Aberdeen New Dawn – COVID positive

COVID positive

COVID positive

In common with other Asian-focused trusts, Aberdeen New Dawn (ABD) has recovered the ground it lost in the early stages of the COVID-19-related market fall and moved into positive territory for 2020 (in NAV terms at least). James Thom, ABD’s manager, was able to make some opportunistic purchases for the portfolio as other investors panicked. He is cautiously optimistic as many of Asia’s largest economies are already returning to normal.

Some of the strongest returns of the past few months have come from stocks within an open-ended fund managed by Aberdeen Standard invested in China A shares (the trust’s second-largest holding). Stock selection was the major driver of ABD’s outperformance over the first half of 2020.

Capital growth from Asia Pacific ex Japan

Capital growth from Asia Pacific ex Japan

ABD aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. ABD holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies. ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms).

Asia recuperating

Asia recuperating

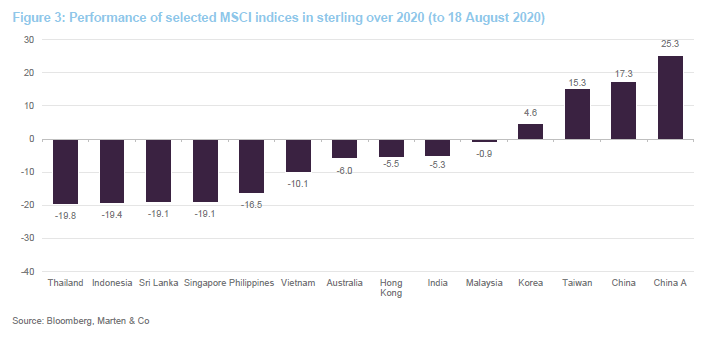

Despite COVID-19, the MSCI AC Asia Pacific ex Japan index, ABD’s performance benchmark, is in positive territory for 2020, having clawed its way back from a low on 19 March 2020.

Whilst all markets have been volatile, there has been quite a high diversification of returns by country over 2020. Returns have been fairly well correlated to success or failure in tackling the spread of COVID-19. The political unrest in Hong Kong and Thailand has held those markets back and smaller markets such as Sri Lanka and Vietnam have been hit by foreign selling. The collapse in the oil price is beneficial for most of these countries (except Malaysia).

Economic activity in China, Taiwan and Korea is returning to normal, although there are restrictions on travel, for example, which are having some impact. Hong Kong, Australia and New Zealand also appear to have handled COVID-19 outbreaks relatively well, although occasional setbacks such as the one that occurred in Melbourne are perhaps likely to flare up from time to time. These countries represent about 80% of ABD’s benchmark index.

China’s domestic, A-share market has performed particularly well. As we discuss on page 5, ABD’s exposure to this area (achieved through an investment in an open-ended fund managed by Aberdeen Standard) has been a big driver of returns. The trust should soon have the ability to invest directly through the Hong Kong Stock Connect facility.

By contrast, countries such as India, Indonesia and Philippines have found it harder to bring the virus under control.

In India, a draconian lockdown proved economically unsustainable. The economy was already struggling in the face of a liquidity squeeze. Banks were understandably risk-averse in the face of slowing growth (GDP growth is estimated to have slowed to 4.2% in FY 2020 from 6.1% in FY 2019 but contracted sharply in the quarter ended 30 June 2020). The lockdown was eased after a few weeks, but cases were rising. James thinks that this first wave of cases in India may not peak for two or three months. The good news is that India’s mortality rate has been relatively low, which could be a demographic effect.

The war of words between the US and China has rumbled on, with TikTok now dominating the headlines rather than Huawei. James notes that there is bipartisan support in the US, for tackling the China trade deficit and other issues around security and human rights. Consequently, the anti-Chinese rhetoric may continue to be a feature if Biden wins in November. James is wary of a possible rollback of pro-market reforms under Biden, which could put pressure on markets globally; he notes that Asian and US markets are fairly well correlated.

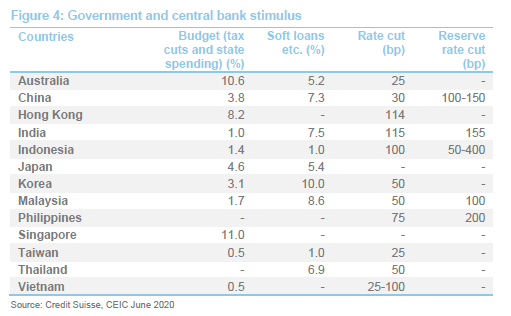

As is evident in Figure 4, many central banks and governments have been deploying significant stimulus and it may be that this is helping to drive the rally in Asian equities. James is cautious on markets after such a strong run, but Asian companies are well capitalised on average. He thinks that, for the region as a whole, valuations, while not compelling, do not look overvalued.

Asset allocation

Asset allocation

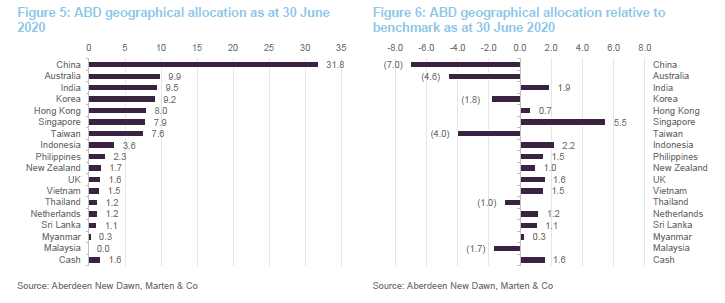

At the start of the year, ABD’s gearing was 9.5%. The level has fallen since then, as the manager has reduced exposure to the market. At the end of June, net gearing was 6.7%.

We would reiterate that, as described in the investment process section of our last note, stock selection drives ABD’s asset allocation. Although the percentage weight in China rose from 27.5% to 31.8% over the first half of 2020, this reflects the relative strength of its stock market during the period. The portfolio retains its underweight exposure to China relative to the benchmark. The allocation to Australia is higher than it was at the start of the year, but the overweight exposure to India has been reduced significantly. The portfolio changes that have driven these moves are described below.

Top 10 holdings

Top 10 holdings

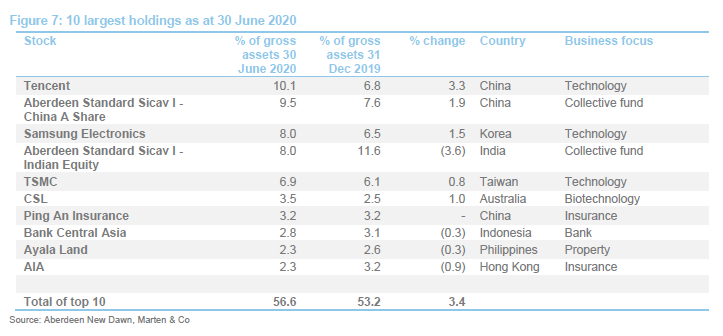

Whilst the constituents of the list of the 10-largest holdings are unchanged from when we last published, ABD’s portfolio has become more focused over the course of 2020. The proportion of the portfolio accounted for by the top 10 holdings rose to 56.6% at the end of June 2020 from 53.2% at the end of 2019, while the overall number of holdings fell to 52 from 54.

The China A share and Indian equity exposures accessed through the two Aberdeen Standard open-ended funds remain an important part of the portfolio, although, as we discuss below, they have experienced contrasting fortunes over the first half of 2020. Tencent has moved into pole position on a combination of strong relative performance and purchases of additional shares.

The manager initiated positions in a few stocks during the market turmoil. These included stocks that he had identified as meeting ABD’s investment criteria but that had previously been too expensive. The market falls brought their valuations down to more attractive levels. He also exited some positions.

Banks

Banks

ABD’s exposure to the banking sector has been reshaped substantially over 2020. HSBC and Standard Chartered have been sold and ABD’s Singaporean bank exposure reduced. The manager felt that their share prices did not reflect the challenges facing the sector (higher default risk, worries about credit quality, falling rates and specific concerns on Hong Kong business as a result of the political strife there).

What would have been a significant underweight to banks and the Chinese banking sector, in particular, has been offset somewhat by the purchase of a small position in China Merchants Bank. The manager feels that this is the highest-quality bank in China. He is attracted to its strong presence in retail banking, its long-term growth trajectory and its digital presence. Its valuation was more reasonable, too.

Some new additions to the portfolio

Some new additions to the portfolio

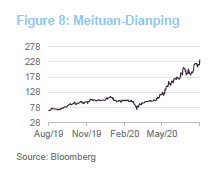

Meituan-Dianping is the Chinese equivalent of Deliveroo, except Meituan is a much larger business (serving 448.6m users over the 12 months ended 31 March 2020). The company started making profits last year, but has slipped back into lossmaking territory in the face of COVID-19. The manager is therefore cautious, but was attracted by Meituan’s market-leading position and took advantage of weak markets to buy a relatively small position for ABD.

In Meituan’s quarterly figures covering the first three months of 2020, revenue fell by 12.6% as COVID-19 lockdown measures impacted on the company. Meituan also has an in-store dining, hotel and travel business, and this business was hit particularly hard. The company is encouraged by the numbers of restaurants signing up to its service. It also sees great potential from additional services that it is rolling out including home grocery deliveries.

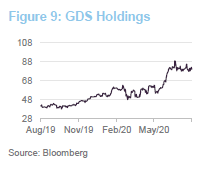

Another new purchase in China was GDS Holdings, a data centre company and a beneficiary of the growth in cloud computing. The strength of this growth is reflected in GDS’s 39% year-on-year increase in net revenue for the quarter ending 31 March 2020. GDS is investing heavily in expanding its business, with over 110,000sqm of space under construction at the end of March 2020 compared to 230,000sqm of operational space at that date.

Like Meituan, GDS is loss-making, but it has substantial cash reserves and profitability should flow through as utilisation rates rise.

James made a number of new additions to ABD’s Australasian exposure. These included two software-as-a-service (SaaS) businesses – Altium and Xero. Altium’s software facilitates the design of printed circuit boards and component management. Xero is a cloud-based accounting package. James notes that the shift to cloud computing is allowing SaaS businesses, such as these, to expand globally without heavy investment in manpower and physical infrastructure.

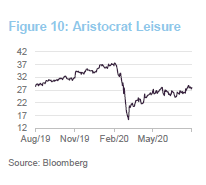

Aristocrat Leisure is a gaming machinery company supplying slot machines and casino management systems globally. It was a company that the team had been following for a while, but it had been too expensive. James was able to buy a stake for ABD in the general market sell-off. The company is strongly cash-generative and has been investing in its business. COVID-19 has put pressure on revenue from casinos, but an increasing proportion of its sales relate to online gaming products and it also has a growing presence in social/casual gaming (no betting element).

Another new stock is Auckland International Airport. Its shares have fallen sharply on COVID-19 restrictions on international travel to New Zealand. However, ahead of the outbreak, this was a highly profitable and fairly well-capitalised company. There is no indication of when New Zealand will reopen its borders.

Disposals

Disposals

ABD’s small position in Woodside Petroleum has been sold. The manager’s conviction towards the stock was already waning when the oil price collapsed. He felt that the company was bound to slash capex, compromising its long-term growth.

Another stock that has been sold is Huazhu Hotels Group. Lockdowns have hit its business, which is now starting to recover but is still running behind levels of 2019. Both rates and occupancy fell sharply.

Performance

Performance

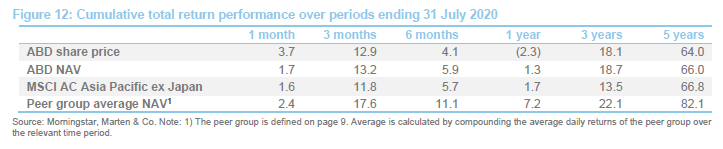

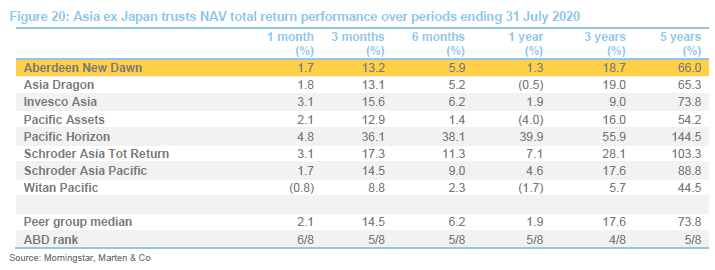

Whilst ABD slipped slightly behind its benchmark over the 12 months ended 31 July 2020, the actions that the manager took to pick up attractively valued stocks, in the depths of the market falls, appear to be paying off.

The peer group average has outpaced ABD in recent months as a couple of competitors have much larger exposures to the region’s technology giants, which have been hitting new highs and trade on increasingly stretched valuation multiples.

As ABD’s discount widened, its share price returns fell behind its NAV returns. As we discuss on page 10, the discount looks too wide to us and we could see this reverse.

Performance attribution

Performance attribution

The manager supplied us with some performance attribution data that shows the contributions to ABD’s returns, relative to the benchmark, over the six months ended 30 June 2020.

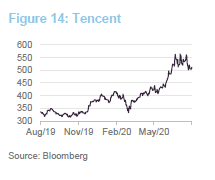

Tencent, which we discussed in our last note, is another stock that James added to when markets were nervous, and it is now one of the highest-conviction positions in the portfolio. The stock has soared since the market turned in March, up over 50% from its low.

The strong performance of China’s domestic stock market has been captured by the dedicated Aberdeen Standard fund, which beat its benchmark over the first half of 2020. James has taken some profits for ABD but retains his conviction in the strength of the stock picking by the managers of the underlying portfolios.

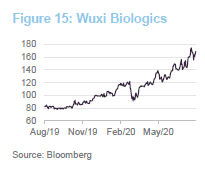

WuXi Biologics recently published a positive profits warning – telling investors that its profit for the first half of 2020 would be more than 58% ahead of last year. Work that it is doing to tackle COVID-19 is contributing to this. The company assists biotech companies with the discovery, development and manufacture of biologics. At the end of December 2019, it was working on 121 pre-clinical projects, 112 projects in early (phase I and II) clinical trials and 16 projects in Phase III. It also had a project on commercial manufacturing of an approved drug.

It has operations in the US, Ireland, Germany and Singapore in addition to China, and has received EMA and FDA approval for its Chinese facilities.

Samsung Electronics’ core semiconductor markets are doing well. COVID-19-related working from home is helping to drive sales of hardware. Memory prices are firm and volumes are rising.

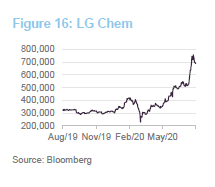

LG Chem is a Korean company. Its petrochemicals operations produce a wide range of products such as ethylene and propylene, and the cyclicality of this business would normally exclude it from ABD’s portfolio. That division has also some higher growth elements to it, such as the production of carbon nanotubes.

However, for James, the key attraction of LG chem is its battery business – used in devices from smartphones to cars, and increasingly in energy storage systems. TESLA has been sourcing batteries from both LG Chem and Samsung SDI as it seeks to diversify its battery supply beyond Panasonic. LG Chem has been supplying batteries from its Nanjing plant to TESLA’s Shanghai Gigafactory.

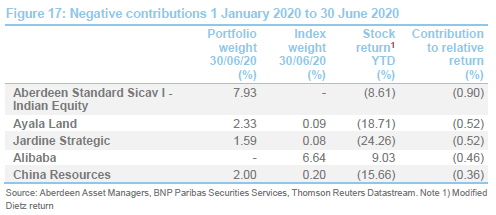

We discussed India’s woes on page 3. Aberdeen Standard Sicav I – Indian Equity was ABD’s largest holding. James has reduced the position but maintained a roughly 2% overweight exposure relative to ABD’s benchmark. The fund has outperformed its benchmark (by 123bp over H1) but still fell in absolute terms.

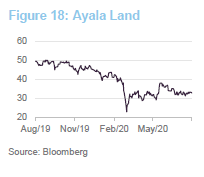

The Philippines’ and Indonesia’s struggles with COVID have affected both Ayala Land and Jardine Strategic. Ayala Land has seen a sharp drop in revenue and earnings since the crisis started but it has a solid balance sheet, which gives James the comfort to maintain the position. Jardine Strategic is exposed to Indonesia through its significant investment in Astra. Jardine also has a large investment in Hongkong Land, which has been hit hard by the political unrest in the city (which has also affected China Resources). Given that, James has been reducing this position.

Not holding Chinese tech giants such as Alibaba and JD.com has cost ABD in relative performance terms.

Peer group

Peer group

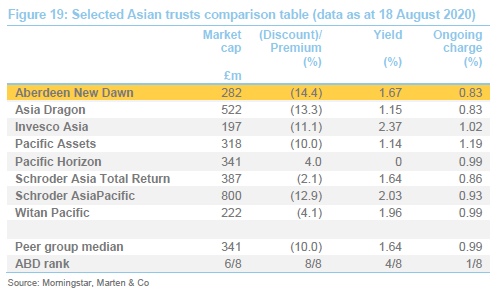

For comparison purposes, we have used a subset of funds in the AIC’s Asia Pacific sector. We have excluded All Active Asset Capital due to both its small size and the tightly held nature of its shares.

Each of the trusts in the peer group is a reasonable size. ABD trades on the widest discount currently, a situation that we find hard to justify, as we discuss on page 10. Yield is not a focus for these funds (there is a separate Asia Pacific Income sector). It is notable that ABD and its stablemate Asia Dragon have the lowest ongoing charges ratios of any of the funds in this peer group.

Pacific Horizon has had a strong run on the back of its overweight exposure to the technology sector; the same is true, but to a lesser extent, of the two Schroder trusts. Witan Pacific looks set to adopt a China-focused strategy, which would exclude it from this peer group in future reports.

Premium/(discount)

Premium/(discount)

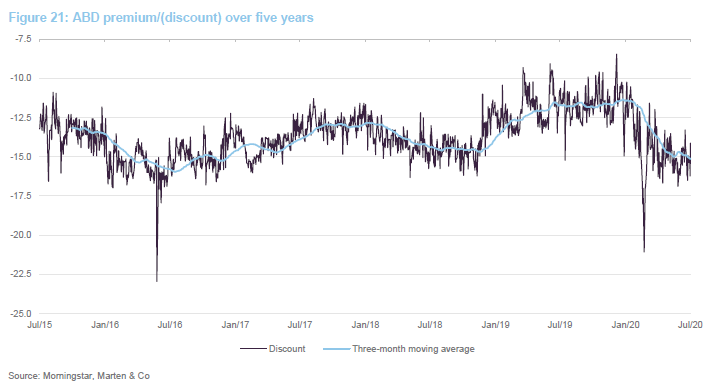

Over the year ended 31 July 2020, ABD’s discount has moved within a range of 21.1% to 8.5% and has averaged 13.3%. At 18 August 2020, ABD was trading at a discount of 14.4%.

The brief spike in the discount when markets were panicking in March was common to most trusts and might have been expected. Less obvious is the cause of ABD’s discount widening in recent weeks. ABD is, as is shown on page 9, the most attractively valued of the funds in its peer group; yet its solid performance record is more middle-of-the-pack. ABD has been using its share buyback powers. We would expect this discount anomaly to correct itself in time.

Fund profile

Fund profile

Aberdeen New Dawn (ABD) aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. ABD holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies. Investments may also be made through collective investment schemes and in companies traded on stock markets outside the Asia Pacific region, provided that over 75% of their consolidated revenue is earned from trading in the Asia Pacific region or they hold more than 75% of their consolidated net assets in the Asia Pacific region.

ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms). We have also included comparisons against the MSCI AC Asia ex Japan index, the MSCI AC World Index and its peer group within this report.

The manager is Aberdeen Standard Fund Managers Limited, which has delegated the investment management of the company to Aberdeen Standard Investments (Asia) Limited (Aberdeen or the manager). Both companies are wholly-owned subsidiaries of Standard Life Aberdeen Plc.

Previous publications

Previous publications

Readers interested in further information about ABD may wish to read our previous notes (details are provided in Figure 22 below). You can read the notes by clicking on them in Figure 22 or by visiting our website.

The legal bit

The legal bit

This marketing communication has been prepared for Shires Income Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.