Ecofin Global Utilities and Infrastructure Trust – Resilient income

Resilient income

Resilient income

Investors in search of income have been hit hard by the COVID-19 crisis as bond yields and interest rates have tumbled, and dividend cuts have proliferated. By contrast, the companies in Ecofin Global Utilities and Infrastructure Trust’s (EGL’s) portfolio have proved relatively resilient. In addition, EGL is able to use distributable reserves to top up any shortfall in revenue. The defensive attractions of the sector have been recognised and EGL is now issuing shares to meet demand (and prevent its shares from trading at an excessive premium).

EGL’s manager has been taking advantage of weak markets to build positions in selected opportunities at attractive valuations. This strategy is already bearing fruit. After a period where there have been few transactions, he expects to see more M&A activity as markets recover. This could prove beneficial to EGL’s portfolio.

Developed markets utilities and other economic infrastructure exposure

Developed markets utilities and other economic infrastructure exposure

EGL seeks to provide a high, secure dividend yield and to realise long-term growth, while taking care to preserve shareholders’ capital. It invests principally in the equity of utility and infrastructure companies which are listed on recognised stock exchanges in Europe, North America and other developed OECD countries. It targets a dividend yield of at least 4% per annum on its net assets, paid quarterly, and can use gearing and distributable reserves to achieve this.

|

|

Pandemic overshadows markets

Pandemic overshadows markets

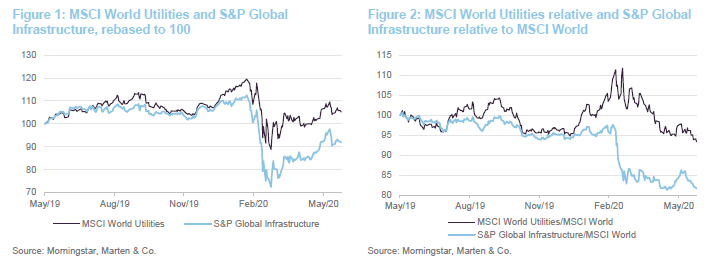

There has been considerable dispersion of returns between utilities and infrastructure over the past few months.

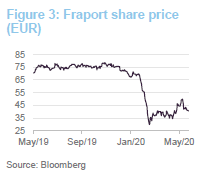

The solid, defensive characteristics of the utilities sector are attracting investors. However, those parts of the infrastructure sector whose revenues are linked to economic activity, toll roads and airports in particular, have sold off. For example, Fraport (the operator of a number of airports, including Frankfurt airport, and a stock that is not held by EGL) fell by 37% over the year to the end of May 2020.

Most regulated utilities are pretty much flat over the year, while some have risen in value and this relatively good performance and resilience has extended to many integrated utilities too which have an attractive combination of regulated businesses and solid growth related to renewables. Jean-Hugues believes that such moves are justified by the fundamentals of these businesses.

Resilient source of income

Resilient source of income

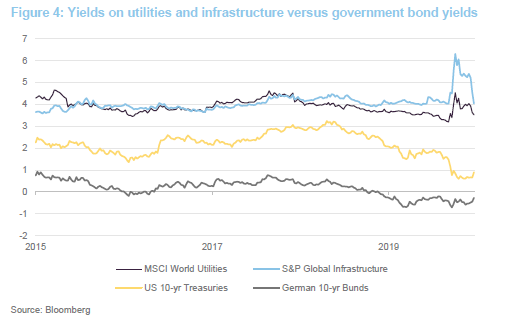

In the wake of the pandemic and the measures taken to prop up economies, yields on government bonds and cash look likely to remain close to historic lows, and inflation may soon become deflation. Lower long-term interest rates should be positive for sentiment towards utilities.

Falling inflation is usually a negative for UK regulated names, especially UK water companies. EGL already has limited exposure to this area. Pennon is in the portfolio, but Jean-Hugues says that the attraction here was principally Pennon’s Viridor recycling and waste management business. This is being sold to Planets UK Bidco Limited, a newly-formed company established by funds advised by Kohlberg Kravis Roberts & Co. LP (KKR), for £4.2bn, representing an EV/EBITDA multiple of 18.5x.

Investors who are reliant on dividend income now face a swathe of dividend cuts. EGL’s portfolio has not been immune to this, but it has fared relatively well in this regard (see below).

Impact on EGL – largely unaffected

Impact on EGL – largely unaffected

When we talked to Jean-Hugues in preparation for this note, 90% of companies in the portfolio had published an update on the impact of COVID-19 on their company. 80% of the companies in the portfolio confirmed previous earnings guidance and confirmed they would pay their dividends.

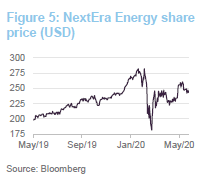

For example, NextEra Energy (www.nexteraenergy.com), the largest position in the portfolio at the end of May 2020, says it will be disappointed if it is not able to deliver financial results at or near the top end of its adjusted EPS expectation ranges for 2020, 2021 and 2022. NextEra Energy is the US’s largest electricity utility (largely serving customers in Florida) and a world leader in renewable energy generation from wind and solar. Earnings growth is underpinned by the company’s considerable investment programme ($50bn-$55bn between 2019 and 2022) and cost savings yet to be extracted from its January 2019 acquisition of Gulf Power. NextEra Energy feels confident enough to predict 12% dividend growth in 2020 and around 10% growth in 2021 and 2022.

In these uncertain times, companies such as NextEra Energy can draw comfort from the predictability of revenues which are largely regulated or subject to long-term power purchase agreements (PPAs) with credit-worthy counterparties.

Some dividend cuts/suspensions

Some dividend cuts/suspensions

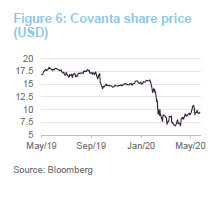

Around 9% of positions had reduced or suspended their dividends. Some of these were companies whose revenues are linked to industrial activity, for example waste management companies Suez, Veolia and Covanta.

Covanta (www.covanta.com), which is the largest waste incinerator company in the US, was one of the stocks that has dropped out of the list of the 10 largest holdings (see page 8). We discussed it in our 2017 initiation note and again in our October 2018 note.

Other utilities faced calls from politicians to suspend dividend payments. Within EGL’s portfolio, in France Engie and EDF, which are partly state-owned, were forced to comply. However, in Germany RWE and EON argued successfully that they were commercial companies that should be free of State interference.

Some yet to pronounce

Some yet to pronounce

At the time of our meeting, the remainder had yet to communicate. Among these were UK companies such as SSE, and Jean-Hugues thought this may reflect political uncertainty. He decided to assume a worst-case scenario and reduced EGL’s exposure to SSE. SSE has reiterated its dividend policy since then, which Jean-Hugues feels is further evidence of the fundamental strength of EGL’s portfolio holdings and investment universe.

Opportunistic purchases

Opportunistic purchases

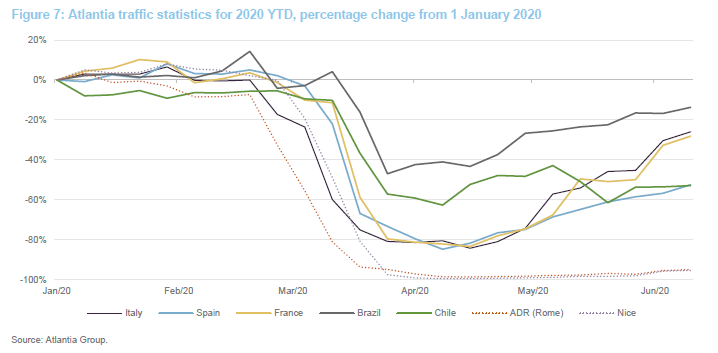

Jean-Hugues has been looking for opportunities to take advantage of weak prices to add to EGL’s infrastructure exposure. He is favouring toll roads over airports as he expects much faster recovery in road traffic than air travel. Airport companies have been hit by loss of retail income as well as landing fees. With many airlines in trouble, there may be pressure on fees going forward.

Italian transport infrastructure company Atlantia publishes weekly data on traffic on its toll roads and through its airports, which illustrate this. In Figure 7, the traffic statistics on toll roads in various countries are shown with solid lines and the traffic statistics for the company’s two airports are shown with dotted lines.

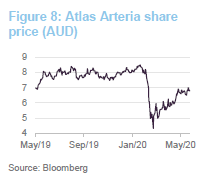

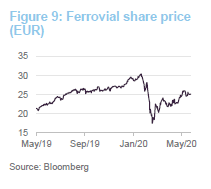

Companies in this category include Atlas Arteria (formerly Maquarie Atlas Roads) and Ferrovial. These are both existing holdings within EGL’s portfolio which have been increased.

Atlas Arteria

Atlas Arteria

Atlas Arteria (www.atlasarteria.com), which we discussed in detail in our last note, is a global operator and developer of toll roads, with an interest in the APRR and ADELAC toll roads, a 2,318km motorway network in the east of France. In the US, it owns a 100% economic interest in the Dulles Greenway, a 22km toll road in the Commonwealth of Virginia, and in Germany it owns the Warnow Tunnel in the north-east city of Rostock.

Its 2020 dividend guidance was for a 20% increase to 36 cents per share (a 5.3% yield on the current share price). However, given a two-thirds drop in traffic over the second half of March in its French and US assets and a one-third drop in Germany, the dividend that would have been paid in March was suspended (later cancelled) to conserve cash. In May, Atlas Arteria raised AUD420m, in an oversubscribed issue, with the aim of restructuring its balance sheet and reducing its overall debt.

Ferrovial

Ferrovial

Ferrovial (www.ferrovial.com) manages 1,474m km of roads in nine countries, and Heathrow, Glasgow, Aberdeen and Southampton airports. It also has a construction company with a strong presence in the transportation sector and a services company with operations in the water treatment and electricity sectors, amongst others. The services business is up for sale.

Again, the toll roads and airports were hit by COVID-19 restrictions, with the airports worst affected. The group’s construction activities in Spain were not much impacted. Ferrovial had a strong balance sheet ahead of the crisis, with €1.6bn of free cash outside the infrastructure assets. To date, its dividend has not been affected and recovering toll road traffic should be supportive going forward.

Power prices weaker

Power prices weaker

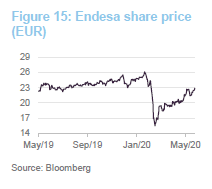

Power prices were trending downwards ahead of the crisis. Coal and natural gas prices have been falling and this has been feeding through into power prices. A COVID-19-related drop in electricity demand has introduced further downward pressure. Jean-Hugues points out that power prices are still above the lows of 2016/17. More importantly for the sector perhaps spot power prices are less of a concern for many generators. Jean-Hugues says that revenues for many generators are about 80% regulated or contracted under long-term power price agreements (PPAs).

In addition, CO2 prices have remained pretty steady, which removes one element of uncertainty.

Asset allocation

Asset allocation

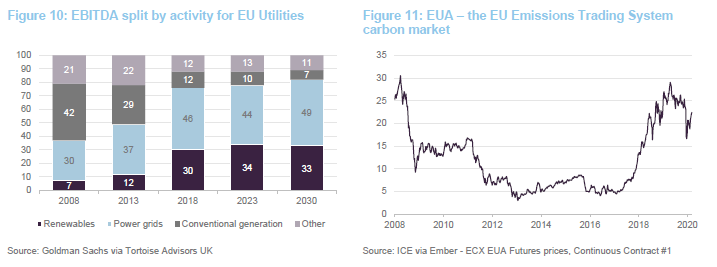

The distribution of EGL’s portfolio by geography did not change much between 30 September 2019 (the data we used in our last note) and 31 May 2020. The allocation to emerging markets fell from 3% to 1% and the allocation to OECD countries ex Europe, North America and the UK, rose to 7% from 3%. On a sector basis, the allocation to transportation is higher, reflecting the opportunistic purchases we referred to above.

Jean-Hugues increased EGL’s gearing to take advantage of lower valuations at a time when growth and income prospects for EGL’s portfolio companies have arguably improved on a relative basis (i.e., compared to the overall market). At the end of May this was 12.7%, having been as high as 15% and 7.4% at the end of January, ahead of the COVID-19-related market falls.

Since 30 September 2019, SSE, Covanta and NextEra Energy Partners have dropped out of the top 10 and have been replaced by Endesa, National Grid and Evergy.

Endesa

Endesa

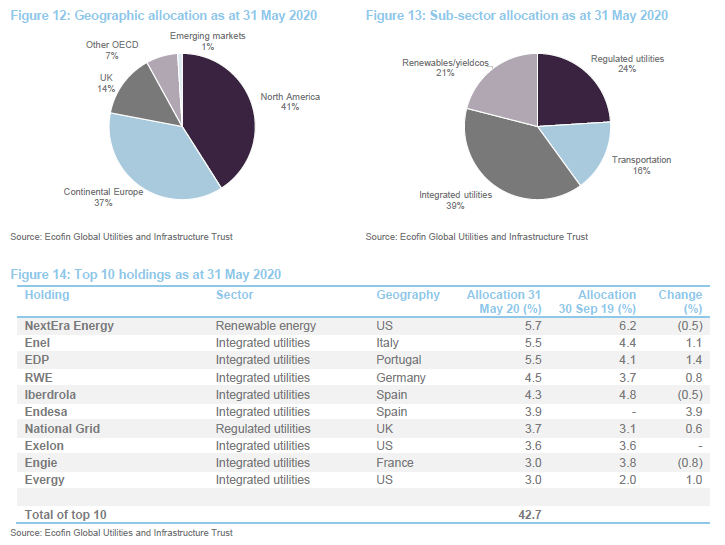

Endesa (www.endesa.com/en) is Spain’s largest energy utility and the second-largest in Portugal (after EDP). Around 70% of the company is owned by Enel. The company has been investing heavily in renewable energy generation (hydro, wind and solar) and areas such as smart meters and EV charging. Endesa’s remaining mainland coal plants are scheduled to be phased out by 2022.

Endesa is not a stock that EGL has had much exposure to in the past. However, a run of poor share price performance had, in Jean-Hugues’ view, left it trading at an attractive value. It offered around an 8% yield when he began to build the position. It has done well subsequently.

National Grid

National Grid

National Grid (www.investors.nationalgrid.com) was discussed in our note published October 2018. The company owns the high-voltage electricity and high-pressure gas transmission system in England and Wales, and is responsible for balancing supply and demand on the electricity network across Great Britain. It also has a presence in the US where it provides electricity to Massachusetts, upstate New York, Rhode Island and Vermont, and natural gas to customers in New York, Massachusetts and Rhode Island.

National Grid’s share price was depressed last year on fears that a possible Labour government would seek to nationalise the company’s UK operations. The decisive Conservative victory in the December 2019 election allayed those fears.

COVID-19 has had minimal impact on the company’s revenues. However, the company has suspended debt collection and customer termination activities in the US, which could translate into higher bad debt provisions.

The shift in the UK’s generation mix towards renewables requires more investment in the power grid, which should underpin National Grid’s growth. In the UK, a regulatory review process is underway and a draft determination is expected shortly.

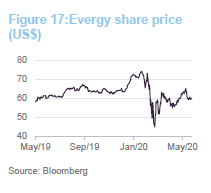

Evergy

Evergy

Evergy (www.evergyinc.com) was formed in 2018 with the merger of Kansas City Power & Light and Westar Energy Inc. The company generates and distributes power to 1.6m customers in Kansas and Missouri. The generation mix is changing as the company invests in renewable energy (both on its own balance sheet and through PPAs) and also upgrades its power grid.

In the short-term, sales of power have been impacted by COVID-19 (commercial sales were 13% lower and industrial sales 15% lower in April 2020 versus April 2019). The company plans to invest $7.6bn over the next five years, but says it has sufficient liquidity and no need to raise additional equity. It has a cost-cutting programme in place (linked to the merger) and is exceeding its targets in this area. No new regulatory rate determination is planned until 2022.

Other stocks that have been added to the portfolio include TransAlta, a Canadian yieldco and its largest clean electricity provider (www.transalta.com), Jean Hugues likes its solid dividend, and First Energy (www.firstenergycorp.com), an Ohio-based integrated power generation business that Jean-Hugues believed was trading at an attractive price after the sharp falls in NextEra’s share price in March (page 5) hit sentiment and dragged down the whole sector.

Performance

Performance

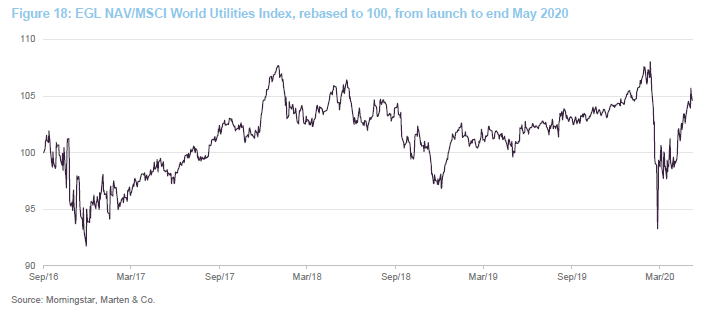

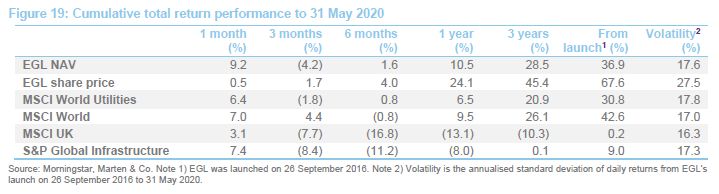

After an extended period of strong absolute and relative performance, EGL was impacted by the market’s loss of confidence in the face of the COVID-19 outbreak. The sharp sell-off proved short-lived, however, and EGL has recovered most of the ground it lost. Investors’ appreciation of the attractions of the utilities market, in particular, has helped drive the recovery. An easing of lockdown restrictions should benefit EGL’s transportation holdings and provide further impetus.

EGL’s NAV has outperformed the MSCI World Utilities Index since launch and, when combined with the elimination of the discount, EGL’s shareholders have benefitted from attractive levels of income and capital growth.

Returns have been especially strong relative to the UK market. The weakness of sterling is one component of this, but the manager sees many more attractive investment opportunities in overseas markets than in the UK.

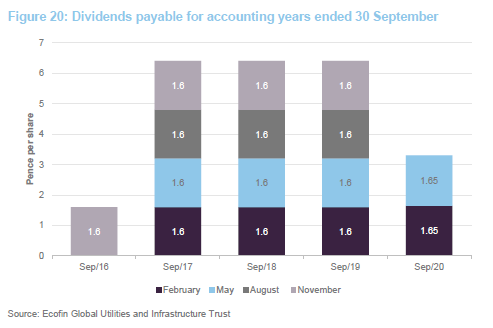

Quarterly dividend payments targeting at least 4% of NAV per annum

Quarterly dividend payments targeting at least 4% of NAV per annum

EGL targets a dividend yield of at least 4% on its net assets. The portfolio generates a reasonable level of income but the trust has the flexibility to augment this with gearing and, if necessary, using its distributable reserves (the result of cancelling its share premium account) to make up any shortfall in its dividend target. For the year ended 30 September 2019, the trust’s revenue was 5.48p per share, sufficient to cover the dividend 0.86x. The equivalent figures for FY18 were 4.82p and 0.75x.

In December 2019, the board resolved to increase the quarterly dividend by 3.1% to 1.65p per share, per quarter, equivalent to 6.6p per annum. In the interim report published on 21 May, the chairman reported that revenue was expected to be approximately 9% lower for the trust’s full accounting year, compared to the previous year. This would reduce the dividend cover in the short term. However, over the medium term, growth in portfolio income is expected to lead to improving dividend cover and the chairman says that this should enable a resumption of EGL’s strategy of increasing dividends.

Dividends are paid on the last business day of February, May, August and November.

Premium/(discount)

Premium/(discount)

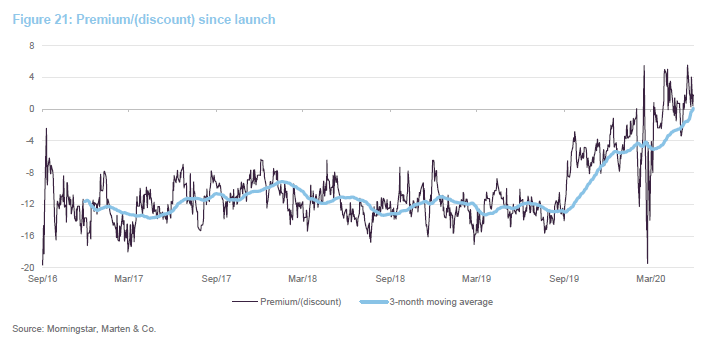

Over the 12 months ended 31 May 2020, EGL’s shares traded between a discount of 19.4% and a premium of 5.5%, and averaged a 7.0% discount. At 23 June 2020, EGL’s premium was 1.8%.

EGL’s rating improved sufficiently to justify the issue of 750,000 new ordinary shares in April 2020, 851,176 over the course of May and a further 425,000 over June, to date. All of these shares were issued at a premium to asset value in accordance with EGL’s policy on share issuance. This has the effect of enhancing the NAV for pre-existing shareholders. Expanding the trust should also have the twin benefits of improving liquidity in the shares and lowering the ongoing charges ratio as fixed costs are spread over a wider base.

Fees and expenses

Fees and expenses

Tortoise Advisors UK Limited is entitled to a fee of 1% of net assets per annum. This is calculated quarterly. There is no performance fee. The fee is charged 50% against revenue and 50% against capital.

For the accounting year ended 30 September 2019, the other expenses of note were an administration fee of £261,000 (FY18: £255,000), directors’ remuneration of £107,000 (FY18: 118,000), advisory and legal fees of £104,000 (FY18: £196,000) and depositary fees of £65,000 (FY18: £58,000).

The administrator is BNP Paribas Securities Services S.C.A. and it delegates company secretarial services to BNP Paribas Secretarial Services Limited. The directors’ remuneration is broken down on page 14. The depositary is Citibank Europe Plc.

The ongoing charges ratio for the year ended 30 September 2019 was 1.68% (FY18: 1.99%). The fall in ongoing charges reflects a 0.25% per annum reduction in the management fee which took effect on 5 March 2019, the increase in the NAV of the fund (as fixed costs are spread over a wider base) and the fall in the amount spent on advisory and legal fees. At the half-year stage (31 March 2020), EGL’s ongoing charges ratio was estimated to be 1.48%.

Capital structure and trust life

Capital structure and trust life

EGL has a simple capital structure with one class of ordinary share in issue. Its manager has discretion to borrow up to 25% of EGL’s net assets, but its articles of association state that it will not have any structural gearing. EGL’s ordinary shares have a premium main market listing on the LSE and, as at 23 June 2020, there were 93,898,423 in issue with none held in treasury.

The trust’s year-end is 30 September. The annual results are usually released in December (interims in May) and its AGMs are usually held in March of each year. EGL has an unlimited life, but offers its shareholders a continuation vote at five-yearly intervals. The last continuation vote was conducted at the AGM in March 2019. The resolution was passed with 97.5% of votes cast in favour of continuation.

Gearing

Gearing

EGL has a has a prime brokerage facility with Citigroup Global Markets Limited and benefits from a flexible borrowing arrangement. The interest rate on borrowings under the Prime Brokerage Agreement depends on the currency of the borrowing, but is generally 50 basis points over the applicable LIBOR rate. The gearing is not structural in nature and borrowings can be repaid at any time. At the end of May 2020, EGL had gearing of 12.7%.

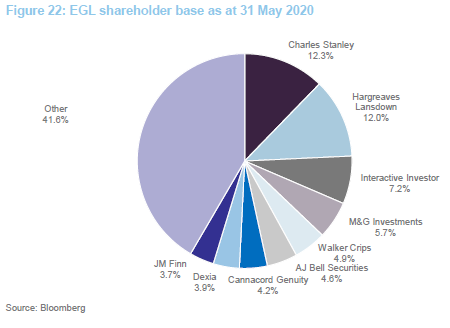

Major shareholders

Major shareholders

Board

Board

EGL’s board is comprised of four directors, all of whom are non-executive and, with one exception – Martin Nègre – are considered to be independent of the investment manager. Martin is not considered to be independent, as he is also chairman of two other funds managed by Tortoise – the Tortoise Vista Long-Short Fund and the Tortoise Global Renewables Infrastructure Fund.

A new director, Susannah Nicklin, has been recruited. She will join the board on 9 September 2020. Susannah is an experienced non-executive director and financial services professional, having been in executive roles in investment banking, equity research and wealth management at Goldman Sachs and Alliance Bernstein in the U.S., Australia and the U.K. She has also worked in the impact sector with Bridges Ventures and the Global Impact Investment Network, and holds the Chartered Financial Analyst qualification.

EGL’s articles of association require that all board members offer themselves for re-election annually and limit total directors’ fees to £200k per annum. Other than EGL’s board, its directors do not have any other shared directorships and, as illustrated in Figure 23, all of the directors have personal investments in the trust.

David Simpson

David Simpson

David Simpson is a qualified solicitor and was a partner at KPMG for 15 years until 2013, culminating as global head of M&A. Before that he spent 15 years in investment banking, latterly at Barclays de Zoete Wedd Ltd. He is chairman of M&G Credit Income Investment Trust Plc, a director of the British Geological Survey and a director of ITC Limited, a major listed Indian company. David was appointed to the board of Ecofin Water and Power Opportunities, the predecessor company to EGL, on 23 May 2014.

Iain McLaren

Iain McLaren

Iain McLaren is a chartered accountant and was a partner at KPMG for 27 years, including senior partner in Scotland from 1999 to 2004, retiring from the firm in 2008. He is a non-executive director of Edinburgh Dragon Trust Plc, Wentworth Resources Plc and Jadestone Energy Inc. He is a past president of the Institute of Chartered Accountants of Scotland. Iain was appointed to the board of Ecofin Water and Power Opportunities, the predecessor company to EGL, on 29 March 2011.

Martin Nègre

Martin Nègre

Martin Nègre was, until June 2001, the chief executive officer of Northumbrian Water Plc, then a subsidiary of Suez Lyonnaise des Eaux, and Suez Lyonnaise’s chief corporate representative in the UK. Prior to that, he was Suez Lyonnaise’s international director in Paris and then its Asia-Pacific president in Hong Kong and Singapore. Before that, he spent 21 years with Alsthom and GEC Alsthom, the Anglo/French engineering company, where he was a senior executive and the chief executive officer of the power generation division. He is chairman of the Tortoise Vista Long-Short Fund and the Tortoise Global Renewables Infrastructure Fund and a non-executive director of Northumbrian Water Limited and Messrs Hottinger & Cie, Paris. Martin was appointed to the board of Ecofin Water and Power Opportunities, the predecessor company to EGL, on 5 December 2001.

Malcolm (Max) King (director)

Malcolm (Max) King (director)

Max King is a chartered accountant and has over 30 years’ experience in fund management, having worked at Finsbury Asset Management, J O Hambro Capital Management and Investec Asset Management. He is currently a non-executive director of Henderson Opportunities Trust Plc and of Gore Street Energy Storage Fund Plc.

Fund profile

Fund profile

Developed markets utilities and infrastructure exposure with an income and capital preservation focus

Developed markets utilities and infrastructure exposure with an income and capital preservation focus

Ecofin Global Utilities and Infrastructure Trust Plc is a UK investment trust listed on the main market of the London Stock Exchange (LSE). The trust invests globally in the equity and equity-related securities of companies operating in the utility and other economic infrastructure sectors. EGL is designed for investors who are looking for a high level of income, would like to see that income grow, and wish to preserve their capital and have the prospect of some capital growth as well.

Reflecting its capital preservation objective, EGL does not invest in start-ups, small businesses or illiquid securities, as these may involve significant technological or business risk. Instead, it invests primarily in businesses in developed markets, which have ‘defensive growth’ characteristics: a beta less than the market average; dividend yield greater than the market average; forward-looking EPS growth; and strong cash-flow generation.

It also operates with a strict definition of utilities and infrastructure as follows:

- Electric and gas utilities and renewable operators and developers – companies engaged in the generation, transmission and distribution of electricity, gas, liquid fuels and renewable energy;

- Transportation – companies that own and/or operate roads, railways, ports and airports; and

- Water and environment – companies operating in the water supply, wastewater, water treatment and environmental services industries.

EGL does not invest in telecommunications companies or companies that own or operate social infrastructure assets funded by the public sector (for example, schools, hospitals or prisons).

No formal benchmark

EGL does not have a formal benchmark and its portfolio is not constructed with reference to an index. However, for the purposes of comparison, EGL compares itself to the MSCI World Utilities Index, the S&P Global Infrastructure Index, the MSCI World Index and the All-Share Index in its own literature. We are using a similar approach here, but are using the MSCI UK Index to represent the UK market. Of the three indices, we consider the MSCI World Utilities to be the most relevant – although it should be noted that this index has a strong bias towards US companies.

Manager

Manager

Tortoise Advisors UK Limited is EGL’s investment manager and AIFM. Tortoise Advisors UK is a subsidiary of Tortoise Investments, LLC (Tortoise) a privately-owned US-based firm which owns a family of investment management companies. At the end of April 2020, Tortoise had approximately $11.7bn of client funds under management including six New York Stock Exchange listed closed-end funds.

EGL’s senior portfolio manager is Jean-Hugues de Lamaze. He has worked for Tortoise Advisors UK Limited since 2008 and has managed both EGL and its predecessor, Ecofin Water & Power Opportunities (EWPO) since March 2016. Prior to joining Tortoise Advisors UK Limited, Jean-Hugues co-founded UV Capital LLP and served as its chief investment officer. Previously, he oversaw the Goldman Sachs European Utilities research team and prior to that he was a senior European analyst and head of French Research & Strategy at Credit Suisse First Boston.

Jean-Hugues’s professional career began at Enskilda Securities. He is a CFAF-certified analyst and a member of the French Financial Analysts Society SFAF. Jean-Hugues completed the INSEAD International Executive Programme, graduated from the Paris-based business school Institut Supérieur de Gestion and earned a LLB in Business Law from Paris II-Assas University. He was voted Top 10 Buy-Side Individual – All Sectors and Top 3 in the Utilities category in the 2018 Extel survey.

Jean-Hugues leads a team of six investment professionals in London and can draw on Tortoise’s extensive resources in Kansas, which includes three individuals dedicated to the listed infrastructure and energy evolution strategy.

The attractions of listed infrastructure

The attractions of listed infrastructure

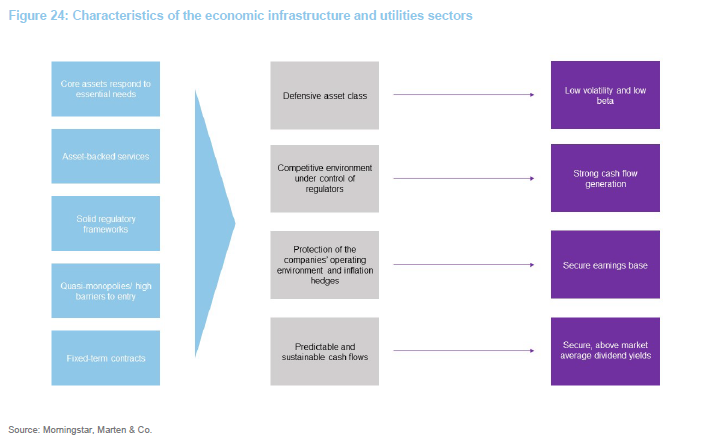

The manager believes that the economic infrastructure and utilities sectors have a number of unique attributes that make them attractive to investors as is illustrated in Figure 24.

Considerable investment is needed in the sector, both to support new renewable technologies and to make historic infrastructure safe. The sums involved are vast – measured in trillions of dollars per year.

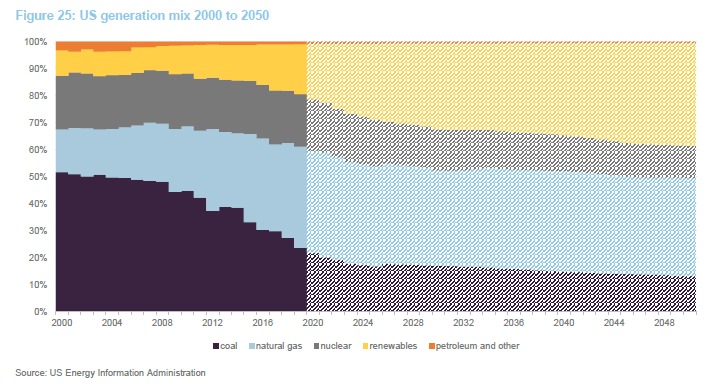

The pace of change in the energy generation sector is illustrated by this forecast from the US Energy Information Administration, which shows the historic and predicted generation mix for the US from 2000 to 2050. The doubling in the share of renewables generation between 2019 and 2050, represents significant growth and investment. Yet these figures, and the persistence of coal in the mix, are said by many to represent a significant underestimate of the likely shift away from fossil fuels.

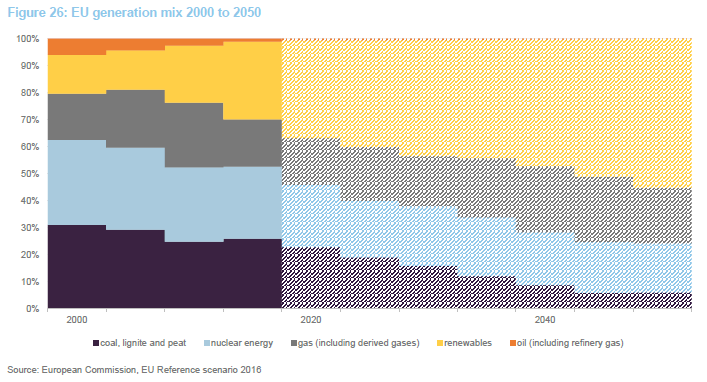

Contrast the US picture with a similar analysis for the EU, which is shown in Figure 26.

Exploiting the shift to renewables is an important theme within EGL’s portfolio. At the end of March 2020, just 10.5% of the electricity produced by the generation companies in EGL’s portfolio was coal-fired (versus 18.2% for the companies in MSCI World Utilities Index) and 27.1% was coming from renewables (20.0%). In terms of CO2 emissions, EGL’s electricity generators’ emissions were 35% less than the MSCI World Utilities Index per $1 invested.

Investment approach

Investment approach

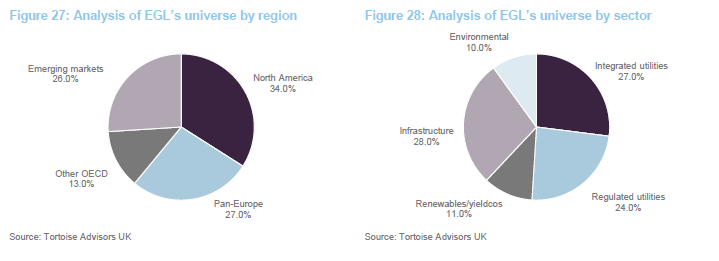

There are 374 companies classified as listed infrastructure that have a market cap greater than $500m and average daily value traded greater than $1m. Companies that do not meet these thresholds would not normally be considered for inclusion within EGL’s portfolio.

Idea generation

Idea generation

Ideas are generated through a number of sources, both quantitative and qualitative. Analysis of industry drivers and subsector trends direct the manager and analysts’ research effort, informing them on where to look for potential opportunities.

Further to this, Tortoise’s Ecofin Platform (formerly Ecofin Limited) is a recognised specialist in the utilities and infrastructure space and, because of its strong reputation, management teams of investee or potential investee companies are keen to meet the Ecofin team. EGL’s manager says that this supports idea generation and, through its superior access to management teams, Ecofin is able to undertake superior analysis and gain stronger insight than a non-specialist manager might be able to achieve.

Analysis

Analysis

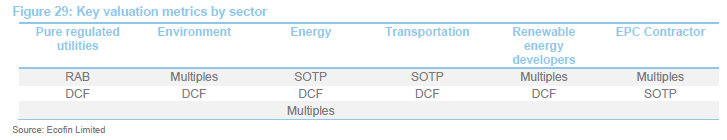

Tortoise’s Ecofin Platform does not rely on sell-side analysts’ estimates and, instead, conducts its own in-house research and builds its own proprietary models. This allows it to identify situations where it has a different view to that of the market and where there may be a potential opportunity. A wide range of valuation metrics are used to make assessments of the risk/reward characteristics of potential investments. The choice of metrics reflects the needs of the various sub-sectors. The managers use what they describe as a ‘multi-angle valuation approach’ to build confidence in their estimates.

Figure 29 illustrates the key valuation metrics used in the main subsectors in which EGL invests.

- Regulatory asset base (RAB) – Regulatory formula is used to derive future earnings. The manager assesses the premium/discount, to the RAB valuation, at which a company is trading.

- Discounted cash flow (DCF) is used in situations where a business generates visible and forecastable cash flow streams.

- Sum of the parts (SOTP) is used when a business has multiple divisions. It is used to measure hidden value and to assess the potential for value accretive disposals.

- Valuation multiples (Multiples) are used for more cyclical stocks. The manager looks to identify earnings and cash flow momentum and so focuses on forward looking metrics. The price-earnings ratio (P/E), cashflow per share and EV/EBITDA are all key.

Catalysts are key to investment decisions

Catalysts are key to investment decisions

Having identified a difference in its valuation of a stock versus the market, the manager then looks to identify suitable catalysts for the market to reshape its expectations about the stock. The manager says this is a key part of the investment process. The team may be able to identify a valuation anomaly, but this is of limited use if there is no opportunity to monetise the differential. Ideas are challenged amongst the investment team to ensure they have high conviction.

Portfolio construction

Portfolio construction

EGL maintains a diversified portfolio of between 40 and 60 holdings. Position sizes will typically range between 1.25% and 5.0% and are determined by the manager’s assessment of risk versus reward. A position could be outside these bounds where, for example, the manager is working to increase or reduce a holding or has a particularly strong view. However, the manager is disciplined in trimming holdings as they rise (although the formal limit is 15% of NAV, the manager says that 8% is his limit as he wants to avoid a situation where one position dominates the portfolio). The manager expects portfolio turnover per annum to be in the range of 40 – 60%.

When constructing the portfolio, no consideration is given to the split between utilities and infrastructure – the manager is looking for the best opportunities at any given time, but likes to maintain a balance between regulated and unregulated exposures. The portfolio is constructed to have what the manager describes as ‘defensive growth’ characteristics. EGL’s holdings currently have betas in the range of 0.5 (e.g. UK regulated utilities) to 1.2 (e.g. renewable energy companies) with an average of 0.4 – 0.6.

Analysis by the risk management team, discussed below, also influences portfolio construction.

Top-down overlay

Top-down overlay

Top down macroeconomic analysis informs the shape of EGL’s portfolio in terms of geographic and sectoral positioning. Consideration is given to:

- Differing regulatory regimes and trends in legislation

- Government energy policies

- Demand growth

- Energy commodity prices

- Industry capex trends

- Credit market conditions and ease of access

- Interest rates.

Risk management

Risk management

The risk team works closely with the portfolio manager to assist in investment decisions. It has automated in-house tools that provide real-time risk monitoring and details of exposures. The team monitors hard risk limits, guidelines and typical ranges, and uses a traffic light system to indicate which limits are coming under pressure. Where a position moves to ‘orange’, the risk management team will work with Jean-Hugues to move the position back to green. Key metrics for the traffic light system are portfolio beta, volatility, dividend yield and liquidity.

The risk team also analyses potential biases within the portfolio (geography, sector, market cap, momentum and valuations) and exposures to key risk factors (e.g. correlations to energy, interest rates etc.); conducts scenario analysis; and stress-tests the portfolio.

Investment restrictions

Investment restrictions

It is expected that EGL will primarily invest in the UK, Continental Europe, the US, Canada and other OECD countries. However, its articles of association state that EGL can invest up to 10% of its portfolio in non-OECD countries. The company is permitted to invest up to 10% of its assets in debt securities and a significant portion may be comprised of cash from time to time.

EGL is also permitted to invest up to 15% of its portfolio in other collective investment schemes, including UK investment companies, but it is not permitted to invest in vehicles that are also managed by its own investment manager. No single position can exceed 15% of the portfolio, at the time of investment, although the manager takes a more conservative approach, limiting investments to a maximum of 8% of NAV.

EGL does not invest in unquoted equities. Furthermore, it does not invest in unlisted securities save for certain bond or derivative instruments which are typically not listed.

EGL does not invest in telecommunications companies, companies which own or operate social infrastructure assets funded by the public sector (for example schools, hospitals or prisons), or early-stage listed companies which involve significant technological or business risk.

Although not a formal requirement, all of EGL’s holdings pay a yield (currently at least 2%). EGL’s manager say that non-yielding companies do not typically meet their investment requirements.

EGL is permitted to use currency hedging instruments, but usually its portfolio is unhedged.

Focus on stocks with above-average dividend growth

Focus on stocks with above-average dividend growth

The manager invests in companies that he expects to exhibit strong dividend growth characteristics.

Previous publications

Previous publications

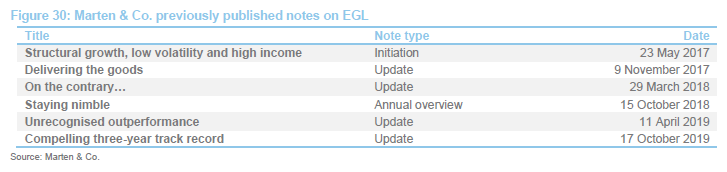

Readers interested in further information about EGL may wish to read our previous notes (details are provided in Figure 30 below). You can read the notes by clicking on them in Figure 30 or by visiting our website.

The legal bit

The legal bit

This marketing communication has been prepared for Ecofin Global Utilities and Infrastructure Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.