Shires Income – Growing again

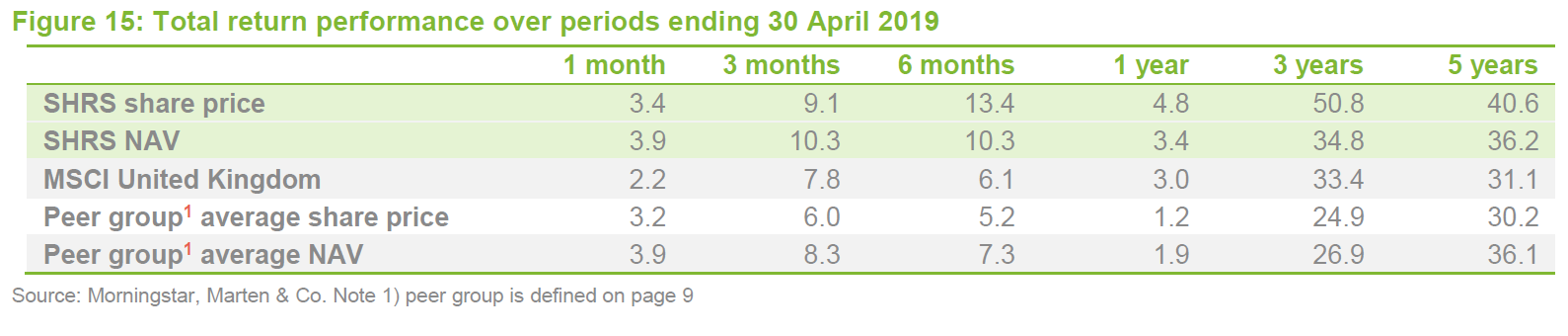

In recent months, Shires Income Trust (SHRS) has been expanding for the first time since 2012. SHRS can boast both an attractive yield and outperformance of both its benchmark and the average of competing listed UK equity income funds (see Figure 15 on page 7, which shows SHRS outperforming over every time period). This appears to be winning new fans for the company. The expansion could help improve liquidity in the shares and lower the trust’s ongoing charges ratio (as fixed costs are spread over a wider base). Shares are being issued at a premium to NAV, ensuring that existing shareholders are not diluted.

SHRS’s manager, Iain Pyle, has been trimming positions in stocks that have done well and has added a number of new positions in stocks that he feels have the potential to drive SHRS’s NAV higher over the coming years as well as contribute to revenue generation. The market has long been favouring growth stories over value stocks; sentiment is against the UK, and the market yield is at decade highs. Now may be a good time to be adding exposure to this area.

High level of income with potential for growth

High level of income with potential for growth

SHRS aims to provide its shareholders with a high level of income, together with the potential for growth of both income and capital from a diversified portfolio substantially invested in UK equities but also in preference shares, convertibles and other fixed income securities.

Market background – UK and ‘value’ out of favour

Market background – UK and ‘value’ out of favour

Politics and Brexit in particular seem to dominate any discussion about the prospects for the UK economy, but it is important to look beyond this. Iain acknowledges that we are late in the economic cycle, and notes that leading indicators of the direction of growth are softening. Emerging market demand is weak, in part thanks to the ongoing trade war between China and the US. Some data, such as very low unemployment and steadily rising consumer spending, might suggest economic strength, but others – such as purchasing managers indices (PMIs) are in decline and the recent, albeit fleeting, inversion of the US yield curve (where it costs more to borrow for the short-term than the long-term) – are a good predictor of a global slowdown. The US Central Bank (the Federal Reserve) has said that US interest rates will not rise in 2019. This either reflects a belief that the economy is softening or suggests that it is bowing to political pressure – either way, this is bad news. At least we can take comfort that there are few signs of inflationary pressures.

Whether we are facing outright recession or a return to a low/no growth scenario is hard to say. SHRS’ manager, Iain Pyle, points out that historically, an inverted yield curve does not translate into an immediate market downturn.

He also stresses that, regardless of the above, SHRS’s portfolio is focused on companies whose growth is not reliant on wider economic growth, and he is not overpaying for stocks. He is not a momentum investor (chasing stocks whose share prices are already rising) and does not buy high beta companies (stocks whose share prices tend to rise faster and fall further than market average moves). Iain notes that valuations of momentum growth stocks are stretched and vulnerable to even minor disappointment.

He says that sectors that are traditionally seen as defensive are not valued attractively. For example, many consumer staples companies, such as Unilever, are expecting slowing sales growth but are rated quite highly by the market. UK utilities only offer a market yield in most cases. This is coupled with low earnings growth and political risk associated with the prospect of a Labour government. This threat may be more benign in reality, but there is a risk that their share prices will react to poll numbers. SHRS does own National Grid, but this has the advantage that it is not directly exposed to the end consumer. Iain also sees some value in its US business.

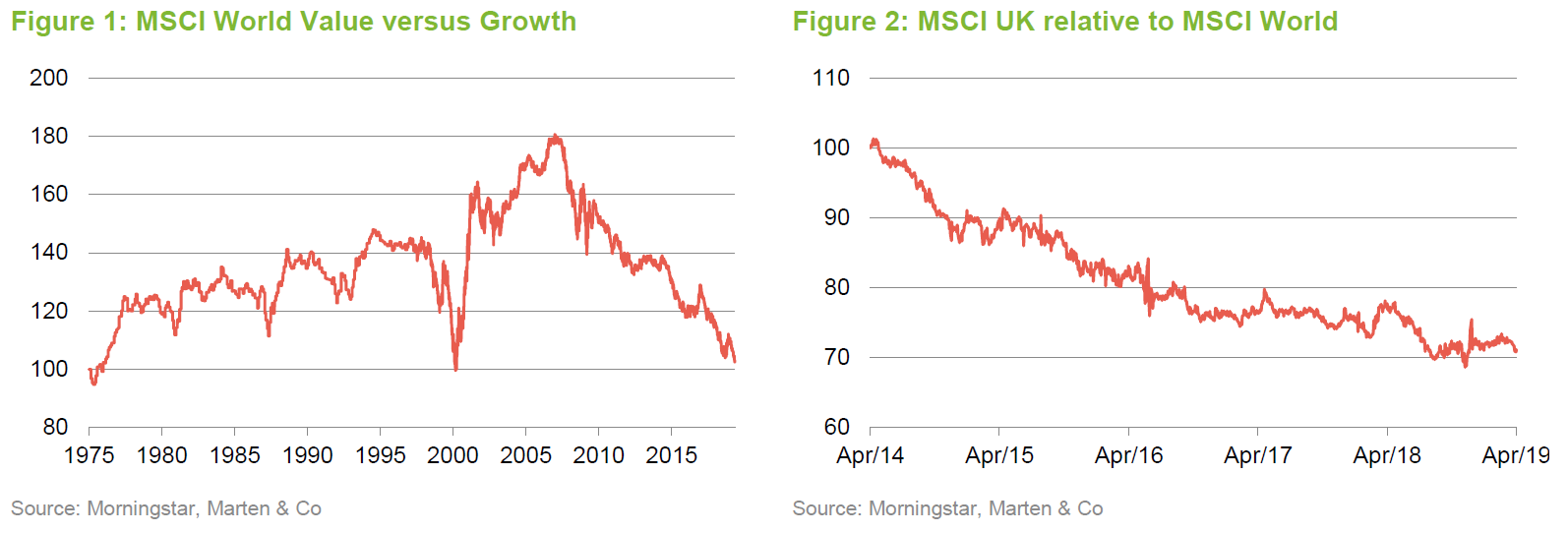

For a decade now, since the global financial crisis, stocks that are perceived to be able to grow earnings and revenues faster than the market have been outperforming stocks that appear to be good value on a range of measures such as price/earnings ratios and dividend yield. Iain highlights that the UK stock market is heavily influenced by sectors where value stocks predominate. A combination of this and concern about Brexit have been weighing on UK share prices and this is reflected in the relatively poor performance of the UK market. Iain is not favouring domestically-orientated stocks within SHRS’s portfolio; stocks are selected on their own merits rather than to reflect any view on economic prospects.

Market yields at decade high

Market yields at decade high

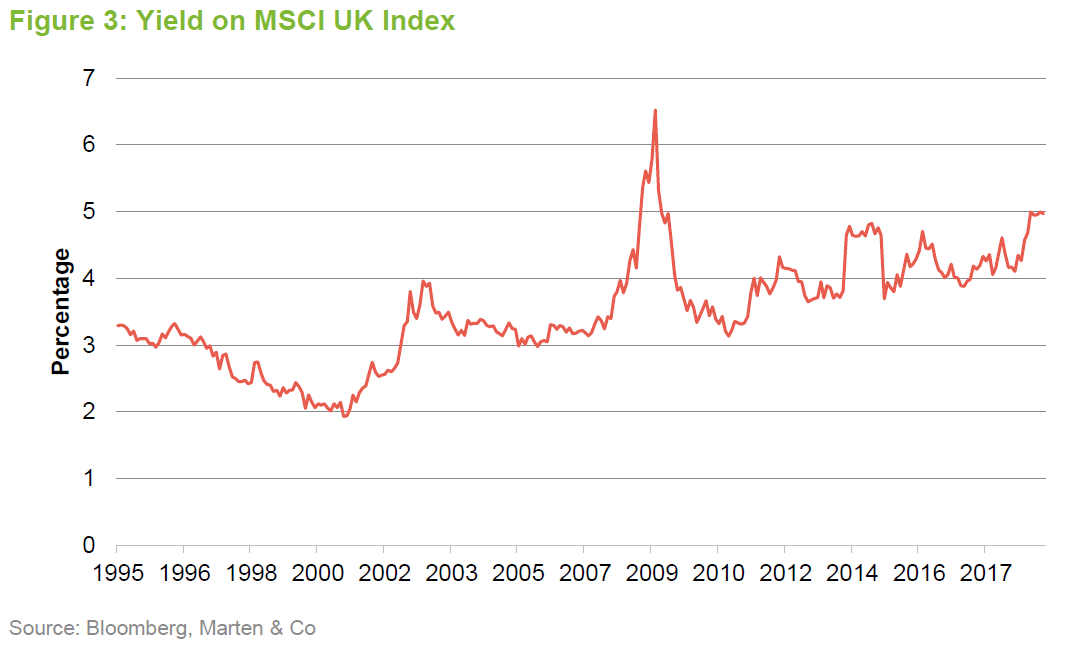

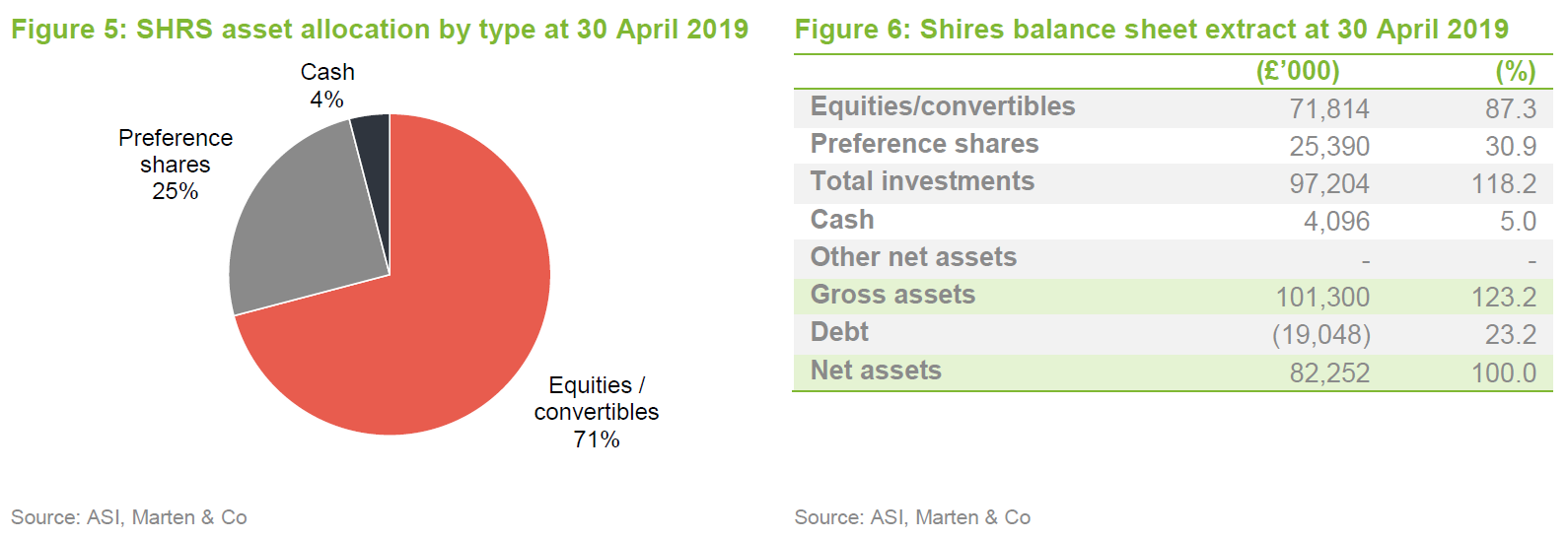

The dividend yield on the UK market is at a decade high. This is despite the fact that pay-out ratios (dividends as a percentage of earnings) are not excessive. Iain does not see much dividend risk overall, although there are a few specific examples where dividends look vulnerable. Generally, companies have been setting dividends at achievable levels and returning excess cash through special dividends and share buy backs.

A combination of high dividend yields and exceptionally low government bond yields mean that the equity yield premium continues to climb. Work done by Aberdeen Standard Investment’s (ASI’s) strategy team suggests that the UK equity market has the potential to be the highest returning developed market over the next three years. At the core of this is the high yield offered by UK equities in a predicted low growth environment.

Asset allocation

Asset allocation

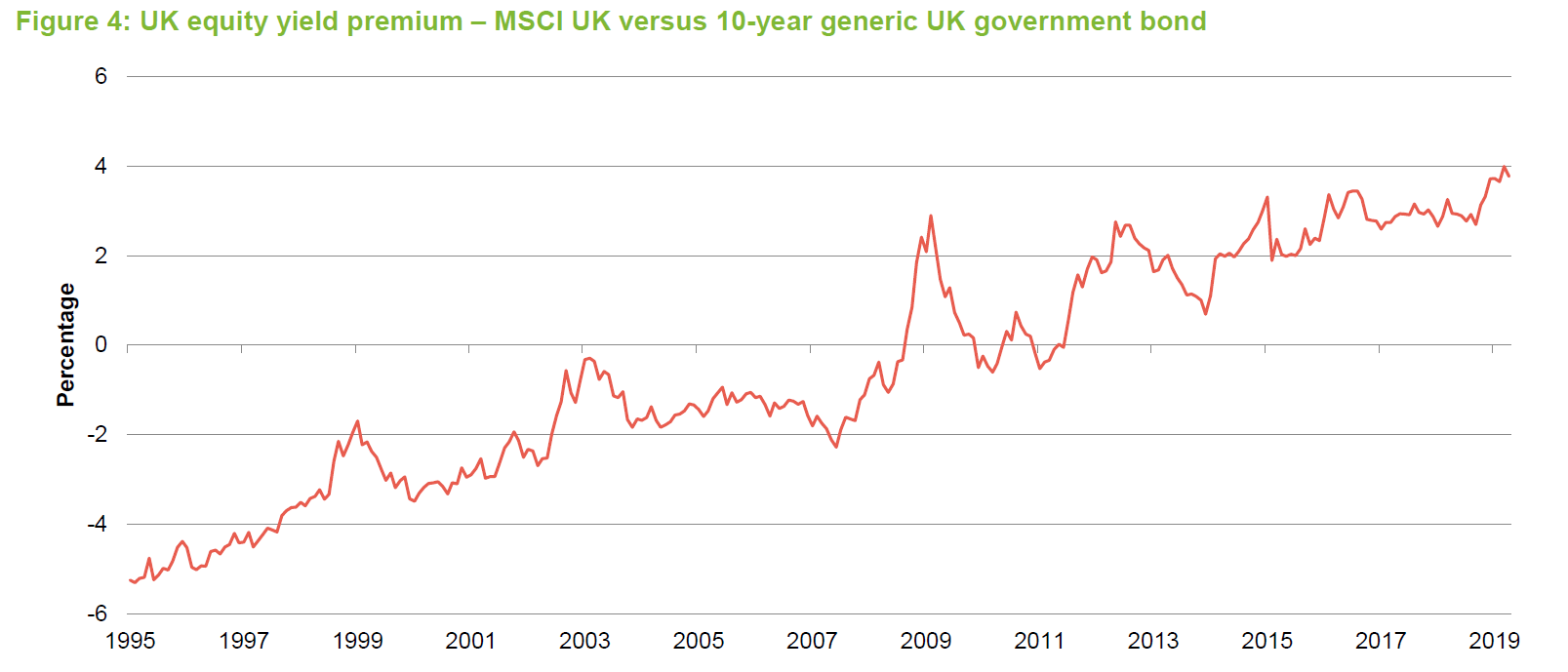

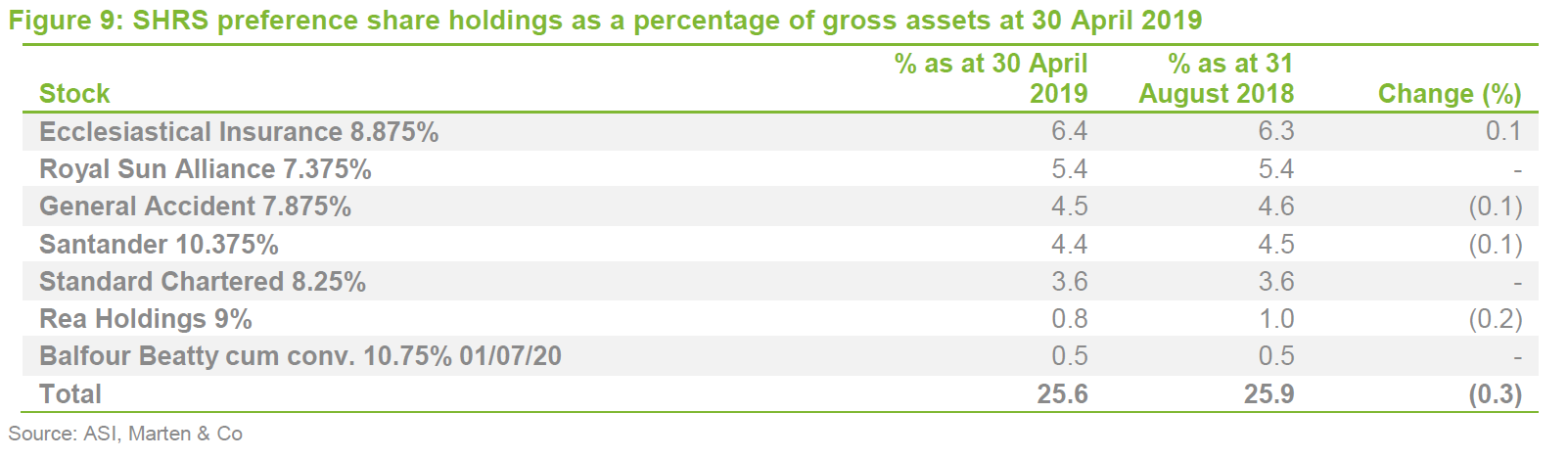

Our initiation note explained SHRS’s policy of maintaining a preference share portfolio financed by a combination of debt and equity (see page 5 of that note). This generates income, giving the manager the freedom to hold some lower-yielding but higher-growth stocks while paying an attractive level of dividend, without converting capital into income by paying out more than it earns. Figure 6 shows how this works in practice. The value of SHRS’s preference shares is higher than its debt, leaving the equity portfolio effectively ungeared.

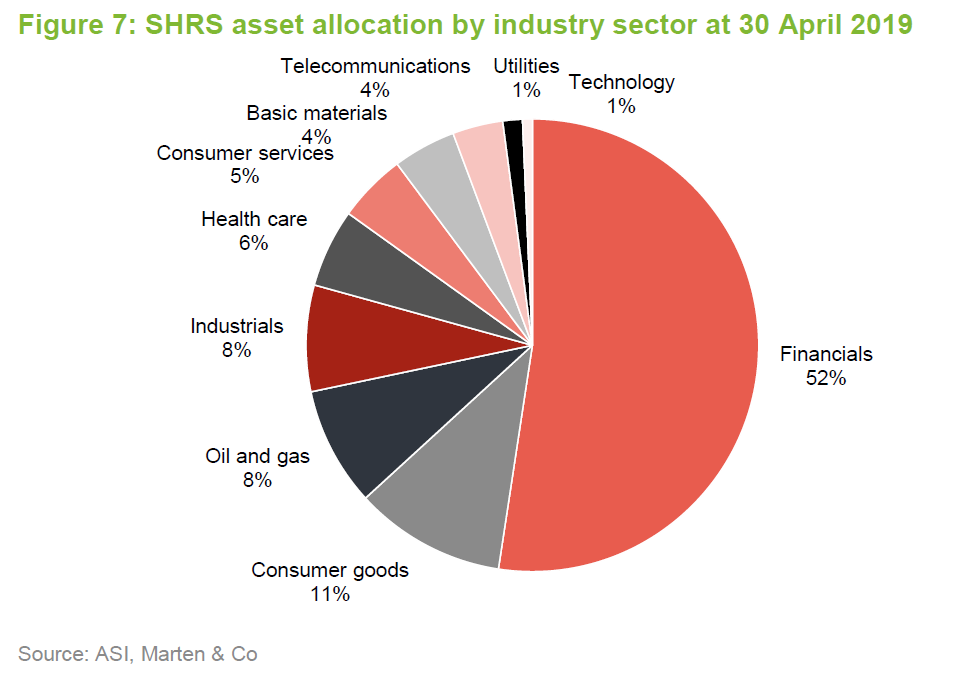

SHRS had 52 investments at the end of April 2019. The distribution of the portfolio by sector shown in Figure 7 is distorted because both Aberdeen Smaller Companies Income Trust (ASCIT), which gives exposure to a diverse portfolio of smaller companies, and the company’s holdings in preference shares have been classified under financials. Sector allocations are driven by stock selection decisions.

Top 10 holdings

Top 10 holdings

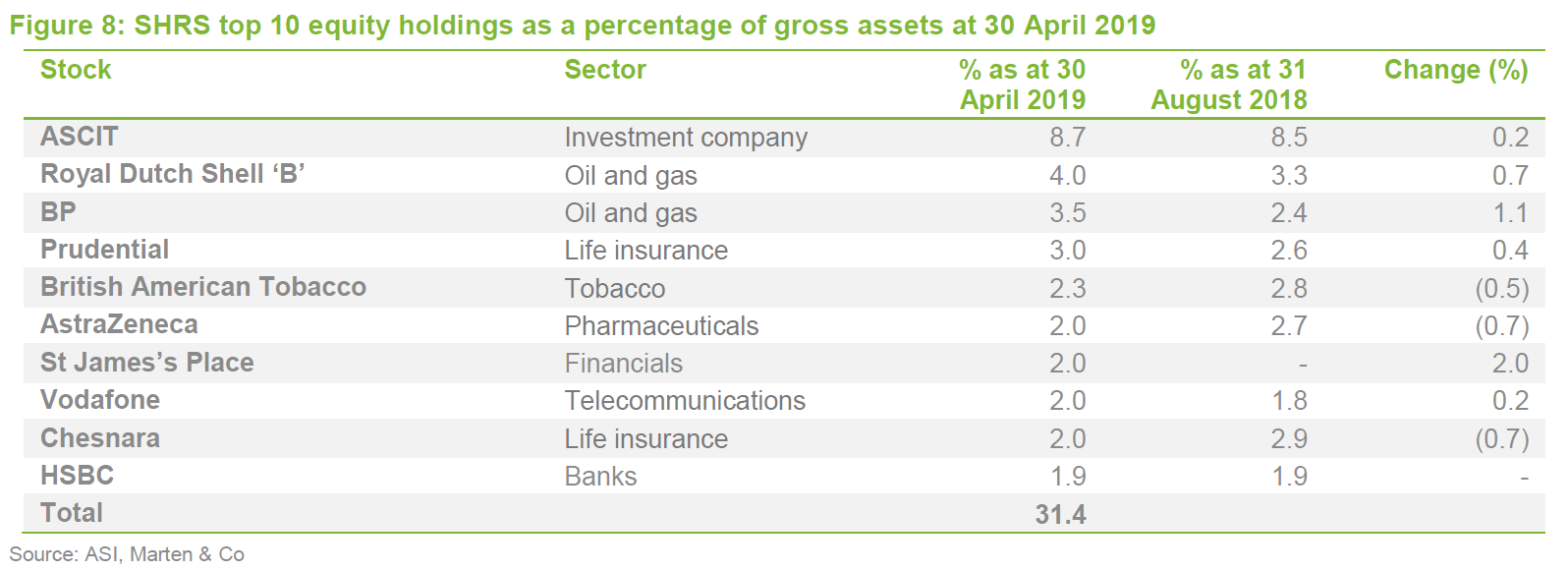

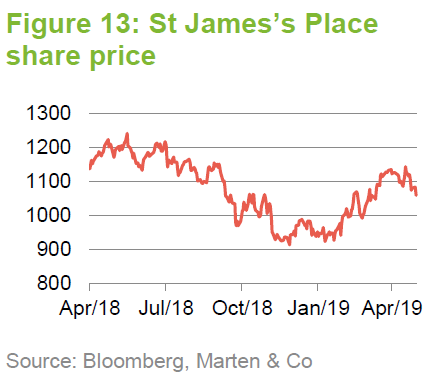

There have been a few minor changes to the composition of SHRS’s list of top 10 equity holdings since our initiation note in October 2018, which used data as at the end of August 2018. GlaxoSmithKline, and BHP Billiton have dropped out and Vodafone and St James’s Place have replaced them. Largely, this is a reflection of market movements, although St James’s Place is a new holding (see below). There has been no change to the composition of the preference share portfolio.

With the exception of the Balfour Beatty convertible, none of the securities listed in Figure 9 has a fixed redemption date.

New additions to the portfolio

New additions to the portfolio

The manager has made a few new additions to the portfolio since our last note was published. These include:

Abcam

Abcam

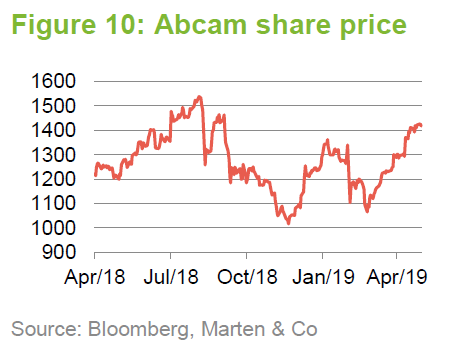

Abcam (www.abcam.com) makes and distributes antibodies used in research, drug development and increasingly, diagnostic applications. It trades on a fairly low yield (currently 0.9%) but is capable, in Iain’s view, of 20% dividend growth. Iain believes it has a defensive business model, based on dominant market shares in its chosen markets (a 15% market share overall), which gives it pricing power. Given the quality of the business, it tends to trade on a fairly high multiple of earnings. Abcam has been investing in its business and this has depressed profits, with the reaction of short-term investors to this creating an opportunity for SHRS. The position was acquired on a multiple of about 32x price/earnings, but this was cheap relative to history. This is a good example of the benefits of being able to buy some relatively low-yielding stocks because of the income provided by the preference share portfolio.

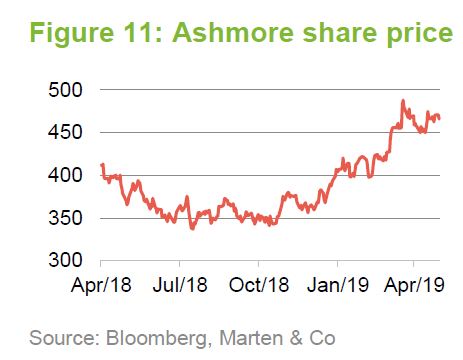

Ashmore

Ashmore

Ashmore (www.ashmoregroup.com) is a fund management company focused on emerging market debt. Iain says that he is usually wary of asset managers, which act as leveraged plays on markets. The attraction with Ashmore was its valuation (which the manager believes was depressed on the back of concerns about the US/China trade war); a sticky client base; decent performance for Ashmore’s funds; and a belief that emerging market debt as an asset class looks like good value. This latter stance is shared elsewhere within ASI. Emerging market currencies have been affected adversely by rising US interest rates. They should strengthen if US rates have plateaued. Iain says that the stock was acquired on a yield of 4% and it has the balance sheet strength to return more to shareholders if it chooses.

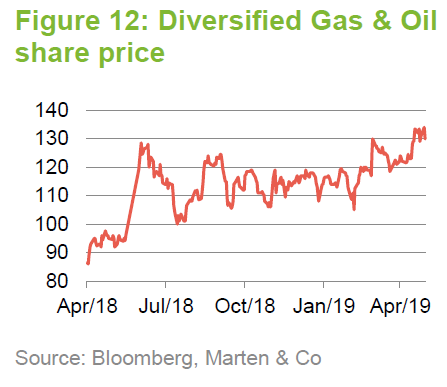

Diversified Gas & Oil

Diversified Gas & Oil

The unpredictable nature of returns generated by oil and gas exploration and production companies tends to mean that they do not feature in SHRS’s portfolio. However, Diversified Gas & Oil’s business (www.dgoc.com) is different. It buys mature wells (focused on the eastern US) producing gas. Some of these wells need some remedial capital expenditure to improve flow levels but generally this is a cash flow positive business. A recent transaction has the potential, in Iain’s view, to drive its dividend yield to 10%. Whilst Iain has an aversion to taking on commodity risk, Diversified Gas & Oil is exposed to gas prices. Considerable supply means that these are already muted. The company hedges between 60% and 80% of production and has no oil price exposure.

St James’s Place Wealth Management

St James’s Place Wealth Management

St James’s Place (www.sjp.co.uk) has a track record of 27% compound annual growth in its dividend over the past 10 years. Iain says it is good at what it does, allowing advisers the freedom to be entrepreneurial, but within St James’s Place’s compliance structure. The company’s pricing model has its detractors, but Iain points out that this is fully disclosed and the business has high client retention rates. The ongoing shift from defined benefit to defined contribution pensions and increasing regulation on financial advisers helps to underpin its growth.

Disposals

Disposals

Generally, the stocks that have exited the portfolio are ones that performed well and consequently were trading on high multiples. Examples include the industrial flow control company, Rotork, and Aveva, a provider of engineering and industrial software. Iain makes the point that investors were perceiving these as low-risk investments. This makes their share prices vulnerable to any disappointment.

Performance

Performance

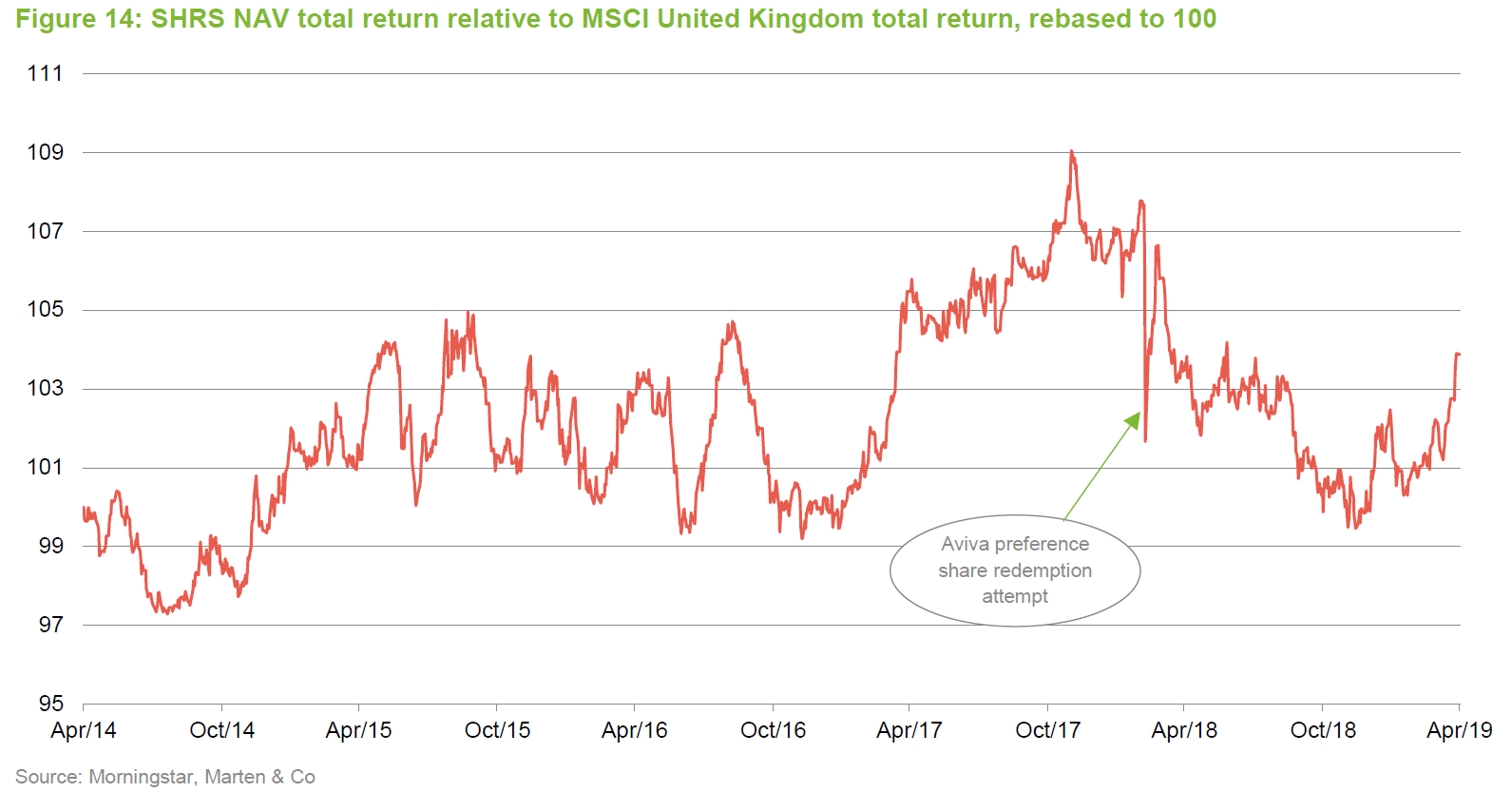

As Figures 14 and 15 show, whilst SHRS has faced some performance headwinds over the course of 2018 – chiefly in the form of investors’ preference for growth stocks and Brexit-related nervousness – it has delivered total returns ahead of the MSCI UK Index over longer periods, notably the past five years, and has done well in 2019.

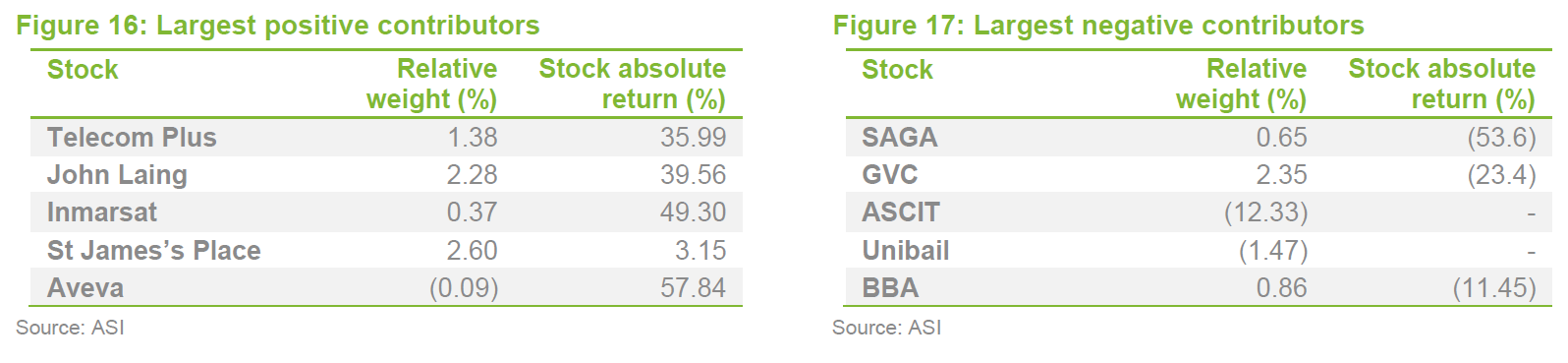

Figures 16 and 17 show the largest positive and negative contributors to SHRS’s performance relative to its benchmark over the year to the end of April 2019, at a stock level. In terms of SHRS’s industry sector allocation, its underweight exposure to oil and gas held it back as the oil price recovered.

Some positives

Some positives

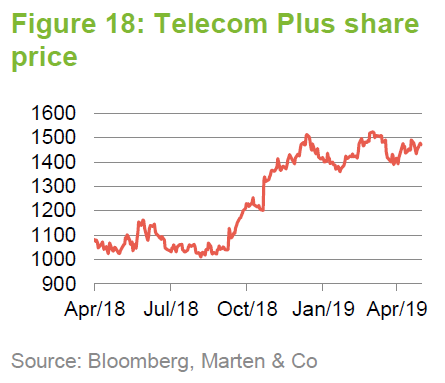

Telecom Plus, the multi-utility (gas, electricity, landline, broadband and mobile) supplier, which owns the utility warehouse website (www.utilitywarehouse.co.uk), has been trading well and taking market share from its competitors. A trading update for the year to the end of March 2019 showed a 4% growth in its customer numbers and modest (3.1%) growth in its projected profit for the year (as warm weather and the Ofgem price cap weighed on gas and electricity revenue).

John Laing builds, operates and invests in infrastructure. It has a portfolio of infrastructure assets that it has built up over the years. It was trading at a discount to its net asset value, but following a bid for John Laing Infrastructure Fund (a separate company), its shares re-rated and it now trades at a small premium. Inmarsat was bid for by a consortium of private equity funds. Aveva has successfully integrated its acquisition of the Schneider Electric industrial software business and has been generating good organic growth. BHP benefited from a $10.5bn sale of its US shale assets to BP. Not holding Glencore proved beneficial over the year to the end of February and a recently announced investigation into its commodity trading business will have reinforced this since then.

Some negatives

Some negatives

In April, SAGA’s results disappointed the market and its share price halved.

GVC owns a range of betting websites including Sportingbet and bwin. The manager says that a frustrating weight of regulation on the online gambling sector has dragged its share price back. Nevertheless, the company is still seeing strong growth and pays a high yield. The CEO sold 75% of his holding, which is unhelpful for sentiment towards the company, but Iain sees no obvious reason why this has happened; SHRS is holding onto its position.

Small cap stocks have been lagging larger ones and, in addition, ASCIT’s discount widened and is now around 15%.

Unibail, which merged with Westfield in 2018, is trading on an attractive yield in excess of 7%. However, retail property exposure is out of favour with investors as the growth of online shopping challenges the shopping centre model.

BBA Aviation’s results disappointed investors as its revenue growth slowed.

Standard Chartered was hit by fines and slowing growth in Asia, linked to the ongoing trade war between China and the US.

Peer group

Peer group

SHRS sits within the AIC’s UK equity income sector. For the purposes of producing this note, we included all the funds in the sector at the end of April 2019 with the exclusion of British & American (which is very highly geared and has an eclectic portfolio).

Figure 15 shows SHRS’s cumulative performance over time period’s ending 30 April 2019 compared with the peer group average. SHRS’s NAV total returns had matched or exceeded the peer group average over every time period.

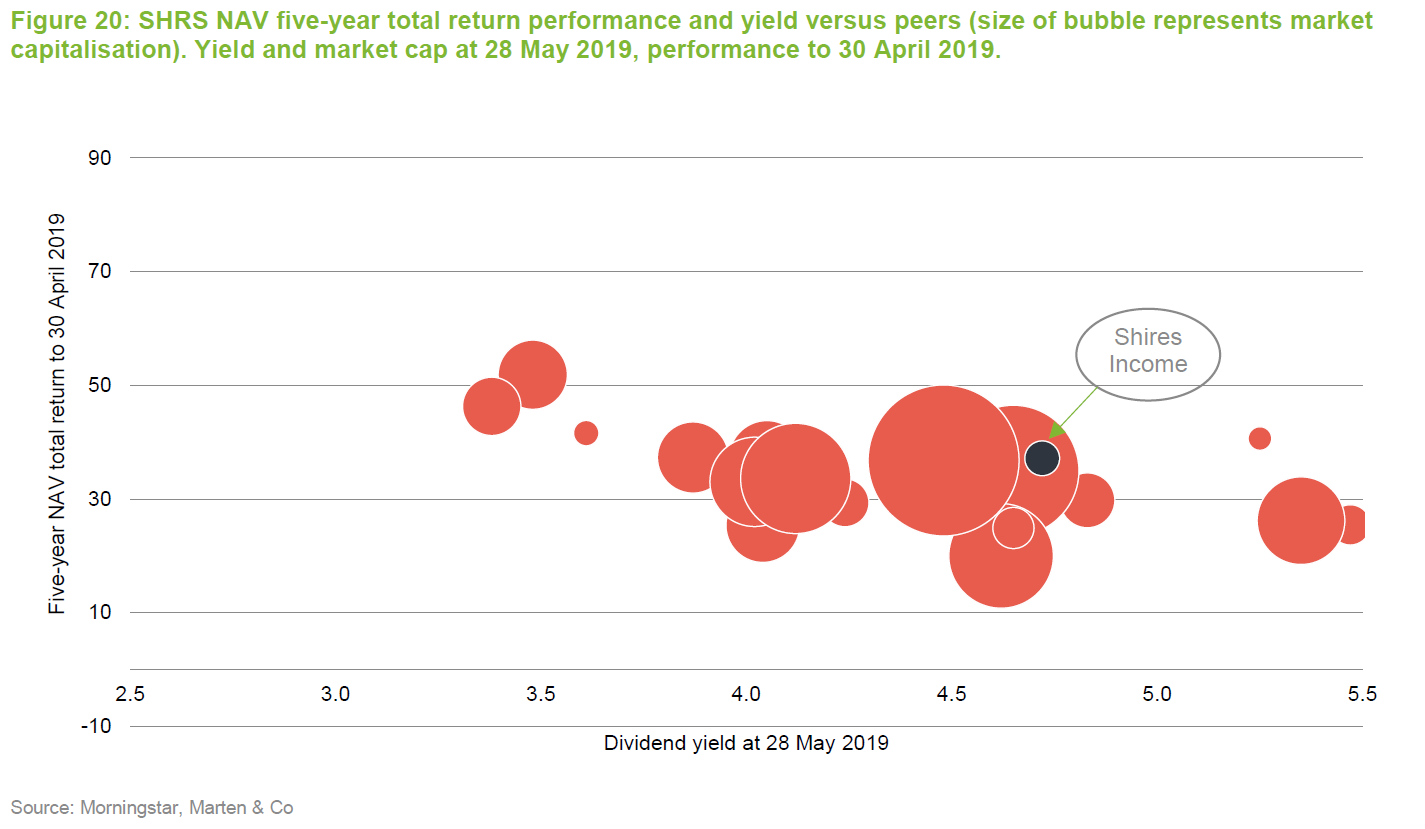

Figure 20 shows how SHRS’s yield and NAV return over five years stack up against the peer group. SHRS is clearly on the small side and, given its attractions (a much higher than average yield coupled with above-average performance), has room to grow.

Premium/(discount)

Premium/(discount)

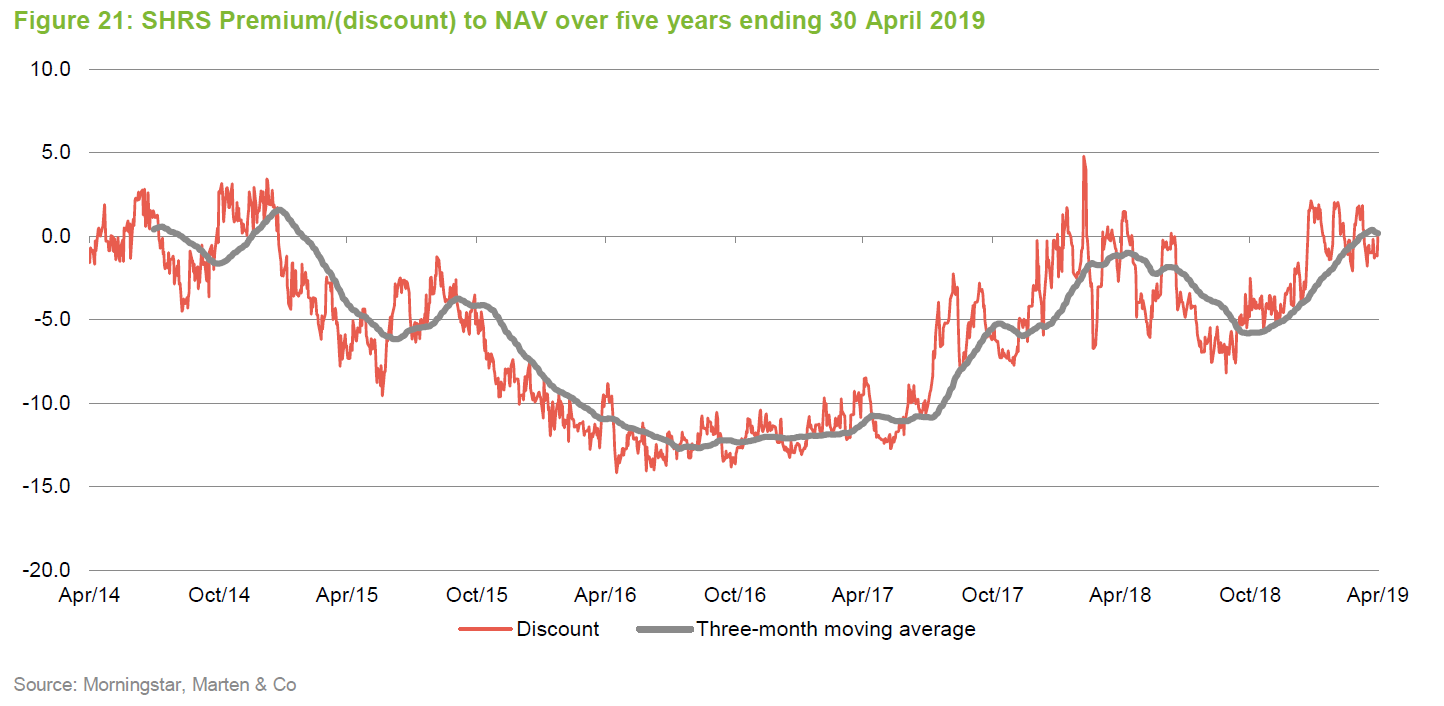

Over the 12 months ended 30 April 2019, SHRS traded within a range of an 8.2% discount to a 2.1% premium and an average discount of 2.1%. At 28 May 2019, the shares were trading at a premium of 2.1%.

Stock issuance

Stock issuance

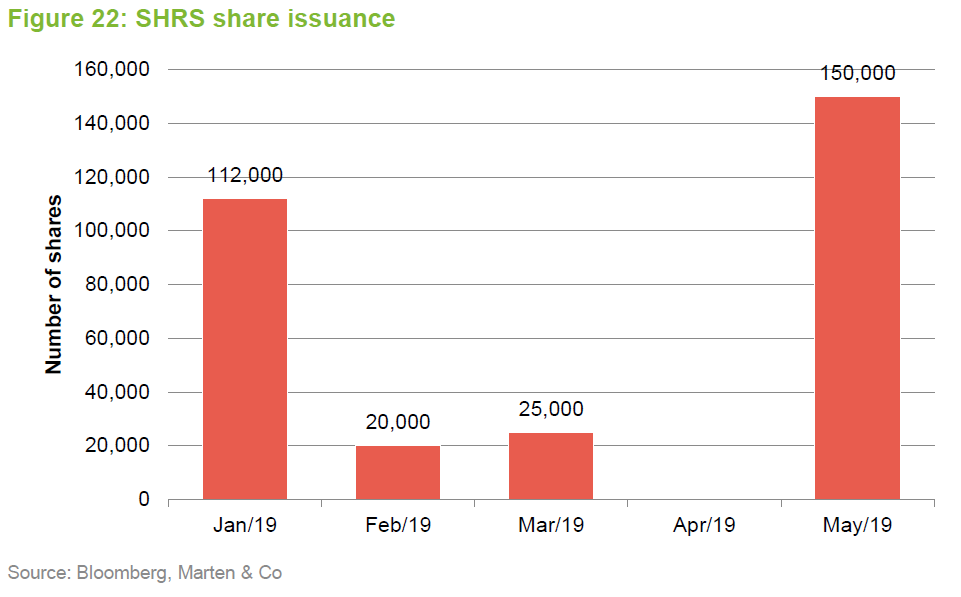

To moderate the premium and expand the trust (which should, all things being equal, bring benefits including increased liquidity and a lower ongoing expense ratio), SHRS has issued 307,000 shares since we published our last note. Prior to this, it last issued shares in 2012. All share issuance is done at a premium to NAV, ensuring that existing shareholders are not diluted. At 28 May 2019, there were 30,304,580 ordinary shares in issue.

Fund profile

Fund profile

SHRS aims to provide its shareholders with a high level of income, together with the potential for growth of both income and capital from a diversified portfolio substantially invested in UK equities but also in preference shares, convertibles and other fixed income securities. The company is benchmarked against the FTSE All-Share Index. We have substituted this with the MSCI UK Index for the purposes of this report.

SHRS generates income primarily from its investments in ordinary shares, convertibles and a geared portfolio of preference shares. It may supplement this by writing call and put options on shares owned by the trust or shares the manager would like to buy.

SHRS’ preference share portfolio is funded, in part, by lower cost debt (effectively, the equity portfolio is ungeared). The income that this arrangement contributes to SHRS’ returns allows the manager to hold some lower yielding equities that offer better prospects for both dividend and capital growth. The pool of income available for distribution is augmented further by writing calls and options. In the past, when interest rates were higher, fixed interest investments and interest on cash deposits would also have made a meaningful contribution to SHRS’ revenue account. This may be the case again if interest rates rise.

SHRS’s manager is Aberdeen Standard Fund Managers Limited which has delegated the day-to-day management of the company to Aberdeen Asset Managers Limited (“Aberdeen” or “the manager”). Both companies are wholly owned subsidiaries of Standard Life Aberdeen Plc. The manager emphasises a team approach to managing money. Since May last year, the lead manager for SHRS has been Iain Pyle. He is also lead portfolio manager for the Standard Life Investments UK Equity High Income Fund and the Bothwell UK Equity Income Fund.

Iain is an investment director on the UK equities team, having joined Standard Life Investments in 2015. Previously, he was an analyst on the top-ranked oil and gas research team at Sanford Bernstein. Iain graduated with a MEng degree in Chemical Engineering from Imperial College and an MSc (Hons) in Operational Research from Warwick Business School. He is a chartered accountant and a CFA charterholder.

The company gains exposure to smaller companies through an investment in Aberdeen Smaller Companies Income Trust Plc (ASCIT). The two companies have no directors in common and the manager does not charge a fee on this portion of the portfolio.

Previous publications

Previous publications

Readers may wish to read our initiation note, Sustainable high yield, published on 19 October 2018. You can read the note by clicking on the link above or by visiting our website.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Shires Income Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.