analysis, the managers divide JFJ’s universe between ‘premium’, ‘quality’ and ‘trading’ companies. Very few companies qualify for inclusion within the premium category, but these are the companies in which the manager has the highest conviction. About 80% of stocks in the index fall into the trading category. Figure 4 shows a breakdown of the portfolio and the benchmark on that basis.

JFJ is not an activist fund. However, the investment approach emphasises contact with companies and the managers will engage in dialogue with management where they feel that ESG improvements are needed. They will also ensure that JFJ exercises its voting rights at company meetings.

Assessing value

Valuations are assessed on the basis of five-year forecasts of sustainable earnings growth, dividends and the multiple that the managers think a stock should be trading on in five years’ time. Cash on the balance sheet is reflected later in the process.

Position sizes will reflect the conviction that the manager has in a stock and whether it has been assigned to the premium, quality or trading buckets. Premium stocks may have a 3%–5% weighting in the portfolio, quality stocks a 2%–4% weighting and trading stocks a 0.5%–2% weighting.

On average, the portfolio will contain between 40 and 80 positions. The portfolio is regularly assessed to ensure that overall risk factors are within acceptable levels.

Investment restrictions

The board seeks to manage risk by imposing various investment limits and restrictions:

- JFJ must maintain 97.5% of investments in Japanese securities or securities providing an indirect investment in Japan.

- No investment to be more than 5.0% in excess of benchmark weighting at time of purchase and 7.5% at any time.

- The company does not normally invest in unquoted investments and to do so requires prior board approval.

- The company does not normally enter into derivative transactions and to do so requires prior board approval.

- The company will not invest more than 15% of its gross assets in other UK-listed investment companies and will not invest more than 10% of its gross assets in companies that themselves may invest more than 15% of gross assets in UK-listed investment companies. In practice, the managers say that they never have and do not ever envisage investing in other investment companies.

- The managers do not hedge the portfolio against foreign currency risk.

These limits and restrictions may be varied by the board at any time at its discretion.

Sell discipline

Generally, JFJ’s is a low-turnover portfolio, reflecting the managers’ long-term investment horizon. However, stocks may be sold if the investment case deteriorates or there is an adverse corporate governance change. Stocks may be replaced if the managers identify a similar investment opportunity with a better risk/reward profile.

The managers like to run their winners, but will take profits if valuations exceed their long-run targets.

Asset allocation

At the end of July 2020, there were 62 holdings in the portfolio.

Sector weights are driven by stock selection, but they reflect the portfolio’s bias to the ‘new Japan’.

The managers say that a bias to growth and quality results in a portfolio that trades on a higher-than-average price/earnings multiple than the benchmark but offers higher returns on equity and faster growth rates.

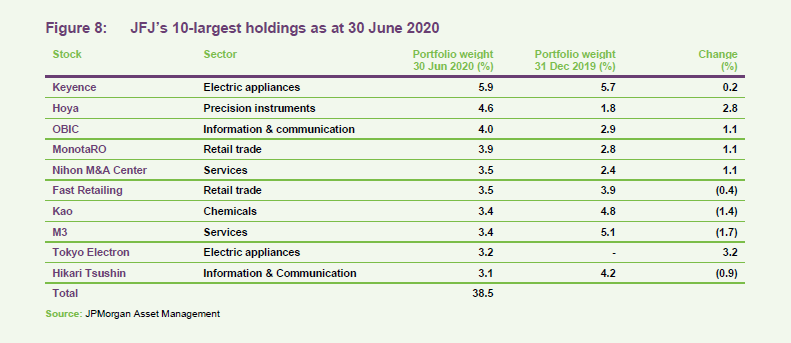

Top 10 holdings

Looking at a few of these in more detail:

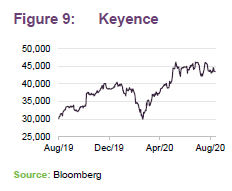

Keyence

Keyence has been the largest position in the trust for many years and a holding since November 2011. The company makes sensors that support factory automation. One of the things that the managers like about the stocks is that it has remained focused on this area rather than being distracted by other business lines. The market for sensors is growing. Factory automation helps strip out costs, improves productivity and allows for repatriation of production from low-wage cost countries, once labour costs are no longer a constraint. In the current climate, it also means that production is less likely to be affected by COVID restrictions.

The company has considerable net cash on the balance sheet. The managers have engaged with the company’s management on this point, as part of their normal approach to corporate governance.

Keyence generates high levels of free cash flow, helped by margins in excess of 50%. These in turn allow it to invest in R&D and in its workforce. Keyence employees are rewarded for productivity rather than length of service (as is common in many Japanese companies), and are relatively highly-paid and loyal.

Keyence was not immune to the global economic slowdown, sales for the year ended 20 March 2020 were 6.0% down on the prior year and earnings per share were 12.4% lower. However, the dividend was raised by 50% and Keyence continues to invest in its business.

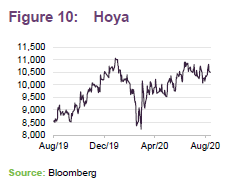

Hoya

Hoya is a manufacturer of high-precision optical glass. Its products are used in a wide variety of end products – from glasses and contact lenses to digital cameras and medical devices. It is a market-leader in each of its specialisms and reinforces that position through investment in R&D.

The managers note that it has a monopoly in the glass substrate used in hard drives – take-up of which is accelerating as data centres expand to support the growth of the cloud.

Whilst its electronics-related business held up well, COVID-19 affected the end demand for its other products, triggering a 22% decline in overall sales over Q2 2020. However, the company shrank costs, cushioning the impact on profit. The company has substantial cash reserves to see it through the slowdown.

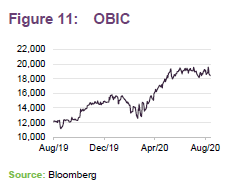

OBIC

OBIC is a software company specialising in system integration services, system support services, office automation services, and package software services but aiming to offer a one-stop solution for its customers. Sales have compounded at 6.5% a year for the past five years and earnings per share at 8.7% a year. The company is forecasting growth in both sales and profits for the current accounting year, regardless of the pandemic. The managers see it as a beneficiary of the surge in investment in IT that was discussed on page 6.

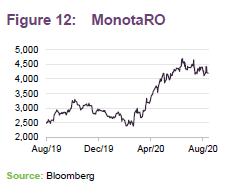

MonotaRO

MonotaRO is an ecommerce site serving the B2B market across Asia (with operations in China, Indonesia and South Korea as well as Japan). Products cover a wide range of sectors including construction, automotive, healthcare and office supply. 18m different products are available on the site, including 461,000 available for next day delivery.

Sales grew by 20% in 2019 over 2018 and have compounded by more than 18% a year over the past five years, while profits have grown at about 20% a year. The company is forecasting 19% sales growth over 2020.

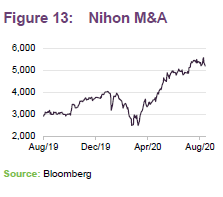

Nihon M&A Center

Nihon M&A Center provides M&A support to SMEs. As SME founders reach and surpass normal retirement age, there is an increased willingness for founding families to look outside for new management expertise and/or relinquish control. The company operates from 19 offices across Japan and offices in Indonesia, Singapore, Malaysia and Vietnam.

It has delivered strong growth in revenue and profits, including 18% year-on-year growth in revenue and 24% year-on-year growth in profit for Q1 2020. This was despite static numbers of transactions that they worked on during the quarter. After a COVID-related hiatus in recruitment, the company has begun expanding again in anticipation of strong demand for its services in Q3/Q4.

The company is consistently distributing more than 40% of its earnings as dividends and is committed to at least maintaining its dividend this year.

Investment activity

Recent new holdings for the trust include Shimano (outdoor pursuits – cycling and fishing, for example), freee KK (software company selling cloud-based accounting packages) and Rakuten (global ecommerce, online retailing and communications business which also offers a streaming TV service).

The managers also added to JFJ’s holding in Nippon Prologis (warehouse fulfilment space, supporting the growth of ecommerce).

Bengo4.com offers online legal services and helps put customers in touch with lawyers. It also offers Cloud Sign Store DX (a service similar to DocuSign), which has seen a huge take-up in its service as COVID-19 restrictions have put barriers in the way of physical contracts. The managers added to the position in Bengo4.com during Q2.

Disposals include Tokio Marine (see page 15), Sansan (B2B contact management) and PeptiDream (a biotech company specialising in non-standard peptide therapeutics).

Performance

JFJ has had a particularly strong 2020 both relative to its benchmark and its peer group, as is evident in Figure 14.

The manager says that when markets fell in March, the trust’s bias to high-quality companies made it relatively resilient. Then, when the panic began to subside and investors started to think about which companies were best placed to recover, the trust’s focus on growth proved beneficial. They believe that this has been a major driver of JFJ’s outperformance.

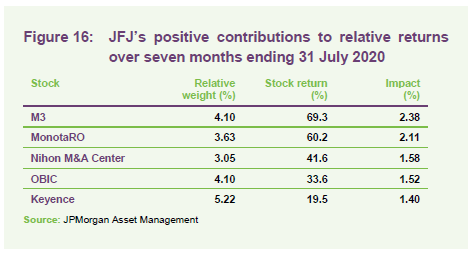

Relative to the trust’s benchmark over the seven months of 2020. Stock selection proved the major driver of returns, whereas asset allocation was broadly neutral.

Many of JFJ’s largest holdings made significant contributions to returns over the first seven months of 2020. Generally, JFJ is underweight the pharmaceutical sector (which has done well this year on the back of the fight against COVID-19) because its managers consider that many of the large cap Japanese pharmaceutical companies do not have the attractive R&D pipelines that would make them future growth stocks. The portfolio does hold a number of companies that have benefited from healthcare buoyancy including M3. This company offers a B2B platform for healthcare professionals and healthcare companies. It also operates the Ask Doctors website, where online doctors respond to questions posed by the general public.

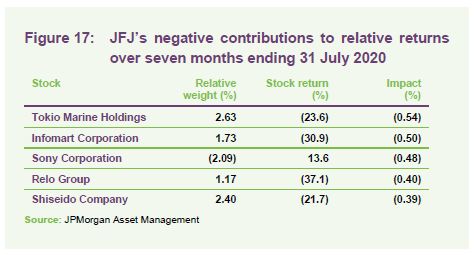

Tokio Marine Holdings is an insurance company, the largest non-life insurer in Japan. COVID-19 has hit the company hard as new business has been impacted in areas such as automotive (linked to a decline in car sales) and travel. At the same time, claims have risen in areas such as its events insurance operations as well as claims related to natural catastrophes. The position has been sold in its entirety.

Infomart provides online food ordering for restaurants, which the managers think would have been a fast-growing business were it not for COVID-19-related closures of restaurants.

Sony Corporation is not held by JFJ but it performed well during the period. Amongst other things, Relo Group provides relocation services to multinational companies, but its business has been impacted by COVOID-19 travel restrictions. Shiseido’s sales have been hit by the impact of COVID-19 on its stores. Q2 sales fell 34% year-on-year.

Peer group

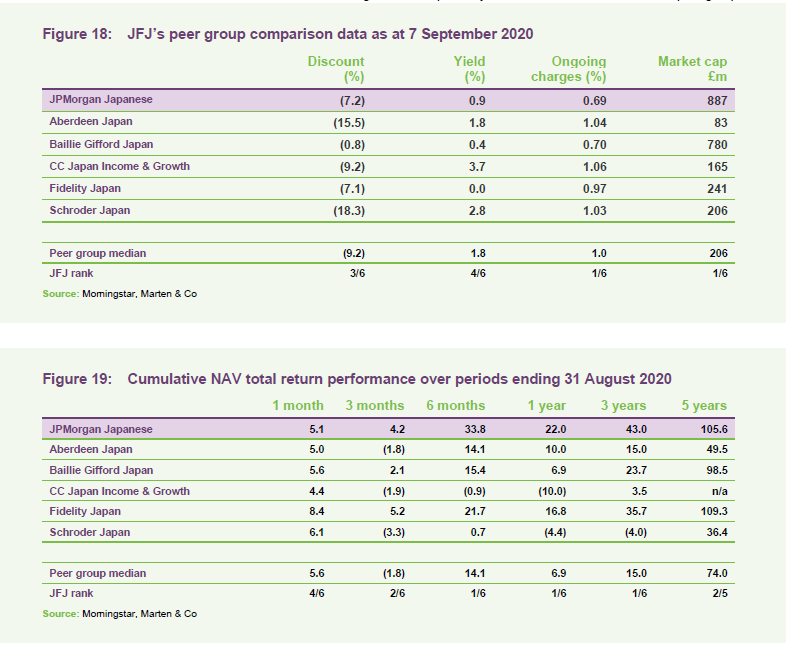

For the purposes of this note, the constituents of the AIC Japan sector have been used as a peer group. The trusts listed here have roughly similar objectives except for CC Japan Income & Growth, which – as its name implies – places more emphasis on income generation and consequently has the highest yield. By contrast, JFJ’s growth focus puts its yield towards the bottom end of the peer group.

JFJ is the largest and most liquid trust in this peer group. Its strong relative performance, illustrated in Figure 19, does not appear to be reflected in its discount. Neither is its much lower ongoing charges ratio.

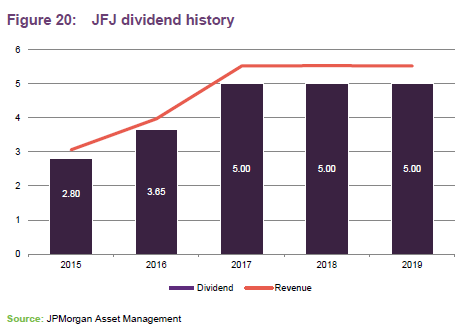

Dividends

The board’s dividend policy is to pay out the majority of the revenue available each year. The investment objective’s emphasis on capital growth means that income generation is not a focus for the managers. A revenue reserve has built up over the years and this stood at £13.4m at the end of September 2019 (equivalent to about 8.4p per share).

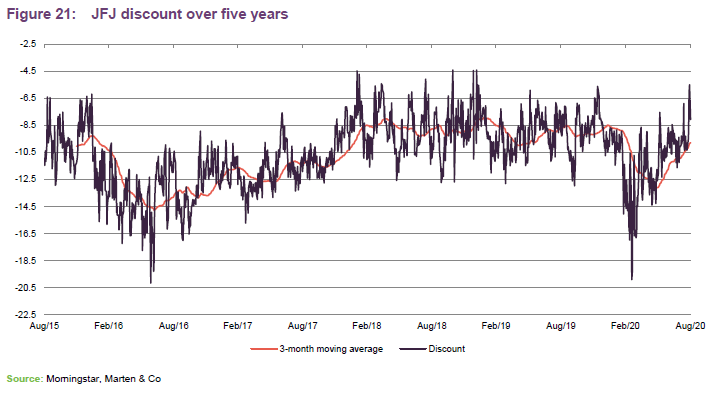

Discount

Over the year to the end of August 2020, JFJ’s discount moved within a range of 19.9% (as investors’ concern about the severity of the pandemic peaked) to 5.5% and averaged 10.3%. At 7 September 2020, the discount was 7.2%.

The board monitors the discount closely and has both stepped up efforts to market the trust and authorised share buy backs.

Each year at the AGM, the board puts forward resolutions that permit the company to issue new shares, reissue shares from treasury and repurchase shares for cancellation or to be held in treasury. The board has stated that shares held in treasury would only be reissued at a premium to NAV.

Fees and costs

The trust employs JPMorgan Funds Limited as its Alternative Investment Fund Manager (AIFM) and company secretary. Management of the portfolio is delegated to JPMorgan Asset Management (UK) Limited, which in turn delegates day to day investment management activity to JPMorgan Asset Management (Japan) Limited in Tokyo. The manager is a wholly-owned subsidiary of JPMorgan Chase Bank which, through other subsidiaries, also provides marketing, banking, dealing and custodian services to the company.

JPMorgan Funds Limited is entitled to an annual management fee calculated as 0.65% of the first £465m of net assets, 0.485% on the next £465m and 0.40% on amounts above £930m. There is no performance fee. The contract can be terminated on six months’ notice. For accounting purposes, the management fee is charged 20% against the revenue account and 80% against the capital account.

Bank of New York Mellon (International) Limited is the company’s depositary and JPMorgan Chase Bank, N.A., is the company’s custodian. Depositary expenses amounted to £96,000 for the year ended 30 September 2019 (down from £100,000 for the prior accounting year).

For the year ended 30 September 2019, the trust’s ongoing charges ratio was 0.68%. Based on the first six months of the current accounting year, this had fallen to 0.67%.

Capital structure

JFJ is a UK domiciled investment trust with a premium listing on the main market of the London Stock Exchange. The company has 160,363,078 ordinary shares in issue and no other classes of share capital. A further 885,000 ordinary shares are held in treasury.

The company’s accounting year end is 30 September and AGMs are usually held in the following January.

The company has the ability to use borrowing to gear the portfolio within the range of 5% net cash to 20% geared in normal market conditions.

The company’s gearing is facilitated by a ¥11bn three-year floating rate revolving credit facility provided by Scotiabank which matures in 2022 and a series of senior secured loan notes:

- ¥2bn fixed rate 10-year series A senior secured loan notes at an annual coupon of 0.76% which will expire on 2nd August 2028.

- ¥2.5bn fixed rate 15-year series B senior secured loan notes at an annual coupon of 0.95% which will expire on 2nd August 2033.

- ¥2.5bn fixed rate 20-year series C senior secured loan notes at an annual coupon of 1.11% which will expire on 2nd August 2038.

- ¥2.5bn fixed rate 25-year series D senior secured loan notes at an annual coupon of 1.21% which will expire on 2nd August 2043.

- ¥3.5bn fixed rate 30-year series E senior secured loan notes at an annual coupon of 1.33% which will expire on 2nd August 2048.

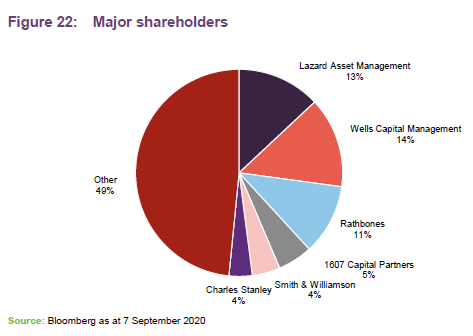

Major shareholders

Core management team

Nicholas Weindling is a country specialist for Japan equities and a member of the Japan team within the Emerging Markets and Asia Pacific (EMAP) Equities team based in Tokyo. Nicholas joined JPMorgan Asset Management in 2006 from Baillie Gifford in Edinburgh, where he worked initially as a UK large cap analyst and latterly as a Japanese equities investment manager. Nicholas obtained a B.A. (Hons) in History from Cambridge University. He was made manager of JFJ in August 2010.

Miyako Urabe is a country specialist for Japan equities and a member of the Japan team within the Emerging Markets and Asia Pacific (EMAP) Equities team based in Tokyo. Miyako joined JPMorgan Asset Management Firm in 2013 from Credit Suisse Securities Equity Sales desk in Tokyo as an Asia ex-Japan specialist. She began her career at Morgan Stanley MUFG Securities covering Japan and Asia ex-Japan. Miyako obtained a Bachelors degree in Economics from Keio University, Japan.

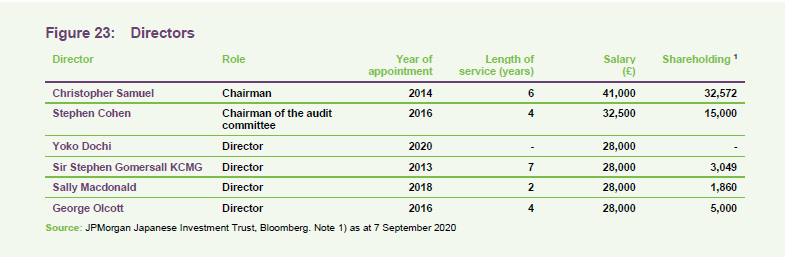

Board

The board consists of six non-executive directors, all of whom are independent of the manager and who do not sit together on other boards.

Christopher Samuel

(Chairman).

Christopher became chairman in December 2018. He is currently chairman of BlackRock Throgmorton Trust Plc and a non-executive director of Alliance Trust Plc, Sarasin & Partners and UIL. Christopher was previously chief executive officer of Ignis Asset Management. He has considerable experience of financial services, including the investment management industry over nearly 35 years and was based in Japan earlier in his career. He is a Chartered Accountant.

Stephen Cohen

(Chairman of the audit committee)

Stephen has had over 34 years in executive roles in asset management, including setting up two businesses in Japan and living there for seven years.

He managed Japanese equity portfolios for 10 years. He also latterly ran a Japanese equity activist business. Currently, he is a non-executive director of Schroder UK Public Private Trust Plc, a commissioner at the Gambling Commission and a council member on the Health and Care Professions Council.

Yoko Dochi

Yoko held positions of managing director, global head of investor relations at SoftBank Group Corp (2018-2020) and general manager, head of global treasury and investor relations at Toyota Motor Europe (2001-2018). She is also a former investment banker at World Bank and the Bank of Tokyo (now Mitsubishi UFJ Financial Group). She is a director of NIPPO Limited, a JASDAQ-listed company in Japan.

Sir Stephen Gomersall, KCMG

Sir Stephen is deputy chairman of Hitachi Europe and a director of a number of Hitachi Group companies in the UK. He entered the Foreign & Commonwealth Office in 1970 and held a number of appointments overseas including being Ambassador to Japan from 1999 to 2004. He has spent over 14 years living and working in Japan.

Sally Macdonald

Sally has 34 years’ experience in asset management, of which seven were in UK markets and 27 in Asian markets, at houses including Sanwa International, Lazard Brothers Asset Management, Canada Life, Morley Fund Managers, Dalton Strategic Partnership and City of London Investment Management. She is currently head of Asian equities at Marlborough Fund Managers and a trustee of Helping the Burmese Delta. Previous board experience includes the Royal College of Nursing Foundation.

Dr. George Olcott

George has 15 years of investment banking and asset management business experience in Japan and Asia with SG Warburg/UBS and has served on the boards of five listed Japanese corporations as an independent director (currently for Denso Corporation and Dai-ichi Life Holdings). He is guest professor at Keio University in Tokyo teaching international management and organisational behaviour.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on JPMorgan Japanese Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.