Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

Performance data

May’s biggest movers in price terms are shown in the chart below.

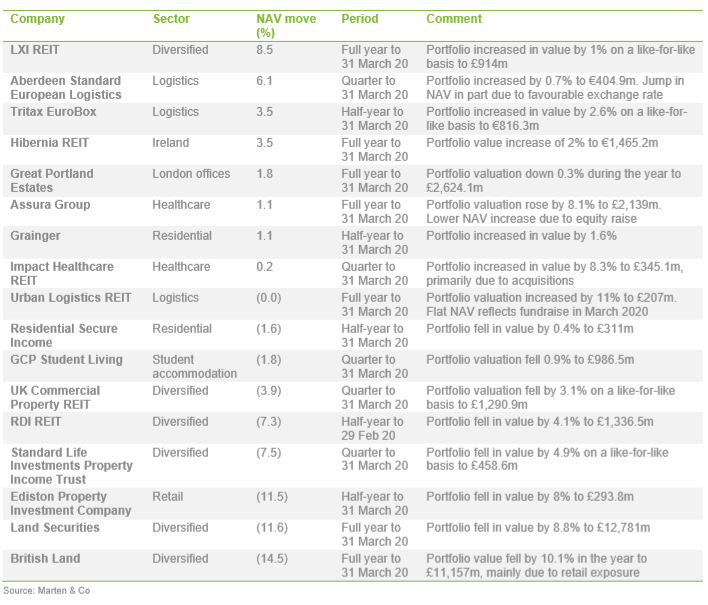

Shares in property companies took another turbulent turn during May as the covid-19 pandemic continued to wreak havoc on property assets. The biggest mover in price terms during the month was an unlikely name in shopping centre owner Capital & Regional. The company’s share price has been battered in recent years as the retail sector has come under pressure, and this has heightened in recent months during the lockdown. However, it saw its share price rise 18.7% in May following the approval of its final dividend. Also high on the list of positive movers was BMO Real Estate Investments. The group saw its price increase 15.4% in May, but in the year to date it has fallen 28.6%. Three logistics-focused companies made the top 10, with Tritax Big Box REIT, Warehouse REIT and Aberdeen Standard European Logistics Income all seeing double-digit rises in their share price. Tritax Big Box has taken longer than some logistics players in recovering its share price following an initial drop-off in March due to covid-19. It is now marginally down year-to-date. The logistics sector is set to emerge from the pandemic in relatively good shape with demand from ecommerce occupiers picking up due to an increase in online shopping. There were some heavy losses felt by property companies in May. Housebuilder Countryside Properties suffered the largest fall, of 28.2%. The fall reflects the turbulent nature of the housing sector at the moment, with the company topping the charts for biggest gains in April but being 36.1% down year-to-date. The crisis playing out in the retail sector, exacerbated by the pandemic, has seen all retail-focused property companies suffer. That was the case for Town Centre Securities and New River REIT in May. Town Centre Securities has a portfolio of retail, leisure and car park assets that have all been heavily impacted during the lockdown. NewRiver REIT’s portfolio, which includes shopping centres and pubs, has a large number of retail parks that are likely to be the first form of retail to open when lockdown is eased due to its social distance-friendly set-ups. Land Securities has also been afflicted by the retail sector. It reported full-year results to the end of March 2020 during May in which its portfolio lost £1.2bn (8.8%) in value, mainly driven by a 20.5% fall in its retail portfolio. The company, which also own central London offices, has recently hired former Unite Group and St Modwen chief executive Mark Allan to turn things around. Valuation moves

Valuation moves

Corporate activity in May

Corporate activity in May

LondonMetric Property raised £120m, in an oversubscribed placing. The company said the proceeds would be used to buy properties from an extensive pipeline of opportunities and expects to deploy a substantially amount of the proceeds within three months. Alternative Income REIT appointed M7 Real Estate as its new investment adviser. AIRE made the appointment after the previous manager departed in February. M7, which is a leading specialist in the pan-European, regional, multi-let real estate market, will undertake a review of each of the group’s assets and the company’s investment policy. Hammerson chief executive David Atkins is to step down from the role after 10 years. Atkins will remain in position until spring 2021 at the latest, while the board conducts a search for his successor. Hammerson, which owns a portfolio of shopping centres, retail parks and outlet centres across the UK and Europe, has suffered from plummeting retail values. Intu Properties said it was seeking standstill agreements with lenders in order to prevent expected covenant breaches. The shopping centre owner, which has debt of almost £4.5bn, said the impact of covid-19 on rental collections and valuations of its malls at the end of June is likely to result in breaches of covenants. The standstills sought would provide relief from financial covenant testing, debt amortisation and facility maturity payments with interest being “pay if you can”. This would provide an opportunity for refinancing debt arrangements to help prevent a total collapse of the retail landlord. Secure Income REIT’s management team and board members increased their holdings in the company with the acquisition of £500,000 of stock during May. It bought 100,000 shares at 250p in early May and a further 111,111 shares at 225p, taking its holding to 40,164,756 shares, equating to 12.4% of the company’s share capital.

May’s major news stories

May’s major news stories

• Capital & Counties agrees deal to buy 26.3% of Shaftesbury Capital & Counties acquired a 26.3% shareholding in rival West End landlord Shaftesbury for £436m. The group will pay 540p per share for the 80.7 million shares from Hong Kong billionaire Samuel Tak Lee. It represented a discount of 13.9% to the closing Shaftesbury share price on 29 May 2020. • Is a central London powerhouse REIT on the cards? Capital & Counties’ acquisition of a huge shareholding in Shaftesbury could be the first steps in a long-mooted merger of the two groups. Combined, Capital & Counties and Shaftesbury own £6.6bn of property in London’s West End. • Supermarket Income REIT buys stake in Sainsbury’s store portfolio Supermarket Income REIT acquired a 25.5% stake in a portfolio of 26 Sainsbury’s supermarkets in a joint venture (JV) with British Airways Pension Fund from British Land for £102m. • AEW UK REIT sells largest asset for £18.8m AEW UK REIT sold its largest asset, a car park asset at Geddington Road, Corby, for £18.8m. It was acquired in February 2018 for £12.4m and has produced a net income yield of 10% against the purchase price and an IRR in excess of 30%. • How will retail work in a post-covid world? With lockdown measures gradually being eased across the UK, retailers will have the chance to open stores for the first time in weeks. However, social distancing restrictions means that it is only really going to be retail warehouse parks that can perform strongly coming out of lockdown. • Great Portland Estates lands major West End office pre-let Great Portland Estates secured a 40,000 sq ft pre-let at its office development at 1 Newman Street and 70/88 Oxford Street to Exane BNP Paribas. The deal is a significant boost to the central London office market as fears around a drop off in demand for office space mount amid the coronavirus crisis. • What next for landlords in battle with Travelodge? Travelodge has threatened to pursue a company voluntary arrangement (CVA) if rent cuts of up to 80% for 18 months was not agreed by its landlords. What does a CVA mean for landlords? • Primary Health Properties buys medical centre portfolio for £47.1m Primary Health Properties acquired a portfolio of 20 purpose-built medical centres for £47.1m and conditionally contracted to acquire a further two medical centres for £6.9m. The acquisition will increase PHP’s portfolio in the UK and Ireland to a total of 510 assets with a gross value of just under £2.5bn and a contracted rent roll of £131m. • Hammerson’s £400m sales of retail park portfolio falls out of bed Hammerson’s £400m deal to sell a portfolio of seven retail parks to Orion European Real Estate Fund V failed to complete. Hammerson will access the £21m deposit, but the news was a hit to its efforts to fix its balance sheet. • Empiric Student Property expects £8m hit on income Empiric Student Property said it expects a reduction of income for the current academic year of up to 12% or £8m. The loss of income from students being released from their rent obligations for the summer semester is below the company’s worst-case scenario of a £21m reduction in income.

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

Logistics

Aberdeen Standard European Logistics Income Tony Roper, chairman: Notwithstanding the unprecedented economic environment we are now operating within, the board and investment manager continue to believe that logistics will remain one of the most favoured sectors for investors in the coming years. The logistics industry is experiencing unprecedented disruption as a result of systemic changes to the way global economies are functioning and these challenges are manifesting themselves in different ways across different sectors. So far, logistics assets have benefited from additional occupier demand arising from necessary supply chain restructuring. New technology is creating challenges for supply chains as clients demand frequency and more complexity whilst the nature of ecommerce, where Europe has lagged the UK, has increasingly required operators to adapt faster to future shifts in consumption, particularly so since the start of European lockdowns. Leasing ‘tension’ has been robust with land values under pressure from competing uses and with income growth prospects potentially stronger than for ultra big-boxes where risk is higher at maturity of the lease as the number of potential occupiers are limited. Urban Logistics REIT Nigel Rich CBE, chairman: Clearly there remains considerable uncertainty about the speed of recovery in the UK’s economic growth. Life will not be the same post covid-19. The lockdown has further improved the adoption of ecommerce which is a central tenet to our business. We believe in our medium to long term strategy and the experience of our manager to invest well in these markets and of the need to invest to generate the income needed to meet the dividend expectations of our shareholders. The investments we have made in March and April will help to grow the income of the business and we are well set to be making further investments in the coming months. At the same time, we will keep a close watch on the financial wellbeing of our tenants and our level of gearing. We are confident that we will continue to successfully grow our business despite all that is happening around us. Tritax EuroBox Robert Orr, chairman: The global spread of covid-19 means we are in a period of prolonged uncertainty. It is not possible to know how long the pandemic will last or its impact on the global economy. Even so, we are continuing to see good interest in our vacant units and are having positive conversations with potential occupiers. Covid-19 is likely to accelerate occupier demand while further tightening supply, creating further upward pressure on rents and demand from tenants for longer leases, so as to secure their supply chains.

Diversified

Diversified

British Land Chris Grigg, chief executive: Longer term, it is our view that many of the macro trends that have informed our strategy will accelerate. This includes the growth of online shopping, reinforcing our focus on delivering a smaller, more focused retail business. We continue to believe there remains a role for the right kind of retail within our portfolio especially assets that can play a key role for retailers in terms of fulfilment of online sales, returns and click and collect. This will particularly be the case for well located, open air retail parks, which lend themselves to more mission-based shopping and people may feel more comfortable visiting, as well as those London assets located conveniently in-and-around key transport hubs. We also expect demand to polarise towards workspace which is high quality, modern and sustainable and supports more flexible working patterns, and this plays well to the space we provide including through Storey. However, it remains early days and we do not yet have clarity around what long term trends will emerge so we will remain alert as things develop and flexible in our approach, including evolving or adapting our strategy as appropriate. Land Securities Mark Allan, chief executive: The speed and scale of the impact of covid-19 on business and the economy are unprecedented and profound long-term consequences will play out long after the government lockdown has lifted. Some of the long-term economic and societal trends which were already disrupting the property industry are likely to accelerate, new ones are sure to emerge and major issues such as climate change will remain as significant as ever. Landsec faces this situation from a position of strength. We have a strong balance sheet, a portfolio of properties that are amongst the highest quality for the sectors in which we operate and a team of talented, dedicated people across the business. These attributes stand us in good stead but will need to be allied to bold, ambitious thinking and a willingness to adopt new and creative approaches. Standard Life Investments Property Income Trust Jason Baggaley, fund manager: Covid-19 is likely to accelerate and accentuate trends that existed before the virus, rather than totally change the fundamentals of the real estate market. Holding the most robust and durable income streams may not be a major point of difference this quarter or next; history suggests this divergence emerges as the market approaches its nadir. But we expect significant relative outperformance of such assets to come through later in the year – and for a protracted period if the economic downside materialise – as the degree of income risk at the asset level becomes clearer. Urban logistics continues to be an area of the market we favour on a structural basis – likely amplified by this crisis – and one where the fundamentals remain supportive of rental tension. There is strong potential for consumers, previously cautious around online shopping, to gain confidence and retain a higher proportion of spending online after the crisis, which will drive increased demand for ‘last touch’ logistics in particular. Online grocery demand has increased substantially with the UK in lockdown, but we do not believe this will have the same impact on logistics as discretionary goods. The crisis has exposed the constraints on capacity for home delivery and the importance of large superstores in fulfilment. The government is providing previously unimaginable levels of stimulus, and yet it remains unclear at present what the nature of recovery is going to look like. We anticipate many tenants having difficulty in meeting rental obligations over the remainder of this year, and quite possibly for the first half of 2021, whilst they try and repair their balance sheets. However, rent is contractual and a fairly rapid pick-up in activity is expected in 2021, which the industrial sector is most likely to benefit from. LXI REIT Stephen Hubbard, chairman: We are in unprecedented times and there is still uncertainty as to how the crisis will develop and on the full economic impact on the UK and Global economy. However, it is now clear that the UK and economies globally will enter a deep recession, the length and depth of which is still to unfold given all the uncertainties that currently exist. The extent of this crisis has been widely recognised as an unforeseen risk in the corporate world. The board has carefully reviewed the additional risks that have now arisen in our portfolio. Many of our tenants are continuing to operate from their premises, and their business models have been comparatively less affected by the crisis.

Retail

Retail

Ediston Property Investment Company William Hill, chairman: The real estate market will have to grapple with some extremely testing issues over at least the next two quarters and possibly beyond, including more difficulty in collecting rent, potential tenant failures and a transactional market that will struggle with price discovery to provide meaningful valuation data points. Where it goes from here will depend considerably on whether we have a V, U or L shaped recovery for the economy and the duration of the restrictions on movement and activity and what those restrictions entail. Whilst the timing of the recovery from the impact of covid-19 is unknown, the board is confident that the convenience-led retail warehouse assets the company owns, together with its other assets, should provide attractive returns to shareholders in the future. The creative and proactive asset management of the Ediston team puts the company in a strong position to deal with the challenges ahead and to identify the opportunities for value creation within the portfolio to unlock in the future. However, the immediate priorities for the company are income collection and value protection.

London offices

London offices

Great Portland Estates Toby Courtauld, chief executive: As we examine the implications [of covid-19] for our business, it is clear that we must plan for a recession with an increase in unemployment, leading to reduced occupational demand for space, implying falling rental and capital values. Key to our market’s performance will be both the depth of the downturn and the shape of the recovery. Whatever the outcome, whilst some working practices might change, our human desire to congregate and create underpins our belief that London’s magnetic appeal as a global business capital will persist for the long term. This belief is reinforced by our current leasing discussions, illustrating occupiers’ ongoing appetite to secure high quality, sustainable space.

Healthcare

Healthcare

Assura Group Jonathan Murphy, chief executive: As we emerge from this crisis, the NHS and its funding needs will be at the forefront of high-level discussions in Westminster and beyond. It is possible that healthcare funding will increase again in the near future, and ensuring that there is sufficient capacity to support this will likely become a key priority for the NHS. However, the nature of its buildings in terms of design, sustainability, built-in technology, and flexibility will all need to be enhanced. As the scale and nature of these evolving requirements become clearer, we are ideally placed to support the needs of the NHS. Despite the unprecedented level of uncertainty at the current time, we will continue to look forward to the future with confidence in Assura’s prospects.

Residential

Residential

Residential Secure Income Rob Whiteman, chairman: Regardless of the unfortunate implications of the covid-19 outbreak, the country will still have a significant shortfall of housing and this supply demand gap will most likely become more acute through a countrywide lockdown causing reductions in earnings and housing delivery (caused by construction sites closing and financial pressures on housing developers), which will likely increase the demand for social housing.

Ireland

Ireland

Hibernia REIT Kevin Nowlan, chief executive: The full impact of the covid-19 pandemic on market rents and property values is yet to be felt but we are well-positioned to withstand it thanks to our experienced team, high-quality portfolio and robust balance sheet. We believe the current health crisis is underlining the importance of city centre offices as places for employees to work together and exchange information and ideas. We remain confident in the long-term prospects of the central Dublin office market and the Dublin residential market and will continue to manage the business and our pipeline of developments accordingly.

Recent publication

Recent publication

Aberdeen Standard European Logistics Income, Resilient to covid-19 Civitas Social Housing, Proved its mettle

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it. No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice. No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note. Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages. Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction. Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.