QuotedData’s Real Estate Monthly Roundup – August 2020

Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

Performance data

July’s biggest movers in price terms are shown in the chart below.

A number of REITs and property companies saw big share price gains over the month of July as covid-19 restrictions started to ease across the UK and greater economic stimulus was revealed. The biggest mover was AEW UK REIT. The company, which has a diverse portfolio worth £171.5m, posted a positive NAV move for the quarter to the end of June and has maintained its dividend.

Fellow diversified trusts UK Commercial Property REIT and Schroder REIT also saw double digit gains in their share price during the month. The share price of generalist property companies that hold a portfolio of diverse property assets have taken a big hit during the pandemic and the discount to NAV on these two funds has perhaps proved too great to ignore. Two logistics-focused companies, LondonMetric Property and SEGRO, continued to see demand for their shares grow – buoyed by the positive sentiment in the real estate sub-sector. In the past three months LondonMetric has seen its share price rise 18.9% and SEGRO by 16.8%. RDI REIT continued its share price bounce off the back of majority investor Redefine’s sale of its near 30% stake to private equity group Starwood Capital.

Retail landlord Hammerson continued to see its share price fall during July and has now lost 79.2% of its value in the year to date – the worst in the real estate sector. The company, which owns shopping centres, retail parks and premium outlets in the UK, Ireland and France, announced meagre rent collection figures for the second quarter.

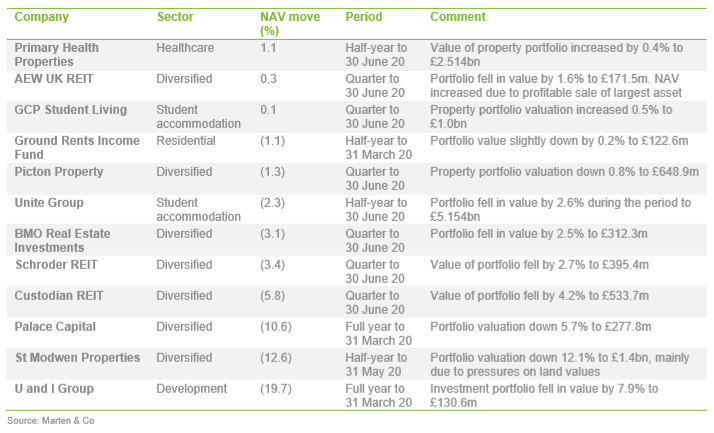

Regeneration specialist U and I Group saw its share price fall 14% in the month and is now down 61.8% in the year to date. During the month it reported full year results in which its NAV plummeted 19.7%. St Modwen Properties, which owns and develops residential and logistics assets, also reported results in which its NAV slid 12.6% due mainly to pressures on land values. The group saw its share price fall 10.9% in July and is down 38% year to date. Tritax EuroBox, owner of logistics warehouses across Europe, was a surprise entry in the biggest share price fallers – seeing its share price drop 11.8% in July. In the last three months its share price has grown 7.1% after a surge in demand for space from ecommerce companies. BMO Commercial Property Trust rounds off the list, with its largest asset – a central London retail and restaurant quarter – weighing on performance.

Valuation moves

Valuation moves

Corporate activity in July

Corporate activity in July

Primary Health Properties raised £140m in a share placing “to further accelerate growth by funding near-term portfolio expansion, forward funded developments and asset management projects”. A total of almost 96.5 million shares were placed at a price of 145 pence, representing a discount of 1.9% to the closing price on 8 July 2020 and a 33% premium to NAV.

Aberdeen Standard European Logistics Income issued 5 million new shares at a price of 104 pence, raising £5.2m. Following a similar issue in June, the company has raised £10.45m for potential acquisitions.

Grit Real Estate completed its delisting from the Johannesburg Stock Exchange, making London its primary listing and Mauritius its secondary.

Helical secured a £140m facility from Allianz to finance the development of the 10-storey office building 33 Charterhouse Street in Farringdon, London. The facility has a four-year term, with the option to extend to a fifth year. It is anticipated that the first drawdown will be in Q3 2020, from which point all future development costs will be fully funded by the facility, and construction is expected to complete in 2022.

Supermarket Income REIT secured a new £60m revolving credit facility (RCF) with Wells Fargo for an initial five-year term. The RCF, which has a margin of 2% above 3-month Libor, also includes a £100m accordion option.

Residential Secure Income entered into a £300m, 45-year secured debt facility with the Universities Superannuation Scheme. The RPI-linked debt has an annual coupon of 0.461% and will be interest only for the first three years.

Schroder REIT’s fund manager Duncan Owen will step down as global head of real estate at Schroders at the end of the year. From next year he will become a special advisor to the company.

Major news stories

Major news stories

• Where are the property bargains?

With so many REIT’s having de-rated heavily, sifting out the companies that were swept along in the coronavirus slump and left with unmerited discounts is fraught with danger. QuotedData looks at the companies that are still languishing on heavy and possibly unjustified discounts.

• LondonMetric intends to increase dividend after strong rent collection

LondonMetric said it intends to increase its first quarterly dividend for the financial year ending 31 March 2021 after announcing it had collected 95% of its June quarter rents, with a further 3% expected to be received imminently.

• Supermarket Income REIT adds Tesco site to portfolio …

Supermarket Income REIT acquired a Tesco Extra store in Newmarket, Suffolk, for £61m, representing a net initial yield of 4.6%. Tesco’s lease at the 68,000 sq ft supermarket runs for another 16 years with annual, upward-only, RPI-linked rent reviews.

• … after buying Waitrose portfolio in a £74.1m deal

Supermarket Income REIT acquired a portfolio of Waitrose supermarkets in a sale and leaseback deal with the grocer for £74.1m. The portfolio comprises six freehold supermarkets let to Waitrose on new 20-year leases with a tenant-only break option in year 15 and are subject to five-yearly, upward-only, CPIH-linked rent reviews.

• LXI REIT forward funds Lidl foodstore and sells social housing assets

LXI REIT exchanged contracts on the forward funding acquisition of a Lidl foodstore in Barnard Castle, County Durham, for £7.5m. It also sold two portfolios of long-let social housing assets for £10.7m.

• CLS Holdings sells Albert-Einstein-Ring office in Hamburg for €36.45m

CLS Holdings exchanged contracts to sell the Albert-EWinstein_ring office complex in Hamburg for €36.45m, with completion expected on 30 September 2020. The sale of the 144,441 sq ft scheme is at a 38% premium to the 31 December 2019 book value and reflects a 3.6% net initial yield.

• RDI REIT fully lets industrial development scheme

RDI REIT let its recently completed 168,154 sq ft industrial and distribution development at Link 9, in Bicester, to electric van maker Arrival Automotive. Arrival now occupies 288,000 sq ft across two units at the scheme paying a total annual rent of just over £2.3m. The development and subsequent lettings have achieved a 7.5% yield on cost.

• Stenprop sells Berlin retail park for €27m

Stenprop exchanged contracts to sell the Neucölln Carrée retail park in Berlin for €27m. The disposal to Union Investment reflects a €3.6m premium to the 31 March 2020 book value and is the latest step in Stenprop’s transition into a fullyfocused UK multi-let industrial property company. Following the deal, multi-let industrial will make up 60% of the portfolio.

• Alternative Income REIT expects 84% rent collection rate for Q3

Alternative Income REIT said it expects to collect at least 84% of rent for the current quarter by September. This would be an improvement on the rent collection for the previous quarter, which stood at 82%.

• Regional REIT completes series of lease renewals

Regional REIT completed eight lease renewals across office, retail and warehouse assets amounting to more than £500,000 in annual rents and at a combined uplift of 20.2% to estimated rental values (ERV).

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Diversified

Custodian REIT

Richard Shepherd-Cross, investment manager:

While greater clarity is emerging on the medium-term picture for rent collection, there has been limited transactional evidence in the market, creating a difficult environment in which to provide valuations. The RICS continues to recommend the imposition of a ‘material uncertainty’ caveat against the valuation of all but industrial and logistics properties to reflect the limited evidence available. With limited transactional evidence, the valuation profession is trying to reflect market sentiment in valuations by applying a risk factor to the collection of deferred rent or rents due from tenants which may be disproportionately affected by the COVID-19 pandemic. The consequential decline in NAV is perhaps inevitable but not, we believe, an irrecoverable structural shift. As improvements in the prevention of COVID-19 (and care for those who catch it) continue we expect that demand from occupiers for commercial real estate will improve from occupiers and the risk factor applied to rents within valuations will dissipate.

As we see increasing confidence in the collection of contractual rent and landlords recover their ability to formally pursue nonpayers is re-instated by Government, positive sentiment towards commercial real estate investment is likely to return. The low return environment, where dividends are under pressure across all investment markets, should put the relatively high dividends from real estate, even if at subdued levels compared to previous years, in focus for income-driven investors.

St Modwen Properties

Rob Hudson, interim chief executive:

The long-term structural growth drivers supporting the industrial/logistics and residential markets remain positive and arguably have strengthened even further. Government policy remains supportive for housebuilding in particular, as shown by the recently announced increase in stamp duty threshold, proposals to simplify planning and plans to stimulate investment in the regions, where most of our activity sits. Still, near-term economic risks remain elevated, as the pandemic adds to the preexisting uncertainties around Brexit, with the UK having formally left the EU in January and the current transition period set to end in December.

Palace Capital

Neil Sinclair, chief executive:

We believe that companies will now examine whether they need to lease expensive offices, or as much office space, in and around London. One of the advantages of the regions is that rents are relatively modest compared to London, while the cost of living is lower, and the quality of life considered high. Prior to covid-19, several companies had already relocated out of London including Talk Talk (Salford), Burberry (Leeds), Channel 4 (Leeds) and Hiscox (York).

In the current climate our view is that companies and the public sector will be very cost conscious, therefore we are reasonably confident that a sizeable proportion of our office vacancy will be let during this financial year.

Student accommodation

Student accommodation

Unite Group

Richard Smith, chief executive:

We have growing visibility and confidence over our income for the 2020/21 academic year, reflective of the strength of our university relationships and demand from UK students. There remains a higher risk than usual of cancellations to reservations by international students for 2020/21 and we continue to closely monitor the risks surrounding a potential second wave of covid-19.

Moving forward, we expect strong student demand in 2021/22 bolstered by an enhanced campus experience, a significant recovery in international student numbers as well as an increase in the 18-year-old population. Participation rates also continue to grow, reflecting the value young adults place on a higher level of education and the financial stability it offers. We anticipate a continued flight to quality by students, with government policy expected to focus on the quality and value of courses. Through our increasing strategic alignment to high and mid-ranked universities, which account for 88% of our income, the company is well positioned for anticipated growth in student numbers over the next decade.

A return to growth in student numbers from 2021/22 is supportive of a positive rental growth outlook for our portfolio. This reflects the value-for-money offered by our high quality, affordable accommodation and a growing opportunity to capture market share from the 855,000 student beds in houses of multiple occupancy (HMOs).

Healthcare

Healthcare

Primary Health Properties

Steven Owen, chairman:

Healthcare provision in the UK has been transformed in the first six months of 2020, as the NHS has responded to the requirements of dealing with the covid-19 pandemic. The resultant backlog of non covid-19 treatments that have been suspended will need to be addressed, with many services expected to move away from hospitals and into primary care facilities. This trend will undoubtedly require substantial investment into other areas, most notably primary care that will be able to take on the non-urgent and periphery procedures. We will continue to actively engage with government bodies, the NHS, HSE in Ireland and other key stakeholders to establish and enact where we can support and help alleviate increased pressures and burdens currently being placed on healthcare networks.

In addition to the covid-19 pandemic, the final outcome and consequences of Brexit for the UK are unlikely to have a direct impact on the primary health centres we invest in, which perform a vital role in the provision of healthcare across the UK and Ireland. Demand for our properties is driven by demographics and in particular populations that are growing, ageing and suffering from more instances of chronic illness.

Despite the continued volatility in the economic and political environment and the prolonged era of low interest rates, there continues to be an unrelenting search for secure and reliable income. Primary healthcare, with its strong fundamental characteristics and government-backed income, has been a significant beneficiary. The UK market for primary healthcare property investment continues to be highly competitive with strong yields and prices being paid by investors for assets in the sector with yields maintained during the first half of 2020.

Development

Development

U and I Group

Matthew Weiner, chief executive:

What is clear is that the timing of gains is difficult to predict in current, extraordinary, market conditions. However, what is equally clear is that the latent value of U+I’s portfolio is significant and the type of regeneration we deliver will be crucial to the UK’s economic recovery following covid-19.

We have one of the most successful track records in our industry of delivering wider economic and social benefit from Public Private Partnership. Our success in delivering for our public sector partners as we emerged from the financial crisis 12 years ago, set the basis for our experience and capacity to deliver impactful regeneration. As we move into a major recovery phase in our economy post covid-19 and prepare for the opportunities that Brexit will offer, we are better placed than many in our industry to hold out our hand to national and local government and offer them a business model that unlocks the value in their derelict and overlooked land through successful partnership.

Publications

Publications

Grit Real Estate Income Group – Africa, substantially de-risked

Aberdeen Standard European Logistics Income – Resilient to covid-19

Civitas Social Housing – Proved its mettle

Standard Life Investments Property Income Trust – Adding value in cautious times

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.