QuotedData’s Investment Companies Roundup – December 2020

| December 2020 | ||

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments |

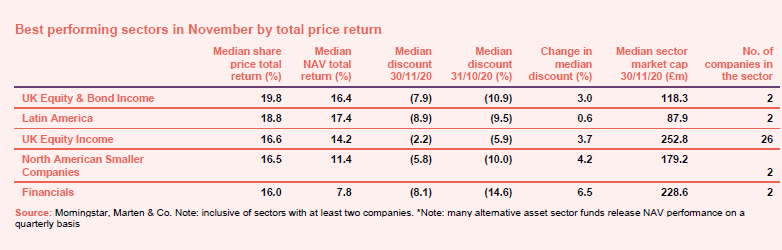

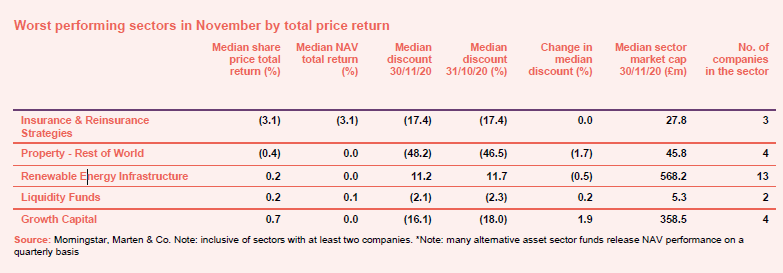

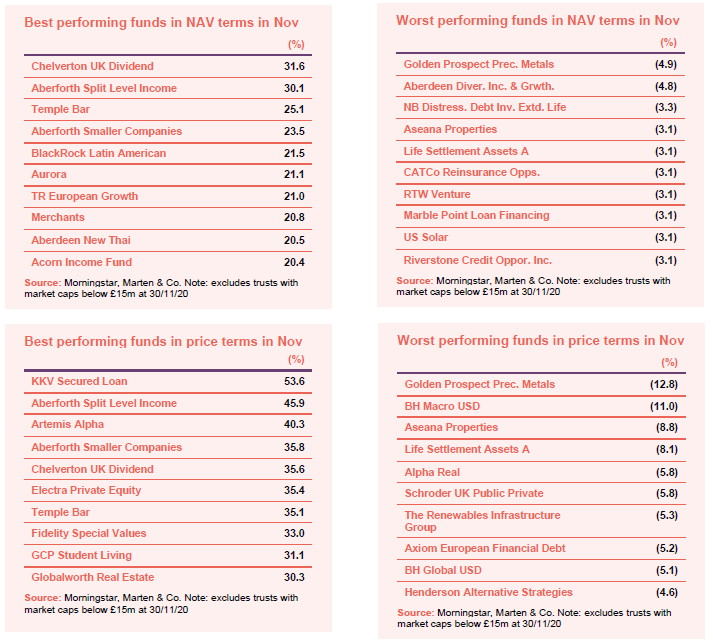

Winners and losers in November

November’s median total share price return from investment companies was 9.2% (the average was 9.9%), which compares with 0.3% last month. Over the year-to-date, median returns are down by (1.7%).

Please refer to the ‘appendix’ section for a comprehensive list of sector-specific performance. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

KKV Secured Loan announced some fairly drastic downward revisions to the value of loans in its portfolio. However, the news was perhaps not as bad as some had feared. The good news about the vaccines gave fresh hope to it and those other companies that have been hit hardest by COVID-19. Latin America has been particularly badly affected, Black Rock Latin benefited from the relief rally. Funds managed with a ‘value’ style were amongst the best performers, including Aberforth Smaller Companies and Temple Bar. Aberforth Split and Chelverton UK Dividend were further boosted by the gearing provided by their zero dividend preference shares. GCP Student Living rose on hopes that occupation rates would return to normal.

The counterpoint to this was that some investors took profits on ‘safe haven’ investments and growth stocks that had performed well through the crisis. BH Macro was one of these. Golden Prospect was under pressure as its subscription shares were exercised and a large block of these new shares placed with investors. This led to its discount widening. Renewables Infrastructure’s share price fell as it raised more money. By and large, however, most investments rose in value and so the list of NAV falls is dominated by funds with US dollar assets that were not revalued in the month, but nevertheless fell in value as the pound strengthened.

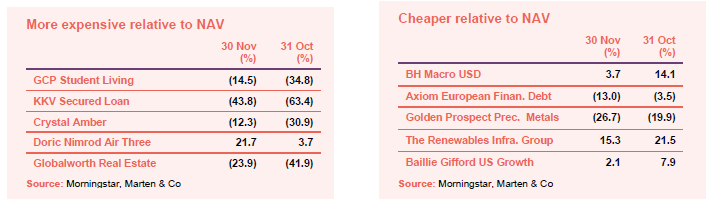

Moves in discounts and premiums

We covered GCP Student Living and KKV Secured Loan above. Crystal Amber’s share price rose in anticipation of a sharp relief rally in its NAV. Doric Nimrod Air Three’s share price recovered but the outlook for its A380 aircraft seems fairly bleak. In the short term Emirates has been using some of its fleet for cargo. Central and Eastern European property company Globalworth’s share price recovered, but there had been no obvious catalyst for it reaching such an extreme discount in the first place.

BH Macro suffered from profit taking as did Baillie Gifford US Growth, which has been one of the best-performing trusts of the year. We discussed Golden Prospect and Renewables Infrastructure above. A large block of shares in Axiom European Financial traded towards the end of the month. This appears to have weighed on its discount.

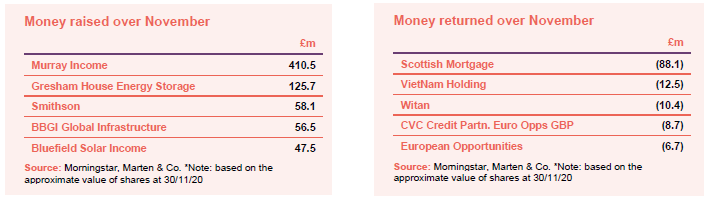

Money raised and returned

The money flowing into Murray Income came from its merger with Perpetual Income & Growth. The battery storage funds have been raising more money. Gresham House Energy Storage has a £200m pipeline of projects it is looking to fund. Smithson remains popular with investors. BBGI Global Infrastructure raised some money to help finance the acquisition of a bridge project in Montreal. Bluefield Solar was paying down is credit facility.

Scottish Mortgage shrank as investors took profits following its strong run of performance. VietNam Holding completed a tender offer. The other funds have been shrinking for some time.

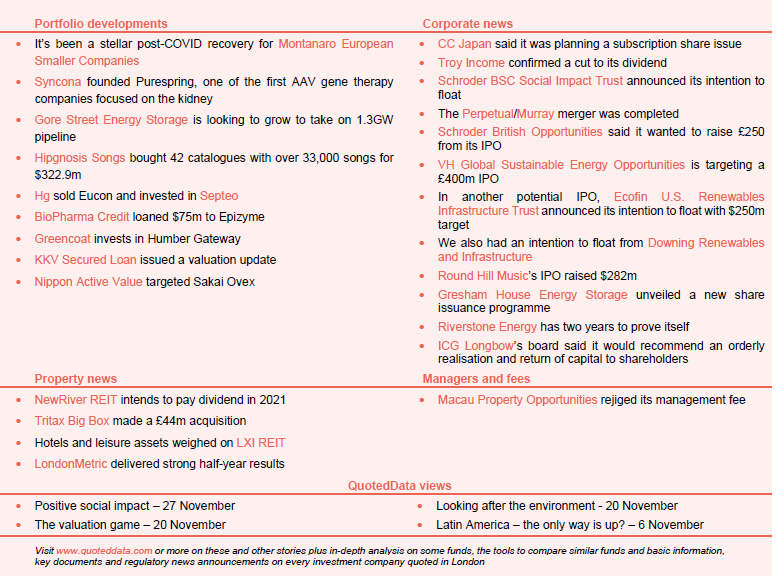

Major news stories and QuotedData views over November

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

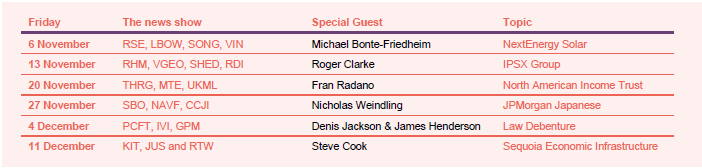

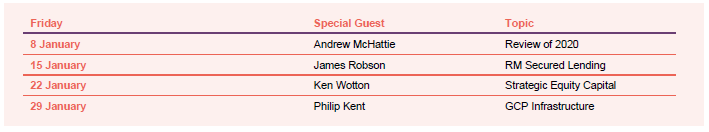

Interviews

Have you been listening into our weekly news round-up shows? Every Friday at 11am (but currently on a winter break), we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

And here is what is coming up:

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.