Montanaro European Smaller Companies Trust – Focus on the small picture

Focus on the small picture

Focus on the small picture

In an environment of slowing growth in Europe, a looming ‘no deal’ Brexit, a US/China trade war spiralling into a currency war and negative bond yields/inverted yield curves (where the cost of borrowing for the short-term is more expensive than the cost of borrowing for the long-term – usually a predictor of recessions), it might be tempting to hide, ‘ostrich-like’, in cash. Montanaro European Smaller Companies (MTE) offers an alternative solution. Its managers see little reward in trying to game the swings in macroeconomic sentiment. Instead, MTE’s manager’s focus is on picking stocks – identifying growing companies with strong business franchises, high-quality management, earnings and corporate structures.

Strong, sector-leading NAV growth (see page 6 in the attached PDF) is attracting new investors to MTE and this is helping to drive down its discount to NAV. The trust’s share price briefly traded at a premium to its asset value earlier this summer. We think it could do so again and for a more sustained period if the trust continues to outperform both its peers and its benchmark.

Continental European smaller companies

Continental European smaller companies

MTE aims to achieve capital growth by investing principally in Continental European quoted smaller companies. The benchmark index is the MSCI Europe ex UK Small Cap Index (in sterling terms).

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI Europe ex UK Small Cap TR. (%) | MSCI Europe ex UK TR (%) | MSCI World total return (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Aug 2015 | 10.00 | 6.80 | 7.60 | 1.10 | 3.50 |

| 2 | 31 Aug 2016 | 22.70 | 30.90 | 24.80 | 14.20 | 25.30 |

| 3 | 31 Aug 2017 | 33.20 | 26.90 | 30.00 | 24.40 | 18.10 |

| 4 | 31 Aug 2018 | 19.70 | 18.10 | 5.40 | 1.00 | 12.10 |

| 5 | 31 Aug 2019 | 9.30 | 4.10 | -5.60 | 4.30 | 7.00 |

Undiscovered gems

Undiscovered gems

As we explained in our initiation note, MTE’s manager seeks to construct a portfolio of about 50 profitable companies. These should have simple business models; defensible, niche, market-leading positions in growing markets; high operating margins and high returns on capital (barriers to entry/a sustainable competitive advantage); trade at sensible valuations; and have trustworthy and high-quality management (aligned to shareholders and demonstrating sound environmental, social and governance (ESG) practices – see below).

This is a strategy that works over the long-term, as is evidenced by MTE’s returns; it delivered a net asset value (NAV) total return of 315.8% over the 10 years ended 31 July 2019 and 352.7% in share price total return terms. This compares to 237.8% for its MSCI European (ex UK) Smaller Companies Index benchmark and an NAV total return of 282.6% for the next best performing European small cap investment trust, European Assets.

This is also a strategy that works well in periods of heightened uncertainty, as investors seek out businesses that are not dependent on cyclical growth. However, finding these businesses is not easy.

In the initiation note, we discussed how the decline in the quality and availability of external analysis, exacerbated by the MiFID II legislation (which said that readers of broker’s research should pay for it), has created an environment where it is possible to find undiscovered gems – companies whose quality and growth potential is unrecognised by the market. Montanaro Asset Management Limited (MAML) believes that it already has the largest and most experienced team in Europe, specialising in researching and investing in quoted small and mid-cap companies. It is about to further strengthen the team by hiring an 11th analyst. It is well-positioned to take advantage of the market inefficiencies that falling analyst coverage has created.

One attribute that MAML looks for is companies whose products or services make up a small but critical part of the end product. The manager believes that these companies have a better-than-average chance of sustaining higher margins. On page 5 (in the attached PDF document) we talk about one of these in more detail.

MTE’s gearing (borrowing) is low when compared to its peers. After cutting it in 2018, the manager has been gradually reintroducing some gearing recently. This reflects a contrarian stance (a contrarian investor makes purchases and sales that are in contrast to the prevailing market sentiment of the time – buying unloved stocks when they are believed to be cheap and selling stocks down when they are in favour), engendered by the valuations of the stocks that they like and a reaction to the all-pervading gloom surrounding Europe and markets. MAML thinks there is a possibility that we are experiencing a third growth pause, within the current economic cycle, rather than seeing the end of it. Yes, profit warnings are picking up, but the manager says that this is to be expected. MTE’s borrowing facility allows it to be opportunistic when other investors are throwing in the towel.

MAML’s attention to ESG issues extends to its own business. Following an extensive evaluation process, it has recently been made a B Corp Certified company (more information is available at bcorporation.net). Evidence, perhaps, that MAML’s ESG credentials are more than skin-deep.

Asset allocation

Asset allocation

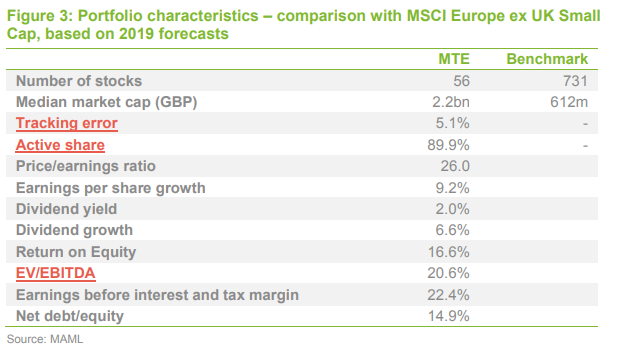

There were 56 holdings in the portfolio at the end of July 2019.

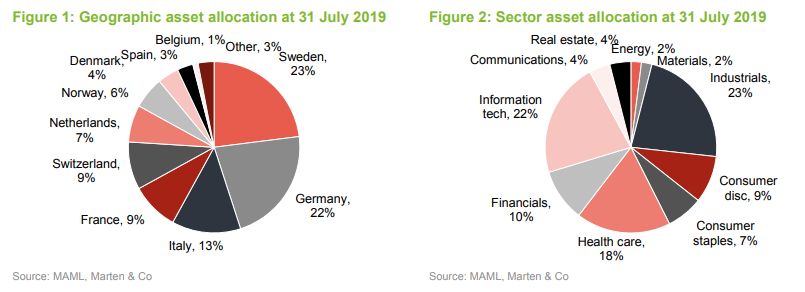

Geographic and sector allocations are a factor of stock selection, but MTE has had a long-term overweight exposure to healthcare and technology companies relative to its benchmark. MTE’s exposure to Italy has fallen since 31 January 2019 (the most recent available data when we published our initiation note) and the exposure to information technology has increased.

*Note: Figure 3 glossary links for indicators highlighted in red: Tracking error, active share and EV/EBITDA.

Portfolio characteristics

Portfolio characteristics

The companies in MTE’s portfolio typically deliver higher sales and earnings growth than the average European small cap company. Their higher quality is reflected in higher margins and returns on equity, as well as lower levels of indebtedness.

10 largest holdings

10 largest holdings

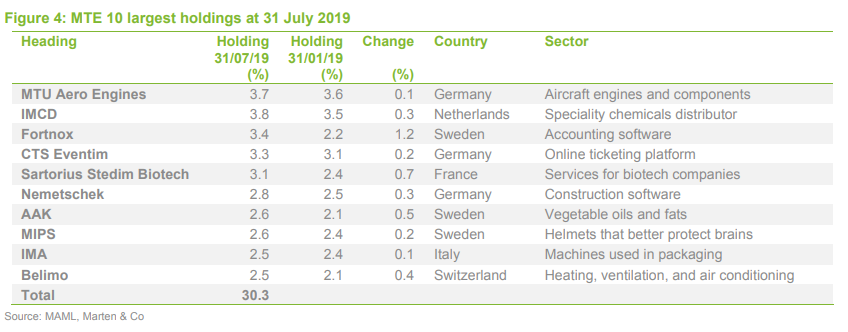

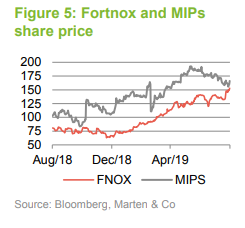

The manager says that Fortnox and MIPS are both good examples of stocks that have become larger within the portfolio by steadily compounding their sales and earnings. Both started as fairly small positions. In Fortnox’s case, the manager believes the stock has no stockbroking analyst coverage. The manager’s style is to run these ‘winners’, hence why they have become significant positions within the portfolio.

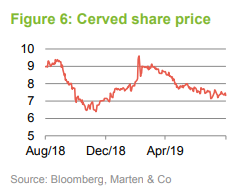

The composition of the top 10 holdings may have changed since 31 January 2019, but this reflects a reordering of the top 20 positions, largely attributable to relative share price moves, rather than any wholesale change to the portfolio. The managers take a long-term view and do not trade much, so this is unsurprising. The only stock featured in the top 10 in January that has been sold in its entirety is Cerved Group.

Disposals – Cerved and ÅF

Disposals – Cerved and ÅF

Two companies that no longer feature in MTE’s portfolio were sold for very similar reasons. Cerved and ÅF both made significant acquisitions in a departure from their usual practice.

At the end of January, Italian credit analysis/credit management company Cerved announced plans to expand beyond the Italian market by acquiring Eurobank Property Services in Greece and its two subsidiaries. That acquisition was completed in April.

MTE’s manager was concerned that Cerved’s growth was stalling and its plans to expand into other countries might be indicative of a perceived lack of opportunity in its home market. He also felt that Cerved would not have the same competitive advantage in new markets that it has in Italy.

In December 2018, ÅF and Pöyry announced a merger to form ‘a leading European engineering and consulting company’. The merger process was completed in February 2019. The manager felt uncomfortable with the scale of the transaction, which was a departure from ÅF’s previous growth strategy.

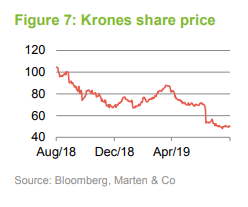

Disposals – Krones

Disposals – Krones

Krones is a manufacturer of plastic bottles. The attraction for MTE was that it was raising prices and its new chief financial officer was promising to cut its costs – suggesting that its margins and profits would rise. However, the company unexpectedly raised wages and guaranteed the jobs of its German workforce. This seemed incompatible with the promise to cut costs. Its working capital situation deteriorated too. From the manager’s viewpoint, clear cracks were appearing in the investment thesis and consequently the position was sold. Three weeks later, Krones issued a profit warning, saying its margins had halved.

Purchases – Marel and NCAB

Purchases – Marel and NCAB

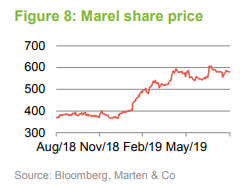

Marel (marel.com) is an Icelandic company which supplies machinery to the food processing industry. It is a leading player in Europe, having been consolidating its industry through a combination of organic growth and small bolt-on acquisitions. Another food company, held by other funds managed by MAML, had spoken highly of Marel and helped bring it to MTE’s attention.

The manager felt that Marel’s stock price might be depressed, reflecting a lack of liquidity in the stock, given that it was only listed in Iceland. When the company announced a dual listing on the Amsterdam Stock Exchange, MTE took a stake. The expectation is that investors’ awareness and interest in the company will increase. Marel should also now find it easier to raise additional capital when needed.

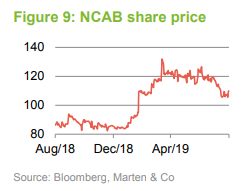

NCAB (ncabgroup.com) is a Swedish company that is not well known, probably because it is only covered by one analyst. NCAB acts a middleman in the printed circuit board (PCB) market and is a good example of the ‘small but critical’ group of companies in MTE’s portfolio that we discussed on page 2 (in the attached pdf).

The manufacturers of PCBs have consolidated, and the industry is dominated by a handful of Chinese companies. Relatively small customers (as opposed to a major OEM – original equipment manufacturer – such as a car company) have very little leverage. However, NCAB can consolidate purchase orders, helping to level the playing field.

It gives preference to PCB manufacturers that it knows and where it is the leading customer. NCAB works in partnership with these manufacturers, placing its own people in the factory to ensure ESG compliance, quality control and help make the factory more efficient. For the end customer, NCAB can advise on PCB design – weeding out costly mistakes (one third of designs need to be re-worked). Therefore, NCAB can add value to both sides.

NCAB’s business is not capital intensive. One attribute that MTE’s manager found intriguing was that NCAB’s most mature markets boast the highest margins. In new markets, it discounts to win business, but once integrated into a supply chain, it is hard to replace and, because PCBs represent only a small part of the cost of the end product, it can earn decent margins. There are still a few PCB manufacturers in Europe. As these go out of business, NCAB is picking up new customers. The company offers an attractive free cash flow yield and dividend yield. The manager is also comforted that NCAB reported flat operating profits in the last downturn.

Performance

Performance

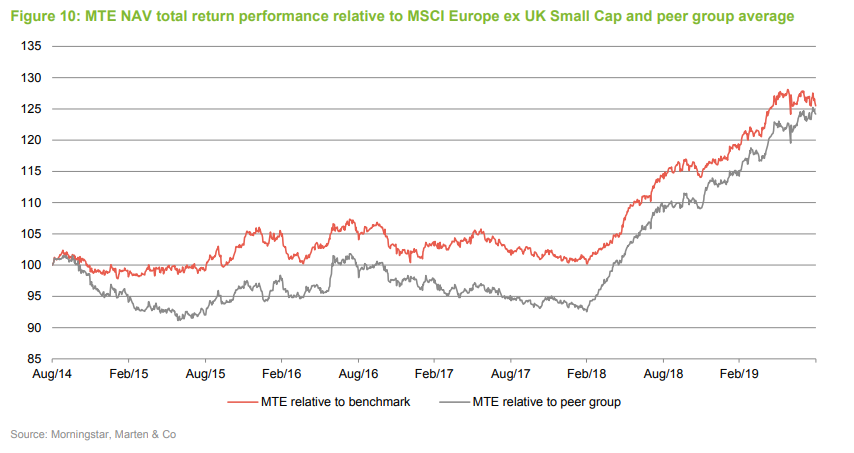

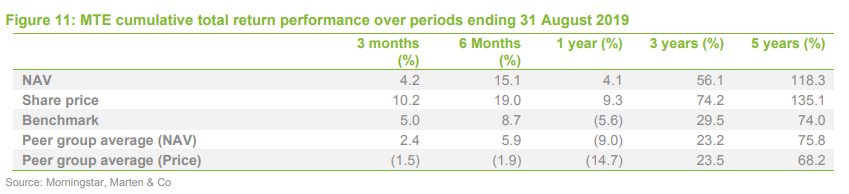

Figures 10 and 11 highlight MTE’s strong performance relative both to its benchmark and its peer group over the past five years. The trust held its own against the benchmark until 2018, but accelerated away once concerns started to build about the pace of economic growth in the first quarter of 2018. Against the peer group, MTE lagged a little in 2014/15 as investors become less risk-averse and lower quality stocks performed well.

Peer group

Peer group

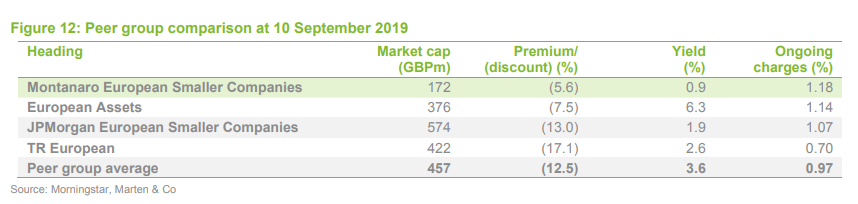

We have compared MTE with the other trusts in the AIC’s European smaller companies sector. Whilst a respectable size, MTE is the smallest of these and it might be hoped that its superior performance will, in time, allow it to expand. This, all things being equal, would also lower its ongoing charge ratio and improve liquidity in its shares. MTE has the lowest yield, reflecting its focus on growing companies.

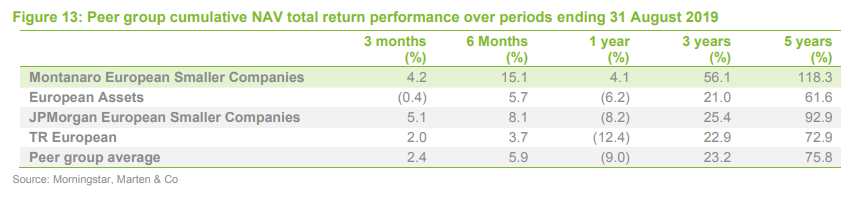

Looking at cumulative performance, MTE remains the best-performing fund in the peer group over all time periods in Figure 13.

Discount

Discount

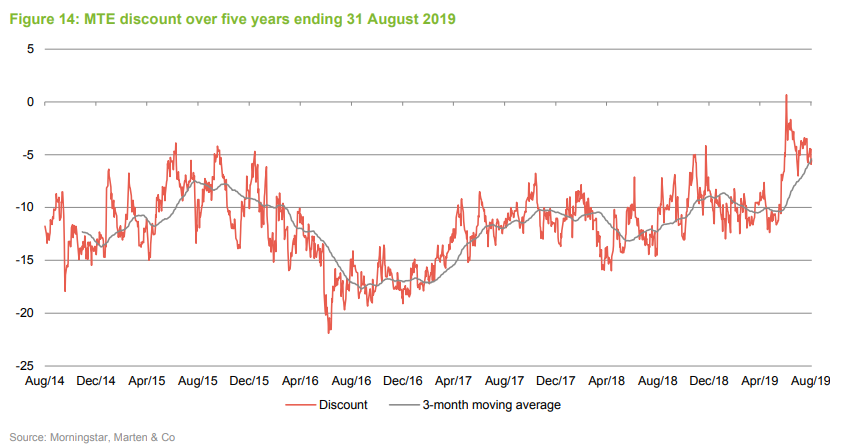

MTE’s discount has been on a narrowing trend for some time and it traded at a premium in July 2019. Over the year to the end of August 2019, MTE moved within a range of a 13.1% discount to a 0.7% premium, averaging 8.7%. At 10 September 2019 it was 5.6%. MTE has powers to issue and buyback shares, which it renews regularly at the AGM. In practice, no shares have been issued or repurchased for some time. Shares repurchased can be held in treasury and may be reissued. At present, MTE has 715,000 shares held in treasury. The board has said that these would only be reissued at a premium to NAV at the time of reissue or at a discount, provided this discount was lower than the weighted average discount at the time the shares were repurchased. The net effect of this should be that purchasing the shares and reissuing them again is profitable for ongoing shareholders.

Fund profile

Fund profile

Montanaro European Smaller Companies Trust (MTE) aims to achieve capital growth by investing principally in smaller, quoted, Continental European companies (those within the European Union, Norway and Switzerland) but is not restricted from investing in smaller companies quoted on other European stock exchanges. The benchmark index is the MSCI Europe ex UK Small Cap Index (in sterling terms).

The original company dates back to 1981, but Montanaro Asset Management Limited (MAML) took on the management of the trust in September 2006 and the European small cap investment approach dates from then. MAML had £2.2bn of assets under management at the end of 31 July 2019.

Since QuotedData last published, MTE has appointed a new company secretary and administrator in Link Company Matters Limited and Link Alternative Fund Administrators, respectively. These companies replaced BMO Investment Business Limited with effect from 1 April 2019. One effect of this was that the company’s registered office address changed with effect from 1 April 2019 to 16 Charlotte Square, Edinburgh EH2 4DF.

Previous publications

Previous publications

Readers interested in further information about MTE may wish to read QuotedData’s initiation note, Quality businesses at sensible prices, which was published in March 2019. Click the link or visit our website, www.quoteddata.com.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Montanaro European Smaller Companies Trust PLC.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.