Aberdeen New Dawn – Illuminating value

Illuminating value

Illuminating value

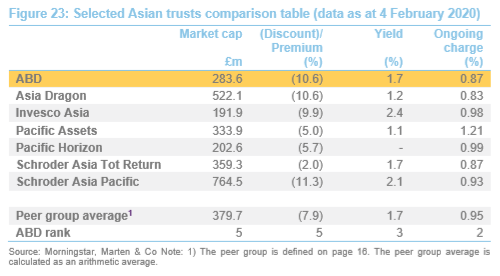

Aberdeen New Dawn (ABD) has provided peer-group-beating performance during 2019 (an NAV total return of 18.4% versus a peer group average of 15.2%). Despite this, and also despite offering one of the lowest ongoing charges ratios amongst its peers, the discount remains broadly unchanged and is still, peculiarly, one of the widest in the sector (ABD is trading on a discount of 10.6% versus a sector average of 7.9%).

The manager has shifted its approach to investing in China, giving it greater flexibility to allocate more to direct Chinese stocks, and the trust has benefitted strongly, as China A shares have performed well during the last 12 months. Assuming that the manager continues to provide an attractive level of performance, relative to peers, we would expect that ABD’s discount should narrow towards the peer group average, and possibly beyond, providing an additional source of return for the patient investor.

Capital growth from Asia Pacific ex Japan

Capital growth from Asia Pacific ex Japan

ABD aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. ABD holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies. ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms).

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI AC Asia Pacific ex-Japan TR. (%) | MSCI AC Asia ex-Japan TR (%) | MSCI AC World total return (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Jan 2016 | 42.90 | 34.80 | 24.80 | 26.40 | 20.20 |

| 2 | 31 Jan 2017 | -11.60 | -3.10 | -4.10 | -5.90 | -1.50 |

| 3 | 31 Jan 2018 | 26.80 | 17.60 | 13.70 | 12.10 | 14.90 |

| 4 | 31 Jan 2019 | -18.30 | -12.10 | -7.50 | -6.80 | 9.30 |

| 5 | 31 Jan 2020 | 22.00 | 20.30 | 20.60 | 24.10 | 17.50 |

Market outlook

Market outlook

Recent history and valuations

Recent history and valuations

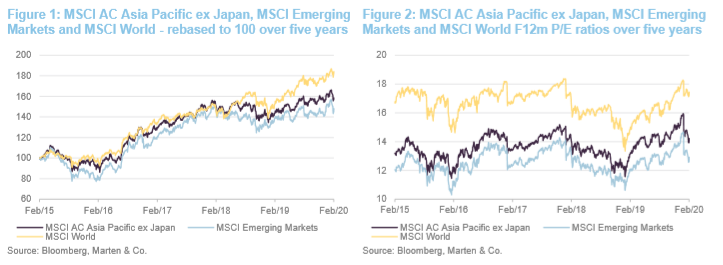

As illustrated in Figure 1, the Asian (as represented by the MSCI AC Asia Pacific ex Japan Index), emerging (as represented by the MSCI Emerging Markets Index) and global equity markets more generally (as represented by the MSCI World Index) have provided strong absolute returns during the last four years. This period has generally been good for equity markets, albeit with the occasional wobble, as the global economy continued on its path of expansion.

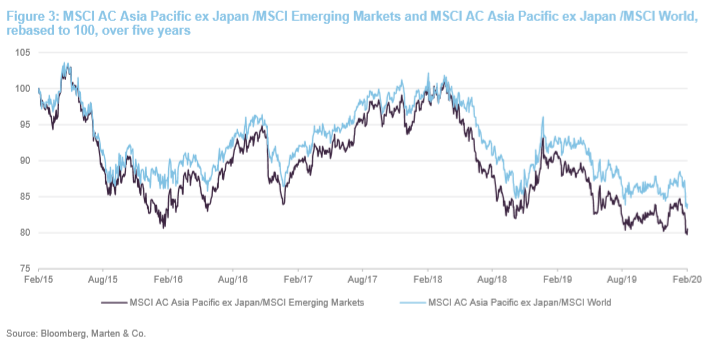

Global markets have been very macro-driven during the past few years, with top-down macroeconomic considerations frequently outweighing company fundamentals. There is some evidence of this in Figure 2, which shows distinct movements in valuations. Markets have continued to make progress, although whilst concerns of a global recession appear to have eased for now, the global economic cycle is advanced, with many economies showing signs of slowing down. Asian markets, with additional concerns of trade wars and sensitivity to currency movements against the US dollar, have not been immune to this.

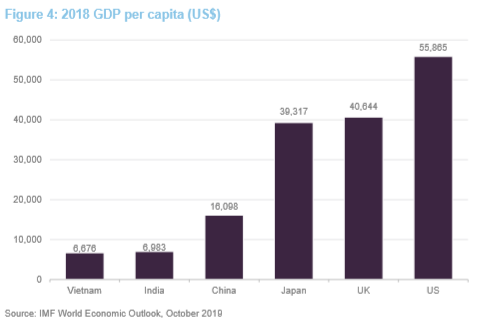

As illustrated in Figure 3, during the last five years, Asian markets have underperformed both emerging and developed global markets. Asian markets broadly held their own against emerging markets until around the end of March 2018, but have steadily underperformed since, barring a run of outperformance between October 2018 and January 2019.

There had been signs of stabilisation, and even modest improvement, during the last six months, as geopolitical concerns around the trade war between the US and China eased. However, in recent days, concerns over the impact of the coronavirus have triggered a further leg down. As is illustrated in Figure 2, Asian equities have tended to trade at a premium to broader emerging markets but at a discount to broader global equities. However, within the Asian basket, there is significant variation. For example, Vietnam – generally considered to be a higher growth market – commands a valuation premium.

As illustrated in Figure 2, valuations for Asian markets, emerging markets and global equities were, until recently, trading close to five-year highs. Following the recent fall, all of them are noticeably cheaper than they have been. For example, as at 4 February 2020, the MSCI AC Asia Pacific ex-Japan Index was trading at a F12m P/e of 14.2x. This is markedly below its five-year high of 15.9x and reasonably close to its five-year average of 13.7x. A similar pattern is seen for both broader emerging markets and global equities.

Asia – strong GDP per capita catch-up potential

Asia – strong GDP per capita catch-up potential

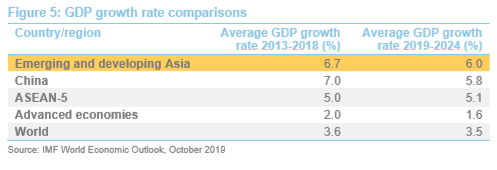

Figure 4 provides a sample of Asian economies’ GDP per capita versus those in more developed markets, even China – which is at the top end of the emerging scale – is around 40% of that of Japan and the UK, and around 29% of that of the US. This illustrates that Asian economies offer significant catch-up potential.

The IMF’s World Economic Outlook for October 2019 forecasts average annual growth for emerging and developing Asia for the period 2019–2024 of 6.0%. This is in excess of China’s, above the average of ASEAN peer group and significantly above world and developed market averages.

Fund profile

Fund profile

Aberdeen New Dawn (ABD) aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. ABD holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies. Investments may also be made through collective investment schemes and in companies traded on stock markets outside the Asia Pacific region, provided that over 75% of their consolidated revenue is earned from trading in the Asia Pacific region or they hold more than 75% of their consolidated net assets in the Asia Pacific region.

ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms). We have also included comparisons against the MSCI AC Asia ex Japan index, the MSCI AC World Index and its peer group within this report.

The manager is Aberdeen Standard Fund Managers Limited, which has delegated the investment management of the company to Aberdeen Standard Investments (Asia) Limited (Aberdeen or the manager). Both companies are wholly owned subsidiaries of Standard Life Aberdeen Plc. At the end of June 2019, Standard Life Aberdeen’s Asia Pacific equities business had AUM of $29.6bn.

As we explain later, Aberdeen’s approach is to manage money using a team approach. We met James Thom, a senior investment manager in the team, for the purposes of preparing this note.

Manager’s view

Manager’s view

Trade war – phase 1 signing provides near term clarity

Trade war – phase 1 signing provides near term clarity

During 2019, the primary factor influencing sentiment towards Asian markets was the ongoing trade war between the US and China. The signing of the phase one trade agreement is now complete (the US has agreed to remove some tariffs and, in exchange, China has agreed to increase its purchases of US farm goods), thereby avoiding another round of tariffs in the near term, and providing some clarity. However, the hiatus will probably be temporary and there will likely be further shifts in sentiment as this year progresses.

Asian central banks are following the Fed

Asian central banks are following the Fed

Asian central banks have generally been following the Fed and cutting interest rates. Changes have been modest and mildly expansionary, helping to offset the effects of a strong US dollar (it is noteworthy that interest rates in Asia are typically much higher than they are in the US, and Asian central banks therefore have a lot more room to cut). James notes that, while interest rate cuts are a mild negative for Asian banks, they are generally beneficial to other areas of the economy.

This is also helping to stabilise Asian currencies. From a funds flow perspective, a stronger US dollar draws cashflows from Asian and emerging markets, depressing the value of their currencies. Having seen a marked strengthening of the US dollar, versus Asian currencies, during the first eight months of 2019, there has been a marked reversal during the last four months.

Election outcomes broadly positive

Election outcomes broadly positive

2019 was a year that saw a number of significant elections (for example, in India and Indonesia). Inevitably, there was considerable market uncertainty in the run-up to these, but governments have generally returned with reform-minded agendas, which have bolstered confidence.

Asian economies are generally in good health

Asian economies are generally in good health

The manager considers that Asia is generally still in good economic health, balance sheets are relatively strong, valuations are undemanding and the manager is expecting reasonable earnings growth this year. As noted above, geopolitical concerns – such as the trade war – are expected to lead to market volatility. More recently the outbreak of the coronavirus is creating considerable uncertainty in the region and is having a tangible impact on the real economy, particularly in China. The Manager is tracking the short-term impact of this on corporate earnings and markets closely, but remains confident than the long-term macroeconomic fundamentals remain supportive.

Reducing Hong Kong in favour of mainland China

Reducing Hong Kong in favour of mainland China

ABD’s manager, James Thom, has been reducing the trust’s exposure to Hong Kong and has mostly recycled the proceeds into mainland China. This has been a steady evolution. Hong Kong has been a tough market, weighed down by negative sentiment in relation to the anti-government protests, and, with no immediate resolution in sight, there remains significant downside risk, though James thinks that the market may be starting to overshoot, potentially creating opportunities in the future. In the meantime, he has shifted ABD’s Hong Kong exposure so that it now comprises companies that are listed in Hong Kong, but whose revenue drivers are elsewhere.

James says that, despite slowing growth and the trade dispute with the US, which have weighed on sentiment towards China during 2019, it is still possible to make very good returns. The key is to focus on long-term structural growth stories while simultaneously avoiding stocks that are particularly exposed to trade related issues. James considers that China is still a very attractive market, with major growth opportunities. China A-shares performed strongly during 2019 and ABD has benefitted from this increased exposure.

India – a challenging market during 2019

India – a challenging market during 2019

As discussed in the performance section of this note, India has been one of the most challenging markets during the last 12 months (ABD has a significant allocation to India through its holding in Aberdeen Standard Sicav I – Indian Equity). A significant contributor to weakness in India’s economy and its stock market has been a liquidity crisis, born out of ill-disciplined lending practices. Specifically, India’s stock market fell sharply following the September 2018 default of Infrastructure Leasing and Finance Services (IL&FS), an AAA-rated, unlisted infrastructure finance company with a $13bn loan book and 349 subsidiaries across India.

Concerned about the potential danger of contagion, India’s central bank (the RBI) pumped liquidity into the system (it also cut rates four times this year). Markets recovered and investor attention moved onto the upcoming election, but the liquidity challenges facing the non-bank financial and housing finance companies continued to overshadow the economy. The difficulty of obtaining borrowing and general adverse sentiment created a cascade effect, causing growth to slow. This has impacted real estate, SMEs and finally the consumer.

Malaysia – zero exposure; poor macroeconomic backdrop, risk-reward not compelling at the moment

Malaysia – zero exposure; poor macroeconomic backdrop, risk-reward not compelling at the moment

As at end of December 0219, ABD’s portfolio had zero exposure to Malaysia. Fuelled by a poor macroeconomic backdrop (Malaysia, along with other markets in the region, has suffered from the US-China trade war, but it is also burdened by a very large debt pile left behind by its former government), James says that he is finding this market very difficult. ABD’s portfolio has previously held both CIMB Bank and Public Bank, but these have since been disposed of in their entirety. He says that there is a dearth of opportunities and the risk-reward ratio for prospective portfolio candidates is not compelling at the moment.

Singapore – teetering on the edge of recession

Singapore – teetering on the edge of recession

Singapore, a small and highly open economy that is generally seen as a bellwether for global growth (it has one of the highest trade-to-GDP ratios globally), has had a tough year. Technically, it has just managed to avoid a recession (its economy grew by 0.6% in Q3 2019, having fallen 3.3% in the previous quarter), but confidence is low and the government is reportedly ready to enact stimulus measures if needed, having already taken steps to stabilise the property market.

James does not find the market particularly exciting at the moment. He continues to like the banks, which he considers to be high-quality, although he has been reducing ABD’s exposure to these slightly (the shift to lower interest rates is feeding through and loan growth has slowed).

Vietnam – bucking the growth trend

Vietnam – bucking the growth trend

We have previously discussed how James has been increasing ABD’s exposure to Vietnam, which he describes as a very exciting growth market. Vietnamese equities have tended to trade at a premium to both global markets and emerging Asia, arguably reflecting its superior growth opportunities.

Looking at Vietnam’s longer-term growth drivers, its GDP per capita is a little below India’s, around 40% of China’s, and significantly below that of more developed nations.

This gives it significant catch-up potential. Relative to many of its Asian peers, Vietnam benefits from a large and youthful population, a relatively well-educated workforce, a high employment to population ratio, a stable socio-political backdrop and high internet penetration. It also increasingly opening up its economy, is well positioned as a manufacturing hub in Asia, has good diversification in terms of trade partners and its capital markets have been on a path of development in recent years.

Australia – an increasingly interesting market

Australia – an increasingly interesting market

ABD’s portfolio is relatively light in terms of its exposure to Australia. Its stock market has provided a strong run of performance during the last 12 months, much of which has been driven by multiple expansion. Despite the devastating impact of the wildfires, investor confidence appears to be undented and the market’s P/E is close to or at a three-year high. However, James says that there are an increasing number of interesting opportunities in the market, which he may consider making an allocation to when valuations are more attractive.

Investment process

Investment process

ABD’s portfolio is managed by ASI’s Asian equities team. There was very little impact on the makeup of the team following the merger between Aberdeen Asset Management and Standard Life that formed Standard Life Aberdeen. However, there is an increased emphasis on individual team members having responsibility for researching a specific sector rather than managing research along geographic lines.

Stock selection is key to portfolio construction but thematic insights (such as technological developments) and structural changes to industries influence stock selection. The core tenets of the Aberdeen approach to managing money are as follows:

• a, long-term, buy and hold strategy;

• a research-intensive process with an emphasis on meeting management; and

• a bias towards high-quality companies (where quality is determined by an assessment of management, business focus, the health of the balance sheet and corporate governance).

A preference for and the promotion of good corporate governance is an important part of the approach. In recent times, Aberdeen has broadened this to include an evaluation of both the environmental and social impacts of a potential investment. ESG analysts are embedded within the investment management team. Aberdeen is not an activist investor, but sees the value of engaging with companies.

No stock is bought unless the manager has met management and follow up meetings are held at least six-monthly. The team had over 1,600 meetings with companies last year.

Any member of the team can put forward a new investment idea, but initial research tends to be carried out by the relevant sector and geographic specialist. Ideas are circulated internally and discussed at team meetings until a consensus has been reached.

With respect to assessing the potential reward available from a stock, an analysis is made of key financial ratios, the market that the company operates within, the peer group and the company’s business prospects.

Risk assessment is focused on ensuring that the portfolio is adequately diversified (on a range of metrics) rather than formal sector or geographic controls. Little attention is paid to market capitalisation, but an evaluation of liquidity does have a role.

New additions to the portfolio tend to be introduced at a 0.5% weighting and will be increased only after they have been tracked for a while and the investment thesis appears to be working. Thereafter, position sizes are driven by conviction and the manager’s assessment of portfolio diversification.

In the day-to-day management of the portfolio, the manager seeks to take advantage of anomalous price movements to either top up or top slice positions. This typically accounts for the bulk of turnover activity. Sales are often also triggered by M&A activity; the manager believes that its emphasis on high-quality companies results in selecting stocks for portfolios that are also likely targets for takeovers. Sales will also be made when the manager’s investment thesis does not go to plan.

The trust’s current gearing level is around 10% and it uses gearing conservatively where opportunities arise. ABD does not hedge currency risk on a continuing basis but may, from time to time, match specific overseas investment with foreign currency borrowings.

Asset allocation

Asset allocation

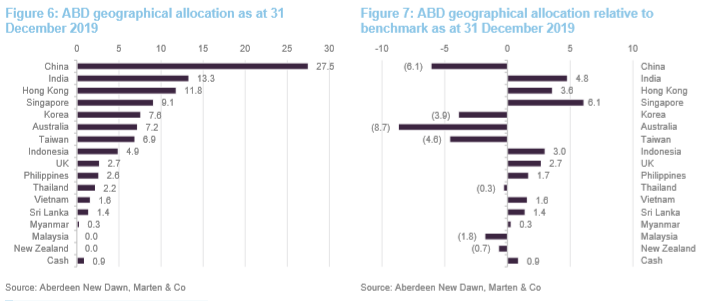

Since we published our update note in July 2019, the manager has been trimming ABD’s exposures to Korea and Hong Kong. In contrast, he has been increasing the exposure to mainland China. This has been an ongoing evolution with the manager seeking to gain direct exposure to mainland Chinese companies, rather than through companies based in Hong Kong and Singapore.

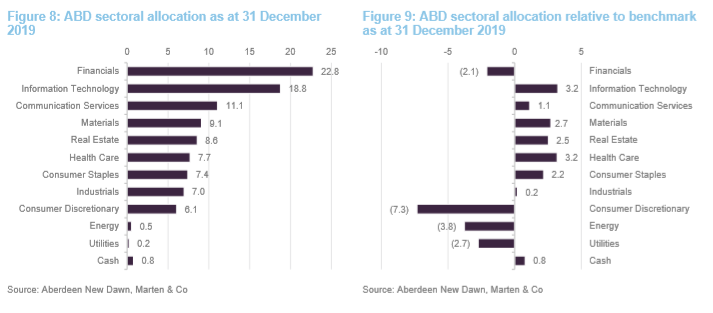

Relative to the benchmark, ABD has a notable underweight exposure to consumer discretionary, as well as underweights to energy and utilities and financials. Instead, the manager has a preference for structural growth opportunities within technology and healthcare, which are key themes within the portfolio. The manager is expecting to see a rebound in the semiconductor market (memory prices are increasing from both the roll-out of 5G and data centre expansion) and ABD’s portfolio is positioned for this with its holdings in Samsung and TSMC, for example. The internet is still seen as a positive force, with Tencent providing the primary exposure.

ABD’s top 10 holdings are discussed in further detail below but, outside of the top 10, the manager has added a new holding, Budweiser Asia Pacific, and has also increased ABD’s holding in China Resources Land. In contrast, the trust’s holding in South Korea’s e-mart has been trimmed; Naver, the South Korean internet stock, has been sold down; property companies Hang Lung (which is listed in Hong Kong, but its core business is shopping malls in mainland China) and Swire Pacific have been reduced; as have banking stocks, HSBC and Standard Chartered. Some of the more interesting changes are discussed below.

Budweiser Brewing Company APAC

Budweiser Brewing Company APAC

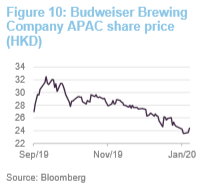

Budweiser Brewing Company APAC is the Asian Pacific operation of Anheuser-Busch InBev (www.ab-inbev.com). The company initially tried to IPO in July 2019, on the Hong Kong Stock Exchange, aiming to raise some US$9.8bn in a bid to reduce its parent company’s debt burden. James Thom says that the company has done extremely well during the last 10 years, but he felt that the indicative range of HKD40-47 per share was excessive and bid below this.

The market shared this view and the IPO was delayed. However, the company was brought back to market in September at a lower price (an indicative range of HKD2730). This time the IPO was successful, with the shares opening at HKD 27.40 (the lower end of the indicative range) and, as illustrated in Figure 10, whilst the share price initially surged, it has since retrenched and the company is currently trading below the IPO price.

James is not perturbed by this. He thinks it reflects sentiment towards Hong Kong, but says that the company’s fundamentals are sound. A key market is mainland China and Budweiser APAC is the largest player in the premium beer segment. James says that this segment has continued to grow, while mass market beer is in decline. With a growing middle class, the trend has been one of consumers upgrading to higher-priced premium brands and he expects this trend to continue. In addition, the company is the largest player in South Korea’s beer duopoly. James says that Budweiser APAC is highquality, has a strong market presence, strong balance sheet, strong cash flow generation and the valuation is undemanding in his view.

China Resources Land

China Resources Land

China Resources Land (en.crland.com.hk) is the property development business of China Resources Group (en.crc.com.cn), a Chinese state-owned conglomerate that owns a number of businesses in mainland and Hong Kong. China Resources Land is engages in a variety of property related activities including development, investment and management. It has a strong focus on shopping malls in mainland China and residential property.

As illustrated in Figure 11, the company has provided a very strong performance during the last 12 months, and particularly during the second half of 2019. ABD’s manager topped up the holding, while reducing the holding in Hang Lung Properties (see below). He thinks that China Resources Land is a better-quality company whose management has a track record of good execution. The holding made a significant positive contribution to ABD’s performance during 2019.

e-Mart

e-Mart

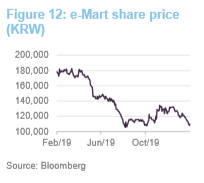

e-Mart (www.emartcompany.com/en/main.do) is the largest retailer in South Korea (established in 1993, it was also the first discount retailer in the country). The company was spun out of the Korean retail behemoth, Shinsegae Group, in 2011.

James says that, whilst e-Mart has been very innovative in the e-commerce space, its core business has been under pressure due to both a slow-down in the South Korean economy (consumer sentiment has been weak and e-Mart’s market leading position has not made it immune to this) and increasing competition from e-commerce rivals, particularly in the food business.

e-Mart has been buying back shares and has been raising cash through sale and leaseback arrangements. However, James thinks that more needs to be done to address the structural challenges the business faces and, reflecting both the outlook for e-Mart’s domestic market and its operations in China (these have also been under pressure for similar reasons), James decided to exit the position in its entirety.

Naver Corporation

Naver Corporation

Naver Corporation (www.navercorp.com/en) is a South Korean internet business. It operates a number of services through its online platform (www.naver.com). This includes its search engine, which is the largest in South Korea, as well as its messaging service, LINE, which is similar to WhatsApp.

James says that, historically, Naver has been very innovative in terms of monetising its internet services. For example, it was an early introducer of stickers for messaging and was able to successfully charge users to purchase these. However, James says that more recently, this commercial edge has dimmed. It is now competing against large global players in its core markets and its balance sheet has not been sufficiently strong to allow it to keep investing to remain competitive with these internet titans. For example, data from Statista suggests that in 2018, LINE was the third-most-popular messaging App in South Korea (with 11.0% of respondents reporting that they use it), behind Facebook Messenger (30.8%) and Kakao Talk (99.2%). Reflecting this, James has trimmed back the position aggressively.

Hang Lung Properties

Hang Lung Properties

Listed in Hong Kong, Hang Lung Properties’s (www.hanglung.com/en-US/home) core business is shopping Malls in mainland China, although it also has some assets in Hong Kong (a mixture of service and residential apartments along with some commercial, office, industrial and car park properties).

James Thom says that Hang Lung’s core Chinese business has been suffering from execution issues and is not performing to plan. Although there are no specific issues with its Hong Kong properties, the difficulties in this jurisdiction also weighed on the stock during 2019. As noted above, James felt that China Resources Land is betterpositioned going forward, and so has sold down Hang Lung and has rotated into China Resources Land instead. Whilst Hang Lung has benefitted from a share price bounce this year, James is more comfortable holding China Resources Land, which he considers to be higher-quality.

Top 10 holdings

Top 10 holdings

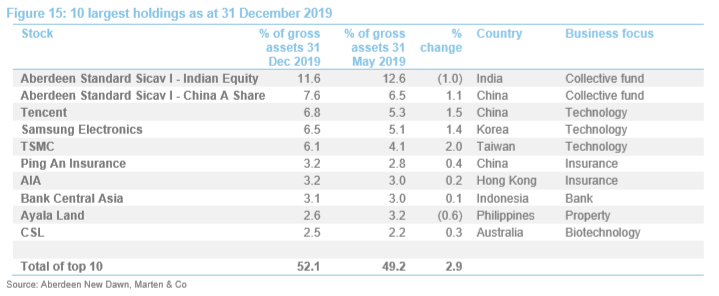

Figure 15 shows the top 10 holdings in the portfolio as at the end of December 2019 and how these have changed since 31 May 2019 (the most recently-available data when we last published). Nine of the top 10 holdings as at 31 December 2019, were constituents of the top 10 as at 31 May 2019, and at 30 November 2018 (the most recently available data when we published our initiation note), albeit the relative positions have changed. This underlines the long-term nature of the approach that is used to manage ABD’s portfolio. The name that has moved out of the top 10 is Jardine Strategic, which has had a difficult year. It is a Hong Kong based conglomerate and has suffered from negative sentiment around the anti-government protests. Biotech company CSL, a core Australian holding, has moved up the ranks to take its place.

As illustrated in Figure 15, ABD’s top 10 holdings account for around half the portfolio. The two largest positions are fund investments: an Indian fund and the China A-share fund, which are held to give ABD diversified exposure to those markets (the investment in the Indian fund provides tax benefits). The management fees on both of these funds are rebated so there is no additional cost to ABD. ABD’s active share at the end of December 2019 was 73.9%.

We comment on the largest positions later. Readers interested in more information on other names within ABD’s portfolio should see our previous notes where some of these have been previously discussed. However, the eight direct holdings within ABD’s top 10 are all relatively well-known Asia Pacific companies.

Aberdeen Standard Sicav I – Indian Equity (11.6%)

Aberdeen Standard Sicav I – Indian Equity (11.6%)

Managed by the Asian equities team, the $1.7bn Aberdeen Standard Sicav I – Indian Equity invests in a concentrated portfolio (29 stocks as at 30 November 2019, down from 33 as at 30 November 2018) of large cap Indian equities. As at 30 November 2019, the fund’s largest allocations were to financials (26.5%), information technology (18.6%), consumer staples (18.0%) and materials (14.9%).

Over the five years to 30 November 2019, the fund’s sterling share class provided a return of 8.23% per annum, beating its benchmark (the MSCI India Index) by 0.73% per annum (returns for the A Accumulation GBP share class). However, over the 12 months ended 30 November 2019, the fund returned 3.33%, behind its benchmark, which returned 4.38%.

Aberdeen Standard Sicav I – China A Share (7.6%)

Aberdeen Standard Sicav I – China A Share (7.6%)

Also managed by the Asian equities team, the $3.6bn Aberdeen Standard Sicav I – China A Share invests in a concentrated portfolio (32 stocks as at 31 December 2019, down from 33 as at 31 August 2018) of large cap Chinese equities. As at 31 December 2019, the fund’s largest allocations were to financials (25.2%), consumer discretionary (17.8%), consumer staples (16.9%) and information technology (10.6%).

Over the period from its launch on 16 March 2015 to 31 December 2019, it has provided a return of 10.38% per annum (figures for the A Accumulation USD share class). In contrast, its benchmark (the MSCI China Index) has lost 3.78% per annum. The year ended 31 December 2019 was particularly strong in absolute terms, with the fund returning 36.1%, mildly underperforming the MSCI China, which returned 37.76%.

Performance

Performance

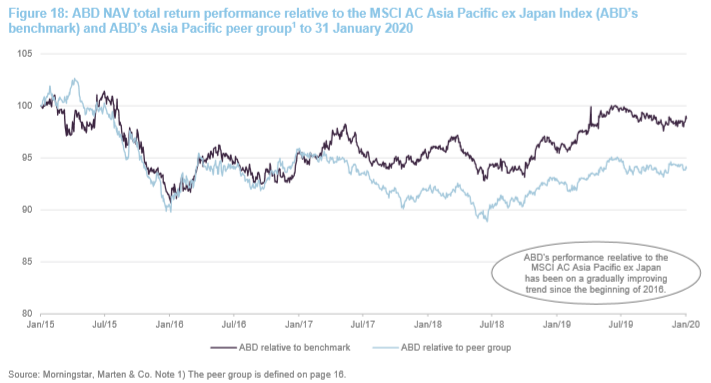

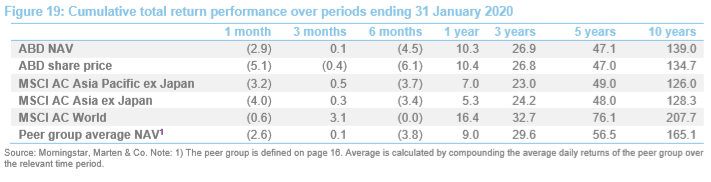

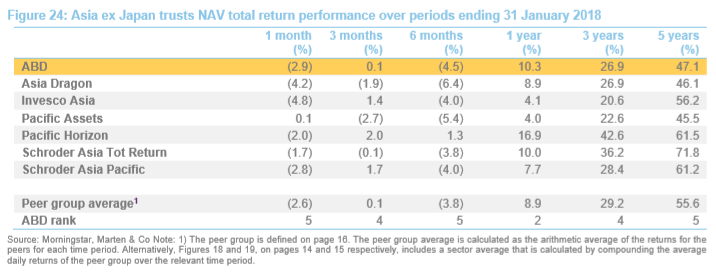

As Figure 18 illustrates, ABD lagged its benchmark in the period from early 2015 to Q1 2016. However, its relative performance has been on an improving trend since, albeit with some volatility. This is particularly apparent during the second half of 2018 and the first half of 2019. Performance relative to the peer group has exhibited greater volatility (see Figure 18) and, following a marked period of outperformance during the second half of 2018, has stabilised. The one-month negative performance, visible for all of the constituents in Figure 19, reflects the market impact of the outbreak of the coronavirus. However, the market has rebounded a little in February. This recovery is not reflected in the performance numbers provided in Figures 18 or 19.

Performance attribution

Performance attribution

As noted in our October 2018 initiation note, ABD’s longer-term underperformance can be attributed to its underweight exposure to both China and the technology sector, both of which dominate returns in the sector in recent years. However, the manager has changed its approach in this area and a market setback was used to reduce the underweight to China. China A shares have performed well, and ABD has benefitted.

Shorter-term analysis, carried out by Aberdeen and BNP Paribas Securities Services, using data from Thomson Reuters Datastream, for the 1 January 2019 to 31 October 2019, suggests that sterling’s depreciation was near universally beneficial. Combined, this added 0.62% to ABD’s performance; only India and Taiwan saw negative currency impacts relative to sterling, both of which were tiny. Overall, asset allocation was negative, to the tune of 1.92% in total, but this was more than offset by stock selection, which added 4.14% (with the exception of India, Malaysia and Thailand, stock selection was positive).

On a sector level, the portfolio’s underweight exposure to energy, consumer staples and consumer discretionary detracted from returns. However, exposure to the financial sector proved beneficial.

Largest positive and negative stock contributions

Largest positive and negative stock contributions

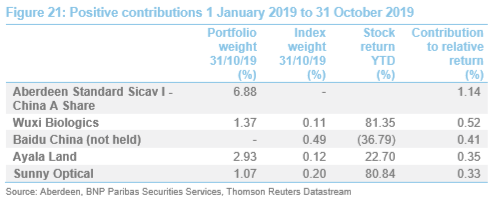

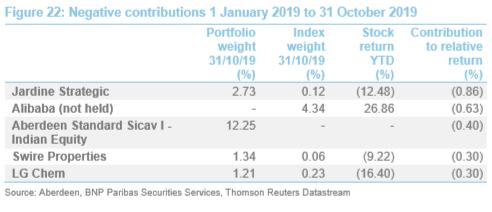

Figures 21 and 22 show the top five largest contributors and detractors to performance during the first 10 months of 2019. The single largest contributor, at the stock level, is the allocation to the Aberdeen Standard Sicav I – China A Share.

Wuxi Biologics is a sub-contractor to a number of biotech companies looking to outsource part of their R&D work and/or manufacturing process. When we last discussed Wuxi in our October 2018 initiation note (see page 10 of that note), we said that the manager believed that the company was becoming a national ‘champion’ in this area and had demonstrated a good track record of business execution. As illustrated in Figure 20, Wuxi has performed strongly during the last 12 months. The manager that high earnings growth has been rewarded with a higher share price.

ABD’s relative performance has benefitted from not holding Baidu (China’s equivalent of Google), which had a difficult 2019, after losing market share to ByteDance (TikTok), which was reflected in its share price performance. Online marketing in China has suffered from increasing regulation while digital marketing revenues have been impacted by the country’s broader slow-down.

ABD’s holding in Jardine Strategic was the largest single performance detractor during the year to 31 October 2019. It is a Hong Kong based (but Bermudan domiciled) conglomerate with a long history that takes a long-term view on its businesses. The managers say that there are periods when the company is viewed as too staid, but they say that it has the management depth to transform and support its businesses and delivers good returns over time.

The second largest detractor from relative performance was not holding Alibaba, which performed very strongly during 2019. The manager prefers Tencent and other smaller internet stocks and, whilst their performance was generally good, they failed to keep pace with Alibaba.

ABD’s holding in the Aberdeen Standard Sicav I – Indian Equity was the third largest detractor. ABD’s portfolio has a significant allocation to the fund and India has had a very difficult year, which is reflected in the fund’s absolute performance. However, stock selection was positive. The fund has a significant exposure to financials, but it is focused on the stronger institutions, which have outperformed and overall it has benefitted from its focus on quality.

Peer group

Peer group

For comparison purposes, we have used a subset of funds in the AIC’s Asia Pacific sector. We have excluded All Active Asset Capital due to both its small size (£0.9m market cap as at 4 February 2020 and the tightly held nature of its shares). We have also excluded Witan Pacific as it has an allocation to Japan (it formerly sat in the AIC’s Asia-including-Japan sector).

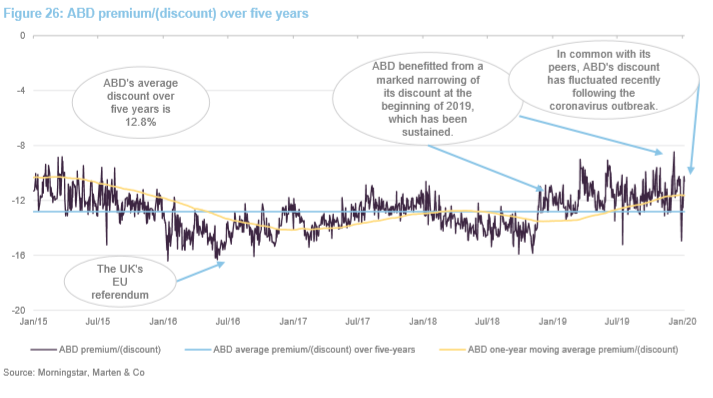

With a market cap of £283.6m as at 4 February 2020, ABD is a reasonable size. As illustrated in Figure 26, ABD’s discount narrowed during 2019, but has fluctuated recently, along with its peers, as markets have responded to the coronavirus outbreak. When we last commented on ABD’s discount relative to its peers, in our initiation note in October 2018, ABD’s discount was one of the widest in the peer group, and this continues to be the case. The improvement in its relative performance does not appear to have been properly reflected in its discount (when we wrote our initiation note, ABD and its stablemate Asia Dragon were struggling relative to the wider peer group, but this has improved since). ABD’s yield is modest, reflecting its focus on capital growth and because, unlike a couple of its peers, it does not make distributions from capital. Nonetheless, its yield is broadly in line with the sector average. Its ongoing charges ratio is competitive.

When we published our initiation note in October 2018, we commented that ABD’s underperformance could be attributed to competing funds less cautious stance on China and the corporate structures that allowed access to Chinese leading technology companies in particular. However, the manager revised its view on ‘variable interest entities’ (structures established to bypass Chinese government restrictions on foreign ownership of internet licences) and a subsequent market setback allowed the manager to increase ABD’s exposure to China.

As discussed earlier, China A-shares have performed well, and ABD has benefitted from this. The improved performance, relative to peers is illustrated in the outperformance of the sector over the one-year period in Figure 24. The success of the Chinese A share fund demonstrates that the manager can outperform in this market.

Biannual dividends

Biannual dividends

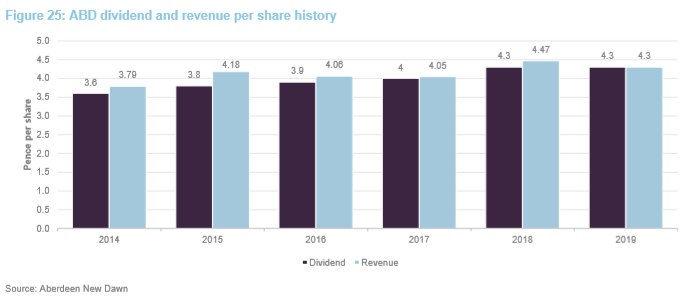

ABD’s focus is on generating capital growth rather than income. It pays two dividends a year, in January and September, from surplus income (unlike some of its peers, which pay a large part of their dividend from capital). As illustrated in Figure 25, ABD’s revenue return per share has generally been on an upward trend during the last five years although there has been some volatility. Arguably reflecting the fall in revenue in come between 2018 and 2019, from 4.47p per share to 4.3p, the dividend for 2019 was held constant at 4.3p per share. However, the dividend was once again covered by current year revenue earnings.

Reflecting the fact that ABD has paid fully covered dividends during the last five years, ABD has grown its revenue reserve per share. ABD’s revenue reserves stood at £13.104m as at 30 April 2019 (2018: £13.118m) or 11.7p per share (2018: 11.6p per share). ABD has built up significant revenue reserves (some 2.7x the total dividend paid for the 2018/19 year) on which it could draw if there was a shortfall in revenue and the board considered this to be appropriate.

Premium/(discount)

Premium/(discount)

As illustrated in Figure 26, ABD’s underwent a marked narrowing at the beginning of 2019, which was sustained throughout the rest of the year. However, with market wobbles in relation to the coronavirus outbreak, ABD’s discount, along with that of its entire peer group, has fluctuated. During the last 12 months, it has tended to trade within a discount range of between 9% and 13%, although this has been as wide as 15.2%, with a one-year average of 12.8%. As at 4 February 2020, ABD was trading at a discount of 10.6%. This is above that of the Asia Pacific sector, which was trading at an average discount of 7.9%.

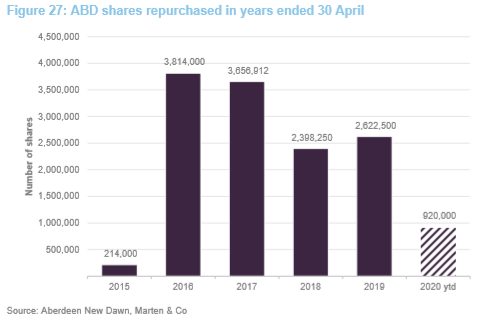

ABD is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. In normal market conditions, ABD repurchases shares when the discount is wider than the board would like. However, the board has no specific discount target in mind. Instead, its aim is to provide a degree of liquidity for shareholders. The authority to repurchase shares is renewed at each AGM (and more frequently, if necessary).

As illustrated in Figure 26, ABD has tended to trade at a tighter discount during 2019 than it did during 2018. It is noteworthy that ABD provided decent outperformance of the benchmark during 2019. If this continues, and investors’ confidence around Asian markets improves, the discount could tighten further from here, but the reverse may also be true. Currently, ABD’s manager believes that there is a degree of uncertainty around Asian markets that is causing investors to sit on their hands. However, he believes that this will reverse, and that this should lead to a further narrowing of the discount.

1.3m shares, or 1.2% of ABD’s issued share capital at the 31 December 2018, were repurchased during 2019. This repurchase activity, which is a continuation from previous years, is arguably reflected in the uptick in ABD’s ongoing charges ratio during the last financial year. It is noteworthy that while we are two-thirds of the way through the financial year, ABD’s share repurchases during the financial year, to date, are around 35% of the total number of shares repurchased during the 2018/19 year (see Figure 27).

Shares are repurchased into treasury and can only be re-issued to the market at a premium to the NAV. In the event that the number of treasury shares represents more than 10% of ABD’s issued share capital (excluding treasury shares), the company will cancel sufficient treasury shares such that the remaining balance will equal 7.5% of the issued share capital.

Fees and costs

Fees and costs

The management fee is payable monthly in arrears based on an annual rate of 0.85% of NAV. There is no performance fee. The fee is adjusted so that there is no additional fee charged on other funds managed by the manager. The management agreement is terminable by either side on not less than 12 months’ notice.

All expenses are charged fully to revenue with the exception of management fees and finance costs, which are charged 50% to revenue and 50% to capital. This allocation reflects the board’s long-term return expectations in terms of income and capital respectively.

In addition to the management fee, the company pays an amount each year to the manager for its promotional activities in relation to the trust. This was £152k for the year ended 30 April 2019, down from £158k for the previous year.

For the year ended 30 April 2019, ABD’s ongoing charges ratio, including look through costs for collective investment schemes, was 1.13% (a modest increase over the ratio for the year ended 30 April 2018 of 1.10%). Excluding look-through costs, ABD’s ongoing charges ratio was 0.87% (2018: 0.84%).

Capital structure and life

Capital structure and life

ABD has a simple capital structure with one class of ordinary share in issue. As at 4 February 2020, ABD had 110,796,348 ordinary shares in issue and 9,433,101 held in treasury. The board determines the gearing strategy for the company subject to a current maximum limit of 25% of net assets. Borrowings are short to medium term and particular care is taken to ensure that any bank covenants permit maximum flexibility of investment policy. ABD has a £35m multi-currency loan facility provided by the Royal Bank of Scotland for this purpose.

This comprises a five-year fixed rate loan of £20 million, with an interest rate of 2.626%, which matures on 7 October 2024, and a £15 million three-year multi-currency revolving loan facility, which matures on 7 October 2022. As at 31 December 2019, ABD had gross gearing of 10.4% and net gearing of 9.4% of net assets respectively.

Discount triggered continuation vote

Discount triggered continuation vote

ABD does not have a fixed life. However, under its articles of association, if, in the 90 days preceding ABD’s 30 April year end, its average discount exceeds 15%, notice will be given of an ordinary resolution to be proposed at the following AGM to approve the continuation of the company.

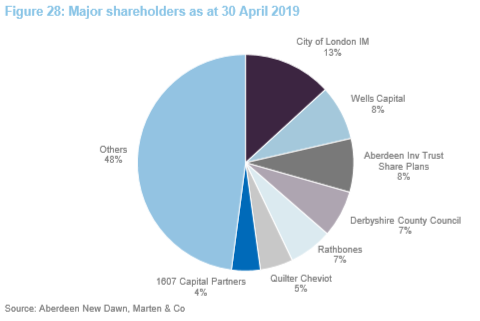

Major shareholders

Major shareholders

Financial calendar

Financial calendar

ABD’s financial year end is 30 April. Its annual results are usually published in June (interims in December) and its AGMs are usually held in September of each year. ABD pays biannual dividends in in January and September.

Management team

Management team

Aberdeen Standard Investments is a global asset management company with offices in over 40 locations and more than 20 investment centres. Within the Asia-Pacific region, it has 11 offices. The newest is its recently opened office in Shanghai, China (when we last discussed this, in our October 2018 initiation note, the Shanghai office was just an aspiration).

Flavia Cheong heads up the 44-strong Asia Pacific equities team and her deputy is Kwok Chem-Yeh. The Singapore office is the manager’s largest. This is where James Thom and ABD director Hugh Young (see below) are based.

Board

Board

ABD’s board currently has six directors, all of whom are non-executive and who do not sit together on other boards. The majority are independent of the manager, with the exception of veteran fund manager Hugh Young (see below), who is a director of various entities connected with or within the Standard Life Aberdeen Group, which owns the manager. Hugh is the longest-serving director, with a tenure of 30.8 years. Neither Hugh nor ASI earns a directors’ fee from his service as a director of ABD. Including Hugh, the average length of service is 8.6 years. Excluding Hugh, the average length of service is 4.2 years.

David Shearer, ABD’s chairman when we last discussed the board in our initiation note, stood down as a director at the close of the company’s AGM on 4 September 2019. Donald Workman, who was appointed to the board on 1 October 2018, has taken up the role of chairman.

John Lorimer, currently the chairman of both ABD’s audit and risk committee and its management engagement committee, has indicated that he intends to step down as a director at the conclusion of ABD’s 2020 AGM (he will have been a board member for over 10 years at that point). In ABD’s last annual report, the board said that they were in the process of recruiting a replacement for John; Stephen Souchon, a chartered accountant who has held the position of audit committee chairman for a number of companies, joined the board with effect from 1 October 2019. This has temporarily increased the number of directors to six, but this will return to its traditional five following John Lorimer’s retirement.

All directors stand for re-election each year. Total directors’ fees are limited to £200,000 per annum and this limit may only be increased by shareholder resolution. The fees are reviewed annually and, if considered appropriate, are increased accordingly. The Directors’ fee levels were unchanged for the 2018/19 year versus the prior year.

Donald Workman (chairman)

Donald Workman (chairman)

Donald had an executive career until 2016 at The Royal Bank of Scotland PLC, where, over a period of 23 years, he held a number of senior positions. Latterly, this included acting as executive chairman of the group’s Asia Pacific business. Donald was a member of the RBS Group Executive Committee from 2014. He was also an independent non-executive director of Standard Life Private Equity Trust Plc between 2006 and 2013. He is currently non-executive chairman of JCB Finance Limited.

John Lorimer (chairman of the audit committee and risk committee)

John Lorimer (chairman of the audit committee and risk committee)

John held a number of management positions in Citigroup prior to joining Standard Chartered Bank, where he was group head of finance and latterly group head of compliance and regulatory risk. He is also a director of BUPA Australia Limited and Bank of Queensland Limited.

Susie Rippinghall (director)

Susie Rippinghall (director)

Susie has over 25 years of fund management experience in Asian markets and was, until 2013, portfolio manager of Scottish Oriental Smaller Companies Trust Plc. She is also a non-executive director of Sovereign Asset Management Limited, NTAsian Discovery Fund and NTAsian Emerging Leaders Fund.

Marion Sears (director)

Marion Sears (director)

Marion had an executive career in stockbroking and investment banking and was latterly a managing director of investment banking at JPMorgan. She is also a nonexecutive director of Persimmon Plc, Dunelm Group Plc and Fidelity European Values Plc.

Stephen Souchon (director)

Stephen Souchon (director)

Stephen is a chartered accountant. He had an executive career until 2015 at Morgan Stanley, where he was latterly head of the EMEA Corporate Financial Control Group. He was a non-executive director and chair of the audit committee of Morgan Stanley’s Swiss Bank, during which time he oversaw the development of the Swiss wealth management business within Asia. He was also the audit committee chair of Morgan Stanley’s Spanish wealth management subsidiary and its Russian bank and broker dealer. Stephen is currently a non-executive director and chair of the audit committee of SMBC Nikko Capital Markets Limited.

Hugh Young (director)

Hugh Young (director)

Hugh Young was an investment manager with Fidelity International and MGM Assurance prior to joining what is now Standard Life Aberdeen in December 1985. He is managing director of Aberdeen Standard Investments (Asia) Limited, responsible for all the Standard Life Aberdeen Group’s investments in Asia. He is also a director of Aberdeen Australia Equity Fund Inc., Aberdeen Asia Pacific Income Investment Company Limited, Aberdeen Asian Income Fund Limited, Aberdeen Standard Asia Focus Plc (alternate) and The India Fund Inc.

Previous publications

Previous publications

Readers interested in further information about ABD may wish to read our previous notes by clicking on the links or by visiting our website.

Market setback creates opportunities, initiation note, published 4 October 2018

Moving up the league table, update note, published 8 July 2019

The legal bit

The legal bit

This marketing communication has been prepared for Aberdeen New Dawn Investment Trust plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.