Expansion on the radar

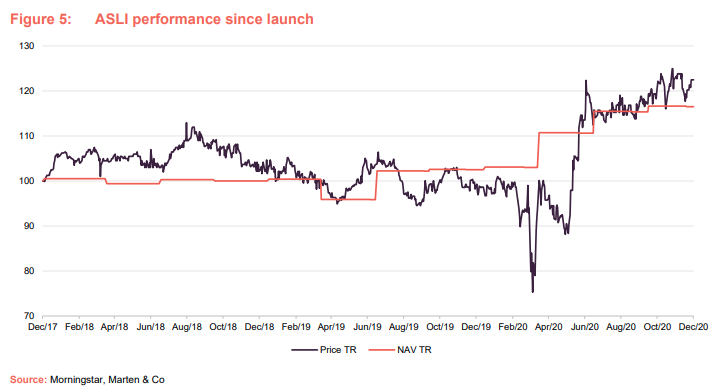

As Aberdeen Standard European Logistics Income (ASLI) marks its third anniversary since launch, it has recorded a net asset value (NAV) total return over the period of 16.5% and a share price total return of 22.5%. The COVID-19 pandemic has only served to reinforce the strong characteristics of the European logistics sector, where a surge in online retailing has resulted in huge demand for space from e-commerce operators. An acceleration in the online retailing trend, as well as a strengthening of supply chains following the shock at the start of the year caused by the closure of borders in Asia as government’s tried to tackle the spread of the virus, is predicted to result in strong rental growth in 2021.

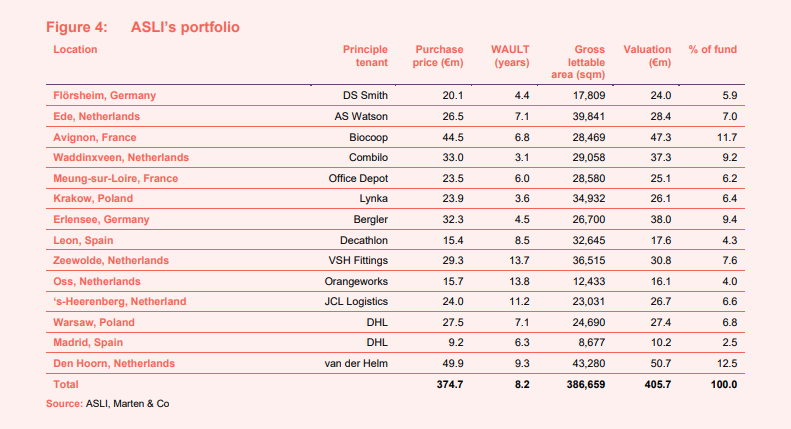

ASLI’s manager is keen to expand its portfolio, from its current 14 assets in five countries, and is exploring its options for raising capital in order to buy identified assets across Europe. In December, it was announced Aberdeen Standard Investments (ASI) would acquire logistics property fund manager Tritax Management, providing ASLI with greater resources to grow.

Big box and urban logistics in Europe

ASLI invests in a diversified portfolio of ‘big box’ logistics and ‘last mile’ urban warehouse assets in Europe with the aim of providing its shareholders with a regular and attractive level of income return together with the potential for long-term income and capital growth (target total return of 7.5% a year in euros).

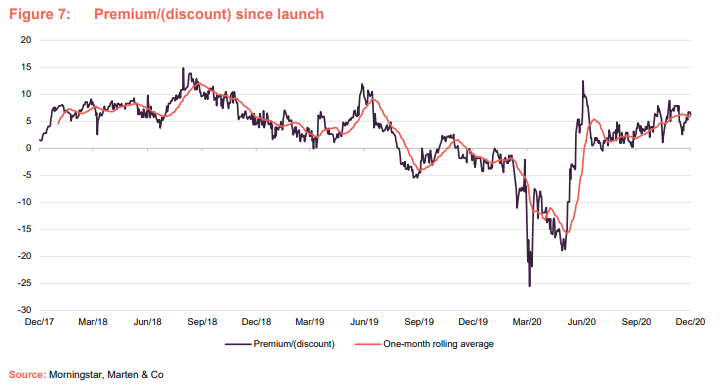

ASLI’s share price slumped in March 2020 as part of a wider market sell-off as the COVID-19 pandemic hit, with its discount to net asset value (NAV) widening to 26%. It quickly regained its losses and as the market recognised the strength of its portfolio and the logistics market, its rating moved to a premium. On 15 December 2020 it was trading at a 6.2% premium to NAV.

ASLI’s NAV initially made modest progress from launch, with rising property values offset by expenses incurred in establishing the portfolio. As the portfolio has expanded and valuations increased, NAV total return has shot up.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | EPRA earnings per share (€) | Dividend per share (€) |

|---|---|---|---|---|---|

| 1 | 31 Dec 2018 | 0.90 | 0.10 | 0.18 | 3.00 |

| 2 | 31 Dec 2019 | -7.30 | 8.10 | 3.49 | 5.08 |

| 3 | 31 Dec 2020 | 4.96 |

Surge in online retailing boosting logistics demand

The European logistics market, in which ASLI invests, has performed strongly during the COVID-19 pandemic. Demand for logistics space has grown exponentially as occupiers try to keep up with burgeoning online retail sales and strengthen their supply chains. We detailed the short- and long-term implications of the pandemic on the sector in our annual overview note on ASLI, which was published in June 2020.

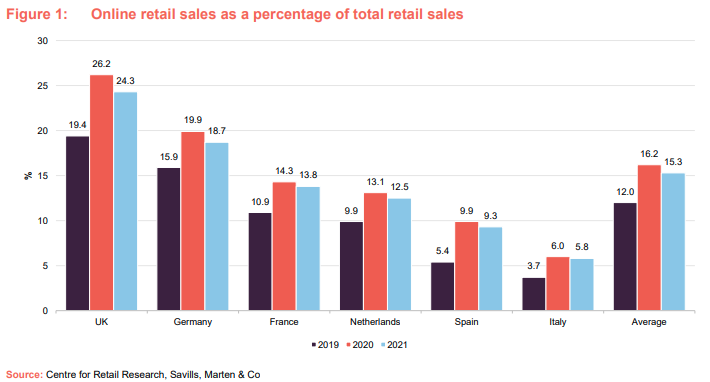

The crisis has forced a whole new cohort of the population into adopting online retailing and has resulted in an acceleration of penetration rates in many European countries, as shown in Figure 1.

The penetration of online retail sales in the UK is greater than most western countries, but all European countries are on a similar growth trajectory. In the UK, Savills identified a tipping point of 10.7% of total retail sales being online, which created rapid growth in occupational demand for warehouse space. Several countries, including France, Germany and the Netherlands, have online penetration rates above 10.7%. These countries are expected to see a similar trajectory in take-up volumes to that of the UK.

Although online retailing is a large factor in the increase in demand, supply chain resilience is also an important part. The pandemic brutally exposed weaknesses in the supply chain of many companies and sectors. A reliance on manufacturing in Far East Asia was exposed as the flow of goods all but ceased as production shut down. A re-shoring of manufacturing back to Europe is likely to take place in order to avoid this scenario, with companies reducing the length of supply chains and bringing operations closer to their customers.

The supply chain shock and a rush of panic buying at the start of lockdown caught many companies out. Retailers and manufacturers had been increasingly moving to a “just in time” logistics model where stock levels were at the optimum level, thereby reducing space. However, a period of inventory building is now taking place as companies tilt their supply chains back towards ensuring sufficient stock over efficient stock handling and just in time fulfilment.

Take-up of logistics space in the first three quarters of 2020 was 10% above the level recorded in the same period last year, reaching 21.8m sqm, according Savills. The Netherlands (+56% year-on-year), Poland (+33%) and the UK (+46%) accounted for the majority of the overall increase, while Germany remained the dominant market for take-up, recording 5.1m sqm of space taken up in the first three months of 2020.

Supply at historic lows

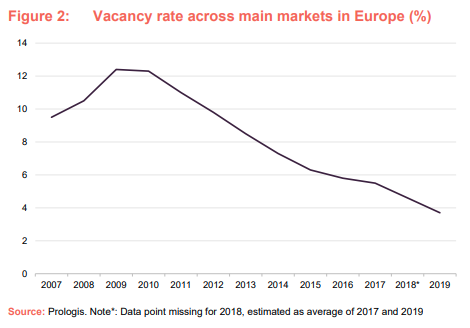

Supply of modern, high-spec logistics facilities in prime locations across Europe have hit record lows. Figure 2 shows that European logistics vacancy rates have been steadily falling from a peak in 2009 (following the financial crash) of over 12% to sub-4% in 2019. The supply of efficient modern stock is even lower, with some parts of the market with no supply at all.

Supply constraints are mainly due to the scarcity of land around most major European cities and logistics developers competing with other property developers – such as residential developers – for sites.

This supply and demand imbalance is the pinnacle for real estate investors as it will ultimately lead to rental growth. Prime rents remained stable during the year, due to the pandemic, but Savills said it expects rental growth to resume across the core mainland European markets in 2021.

Investment activity rampant

After a period of subdued investment activity following the outbreak of COVID-19, the investment market has taken off since September with a number of big-ticket transactions in the offing. A total of €22bn was transacted in the first three quarters of the year and this is expected to exceed €30bn by year end. Real estate funds and investors, attracted by the strong fundamentals of the sector, have increased their target portfolio allocation to logistics to around 30-35%.

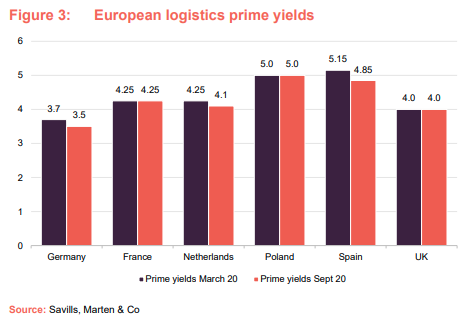

At the end of the third quarter, Savills had observed average prime investment yield compression over the six-month period of 7 basis points (bps – equivalent to 0.07%) to 4.84% across Europe. Germany (-20 bps to 3.5%), the Netherlands (-15 bps to 4.10%) and Spain (-30 bps to 4.85%) were among the countries to see the biggest yield compression.

With increased investment activity in the final quarter, Savills says it has witnessed further yield compression of between 50 bps and 100 bps in some core western European markets since March 2020.

ASLI’s manager says the flood of capital focused on the European logistics sector has seen some investors divert from real estate investment fundamentals and not price in risk. An example of this was a potential investment in the Netherlands that ASLI was in advanced due diligence on but pulled out of due to the discovery of heavily polluted soil on the land needing expensive remedial work. The sale went back to the underbidder, which paid substantially more than ASLI had bid.

Portfolio update

Increased investor activity in the European logistics sector in the final quarter of the year and subsequent yield compression has meant ASLI’s manager has had to work harder to identify new acquisitions that fit its investment strategy, which is explained in detail in our annual overview note.

The company is close to acquiring its 15th asset – a new warehouse in Poland valued at around €26m and reflecting a net initial yield of around 5.5%, which is expected to complete in early 2021. ASLI’s current portfolio of 14 assets is located across five European countries and was valued at €405.7m on 30 September 2020.

ASLI’s manager is keen to grow the fund. The potential Polish acquisition will be acquired using available cash, after the company conducted two small tap issues this year raising €11.5m and opened a new €40m credit facility that it signed with Investec Bank in October.

The company will use the debt facility to acquire new assets before raising fresh equity to pay down the loan. The manager says small equity raises and tap issues are the best way forward at the moment, ultimately, to reduce the impact of cash drag in a larger equity raise.

Rent collection expected to be at 97% at year end

A small number of tenants requested rent deferrals or rent-free periods in the second quarter of the year, which saw a collection rate in the second quarter of 85%. The majority of the deferred rent was due to be paid in the second half of this year or early 2021 and all rents due under the terms of the deferral agreements have so far been paid on time. The small number of agreed rent-free periods were negotiated in exchange for material lease extensions.

The manager expects 97% of full year rental income to be received by the year end.

Strong ESG credentials

ASLI has been awarded four green stars out of a maximum of five by the Global Real Estate Sustainability Benchmark (GRESB) survey after making significant progress with environmental, social and governance (ESG) across its portfolio. This compares to the previous two stars awarded in 2019.

The portfolio’s GRESB score of 79/100 compares favourably to the 68/100 average score for the Western Europe Industrial Distribution Warehouse peer group, which contains 19 funds.

ESG initiatives include a significant roll out of solar panel installations, a tenant satisfaction survey, LED lighting in all buildings and 100% data collection across the portfolio linked to Envizi, which is used to analyse energy consumption. The manager plans to further enhance ESG credentials across the portfolio.

Aberdeen Standard Investments acquires stake in Tritax

It was announced in early December that Aberdeen Standard Investments (ASI) was set to acquire a 60% stake in Tritax Management, the manager of Tritax Big Box REIT and Tritax EuroBox.

As part of the deal, Tritax partners will lead ASI Real Estate’s Global Logistics team. Tritax and ASI have said Tritax Big Box, EuroBox and ASLI would retain their investment decision making autonomy and control following the deal, which is expected to complete in early 2021 subject to the receipt of regulatory approvals.

Performance

ASLI has recorded a NAV total return of 16.5% and a share price total return of 22.5% over the three-year period since it launched. ASLI’s NAV initially made modest progress from launch, with rising property values offset by expenses incurred in establishing the portfolio. As the portfolio has expanded and valuations increased, NAV total return has shot up. The NAV is reported in both euro and sterling. The NAV in Figure 5 is in sterling and can be sensitive to the euro-sterling exchange rate.

Peer group

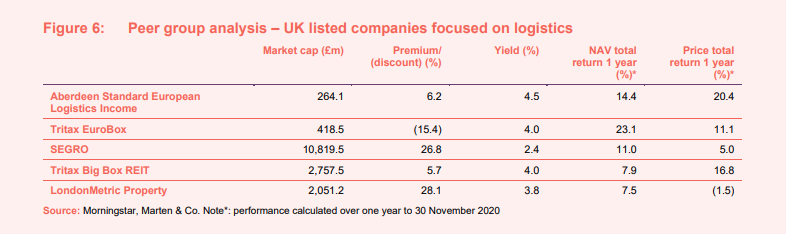

Most of those investing in European logistics are unlisted funds or subsidiaries of larger groups. The listed peer group we have assembled consists of: Tritax EuroBox, ASLI’s closest competitor; SEGRO, which owns a mixture of ‘big box’, urban and industrial space, about a third of which is located in continental Europe; Tritax Big Box; and LondonMetric Property. The latter two are UK-focused.

ASLI is at the smaller end of this peer group, for the moment, as it continues to grow its portfolio. The yield is superior to peers and over the last year it has produced solid NAV and share price total returns, as well as high risk adjusted returns, strong ESG credentials, and has low levels of borrowing.

Premium/(discount)

ASLI has almost exclusively traded at a premium following its launch. Its share price slumped in March 2020 as part of a wider market sell-off as the COVID-19 pandemic hit, with its discount widening to 26%. It quickly regained its losses and as the market recognised the strength of its portfolio and the logistics market, its rating moved to a premium. On 15 December 2020 it was trading at a 6.2% premium to NAV.

Fund profile

ASLI invests in a portfolio of European logistics assets, diversified by both geography and tenant, with a focus on well-located assets at established distribution hubs and within population centres. ASLI’s aim is to provide its shareholders with a regular and attractive level of income return, together with the potential for long-term income and capital growth (it has targeted a total return of 7.5% a year in euros). ASLI benefits from inflation-linked leases across its portfolio.

ASLI has an annual dividend yield target of 5% of the IPO price (100p), which it is on track to achieve this year. Dividends are paid in sterling, but the assets and the income derived from them are predominantly in euros. The manager may use currency hedging to help reduce the volatility of the income, but there is no current intention to hedge the capital value of the portfolio.

ASLI’s portfolio management services are undertaken by Aberdeen Standard Investments Ireland Limited, part of the Aberdeen Standard Investments group of companies, and is led by Evert Castelein. Aberdeen Standard Investments Real Estate is the second-largest European real estate investment manager and has an extensive regional presence, with 25 offices in 14 countries across Europe.

Previous publications

QuotedData has published three previous notes on ASLI.

Poised to grow?, initiation note, published March 2019

On the crest of a wave, update note, published October 2019

Resilient to COVID-19, annual overview, published June 2020

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Aberdeen Standard European Logistics Income.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.