Premier Global Infrastructure Trust – Strong income growth

Strong income growth

Strong income growth

Aided by the significant gearing provided by its ZDP shares, Premier Global Infrastructure Trust’s (PGIT’s) ordinary shares have provided an NAV total return of 34.4% during the last 12 months.

The returns have been achieved despite PGIT having a significant allocation to Asia, and particularly China, which has faced a headwind from a trade dispute with the US. H1 2019 saw PGIT’s revenue income grow by some 13.3% and the manager expects to see decent growth in the second half of 2019, which bodes well for the dividend in the future. While the share prices of Asian growth equities struggled, underlying performance was nonetheless strong and PGIT’s managers believe that there is the prospect for these stocks to re-rate when markets are less focused on macro concerns and more on fundamentals.

Geared global utilities and infrastructure exposure

Geared global utilities and infrastructure exposure

PGIT invests in equity and equity-related securities of companies operating in the utilities and infrastructure sectors, with the twin objectives of achieving high income and long-term capital growth from its portfolio. The portfolio has a strong emphasis on emerging markets, smaller companies, special situations and lower weightings to traditional, developed-market utility companies. It is split into three distinct areas: income equities; growth equities; and yieldcos and investment companies. Its zero dividend preference shares (ZDPs) provide a high level of gearing to its ordinary shares.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI World Utilities TR (%) | MSCI World TR (%) | MSCI UK TR (%) |

|---|---|---|---|---|---|---|

| 1 | 30 Sep 2015 | -12.20 | -12.10 | 3.10 | 2.10 | -5.90 |

| 2 | 30 Sep 2016 | 16.90 | 22.20 | 29.30 | 30.60 | 18.50 |

| 3 | 30 Sep 2017 | 7.00 | 0.40 | 7.00 | 15.00 | 11.10 |

| 4 | 30 Sep 2018 | -22.70 | -25.10 | 4.00 | 15.10 | 5.90 |

| 5 | 30 Sep 2019 | 21.40 | 34.40 | 27.60 | 8.40 | 2.80 |

Market outlook and valuations update

Market outlook and valuations update

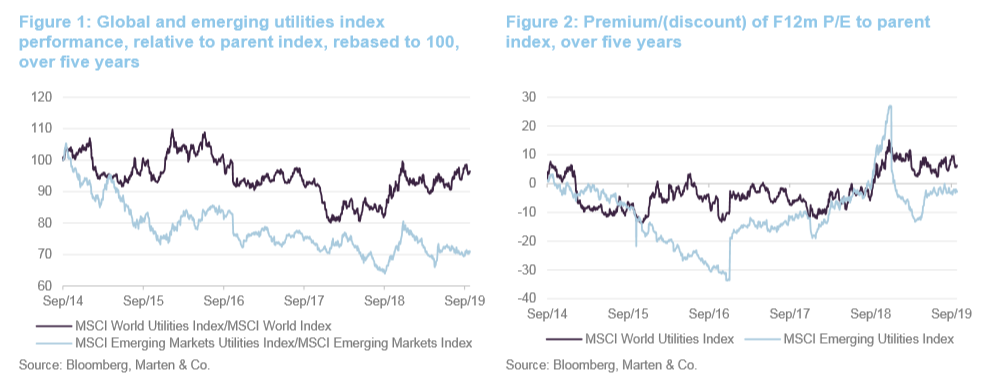

As illustrated in Figure 1, both developed and emerging market utilities have underperformed their parent indices during the last five years. However, developed market utilities have staged a strong recovery during the last 18 months, outperforming the parent index, albeit with marked periods of volatility. The same cannot be said of emerging market utilities, which have continued to underperform broader emerging market equities.

In both cases, the periods of under- and outperformance have been largely driven by top-down macroeconomic considerations, outweighing company fundamentals (a subject we have discussed in our previous notes – see page 14 of this note). It is noteworthy that in both developed and emerging markets, earnings growth for utilities has generally been strong (balance sheets are stronger following periods of deleveraging), but in the case of emerging markets, this has not translated into improved share price performance.

The consequence of these movements is that developed market utilities are trading at a premium to broader global equity markets (as illustrated in Figures 2 and 3) and the MSCI World utilities Index is trading at a P/E ratio that is above its five-year average (18.02x versus 16.1x). However, it is worth noting that MSCI World Utilities has tended to trade in a relatively narrow band of 14x–18x, and so whilst it is towards the top end of the range, it is not excessively above the long-term average.

In comparison, emerging markets utilities continue to trade at a discount to broader emerging market equities, although the discount has narrowed.

PGIT’s managers have tilted their focus more during the last couple of years towards absolute return ideas, reflecting the sector’s higher relative valuations. The emerging markets discount (and developed market premium) continues to be expressed by having a higher exposure to emerging markets. The managers say that whilst there has been considerable noise within emerging markets (global economic weakness and the US-China trade war, for example), emerging markets earnings growth continues to be strong and with current valuations they see the potential for capital improvements once markets are less macro and more fundamental driven.

Managers’ view

Managers’ view

The managers’ long-term arguments for investing in the utilities and infrastructure sectors and their preference for higher-growth emerging markets remain broadly unchanged, and we recommend readers see our previous notes for more discussion.

Since we last published, global utilities have become a little more expensive (an F12m P/E of 18.02x versus 17.32x at the end of March 2019) while emerging market utilities are also a little more expensive (an F12m P/E of 13.04x versus 11.56x at the end of March 2019). Both are trading modestly above their five-year averages.

Emerging markets are excellent value

Emerging markets are excellent value

As illustrated in Figure 1 above, over the last five years, global utilities have modestly underperformed global equities, while emerging market utilities have markedly underperformed broader emerging market equities. At the same time, developed market utilities (as represented by the MSCI World Utilities Index) have become more expensive relative to global equities (as represented by the MSCI World Index), while, in contrast, emerging market utilities have become cheaper relative to their parent index.

PGIT’s managers see stronger growth prospects in emerging markets, a backdrop of improving regulation (for example in Brazil), relatively benign political risks and modest foreign currency risks. Given current valuations, and, as highlighted above, emerging market utilities trade at a discount to broader emerging market equities, while developed market utilities are trading at a marked premium, they consider emerging market equities to be excellent value. As is discussed later in this note, the managers are seeing strong earnings growth in their portfolio companies that is not being reflected in share prices, particularly in Asian markets. This reflects the fact that markets have been very macro-driven during the last few years, which has outweighed more fundamental considerations. PGIT’s managers see the potential for strong re-ratings as these companies continue to perform, particularly as they offer the prospect for enhanced growth in a low-growth world.

UK utilities – the Corbyn nationalisation threat is reduced

UK utilities – the Corbyn nationalisation threat is reduced

Concerns that utilities and infrastructure could be subject to nationalisation under a Corbyn-led Labour government have been a key reason for the underperformance of these sectors during the last couple of years. PGIT’s managers have made no secret of their view that the market’s reaction to this threat was significantly overdone (see page 5 of our March 2019 annual overview note, and pages 4 and 5 of our May 2018 update note). However, in their opinion, this threat has significantly diminished.

Despite the gyrations of Brexit, it now seems unlikely that Labour could muster a majority and, in the event that Labour were to lead a unity government, there is a lack of cross-party consensus for nationalisation. Furthermore, if a Conservative majority were to emerge, PGIT’s managers see an upside to UK utilities and infrastructure.

With regards to the other risks surrounding the UK market that we have previously discussed, price caps on electricity and gas would appear to be having the effect of driving smaller players out of the market, and the risk of interest rate rises appears to be diminished for now. Overall, the UK market is now much better value than, say, the US (see below).

The US – fully valued following strong performance; pipeline companies are the exception

The US – fully valued following strong performance; pipeline companies are the exception

Bolstered by a more dovish stance by the US Fed with regard to interest rates (PGIT’s managers comment that the US market is highly driven by interest rates with a major emphasis on bond-proxy type returns), US utilities, and particularly the US yieldcos, have performed very strongly. PGIT has a significant exposure to the US, and so the trust has benefitted in absolute terms. However, with its focus on emerging markets, PGIT is underweight compared to the main market indices and this has hurt its relative performance.

Following this, the managers say that many US infrastructure companies look fully valued, with one notable exception: US pipeline companies. As discussed in our annual overview note of March 2019 and update note in May 2018, US pipeline companies have suffered from a weak oil price (although their profitability is largely insensitive to this – see page 8) and a breakdown in their funding model whereby they previously paid out a very high proportion of cashflows with new investment funded by new equity. Distributions have now been reduced and capital expenditure is now being funded through retained cashflows. This has inevitably led to some market dislocation in the sector.

China – deep value opportunities

China – deep value opportunities

In contrast to the US, slowing global growth and concerns over the impact of the trade war have stemmed demand for China and Hong Kong listed equities, with utilities and infrastructure being no exception. The managers say that this is despite these companies being geared to the domestic economy, their strong growth prospects, significant progress in deleveraging and a track record of compelling earnings and dividend growth.

PGIT’s managers are long-term deep value investors and they say that they are seeing these kinds of opportunities in China, and more broadly Asia, currently. They comment that the underlying businesses are very profitable, with high returns on capital. Dividends are also growing strongly, which has given rise to healthy revenue generation in H1 2019 (see page 12). They believe that, with earnings and dividend growth coming through, these companies will benefit from a re-rating and the capital growth will ultimately take care of itself.

PGIT’s portfolio is cheap relative to the wider sector

PGIT’s portfolio is cheap relative to the wider sector

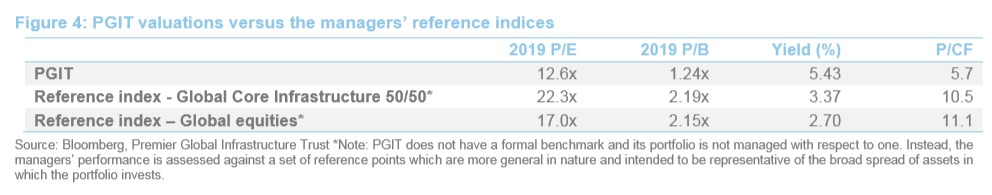

As is illustrated in Figure 4, PGIT’s portfolio is markedly cheaper than both of the indices that are used to assess the manager’s performance. However, its income generation is markedly higher. This data, which has been supplied by the manager, shows that the portfolio is trading at a discount in excess of 40% to the wider sector and around a 26% discount to broader global equities.

Asset Allocation

Asset Allocation

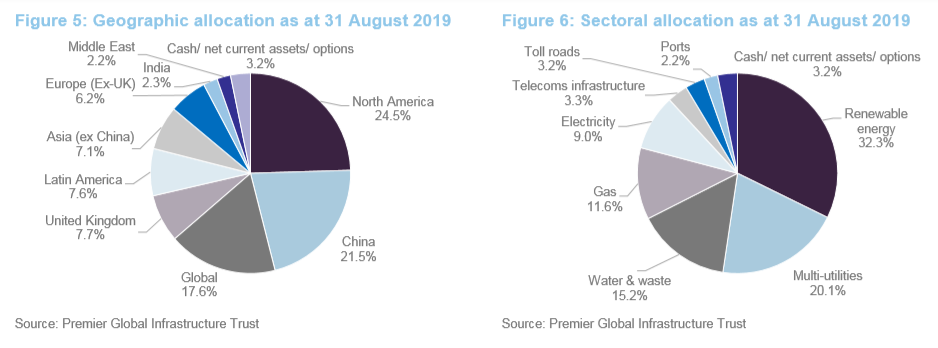

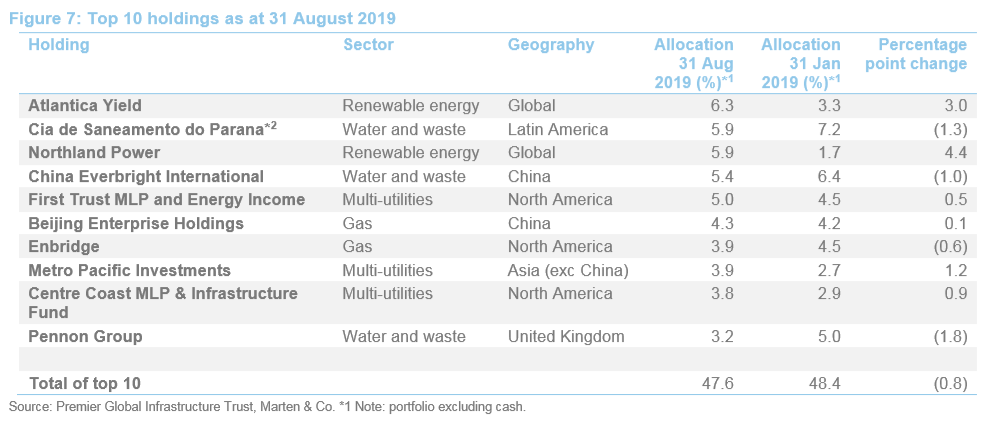

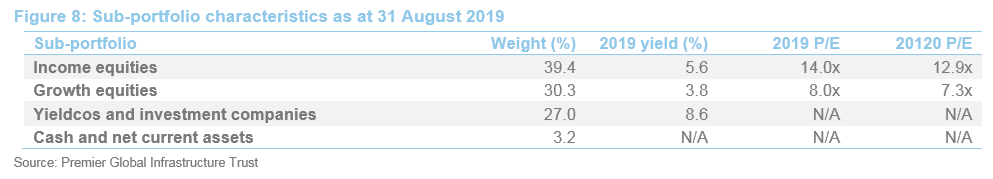

PGIT maintains a portfolio of relatively high-conviction positions that fall into one of three sub-portfolios: growth equity, yield equity and yieldco. As illustrated in Figure 7, comparing PGIT’s portfolio as at 31 August 2019 and 31 January 2019 (the most recently available data when we last published) there has been a mild reduction in portfolio concentration (the number of portfolio holdings has increased from 34 to 38, while the proportion of the portfolio accounted for by the top 10 holdings has reduced from 48.4% to 47.6%). (Note: prior to the portfolio rationalisation that started in November 2017, PGIT maintained a portfolio of around 50 holdings). PGIT’s portfolio has an active share of 87%.

In terms of geographical allocation changes, there has been a marked reduction in the allocation to the UK (a seven percentage-point reduction) and Latin America (5.1 percentage points), which is offset by increases in the allocations to North America (3.2 percentage points) and Europe ex UK (3.1 percentage points). In many respects, this reflects the relative performance of these markets. The US has performed particularly strongly, while the UK has lagged.

Comparing sectoral allocations, there has been a marked increase in the allocation to renewable energy (a 5.2 percentage point increase) while the standout reduction is to water and waste (a 6.6 percentage point fall).

While the managers have been making portfolio adjustments, the changes in weightings are in part a reflection of the relative performances of the different markets in which it invests. Specifically, North American companies have generally performed well (PGIT has benefitted from the managers’ previous moves to add to this space, particularly US yieldcos), while China and the rest of Asia have been weaker on the back of trade war concerns and slowing global growth. Brexit uncertainty and the threat of nationalisation under a Corbyn government have hampered the UK.

Figure 7 shows PGIT’s top 10 holdings as at 31 August 2019 and how these have changed since 31 January 2019 (the most recently available data when we last published). New entrants to the top 10 are Atlantica Yield (PGIT’s largest holding) Northland Power, Metro Pacific Investments and Centre Coast MLP & Infrastructure Fund.

Names that have slipped out of the top 10 are National Grid (currently PGIT’s 13th largest holding at 2.9% – the rebuilding of a position in National Grid was discussed in some detail in our May 2018 note – see pages 5 and 6 of that note), OPG Power Ventures (a former number one holding), China Longyuan Power Group (currently PGIT’s 12th largest holding at 2.9%) and EcoRodovias. We discuss some of the more interesting changes below. Readers interested in other names in the top 10 should see our previous notes, where many of these have been previously discussed (see page 14 of this note).

Atlantica Yield (6.3%) – position established following share price weakness

Atlantica Yield (6.3%) – position established following share price weakness

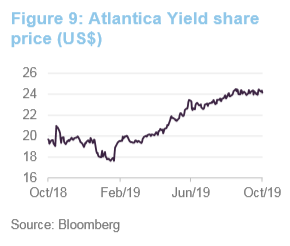

In our March 2019 note, we commented that PGIT’s managers had established a position in Atlantica Yield (www.atlanticayield.com) using the sale proceeds from Saeta Yield (Spanish renewable energy), which had been subject to a bid (Saeta Yield was acquired by Terraform Power in a transaction that closed in July 2019). As Figure 9 illustrates, this appears to have been a good decision; Atlantica Yield has returned 23.1% since the end of March this year and was PGIT’s largest holding as at 30 September 2019.

Atlantica Yield saw its share price suffer in the wake of the PG&E bankruptcy, as investors became concerned that PG&E would be able to break or renegotiate the PPAs to purchase power at lower prices. So far, the company (and other companies supplying renewable energy to PG&E) have not been dragged into the proceedings and the shares have recovered.

Atlantica Yield describes itself as “a total return sustainable infrastructure company that owns, manages and acquires a diversified portfolio of contracted assets in the power and environment sectors”. Specifically, it owns a portfolio of renewable energy assets located in North and South America, and certain markets in EMEA, along with electricity transmission, gas generation and water production assets.

All of Atlantica Yield’s assets have contracted revenues (regulated revenues in the case of its Spanish assets and its transmission line in Chile) that are underpinned by long-term contracts, and most of its assets have project-finance agreements in place. As at 31 December 2018, the company’s assets had a weighted average remaining contract life of approximately 18 years. The company targets the distribution of a very high percentage of its cash available for distribution and seeks to increase its cash dividends over time.

Northland Power (5.9%) – offshore wind farms in the North Sea to drive future growth

Northland Power (5.9%) – offshore wind farms in the North Sea to drive future growth

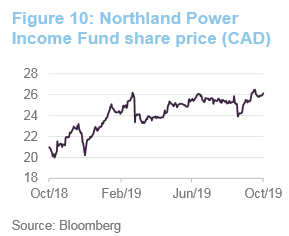

Northland Power (www.northlandpower.com) is a relatively new holding for PGIT. Like China Longyuan (discussed below) it plays into the managers’ key theme of renewables. The trust acquired its initial stake in January 2018, and a combination of positive share price performance and an increase in the size of the position earlier this year as PGIT’s managers gained confidence in the holding, has pushed Northland up PGIT’s rankings.

Northland describes itself as a power producer dedicated to developing, building, owning and operating clean and green power infrastructure assets in Canada, Europe and other selected global jurisdictions. The bulk of its facilities are in Canada, but it also has sites in Germany, The Netherlands and Taiwan. The company is expanding its footprint in Europe. It has established a European division with an office in the UK and two offices in Germany.

As at 31 December 2018, Northland had a total gross generating capacity of 2,429MW. This comprises 973 MW of thermal generation (primarily natural gas with a small component of biomass), 1,326MW wind and 130MW solar. The company also had an additional 399 MW of wind projects under construction and 1,044 MW in advanced development.

Northland owns two operational offshore wind farms in the North Sea and is currently building a third, which PGIT’s managers believe will drive future earnings growth. In the meantime, the company is offering a yield of circa 5%. The company has also been taking over a number of functions, which had been outsourced, for its European operations – it is expected that this will significantly increase the company’s margins.

Metro Pacific Investments (3.9%) – benefits of build out yet to come through

Metro Pacific Investments (3.9%) – benefits of build out yet to come through

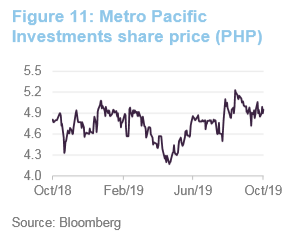

Metro Pacific Investments (www.mpic.com.ph) is a Philippines-based holding company with a portfolio of infrastructure assets that includes power, toll roads, water, healthcare, light rail and logistics interests. Its primary asset is MERALCO, the largest electricity distribution company in the Philippines. MERALCO has a franchise area of 9,685 square km, encompassing 36 cities and 75 municipalities. This includes Manila and the surrounding area, all of the provinces of Rizal, Cavite and Bulacan, and parts of the provinces of Pampanga, Batangas, Laguna and Quezon.

Its water assets include a 52.99% economic interest in Maynilad, which provides clean water and wastewater services provider for the west zone of Greater Metro Manila. Maynilad has a concession area that covers 540 square km and encompasses 17 cities and municipalities.

Metro Pacific Toll Roads is the largest toll road operator and developer in the Philippines. It operates and maintains 212km of toll roads across three major Philippine toll road systems. The company says that over the next five years, it will be adding a further 84km of expressway in the Philippines at a cost of approximately PHP104 billion.

PGIT’s managers observe that the company has had a major build out which, in the short term, has ramped up debt but there has yet to be the corresponding uplift up in earnings to compensate. They say that this has made the market very uncomfortable, it is failing to factor in the significant underlying growth in earnings that is coming through. In PGIT’s managers’ view, the company has a value that is significantly ahead of where the market is currently placing it. They have bought in early on the anticipation of a significant re-rating over time.

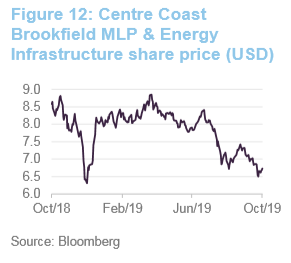

Centre Coast Brookfield MLP & Energy Infrastructure Fund (3.8%) – share price weakness used to rebuild the position

Centre Coast Brookfield MLP & Energy Infrastructure Fund (3.8%) – share price weakness used to rebuild the position

Centre Coast Brookfield MLP & Energy Infrastructure Fund (click here to visit the manager’s website) is a US pipeline company that is similar to First Trust MLP (a long-time holding of PGIT’s that has featured in its top 10 holdings for some time) that invests in US oil and gas pipelines and other infrastructure. Broadly, the share prices of US pipeline companies have struggled during the last three years. A primary driver has been a weaker oil price, but MLPs have also been hampered by changes to the tax regime in the US that have eroded the benefits of the MLP structure.

However, as discussed in our previous notes, the pipelines benefit from long-term (typically 20-year) contracts that are inflation-linked, unregulated and not price- and volume-sensitive. PGIT’s managers say that, while the market frets about the impact of a lower oil price, the structure of the transit contracts for pipeline companies means that, like toll roads, their earnings are largely indifferent to the value of the commodity they are transporting. In fact, a lower oil price suggests high volumes and higher earnings at the margin (the managers say that underlying growth in volumes has been strong and this is feeding through to earnings growth) and shipping and oil companies still need to pay to get their product to market.

Like First Trust, Centre Coast has been a long-time constituent of PGIT’s portfolio. However, share price weakness during 2019 has provided PGIT’s managers with the opportunity to rebuild the trust’s position, pushing it up PGIT’s rankings. The managers say that net income generation has been very strong, despite market perceptions, and the fund currently yields over 15%.

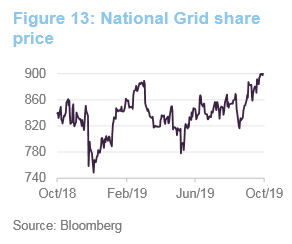

National Grid (2.9%) – sold down into strength

National Grid (2.9%) – sold down into strength

In our May 2018 note (see pages 5 and 6 of that note), we discussed how, historically, there was a degree of correlation between the downward movement in interest rates and the upward movement in National Grid’s share price from early 2013 until mid-2017, when the relationship appeared to break down. Specifically, as gilt yields increased modestly, National Grid’s share price fell dramatically as markets focused on regulatory concerns and the threat of nationalisation.

PGIT’s managers felt that a return to an average historic yield would imply a higher share price for National Grid (www.nationalgrid.com). They also observed that the share price decline had come against a backdrop of good news from its US business, which they felt would be the main driver of growth for the business over the subsequent five-to-six years (National Grid spends almost two-thirds of group capex in its US business, but just over one-third of its EBITDA came from the US in the 12 months to 31 March 2018).

Figure 13 illustrates that the company has benefitted from a recovery in its share price, which in part reflects a reduction in the “Corbyn-threat”. PGIT’s managers sold down the trust’s position into this strength.

OPG Power Ventures – significant latent value

OPG Power Ventures – significant latent value

Indian power generation company, OPG Power Ventures (OPG – www.opgpower.com) is a long time holding of PGIT’s and a former number one position within the portfolio. When we last discussed OPG, in our March 2019 annual overview note, we commented that, after a difficult 2016 and 2017 (see page 8 of our May 2018 update for details), OPG’s share price continued to fall in the first 11 months of 2018, before recovering all of that loss in December, when the coal price fell to the benefit of OPG’s remaining Chennai plant.

In share price terms, 2019 YTD has been another difficult period for OPG (its share price has fallen some 30.7% YTD as at 24 October 2019). However, PGIT’s managers say that the outlook for OPG has improved significantly, particularly on the back of lower coal prices, but the market is yet to fully appreciate this. For example, despite the first generating unit at Chennai being shut down between December 2018 and March 2019, to facilitate a standard maintenance outage, the company’s interim results showed a marked improvement in financial performance (adjusted EBITDA of £35.3m (a 25.1% margin) compared with £24.7m (a 17.6% margin) in FY18). However, despite the improvement, the results would appear to be below market expectations as the share price fell 11.8% on the day of the announcement.

PGIT’s managers believe that more needs to be done to improve OPG’s corporate governance and its communications. They are engaging with the company on how to improve both of these and to help the company better demonstrate its significant latent value to the market.

China Longyuan Power Group – strong underlying business; performance not reflected in its share price

China Longyuan Power Group – strong underlying business; performance not reflected in its share price

China Longyuan Power Group (www.clypg.com.cn) is a Chinese power company focused on renewable generation. The overwhelming bulk of its generation capacity is wind (18,919MW as at the end of December 2018, making it one of the world’s largest wind generators), followed by thermal (2,875MW, coal fired but ultra-low emission), solar (190MW) and biomass (54MW). It also has a 2MW geothermal plant (built for demonstration purposes) and a 4.1MW tidal plant (the largest in China and the fourth largest in the world).

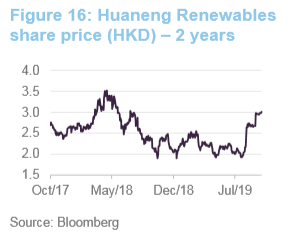

The managers’ long-term deep value approach tends to mean that PGIT’s investments tend to be long held. As such, China Longyuan is a relatively new holding for PGIT; the managers initiated a position in April 2018 and built this up opportunistically over the remainder of 2018 (see below). It was funded by selling part of PGIT’s holding in Huaneng Renewables (en.hnr.com.cn), now sold in its entirety following a take-private bid from its parent.

The managers continue to like both companies (both are growing their portfolios and providing decent earnings growth) but, as illustrated in Figure 16, at the time the managers began to make the switch, Huaneng Renewables had benefitted from a period of strong price performance and the managers were happy to take some profits.

For the year ended 31 December 2018, China Longyuan grew its installed capacity by 2.2%, revenue grew by 7.3% and EPS grew by 6.4%. In contrast, its share price fell by 4.1%. Furthermore, from its peak in May 2018, the company’s share price fell 30.4% over the remainder of 2018 and, as at 24 October 2019, it has fallen 18.8% year-to-date.

In PGIT’s managers’ view, China Longyuan’s share price performance has been bogged down by concerns over Chinese growth, large subsidy receivables from the government and trade wars (something that, as a domestic power producer, it is largely unaffected by) and has been completely out of touch with the performance of the underlying business and its growth prospects (in addition to its existing installed capacity, the company has consents in place for a further 7GW of projects, which the managers expect to underpin future growth). The share price performance allowed PGIT’s managers to build a position at consistently improving valuations. Given the performance of the underlying business, the managers expect to see a strong re-rating over the longer term as the market appreciates the fundamental strengths of the business.

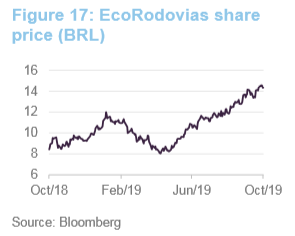

EcoRodovias Infraestrutura e Logistica – exited in its entirety

EcoRodovias Infraestrutura e Logistica – exited in its entirety

The Brazilian market suffered in the run-up to the presidential election, but recovered strongly in the fourth quarter of 2018 following Jair Bolsonaro’s comfortable win. Brazilian toll road company, EcoRodovias Infraestrutura e Logistica (www.ecorodovias.com.br), was no exception to the pre-election malaise. PGIT’s managers initiated a position in 2018 when the market was depressed and, as illustrated in Figure 17, the position has benefitted strongly from the subsequent recovery.

Performance

Performance

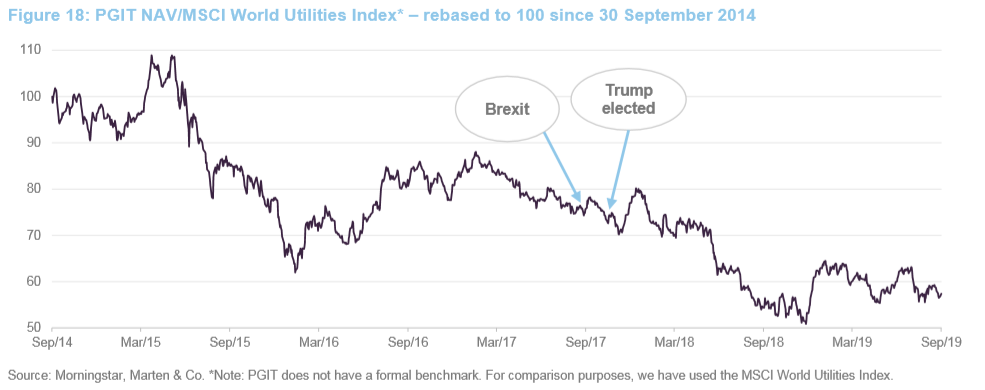

As illustrated in Figures 18 and 19, while PGIT has generated particularly strong absolute returns during the last 12 months, its returns over the six months to 30 September 2019 have lagged those of the MSCI World Utilities Index. This reflects the fact that the MSCI World Utilities Index is focused on developed markets, primarily the US, which have performed very strongly (these are areas that PGIT’s managers now think to be very expensive). For US yieldcos and Australian toll roads, the managers consider that the market is primarily focused on yield and not giving adequate consideration to underlying earnings. Moreover, they believe that while PGIT’s portfolio has underperformed in share price terms, it has likely outperformed in terms of earnings growth. Irrespective of this, PGIT’s NAV total return over the one-year horizon has outperformed all of the indices provided in Figure 19, aided by the significant gearing provided by its ZDP shares.

H1 2019 performance

H1 2019 performance

During the first half of 2019, PGIT’s yield equities and yieldcos and investment company sub-portfolios performed very strongly, providing returns of 19.2% and 24.7% respectively, while the growth equities element of the portfolio recorded a negative return of 1.1%. PGIT’s managers say that this reflects the current macro driven nature of markets (PGIT’s growth equities portfolio has a bias towards Asian and Chinese equities, which account for around a third of the portfolio). The managers say that despite the underwhelming share price performances, these companies have performed well in terms of business growth, earnings and dividends.

For example, China Everbright International saw its shares fall sharply in 2018 following a rights issue undertaken to fund growth development. The company reported strong 2018 results, with a 55.3% increase in waste volumes treated and earnings per share up 12.6% (despite the dilution from the rights issue). Whilst the first half of 2019 has seen a steady flow of new contracts to build and operate waste to energy facilities, the company’s shares failed to respond. Beijing Enterprise Holdings was another disappointment. Its shares fell despite increasing gas volumes by 15.4% in 2018 and growing its earnings. Metro Pacific Investments (discussed on page 8) saw modest gains despite reporting solid results and OPG power also suffered heavily despite an improving outlook (see page 9).

Looking at the yield equities sub portfolio, stand out performance came from Cia de Saneamento de Parana, with a 31% increase in its share price, despite regulatory challenges. (PGIT’s managers continue to like the company but have taken the opportunity to reduce the position into share price strength to reinvest in better value opportunities).

A number of UK listed regulated names (National Grid, Pennon and Severn Trent) reported strong operational performance, financial results and higher dividends. Whilst their share prices have responded, the managers consider that their relative performance has been held back a little by political uncertainty.

Looking at the yieldcos and investment companies portfolio, those investing into US energy infrastructure performed well, aided by a helpful interest rate environment in the US (Atlantica Yield, Pattern Energy, Brookfield Renewable Energy, and Transalta Renewables recorded share price gains of 15.7%, 24.0%, 28.1% and 33.6% respectively).

Strong income generation during H1 2019

Strong income generation during H1 2019

PGIT’s interim accounts for the six months ended 30 June 2019 show a 13.3% increase in revenue income for H1 2019 year-on-year (from 5.48p per share to 6.21p per share). There was a small currency effect (sterling depreciated, which increases the value of PGIT’s significant overseas income once converted back to sterling) but, as there was some currency hedging in place (to lock in some of PGIT’s previous gains from sterling’s depreciation), the effect was limited. The managers say that the increase largely reflects the strong underlying dividend growth they are seeing from portfolio companies.

The quarterly level has been maintained at 2.5p per share (a total of 5p for the half year is unchanged year-on-year), which arguably leaves scope for an increased final interim dividend. (Note: PGIT pays quarterly dividends on its ordinary shares in June, September and December and March. All dividends are paid as interim dividends. Traditionally, the first three interim dividends (June to December) were smaller, with a larger fourth interim in March. For further information on PGIT’s dividend policy, dividend payments and revenue generation, see pages 10 and 11 of our March 2019 annual overview note).

Premium/(discount)

Premium/(discount)

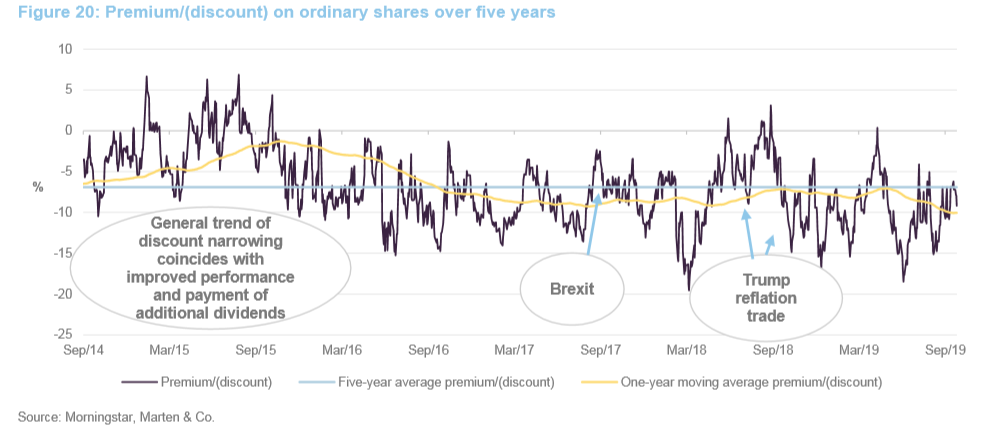

As we have discussed in our previous research notes (see page 14 of this note) the volatility present in PGIT’s ordinary share discount is in part a feature of its split capital structure and the high level of gearing that is provided by its zero dividend preference shares (ZDPs). As illustrated in Figure 20, having widened significantly between May and July 2019, PGIT discount has narrowed again. However, as at 28 October 2019, PGIT’s ordinary shares were trading at a discount of 9.7%.

PGIT’s ordinary shares are now trading at a discount that is wider than its five-year average and close to its one-year moving average (see Figure 20). Historically, PGIT’s discount target has tended to narrow with improving performance and yield, while the reverse has also been true (see page 9 of our July 2017 annual overview note for more discussion). It seems reasonable to us that, if performance improves, this could lead to a narrowing of the discount.

ZDP coverage

ZDP coverage

PGIT is a split-capital investment trust with two types of security in issue: ordinary shares and ZDPs. The ZDPs provide substantial gearing to PGIT’s ordinary shares, facilitating both income enhancement and amplifying performance. (see pages 13 and 14 of our March 2019 annual overview note for more information on PGIT’s capital structure).

As at 24 October 2019, PGIT had 18,088,480 ordinary shares and 24,073,337 ZDP shares in issue. With NAVs of 142.32p and 119.38p for the ordinary shares and ZDP shares respectively as at 24 October 2019, we estimate PGIT had gross gearing of 111.6% and net gearing of 106.3%.

The ZDP shares mature on 30 November 2020 with a final entitlement of 125.6519p per 2020 ZDP share. This is equivalent to a GRY of 4.75% per annum over the life of the ZDPs. As at 24 October 2019, the ZDPs had an attributable asset value of 119.38p per share and were trading at 119.50p (a premium of 0.1%). With the final entitlement noted above, the ZDPs offer a yield to maturity of 4.65% per annum. The ZDPs have a coverage ratio of 1.80x.

Income from utility exposure

Income from utility exposure

Premier Global Infrastructure Trust Plc is a UK-listed investment trust that invests globally in the equity and equity-related securities of companies operating in the utility and infrastructure sectors. It maintains a relatively concentrated portfolio, which includes exposure to both developed and emerging markets (split 56.0%/40.8% with the balance in cash as at the end of August 2019). PGIT aims to pay a high level of income on its ordinary shares (a yield of 7.8% as at 24 October 2019) and provide long-term capital growth. It is aided, in this regard, by the significant gearing provided to the ordinary shares by its zero dividend preference shares (net gearing of 106.3% of the ordinary shares’ NAV).

Increased emphasis on infrastructure

Increased emphasis on infrastructure

On 1 November 2017, PGIT announced that it had changed its name from Premier Energy and Water Trust, to Premier Global Infrastructure Trust, to reflect a change in investment emphasis that now gives a greater prominence to infrastructure investments. It should be noted that the trust still focuses primarily on energy and water, which will continue to comprise at least 75% of gross assets (at the time of investment). Readers interested in more detail surrounding the shift should see pages 2 and 3 of our November 2017 update note (see previous publications below).

Premier – merging with Miton Group looks set to proceed

Premier – merging with Miton Group looks set to proceed

PGIT’s portfolio has been managed by Premier Fund Managers, part of Premier Asset Management Group Plc, since its launch in 2003. On 4 September 2019, the boards of Premier Asset Management and Miton Group announced that they had agreed terms for a recommended merger between the two. On 9 October 2019, court and shareholder meetings approved the resolutions that were required to allow the merger to proceed. There are some further conditions to be satisfied but it is expected that the merger will complete by the end of the year.

James Smith, who took over the management of the fund on 1 June 2012, and Claire Long are responsible for the management of PGIT’s portfolio. They follow a bottom-up investment process based on fundamental research and the portfolio is not managed with respect to any particular benchmark. See our initiation note for more detail.

Previous publications

Previous publications

Readers interested in further information about PGIT may wish to read our previous notes:

- A step change in performance – Initiation – 18 June 2014

- Solid interims and plans for the future – Update – 7 August 2014

- Value in emerging markets – Update – 2 February 2015

- 3 years later, in a new league! – Annual overview – 18 July 2015

- It’s a £24m rollover! – Update – 4 February 2016

- A BREXIT beneficiary – Update – 5 September 2016

- Pocket rocket – Annual overview – 12 July 2017

- Evolution, not revolution – Update – 28 November 2017

- Swings and roundabouts – Update – 10 May 2018

- Quick out of the blocks in 2019 – Annual overview – 29 March 2019

The legal bit

The legal bit

This marketing communication has been prepared for Premier Global Infrastructure Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.