QuotedData’s Investment Companies Roundup – February 2020

Investment Companies Roundup

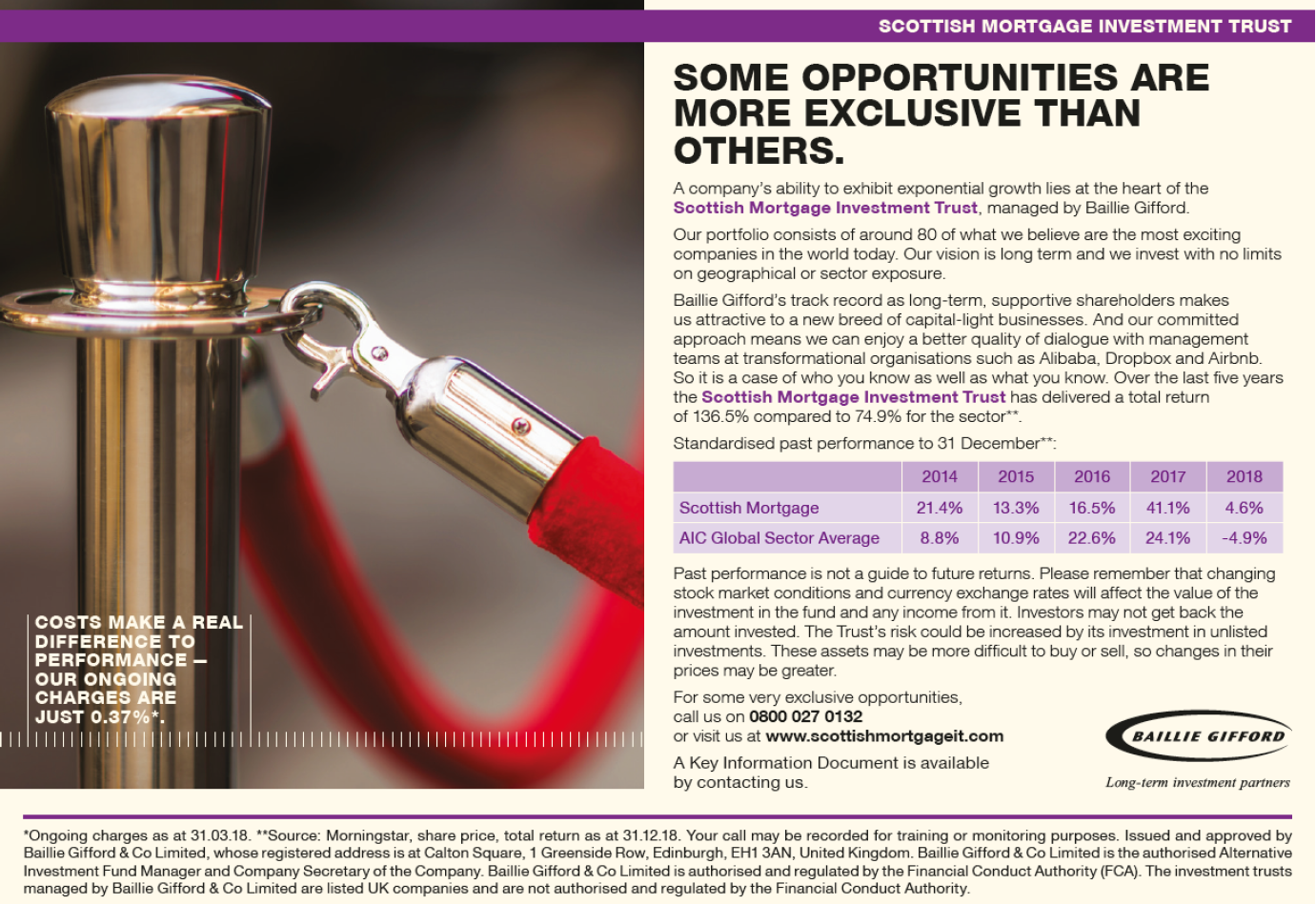

Kindly sponsored by Baillie Gifford

Table of contents

Table of contents

- New research

- In this issue

- Performance data

- Discounts and premiums

- Money in and out

- Major news stories

- Income

- Events

- Guide

New research

New research

Here is a list of research we published over January:

An annual overview note on Shires Income (SHRS)

“Shires Income (SHRS) will look to build on a strong second half to 2019 over the coming year. The trust’s strategy allows it to augment its income focus with a portfolio of preference shares and convertible securities, which allows it to invest in growth-focused companies. The trust continues to issue shares, and this should both help widen its audience, improve liquidity in the shares, and reduce its average running costs.”

An initiation note on GCP Infrastructure (GCP)

“We have initiated coverage on GCP Infrastructure (GCP), which for almost 10 years, has met its objective of delivering high and stable income for its shareholders with low volatility In an age where real yields on government securities are negligible, there are clear attractions to a fund that derives a high proportion of its revenue from government bodies yet offers a 5.9% yield.”

An annual review of Investment Companies in 2019

“In our annual review of the investment companies sector, we looked at the main trends across performance by sector, movements in discounts/premiums, capital raising and major news stories. There was plenty to worry about going into 2019, though this did not stop risk assets having a year that would have defied all but the most optimistic forecasters. The initial trigger came from the US, where the central bank performed a U-turn, abandoning planned interest rate increases. Gold also had its best run in years.”

An annual review of listed Real Estate Companies in 2019

“We also published a dedicated review of the property sector. Listed property companies and REITs performed well, all things considered. The total market capitalisation of property companies reached £88.6bn at the end of the year, an increase of 24% over the course of 2019.The year ended on a positive footing for the property sector as the Conservatives’ big general election win brought much-needed political certainty.

Alternative property sectors – self-storage, student accommodation and healthcare – were the standout performers as the specialist nature of the sectors and positive market dynamics were recognised.”

In this issue

In this issue

- Performance – After beginning the year in the ascendancy, helped by easing tensions between the US and Iran, the outbreak of coronavirus in China pulled the breaks on risk assets, particularly hitting Asian and resource funds. Significant selling has taken place in early February (not included in this roundup), following the end of the Chinese new year celebration. Out of the bottom 10 performers by NAV, seven were either Asian or resource-focused. Amongst the outperformers, New life-sciences fund, RTW Venture had the third best NAV return behind Manchester & London and Oakley Capital. Manchester & London’s NAV return owed to good months for tech-based holdings, including Amazon and Alphabet;

- Discounts/premiums – Before January, Standard Life Private Equity’s discount had widened to a point where a lot of investors began to see value. Elsewhere, Baillie Gifford European Growth’s share price has been increasing since Baillie Gifford took over the management contract from Edinburgh Partners. Several renewables funds came under attack (see the news section) from brokers, pulling down Bluefield Solar‘s premium;

- Money in and out – It was a quiet month of fundraising with no major placings;

- Major news stories – Renewable energy funds came under attack from brokers and SQN Asset Finance discussed the problems it was having with anaerobic digestion plants.

Performance data

Performance data

January’s biggest movers in NAV and price terms are shown in the charts below:

On the positive side:

- Amongst the outperformers, Adamas Finance Asia’s price move stands out. It announced that one of its key positions, Future Metal Holdings, had commenced dolomite production in China;

- New life-sciences fund, RTW Venture had the third best NAV return behind Manchester & London and Oakley Capital. Manchester & London’s NAV return owed to good months for tech-based holdings, including Amazon and Alphabet. This helped Allianz Technology too;

- Elsewhere, Standard Life Private Equity’s annual results were well received. It believes valuation in its core mid-market European focus are less stretched than in the US.

On the negative side:

- Significant selling has taken place in early February (not included in this roundup), following the end of the Chinese new year celebration. Out of the bottom 10 performers by NAV, seven were either Asian or resource-focused;

- Aberdeen New Thai’s NAV also declined in December, before the coronavirus outbreak. Still, a ban by China on outbound tour groups into Thailand hit all Thai assets;

- BlackRock Energy and Resources Income, BlackRock World Mining and CQS Natural Resources Growth & Income were hit with demand for resources likely to slip markedly over the coming weeks and months;

- Elsewhere, SQN Asset Finance Income was hit by a write-down to one of its main loan assets, leading to an exodus in the shares;

- The pullback in Infrastructure India’s shares came after they nearly doubled over December.

Discounts and premiums

Discounts and premiums

The table below shows the top five movers in either direction (more or less expensive relative to NAV):

| wdt_ID | Fund | 31 Jan (%) | 31 Dec (%) |

|---|---|---|---|

| 1 | Adamas Finance Asia | -63.70 | -76.80 |

| 2 | Standard Life Private Equity | -10.10 | -20.50 |

| 3 | Henderson Alternative Strategies | -11.20 | -21.10 |

| 4 | Baillie Gifford European Growth | 1.90 | -7.90 |

| 5 | Jupiter Green | 5.10 | -4.20 |

| 6 | Schroder UK Public Private | -38.30 | -28.90 |

| 7 | JPMorgan China Growth & Income* | -12.50 | -3.00 |

| 8 | Bluefield Solar | 13.80 | 23.40 |

| 9 | Hadrian's Wall Secured | -38.60 | -28.10 |

| 10 | SQN Asset Finance Income | -44.60 | -11.00 |

More expensive relative to NAV:

- We touched on the catalyst behind Adamas Finance Asia’s above while Standard Life Private Equity’s discount had widened to a point where a lot of investors began to see value;

- Henderson Alternative Strategies’s discount narrowing was price-led after it said it would seek approval to realise its assets and wind up the company;

- Baillie Gifford European Growth’s share price has been increasing since Baillie Gifford took over the management contract from Edinburgh Partners;

- Jupiter Green’s shares were stronger for a second month in succession, having earlier been weighed down by its underweight allocation to the US as well as stock selection.

Cheaper relative to NAV:

- SQN Asset Finance Income was discussed in the ‘winners and losers section’ while Hadrian’s Wall Secured Investments’s shares began to fall last July and this continued over the rest of the year. The market’s initial reaction was believed to be a knock-on from provisions the fund made in May against two loans made to wood pellets companies, while Funding Circle’s wind up has affected the sector as well;

- Several renewables funds came under attack (see the news section) from brokers, pulling down Bluefield Solar;

- JPMorgan China Growth & Income’s discount was hit by the virus, though this has been much more pronounced in early February.

Money in and out

Money in and out

Fundraising highlights from the month:

Money coming in:

- It was a quiet month of fundraising with no major placings. Impax Environmental Markets, Smithson Investment, JPMorgan Global Core Real Assets, Bankers and City of London were the main issuers of new shares.

Money going out:

- Pershing Square regularly leads the sector’s buyback activity.

- Honeycomb, NB Global Floating Rate Income GBP, Alcentra European Floating Rate Income, Biotech Growth, SME Credit Realisation and Perpetual Income & Growth were the other companies to return more than £10m.

Major news stories

Major news stories

Portfolio Developments:

- US Solar’s manager was the victim of a fraud in relation to contracted construction payments totalling £6.9m. It also announced it was acquiring approximately 177MW portfolio of twenty-two operating utility-scale solar power projects

- Syncona provided an update on its Autolus holding

- JLEN’s NAV was impacted by a fall in the power price. JLEN also made a €25m commitment to Foresight Energy Infrastructure Partners

- CC Japan Income & Growth reported annual results as Shinzo Abe became the country’s the longest serving Prime Minister

- Merian Chrysalis reported inaugural annual results

- Hipgnosis acquired music catalogues from Brian Higgins, Ammar Malik and Blink-182. Hipgnosis also announced it had invested £214m of the proceeds of its C share fundraising from October 2019, representing around 95% of the net proceeds

- SQN Asset Finance discussed the problems it is having with anaerobic digestion plants

- Asia-focused Symphony International existed IHH investment with returns of 1.8x original cost

- Jupiter Emerging and Frontier celebrated a good year

- FastForward Innovations sold bond holdings in Cryptologic following the company’s pivot towards cannabis

- Augmentum Fintech invested in a bookkeeping platform

- Gresham House Energy completed a 49MW Red Scar battery storage investment

Corporate news:

- Renewable energy funds came under attack from brokers

- Invesco Income Growth faces a continuation vote

- Sequoia Economic Infrastructure announced it had committed the proceeds of its £280m revolving credit facility

- Henderson Alternative Strategies said it would seek approval for a realisation process

- A private placement by Scottish Mortgage raised £188m

- GCP Asset Backed Income’s credit facility was increased

Managers and fees:

- Fidelity Special Values got a new co-manager

- Riverstone Energy announced amendments to performance allocation arrangements

Income

Income

The following funds announced their full year dividends in January (please refer to the attached document for a list of the notes around the numbers):

Return to top

Events

Events

Here is a selection of upcoming events:

- BMO Capital & Income AGM 2020, 11 February 2020

- Keystone AGM 2020, 11 February 2020

- JPMorgan Asian AGM 2020, 13 February 2020

- GCP Infrastructure AGM 2020, 13 February 2020

- Aberdeen Diversified Income And Growth AGM 2020, 26 February 2020

- Standard Life Private Equity AGM 2020, 24 February 2020

- Jupiter Emerging and Frontier AGM 2020, 26 February 2020

- Polar Capital Global Healthcare AGM 2020, 26 February 2020

- Aberdeen Diversified Income And Growth AGM 2020, 26 February 2020

- Bankers AGM 2020, 26 February 2020

- BlackRock Throgmorton EGM 2020, 27 February 2020

- Finsbury Growth & Income AGM 2020, 28 February 2020

- JPMorgan Russian Securities AGM 2020, 2 March 2020

- Ecofin Global Utilities And Infrastructure AGM 2020, 6 March 2020

- CC Japan Income & Growth AGM 2020, 10 March 2020

- Independent Investment Trust AGM 2020, 26 March 2020

- Master Investor – the UKs largest private investor show, 28 March 2020

- Polar Capital Technology AGM 2020, 2 September 2020

Master Investor – the UKs largest private investor show – 28 March 2020

Guide

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.