The North American Income Trust – Time to grow?

The North American Income Trust (NAIT) has been generating an attractive and increasing dividend (up 9% for the year ended 31 January 2019). It is also generating reasonable capital growth, despite an environment that has been favouring low-yielding, high-growth companies. The manager, Fran Radano, is not unduly concerned about the health of the US economy. He continues to recycle the portfolio into good quality stocks that offer the prospect of reasonable dividend growth and should prove resilient in the event of a slowdown in the US economy.

Since we last published, the discount has narrowed considerably and, if this is sustained, it might be possible for the trust to see a well-deserved expansion.

Shareholders should note that, at the AGM planned for 4 June 2019, they will be asked to approve the subdivision of the shares on a five-for-one basis. This is designed to help investors who want to invest relatively small sums of money.

Above average income and long-term growth

Above average income and long-term growth

NAIT’s objective is to invest for above-average dividend income and long-term capital growth, mainly from a concentrated portfolio of S&P 500 US equities.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI USA Value total return (%) | MSCI United States (%) | S&P500 total return (%) |

|---|---|---|---|---|---|---|

| 1 | 30/04/15 | 7.9 | 16.7 | 18.0 | 23.6 | 23.4 |

| 2 | 30/04/16 | 8.8 | 8.2 | 4.7 | 4.7 | 5.5 |

| 3 | 30/04/17 | 37.7 | 33.3 | 31.3 | 32.9 | 32.7 |

| 4 | 30/04/18 | 7.9 | 5.1 | 0.6 | 5.8 | 5.8 |

| 5 | 30/04/19 | 19.8 | 15.4 | 15.6 | 19.1 | 19.2 |

Easing off the brakes

Easing off the brakes

The major change in the economic backdrop since we published our initiation note on NAIT has been the abrupt change in stance of the Fed. Having been quite hawkish early in December, with some justification (although there was not much sign of inflation), in January Fed chairman, Jerome Powell, said it was unlikely that US interest rates would rise in 2019 and that the central bank would no longer look to shrink its balance sheet (quantitative tightening). The odd thing was that there was no real exogenous shock to trigger this, beyond a sudden increase in risk aversion in markets towards the end of December (investors pulled $134bn out of mutual funds and ETFs in December 2018 according to the Investment Company Institute).

The effect of Powell’s about-turn was to revive the US equity market, allowing it to recover losses incurred in Q4 2018 and push on to new highs. However, in recent weeks, concerns about an escalation of the US/China trade war have pulled the market back.

US GDP growth came in ahead of consensus estimates in Q1 2019. The manager expects this to moderate but is not forecasting a recession. Inventory building was a contributory factor to Q1 GDP growth. This may relate to the ongoing trade spat and might be expected to reverse at some point.

It is hard to read Trump and his intentions with regard to China. The market has reacted adversely to the tariff increase; this could reverse on the back of the right tweet.

Tax reforms enacted at the end of 2017 were supportive to growth (US corporation tax dropped from 35% to 21%). The benefits of these persist in 2019. More recent changes to the treatment of state and local taxes have impacted on high earners and people living in coastal states, but most people saw a tax break. The adjustment to corporation taxes has encouraged the repatriation of foreign cash (good news, in Fran’s view, as previously there was a temptation to use offshore cash to make expensive foreign acquisitions). Changes that allow capex to be expensed immediately after it is incurred are encouraging investment. Notably, IT is being upgraded and manufacturers are investing in automation. This should help increase productivity.

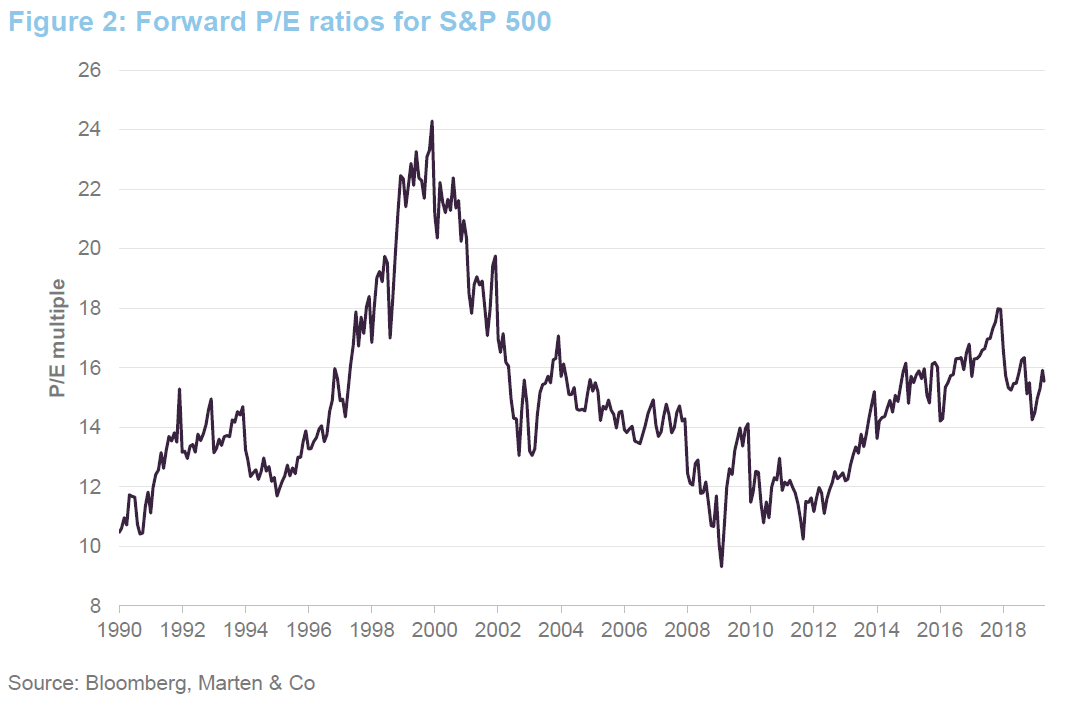

Fran notes that valuations are above long-term averages, but believes that they are well-supported by earnings growth and inflation remains under control. He says that strong cash flow and capital discipline are generating increased distributions from underlying holdings, both in dividends and buybacks. He thinks the pace of dividend growth may be closer to earnings growth in 2019, after a bumper year for dividends in 2018.

Generally, he thinks consumer spending alone cannot sustain the economy; productive corporate investment might.

Asset allocation

Asset allocation

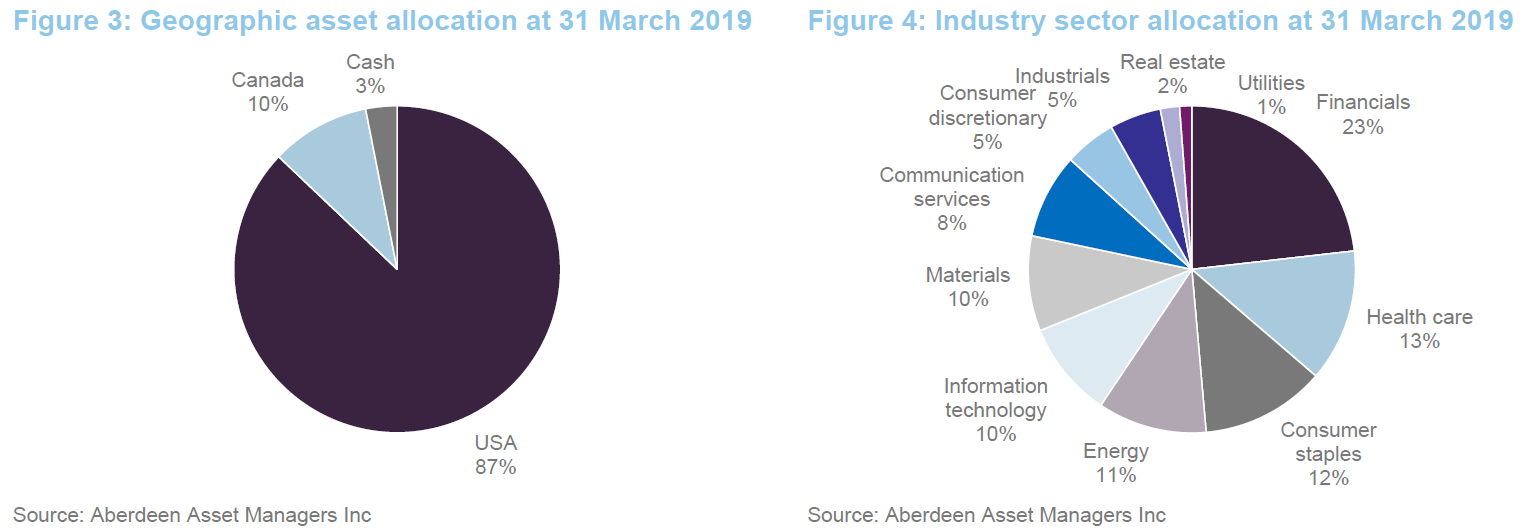

Asset allocation outcomes largely reflect stock selection decisions. At the end of March 2019, NAIT had 41 equity investments and 11 fixed income investments (this latter group represented 2.4% of the portfolio). The active share was 84.2% at this time.

There were five open option positions covering about 4% of the equity portfolio at the end of March. Page 7 of our initiation note explains the manager’s approach to option writing. The revolving credit facility was paid down by $10m in April 2019 to leave $40m outstanding.

Relative to its benchmark, NAIT continues to have an underweight exposure to utilities, real estate and industrials and an overweight exposure to consumer staples and materials.

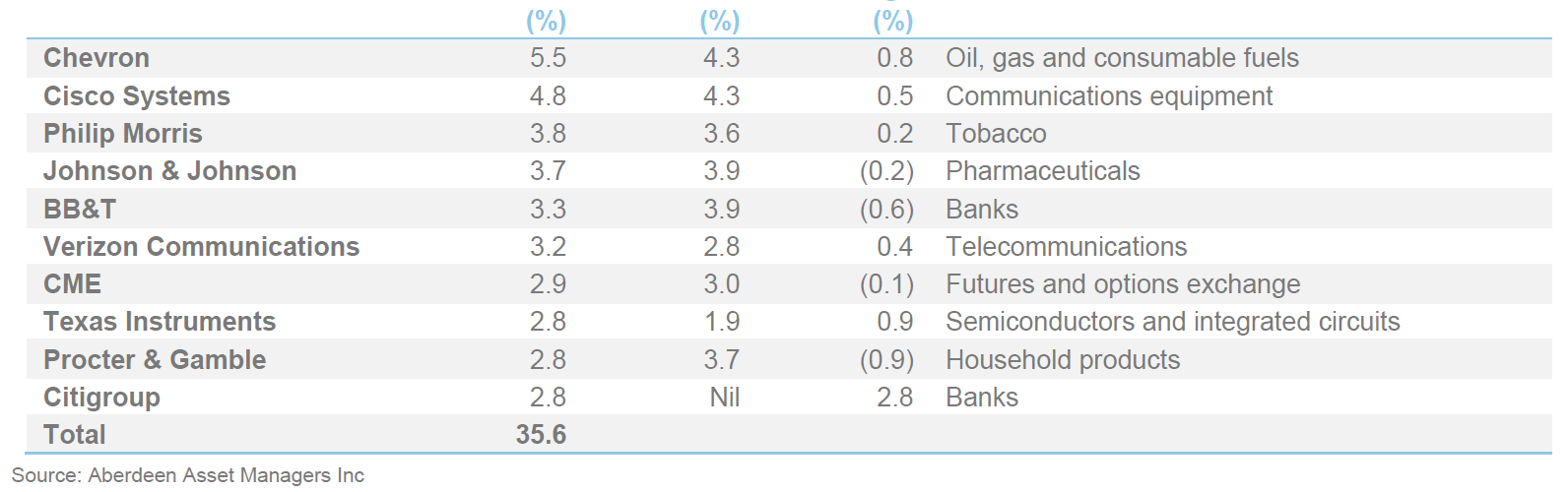

Top 10 holdings

Top 10 holdings

Most of the changes to the portfolio since we last published reflect market moves. Turnover within the portfolio is usually limited to top slicing and topping up of holdings. Over the year to the end of January 2019 (NAIT’s accounting year), eight or nine holdings actually entered/exited the portfolio. Fran says that this is an unusually high number.

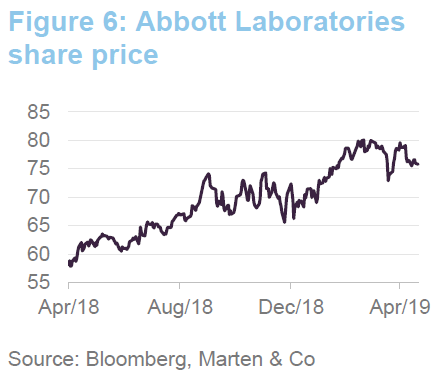

Stocks exiting the portfolio included Abbott Laboratories and Praxair. Abbott Laboratories (www.abbott.com) almost doubled in price and, since it was already a relatively low-yielding stock within the portfolio, Fran felt it should make way for a higher-yielding company.

Praxair (www.linde.com/en) was another stock that was at the lower end of the typical range of yields within the portfolio. Fran decided to sell the stock after its merger with Linde AG (to form Linde Plc). He was not convinced that the enlarged group could maintain its margins.

New holdings include:

New holdings include:

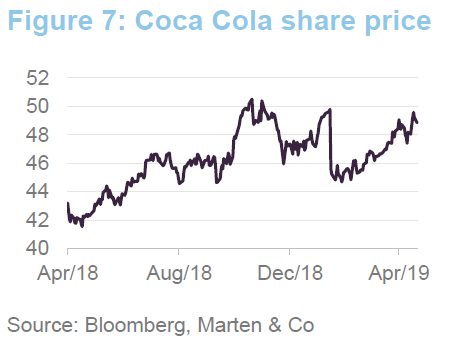

Coca Cola (www.coca-cola.com), which was acquired on the day that Coca Cola bought Costa Coffee from Whitbread. NAIT has been a longstanding investor in Pepsi. However, Fran says that the success of that holding has largely been attributable to its Frito Lay snacks business. Sentiment is against carbonated soft drinks and Fran believes that this has weighed on the price of Coca Cola’s stock.

Lockheed Martin (www.lockheedmartin.com). When NAIT first invested in Lockheed Martin in 2012, the company was weighed down by a perceived pension deficit and low demand for its arms business. By the beginning of 2018, the perception was that the government stands behind the company’s pension liabilities and the F35 fighter programme was proving a success. Fran sold the position (writing an option that was called – the deal that flattered 2018’s revenue account – see page 10 of our initiation note). The share price slipped later in 2018 and Fran bought back into the company around the $290 mark.

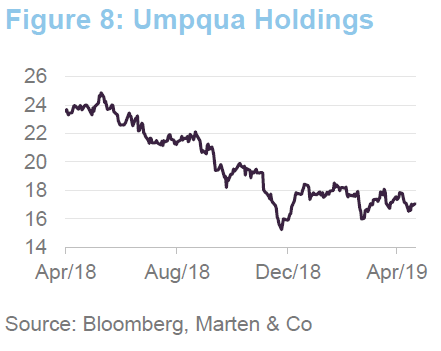

Umpqua Holdings (www.umpquabank.com), a US regional bank focused on the west coast of the country. The company is shedding branches and cutting costs. It is well-capitalised with a Tier 1 ratio of 10.7% and has had good dividend growth over the past few years (the quarterly dividend is 40% higher than it was in 2015).

Genuine Parts (www.genpt.com), a global distributor of automotive parts and also has a business distributing industrial replacement parts and electrical speciality materials. It is projecting modest revenue growth for 2019. Genuine Parts trades on a yield close to 3% and has been growing dividends at about 6% a year for the past decade.

International Paper (www.internationalpaper.com) is a world-leading pulp and paper company. Its shares are almost 30% off the high achieved at the start of 2018. It offers a yield close to 4.5%.

Fran also bought back into the jeweller, Tiffany & Co (www.tiffany.com).

Performance

Performance

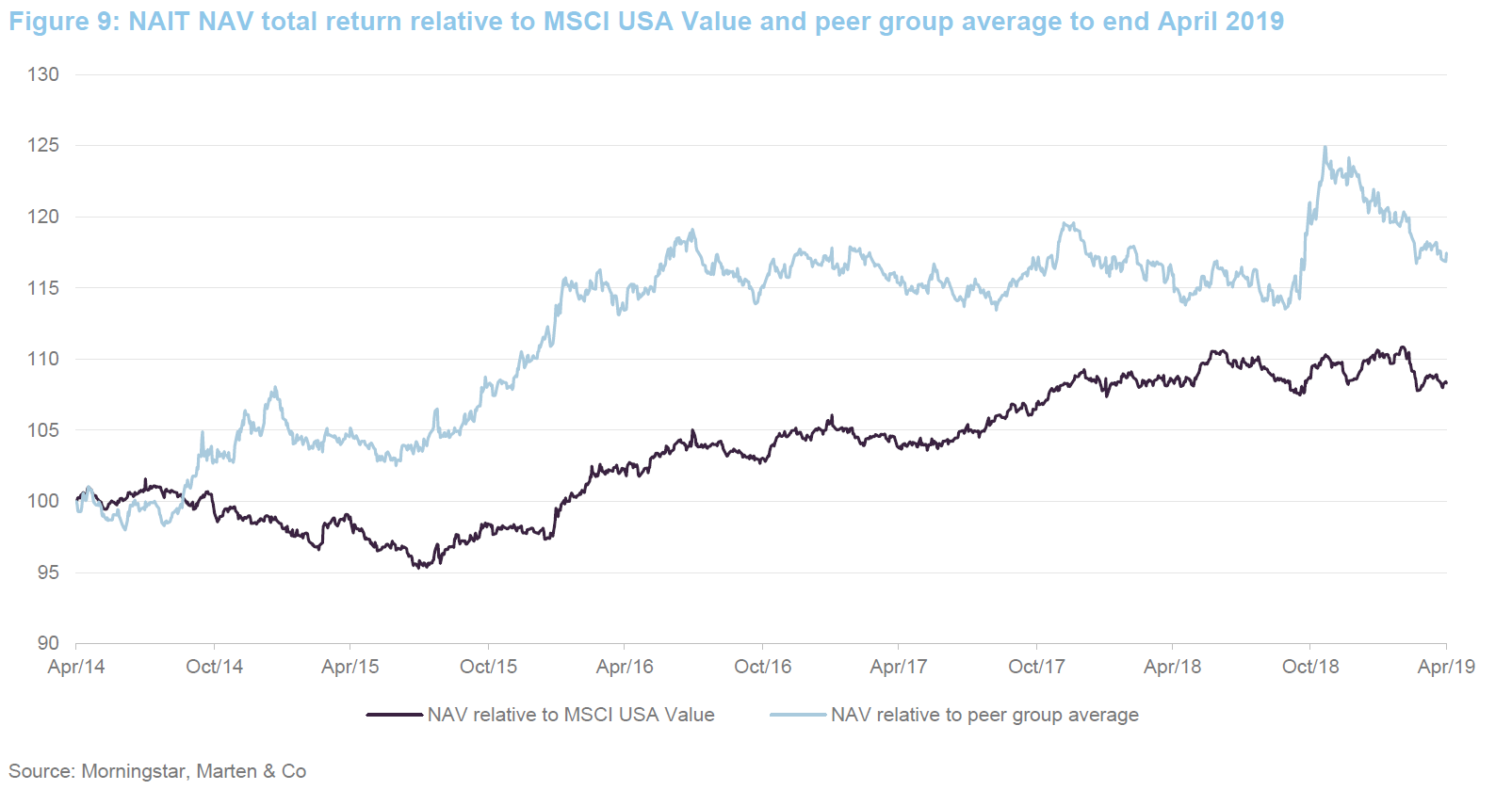

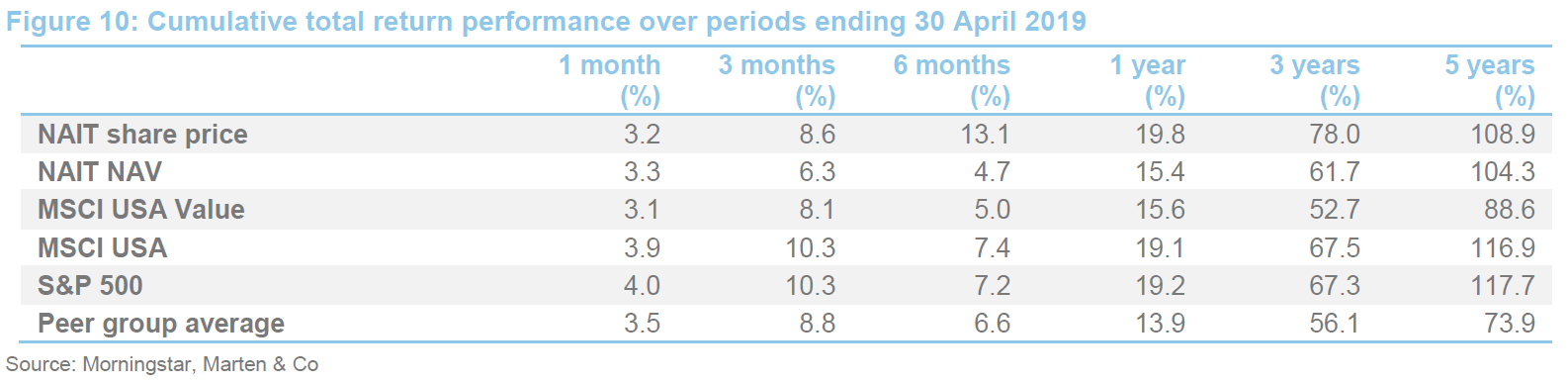

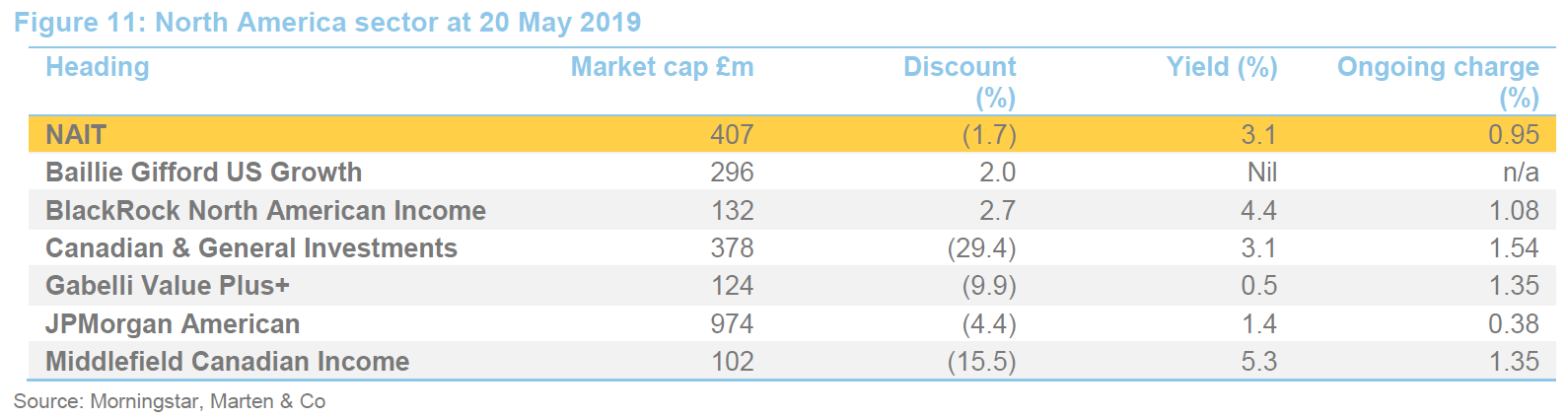

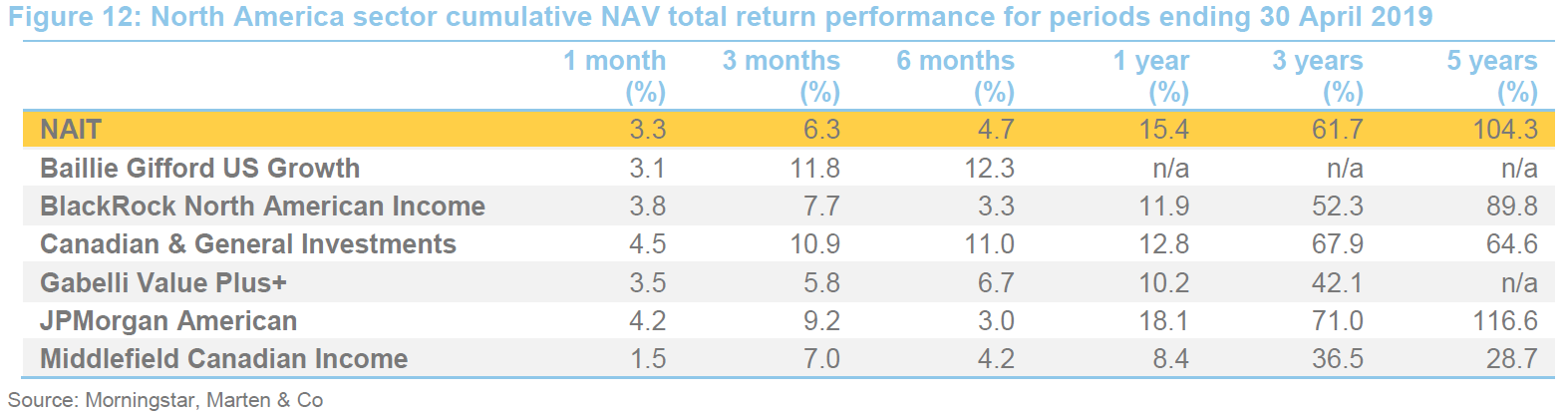

We have also compared NAIT’s performance to that of its AIC North American sector peer group, the constituents of which are listed in Figures 11 and 12. We acknowledge that this is not a perfect comparison, given that it includes two trusts focused largely on Canadian stocks and only one other trust, BlackRock North American Income, with a similar remit to NAIT.

NAIT’s performance has been quite close to that of the MSCI USA Value Index over the past 18 months. Relative to the peer group, it exhibited very strong performance as growth and momentum driven sectors, which have long dominated markets, sold off in a bout of risk aversion. The market rebound in 2019, to date, has reversed that trend. Nevertheless, over the longer term, NAIT’s performance is well ahead of both value-oriented indices and its peer group.

Whilst it offers a lower dividend yield, on a total return basis, NAIT has outperformed the BlackRock fund over most time periods and remains the larger, more liquid trust. JPMorgan American’s portfolio more closely resembles that of the S&P500 index.

Dividend

Dividend

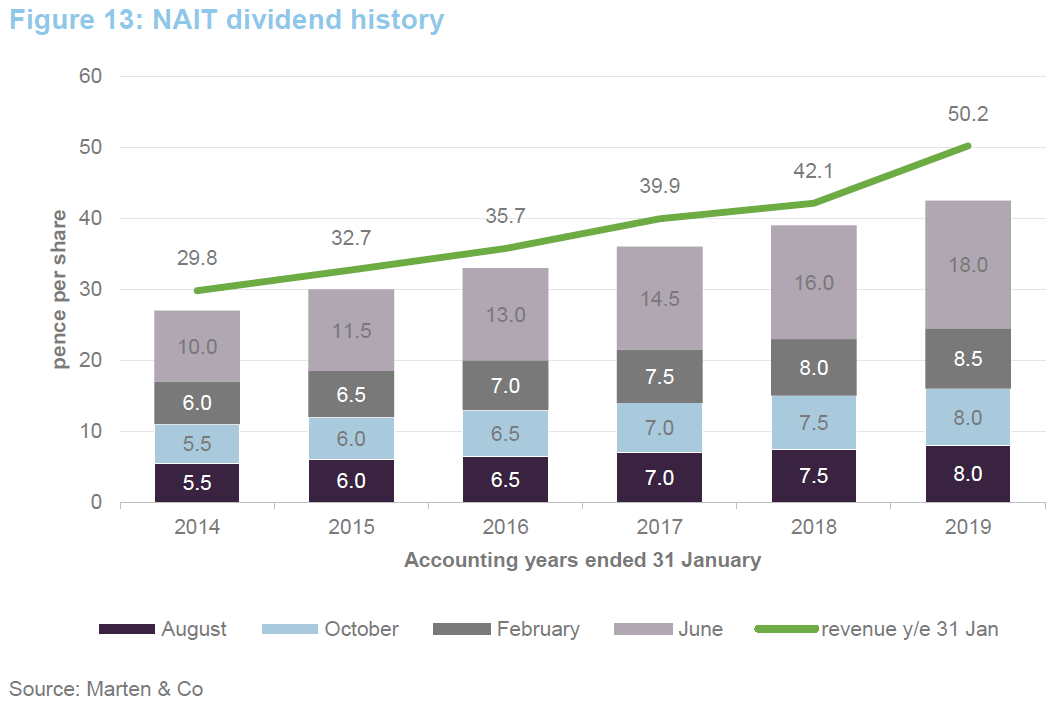

NAIT pays quarterly dividends in August, October, February and June. For the year ended 31 January 2019, NAIT increased its total dividend by 9.0% to 42.5p. This dividend was covered 1.18x by revenue and the trust’s revenue reserve rose again to £16.7m or 58.8p per share.

The revenue account was boosted by the accounting treatment of option income recorded at the start of the financial year (we discussed this on page 11 of our initiation note). Options provided 20% of NAIT’s income over the year ended 31 January 2019. It might be reasonable to expect that the pace of revenue growth slows in the current financial year, in the absence of this one-off event. Nevertheless, Fran is seeing dividend growth across the portfolio as a whole (this was 10.6% for the financial year ended 31 January 2019). The next two quarterly dividends should, in the absence of unforeseen circumstances, be 8.5p per share.

Discount

Discount

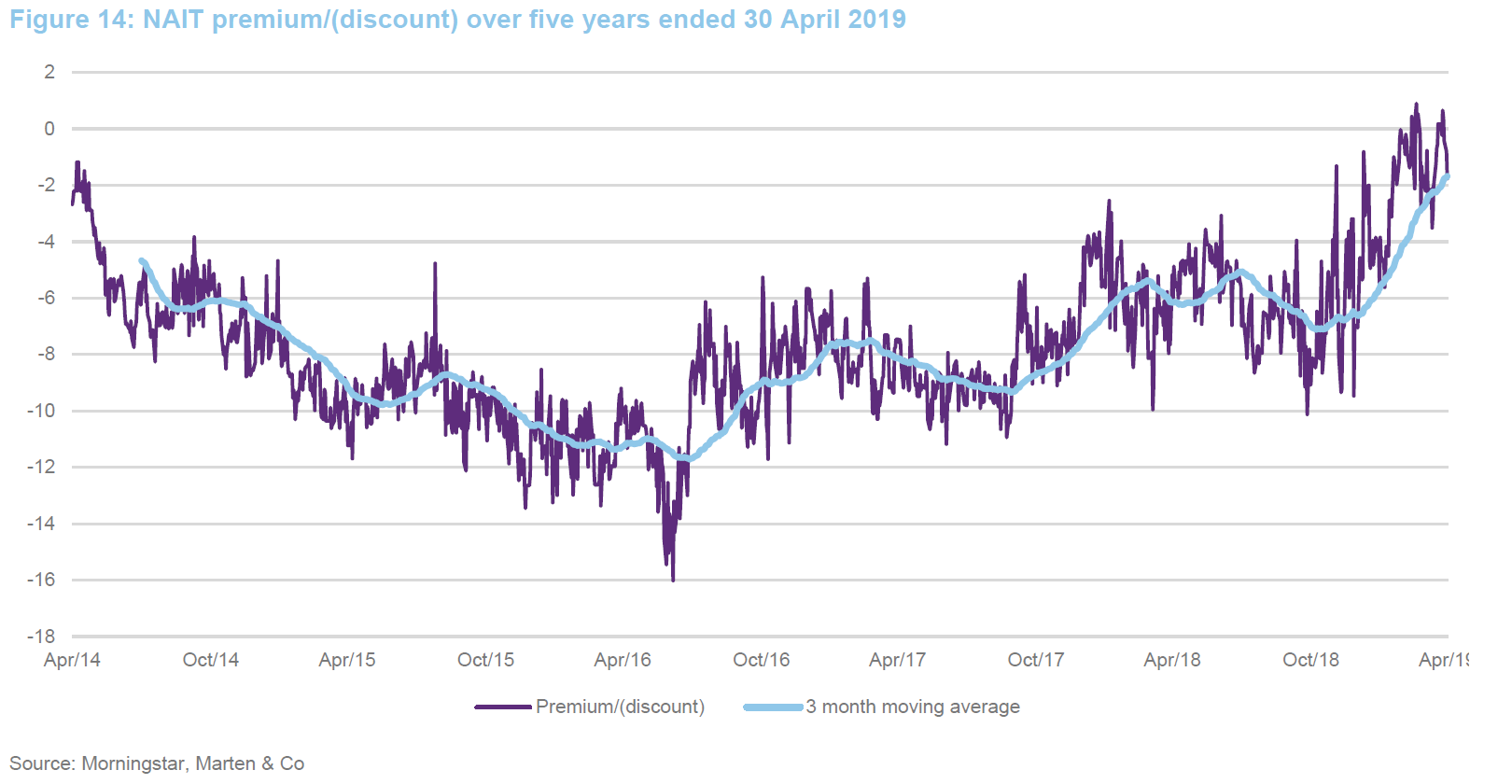

Over the year to the end of April 2019, the discount moved within a range of a 10.1% discount to a 0.9% premium and averaged 4.8%. At 20 May 2019 the discount was 1.7%.

The discount has been on a marked narrowing trend since we published our last note on 26 October 2018. NAIT is not holding any shares in treasury, but does have powers to issue shares which will be renewed at the forthcoming AGM. The directors have said that they will only issue new shares if they believe it is advantageous and in the best interests of shareholders.

As highlighted on the front page of this note, if shareholders approve it, NAIT plans to subdivide its shares on a five-for-one basis. The rationale is that this will make it easier to invest small sums of money, through a regular savings plan, for example.

Fund profile

Fund profile

NAIT’s objective is to provide investors with above-average dividend income and long-term capital growth through active management of a portfolio consisting predominantly of S&P 500 US equities. NAIT may also invest in Canadian stocks and US mid and small-cap companies as a way of accessing diversified sources of income. Up to 20% of NAIT’s gross assets may be invested in fixed income investments, which may include non-investment grade debt.

The company maintains a diversified portfolio of investments, typically comprising around 40-45 equity holdings and around eight to 10 fixed interest investments (which tend to be much smaller positions), but without restricting the company from holding a more or less concentrated portfolio from time to time.

NAIT benchmarks itself against the Russell 1000 Value Index, but we have used MSCI USA Value, MSCI USA and S&P 500 indices as comparators for the purposes of this report.

The board has appointed Aberdeen Fund Managers Limited to act as NAIT’s alternative investment fund manager. The portfolio is managed on a day-to-day basis by Aberdeen Asset Managers Inc. (AAMI) and the lead manager is Fran Radano (Fran or the manager). Fran is a senior investment manager within the AAMI team, which is led by Ralph Bassett, who is a named co-manager of NAIT.

NAIT’s history goes back to 1902 but the trust has only been in its current form since 2012. Before that, its portfolio tracked the S&P 500 Index. Fran has been working on the trust since 2012 and took over as lead manager in 2015. The equities team is based in Philadelphia and Boston.

Previous research

Previous research

Readers may wish to read our initiation note, Reasons to be cheerful, published on 26 October 2018. You can read the note by clicking on the link above or by visiting our website.

The legal bit

The legal bit

This marketing communication has been prepared for The North American Income Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.