Herald Investment Trust – “Profits are only profits when they are realised”

“Profits are only profits when they are realised”

“Profits are only profits when they are realised”

Herald Investment Trust (HRI) generated strong absolute returns in the first half of 2019, with marked outperformance by both its UK and US portfolios of their local market indices. Both a general market recovery and a recovery in global technology stocks have helped, but HRI’s UK and US portfolios have both benefitted from a wave of takeover activity, allowing HRI to lock in significant premiums.

This illustrates how HRI’s holdings can move very quickly, validating the manager’s strategy of maintaining an extensively diversified portfolio. However, liquidity is an ever-present issue and these disposals also validate Katie Potts’s approach. In her own words, “in small caps, profits are only profits when they are realised”.

Small-cap technology, telecommunications and multi-media

Small-cap technology, telecommunications and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia and technology. Investments may be made across the world, although the portfolio has a strong position in UK stocks. The business activities of investee companies will include information technology, broadcasting, printing and publishing and the supply of equipment and services to these companies.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Numis ex IC plus AIM (%) | Bloomberg World Tech Total Return (%) | MSCI World Index Total Return (%) |

|---|---|---|---|---|---|---|

| 1 | 30 Sep 2015 | 1.90 | 5.60 | 4.10 | 5.90 | 3.50 |

| 2 | 30 Sep 2016 | 15.40 | 18.70 | 5.10 | 36.10 | 25.30 |

| 3 | 30 Sep 2017 | 35.30 | 28.60 | 23.70 | 33.20 | 18.10 |

| 4 | 30 Sep 2018 | 25.50 | 21.40 | 4.50 | 28.90 | 12.10 |

| 5 | 30 Sep 2019 | -3.30 | -1.80 | -9.80 | 9.80 | 6.50 |

Market valuation

Market valuation

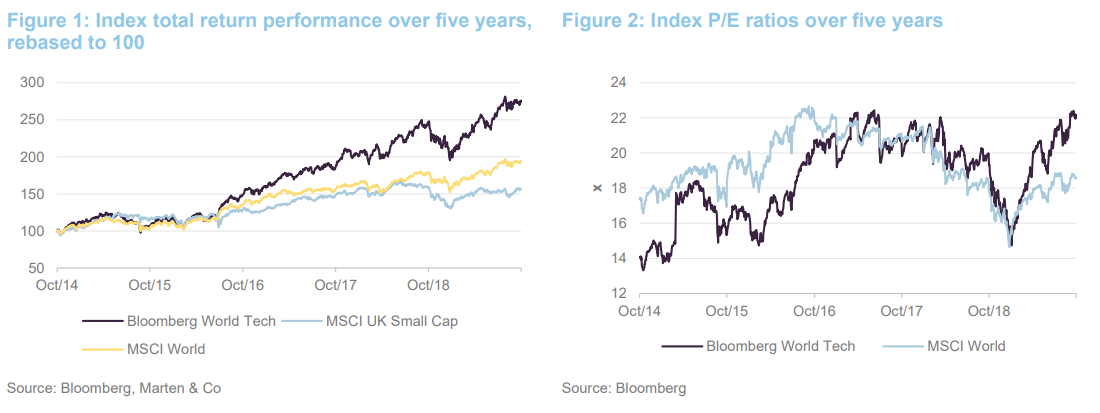

Figure 1 provides a useful illustration as to why investors may wish to consider having an allocation to the technology sector. As shown in Figure 1, the global technology sector – as represented by the large cap Bloomberg World Technology Index – has provided marked outperformance of global equities as measured by the MSCI World Index (all in sterling terms) during the last five years and particularly during the last three years (a similar pattern is seen if a 10-year horizon is taken with global technology providing a marked outperformance). It is noteworthy that global technology suffered more heavily during the more challenging markets in the second half of 2018, but has strongly outperformed year-to-date (YTD). As illustrated in Figure 2, not all of the marked outperformance of the last three years has been driven by multiple expansion. However, large cap global technology valuations have increased as markets have recovered during 2019 and are now close to five-year highs.

Manager’s view

Manager’s view

The manager’s investment themes tend to be long-term in nature. In the team’s view, the TMT space has attractive growing end markets that are a source of growth in a low GDP-growth world. Furthermore, it believes that the sector has an unusual ability to earn super-normal margins that can be sustained (for example software and semiconductors); business models that are scalable with high levels of recurring or predictable earnings; businesses that offer the opportunity for margin improvement, particularly in developing companies; a strong tendency towards entrepreneurial management; and strong cash flow generation. The manager sees a broad opportunity across the technology space and highlights the following themes:

- Internet of things; architecture and platforms;

- Wireless charging technology;

- Digital media;

- Graphene;

- ADAS – driver monitoring;

- 3D memory and 3D logic;

- NFV and SDN;

- Data replication and analysis;

- Machine learning and AI;

- Robotics;

- Adaptive security architecture;

- Mesh app and service architecture;

- User programmable software;

- Spin-torque memory (STT MRAM);

- Cloud computing advancement;

- Advanced cyber defence;

- SSD;

- Falling cost of storage;

- Big data;

- Telehealth;

- Energy storage; and

- Hydrogen fuel cells.

The UK versus the US – a dilemma for small cap tech investors

The UK versus the US – a dilemma for small cap tech investors

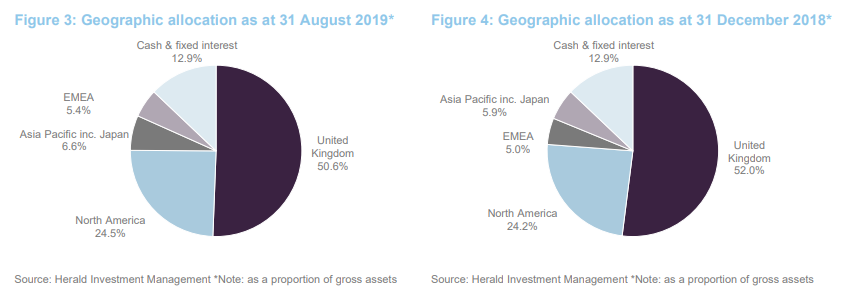

As illustrated in Figure 3 on page 4, HRI’s allocation to the UK has decreased modestly since we last published in February 2019. The scale of this movement reflects the fact that the UK currently presents a dilemma for the manager. On one hand, the manager thinks that the UK currently offers the best value for small cap tech investors (it was the worst-performing territory for HRI in H1 2019 with a, still respectable, IRR of 15.8% – see page 7 in the attached PDF version) but poor liquidity, an advanced economic cycle with the looming prospect of a recession and the short-term disruption of Brexit are negatives for the UK market. Taking the balance of these considerations, the manager has looked to reduce HRI’s exposure to the UK at the margin, viewing this as prudent risk management.

(Note: as we have discussed in our previous notes, Katie does not consider Brexit to be a major issue for HRI’s portfolio. HRI does not have direct exposure to consumer electronics companies, which would be more obviously impacted, and HRI’s holdings tend to be exposed to global markets and trends, rather than to the domestic UK economy.)

UK portfolio has seen a strong period of placings

UK portfolio has seen a strong period of placings

The UK has seen an unprecedented number of placings; some 20 during the first half of 2019. As noted above, the manager has been working to reduce HRI’s exposure to the UK, and so has passed on the majority of these. However, challenges in redeploying capital into the US market (which has seen a period of significant realisations) and a desire to support existing holdings have seen some cash redeployed into the UK. Katie says that, in certain instances, you can damage your own property by failing to support a fundraise.

UK – a fertile hunting ground for small cap investors

UK – a fertile hunting ground for small cap investors

Katie considers that the UK offers a more fertile ground for small cap tech investors than the US. Since the advent of Sarbanes-Oxley, the costs of maintaining a listing in the US have increased markedly. This typically costs US$2m–$3m per annum, which is a heavy burden for a US$200m cap company. These costs, coupled with greater availability of venture capital in the US, mean that small cap US companies now tend to stay private for longer, and the number of listed smaller US listed companies has shrunk dramatically.

Furthermore, when these companies have their IPOs, these are generally exits for sophisticated investors and the return prospects are lower as a result (US IPOs are frequently too large to be considered for HRI’s portfolio). In contrast, IPOs in the UK are more about raising development capital and therefore tend to have superior return opportunities.

This is not Katie’s only concern. She also observes that US companies have a greater tendency to raise significant amounts of cash and dilute existing investors. Salary inflation on the west coast is high and, in her view, the cost of restricted stock units (RSUs) and other share-based payments are not being adequately discounted by the market. In contrast, Katie prefers founder-management that hold large positions and do not want to be diluted themselves.

Asset Allocation

Asset Allocation

The changes to HRI’s asset allocation, since we last published, have been minor. The largest change has been a 1.3 percentage point reduction in HRI’s cash and fixed interest allocation. HRI’s cash had previously crept up as the portfolio has benefitted from takeover proceeds, and while this trend has continued – particularly in the US (around 20% of HRI’s US positions had approaches) – Katie has managed to deploy some of the proceeds. The number of holdings has seen a small increase from 285 to 288. The top 50 companies represent around 54% of the HRI’s portfolio, which illustrates that it has a long tail of smaller positions. However, successful companies tend to become larger positions as they grow. This is both due to valuation increases and because HIML will add to a position as the company delivers and the team gains confidence in the company.

Since we last published, YouGov has re-entered HRI’s top 10 holdings and The Descartes Systems Group has also made a top 10 appearance. The names that have dropped out are Attunity, which was taken over by Qlik Tech International, and Craneware, whose shares fell heavily on the back of a trading update at the end of June 2019 (the update showed lower than expected sales growth). We discuss some of these developments in more detail on the following pages, but would also recommend that readers see our previous notes, as well as the performance section of this note, for discussion of other portfolio companies.

YouGov – strong performance year-to-date

YouGov – strong performance year-to-date

YouGov (YOU – www.yougov.co.uk) is an international data and analytics group. The core offering of opinion data is derived from a participative panel of five million people worldwide. This continuous stream of data is combined with deep research expertise and broad industry experience into a systematic research and marketing platform. The suite of syndicated, proprietary data products includes YouGov Brand Index, the daily brand perception tracker and YouGov Profiles, a planning and segmentation tool. YouGov Omnibus provides a fast and cost-effective service for obtaining answers to research questions from both national and selected samples. With 30 offices in 20 countries and panel members in 38 countries, YouGov has one of the world’s top 10 international market research networks. HRI’s holding in YouGov has benefitted from its strong price performance YTD (an increase of 35.7% as at 30 September 2019), which has moved YouGov back up HRI’s rankings.

The Descartes Systems Group – reduced into strength

The Descartes Systems Group – reduced into strength

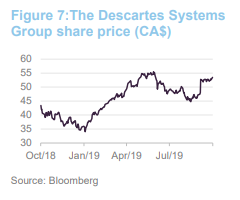

The Descartes Systems Group (DSG) is a Canadian based provider of logistics software, supply chain management software, and cloud-based services for logistics businesses. Its software and services allow customers to make and receive shipments, and to manage the associated resources. Its platform connects businesses to their trading partners and enables business document exchange; regulatory compliance and custom filing, route and resource planning; inventory and asset visibility; rate and transportation management and warehouse operations.

DSG is a long-term HRI holding (HRI first invested in 2006). The manager continues to like the business, but has recently reduced the holding following a strong performance. For this reason, HRI did not participate in DSG’s recent fundraising. However, Katie says that the business continues to benefit from structural growth and has a strong record of converting EBITDA to cashflow.

Attunity – taken out by Qlik

Attunity – taken out by Qlik

The Descartes Systems Group (DSG) is a Canadian based provider of logistics software, supply chain management software, and cloud-based services for logistics businesses. Its software and services allow customers to make and receive shipments, and to manage the associated resources. Its platform connects businesses to their trading partners and enables business document exchange; regulatory compliance and custom filing, route and resource planning; inventory and asset visibility; rate and transportation management and warehouse operations.

DSG is a long-term HRI holding (HRI first invested in 2006). The manager continues to like the business, but has recently reduced the holding following a strong performance. For this reason, HRI did not participate in DSG’s recent fundraising. However, Katie says that the business continues to benefit from structural growth and has a strong record of converting EBITDA to cashflow.

Attunity (attunity.com) is an Israeli business whose software integrates applications and data sources through industry-standard interfaces. Its solutions are designed to allow its customers to access and manipulate data in real time. It also makes it easier for companies to migrate data from legacy systems. We discussed Attunity in our February 2019 annual overview note (see page 11 of that note). However, shortly after we published, Qlik announced an offer for Attunity of US$23.50 per share (a premium of 18% to the previous closing price), valuing Attunity at US$560m. On 7 April 2019, Attunity’s shareholders approved the acquisition and the transaction completed on 6 May 2019.

HRI was a cornerstone investor in a fundraise carried out by Attunity in 2017, providing $4.75m of a total $23m. As shown in Figure 8, which illustrates Attunity’s share price over the two years prior to its delisting, with an entry price of around $7, this has been a very profitable investment for HRI. This has been aided by Attunity’s strong financial performance. Attunity recently reported full-year 2018 license revenue growth of 61% year-over-year and total revenue growth of 39% year-over-year.

Craneware – lower than expected sales growth

Craneware – lower than expected sales growth

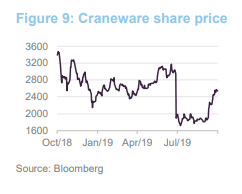

Craneware (craneware.com) provides technology to US hospital groups, aimed at optimising their profitability. The company claims to have around a quarter of US hospitals as customers and is broadening the range of services that it provides to them. We discussed Craneware in our February 2019 note (see page 11 of that note), where we noted that it has a good track record of improving its revenue and profits and, for a UK-based investor, its dollar earnings have been flattered by sterling weakness.

A trading statement released on 21 December 2018 said that the company “expects to report increases in both revenue and adjusted EBITDA in the range of 15% to 20% for the six-month period ending 31 December 2018”. It achieved both of these aims with revenue growth of 15% to $35.8m and adjusted EBITDA increased 20% to $11.6m. However, in its trading update on 28 June 2019, Craneware warned of a slowdown in sales during the second half of its financial year. Specifically, it said that “whilst the Group continues to sign new contracts with hospitals of all strata, the timing and quantity of sales closed in the second half of the year have been lower than anticipated”. It said that, as a result, revenue growth for the 12-month period over the prior year is expected to be approximately 6% and adjusted EBITDA growth approximately by 10%. The market reacted negatively to the announcement, with Craneware’s share price falling 35.4% on the day.

Performance

Performance

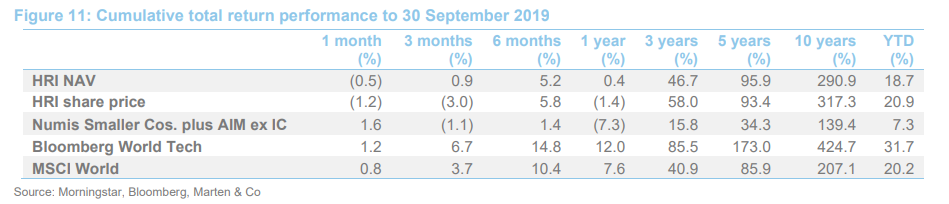

Since we last published, HRI has continued to outperform the Numis Smaller Companies plus Aim ex Investment Companies Index (see Figure 10 in the attached PDF version), while underperforming the Bloomberg World Tech Index (as illustrated in Figures 10 and 11). As illustrated in Figure 11, and discussed overleaf, HRI’s absolute performance has been strong YTD, most of which came during the first half of the year. This is in part a reflection that markets have recovered this year, after their malaise in the last quarter of 2018.

2019 H1 – a very strong performance

2019 H1 – a very strong performance

HRI’s NAV grew 17.2% during H1 2019. Of the geographies that HRI focuses on, the UK was the worst-performing (the UK portfolio’s IRR was 15.8%), while EMEA, Asia and North America provided IRRs of 20.5%, 22.8% and 28.7% respectively. However, whilst the UK portfolio was arguably the laggard, it strongly outperformed the return provided by the Numis Smaller Companies plus AIM ex Investment Companies Index (Numis Index) of 9.7%.

The UK portfolio also included the three best performing stocks in sterling terms: Future, GB Group and Next Fifteen Communications (discussed on the following pages). It also benefitted from five takeovers; these totalled £14m and were completed at a 51% premium to their carrying values as at 31 December 2018.

The US also strongly outperformed its local market index (according to HRI the local market index returned 23.0% in sterling terms). HRI’s US portfolio was the beneficiary of a significant number of takeovers during the period (according to HRI, stocks that represented 20% of the US portfolio at 31 December 2018, “received completed or incompleted takeovers with a combined value 43% higher than the value of those stocks at the start of the year”.

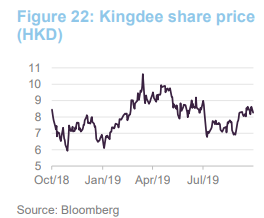

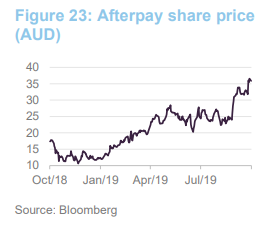

Both the EMEA and Asia portfolios performed well in the first half of 2019, although they underperformed their local market indices. For EMEA, the largest positive contributors were Isra Vision, Esker, BE Semiconductor and Data Respons, although Datalex was a major detractor. In Asia, Realtek, Kingdee and Afterpay were the strongest positive contributors.

Future – the market’s current hot media favourite

Future – the market’s current hot media favourite

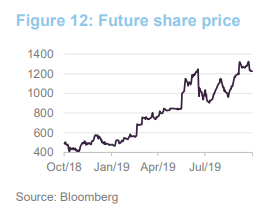

Future (futureplc.com) is a holding that we discussed in our February 2019 note. At that time, we highlighted that it had been growing, both organically and by acquisition, and that HRI had supported a rights issue in July 2018 (to fund the acquisition of the business to consumer businesses of Purch, a US consumer online technology media publisher). This participation, and Future’s strong price performance, moved the company up into HRI’s top 10 holdings, where it remains. Katie describes Future as being the market’s “current hot favourite” in the media space. It has continued to perform well, returning 156.5% YTD (as at 30 September 2019).

The company’s pre-close trading statement, published on 5 September 2019, said: “Trading for the final quarter of the current year in the Group’s core operations is stronger than the Board’s previous expectations.” The statement cited a positive performance from Amazon Prime Day related activity, strong ongoing trading in the US, as well as some additional benefits from foreign currency translations. It also said: “Full year EBITDA is now expected to be materially ahead of current Board expectations.”

Future publishes a range of special interest consumer magazines and websites across Tech, Gaming & Entertainment, Music, Creative & Photography, Home Interest, Education, and Television. Brands include the PlayStation and XBOX official magazines, Music Week and Digital Camera. It has a portfolio of over 200 print titles, applications, websites and events.

GB Group –positive trading statement

GB Group –positive trading statement

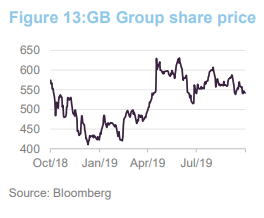

GB Group (www.gbgplc.com) is a long-time constituent of HRI’s portfolio (HRI first invested in February 2008) that has consistently been a top 10 holding during the last two years, frequently occupying the top spot. When we last discussed GB Group (see page 6 of our July 2017 note) we noted that, on the back of a previous poor trading statement, Katie remained convinced of the merits of the company and had topped up the holding. A subsequent strong recovery helped propel GB Group up HRI’s rankings.

As illustrated in Figure 13, GB Group suffered as markets retreated at the end of 2018 but has recovered well during 2019. However, the market reacted very positively to the announcement of its pre-close trading statement on 17 April 2019 (up from 550p to 630p per share; an increase of 14.5%). This showed an increase in total revenue of 19.7%, with 11.3% from organic growth; and a 20.6% increase in adjusted operating profit. Both of these were ahead of market consensus.

Next Fifteen Communications – it’s a grower

Next Fifteen Communications – it’s a grower

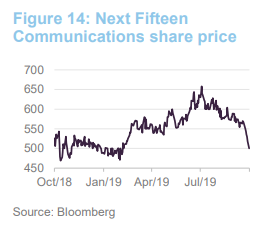

Next Fifteen Communications (www.next15.com) is another long-time holding for HRI that has made a regular appearance within its top 10 holdings. A marketing agency group, its strategy is to build a portfolio of businesses that cater to the different needs of the various market sectors and geographies in which it operates. It now consists of approximately 20 subsidiary agencies (it has 50 offices in 14 countries). These span digital content, marketing, public relations, consumer, technology, marketing software, market research, public affairs and policy communication.

It has three businesses that specialise in the technology sector: Bite, Text 100 and the Outcast Agency (it has worked with Apple, Cisco, Google, Hasbro, Marriott, Microsoft, Sony, Telefónica Digital and YouTube) as well as two businesses focused on the consumer sector: Lexis and M Booth).

The company’s share price retrenched over the summer and the announcement of both its half-year results and its acquisition of Health Unlimited LLC drove a further leg down in NFC’s share price (1.5% on the day of these announcements).

Health Unlimited is a global health consultancy and communications agency. Next Fifteen is purchasing its US division, Health Unlimited LLC, which will trade as M Booth Health and operate as a separate agency. The initial consideration is approximately US$27.7m (US$21.0m in cash with the balance in Next Fifteen shares). Further considerations may be payable around May 2020 and May 2021 dependent on the EBITDA performance of Health for the years ending 31 March 2020 and 31 March 2021 respectively.

The company’s annual results for the year ended 31 January 2019 were strong. They showed a 14% increase in net revenue to £224.1m; a 30% increase in net cash from operating activities to £32.1m; an increase of 19% in diluted earnings per share to 33.1p per share; and a 20% increase in dividend per share to 7.56p. The latest interims show an 11% increase in net revenue during the first half; a 150.6% increase in net cash from operating activities and an increase in adjusted diluted EPS of 7% (although statutory EPS fell from 9.4p to 1.8p year-on-year).

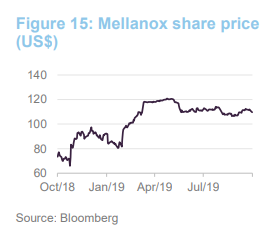

Mellanox Technologies – under offer from Nvidia

Mellanox Technologies – under offer from Nvidia

Mellanox Technologies (mellanox.com) supplies semiconductor-based interconnect products that improve connection speeds and reliability. For example, increasing the efficiency of data centres. When we last discussed Mellanox (see page 11 of our February 2019 note), we noted the company’s strong performance (it broke through $1bn in revenue for the first time in 2018, with a 26% growth in revenue and was predicting revenue of about $300m in Q1 2019 and gross margins of about 68%) as well as Katie’s view that, as an Israeli company with a US stock market listing, its Israeli domicile means that it is excluded from index benchmarks and was being neglected by many investors.

However, since publishing in February, this would appear to have changed. In March 2019, Mellanox received an offer from Nvidia for US$125 per share in cash. This was a 14.3% premium to the previous day’s closing price and values Mellanox at some US$6.9bn. As illustrated in Figure 15, Mellanox’s share price has retrenched a little since the announcement and, as at 30 September 2019, it was trading at a 12.3% discount to the offer price. Katie says that, irrespective of this, HRI has made in the region of £2.5m YTD. She believes that some market participants are worried that the offer won’t go through and this has caused the share price to come off. However, Katie thinks that this may yet have another leg up.

Isra Vision – market reacted positively to strong results

Isra Vision – market reacted positively to strong results

Frankfurt listed Isra Vision (www.isravision.com/en), describes itself as a “World market leader for robotic vision systems, inline measurement technology & inspection technology”. Its products help robots to ‘see’, aid quality control through surface inspection and are used as control systems for quality assurance (for example, in production lines). As illustrated in Figure 16, the market has responded very well following the announcement of the company’s third-quarter trading statement on 30 August 2019 (as at 16 September 2019, the share price has increased by 24.0%). The trading statement showed EBITDA up 20%, with margins of 35% of revenues and 31% of total output; EBIT growth of 19%; and earnings per share growth, after taxes, of 15% to €0.76 per share.

Esker – H1 2019 sharp rise in the value of new contracts

Esker – H1 2019 sharp rise in the value of new contracts

Esker (www.esker.com) describes itself as a recognised leader in an AI-driven process automation software globally. Its clients use Esker cloud-based solutions to drive greater efficiency, accuracy, visibility and cost savings throughout their purchase-to-pay (P2P) and order-to-cash (O2C) processes (in essence, improving their cashflow cycles). The company’s half-year results, announced on 12 September 2019, show that sales revenue grew 18% year-on-year (15% based on a constant exchange rate), while Esker’s cloud-based process automation solutions increased by more than 19% to €44.8m, representing nearly 90% of total company revenue. Furthermore, Esker says that the first half of 2019 was also marked by a sharp rise in the value of new contracts signed (cumulatively in excess of €11m, an increase of 52% compared to the first half of 2018). The company says that this was fuelled by a successful sales performance coupled with a positive base effect on the US markets.

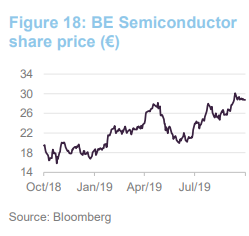

BE Semiconductor – resilient, maintaining a net margin of 16%, despite revenue falling 45%

BE Semiconductor – resilient, maintaining a net margin of 16%, despite revenue falling 45%

BE Semiconductor (www.besi.com) produces assembly equipment for the semiconductor industry. Katie says that the company is exposed to a very attractive end market that benefits from long-term structural growth. Semiconductor businesses typically have very high margins (these can be as high as 70%) and the businesses tend to be highly scalable. The business has proved resilient in the face of a downturn in the semiconductor space. The company says that “flexible production and strategic headcount initiatives have kept costs under control”. Reflecting this, the company has maintained a net margin of 16%, despite revenue falling 45% year-on-year. There is room for margin expansion (gross margins are in the region of 55-57%) and net margins reached 29% during the last semiconductor market peak. Katie says that the semiconductor market is quite macro-sensitive and HIML expects the company to have a better second half.

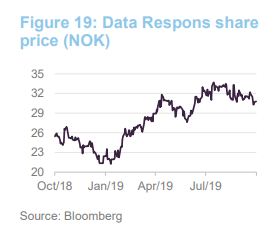

Data Respons – growth in all of its geographies

Data Respons – growth in all of its geographies

Data Respons (www.datarespons.com) is a Norwegian ‘Internet of Things’ company. It develops embedded systems for a wide range of applications and undertakes bespoke R&D projects for customers. The company posted strong second-quarter results (all- time high revenue and EBITA for both Q2 and the first half of 2019) and Q2 revenue was up 21.3% year-on-year. The company experienced growth in all of the countries that it operates in (Sweden, Germany, Norway and Denmark) and in both of its main business areas (R&D Services and Solutions).

Datalex – a major detractor; shares suspended in May

Datalex – a major detractor; shares suspended in May

Dublin listed Datalex (www.datalex.com) was a significant disappointment during the first half of 2019. While many other technology companies were recovering during H1 2019, Datalex began 2019 by issuing a trading update on 15 January that revised down its guidance for FY 2018. It said that it expected an EBITDA loss in the range of €1m-€4m. It blamed a failure to recover costs, by year end, that were incurred in the delivery of the “services revenue component of a significant customer deployment”. Furthermore, the statement said that the adjusted EBITDA and profit for the half-year ended 30 June 2018 may have been misstated, due to the accelerated recognition of the aforementioned revenue.

Datalex then compounded its woes by failing to publish its annual results in time. As a consequence, Datalex’s shares were suspended on 1 May 2019. At Datalex’s AGM on 18 September 2019, acting CEO Sean Corkery said that former management had misled the company’s board. A board report prepared by PWC identified a US$4m dividend paid by a subsidiary Datalex (Ireland) Ltd to the parent company, Datalex Plc, in May 2018. The report says that this dividend contravened company law, as the subsidiary did not have enough earnings to fund the payment. The parent company then used the cash to pay a US$3.8m dividend paid to its shareholders in September 2018. The PWC report has been referred to the Office of the Director of Corporate Enforcement.

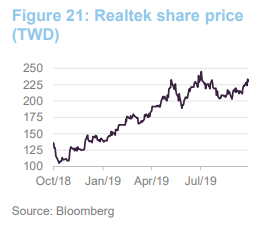

Realtek Semiconductor – outperforming its market

Realtek Semiconductor – outperforming its market

Established in 1987, Realtek Semiconductor (www.realtek.com) is an integrated circuit (IC) design house based in Taiwan. It specialises in communication network ICs, computer peripheral ICs and multimedia IC, which it designs, tests and distributes. Realtek annual results, for the year ended 31 December 2018, were announced on 30 April 2019. These showed a strong year of performance with consolidated revenues of TWD 45.8 billion, a 9.9% growth from the previous year; gross profit of TWD 20.5 billion, up 14.3% from the year before; net profit after tax was TWD 4.35 billion, a 28.3% year-over-year increase; while earnings per share increased by 27.7% to TWD 8.57. The company says that, according to IC Insights, global semiconductor market revenue grew by 16% (including memory) and 8% excluding memory. In comparison, Realtek delivered a 10.9% year-over-year revenue growth in US dollars. This is above the 8% growth average of non-memory companies, and above the 7.4% growth average of global fabless IC design companies.

Kingdee International Software Group – strong growth in cloud services business

Kingdee International Software Group – strong growth in cloud services business

Founded in 1993, and listed on the Hong Kong Stock Exchange, Kingdee International Software Group (www.kingdee.com.hk/en) provides management software and cloud services to enterprises (it has over 6.8m enterprise clients and 80m users). Kingdee’s interim results show a 16% increase in total revenue for H1 2019. The company has been investing in its cloud services business, and revenue from this business grew by 54.9% year-on-year. In contrast, revenue from Kingdee’s enterprise resource planning (ERP) business increased by just 1.2% year-on-year. However, the investment in the cloud services business saw profit attributable to shareholders fell by 35.4% year-on-year.

Afterpay Touch Group – Afterpay growing very strongly

Afterpay Touch Group – Afterpay growing very strongly

Afterpay Touch Group (www.afterpaytouch.com) is an Australian fintech company with operations in the US, UK, Australia and New Zealand. It describes itself as “a technology-driven payments company with a mission to make purchasing feel great for a global customer base”. It comprises two businesses: Afterpay and Touch, which were brought together in a merger in 2017.

Pay Later, better known as Afterpay, is a retail consumer brand that allows retailers to offer a ‘buy now, receive now, pay later’ service. It has around 4.3 million active customers and approximately 30,600 active retail merchants on-boarded. Pay Now, or Touch, is a digital payments business that services major consumer-facing organisations in the telecommunications, health and convenience retail sectors in Australia and overseas.

The company is yet to achieve profitability, but its Afterpay product is growing very strongly. The market responded very positively to the group’s results, which were announced on 28 August 2019. These showed a 91% increase in total income year-on-year (this included a 115% increase in revenue for Afterpay and an 18% fall for Pay Now); a 1% increase in total EBITDA (including a 60% increase in EBITDA for Afterpay); and a decrease in debt of $111.4m or 69% as proceeds from equity raises completed in FY19 were used to reduce this.

Discount

Discount

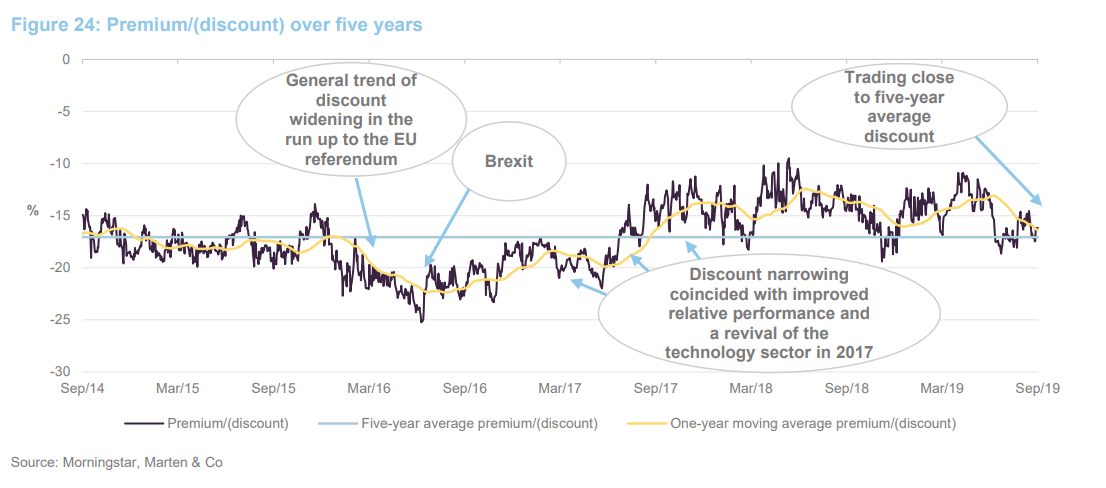

As Figure 24 shows, HRI has tended to trade within a discount range of 10% to 20% during the last couple of years. As discussed in the previous section, performance has been strong in H1 2019. There has recently been a modest narrowing and HRI’s discount is currently around the middle of its recent trading range.

As we have previously noted, HRI’s discount narrowed between mid-2016 and early 2018, which coincided both with an improvement in HRI’s relative performance and a marked revival in the performance of the global technology sector, particularly during 2017. It seems reasonable that if HRI continues with a decent run of performance, this should further stimulate investors’ appetite for HRI shares and put downward pressure on HRI’s discount (the reverse is also true).

HRI has recently been benefitting from strong cash inflows from portfolio realisations. In the past, some of these proceeds have been used to repurchase shares. Over the past year, the discount has moved within a range of 10.9% to 19.4% with an average of 14.9%.

Fund profile

Fund profile

Established in 1994, HRI invests globally in small technology, communications and multimedia companies with the aim of achieving capital growth. It is the only listed fund of its type. The trust invests globally, but has a strong bias towards the UK, which further distinguishes it from other global technology funds, which tend to be biased towards the US.

New investments in the fund will typically have a market capitalisation of $3bn or less, but are generally much smaller when the first investment is made. If successful, these can grow to be a multiple of their original valuation. This type of investing is longer-term in nature and so the trust tends to have low turnover. Reflecting the risks inherent in this type of investing, the trust maintains a highly diverse portfolio of investments (typically in excess of 250) to help mitigate this risk.

HRI has had the same lead fund manager since launch: Katie Potts. She was a highly regarded technology analyst at SG Warburg (later UBS) prior to launching the fund. Katie owns a substantial stake in the company and a significant minority stake in the management company and, clearly therefore, is motivated to ensure the success of the fund.

Previous publications

Previous publications

Readers interested in further information about HRI may wish to read Marten & Co’s previous notes, which are summarised below:

- Invest in the future – Initiation

- Tech bids demonstrate value – Update

- Backing growing businesses – Update

- Who wants to be a billionaire? – Annual overview

- From small acorns…. – Update

- Shifting sentiment – Annual overview

The legal bit

The legal bit

This marketing communication has been prepared for Herald Investment Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.