CQS Natural Resources Growth and Income – Recovery on-hold, hold on

Recovery on-hold, hold on

Recovery on-hold, hold on

The managers of CQS Natural Resources Growth Income Trust (CYN) say that the pandemic has delayed, rather than ended, the recovery they were seeing in the mining sector. After sharp falls, April and May have seen share prices recoup some of their losses, but the managers believe there is much more to go for.

China and the rest of Asia is tentatively emerging from lockdown, and while a ‘V’-shaped recovery for the economy looks unlikely, the market is looking through this shock already, whilst the long-term fundamentals that support commodities remain intact (for example, real demand for commodities has been growing; and a reduction in capex has seen capacity removed from the market. This has been exacerbated by the pandemic). The managers believe that, as we move beyond this phase, commodities and mining companies could see their prices move up quickly, as aggregate demand recovers. If they are correct, now may be a good entry point for investors who are prepared to be patient and are able to look through the volatility.

Capital growth and income from mining & resources

Capital growth and income from mining & resources

CYN aims to provide investors with capital growth and income by investing in a portfolio that predominantly comprises mining and resource equities, as well as mining, resource and industrial fixed interest securities. The fixed income securities include, but are not limited to, preference shares, loan stocks, corporate bonds (convertible and/or redeemable) and government bonds.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Composite benchmark total return (%) | Euromoney global mining total return (%) | MSCI World total return (%) |

|---|---|---|---|---|---|---|

| 1 | 31 May 2016 | -6.50 | -6.80 | -14.60 | -21.80 | 1.30 |

| 2 | 31 May 2017 | 30.40 | 21.50 | 25.00 | 29.70 | 32.00 |

| 3 | 31 May 2018 | 13.00 | 13.40 | 19.40 | 28.50 | 8.80 |

| 4 | 31 May 2019 | -25.70 | -21.40 | -1.50 | -5.00 | 5.90 |

| 5 | 31 May 2020 | -8.70 | -13.20 | 7.40 | 10.20 | 9.50 |

Natural resources remain cheap relative to global equities

Natural resources remain cheap relative to global equities

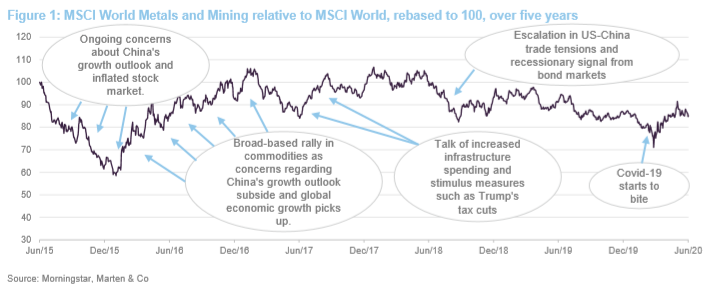

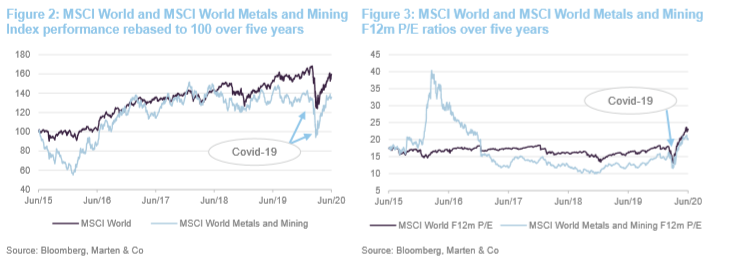

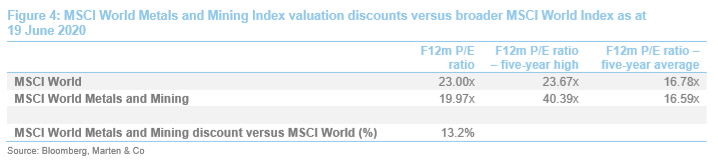

As illustrated in both Figures 1 and 2, commodities and natural resources (as represented by the MSCI World Metals and Mining Index) have underperformed the broader global economy (as represented by the MSCI World Index) during the last five years, with a broad trend of gradual underperformance during the last two years.

The outbreak of covid-19 initially increased this underperformance, but since the middle of March, commodities and natural resources have rallied so that, whilst they still trade at a discount to global equities, this is not as marked as it had been previously (13.2% as at 19 June 2020 – see Figures 3 and 4). This rally has followed on from significant supportive action by the authorities and, based on forward earnings, global equities and commodities are trading significantly above their fiveyear averages. Nevertheless, while global equities are trading close to highs, commodities remain well below their peak.

Managers’ view

Managers’ view

Covid-19 – commodities heavily impacted as investors sought liquidity

Covid-19 – commodities heavily impacted as investors sought liquidity

The outbreak of covid-19 has taken the wind out of global growth and financial markets were hit hard as investors sought liquidity in March. Most commodities, which are inherently cyclical, found themselves at the sharper end of the demand shock and while most segments have experienced some form of recovery during April and May, commodities remain markedly below their pre-pandemic levels.

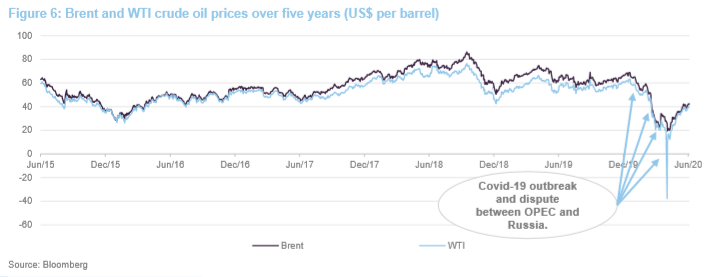

Base metals and energy were hit particularly hard, as industry ground to a halt under the imposition of lockdown restrictions globally. Oil, which was already weighed down by the dispute between OPEC and Russia, fell further as travel restrictions took effect and economic activity was been curtailed (WTI crude briefly saw negative pricing in April – see Figure 6).

One bright area is gold. Demand for physical gold, largely from physically backed ETFs, has remained strong (demand for jewellery, in comparison, has been falling away), which has driven the gold price higher, although gold equities appear to be better value. CYN has benefitted from its exposure to precious metals, including gold, and its relatively low exposure to energy.

The world is slowly reopening and commodities are geared to the recovery

The world is slowly reopening and commodities are geared to the recovery

While the collapse in demand caused by the pandemic has been negative for most commodities, this has begun to ease as China and the rest of Asia emerges from lockdown, followed by parts of Europe and the US. The trend appears to be one of gradual easing and the opening up of economies (although there may be further restrictions if a second wave emerges). CYN’s base metals exposure is benefitting as restrictions ease (China is the primary driver of base metal demand).

Some commodities, such as copper (an area that CYN’s managers have increased exposure to), have found price support from restricted supply as lockdowns have been implemented. Production in Peru, Chile and Mexico, which collectively account for around 20% of copper supply, went off line and, while this is a temporary cessation, it has come at a time when there’s a huge stimulus in China (and elsewhere) with an emphasis on infrastructure expenditure (for example, China’s national grid is a major consumer of copper and it has been instructed to roll out a large infrastructure development plan). In addition to this, China SOEs have been instructed to buy assets that are lowly priced in the west (for example copper and zinc) and this is providing pricing support in the short term, while aggregate demand recovers.

The price of copper producers has recovered somewhat, but CYN’s managers believe there is room for further gains from here. As illustrated in Figure 5, First Quantum Minerals, which is CYN’s largest holding (see Figure 10) has seen its share price recover from a low of CAD5.04 on 23 March to CAD9.18 on 8 June, but this is still way below its pre-pandemic trading range of CAD12-14. CYN’s managers say that First Quantum is very resilient and is well positioned to weather the current downturn. In the meantime, it is benefitting from the tight pricing environment aided by the additional capacity offered by its Panama facility, which is now on stream (see page 12 of our June 2019 note for further discussion of First Quantum Minerals).

Commodity recovery drivers remain in place

Commodity recovery drivers remain in place

CYN’s managers say that while the pandemic has created some disruption, some of which will be enduring, the factors that were driving a recovery in commodities remain in place. Overall, they believe that the outbreak has delayed, rather than cancelled, the recovery in the sector’s fortunes. Furthermore, although the timing of the recovery is difficult to predict, the managers believe that both commodities and mining companies may see their prices move up quickly from here.

If the managers are correct, now may be a good entry point for investors who are prepared to be patient. In the meantime, the managers are focusing their attention on areas that they believe have not participated fully in the relief rally.

We explored their views on a resurgent commodities sector in our June 2019 note, and we recommend readers review this; however, we are providing a summary here:

• On the demand side, the global population is growing and, whilst global GDP growth has slowed and a contraction is likely, the longer-term trend is still positive. This suggests greater demand for commodities and real demand for commodities is still trending upwards.

• On the supply side, overall supply is constrained. The pandemic may have accelerated closures and curtailed investment plans. With increased capital discipline, there has been a lack of capex to maintain existing output (this is key in commodity production).

• China, which has been a significant source of demand in recent years, has been transitioning away from high commodity-intensive investment. However, it is also focusing on clean energy and it needs a lot of infrastructure to achieve this. As noted above, Chinese infrastructure has been given a boost by the covid-19 outbreak.

• China is not alone; Vietnam, Philippines and the like are also focusing on clean energy and the trend of urbanisation continues. Over the longer term, the managers expect India to do the same, but this process will be slower due to red tape.

• Mining companies have much better balance sheets than they used to. With increased capital discipline, there is now much more focus on dividends, buybacks and repaying debt, rather than expanding capex to build new projects. Because of these developments, commodities should trade above their cost curve.

• In a post MiFID II world, markets are less efficient. CYN’s managers see the strongest opportunities in the mid-caps, which are less well-researched; and have suffered as specialist funds have exited and ETFs have increased their minimum market caps. These general trends have left miners, and particularly those at the smaller end of the spectrum, trading at low valuations, which is not sustainable in the managers’ view.

Rotated away from oil…

Rotated away from oil…

As illustrated in Figure 6, the oil price has collapsed this year and, while there has been a recovery during the last six weeks, oil has still lost around 35% of its value year to date. This has been negative for all producers, and particularly those with higher extraction costs. For much of the US shale industry it is not economical to extract oil at current prices. Shale companies have been cutting costs, but this is unlikely to be enough, particularly if the price remains low for an extended period. US Shale producer Whiting Petroleum was the first major shale producer to fall foul of the low oil price; filing for Chapter 11 bankruptcy protection in April.

As we have discussed in previous notes, CYN’s managers are generally cautious on the long-term outlook for oil, and consequently their weighting to these stocks is low. This has been beneficial to CYN’s relative performance so far this year, as energy stocks have suffered heavily during the downturn. To summarise, the managers believe that there is excess capacity for oil production globally and that it is increasingly difficult for OPEC to maintain higher prices.

Prior to the pandemic, OPEC had cut its own production in the face of falling prices, but it was handing market share to US shale operators. While the price collapse has made US shale production uneconomical, the managers believe that this is temporary and will not drive these producers out of the market in any meaningful way. As economies normalise and demand for oil returns, the managers believe that shale production will quickly come back online, once again anchoring oil in the US$50-60 per barrel range; this being the level at which shale production is profitable. Costs should continue to fall as the efficiency of shale rigs improves and new pipelines come on stream. However, in the meantime, as the oil price has recovered and liquidity in these stocks have improved, the managers have reduced CYN’s oil exposure further and have increased the portfolio’s exposure to uranium, which they believe offers a much stronger opportunity.

…into uranium

…into uranium

As we discussed in our November 2019 note on CYN’s sister fund, Geiger Counter, 2019 saw the uranium market move into supply deficit, weighed down by the additional uncertainty created by the Trump administration’s response to the section 232 investigation into the security of uranium supply.

The managers believe that the fundamentals of the uranium industry are showing a marked shift in fortunes. This follows a 10-year bear market, which has left the valuations of underlying mining equites at extremely attractive levels, in their opinion. CYN’s managers see the potential for a strong resurgence in the uranium price as more reactors come online (particularly in China and India), while major producers hold off from reactivating mothballed mines. The pandemic has only served to exacerbate the supply deficit; around 20% of global uranium production capacity has been lost during the last four months, with above ground stocks being depleted at an even faster rate. Reflecting this, the uranium price has been increasing recently.

Portfolio positioning – remain diversified and focus on quality assets

Portfolio positioning – remain diversified and focus on quality assets

While the managers have been making portfolio adjustments opportunistically (for example a purchase of 2020 Bulkers), the managers intend to keep the broad diversification within the portfolio. Crucially, they still prefer quality assets and will not purchase stocks just because they look cheap. They are focusing their attention on stocks where they can see greater certainty of asset value, and purchase positions as they arise where there is distress. They believe that the valuation gap between large and small cap companies has now peaked and that this will drive an uptick in M&A activity. Overall, restrictions are now easing and they expect to see an increase in demand as companies start to backfill their depleted reserve bases.

Asset allocation

Asset allocation

Diversified portfolio that is biased to mid-caps and producers

Diversified portfolio that is biased to mid-caps and producers

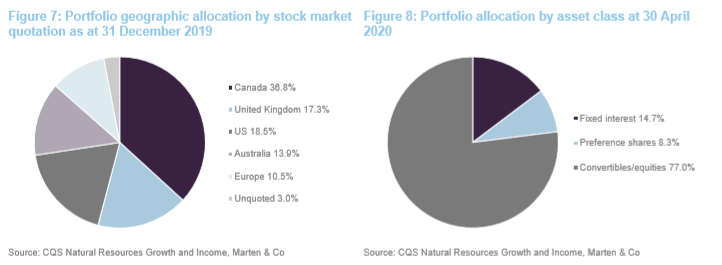

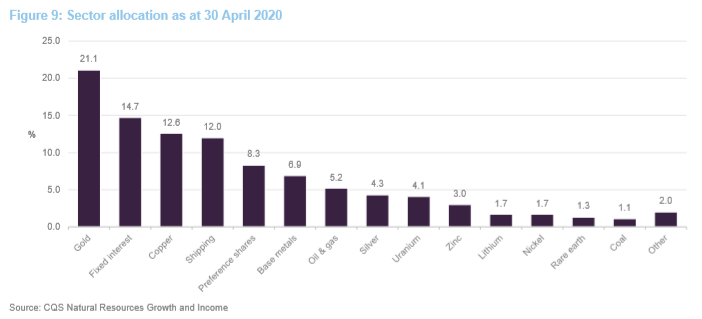

As illustrated in Figures 7, 8 and 9, CYN offers investors a broad natural resources exposure with a significant fixed income element.

CYN’s portfolio has a bias towards mid-cap stocks, as the managers believe that this is generally where the best opportunities are to be found (this is a key differentiator versus some of its larger peers). They say that the sector has seen significant flows into passive ETFs but that these are generally focused on the large cap stocks and, in a post MiFID II world, less research coverage generally, means that they are more likely to find an undervalued security further down the market cap scale.

The portfolio has very little exposure to exploration and is biased towards producers, which make up its core. The managers prefer companies that are cash-flowgenerative and can sustain themselves through the cycle. This can exclude some smaller-cap operations.

The managers typically expect portfolio turnover to be around 50% per annum but much of this will be trimming stocks whose prices have got ahead of themselves and adding to holdings where the managers see more value. Recent market turbulence in response to the outbreak has thrown up market inconsistencies, which CYN’s managers have sought to take advantage of. However, the managers say that no new positions have entered the portfolio, and nothing has been exited in its entirety. As at 30 April 2020, CYN’s portfolio had exposure to 118 issues; the same level as at the end of April 2019.

Looking at Figure 9, and comparing this against the allocations when we last published, the allocations to fixed income securities and preference shares are broadly similar. The allocation to gold has increased recently, reflecting an uplift in the gold price as investors look to physical gold as a safe haven asset in the face of covid-19. In line with other industrial metals, the allocation to copper has fallen as the outlook for industrial production has dimmed. Silver is up at the margin (precious metals have performed well in the current environment, and silver tends to follow gold, but with a lag). The allocation to shipping is relatively high as this sector has performed well.

Gearing

Gearing

It is worth noting that CYN is no longer shackled by the effects of structural gearing, as it was in previous market downturns, when its capital structure included CULS. CYN now has an RCF to provide gearing, which is much more flexible and which the managers say is working well. All things being equal, as equity values fall, gearing will increase, but it is much easier for the managers to take money off of the table when they believe it is appropriate, and the fixed income and preference share elements of the portfolio (which collectively account for around 23%) are inherently less correlated with equity markets and provide a natural hedge in more difficult periods.

Top 10 holdings

Top 10 holdings

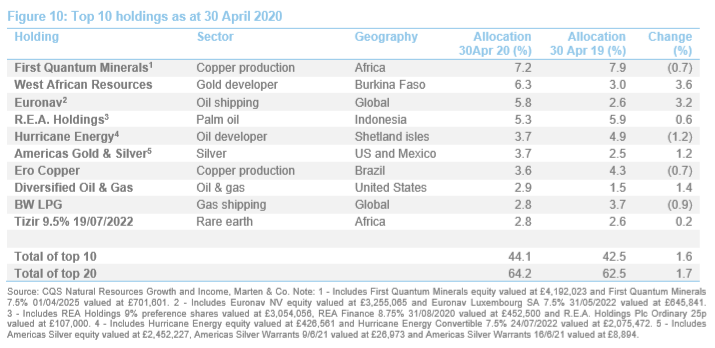

Figure 10 shows CYN’s top 10 holdings as at 30 April 2020 and how these have changed since 30 April 2019. Reflecting the manager’s long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular followers of CYN’s portfolio announcements and our notes on the company.

New entrants to the top 10 are Euronav, Americas Gold and Silver, Diversified Oil and Gas and Tizir. Names that have slipped out of the top 10 are Trevali Mining, Ascendant Resources, Goodbulk and Metals X. We discuss some of the more interesting developments later and have provided a brief update on most of the top 10 holdings. However, readers interested in more detail on these top 10 holdings, or other names in CYN’s portfolio, should see our initiation note (see page 17 of this note), where many of these have been discussed (for example, First Quantum Minerals, R.E.A. Holdings, Hurricane Energy, Trevali Mining, Ascendant Resources and Ero Copper).

Euronav (5.8%) – strong earnings growth as day rates spike, coupled with an improved dividend payout ratio

Euronav (5.8%) – strong earnings growth as day rates spike, coupled with an improved dividend payout ratio

Euronav (www.euronav.com) is an international crude oil shipping company that describes itself as the largest NYSE-listed independent crude oil tanker company in the world. It owns and operates a fleet that primarily comprises very large crude carriers (VLCCs). However, it also owns V-Plus and Suezmax tankers, and can supply and operate floating, storage and offloading (FSO) vessels (either through converting an existing vessel or through new builds).

Euronav operates its fleet both in the spot and the period market. Most of Euronav’s VLCCs and 1 V-Plus operate in the Tankers International Pool, while its Suezmax fleet is partly fixed on long-term charter and partly operates in the spot market.

Euronav experienced very strong earnings in Q4 2019 (it posted a profit of around US$160m, versus a break-even result in Q4 2018, with a similar cost base in both years). This surge in profitability followed the US administration’s decision to impose sanctions on the Chinese shipping conglomerate, Cosco Shipping Corporation, on 25 September 2019 (as well as four other Chinese companies and several individuals). The company’s Dalian tanker unit was accused of continuing to transport Iranian crude after sanctions waivers lapsed in May 2019 (China is the world’s only major importer of Iranian oil and the US is trying to halt Iran’s nuclear programme).

The sanctions spooked oil traders and tanker day rates saw a sharp increase; VLCC freight rates reportedly reached $300,000 a day in October and, while they quickly dropped again, remained elevated through to the end of January 2020. In Euronav’s results, the company said that the rates for both VLCCs and Suezmax were the highest seen for a quarter since 2008.

VLCC freight rates have since retrenched significantly, both in the face of the covid-19 outbreak and as sanctions have been lifted on one of Cosco’s Dalian units bringing supply back into the market (the sanctions are reported to have removed at least 25 VLCCs from the market for a three month period). Nonetheless, Euronav has said that Q1 2020 started very strongly (it has booked around 60% of the quarter at close to $90,000 per day for its VLCCs and $57,000 per day for its Suezmax). Covid-19 aside, Euronav believes that the signing of the phase 1 trade deal between China and the US is positive for its business. It believes that, if quotas are achieved, the deal will lead to an increase in shipping demand, particularly for energy shipping firms.

Euronav has also announced improvements to its dividend policy and an increased payout ratio (for the 2019 year it is distributing 80% of its net income after adjusting for capital gains). Euronav is also adopting a Belgian corporate code, which will allow it to pay quarterly dividends and thereby better match its cashflows with its distributions.

CYN’s managers remain positive on the outlook for the company and recently converted some of its holding in Euronav bonds to equity as they saw good discounts to the underlying value of the fleet as well as the possibility of further dividend increases due to elevated day rates reflecting a lack of available storage.

Americas Gold and Silver (3.7%) – share price supported by its Nevada project, which is expected to go into production shortly

Americas Gold and Silver (3.7%) – share price supported by its Nevada project, which is expected to go into production shortly

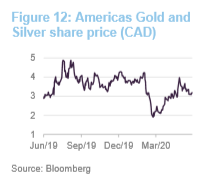

Americas Gold and Silver (www.americas-gold.com) is a Canada-based junior silver producer with assets in the US and Mexico. It has a focus on assets in production or with the potential for near-term production. The company’s Relief Canyon Mine and processing facility, located in Pershing County, Nevada, is expected to go into production shortly, which the managers say has been supporting the company’s share price.

The Relief Canyon Mine project encompasses an open pit mine and heap leach processing facility that has all the necessary state and federal permits required to begin mining and processing operations. The company’s landholdings cover approximately 25,000 acres, which includes land surrounding the mine in all directions. This provides the opportunity to both expand the Relief Canyon deposit and potentially make new discoveries nearby. The processing plant has the capacity to be expanded, and is conveniently situated to allow it to process ore from future discoveries of satellite deposits. Electricity is available on the property, and water is available from two wells located east of the processing plant.

The company is following a two-phase approach for project permitting. Phase I, which will take the project through the first 30 months of its operation, has been approved. The Phase II permitting process, which will allow production from the entire reserve, is expected to conclude in the second half of 2020.

The gold recovery plant has the capacity to handle three thousand gallons per minute of gold bearing solution, while the leach pad is permitted to hold 21 million tons and can be readily expanded. A crushing and conveying system is to be constructed to allow ore placement of over 6 million tons per year.

Diversified Gas & Oil (2.9%) – should benefit from reduced gas output from US shale oil producers

Diversified Gas & Oil (2.9%) – should benefit from reduced gas output from US shale oil producers

Diversified Gas & Oil (www.dgoc.com) owns and operates natural gas & oil wells that are primarily located in the Appalachian Basin in the United States. DGOC’s production operations are concentrated within Tennessee, Kentucky, Virginia, West Virginia, Ohio, and Pennsylvania, where it describes itself as being one of the largest independent conventional producers. The company has grown its output in recent years, both through acquisition (it has been acquiring assets from industry players who have been refocussing their businesses on shale production) and by enhancing the efficiency of its existing operations. Its assets typically have predictable production rates, long-lives (40 to 50+ years), and relatively low rates of decline in output.

While CYN’s exposure to oil exploration and production companies is limited (see Figure 9), due to the mangers outlook on the long-term pricing for oil, they have increased exposure to Diversified Gas & Oil. They say that the company’s low cost of production means that it is well positioned to weather the current low oil price environment (its geographical focus affords it economies of scale). It should also benefit from a reduction in the output of gas from shale production as this has become uneconomic for many producers at present.

CYN’s managers say that the company is very cash generative and has a significant land bank that offers it the opportunity to grow organically through infill drilling. As a recognised player, DGOC benefits from good deal flow, which has been strong given the current market backdrop. Furthermore, with both experienced management and its efforts concentrated in resource rich locations that are well known to the company, DGOC’s operations tend to be reasonably low-risk. The company says that, where the commodity pricing environment is favourable, it can activate a low-risk development program that ensures a quick return on its investment. This could offer significant potential upside should oil markets tighten. In the meantime, DGOC continues to offer an attractive yield.

TiZir Limited 9.5% US dollar drop lock bonds 2017 (20/19-22)

TiZir Limited 9.5% US dollar drop lock bonds 2017 (20/19-22)

TiZir (www.tizir.co.uk) is a 50/50 joint venture between Eramet and Mineral Deposits Limited of Australia (MDL). It describes itself as “a vertically integrated zircon and titanium business”. Headquartered and domiciled in the UK, TiZir business produces ilmenite, zircon, rutile, leucoxene, titanium slag and high-purity pig iron. It is one of the main suppliers of raw materials for the titanium dioxide industry. The business has two key assets: the Grande Côte mineral sands mine (GCO) in Senegal, west Africa; and a smelter in Tyssedal, Norway. However, it earns most of its revenues in US dollars, which is one of the attractions for the managers.

GCO is the largest single dredge mineral sands operation in the world. It primarily produces high-quality zircon and ilmenite as well as small amounts of rutile and leucoxene and has an expected mine life of at least 25 years. The operations comprise a dredge, a wet concentrator plant (WCP), a mineral separation plant (MSP), rail, port facilities and a power station. The mine benefits from its close proximity to Africa’s largest international shipping port in Dakar. More information is available at: www.tizir.co.uk/projects-operations/grande-cote-mineral-sands.

The Tyssedal Titanium & Iron ilmenite upgrading facility is one of only six such operating facilities of its type in the world, and the only one in Europe. It upgrades ilmenite to produce a high-value titanium slag, primarily sold to pigment producers; and a high-purity pig iron, a valuable bi-product, which is sold to ductile iron foundries.

Positioned on the edge of the Hardanger fjord in Tyssedal, Norway (approximately 180 kilometres south-east of Bergen and 365 kilometres from Oslo), it is well positioned to access cheap and clean power and year-round shipping (it is equipped for on-site ship handling).

The CQS team consider that TiZir has high quality assets that are well located, a good management team and strong joint venture partners in the form of Eramet and Mineral Deposits Limited of Australia (MDL). The business is highly cash-generative and is well positioned to meet its coupon obligations in their view. As illustrated in Figure 14, the market appears to share a similar view. While there has been some short-term volatility in the bond price, it has rebounded and is now trading close to pre-pandemic levels.

West African Resources (6.3%) – first gold poured and agreement signed to acquire the Toega Gold Deposit

West African Resources (6.3%) – first gold poured and agreement signed to acquire the Toega Gold Deposit

West African Resources (www.westafricanresources.com) is a gold mining company with the bulk of its operations in Burkina Faso. It is currently transitioning from being a developer to a producer, after pouring its first gold at its Sanbrado Gold Project on 18 March 2020. Sanbrado is expected to produce more than 300,000oz gold in its first year of production and an average of 217,000oz a year in its first five years, at an AISC of less than US$600/oz. The company says that Sanbrado has an initial 10-year mine life, including 6.5 years of underground mining, with strong early cashflow and a rapid payback of capital at US$1300/oz gold. There is also the potential for depth extensions at the mine. CYN’s managers say that the company has contingency plans in place to deal with the pandemic and note that it is relatively easy to quarantine a remote mine site such as Sanbrado.

In April 2020, West African Resources acquired the 1.1Moz Toega Gold Deposit, from Canada’s B2Gold, for US$45m. Toega, which is situated on the Nakomgo exploration permit, is located 14km from Sanbrado and the permit will be paid for in stages. The first U$10m was paid in cash from existing reserves. The following US$10m is to be paid in cash or shares on the completion of a feasibility study, which is to occur prior to the second anniversary of the signing of the agreement. The payment of the second tranche triggers the transfer of ownership of the exploration permit to West African Resources and, assuming the project progresses beyond this stage, a further US$25m will be due in production royalty payments. These are equal to 3% of the net smelter returns for production from the Nakomgo exploration permit area.

The company says that it expects the acquisition of Toega to increase the Sanbrado production profile and mine life, with a relatively low capital expenditure. It expects to commence exploration field work at Toega following the 2020 wet season and to bring Toega ore into the Sanbrado mine plan within three years.

BW LPG (4.3%) – very strong 2019 results, but heavily exposed to US shale

BW LPG (4.3%) – very strong 2019 results, but heavily exposed to US shale

BW LPG (www.bwlpg.com) describes itself as the world’s leading owner and operator of LPG vessels. It has over 40 years of experience in the liquefied petroleum gas (LPG) market and its fleet of around 50 ships is composed of very large gas carriers (VLGCs) and large gas carriers (LGCs).

Following a difficult 2018, BW LPG’s annual results were very positive and well received by the market (up 6.6% on the day). Its time charter equivalent (TCE) income increased by 126.5% in Q4 2019 to US$191.6m (Q4 2018: US$84.6m). This was mainly attributable to higher LPG spot rates and higher fleet utilisation. Reflecting this, EBITDA for the quarter amounted to US$154.1m (Q4 2018: US$35.7m) with an EBITDA margin of 80.4% (Q4 2018: 42.1%).

Looking at the annual results, TCE income for 2019 increased by 81.9% year on year to US$547.3m (2018: US$300.9m), while EBITDA for the year increased by 283.1% to US$398.8 million (2018: US$104.1 million). Overall, earnings per share were US$1.97 per share for 2019 (2018: loss per share of US$0.51). The company’s ROE was 25.3% for 2019 (2018: -7.0%).

CYN’s managers say that they remain cautious on the long-term outlook for oil and prefer to use shipping as an alternate way to get exposure that is less price-sensitive. BW LPG offers a way of getting exposure to, what was previously, the rapid growth in US shale products. However, the outlook for US shale looks severely challenged following the collapse of the oil price. The company transports propane – primarily from the US to Asia – which is produced as a by-product of shale production. It was anticipated that, as shale production increases, this would increase flows and the spread between pricing, which should support higher day rates for BW LPG’s vessels.

2020 Bulkers – opportunistic purchase from a distressed seller

2020 Bulkers – opportunistic purchase from a distressed seller

2020 Bulkers (2020bulkers.com) is an independent dry bulk shipping company that owns and operates a fleet of eight 208,000 DWT Newcastlemax dry bulk carriers (six of these are in service and two are under construction in China, with delivery expected this month). All of the company vessels are modern, fuel efficient and fitted with both scrubbers (exhaust gas cleaning systems) and ballast water treatment systems.

The fitting of scrubbers means that all of the company’s vessels are compliant with the IMO’s new emissions regulations that came into effect on 1 January 2020, which limit sulphur emissions from ships. Despite the recent passing of the deadline, many vessels are not yet equipped with scrubbers, meaning that they must instead use more expensive low sulphur fuel.

While CYN already had a small position in the company, the managers were able to add to the holding opportunistically, purchasing from a distressed seller at a good discount. They say that dry bulk has been through a difficult period, where earnings have been very low, but these companies are now very cheap and now is a good time to invest. With bulk rates low, no new ships are being built and old supply is coming out of service. This should support a strong environment for returns going forward, with quality operators well placed to benefit as the economic cycle improves.

Performance

Performance

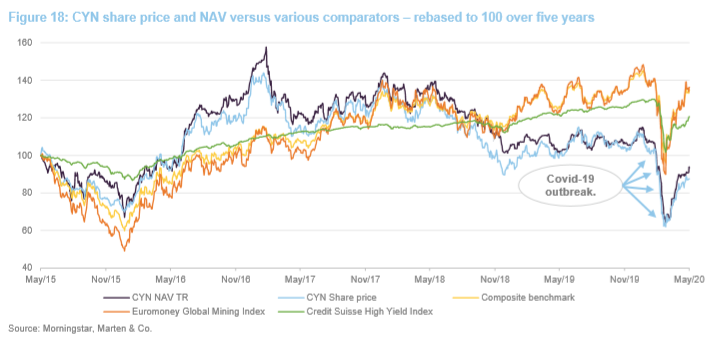

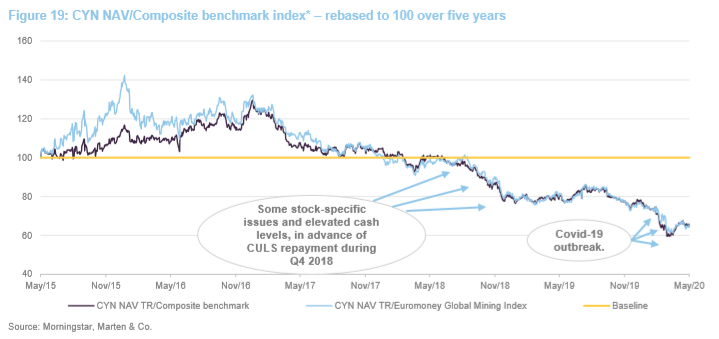

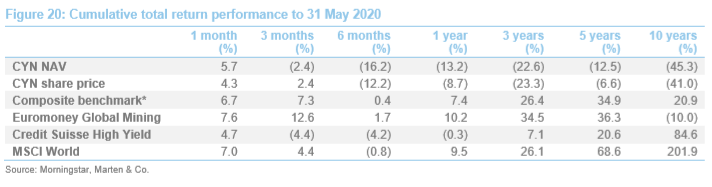

In our June 2019 note, we commented on how, during the second half of 2018, CYN’s NAV markedly underperformed its composite benchmark and the Euromoney Global Mining Index, and that this had eroded CYN’s longer-term record, which was otherwise one of moderate outperformance during the previous five years, albeit with marked periods of under- and outperformance within this. (Note: CYN’s composite benchmark comprises 2/3 the Euromoney Global Mining Index and 1/3 the Credit Suisse High Yield Index.)

The first three quarters of 2019 saw CYN regain some of the previous underperformance of its NAV against both its composite benchmark index and the Euromoney Global Mining Index (CYN’s NAV returned 17.9%, while the composite benchmark returned 12.2% the and Euromoney Global Mining Index returned 12.4%). However, underperformance during the final quarter saw CYN’s 18.4% NAV total return for 2019 lag both the 23.2% return of both the composite benchmark and that of the more large-cap-weighted Euromoney Global Mining Index, which returned 27.0%. The other component of CYN’s composite benchmark is the Credit Suisse High Yield Bond Index. This returned 14.0% during 2019 (all figures in sterling total return terms).

Recent performance

Recent performance

Moving into 2020, the picture changed dramatically with the outbreak of covid-19. Markets retrenched significantly as the infection rate has accelerated, whilst safe haven assets (for example, gold and precious metals), and exposures that may benefit (such as biotechnology and technology assets), rallied in response. Physically-backed ETF gold holdings are close to all-time highs.

Commodity markets are inherently economically sensitive (commodity demand, and therefore pricing, is strongly related to industrial production) and were at the sharp end of the downturn in March but saw a substantial bounce during April, which continued in May (CYN’s NAV comfortably holding its own despite increased volatility).

Looking in more detail at CYN’s sources of returns, precious metals and shipping companies performed well during 2019, having been poor during 2018. CYN has also benefitted from its low weighting to energy and its significant fixed income component during the recent market turmoil.

Quarterly dividend payments

Quarterly dividend payments

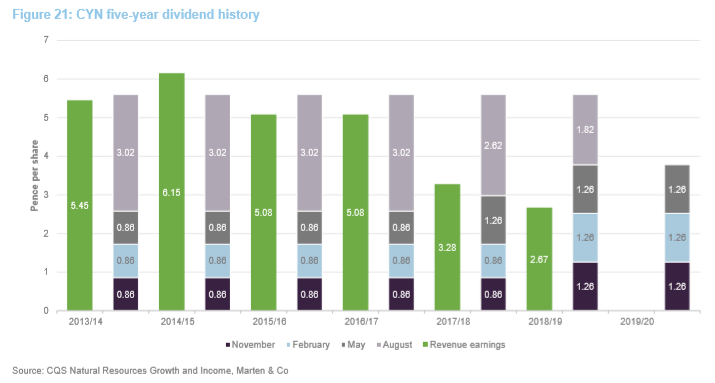

CYN aims to pay an attractive level of dividend income to shareholders on a quarterly basis, with all dividends paid as interim dividends. The trust is permitted to pay dividends out of capital and, in March 2018, the board announced its intention to use CYN’s capital reserves, when required, to maintain or potentially increase the dividend level (see page 19 of our June 2019 note for more detail).

For a given financial year, the first interim dividend is paid in November with the second, third and fourth interims paid in February, May and August. The total dividend paid for each of the last six financial years has been 5.6p per share and the target for the year ending 30 June 2020 was to maintain this. This equates to a yield of 7.3% on CYN’s share price of 76.4p as at 18 June 2020.

While the target was set before the pandemic took hold, CYN has maintained the first three interims, which most recently includes the third interim paid in May, at the 1.26p level. As at 31 December 2019, CYN had revenue reserves of £611k, or 0.91p per share (2018: £2,363k or 3.53p per share), which is equivalent to 16.3% of the 5.6p target for the year. In addition, as at 31 December 2019, CYN had a capital reserve of £24.9m or 37.20p per share (2018: £14.4m or 21.59p per share), which suggests that CYN has plenty of capacity to maintain the dividend at 5.6p per share, provided the board is still comfortable to pay this out of capital.

Premium/(discount)

Premium/(discount)

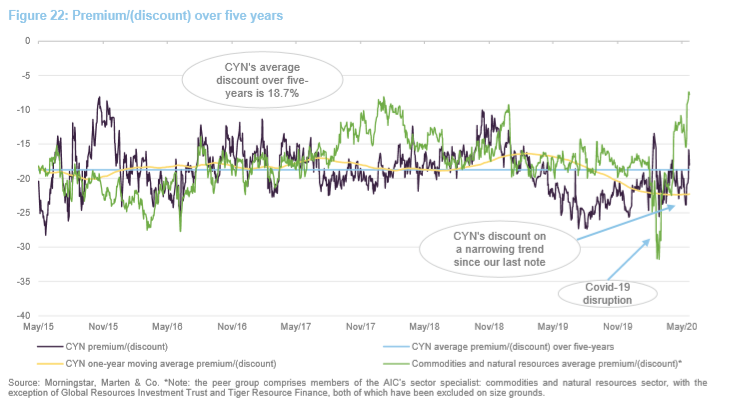

As illustrated in Figure 22, since we last published in June 2019, CYN’s discount has broadly been on a narrowing trend, prior to the market disruption caused by the outbreak of covid-19. During the last 12 months, CYN has traded at discounts between 13.4% and 27.4%, and an average of 22.3%. As at 18 June 2020, the discount was 16.5%, which is modestly below its longer-term five-year average and towards the narrower end of its one-year trading range. However, CYN’s discount is noticeably wider than the sector average of 7.8%. In comparison, the sector’s fiveyear average discount is 17.7% (with a range of 7.4% to 31.8%). CYN’s five-year average discount is 18.7% (with a range of 8.1% to 27.5%).

Arguably reflecting the more cyclical nature of resource companies, CYN’s discount has exhibited a degree of cyclicality whereby it has tended to narrow when markets rally and investors are seeking more cyclical exposures, and widen when markets soften and investors’ appetite for more defensive exposures has increased. CYN’s mid-cap bias may amplify these movements, although its relatively-high yield (the highest in the sector) offers investors a degree of comfort in that they are paid to wait.

While CYN has the authority to repurchase up to 14.99% and allot up to 9.99% of its issued share capital, the board says that it has no current intention of using this authority and, to date, CYN has not repurchased any of its shares. The board considers that share repurchases would likely have a limiting ability to provide any sustained change in the discount and, reflecting this, there is no formal discount control mechanism or discount target.

We have previously said that, given CYN’s current size, we believe share repurchases would likely have a limited impact on the discount as they would also serve to reduce liquidity and put upward pressure on CYN’s ongoing charges ratio (its fixed costs being spread over a smaller asset base). Instead, we believe that CYN would be better served by increasing its size. The board and manager share this view and are focused on increasing awareness of the trust among investors.

Fund profile

Fund profile

Diversified natural resources exposure

Diversified natural resources exposure

CYN’s aim is to provide investors with capital growth and income by investing in a portfolio that predominantly comprises mining and resource equities, as well as mining, resource and industrial fixed interest securities.

Investments are typically made in securities that the manager has identified as undervalued by the market (both equities and fixed income) and that it believes will generate above average income returns relative to their risk, thereby also generating the scope for capital appreciation.

CYN’s portfolio is biased towards mid-cap stocks; meaning that it offers a more idiosyncratic exposure when compared against its large-cap focused peers. It also offers a markedly different exposure to ETFs and the major natural resource focused indices.

CQS Group and New City Investment Managers

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been CYN’s investment manager since June 2003, when the trust underwent a major reorganisation that saw a complete change of focus to natural resources (previously it had been focused on Latin American investments). On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies with AUM of US$16.9bn as at 29 May 2020. Ian Francis, Keith Watson and Rob Crayfourd are responsible for the day-to-day management of CYN’s portfolio. Keith and Rob focus on CYN’s equity holdings, while Ian primarily focuses on its fixed income holdings (see pages 23 and 24 of our June 2019 initiation note for more details of the management team).

Composite benchmark index

Composite benchmark index

CYN has a composite benchmark index that is weighted two-thirds the Euromoney Global Mining Index (formerly the HSBC Global Mining Index) and one-third the Credit-Suisse High Yield Index. The composite is calculated using a base date of 1 August 2003 in sterling-adjusted total return terms. However, despite having this composite benchmark, CYN’s portfolio is not constructed with reference to it, or to any other index.

Previous publications

Previous publications

Readers interested in further information about CYN, such as investment process, fees, capital structure, life and the board, may wish to read our initiation note “Strong recovery potential?”, published on 11 June 2019 by clicking on the link.

The legal bit

The legal bit

This marketing communication has been prepared for CQS Natural Resources Growth and Income Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.