Following on from an exceptional year of performance for the ordinary shareholders of Premier Global Infrastructure Trust (PGIT) in 2019, the trust had a good start in 2020. Whilst it suffered heavily in the pandemic-related market crash, it has bounced back strongly (in both cases the moves were amplified by the gearing effect of PGIT’s split capital structure). By the end of July, it had recovered the lost ground, and has seen further gains in August. This is important as 2020 is a seminal year for PGIT.

The trust passed its five-yearly continuation vote in May and, with the significant recovery in its assets, it now seems reasonable that, absent another major market fall, PGIT will have sufficient assets left over once its zero dividend preference shares (ZDPs) mature in November to be viable. The board has said that, subject to market conditions, it plans to put in place another five-year ZDP (maturing in 2025). The board and managers are therefore looking to the future and are developing a more targeted strategy based around the listed securities of companies focused on renewables (see pages 2 to 5).

Geared global utilities and infrastructure exposure

Geared global utilities and infrastructure exposure

PGIT invests in equity and equity-related securities of companies operating in the utilities and infrastructure sectors, with the twin objectives of achieving high income and long-term capital growth from its portfolio. Its ZDPs currently provide a high level of gearing to its ordinary shares.

| wdt_ID | Year ended | Share price TR (%) | NAV total return (%) | MSCI World Utilities TR (%) | MSCI World TR (%) | MSCI UK TR (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Aug 2016 | 17.40 | 26.90 | 29.20 | 26.00 | 12.80 |

| 2 | 31 Aug 2017 | 4.70 | 5.60 | 16.20 | 18.80 | 14.00 |

| 3 | 31 Aug 2018 | -17.50 | -25.00 | -1.90 | 12.70 | 3.60 |

| 4 | 31 Aug 2019 | 10.80 | 21.80 | 23.80 | 7.60 | 1.30 |

| 5 | 31 Aug 2020 | 15.30 | 8.40 | -7.40 | 7.30 | -16.00 |

What’s happened since we last published in March?

What’s happened since we last published in March?

Much has happened in markets since QuotedData published its annual overview note on PGIT on 11 March 2020. To recap, in that note we discussed how, following a difficult 2018, PGIT had provided a stellar year of performance in 2019 and, prior to the onset of the pandemic, PGIT had started 2020 well. We also discussed how the move to net zero carbon emissions by 2050 represents a seismic shift for the sector and how PGIT’s manager is now giving increased consideration to the longer-term implications of this trend in managing PGIT’s portfolio. At that time, PGIT’s manager said that it envisaged that, for the first time in a long time, investors in the space will benefit from growth assets rather than facing a managed decline in consumption.

Within two weeks of publishing that note, financial markets collapsed as investors tried to assess the implications of an accelerating covid-19 infection rate on economies and companies, with the market trough being around the 23 March. In a market dislocation such as this, macroeconomic considerations tend to overwhelm the micro, and the ensuing rout throws up opportunities for investors that are prepared to look through the short-term noise. The covid-19-related collapse of 2020 was no exception and, as we discuss in the following pages, PGIT’s manager took the opportunity to significantly increase the trust’s exposure to renewable energy assets. As at 30 June 2020, these represent 66.0% of PGIT’s portfolio.

Following the publication of its annual report in early March, PGIT held its AGM in May, which saw its ordinary shareholders approve its continuation for another five years. This gives the board and manager the green light to refinance the trust’s ZDPs when they mature in November this year. Furthermore, with the recent publication of its interim report, PGIT’s board have confirmed that, subject to market conditions, they intend to refinance the maturing ZDP with a similar five-year ZDP that will mature in 2025. They have also confirmed that, with the manager having expanded its expertise in the renewable energy sector in recent years, the board and manager are planning a change in investment strategy, of which renewables will be a major part. We discuss the shift to renewables in the following section.

Shift to renewables

Shift to renewables

The outlook for the renewable energy sector appears rosy. Pressure to tackle the climate emergency is building. The UK’s commitment to net zero carbon emissions by 2050 is already being replicated by many other countries across the globe, and a change of leadership in the US could see it recommit to the 2015 Paris Agreement. At the same time, governments are keen to revive their economies, and see infrastructure spending – and investment in renewables in particular – as one way of accomplishing that.

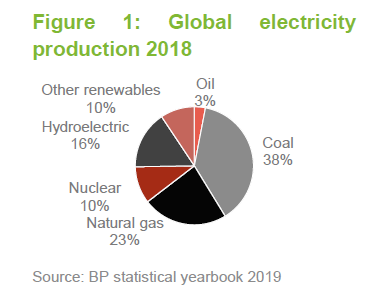

The scale of the task is enormous. In 2018, excluding hydroelectric, renewables accounted for just 9.3% of global electricity generation (BP statistical yearbook). Bloomberg New Energy Finance (BNEF) estimate that $13.3trn will be invested in renewable energy between 2018 and 2050, including $5.3trn in wind and $4.2trn in solar. They suggest that wind and solar could account for almost half of all generation by 2050. In Europe, renewables could account for 92% of all electricity production by then. Some of the greatest opportunities will be in Asia – BNEF foresees $4.3trn of investment in China and India.

Cost and productivity improvements help drive adoption of renewables

Cost and productivity improvements help drive adoption of renewables

The shift to renewable generation is being driven by price as much as consideration of curbing CO2 emissions. The all-in cost of producing energy from electricity and wind has become increasingly competitive.

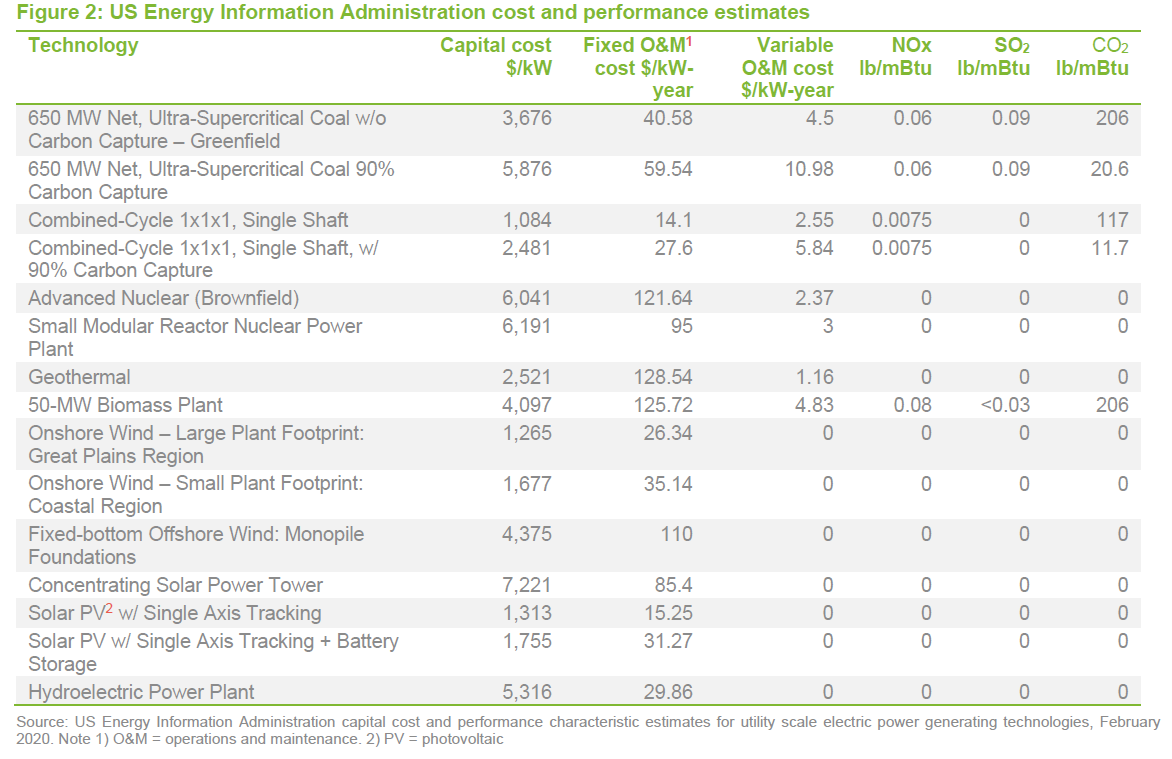

Figure 2, which is based on data for the US, shows the costs of producing electricity for various forms of generation and the associated production of greenhouse gases.

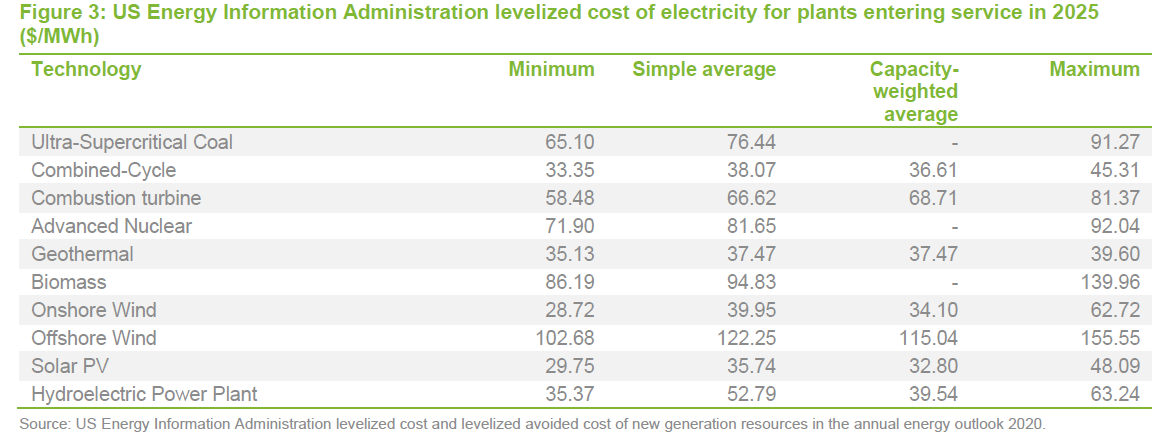

Figure 3 shows how, for some of these, the assumptions translate into a levelised cost of electricity (in dollars per MWh) and how these vary regionally.

The cost-competitiveness of solar and onshore wind is obvious in Figure 3, but we should highlight that, with the right conditions, offshore wind can be competitive too. In 2019, in the UK’s last auction of contracts for difference (the latest form of subsidy in the UK, which guarantees a minimum price for electricity produced), 5.5GW of capacity was awarded to offshore wind at an all-in price (including grid connection) of £40.63/MWh. In 2019, commitments were also made to the construction of subsidy-free offshore wind projects in the Netherlands and Germany.

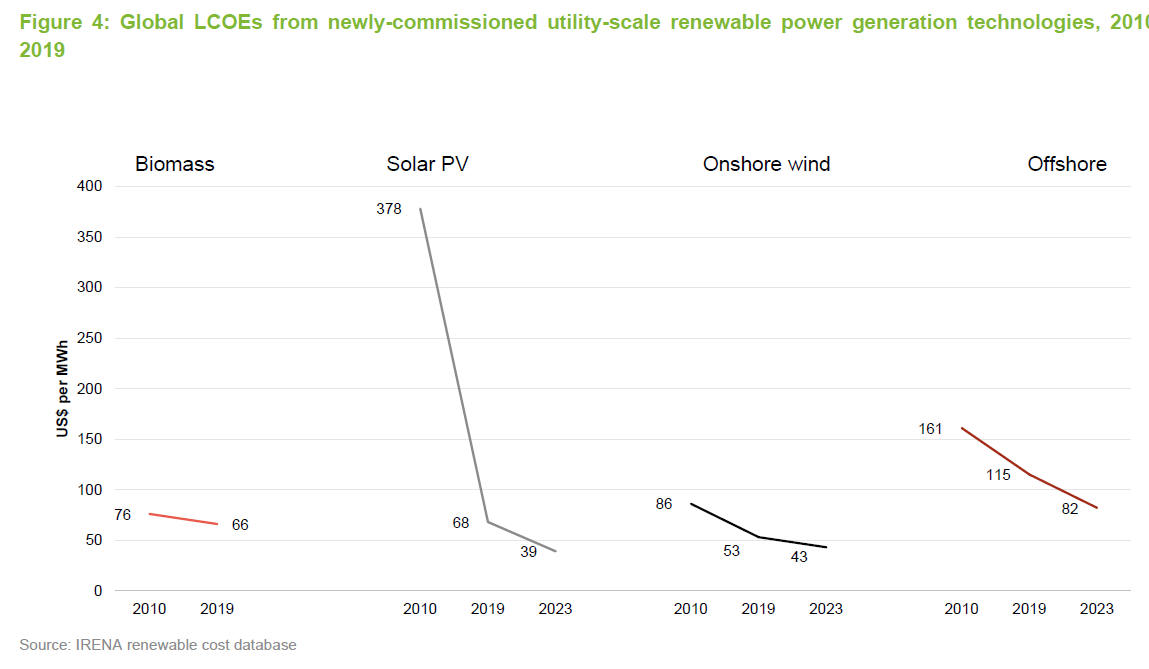

The all-in cost of electricity generated by renewables has been falling, as is evidenced in Figure 4, which compares the global weighted average levelised cost of electricity (LCOE) for various technologies in 2010 with that in 2019 and a forecast level for 2023.

The most dramatic falls have been in solar PV, driven by a 90% collapse in module prices. BNEF suggests that solar module prices could fall by 37% between 2018 and 2025.

At the same time, wind turbines have become larger and more efficient. In many cases, there is money to be saved by closing existing coal-fired plants and replacing the capacity with onshore wind or solar regardless of the climate change benefit. Carbon Tracker estimates that over half of coal plants operating today cost more to run than building new renewables. BNEF thinks that by 2030, new wind and solar plants will be cheaper than equivalent coal and gas plants just about everywhere in the world.

Lower power prices

Lower power prices

Measures taken to tackle COVID-19 have reduced demand for energy, putting downward pressure on prices. Forecasters recognise that this effect will be temporary, but have also been reducing their long-term power price estimates in response to a number of factors, one of which is the proliferation of renewables.

Concerns have been raised in some quarters that the falling cost of renewables will drive down power prices, cannibalising returns for existing plant. Should this happen, in many markets investors in renewable energy assets will be cushioned by subsidies, which comprise a significant part of the revenue of renewable assets in the UK, for example. In markets such as the US, where subsidies are front-end-loaded in the form of tax credits, long-term power purchaser agreements (PPAs) should help delay the impact of falling prices.

Managers of renewable energy assets point out that they will not invest in new assets unless they offer acceptable levels of return. The UK government recently announced that it was considering reintroducing subsidies for new onshore wind and solar plants. This might be a way of overcoming this problem.

Complex subsidy regimes

Complex subsidy regimes

Subsidies helped to drive the early success in the sector and may continue to play an important role. However, the form and the quantum of these have changed over time and there is considerable variety of structure by country as well. This complexity reinforces the case for outsourcing investment in this area to a specialist in the sector.

Batteries are a key area of growth

Batteries are a key area of growth

One drawback of renewable production is that it is unpredictable in the short term, making it unsuitable for baseload generation (note: baseload is the minimum level of demand on a electrical grid over a given period of time. The grid needs to be able meet this demand and respond to demand increases as they occur). However, advances in battery technology look set to ameliorate this. By releasing stored power when production from renewable generators dips, batteries can help stabilise grid frequencies, act as emergency supply in the event of outages, help restart grids after a blackout and be a mechanism for investors to exploit the fluctuations in power prices over a typical day. Again, part of the rapid growth in this area of the market is being driven by the rapidly falling costs of the batteries themselves.

Long-term outlook for renewables is rosy

Long-term outlook for renewables is rosy

Faced with an uncertain future, many fossil-fuel generators are trying to reposition themselves for this changing landscape. There will be clear winners and losers from the shift to renewables.

James Smith, PGIT’s manager, believes that renewable companies display high growth, high returns, resilient dividends and non-correlated risks. In his opinion, they also offer unparalleled long-term visibility and exceptional cash generation.

Asset allocation

Asset allocation

PGIT maintains a portfolio of relatively high-conviction positions that, for the time being, fall into one of three sub-portfolios: growth equity, yield equity and yieldco (yieldcos are asset owning companies set up to stream income to investors in a tax-efficient manner). The top seven or eight largest holdings tend to be core positions that the managers are happy to hold for the medium to longer term.

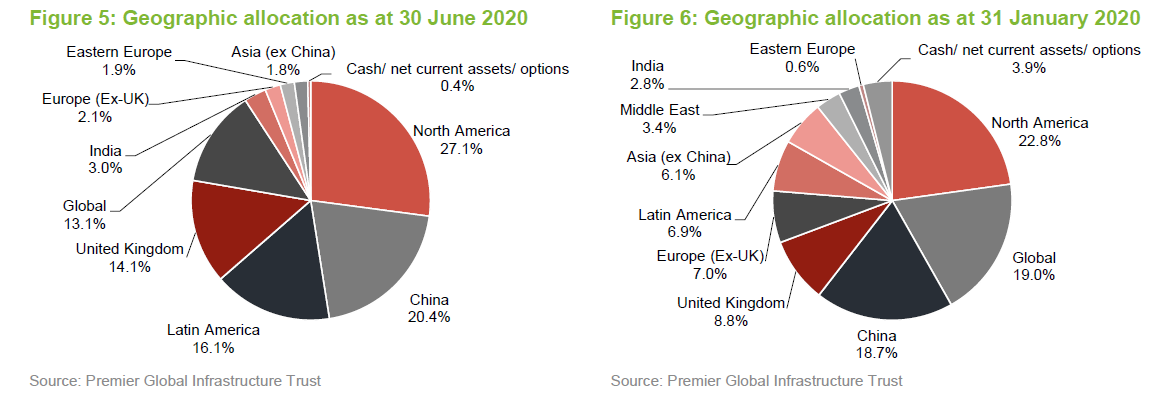

Comparing PGIT’s portfolio as at 30 June 2020 and 31 January 2020 (the most recently available data when we last published) there has been a mild increase in portfolio concentration within the top 10 holdings (these accounted for 47.4% at the end of June versus 46.5% at the end of January), although, counter to this, the number of portfolio holdings has actually increased markedly from 39 to 48.

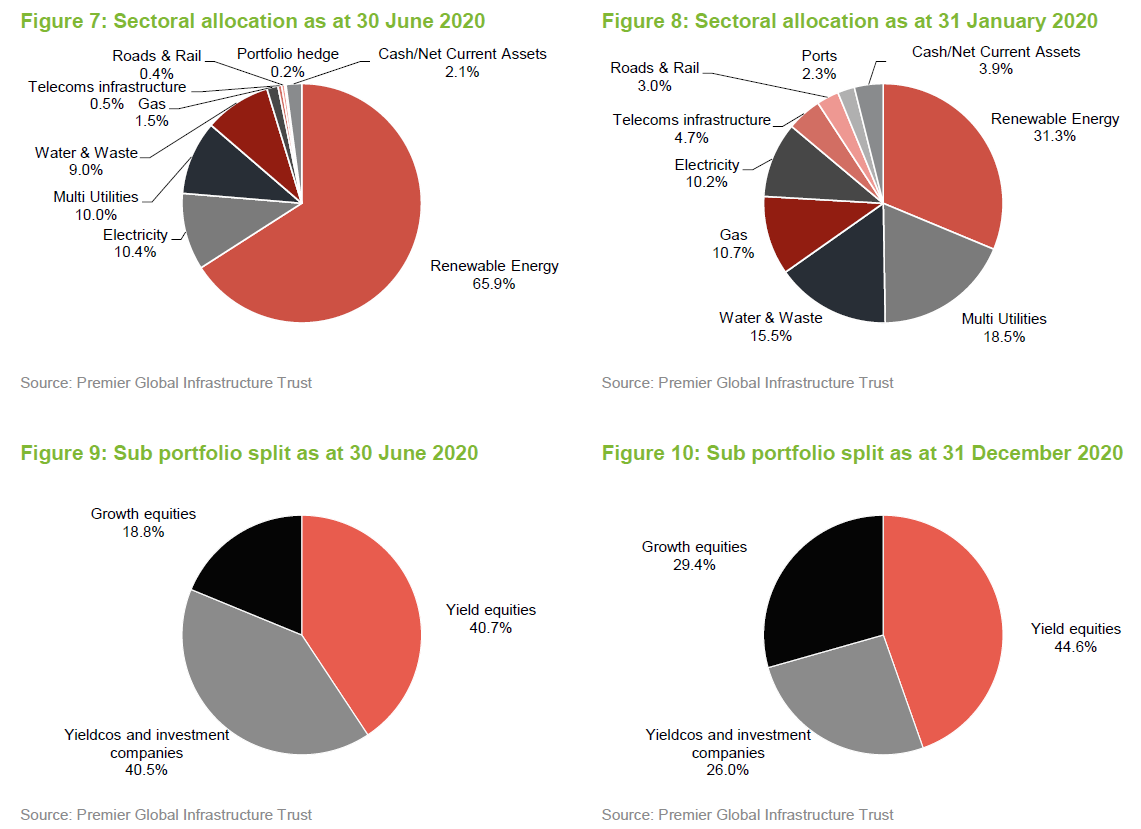

The major difference, however, is the marked increase in the allocation to renewables, which is illustrated by comparing Figures 7 and 8. As at 30 June 2020, PGIT’s allocation to renewables accounted for 65.9% of its portfolio, up from 31.3% as at 31 January 2020. This shift reflects the manager’s decision to use the opportunity presented by the market dislocation to markedly increase the portfolio’s exposure to renewable energy assets while these were at compelling valuations, as noted on page 2. As illustrated in Figures 9 and 10, the increased exposure to renewables has led to a material shift in the balance of investment between yield equities, growth equities and yieldcos. In summary, PGIT’s exposure to yieldcos and investment companies has increased. This has largely been funded through a reduction in growth equities, along with a more modest reduction in yield equities.

Yieldcos and Investment Companies

Yieldcos and Investment Companies

Since QuotedData last published, PGIT’s exposure to Atlantica Sustainable Infrastructure (formerly Atlantica Yield) has been increased through the purchase of additional shares. Atlantica Sustainable Infrastructure remains PGIT’s largest holding, but as illustrated in Figure 11, PGIT’s allocation has moved up from 6.7% at the end of January to 9.3% as at the end of June. The manager also added NextEra Energy Partners (an investor in renewables in the US) and Australian listed New Energy (almost all of its investments are also in the US). In the UK, the manager took advantage of share price weakness to establish a position in Greencoat UK Wind as well as to top up PGIT’s existing positions in GCP Infrastructure and Gresham House Energy Storage Fund.

New investments have been made in US-based Hannon Armstrong, as well as in SDCL Energy Efficiency Income Fund in the UK. PGIT’s manager says that both of these companies generate long-term returns from financing transformative energy projects with creditworthy clients and that they benefit from a longer-term tailwind of demand for energy efficiency and renewable financing as companies seek to cut emissions generated in industrial property and processes. US renewables yieldco Pattern Energy has left PGIT’s portfolio. The company was subject to a bid and the manager therefore disposed of the holding.

PGIT’s exposures to the First Trust MLP and Energy Income Fund and the CenterCoast MLP & Energy Infrastructure Fund have been reduced. As discussed on page 11, the performance of both have suffered recently as their portfolios have lost value in the face of an ongoing low oil price. PGIT’s manager reiterates that neither is directly exposed to lower oil prices. However, they are reliant on oil and gas shippers remaining viable. This has been brought into question given the continuing low oil and gas prices, coupled with the higher levels of borrowing that tend to prevail in this sector.

Growth Equities

Growth Equities

PGIT’s manager has taken the decision to reduce – and in some cases sell out altogether – a number of PGIT’s Hong Kong-listed Chinese stocks. These have continued to underperform (see page 11) and, whilst this is in part a reflection that international geopolitical tensions remain high, the manager has nonetheless become concerned that many of these companies will continue to trade on low valuations. Metro Pacific, the Philippine infrastructure conglomerate, has been reduced significantly as the manager believes that the political risks have increased. Other examples include Beijing Enterprises Holdings, China Water Affairs, and Kunlun Energy.

However, while some of these positions have struggled, PGIT’s manager says that it has retained and, in some cases, has taken the opportunity to increase exposure to companies exposed to renewables as it believes the prospects remain compelling. Specifically, the manager says that the continuing reduction in Chinese renewable energy costs is allowing the country to transition from a subsidy-based model to one that is more driven by market prices. It says that this is leading to a combination of lower political risk, improved affordability and, as a consequence, superior long-term growth prospects. An example of this is China Longyuan Power, which despite an otherwise positive backdrop, saw its share price fall by 11.8% in the first half of 2020. Similarly, the manager also added to PGIT’s position in China Suntien Green Energy, which saw a share price decline of some 21.3%. PGIT’s holding in port operator DP World has been sold. The share price rose following a bid for the company from its majority shareholder and PGIT’s manager took the opportunity to exit.

Yield equities

Yield equities

PGIT’s manager has been reducing the trust’s long-term holding in the Brazilian water company Cia de Saneamento de Parana (Sanepar) as it considers that the economic and political risks in Brazil are increasing. The manager has continued to add to the Finnish electricity generator Fortum, which QuotedData discussed in more detail in its March 2020 note (see page 10 of that note). To recap, the company has substantial zero carbon hydro and nuclear generation assets and PGIT’s managers believe that it should benefit from any future increases in electricity prices resulting from higher European carbon pricing. The manager believes the market has been underestimating Fortum’s potential benefit from this, although Fortum’s share price fell 23.2% in the first half of 2020 as the market focused on the prevailing low electricity price.

PGIT’s manager also increased the trust’s position in Spanish renewables developer Acciona. The manager says that Acciona has a strong pipeline of new development projects, and it believes that there is potential for the group to improve its market rating as it divests non-core businesses from the business in the future.

Top 10 holdings

Top 10 holdings

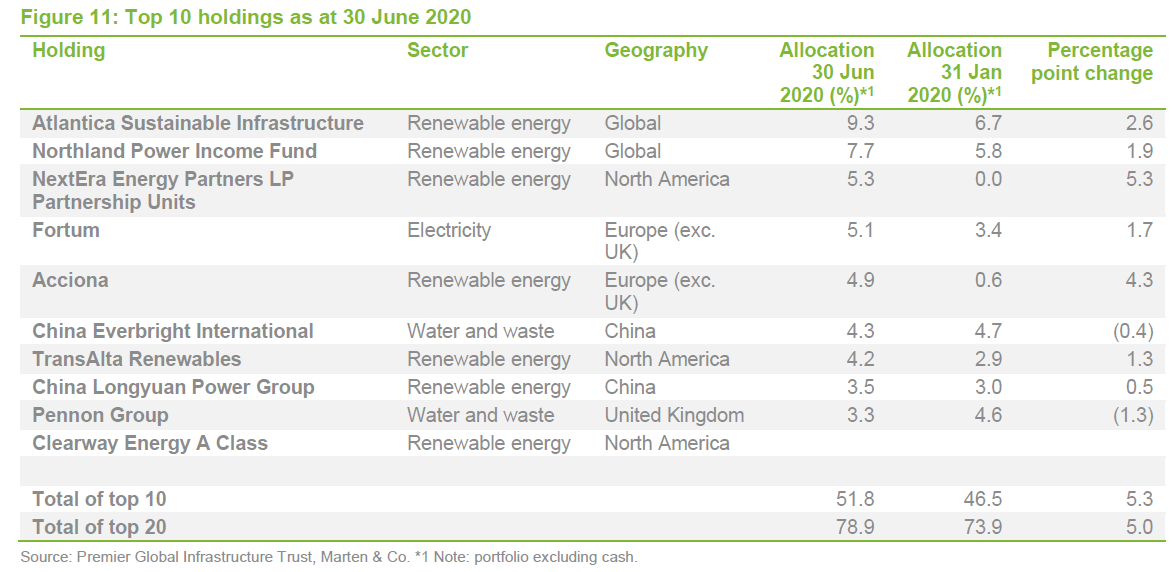

Figure 11 shows PGIT’s top 10 holdings as at 30 June 2020 and how these have changed since 31 January 2020 (the most recently available data when QuotedData last published). The changes, which are summarised below, largely reflect the shift towards renewables. Specifically:

- Atlantica Sustainable Infrastructure (formerly Atlantica Yield) continues to be PGIT’s largest holding, while Northland Power Income Fund continues to occupy the number two position.

- New renewable energy holding NextEra Energy Partners holds the number three position.

- Fortum (See QuotedData’s March 2020 note for more discussion) has moved up PGIT’s rankings.

- TransAlta Renewables is a new top 10 holding.

- China Longyuan Power Group has moved back up into the top 10, reflecting its focus on renewable energy.

- Brazilian water and waste company Cia de Saneamento do Parana (Sanepar) is out of the top 10. As noted above, it has been reduced in the face of increasing political risk.

- First Trust MLP and Energy Income (multi-utilities) and Beijing Enterprise Holdings (gas) have both moved out of top 10, although PGIT retains a holding in both. PGIT’s positions in Enbridge (gas) and Engie (multi-utilities) have both been sold in their entirety.

- China Everbright International remains a top 10 holding but has moved down PGIT’s ranks. The manager added to the position when its share price was weak following the market collapse.

- Pennon Group (water and waste) continues to be a top 10 holding but its allocation has been reduced as the manager refocuses on renewables.

Readers interested in more detail on these top 10 holdings, or other names in PGIT’s portfolio, should see QuotedData’s earlier notes, where many of these have been discussed previously (see page 17 of this note).

As QuotedData discussed in its March 2020 note, after a difficult 2018, 2019 was an exceptional year of performance for ordinary shareholders in PGIT. The total return on its gross assets was 19.0% (2018: -11.0%) but the significant level of gearing provided by PGIT’s ZDPs amplified this gain so that the ordinary share NAV total return was 38.9% (2018: -25.4%). PGIT’s share price captured almost all of this, returning 38.3% in total return terms. In comparison, the MSCI World Utilities, which has a much higher weighting to developed markets, gained 17.8% (still very respectable in absolute terms, but less than half the return provided by PGIT).

Ground lost due to covid-19 recovered by the end of July

Ground lost due to covid-19 recovered by the end of July

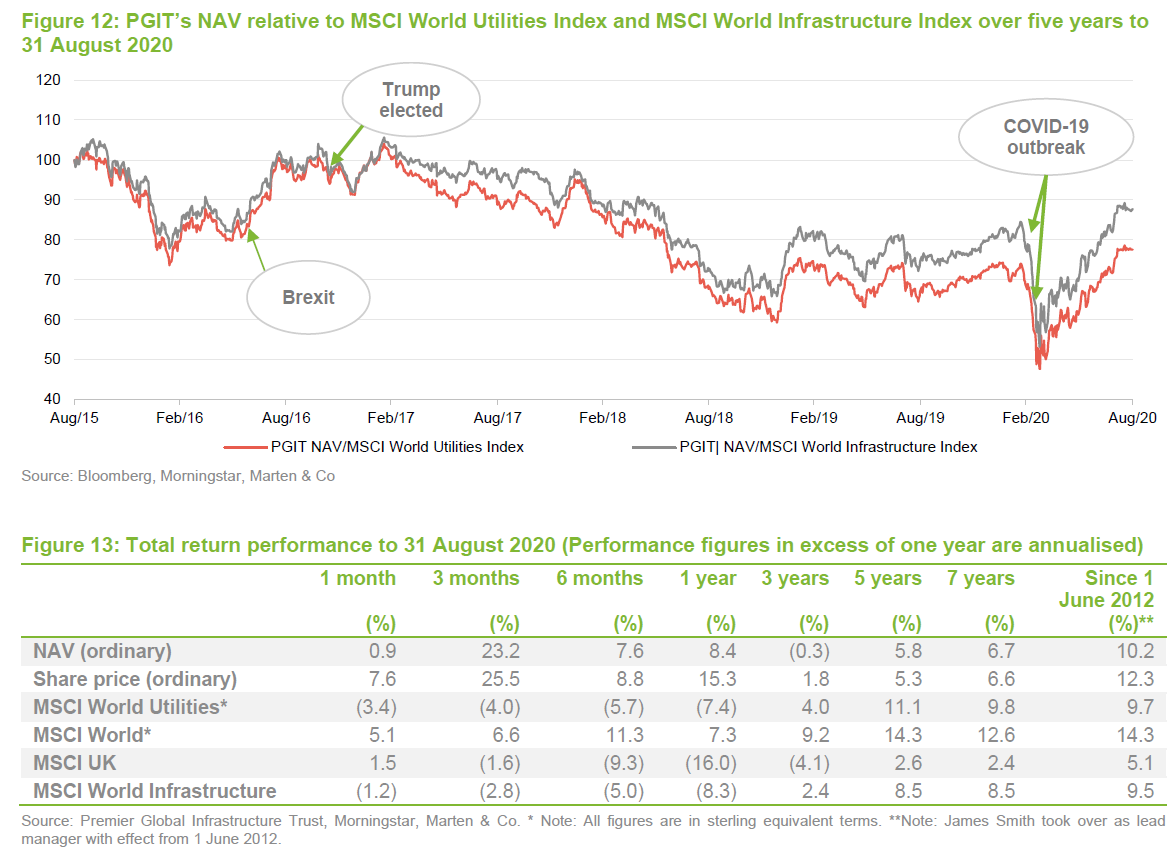

As discussed in QuotedData’s March 2020 annual overview note, before the viral panic engulfed markets, PGIT was having a strong start to 2020 as well (its NAV and share price hit 163.36 and 144.50p on the 19 February and 20 February respectively). As illustrated in Figure 12, PGIT’s NAV suffered relative to both the MSCI World Utilities Index and the MSCI World infrastructure Index (both of which are more weighted towards developed markets). However, it has performed very strongly since so that, by the end of July, PGIT had recovered the ground it had lost and, in total return terms, its ordinary share NAV had grown by 1.4% year-to-date (in comparison, its share price was up by 0.8% reflecting a slight widening of the discount during the period).

Marked outperformance for eight months to end August 2020 – aided by £4.2m of gains on market hedging

Marked outperformance for eight months to end August 2020 – aided by £4.2m of gains on market hedging

PGIT has also had a good August, returning 0.9% in NAV total return terms. However, its share price has performed noticeably better than this (it has returned 7.6% in total return terms), which reflects a marked narrowing of the discount over the month. Overall, this means that PGIT has provided an NAV total return of 2.3% year-to-date to 31 August 2020, and a share price total return of 8.4%. Both strongly outperformed the returns provided by the MSCI World Utilities Index and MSCI World Infrastructure Indices (total returns of -4.7 and -6.5% respectively).

In many respects, this outperformance is quite remarkable. Given the highly geared nature of PGIT’s portfolio, it would have been perfectly reasonable to have expected a substantial underperformance of both of these indices this year. The manager says that one factor that has contributed to this outperformance is £4.2m of gains made on PGIT’s market hedging during the downturn. The results for the half-year ended 30 June 2020 provide some additional clarity on the other drivers of PGIT’s outperformance through the market rout (see next section).

Results for the half-year ended 30 June 2020

Results for the half-year ended 30 June 2020

As noted above, whilst PGIT began the year well, it suffered heavily as markets rolled over in the face of the pandemic. However, its portfolio outperformed global infrastructure through a combination of strong performances in some of its larger renewable energy holdings and a level of market hedging taken out during the downturn (as markets began to fall in February the manager put some partial portfolio protection in place via short index futures, which made a £2.6m profit for the trust). PGIT’s manager says that the advent of covid-19 largely accelerated trends seen in recent years (for example, the out-performance of growth over value, weakness in both the UK stock market and sterling, and concerns over the financial stability of Europe and the Euro) while Asia, with its more recent experience of tackling pandemics, has been less disrupted than the west.

As QuotedData has commented in its previous notes, in recent years macro-influences have tended to outweigh microeconomic developments, and the pandemic appears to be no exception. Whilst some holdings performed as the manager would have expected, the manager says that some holdings suffered to a far greater extent than it felt could be justified by fundamentals. It says that this was particularly acute at the height of the market turmoil where it saw several high-quality renewable energy companies, selling power at predominantly fixed prices with priority over dispatch, suffer heavy share price falls despite there being little evidence to suggest that these businesses would be greatly affected. (Note: priority of dispatch occurs when national transmission system operators give the priority to electricity generators that use renewable energy sources to the extent that the secure operation of the grid permits.)

Yieldcos and investment companies – continued to perform well

Yieldcos and investment companies – continued to perform well

The manager therefore took advantage of the opportunity provided by the market collapse to add to PGIT’s holdings in Atlantica Sustainable Infrastructure (formerly Atlantica Yield), GCP Infrastructure and Gresham House Energy Storage Fund as well as to initiate new positions in NextEra Energy Partners, New Energy Solar, Greencoat UK Wind, Hannon Armstrong and SDCL Energy Efficiency Income. The manager says that all of these additions have proved to be fortunate both in terms of timing (they were acquired largely at depressed prices) and because the companies have recovered well as investors have realised their business models were not particularly exposed to the economic downturn. For example, Atlantica’s share price increased by 10.3%, NextEra Energy Partners provided a return of 31.1%, while Hannon Armstrong provided an increase of 34.1% at the period end.

On the downside, PGIT’s holdings in the First Trust MLP and Energy Income Fund and the CenterCoast MLP & Energy Infrastructure Fund were both very disappointing. PGIT’s manager says that while these are not directly exposed to lower oil prices, they are reliant on oil and gas shippers remaining viable and, given the level of gearing in the sector and the low level of oil and gas prices, this is now open to question (PGIT’s manager has substantially reduced both exposures, crystallising a loss in the period).

Growth Equities – further underperformance

Growth Equities – further underperformance

The growth equities portfolio continued to underperform, with PGIT’s emerging market investment being the primary driver. PGIT’s Hong Kong-listed Chinese stocks struggled in the face of geopolitical tensions. For example, waste to energy company China Everbright International saw its shares fall by 34.6% during the first half of 2020, despite reporting strong 2019 results (earnings up 20.5%). As discussed on page 7, the manager sold a number of stocks where it felt valuations would remain low, but has added to companies exposed to renewables as it believes the prospects remain compelling.

Yield equities – generally performed well

Yield equities – generally performed well

Cia de Saneamento de Parana (Sanepar) continued to perform well, although the manager reduced the position as it feels that the economic and political risks in Brazil are rising. Another strong positive contributor was Canadian-listed renewable energy company Northland Power, which saw its shares gain 24.9% in the first half of 2020 as it commissioned its third North Sea wind farm. On the downside, Finnish generator Fortum saw its share price fall some 23.2% as the market has focused on lower near-term electricity prices.

Currency effects

Currency effects

PGIT’s has had a policy of partial currency hedging in place for a number of years, particularly to ensure that its sterling exposure is at least as great as its ZDP share liability (this is because the manager has sought to avoid the trust from running a geared currency exposure). At the time of the market collapse in March, sterling was relatively buoyant, and it consequently fell sharply during as markets collapsed. However, as a consequence of having the partial hedging in place, the currency gain that would have otherwise accrued to PGIT from owning a predominantly non-sterling portfolio was reduced (this is because foreign exchange hedging losses offset some of the currency gains that were made elsewhere in the portfolio).

PGIT’s manager says that currency hedging will be kept under close review in the second half of 2020. While the world is focused on the pandemic, Brexit still has the potential to move sterling materially up or down. Similarly, the outcome of the US presidential election in November is an event that has the potential to heavily impact the US dollar.

Premium/(discount)

Premium/(discount)

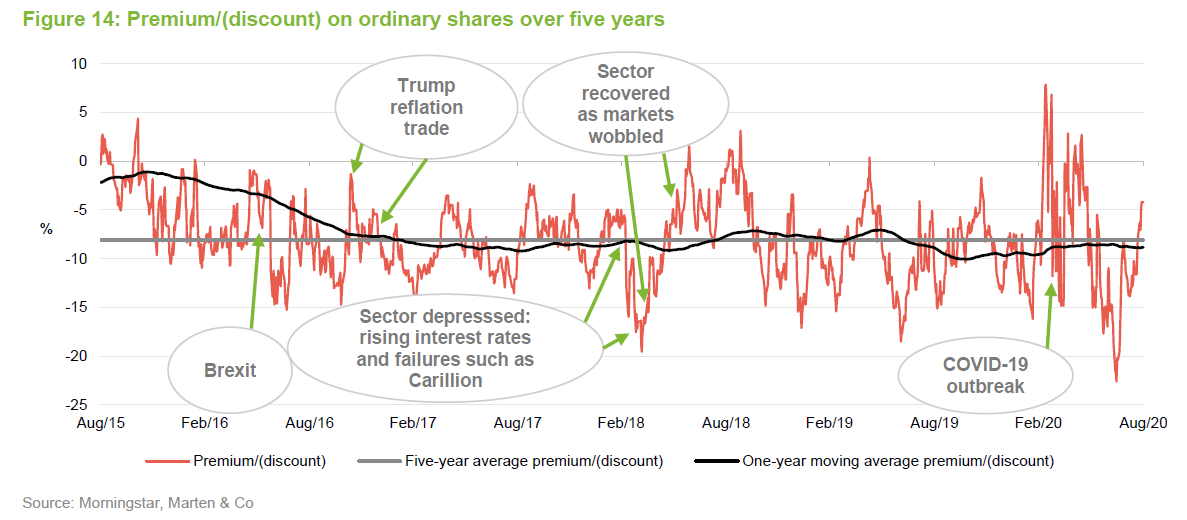

As QuotedData has discussed in its previous notes (see page 17 of this note) the volatility present in PGIT’s ordinary share discount is in part a feature of the high level of gearing that is provided by its ZDPs and the volatility that this leads to within PGIT’s ordinary share NAV. As illustrated in Figure 14, PGIT’s ordinary shares moved from trading at about an 8% premium to about a 15% discount, as markets collapsed in the face of an accelerating covid-19 infection rate. Whilst this quickly reversed, with PGIT once again trading at a premium in early May, this proved short-lived. PGIT’s discount reached a five-year high of 22.6% on 15 July 2020. Fortunately, the discount has narrowed again since, although PGIT was trading at a discount wider than both its one-year moving average and its five-year average prior to the marked narrowing in August.

It seems reasonable to us that, if PGIT continues to provide strong performance, this could lead to a sustained narrowing of the discount from here. Furthermore, in the absence of another dramatic market correction, PGIT should be able to refinance its ZDPs in November and complete its strategy shift towards a focus on renewables.

Investors’ demand for income remains ever-present, especially in an environment of lower for longer interest rates. PGIT’s new strategy should provide a source of reasonably reliable and largely inflation protected cash flows, and, in turn, a relatively high dependable dividend yield. While the structure will continue to amplify NAV volatility, the new focus should be attractive to investors, helping to drive down its discount, and potentially pushing PGIT’s ordinary shares back to a premium rating.

Quarterly dividend payments

Quarterly dividend payments

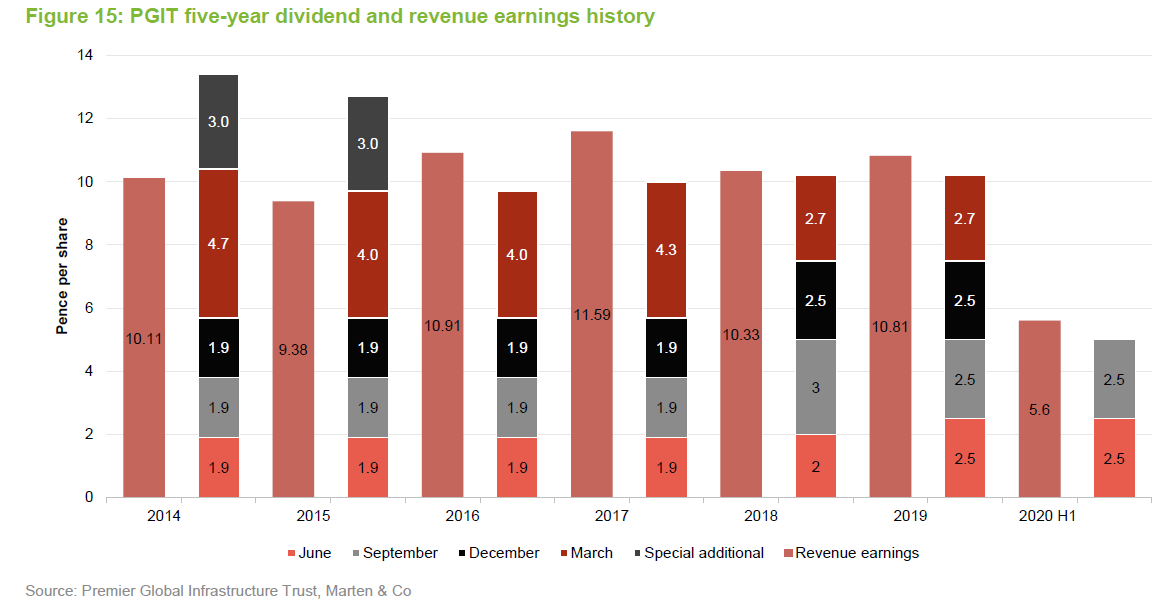

PGIT pays quarterly dividends on its ordinary shares in June, September and December and March. All dividends are paid as interim dividends. Traditionally, the first three interim dividends (June to December) were smaller, with a larger fourth interim in March. However, in 2018, PGIT moved towards more equal dividend payments throughout the year and, for the year ended 31 December 2019, PGIT paid its first three interims at 2.5p per share, with a fourth interim dividend at 2.7p per share (a total of 10.2p per share for the year, which is a yield of 7.6% on PGIT’s ordinary share price of 135.00p as at 28 August 2020).

For the year ending 31 December 2020, PGIT has maintained its quarterly dividend rate at 2.5p per share for its first and second interim dividend payments. PGIT’s revenue return is down by 9.8% for the first half of 2020 but, as discussed below, this is largely an issue of timing and should reverse. However, we would also note that, when compared to the prior year, PGIT’s dividends, at 5.00p per share, are nonetheless well-covered by revenue income of 5.60p per share (down from 6.21p for the previous year). Readers may wish to note that, in terms of income generation, PGIT’s ordinary shares benefit from the significant finance provided by the ZDP borrowings. The ordinary shares incur the cost of financing the ZDP borrowings, but this is charged to capital, thereby bolstering the revenue account.

9.8% fall in revenue income was temporary and has since been reversed

9.8% fall in revenue income was temporary and has since been reversed

As noted above, PGIT’s revenue income was down by 9.8% year-on-year for the first half of 2020. PGIT’s manager says that the primary cause of this was dividends from National Grid and China Suntien Green Energy that did not materialise in the first half as had been expected. National Grid’s final dividend for its March 2020 year went ex-dividend in early July (as opposed to June in previous years) and will be accounted for in the Trust’s second half (this dividend has already been received).

Hong Kong listed China Suntien Green Energy did not declare a dividend for 2019 in the first half of 2020 (it usually declares its dividends in the March following its December year-end) as it was in the process of issuing shares in the Chinese domestic market. Chinese law prohibits companies from paying a dividend while a share listing is pending; however, with the share issue out of the way, on 20 August 2020, Suntien declared a dividend for the 2019 year that was unchanged versus the prior year.

As such, while both the National Grid and Suntien Energy dividends have shifted into the second half, they will otherwise be at normal levels. Furthermore, PGIT’s managers say that, adjusting for these two dividends, underlying income generation was in line with the prior year. Furthermore, the manager does not expect revenues for the vast majority of PGIT’s holdings, and particularly its renewable energy holdings, to see any material effect from the Covid-19 downturn.

Revenue reserves are 57% of the 2019 dividend, after payment of the second interim dividend

Revenue reserves are 57% of the 2019 dividend, after payment of the second interim dividend

As at 30 June 2020, PGIT had revenue reserves of £1.505m or 8.32p per share (equivalent to 5.82p per share after deducting the second interim dividend for the year of 2.5p per share, which goes ex-dividend on 3 September 2020). The 5.82p per share is equivalent to 57% of the total dividend for the 2019 year, suggesting that PGIT retains some capacity to smooth dividends going forward.

ZDP coverage

ZDP coverage

PGIT is a split-capital investment trust with two types of security in issue: ordinary shares and ZDPs. The ZDPs provide substantial gearing to PGIT’s ordinary shares, facilitating both income enhancement and amplifying performance (see page 16 of QuotedData’s March 2020 annual overview note for more information on PGIT’s capital structure).

As at 28 August 2020, PGIT had 18,088,480 ordinary shares and 24,073,337 ZDP shares in issue. With NAVs of 140.93p and 124.16p for the ordinary shares and ZDP shares respectively as at 28 August 2020, we estimate PGIT had gross gearing of 117.2% and net gearing of 111.6%.

The ZDP shares mature on 30 November 2020 with a final entitlement of 125.6519p per 2020 ZDP share. This is equivalent to a gross redemption yield (GRY) of 4.75% per annum over the life of the ZDPs. As at 28 August 2020, the ZDPs had an attributable asset value of 124.16p per share and were trading at 121.50p (a discount of 2.1%). With the final entitlement noted above, the ZDPs offer a yield to maturity of 13.94% per annum. The ZDPs have a coverage ratio of 1.83x.

PGIT: Income from utilities and infrastructure exposure

PGIT: Income from utilities and infrastructure exposure

Premier Global Infrastructure Trust Plc (PGIT) is a UK-listed investment trust that invests globally in the equity and equity-related securities of companies operating in the utility and infrastructure sectors. The relatively-concentrated portfolio has a strong emphasis on emerging markets, smaller companies, special situations and lower weightings to traditional, developed-market utility companies. It is split into three distinct areas: income equities; growth equities; and yieldcos and investment companies.

Additional information on PGIT is available at the fund manager’s website: premiermiton.com

Geared by zero dividend preference shares

Geared by zero dividend preference shares

PGIT aims to pay a high level of income on its ordinary shares (a yield of 7.6% as at

28 August 2020 – see page 14 for further details) and provide long-term capital growth. PGIT’s income generation is enhanced by the significant gearing provided to the ordinary shares by its ZDPs (net gearing of 111.6% of the ordinary shares’ NAV, as at 28 August 2020, on our estimates – see page 15), but this structure significantly increases the volatility of NAV returns. As discussed on page 2 and above, PGIT ZDPs mature on 30 November 2020 and the board has said that, subject to appropriate market conditions at the time, it anticipates refinancing these with another five-year ZDP issue that matures in 2025.

Moving to a renewable energy focus

Moving to a renewable energy focus

As discussed on pages 2 to 5, the board and manager are proposing to revise PGIT’s investment policy and it is expected that renewable energy will be a major part of the new policy. Renewable energy is an area that the manager has been building its expertise in during recent years, during which it has also been one of PGIT’s strongest areas of performance.

Premier Miton Investors

Premier Miton Investors

PGIT’s portfolio has been managed by Premier Fund Managers, part of Premier Miton Group Plc, since its launch in 2003. Premier Miton was formed in November 2019 with the merger of Premier Asset Management Group Plc and Miton Group Plc. The combined group had some £10.3bn of assets under management as at 30 June 2020.

James Smith is responsible for the management of PGIT’s portfolio. He follows a bottom-up investment process based on fundamental research and is able to draw on the wider resources of Premier Miton Investors. See our initiation note for more details of the manager’s investment process.

No formal benchmark

No formal benchmark

PGIT does not have a formal benchmark and its portfolio is not managed with respect to one. Instead, the managers’ performance is assessed against a set of reference points that are more general in nature and intended to be representative of the broad spread of assets in which the portfolio invests. These references include the FTSE Global Core Infrastructure 50/50 Total Return Index, FTSE All-World Total Return Index and FTSE All-Share Total Return Index. As with previous notes, we are using the MSCI World Utilities Index, the MSCI World Infrastructure Index, the MSCI World Index and MSCI UK Index for performance comparison purposes.

Previous publications

Previous publications

Readers interested in further information about PGIT may wish to read QuotedData’s previous notes:

- A step change in performance – Initiation – 18 June 2014

- Solid interims and plans for the future – Update – 7 August 2014

- Value in emerging markets – Update – 2 February 2015

- 3 years later, in a new league! – Annual overview – 16 July 2015

- It’s a £24m rollover! – Update – 4 February 2016

- A BREXIT beneficiary – Update – 5 September 2016

- Significant latent value – Annual overview – 12 July 2017

- Evolution, not revolution – Update – 28 November 2017

- Swings and roundabouts – Update – 10 May 2018

- Quick out of the blocks in 2019 – Annual overview – 29 March 2019

- Strong income growth – Update – 30 October 2019

- Don’t stop me now – Annual overview – 11 March 2020

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Premier Global Infrastructure Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.