Herald Investment Trust – Hot chips

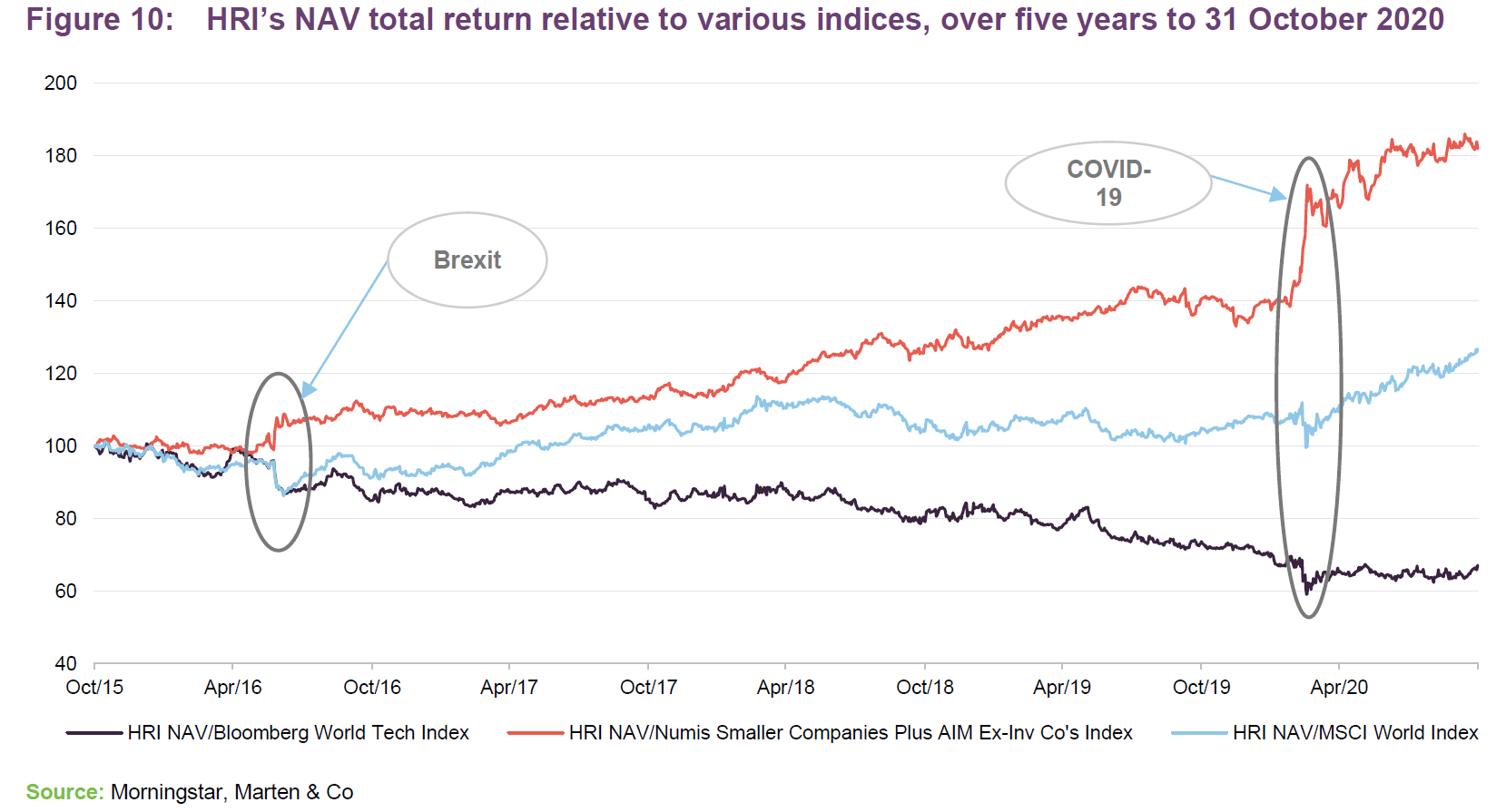

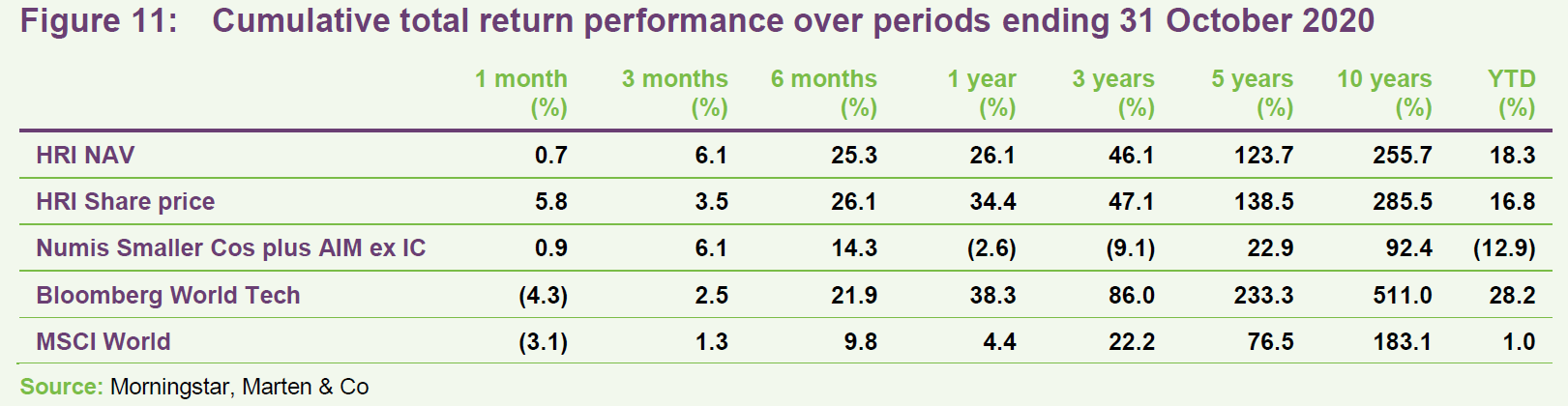

Herald Investment Trust (HRI) has generated an impressive uplift in NAV over the last 12 months. Reflecting its focus on technology, which has generally performed well as the world tries to adjust to life under the pandemic, HRI’s NAV total return of 26.1% eclipses the return on the Numis Smaller Companies plus AIM Index, which fell by 2.6%. Whilst the performance of large cap tech has eclipsed that of its small cap tech over the last five years, HRI’s NAV has outperformed the large cap dominated Bloomberg World Technology index over the last six months. Furthermore, HRI has a significant cash balance and its manager continues to see a wealth of investment opportunities.

Small-cap technology, telecommunications and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia and technology. Investments may be made across the world, although the portfolio has a strong position in UK stocks. The business activities of investee companies will include information technology, broadcasting, printing and publishing and the supply of equipment and services to these companies.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Numis ex IC plus AIM (%) | B’berg World Tech TR (%) | MSCI World Index TR (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Oct 2017 | 42.20 | 30.80 | 26.10 | 30.10 | 12.90 |

| 2 | 31 Oct 2018 | 1.30 | 3.60 | -8.20 | 12.00 | 5.10 |

| 3 | 31 Oct 2019 | 8.10 | 11.90 | 1.70 | 20.10 | 11.30 |

| 4 | 31 Oct 2020 | 34.40 | 26.10 | -2.60 | 38.30 | 4.40 |

| 5 | 31 Oct 2020 | 34.40 | 26.10 | -2.60 | 38.30 | 4.40 |

Market valuations

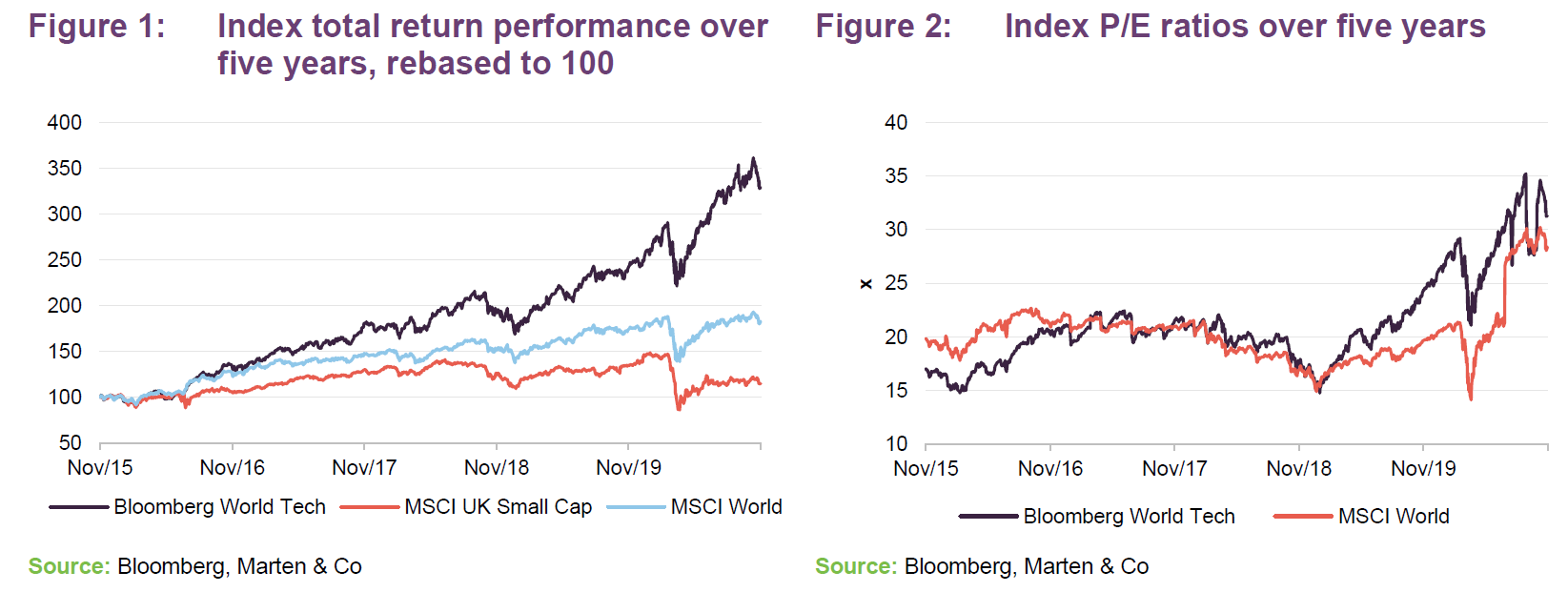

Figure 1 provides a useful illustration as to why investors may wish to consider having an allocation to the technology sector. The global technology sector – as represented by the large-cap Bloomberg World Technology Index – has provided marked outperformance of global equities – as measured by the MSCI World Index – (all in sterling terms) during the last five years. However, it is also clear that there has been a marked acceleration of this trend following the market collapse in March.

As the number of cases grew and markets dived, governments and monetary authorities sought to shore up the system. They have pumped considerable stimulus and liquidity into markets and economies, thereby extending the low-growth, low-interest-rate narrative. In this environment, stocks that offer the prospect of growth have been prized and technology has been strongly sought after.

This is reflected in Figure 2, which suggests that there has been considerable multiple expansion in both global stocks and technology stocks. However, we would caution that uncertainty created by recent events, particularly around earnings, has blunted the effectiveness of certain valuation metrics such as F12m P/E ratios. We would therefore say that, whilst these are perhaps illustrative, they should also be taken with a degree of scepticism.

Manager’s view

As QuotedData has discussed in its previous notes, the manager’s investment themes tend to be long-term in nature. In the team’s view, the TMT space has attractive demand drivers that represent a source of secular growth in a world where many economies are struggling. For many of the subsectors in which HRI invests, this theme has, at least in the near term, been underscored by the effects of

COVID-19, which has been reflected in the trust’s performance YTD.

Inevitably, there is a mixture of competing effects on businesses, and while some areas are net beneficiaries (for example, companies exposed to e-commerce, virtual conferencing, digital customer experience, video streaming and home entertainment, gaming, data centres, pcs and peripherals, internet bandwidth and connectivity), some areas face significant headwinds (traditional advertising, physical events, retail and leisure). It should also be recognised that most businesses will, to varying degrees, be affected by problems such as economic recession, higher unemployment, supply constraints, cash flow issues, capex delays and corporate bankruptcies.

Internet development has been key to keeping the economy functioning in the current environment

HRI lead manager Katie Potts says that it is evident that to all how much the development of the internet and cloud technologies have enabled the economy to function as well as it has in lockdown. These developments have also improved the quality of people’s lives during this difficult period. This would not have been possible, to anywhere near the same extent, just 10 years ago. Obvious examples are that technological advancements in these areas have enabled the boom in remote working (the advancements in VoIP phones, teleconferencing services, remote desktop access, VPNs, etc have made the transition for many practically seamless). At the same time, groceries and all manner of other consumer goods can now be ordered online, with same or next day delivery, enabling people to better satisfy their needs without the need to leave the home.

Risk of Chinese manufacturing disruption has receded

In our April 2020 note, we commented that, while HRI’s direct exposure to Chinese companies is minimal, the impact on the technology sector would be significant in the event that COVID-19 were to lead to a prolonged disruption in manufacturing in China. To recap, many technology companies are exposed to Chinese manufacturing (either directly through their own operations in China, or through subcontractors and suppliers). Furthermore, many companies use PCs and servers that, at the very least, have components that are manufactured in China. However, whilst this continues to be an area of concern, China’s success in suppressing the virus to date has allowed its economy to emerge relatively quickly from lockdown, and the risk of a prolonged shut-down in Chinese manufacturing appears to have receded.

COVID restrictions are impacting research efforts in the near term

Historically, one of HIML’s key advantages and USPs has been its research efforts which are underpinned by the large volume of face-to-face meetings that are conducted by the team each year. Katie says that in the current environment, they are not getting the access that they used to.

Firstly, virtual one-on-one meetings have been replacing face-to-face interactions, but Katie feels that these are inherently less valuable. Secondly, the large technology conferences have either been cancelled or replaced with virtual conferences. The HIML team take full advantage of the traditional conferences by filling their days with one-to-one meetings (participants are keen to take a meeting with the HIML team, as they are significant investors in the space) – however, HRI’s manager says that this does not appear to be the case with virtual conferences currently. For example, at one technology conference in 2019, Katie received 27 one-to-one meetings. For the 2020 virtual conference, she was allocated five, which was subsequently upgraded to seven (about a quarter of what she would usually receive). Katie believes that this could reflect the popularity of the sector, as larger generalist asset managers are now hot on the technology trail. For example, one large asset manager sent three people to the conference last year, but this year around 50 of their employees wanted one-on-ones.

Whilst Katie doesn’t think that this situation will persist, she is now questioning both the merits and the costs of these conferences and virtual meetings. For example, a conference place typically costs around $50,000, but if this now equates to around seven virtual meetings that the HIML team could set up themselves for free, then there is limited value added. HIML spends around £1m per annum on external research and the team are thinking about how this can be best allocated to reflect the new normal.

Technology offers sustainable supernormal margins

HRI’s manager believes that the sector has an unusual ability to earn super-normal margins that can be sustained (for example, software and semiconductors); business models that are scalable with high levels of recurring or predictable earnings; businesses that offer the opportunity for margin improvement, particularly in developing companies; a strong tendency towards entrepreneurial management; and strong cash flow generation. The manager sees a broad opportunity across the technology space and continues to highlight the following themes:

- Internet of things; architecture and platforms;

- Wireless charging technology;

- Digital media;

- Graphene;

- ADAS – driver monitoring;

- 3D memory and 3D logic;

- NFV and SDN;

- Data replication and analysis;

- Machine learning and AI;

- Robotics;

- Adaptive security architecture;

- Mesh app and service architecture;

- User programmable software;

- Spin-torque memory (STT MRAM);

- Cloud computing advancement;

- Advanced cyber defence;

- SSD;

- Falling cost of storage;

- Big data;

- Telehealth;

- Energy storage; and

- Hydrogen fuel cells.

Note: some of these themes are explored in greater detail in QuotedData’s previous notes (see page 17 of this note).

Long-term growth above the wider economy; sector more defensive than market appreciates

Despite near-term disruption from COVID-19, the manager continues to be confident that the technology sector can provide growth over and above that available in the wider economy, and that with much of the sector now exposed to non-cyclical spending, it is perhaps more defensive than the market appreciates. In particular, she feels that the recurring revenues associated with IT infrastructure and applications – used by corporations, consumers and governments alike – are effectively non-discretionary spending. However, in the face of geopolitical uncertainties, the constraints of smaller companies’ liquidity, and valuation levels that are potentially vulnerable to rising interest rates, the manager continues to maintain higher-than-normal cash levels to ensure that it can exploit buying opportunities when they occur. However, as noted in the asset allocation section overleaf, such opportunities do not necessarily arise during times of market distress. HRI’s cash reserves can also be used to support investee companies where necessary.

Higher valuations reflect the scarcity of growth opportunities

The manager acknowledges that valuations have increased, reflecting the strong demand for stocks providing growth opportunities. She believes that this increase reflects the scarcity of growth at the current time, and whilst this could recede as economies and earnings normalise, in many instances the current situation is accelerating long-term pre-existing structural trends. As such, there should be some momentum to the growth seen during the crisis, with earnings growing into their current valuations.

Overall, the manager believes that technology is better positioned than a lot of sectors. Borrowings are relatively modest and there is a high element of recurring revenue. Smaller companies continue to benefit disproportionately from being able to rent low-cost cloud infrastructure, and disruptive technologies can open up new markets altogether.

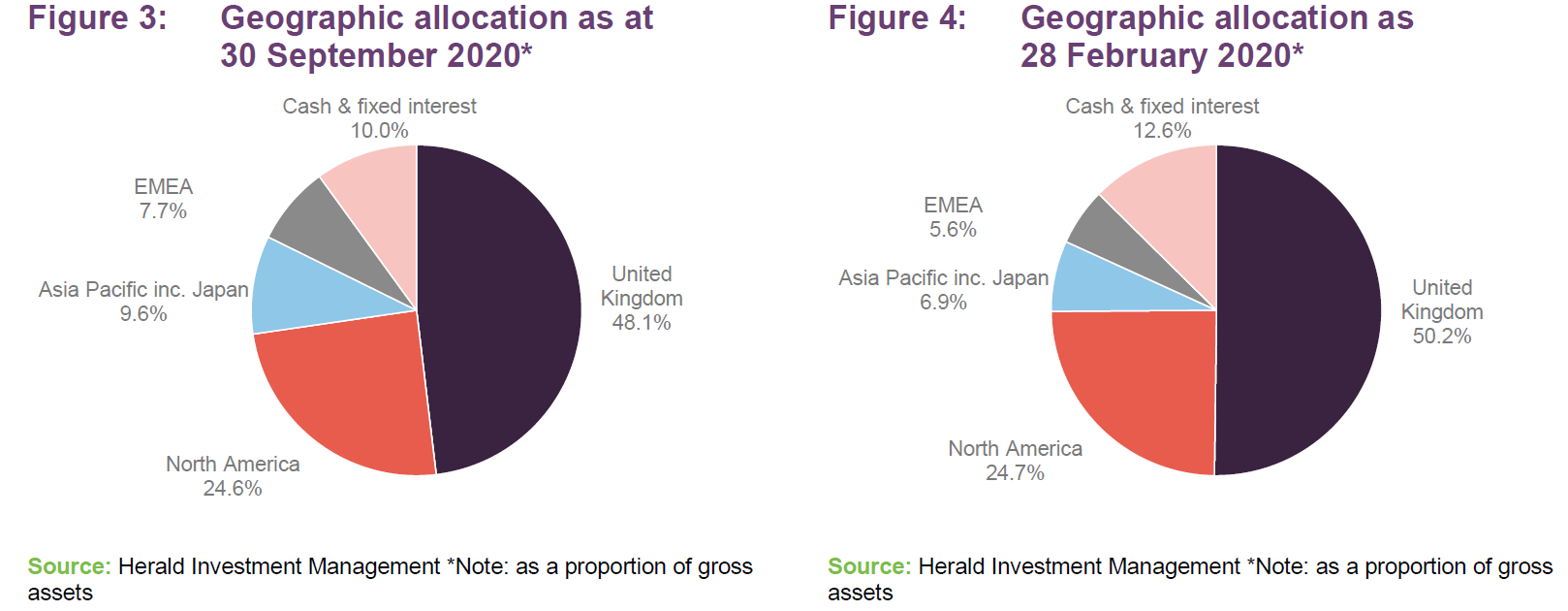

Asset Allocation

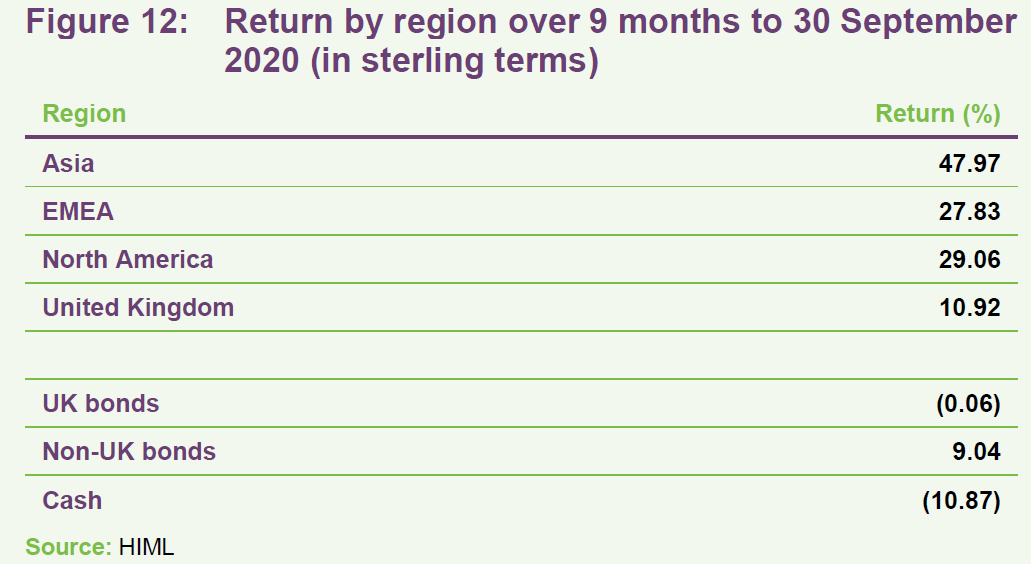

The changes to HRI’s asset allocation since we last published, using data at the end of February 2020, have been relatively modest. The trend has been one of taking money out of the UK, and redeploying this in Europe and Asia. The allocation to North America is practically unchanged.

Prior to the outbreak of COVID-19, HRI had for some time been benefitting from takeover activity, particularly in the US. Whilst Katie redeployed some of the proceeds, finding opportunities that were good value in such a buoyant market were a challenge and cash levels had risen. The HIML team says that, ahead of COVID-19, pricing was quite strong in the US, reflecting demand from private equity investors. However, since the market collapse, takeover activity has dried up.

The top 50 companies represented 48.8% of the HRI’s portfolio, which illustrates that it has a long tail of smaller positions. However, successful companies tend to become larger positions as they grow. This is both due to valuation increases and because HIML will add to a position as the company delivers and the team gains confidence in the company and gets to know its management team. Since QuotedData last wrote, the number of holdings has increased from 301 to 314.

The COVID-19 market rout did not lift turnover dramatically

As we have discussed previously, HRI tends to hold positions for the long term with the manager topping and tailing positions along the way where it feels these have run ahead of themselves or represent good value. Portfolio turnover is typically in the region of 15% per annum, suggesting an average holding period of around six to seven years, but much of the sales activity occurs through M&A, while positions are frequently added to when companies are fundraising. The average holding period for the top 20 holdings is over 13 years. Open market buying and selling also takes place, but liquidity is lower in small caps and so opportunities to do this may at times be limited.

Many trusts saw portfolio turnover increase rapidly during H1 2020 as managers, taking a long-term view, scrambled to take advantage of what they expected to be short lived pricing anomalies as stocks largely crashed in unison. During the turmoil, HRI had a strong cash buffer, which Katie would have ideally tried to deploy to take advantage of the cheap valuations. However, through a combination of limited liquidity and volatility that saw the market ripsaw too quickly, Katie says that the rout did not throw up the opportunities that the HIML team would have hoped for. Consequently, portfolio changes were limited. Another consideration is that investors, both UK domestic and foreign, are inherently negative on the UK at present, reflecting concerns over a possible no-deal Brexit as well as the government’s handling of COVID-19. Reflecting this, Katie says that some of the best opportunities when the market crashed were to be found in UK stocks. However, HRI was already heavily overweight the UK, and the manager did not wish to increase the exposure even further. Nevertheless, Katie says that UK stocks have issued lots of primary capital (frequently for acquisitions as well as some rescue funding), which is arguably reflected in the increased number of holdings noted above.

Top 10 holdings

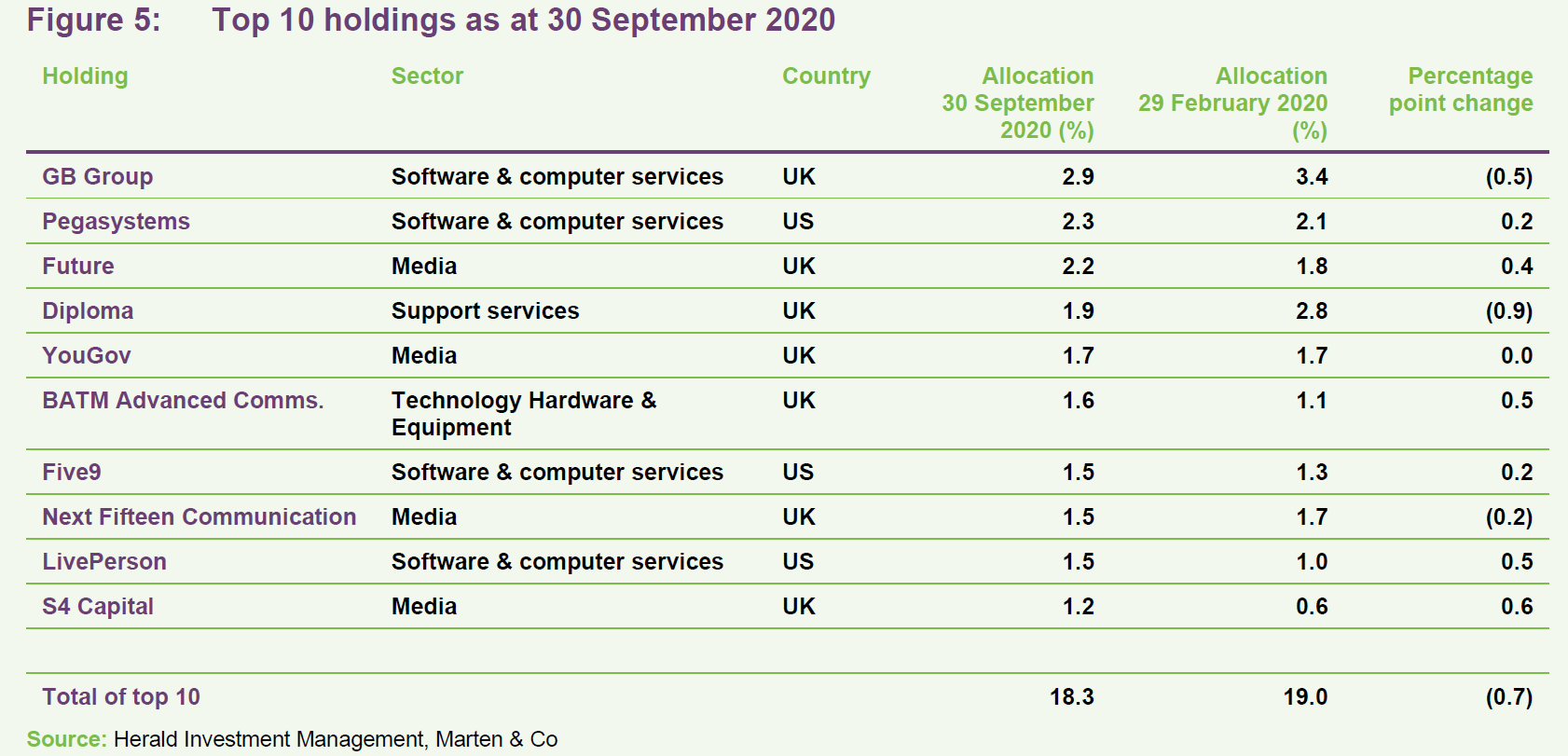

Figure 5 shows HRI’s top 10 holdings as at 30 September 2020 and how these have changed since 29 February 2020 (the most recently available data when we last published). Reflecting the manager’s long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular readers of our notes on HRI.

Since we last published in April 2020, Mellanox Technologies, Radware and Descartes Systems have dropped out of HRI’s top 10 holdings, with LivePerson, BATM Advanced Communications and S4 Capital moving up in their stead.

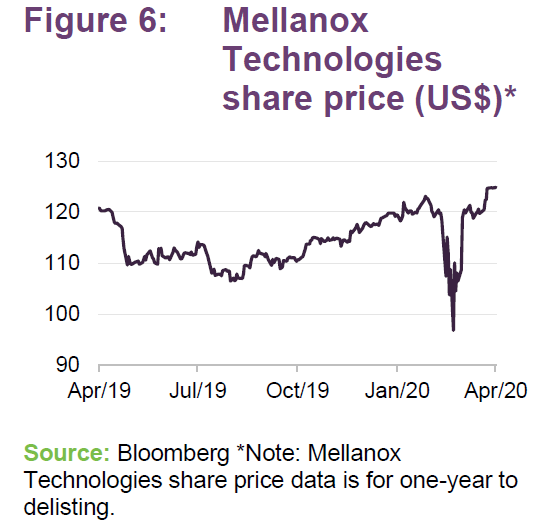

We last discussed Mellanox Technologies in our October 2019 note (see page 9 of that note), where we explained that in March 2019, it received an offer from Nvidia (US$125 per share in cash – a 14.3% premium to the previous day’s closing price) but that by 30 September 2019, Mellanox was trading at a 12.3% discount to the offer price. At that time, Katie believed that some market participants were worried that the offer would not go through, and this had caused the share price to come off. Ultimately, the transaction completed on 27 April 2020. Otherwise, as is common for HRI, the changes to the top 10 reflect differences in relative performance, rather than any significant portfolio movements.

We discuss these developments in more detail on the following pages. However, readers interested in more detail on HRI’s top 10 holdings – or other names in HRI’s portfolio – should see QuotedData’s earlier notes, where many of these have been discussed previously (see page 17 of this note).

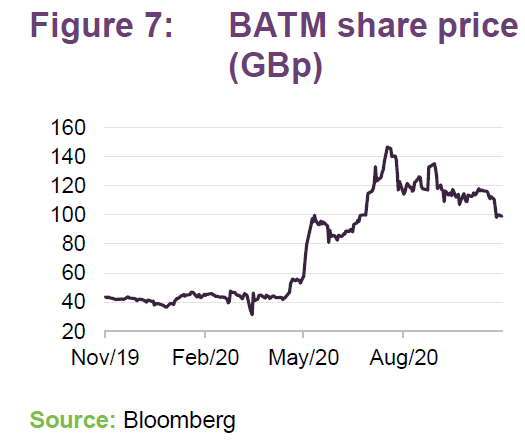

BATM Advanced Communications (1.6%) – very strong performance following market collapse

BATM Advanced Communications (www.batm.com) describes itself as a leading provider of real-time technologies for networking and cyber security solutions and for bio-medical and bio-waste treatment solutions. The company suffered a marked leg-down in March as markets collapsed but, as is illustrated in Figure 7, this has been eclipsed by the company’s performance since. The outbreak of COVID-19 appears to have positive benefits for both of BATM’s key operating divisions.

BATM’s medical laboratory systems division is making COVID testing kits and, on 5 October 2020 the company announced that it had received an initial order for €4.3m from major lab for COVID-19 real-time PCR diagnostic test kits and instruments. The order, which is to be delivered in Q4, is from a major new customer that BATM describes as “a significant global private laboratory group headquartered in Italy that provides COVID-19 testing throughout Europe, primarily for large businesses such as airports”. BATM said that it expects to receive further significant orders from this new customer during Q4 2020 and over the next 12 months.

Demand for telecommunications services has increased as the world adjusts to the new normal, and on 27 August 2020 BATM announced that its networking division had signed its first tier 1 customer for its NFVTime virtual networking solution. BATM said that the customer is an Asian-headquartered leading telecommunications provider to multi-national enterprises and communication service providers globally. The three-year licensing agreement follows the completion of a successful proof-of-concept, and BATM will receive a licence fee for a minimum of three years for each deployment of NFVTime, with a separate deployment required for each end customer (whether direct or via an operator) that adopts the solution.

The agreement marks a significant milestone for BATM. Network function virtualisation (NFV) enables network functions to be run in software, with a single piece of equipment, rather than requiring multiple pieces of physical hardware. This reduces the time, cost and carbon footprint of service deployment and management. NFV can also be a key element in leveraging the benefits offered by 5G and the internet of things. Furthermore, as a software solution NFVTime can be deployed remotely, is highly scalable and BATM says that it carries a significantly higher margin than the Group’s traditional carrier Ethernet products. BATM’s products has a key advantage in that it is one of a few solutions that can operate on both Arm-based and Intel-based architectures, and it believes that the potential market for NFVTime is substantial. For example, its new customer serves enterprise and wholesale customers, including hundreds of operators, in more than 160 countries and 3,000 cities across North and South America, Asia, Europe, the Middle East and Africa.

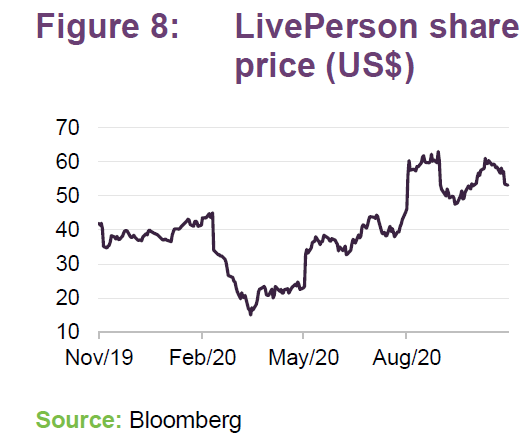

LivePerson (1.5%) – Strong performance following market rout; now trading markedly above pre-COVID levels

LivePerson (www.liveperson.com) is a technology company that develops conversational commerce and AI software for its clients to use in their interactions with their customers. It uses its AI-powered Conversational Cloud platform to orchestrate interactions between humans and AI, at scale, with the aim of creating a convenient and seemingly personal relationship. LiveEngage, its enterprise-class platform, effectively co-ordinates the elements of a conversation to produce the outcome that its customer desires, but in a way that is largely invisible to the end user.

LivePerson says that its AI conversational software has made over a billion brand-to-consumer conversations possible. It believes that its products make it easy for consumers to ask questions and make purchases in the messaging channels they use on a day to day basis, thereby avoiding wasting time on hold to call centres.

LivePerson says that it offers an end-to-end solution for the creation, management and optimisation of bots for all businesses. In addition to reportedly increasing user satisfaction, it offers real-time chat analytics, 24/7 technical support and a wide variety of ways to integrate with existing systems (40+). According to the company, over 18,000 businesses, including HSBC, Orange, GM Financial, and The Home Depot, use its products to “create meaningful connections with consumers”.

LivePerson’s business has benefitted as the world has scrambled to move to a new normal in the face of COVID-19. Specifically, as populations have moved into lockdown, end-users have sought alternatives to face-to-face engagement that call centres alone have struggled to meet due to the restrictions they have faced (customer support via telephone has in some cases been suspended and in other instances there has been an increase in hold times).

In an announcement on 24 June 2020, LivePerson said that the pandemic has dramatically accelerated consumer interest in messaging, with conversation volume on its platform increasing by approximately 40% since shelter-in-place and social distancing requirements were enacted. Specifically, messaging volume for telcos rose by 30%, consumer/retail volume rose by 50%, and financial services volume rose by 60%. Reflecting this, the company has exhibited very strong share price growth this year, particularly since the market collapse, so that it is now trading markedly above its pre-COVID level. HRI has benefitted from this strong growth (it became a £20m position), and the manager decided to trim the trust’s holding.

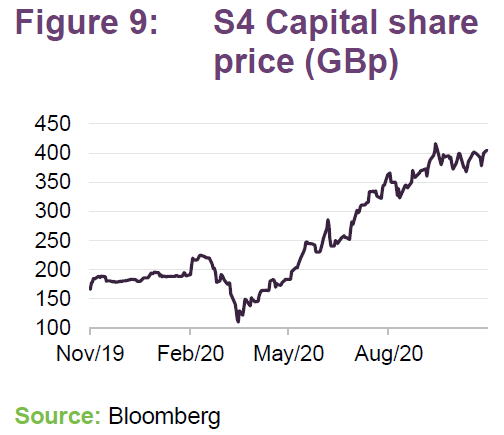

S4 Capital (1.2%) – Epic recovery post-COVID-19 rout; now trading way above pre-COVID levels

S4 Capital (www.s4capital.com) is a digital advertising and marketing services company that was established by Sir Martin Sorrell, the founder of WPP (the world’s largest advertising and PR group), in May 2018 following his retirement from WPP in April 2018. The company has a worldwide customer base and employs 2,650 people in 30 countries, across The Americas, Europe, the Middle East & Africa and Asia Pacific.

S4 Capital strategy is to build a purely digital advertising and marketing services business, initially by integrating leading businesses in three practice areas: first-party data, digital content, digital media planning and buying.

The company suffered as markets tumbled in March in the face of an accelerating COVID-19 infection rate, but covered very strongly in Q2 and Q3 as the underlying business continued to perform strongly. In its first-half results, S4 Capital reported an increase of 60.7% in revenue to £141.3 million, with an increase 6.9% on a like-for-like basis, despite the impact of COVID-19. In terms of gross profit growth on a like-for-like basis, S4 Capital provided an increase of 18.8% in Q1 and 6.5% in Q2 due to COVID-19. This bottomed in April at over 3%, increased in May to over 5%, in June to over 11% and into the second half of 2020 in July to over 18%.

Performance

When we last published on 1 April 2020, we used performance data to end February that was starting to show the effects of the pandemic but did not include the market collapse towards the end of March. However, since this time, HRI has been through the market rout (its NAV lost 11.7% in total return terms during March), but recovered very strongly in the second quarter (gaining 13.0% in April, 9.6% in May and 4.3% in June), thereby providing an overall return of 33.2%. HRI’s share price did even better than that, reflecting a narrowing of this discount, returning 41.7%.

In the second quarter, HRI’s share price and NAV total returns were both ahead of those of the Numis Smaller Companies Plus AIM Index (up 21.4%), the Bloomberg World Tech Index (up 33.0%) and the MSCI World Index (up 21.1%). The index differentials illustrate the strong demand for tech in the recovery period following the market collapse.

HRI has continued to provide strong absolute returns into Q3. Its NAV gained 3.4% in July, 5.4% in August (a month where markets were generally up as restrictions were relaxed, positive news came through on the vaccine and better-than-expected economic data emerged) and then held steady in September (see Figure 11 overleaf), so that overall it increased by 9.2% in Q3. There has also been modest growth in Q4 so far, with HRI’s NAV increasing by 0.7% during October.

As is illustrated in Figure 10 overleaf, in addition to these strong absolute returns, HRI’s NAV has strongly outperformed both the Numis Smaller Companies Plus AIM Index and the MSCI World Index (all in sterling-adjusted total return terms), following the market collapse. Outperformance against the large-cap focused Bloomberg World Tech Index is less marked (HRI’s NAV has returned 43.4%, versus 39.9% for the six months ended 30 September 2020), but has started to reverse the trend of underperformance against large cap that has prevailed during the last four years (see Figure 10).

Year-to-date performance to 30 September 2020

HIML kindly supplied us with some performance data for HRI’s investments by geography, which has been reproduced in Figure 12.

Key performance contributors YTD to 30 September 2020

Their analysis suggests that the strongest positive contributions have come from:

- ITM Power – which manufactures integrated hydrogen energy equipment to enhance the utilisation of renewable energy that would otherwise be wasted, specialising in electrolysers, and hydrogen for fuel cell products – performed very strongly in the first half of 2020, providing a return of £18.5m as investors become increasingly convinced by hydrogen as a source of clean energy.

- BATM Advanced Communications performed very well in the first half of 2020 returning £14.9m, which has continued into the third quarter (see page 9 for further discussion). Its medical laboratory systems division is making COVID-19 testing kits, while its networking division has signed its first tier 1 customer for its NFVTime virtual networking solution.

- Five9 (discussed in detail in our April 2020 note – see page 10 of that note) provides cloud-based software for contact/call centres. It has a purpose-built virtual contact centre (VCC) cloud platform that is both secure and highly scalable. The stock has performed very strongly as investors recognised the attractions of the business model in this environment.

- Pegasystems (last discussed in our July 2017 note) has been a feature of Herald’s portfolio since 2003 (when Katie was buying stock at around the $4 mark). The company’s rules-based workflow software has applications in the fields of CRM and BPM, and it competes with companies such as SalesForce. It was the fifth-largest contributor during the first half of 2020 (the stock began the year trading around the US$80 mark, fell to US$61 during the crash and was trading at US$131.71 at the 22 October 2020). Pegasystems provides cloud software for customer engagement and operational excellence (encompassing digital process automation, robotics, and AI). Having performed strongly during 2019, the company has benefitted from strong demand as its customers have sought to adjust their offering for a post-COVID-19 world. Its Q1 2020 revenue was up 25% year-on-year, driven by a 57% increase in revenue from Pega Cloud.

- Kingdee International Software Group (see page 12 of our October 2019 note for further discussion) provides management software and cloud services to enterprises. It performed strongly during 2019 and has performed strongly during 2020 as businesses have sought to adjust their operations post-COVID-19.

- Future was discussed in both our October 2019 and April 2020 notes (see pages 8 and 13 of the notes respectively). The company publishes a range of special-interest consumer magazines and websites and has been a strong long-term performing holding for HRI. Future performed strongly during 2019 (Katie described it at the time as “the market’s current hot media favourite”) but then came under significant pressure as markets retreated. Investors initially assumed that Future was traditional media and therefore dependent on advertising revenue, which the market had concluded would be in short supply. However, its Tech Radar website has performed very strongly. Tech Radar provides reviews for tech products, and then offers options to fulfil the product, on which it takes a commission. This side of the business has boomed as people have sought more tech to work (and play) from home.

- S4 Capital (this benefitted from a strong recovery in media during the second quarter – see page 11).

Key performance detractors YTD to 30 September 2020

Notable negative contributions have come from:

- Next Fifteen Communications, a marketing agency group, which consists of approximately 20 subsidiary agencies. The stock suffered heavily during the market collapse as the investors turned away from companies dependent on advertising revenue. Whilst it recovered strongly in the second quarter, it was still the largest detractor during the first half of 2020, despite reporting earnings ahead of last year.

- Time Out has is another media company that has been heavily impacted by COVID (this was the fifth largest detractor in the first half of 2020). In addition to the ongoing concerns around advertising revenues, one of Time Out’s activities is to rent restaurants and run paid for events, but these have been closed by COVID-19 restrictions, which has impacted heavily on its earnings. Note: a lot of media stocks suffered heavily in the market collapse (media as a whole fell around 20%), but it was a minority position in HRI’s portfolio when compared to tech, and so the impact overall has been relatively limited, particularly as HRI’s media holdings tend to be less dependent on advertising revenue when compared to the average media company.

- Euromoney is a media and data company, which describes itself as a global, multi-brand information business that provides critical data, price reporting, insight, analysis and events to financial services, commodities, telecoms and legal markets. The company has an asset management business, which is currently undergoing executing a turnaround plan, has suffered in the aftermath of COVID-19 as many events, which are a key component of the business, have been cancelled. However, Katie says that Euromoney has lots of strong underlying businesses, which – coupled with a strong balance sheet – should be able to weather the current challenges.

- M&C Saatchi. As discussed in our April 2020 note, M&C Saatchi was HRI’s largest single detractor from performance during the year ended 31 December 2019. The profits warning in December reflected a lack of financial controls but the CFO was replaced and the company now has a group treasurer. Whilst the incident was damaging, the company remains profitable and Katie believes it will continue to trade well. Importantly, the CEO has shareholder support, which in her view is key.

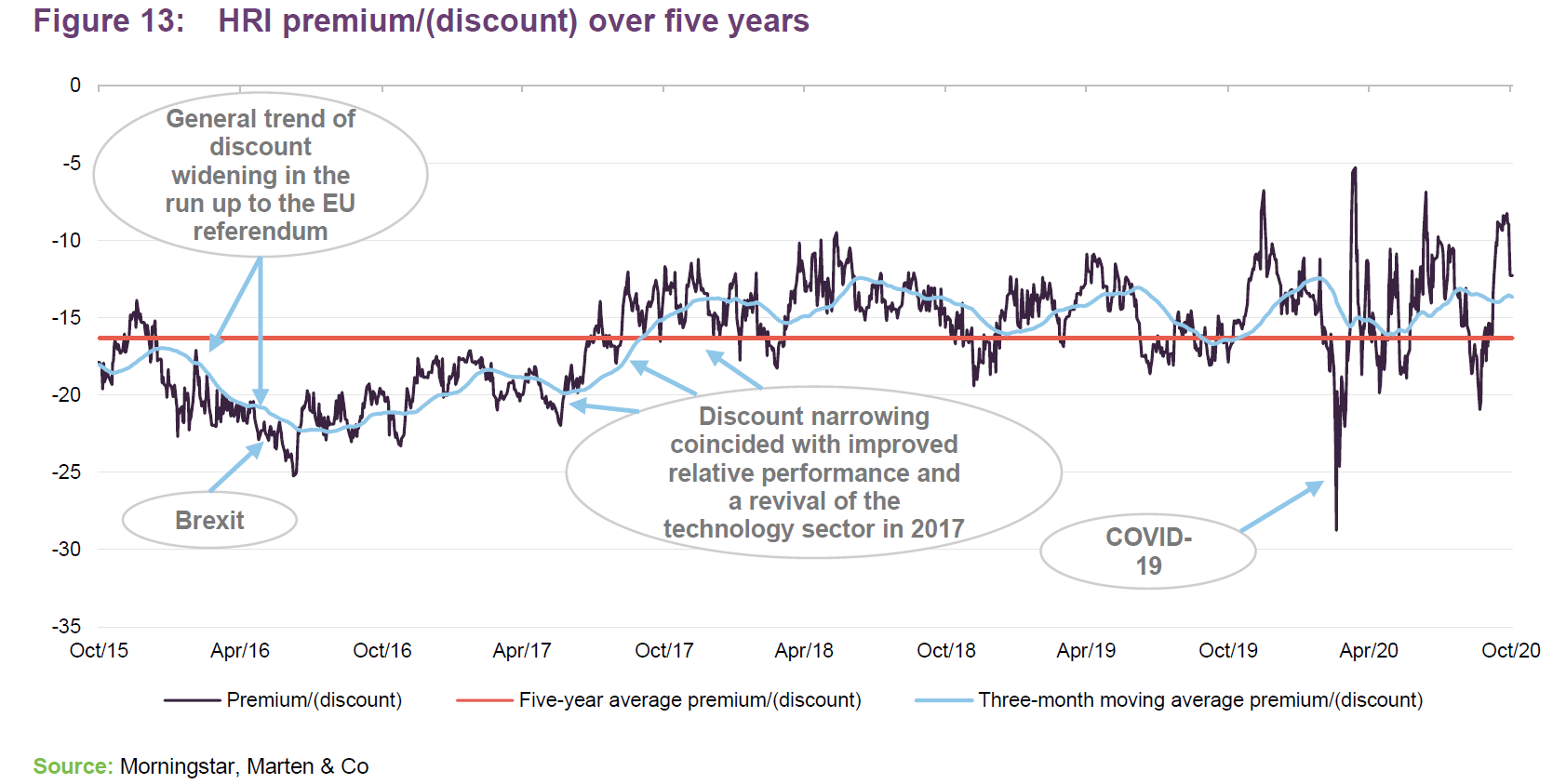

Discount

As Figure 13 shows, HRI has tended to trade within a discount range of 10% to 20% during the last three to four years. As we have discussed in our previous notes, HRI’s discount has tended to narrow during periods were performance is strong or when the technology sector has been in favour – for example, between mid-2016 and early 2018, which coincided both with an improvement in HRI’s relative performance and a marked revival in the performance of the global technology sector, particularly during 2017; then again during the first half of 2019 and again during the final quarter of 2019.

When QuotedData last published on HRI at the beginning of April, we commented that the discount had widened dramatically, reaching a five-year nadir of 28.8% (as at 19 March 2020) as markets collapsed in the face of an accelerating COVID-19 infection rate. However, HRI hit a five-year discount low on 9 April of 5.6%.

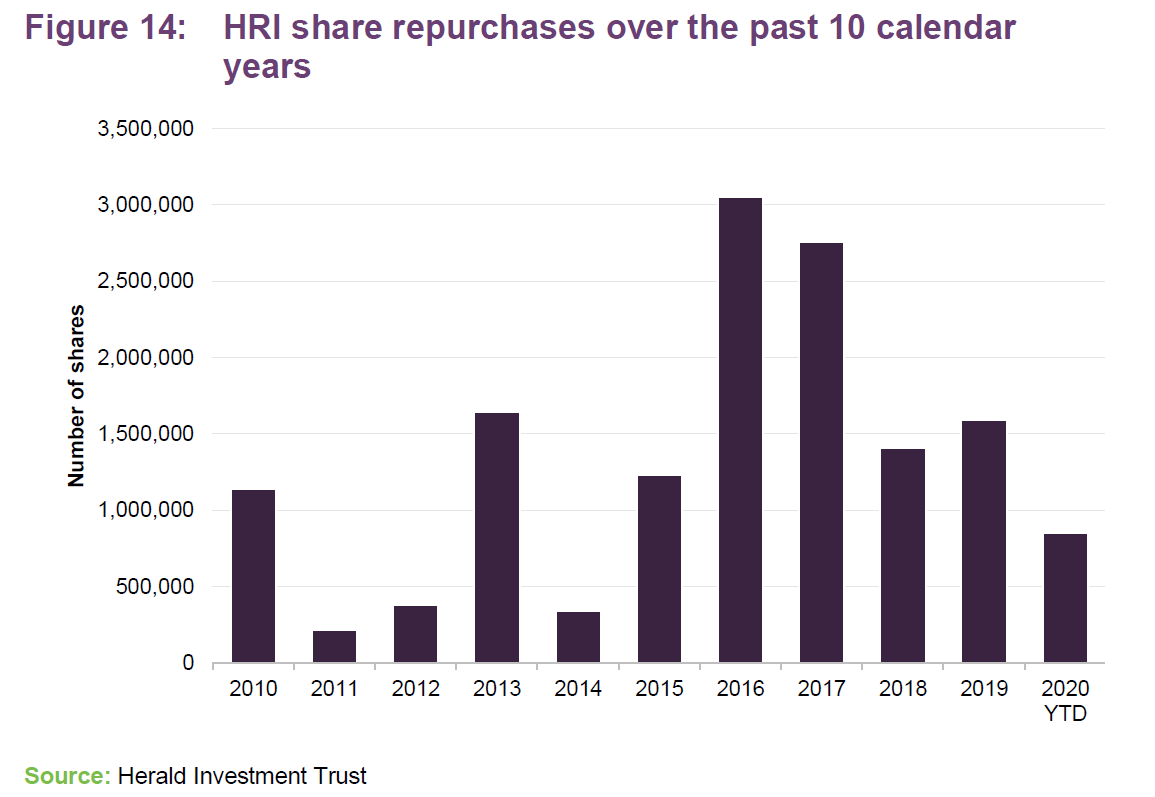

Whilst HRI’s board has not set a formal discount target, it has authorised the use of share buybacks with the aim of helping to provide some liquidity (the board takes the powers each year to repurchase up to 14.99% of HRI’s then-issued share capital – any shares repurchased are cancelled). As is illustrated in Figure 14, the board is prepared to use its repurchase authority, although it should be noted that its ability to do so has often been restricted. This is despite HRI trading at a wider discount than it would like. This has been because the discount has been driven by the trading of a relatively small number of shares and, despite the broker’s best efforts, there has not been sufficient liquidity available to undertake a meaningful repurchase transaction.

Over the year to 31 December 2019, HRI repurchased 1.59m shares or 2.3% of its issued share capital at the beginning of the year (2018: 1.41m shares and 2.0% of HRI’s issued share capital). Year-to-date, HRI has repurchased 1.33m shares (or 1.98% of its issued share capital). Since the height of the market panic on 23 March 2020, HRI has repurchased 1.11m shares. As at 2 November 2020, HRI was trading at discount of 12.4%. This is narrower than its five-year average of 16.3%, but comfortably within its longer-term trading range. During the last 12 months, HRI’s discount has moved within a range of 5.3% to 28.8% with an average of 14.1%.

Fund profile

Established in 1994, HRI invests globally in small technology, communications and multimedia companies with the aim of achieving capital growth. It is the only listed fund of its type. The trust invests globally, but has a strong bias towards the UK, which further distinguishes it from other global technology funds, which tend to be biased towards the US.

New investments in the fund will typically have a market capitalisation of $3bn or less, but are generally much smaller when the first investment is made. If successful, these can grow to be a multiple of their original valuation. This type of investing is longer-term in nature and so the trust tends to have low turnover. Reflecting the risks inherent in this type of investing, the trust maintains a highly diverse portfolio of investments (typically in excess of 250) to help mitigate this risk.

Katie Potts has been HRI’s lead fund manager since launch. She was a highly-regarded technology analyst at SG Warburg (later UBS) prior to launching the fund. Katie owns a substantial stake in the company and a significant minority stake in the management company, and therefore is clearly motivated to ensure the success of the fund.

More information can be found at the trust’s website: www.heralduk.com.

Previous publications

Readers interested in further information about HRI, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note Change is a coming, published on 1 April 2020, as well as our previous update notes and our initiation note (details are provided in Figure 15 below). You can read the notes by clicking on them in Figure 15 or by visiting our website.

Invest in the future, Initiation, published 16 August 2016

Tech bids demonstrate value, Update, published 20 December 2016

Backing growing businesses, Update, published 11 July 2017

Who wants to be a billionaire?, Annual overview, published 07 December 2017

From small acorns…., Update, published 12 June 2018

Shifting sentiment, Annual overview, published 12 February 2019

“Profits are only profits when they are realised”, Update, published 08 October 2019

Changer is a coming, Annual overview, published 1 April 2020

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Herald Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.