Polar Capital Technology – More to go for

More to go for

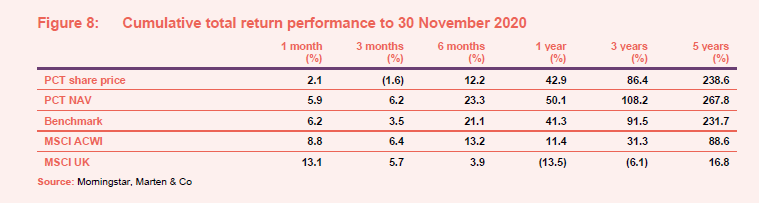

Polar Capital Technology (PCT) has shrugged off the effects of the COVID-19 pandemic, delivering returns of over 50% over the 12 months to the end of November 2020 and beating its benchmark (the Dow Jones Global Technology Index, in sterling terms) by a substantial margin. This just extended a long run of good absolute and relative performance from the trust that has helped it become a £3bn company.

Measures to tackle COVID-19 accelerated the shift to online retail and encouraged a move to home working, which may last longer than the lockdowns. Many technology companies provide the products and services that enabled this.

After such a good run, some commentators have asked how long the party can last and have questioned valuations in the sector. Ben Rogoff, PCT’s manager, thinks that while some companies have pulled forward sales and may now see a pause in growth, he has factored this into his stock selection. The sector is constantly evolving, provides access to secular growth and prices are supported by rising profitability. There is more to go for.

Global growth from tech portfolio

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors within the overall investment objective to reduce investment risk.

Market background

COVID-19 continues to dominate headlines, but now at least there is hope on the horizon in the form of a vaccine or vaccines. The technology sector was an obvious beneficiary of measures taken to control the pandemic. Now, commentators are starting to ask whether the sector’s momentum can be sustained. However, many of the societal shifts we have seen over the past few months may prove persistent, and there are always new technologies and advances to continue to drive the sector forward.

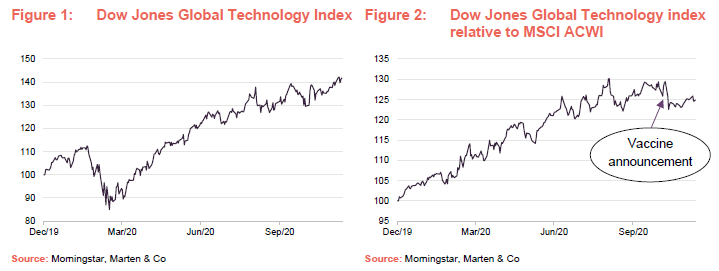

As Figure 1 shows, the technology sector (as represented here by PCT’s benchmark index, the Dow Jones Global Technology Index) quickly overcame the panic that hit markets in February and March and had a good year. Figure 2, shows how that index performed relative to all stocks (as represented here by the MSCI All Countries World Index – MSCI ACWI). Technology outperformed significantly until the start of September. Then it underperformed when news emerged about an effective vaccine.

Whilst not immune to the general market panic that set in during the Spring, the tech sector beat the wider market and extended its run of outperformance. Products and services that supported the shift to home working and the growth in online retail did particularly well. PCT had positions in the likes of Zoom and Twilio, which reported significant sales uplifts (Zoom’s second quarter revenues soared by 355% year-on-year). At the start of October, cloud communications company Twilio felt confident enough to predict 30%+ organic annual revenue growth over the next four years.

In the wider economy, companies slashed overheads, with marketing spend being an obvious place for many companies to make a cut. However, Ben Rogoff highlights the resilience of businesses providing online advertising, such as Facebook, Snapchat and Pinterest (all of which are held within the portfolio). The lockdowns shut off many other advertising routes, but as Ben points out, as retail moves online, businesses often find it hard to attract customers without advertising. He highlights the recent launch of ‘Heinz to Home’, that company’s first direct-to-consumer service, as evidence of this trend.

Ben has increased PCT’s position in Alphabet, Google’s parent, slightly. Search engine revenues have held up but the stock has been held back as about 12% of its business is thought to be travel-related and this is yet to recover. Investors also believe that it faces regulatory risk, as we discuss below.

The boost that lockdowns gave to various new technology businesses may have brought forward the demise of older incumbent firms. Ben thinks that there is perhaps even less time available to these incumbents to reinvent themselves (not that many of these companies are capable of doing that in any case). For example, Ben initially thought that Intel might be a beneficiary of lockdowns as demand for personal computers rose. However, its manufacturing problems persisted and the position was sold (this turned out to be a good decision – see page 11). Advanced Micro Devices continues to take market share from Intel.

Similarly, business software company SAP, which was only a small position but faces heightened competition from a number of software-as-a-service (SaaS) firms, has now been sold in its entirety. The share price fell subsequently.

Historically, Microsoft has been a good example of an established business which did manage to reinvent itself. This is evident in its success relative to the likes of Dell and Oracle. Nevertheless, Zoom is taking share from some parts of Microsoft Teams’ product suite and might start adding on ancillary services. Ben is also conscious that there is risk of an economic slowdown as the long-term effects of the pandemic become more apparent. For example, although its cloud computing business is doing very well, Microsoft’s software arm could face a headwind if the pace of job losses and business closures accelerates.

Sales pulled forward?

Ben notes that the third-quarter earnings season was broadly encouraging for the sector, with many of the largest tech stocks reporting strong revenue growth. One of the big questions that investors in technology need to pose is the degree to which the boom in business since the start of the pandemic represents pulled-forward sales.

One stock that Ben feels might have experienced this is Netflix. Its subscriber growth figures have been particularly strong over the first three quarters of 2020. There is a finite addressable market for its service, and sales growth must slow at some point. However, Ben notes that subscribers seem more ready to pay for multiple entertainment streaming services than had previously been thought.

Comparing projected revenues against the total addressable market can give a good indication of companies nearing the inflexion point of slow/negative growth.

Amazon’s online shopping business has experienced unequivocal success over 2020, as online captures a much larger share of the retail market. However, this bonanza is attracting new competition, in many cases facilitated by the Canadian success story Shopify. Amazon’s data centre division, however, goes from strength to strength.

The roll-out of 5G appears to have been delayed by COVID restrictions. Telecoms infrastructure companies have not benefitted to the degree that Ben had anticipated. PCT does not hold Nokia or Cisco, but does hold Ericsson.

With a second wave of the virus upon us, Ben feels that the positive effect on the tech market will not match that of the first wave. In addition, good news on vaccines might not be good news for tech in the short-term, as investors turn their attention to sectors that are more sensitive to our position in the economic cycle. Ben thinks that Alphabet, Visa and Mastercard could benefit in this scenario. He is running with some cash, ready to pick up bargains if they appear, augmented by a small amount of puts on the NASDAQ 100 Index.

Overall, however, Ben is optimistic. Despite some companies trading on elevated valuation multiples, he does not think that we are seeing a repeat of the tech boom of the late ‘90s/early 2000’s. This time around, companies have earnings and cash flow. He expects many trends that emerged in lockdown will persist, including areas such as telemedicine, digital payments, online banking, social commerce, direct-to-consumer retail and food delivery.

Heightened regulation?

The EU has long been waging a war on perceived anticompetitive practices within the tech industry, but now both the US and China seem to be following suit.

In China, the State Administration for Market Regulation has set out a number of antitrust rules designed to break the ‘walled gardens’ that many leading tech companies have built around their products that frustrate competitors from offering products to their customers. Shares in both Alibaba and Tencent have fallen, although Alibaba appears to have been hit harder. Alibaba was already under pressure after the planned $300bn IPO of its Ant Financial subsidiary was pulled following the introduction of tighter regulations on lending in China. In the wake of this, Ben decided to trim the position.

The US Department of Justice has filed a case alleging that Google is “unlawfully maintaining monopolies through anticompetitive and exclusionary practices in the search and search advertising markets.” Ben points out that the case is pretty narrowly defined and looks less bad for the company than some investors had feared. While there is always a risk that under the Democrats the case will be expanded, as discussed above, the overall advertising environment is okay.

Ben also notes that part of the case concerns the fees that Google pays to the likes of Apple for directing search queries to its site. If these were banned, Google would save on the fees, but inertia would probably mean that it would continue to attract the majority of search queries. For context, Google pays about $8bn to Apple for traffic. Apple stands to lose revenue, but Google might get the business for free. Whatever the outcome, it is likely that the case will take years to work its way through the courts.

Another topic that came up during the course of the US election was the potential for a repeal of s230 of the Communications Decency Act. This clause helps protect the likes of Facebook and Twitter from being held responsible for the content of the posts on their sites. A repeal could open the floodgates for a series of lawsuits, reducing the profitability of these businesses.

Taxes might rise under the Biden administration, but the absence of control of both Houses will likely temper this. Ben feels that if higher taxes are associated with higher spending and economic growth, then this may be good news overall. For balance, he acknowledges that if circumstances lead to higher yields (unwieldy deficits, rising money supply and higher inflation perhaps), the tech sector may come under some pressure.

The next big things

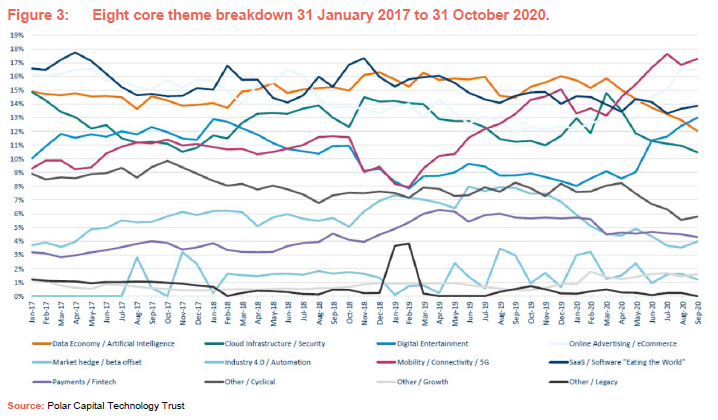

The portfolio continues to be tilted towards stocks that will benefit from eight core themes:

- Software as a service (SaaS)

- Industry 4.0/automation

- Cloud infrastructure/security

- Digital entertainment

- Mobility/Connectivity/5G

- Payments/Fintech

- Data economy/artificial intelligence

- Online advertising/ecommerce.

In addition, at the margin, Ben has been building some positions in stocks that could benefit from increased spending on measures to tackle climate change. Biden has promised to sign the Paris Agreement, and a commitment to net zero emissions in the US might follow soon after, bringing it into line with Europe and China.

Ben thinks we are at or near an inflexion point in electronic vehicles, but sees Europe and Asia as better-placed than the US in this regard. PCT has a modest position in TESLA.

Over the course of 2020, the exposures to the data economy/artificial intelligence and industry 4.0/automation were reduced to the benefit of digital entertainment and online advertising/ecommerce – both beneficiaries of the pandemic. To some extent, Ben is starting to reverse that in anticipation of a return to more normal conditions.

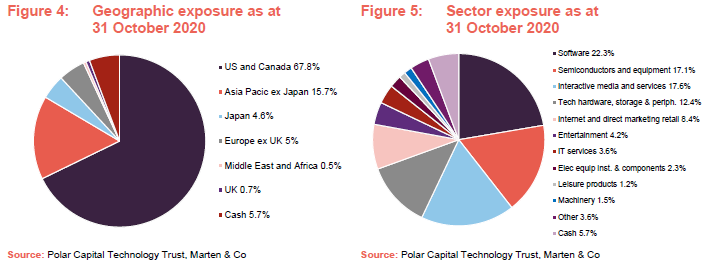

Asset allocation

At the end of October 2020, there were 100 stocks in PCT’s portfolio. The portfolio is still constructed so that it does not deviate too far from the benchmark, in line with the overall investment approach (see our initiation note for more detail), but Ben says that the active share is higher than usual at the moment.

Reflecting Ben’s caution on the sector, the cash level has risen from 3.7% at the end of March to 5.7% at the end of October, but has been higher than this during this period.

Ben is not trying to add value through asset allocation. Different markets offer better access to selected sectors; robotics in Japan, semiconductors in Taiwan, and China for ecommerce/internet stocks, for example. He notes that the chip market is in a state of flux. Its customers are in Asia. It makes sense, therefore, that the industry will shift in that direction regardless of the efforts that the US makes to block this. Ben recently sold a longstanding holding, Texas Instruments, for this reason.

There are few changes of note within the geographic and sector allocations since we last published (using data for the end of March 2020).

10 largest quoted holdings

There has been very little change to the constituents of the top 10 list – Taiwan Semiconductors and Adobe have moved into the list, replacing Advanced Micro Devices and NVIDIA – but all four feature in the list of the 15-largest holdings both in March and in October.

Ben has made modest net additions to PCT’s position in Apple since we last published, although he did take some profit when the stock traded above $130 in August. Apple’s third-quarter revenue figures were fairly flat year-on-year and profits and earnings per share fell slightly, as iPhone sales fell. Those figures come before the launch of the iPhone 12, which went on sale in October.

The holding in Facebook was increased, reflecting Ben’s confidence in its advertising model that we referred to on page 4. The stock’s third-quarter results were strong (revenue up 21%).

Performance

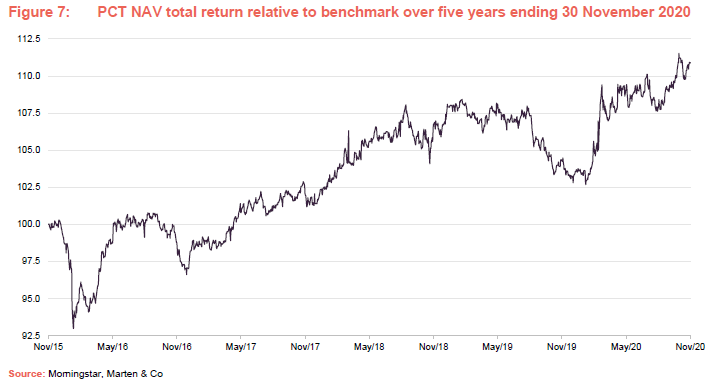

PCT did well as the COVID-19 panic set in, reversing the brief six-month period of modest underperformance relative to the benchmark in a matter of weeks. Since then, PCT has continued to gain ground against the benchmark index, with NAV returns 8.8 percentage points higher than the Dow Jones Global Technology Index over the 12 months ended 30 November 2020.

For a UK investor, the five-year figures illustrate just how badly you would have done if you had stuck to your home market, which is substantially underweight the technology sector relative to many other developed markets.

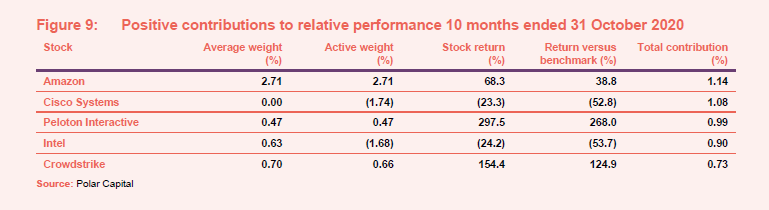

The next table shows the five stocks that have had the greatest positive contribution to PCT’s relative returns over 2020 (up to 31 October). Two of those – Cisco and Intel – are stocks that PCT does not hold and which did relatively badly. Both of these represent companies that Ben believes are mature, low/negative growth businesses being disrupted by newer technologies. As we described in our initiation note (see page 4 of that note), identifying technologies that are in their emerging phase and then selecting those companies best-placed to benefit from this is key to PCT’s long-term success. So, too, is getting out of the companies reliant on mature, mainstream technologies.

Amazon

Amazon was an obvious beneficiary of the economic shifts triggered by the pandemic. Over the year ended 30 September 2020, its operating cash flow increased by 56% to $55.3bn. Sales were up 36% compared to the equivalent period last year for the three months ended 30 September 2020. The rise in online shopping, accelerated take-up of home streaming, new launches in the home gaming market, an expansion of the capabilities of Alexa and the Ring family of security products, and continued growth of its data management business (43% income growth for the third quarter of 2020 over the same period in 2019) all helped to drive the company forward. Amazon has guided analysts towards revenue growth of between 28% and 38% for the final quarter of 2020, compared with the same three months in 2019. However, income may be impacted by COVID-related costs associated with factors such as testing and the provision of PPE for staff.

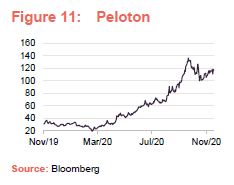

Peloton Interactive

The lockdowns provided a significant boost to Peloton’s home fitness business, allowing it to launch new products and grow its subscriber base. Revenue for the year ended 30 June 2020 was double that of the previous year. The company surpassed 1m connected fitness subscriptions during the summer and these had hit 1.3m by the end of September, with a total membership of 3.6m. The quarter ended 30 June was its first as a profitable business. The customer retention rate at end September 2020 was 92%.

It remains to be seen how the business will perform once lockdowns end and it is easier to get to gyms. The shares have fallen as vaccine hopes have risen.

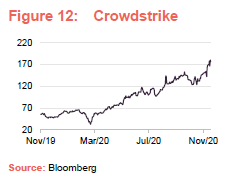

Crowdstrike

Crowdstrike is a cybersecurity company whose cloud-based products have been in demand as businesses seek to ensure that their systems are secure even with increased home working.

It believes that its addressable market will be worth $12.4bn in 2023. That compares to an estimated total spend of $1.2bn on cloud security in 2020. It sees part of its role as convincing customers that they aren’t spending enough on cloud security.

At 31 July 2020, its 12-month revenue was up 87% year-on-year and 93% of sales for the three months to the end of July were recurring revenue. The company is forecasting that it will be profitable over the accounting year ended 31 January 2021.

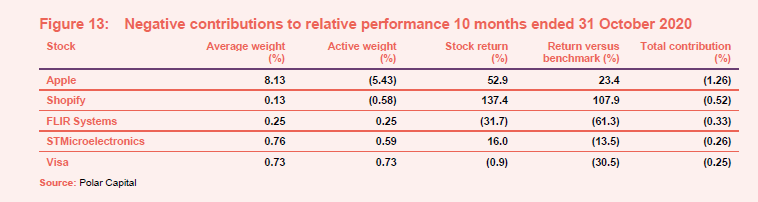

On the negative side, the biggest hit to relative performance came from the trust’s cash position. As the sector soared, this held back returns by 2.02% over the 10 months ended 31 October 2020.

In terms of stocks, underweight exposures to Apple and Shopify held back relative returns. Of the three other stocks in this table, only FLIR Systems fell by much in value.

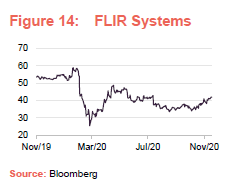

FLIR Systems

FLIR Systems describes itself as a world leader in the design, manufacture, and marketing of intelligent sensing technologies that enhance perception and awareness. These are used in products such as thermal imaging cameras and imaging sensors.

Results released at the end of February 2020 disclosed ‘challenges’ within its commercial business unit. Organic revenue (excluding the impact of acquisitions) fell by 1.5% over 2019. These results coincided with the growing market panic over COVID-19. The shares have not recovered the ground that they lost at this time.

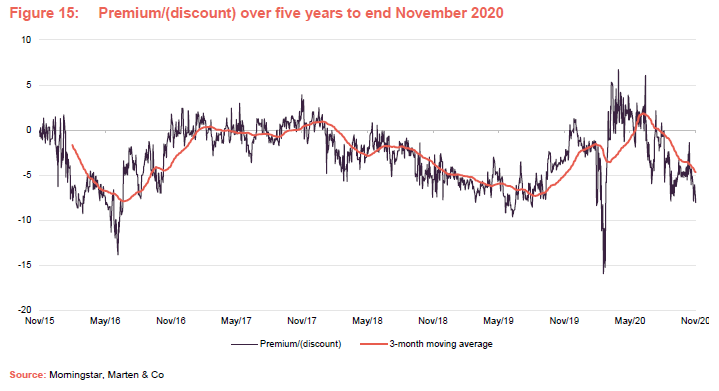

Premium/discount

During the 12 months to 30 November 2020, PCT traded between a discount of 15.9% (at the peak of the market panic over COVID-19 in March) and a premium of 6.7%. The average discount over this period was 1.9%. At 11 December 2020, PCT’s shares were trading at a discount of 6.5%. The discount has rarely been this wide in recent years. Investors may see this as a buying opportunity.

We would have thought that, given the strong returns that PCT has posted this year, it would be trading much closer to asset value. However, it feels as though the good news on the vaccine front has taken the wind out of the sails of the technology sector for the time being. Some investors have been booking profits and reinvesting in areas that were hard-hit by the lockdown in anticipation of a recovery. This should be a short-term phenomenon, however. The technology sector’s long-term fundamental growth drivers remain intact.

Fund profile

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors. PCT launched in December 1996 as Henderson Technology Trust and, following a change of manager, became Polar Capital Technology Trust in April 2001.

Management arrangements

PCT’s AIFM is Polar Capital LLP and the lead manager assigned to the trust is Ben Rogoff, a partner in Polar Capital LLP. He is supported by a team of eight technology specialists, including another partner, Nick Evans. Polar believes that this is one of the best-resourced teams dedicated to this sector within Europe. In addition to PCT, the team also manages two open-ended funds, Polar Capital Global Technology Fund and the Automation & Artificial Intelligence Fund.

Ben joined the team from Aberdeen in 2003, having started his career in the years running up to the technology boom. The events surrounding the collapse of the tech bubble have influenced the way in which he manages money. One important lesson is that there is no permanence in the technology sector, it is forever engaged in a process of creative disruption. Change in the sector is a non-linear process. Once-great companies can disappear and minnows can become giants. This dynamic is part of the appeal for Ben – the sector is never boring.

Nick Evans joined the team from Framlington in 2007. He complements Ben in that Nick has a more bottom-up approach to selecting stocks, where Ben has a bias to a top-down stance.

Previous publications

Readers interested in further information about PCT may wish to read our initiation note Confidence building which was published in May 2020.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Technology Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.