Seneca Global Income & Growth Trust – Knit one, purl one

Seneca Global Income & Growth Trust’s (SIGT’s) UK-biased value style and mid-cap exposure suffered heavily as markets collapsed during the first quarter of 2020. However, the manager used the rout to take advantage of deep value opportunities, while adding risk to the portfolio, and SIGT has benefitted during both recovery phases. While small-mid caps have recovered relative to larger stocks, though, and sterling has shown some appreciation, value remains deeply unloved by most investors. SIGT’s manager, Seneca IM, says that it is difficult to identify a specific catalyst that will drive a rotation back into value, but the move could be very quick when it occurs. It is therefore sticking to its knitting, focusing on deeper value opportunities that it believes will yield results over the longer term.

Multi-asset, low volatility, with yield focus

Over a typical investment cycle, SIGT seeks to achieve a total return of at least inflation as measured by the Consumer Price Index (CPI) plus 6% per annum, after costs, with low volatility and with the aim of growing aggregate annual dividends at least in line with inflation. To achieve this, SIGT invests in a multi-asset portfolio that includes both direct investments (mainly UK equities) and commitments to open- and closed-end funds (overseas equities, fixed income and specialist assets).

Sticking to its knitting, while waiting for a recovery in value

As QuotedData discussed in its April 2020 and August 2020 notes, as markets collapsed in the face of the pandemic, SIGT’s portfolio was hit from a number of directions and did not offer the level of downside protection that the manager would have hoped for. SIGT’s NAV saw a marked recovery during the second quarter of 2020 (the trust’s NAV gained 8.1% in April, 5.1% in May and 2.5% in June in total return terms), and while the third quarter was more mixed (a fall of 1.3% in July, followed by a gain of 6.7% in August, followed by a fall of 2.5% in September), a gain of 2.7% was made overall.

In our April 2020 note, we highlighted how SIGT suffered a triple whammy from its UK-biased value style, its mid cap exposure and the correlation of alternative asset fund prices to equity markets. However, Seneca Investment Managers (Seneca IM or SIGT’s manager) decided to add risk to the portfolio at the bottom of the market (equities were increased, particularly in the UK, gold was decreased and fixed income was decreased) meaning that it had a higher beta to both phases of recovery so far.

More recently, small and medium-cap stocks have been outperforming large caps and sterling has seen a modest recovery, but the big negative during the market collapse was SIGT’s exposure to value, which is yet to see any kind of recovery. The value style of investing had already been out of favour for some time prior to the onset of the pandemic, as investors sought growth in a low-growth, low-interest-rate world. The negative impact of COVID-19 on economies globally has extended the low-growth, low-interest-rate narrative for longer and pushed value even further out of favour.

SIGT’s manager believes that investors’ desire for growth stocks is now significantly overdone and that, over the longer term, the current situation is not sustainable. The COVID-19 infection rate appears to be on the rise again and winter is now approaching, so considerable uncertainty remains in the near term, but SIGT’s manager says that whilst the road will be bumpy, value has always recovered eventually, and the recent poor performance of value presents a compelling argument for strong future returns.

Seneca IM says that too many people are chasing too few growth companies, and while it is difficult to identify a specific catalyst that will drive a rotation back into value, the emergence of a viable vaccine is one strong possibility identified by SIGT’s manager (a lot of COVID-impacted companies fall into the value category and the emergence of a vaccine could cause these to re-rate). It also believes, though, that the cause could be something left-field that the market doesn’t see coming. However, irrespective of the trigger, Seneca IM believes that, at some point, investors will start to question the valuations of growth stocks. It thinks that this could lead to a renaissance in value and that their recovery could be very quick. In this environment, SIGT’s manager is sticking to its knitting, focusing on deeper value opportunities that it believes will yield the best results over the longer term.

Asset allocation

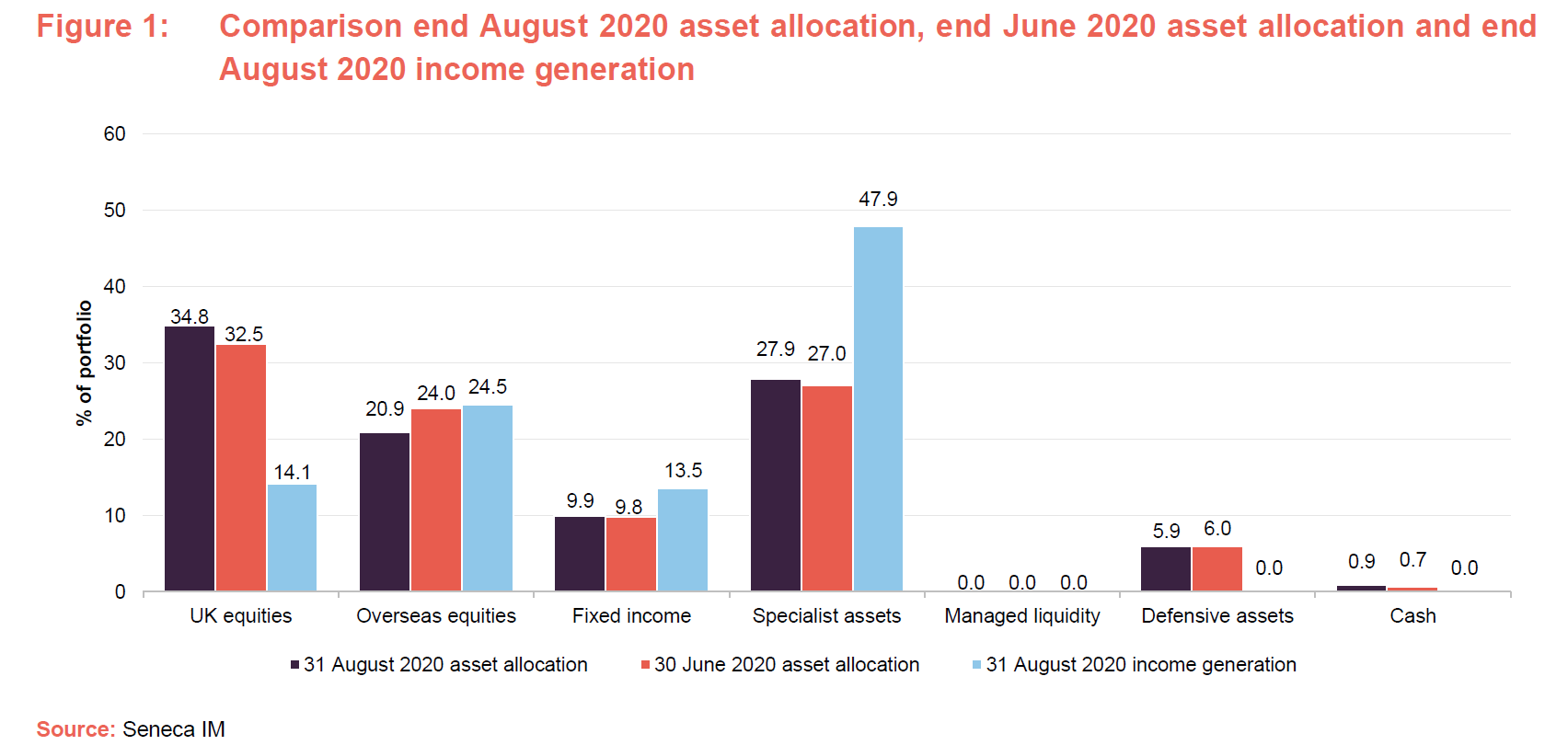

Figure 1 compares SIGT’s asset allocation as at the end of August 2020 and its asset allocation as at the end of June 2020 (the most recently available data when we last wrote on SIGT). The proportion of income generation, as at the end of August 2020, for each asset class is also included. Comparing the end of August asset allocation with the end of June asset allocation (see Figure 1), it is clear that the portfolio has seen a further increase in the allocation to UK equities (of 2.3 percentage points – as discussed in our August 2020 note, the manager increased the allocation to both UK and overseas equities reflecting the fact that it saw considerable value in both following the market collapse), although the allocation to overseas equities has more than offset this (a reduction of 3.1 percentage points) so that overall equities (UK and overseas combined) have seen a reduction of 0.8 percentage points.

The allocation to fixed income is practically unchanged although, as discussed below, the number of holdings has increased from three to four. The reduction in equities is otherwise compensated for by an increase in specialist assets of 0.9 percentage points. Managed liquidity remains at a nil allocation, while the allocations to defensive assets (those that are less sensitive to economic activity, for example gold) and cash have been very small (increases of 0.1 and 0.2 percentage points respectively).

SIGT’s manager says that recently, portfolio activity has been relatively limited. Most action was taken between February and May when volatility was at its peak, and the team is happy with the composition of the portfolio.

Specialist assets are currently providing the lion’s share of income

Although not illustrated here, another big change over the course of 2020 is the split of income generation by asset class. Specifically, reflecting the extensive dividend cuts seen across the UK market, the proportion of income provided by UK equities has fallen dramatically. However, there have been improvements within specialist assets, particularly the infrastructure space, that have gone some way to offsetting the income drop in UK equities and, consequently, the proportion generated by specialist assets has increased significantly.

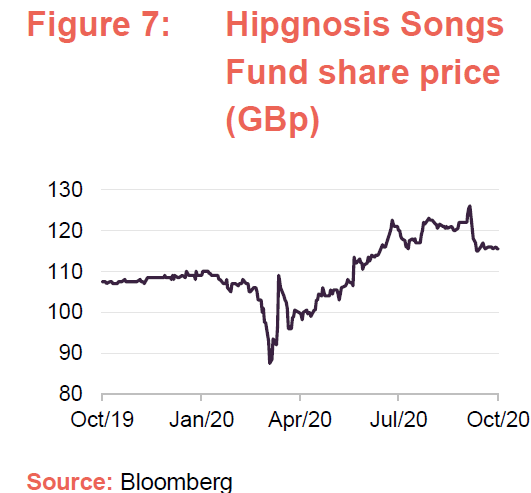

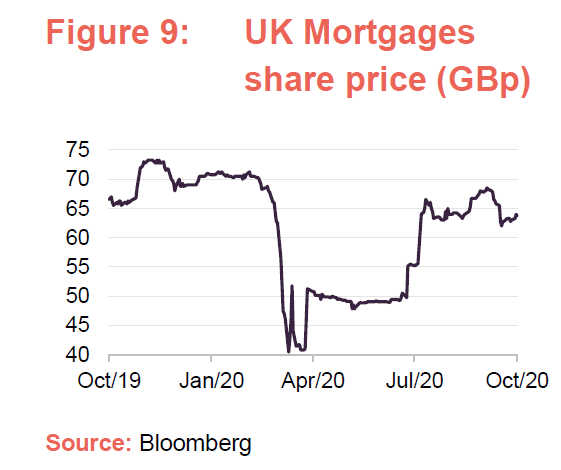

Seneca IM highlights the likes of UK Mortgages, which cut its quarterly dividend to 1.5p, but has since moved it up to 4.5p; Fair Oaks Income, which has reinstated its dividend; Hipgnosis Songs Fund, which has increased its quarterly dividend from 5.0p to 5.25p per share; and Ediston Property Company, which cut its monthly dividend by 30% (from 0.4792p to 0.3333p), but whose rent collection has been good, meaning that its new lower dividend is well covered by revenue (circa 130%). The dividend is likely to increase again.

Largest investments

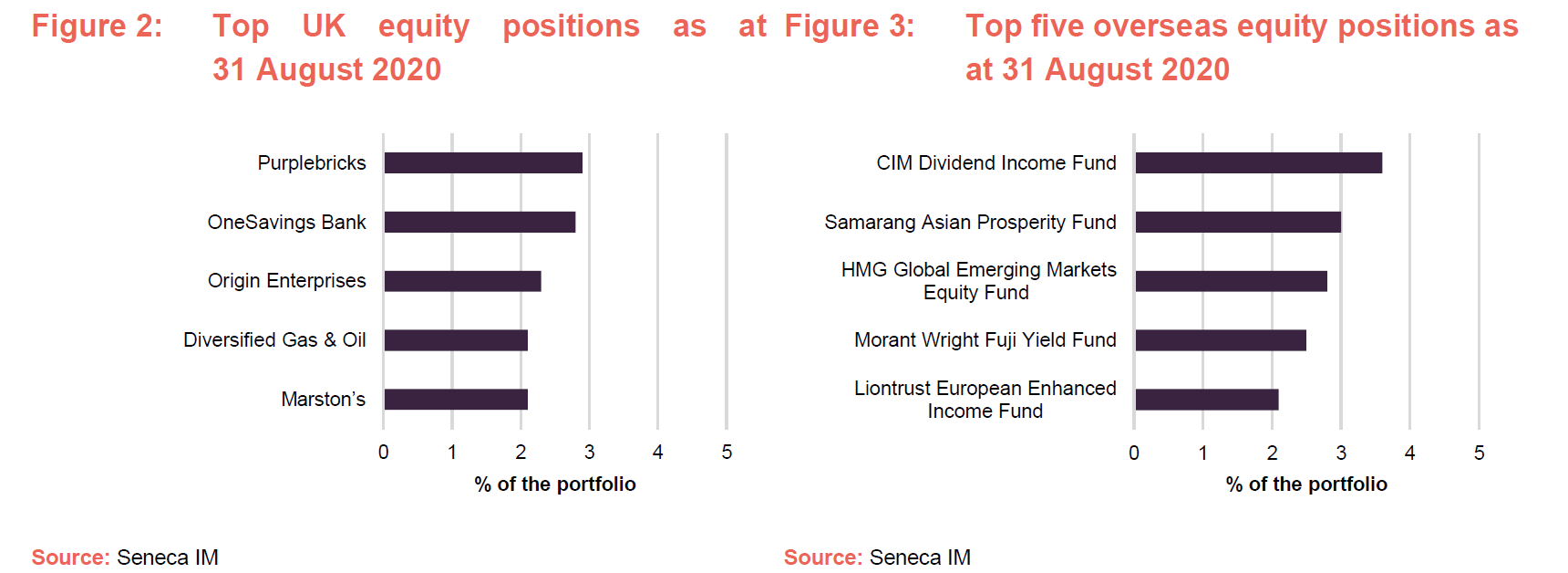

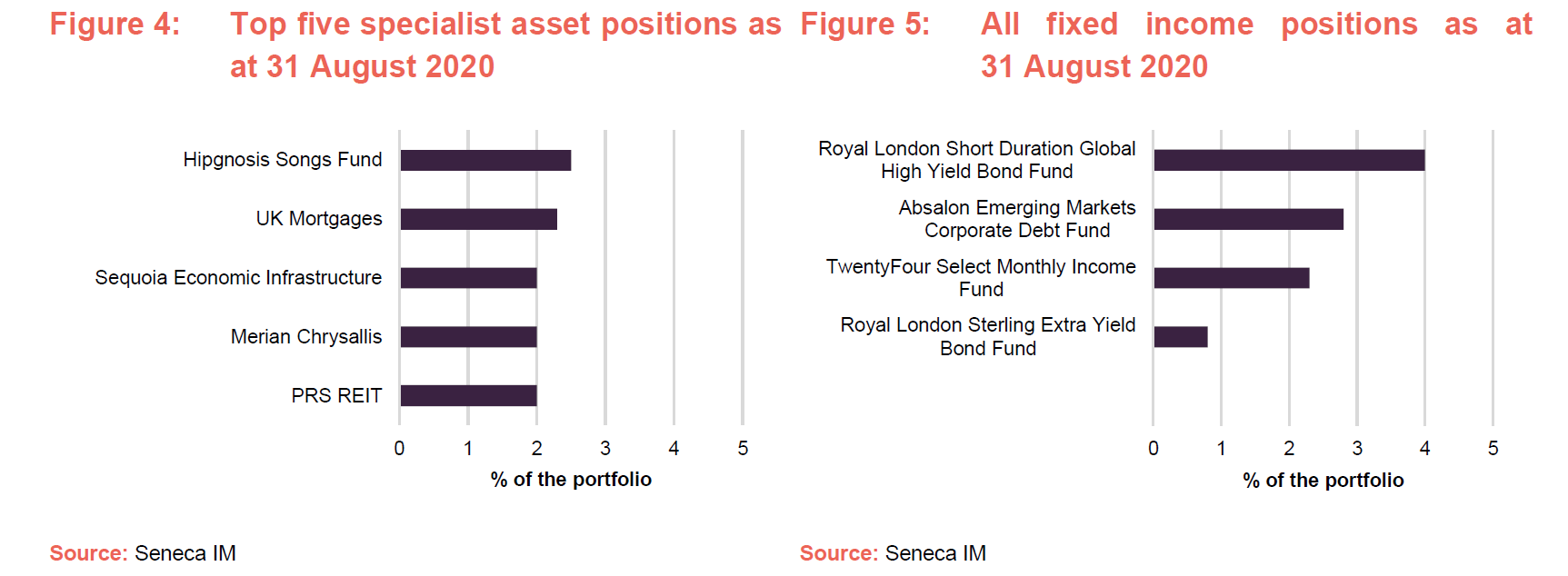

Figures 2 to 5 show the largest positions in each part of the portfolio as at 31 August 2020. Details of the rationale underlying some of these and other positions can be found in QuotedData’s previous notes (see page 16 of this note). For example, readers who would like more detail on Polypipe, Primary Health Properties, UK Mortgages, London Metric Property, Ediston Property and LXI REIT should see our April 2020 update note. Some of the more interesting developments are also discussed in detail below.

Within UK equities, PurpleBricks – which was discussed in detail in our November 2019 note (see page 11 of that note) – has not only moved up into the top five, but is occupying the top spot, largely on the back of strong performance. New holdings Origin Enterprises and Diversified Oil & Gas have also performed well (see the performance section of this note for more details) and have moved up into the top five. The three holdings that have been displaced are Clinigen, Legal and General and BT Group.

Within overseas equities, Liontrust European Enhanced Income (a long-term holding) has moved back up into the top five, displacing Prusik Asian Equity Income.

Within specialist assets, UK Mortgages, which was discussed in detail in our April 2020 note, has moved up into the top five, displacing Fair Oaks Income.

Within fixed income, the Royal London Sterling Extra Yield Bond Fund has re-joined the portfolio pushing the number of fixed income holdings back up to four.

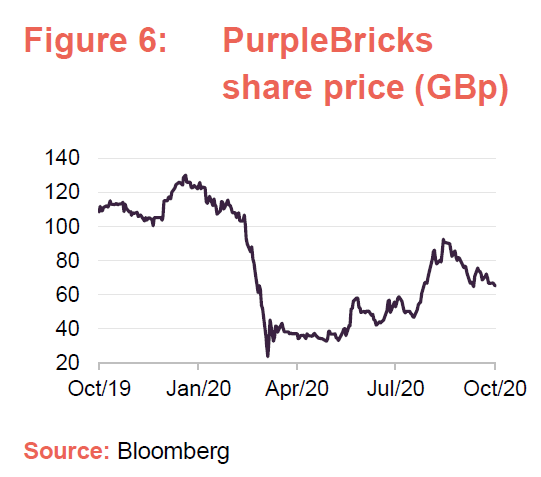

PurpleBricks (2.9%) – expansion problems are behind it

Seneca IM topped up SIGT’s position in PurpleBricks (www.purplebricks.co.uk) earlier in the year, following the market collapse, at around the 34p level. While some of the gains made between April and August were given up in September, the shares were trading at 65.0p as at 14 October 2020, which is well above the price that Seneca IM topped up at.

SIGT’s manager says that PurpleBricks’s overseas expansion problems are behind it, having exited its problematic Australian and US businesses. The company has also sold its successful Canadian business, which has given it a very strong balance sheet (£66m of cash and no debt) and allowing it to focus on its core UK market. The government’s stamp duty relief has led to a surge in listings and Seneca IM believes that, in the current environment, PurpleBricks’s online proposition gives it a significant advantage versus traditional high-street estate agents.

In this regard, it is noteworthy that Soros Fund Management has been buying the stock, having reportedly picked up the 10.8% stake that was previously held by funds managed by Woodford Investment Management. SIGT’s manager considers that, despite the recent strong gains, the company is still very misunderstood and, as the market comes to better understand its proposition, there is a lot more share price appreciation to come.

Hipgnosis Songs Fund (2.5%) – now an employer???

Hipgnosis Songs Fund (www.hipgnosissongs.com) was discussed in detail in QuotedData’s November 2019 note (see page 10 of that note). At that time, we said that whilst there had been some concerns raised in the market around the visibility of SONG’s earnings, Seneca IM’s internal analysis has allowed it to get comfortable with SONG, its ability to generate cash and the prices being paid to acquire catalogues. SIGT participated in the 2018 IPO and then in the fundraise that closed on August 2019 as well as the subsequent C-share offering.

Hipgnosis has been very busy acquiring music catalogues, investing the proceeds of its most recent C-share issue, which allowed these to merge with the ordinary shares on 30 September. However, its purchase of Big Deal Music, announced on 10 September (click here to read story on the QuotedData website) marked a departure from its previous strategy as Big Deal Music employs 35 staff who reportedly have a proven track record of identifying and developing new songwriters and artists as well as promoting and marketing songs. This has raised concerns in some quarters that this moves the fund more in the direction of becoming a traditional record company.

The announcement highlighted a number of benefits to having inhouse administration in the US (greater control of, and reduced, third party administration costs; faster collection of royalty income; creation of a direct relationship with digital service providers (such as Spotify, Apple Music, Tencent, etc) to allow Hipgnosis to leverage its portfolio to obtain better rates; receiving credit for the portfolio’s market share in royalty settlements (e.g. Peloton/Facebook) and black box income (unclaimed royalties for which a publisher or write is named but cannot be traced by a collection society). However, this shift in approach is not without its risks.

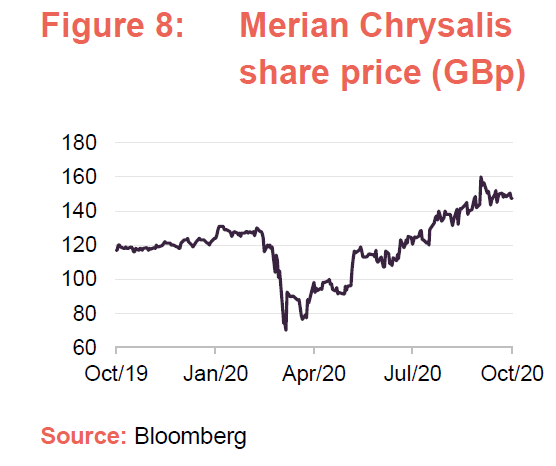

Merian Chrysalis (2.0%) – benefitted from THG Holdings IPO

Merian Chrysalis (www.merian.com/chrysalis) is an investment company that invests in late-stage private companies and maintains a concentrated portfolio of these. SIGT invested when the company had its initial public offering (IPO) in November 2018, and we discussed the holding in detail in our April 2019 note. At that time, Seneca IM said that it is very familiar with the management team (the fund is managed by Richard Watts and Nick Williamson, who are ex-Old Mutual), whom it has followed for some time and who have an enviable track record.

The fund benefitted heavily from the IPO of one of its largest holdings, The Hut Group (www.thehut.com) on 16 September 2020. The Hut Group is a British e-commerce company that operates over 100 international websites that sell fast-moving consumer goods direct to the consumer. It has performed well during the pandemic.

Merian Chrysalis invested in The Hut Group shortly after its own IPO in 2018 and topped up its holding in 2019. Prior to the announcement of The Hut Group’s intention to list, Merian Chrysalis’s holding represented around 9% of the fund but the announcement of what is the largest IPO in the UK in 2020 so far pushed the holding to around 12%. However, having listed at 500p per share THG Holdings has moved markedly higher and was trading at 595.00p per share as at 14 October 2020. Seneca IM says that incubating the HUT Group IPO is exactly the type of investment that Merian Chrysalis was designed to do. It also notes that Merian Chrysalis is focused on companies using technology to disrupt established businesses, and value managers do not usually get access to these. It is therefore a nice uncorrelated asset to have in SIGT’s portfolio.

UK Mortgages (2.3%) – M&G bid has illustrated latent value

We last discussed UK Mortgages (UKML) (twentyfouram.com/funds/uk-mortgages-fund) in our April 2020 note, but since that time it has fought off a takeover approach from M&G Investment Management. Whilst the offer is off the table for now, it has nonetheless illustrated the latent value present in UKML’s portfolio.

When we were writing in April, we noted that UKML had cut its dividend significantly (from 1.25p to 0.375p per quarter) and that, previously, UKML had been slow in deploying its capital (arguably reflecting strong underwriting standards) which, when coupled with low interest rates, had dragged on its returns and ultimately contributed to an elevated discount.

However, we also noted that moves were afoot to address this. UKML had put two forward flow agreements in place, which had led to a marked uplift in capital deployment and the manager has also secured agreement from the board to increase the fund’s leverage (borrowing), which would amplify the returns. The leverage increase would be incremental as each securitisation was refinanced it would be completed at a higher multiple increasing the leverage and releasing capital to be allocated elsewhere. The latest securitisation was Oat Hill number one which was originally due to be refinanced in May.

Then the pandemic broke. This not only extended the period of lower interest rates for longer, but also raised questions over all borrowers’ abilities to service their debt. Furthermore, the performance improvement plan included gearing up the portfolio, which was contingent on the Oat Hill refinancing. However, this could not be done efficiently with credit markets locked. Fortunately, the securitisation did not have a hard closing date and could continue with the existing lender. It just means that UKML would not be able to generate the cost savings as soon as it had hoped to and the costs would go up marginally, although the interest rate was not punitive.

The refinancing was expected to generate savings of £30-£50m of capital, which could be used for buy-backs or further lending, which would obviously be delayed. This combined with an aggressive dividend cut saw the discount move out from low double digits pre-crisis to circa 40%, making UKML vulnerable. SIGT’s manager felt that UKML was being punished heavily for short-term issues that should not be meaningful in the long-term and decided to add to SIGT’s position. However, M&G then made an offer for UKML at 67p per share (on behalf of the M&G Specialty Finance Fund) on 20 July 2020, which was subsequently increased to 70p on 13 August 2020.

SIGT’s manager felt that UKML’s board’s strategic plan was starting to come together, but that M&G, seeing an opportunity to grab a bargain, had come in with a low-ball offer that really undervalued the assets. SIGT’s manager does not believe that M&G were going to do anything more than UKML’s board were already proposing and that the revised offer still significantly undervalued the assets. It believes this is why M&G did not get the support they had hoped for. However, the process has left UKML trading much closer to NAV than before the dividend cut was announced. The board have reinstated the 4.5p dividend and are paying a 1.5p special dividend to compensate for the lower income earlier in the year. The Oat Hill refinancing was also completed in August which released £30m of capital. The majority of this capital has been used in recent weeks to buy back shares at significant discount.

SIGT’s manager considers that UKML is a very good vehicle that is currently misunderstood by the market. It sees the potential for strong share price appreciation as the improvement plan delivers and the market comes to better understand the revised proposition.

Performance

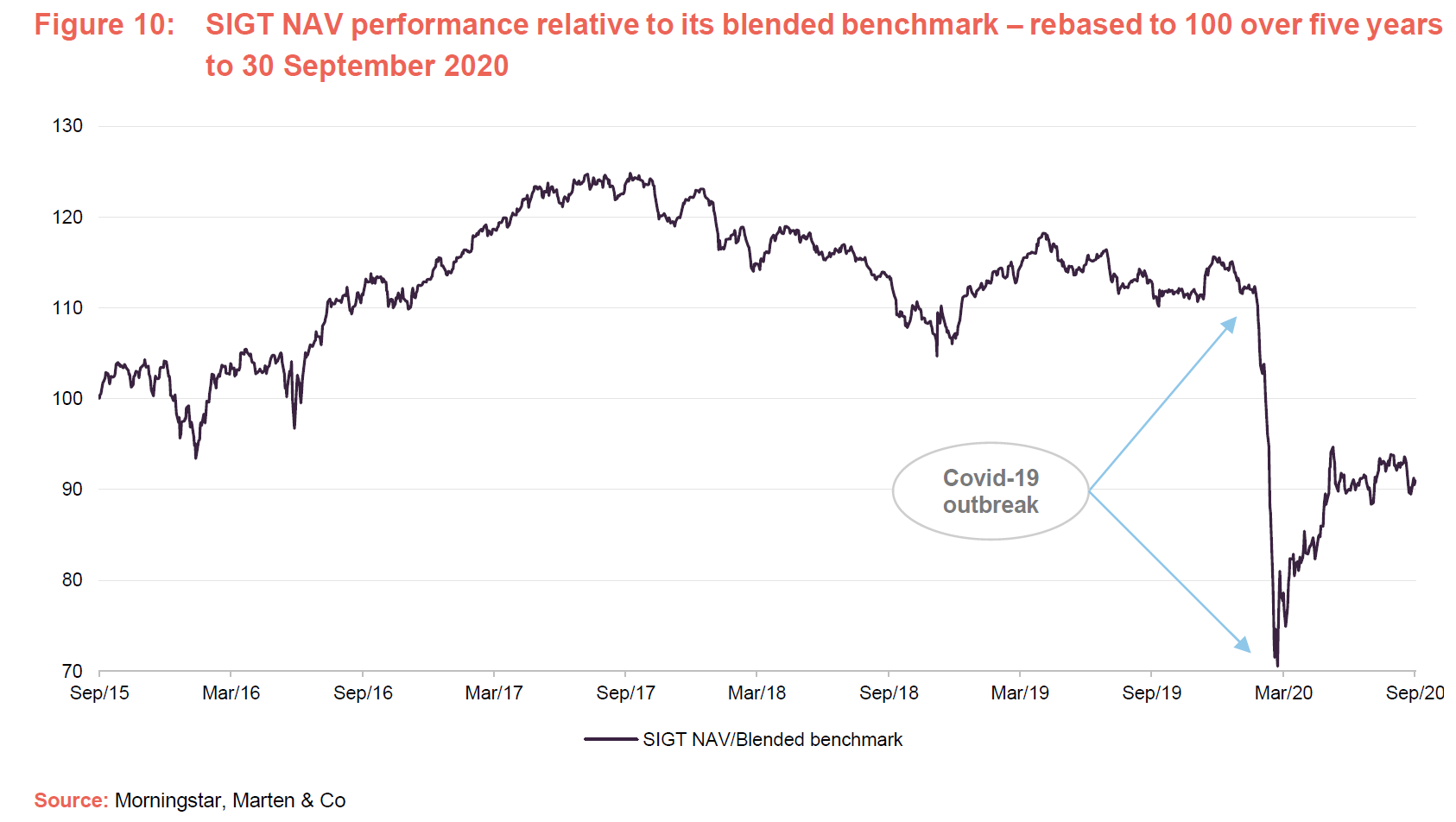

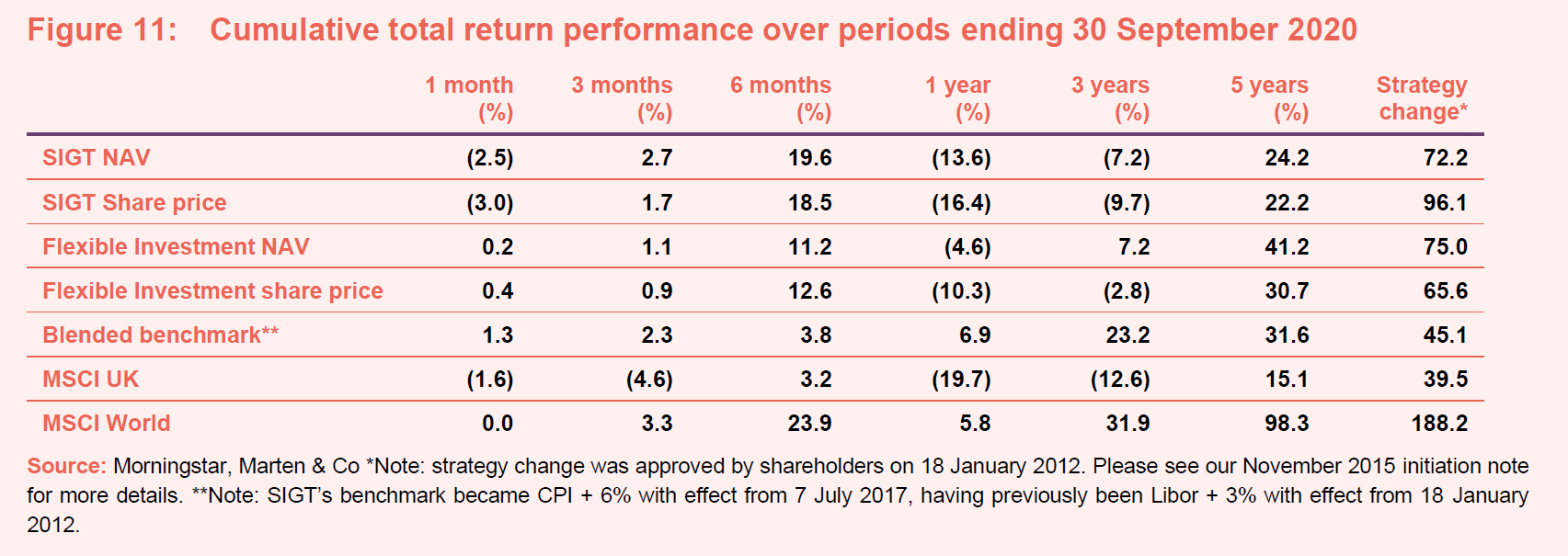

Figure 11 illustrates SIGT’s share price and NAV total return performances in comparison with those of its peer group, its blended benchmark, the MSCI UK and MSCI World indices. As we discussed in our April 2020 update note, and then in our August 2020 note, SIGT has had a very difficult start to 2020. The outbreak of COVID-19 has had a starkly negative effect on financial markets and SIGT’s NAV lost 30.4%, in total return terms, during the first quarter of 2020. Most of this occurred in March, where the NAV was down 23.6% during that month alone.

However, as is visible in both Figure 10 and the six-month period in Figure 11, SIGT’s NAV rebounded strongly during the second quarter of 2020 as central bank intervention supported asset prices and lifted equity markets (the trust’s NAV gained 8.1% in April, 5.1% in May and 2.5% in June in total return terms) providing a total return of 16.5% in these three months). Seneca IM says that, between March and July, SIGT’s NAV benefitted from the manager’s decision to add risk at the bottom of the market. Specifically, they increased equities (particularly in the UK), decreased gold and decreased fixed income, and the portfolio performed as they would have expected during the rebound to June.

Moving into the third quarter and NAV performance was more mixed (a fall of 1.3% in July as markets paused; followed by a gain of 6.7% in August as restrictions were relaxed, positive news came through on the vaccine as well as better than expected economic data drove the market upwards; and a fall of 2.5% in September as markets have stumbled as the infection rate has increased again), but overall, SIGT’s NAV increased by 2.7%. Moreover, SIGT’s portfolio had a higher than usual beta to both phases of recovery seen so far.

As QuotedData discussed in its April 2020 and August 2020 notes, SIGT was hit by a trio of headwinds during the market collapse, and these are yet to abate. Specifically, when compared to its peers, we believe that SIGT’s higher weighting to equities (one of the highest in the peer group), and particularly UK small and mid-cap value stocks, held it back. SIGT’s peers are overwhelmingly capital-growth-focused and they have been able to make higher allocations to more defensive assets – such as gold and cash – that are not suitable for SIGT’s portfolio because of its income requirement. An additional consideration is that SIGT’s portfolio has a large allocation to stocks hurt by the effects of people social distancing (for example National Express, Marston’s and The Doric Nimrod Funds). It also holds investments in funds, whose discounts tend to widen in times of market distress.

However, these left it well positioned to benefit as markets initially bounced and it remains geared into subsequent improvements as restrictions ease and economies ultimately normalise. Recent positive drivers have been sterling, closed-end fund discounts and SIGT’s small-mid-cap bias. However, there has still not been a recovery in value. SIGT’s manager believes that this will come and that, when it does, this will be a massive tailwind for the trust. It expects that performance will be very strong in absolute terms and versus SIGT’s more US focused peers.

Recent strong contributors and detractors for performance

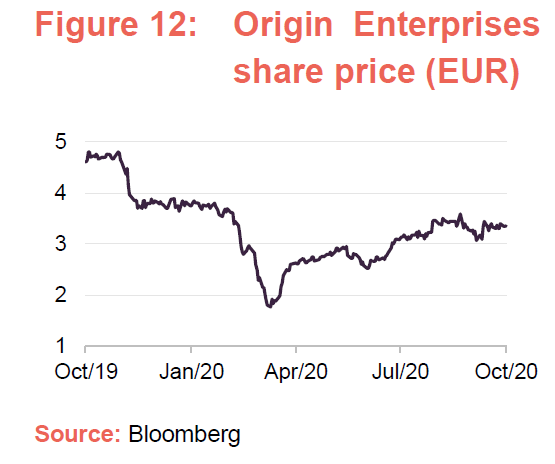

In terms of performance attribution, PurpleBricks (discussed on page 6) has made a strong positive contribution. Origin Enterprises (a new position that was initiated during the downturn at around €2 per share – see page 5 of our August 2020 note for a detailed discussion) has performed well and was trading at €3.40 as at

14 October 2020. Seneca IM says that the company is not well understood by the market and was heavily oversold (this followed three weather-related profits warnings after which SIGT bought into the stock). Origin has cut its dividend, but SIGT’s manager believes this makes sense at the moment. However, over the longer term, this is a business (advising farmers) that is difficult to disrupt with online/digital provision and is well positioned to recover and grow. Seneca IM sees it as a good long-term holding.

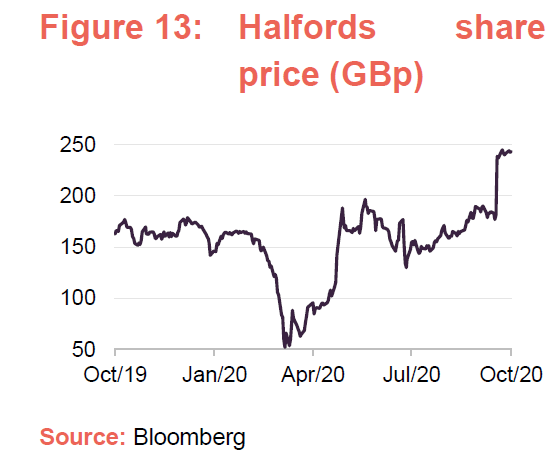

Halfords, a long-term SIGT holding, suffered heavily as markets reeled from the effects of COVID-19. Investors initially labelled it as another beleaguered retailer that would be under further pressure from online sellers due to the pandemic. However, Halfords was able to stay open as an essential retailer (servicing and providing spares for cars and the like) and benefitted from a huge spike in demand for bikes as people sought COVID-safe alternatives to public transport. Reflecting this, its share price is trading well above its pre-pandemic levels, as is illustrated in Figure 13.

Diversified Gas and Oil (a new position that QuotedData discussed in detail in its August 2020 note – see page 8 of that note) is another stock that has performed well. The company was oversold following the fall in the oil price but, with its low cost of production, the company it is well positioned to weather such an environment and has benefitted as more expensive shale production has been taken off line.

Merian Chrysalis (see pages 7 and 8) has benefitted recently from the IPO of one of its largest holdings, The Hut Group. AEW UK REIT is another specialist asset that has performed well, along with UK Mortgages. In the case of AEW, it was initially weighed down by its exposure to Travelodge. However, its portfolio is actually well diversified and rent collection is circa 95%, which has driven a recovery in its fortunes.

In terms of detractors, Senior (aircraft parts) and National Express are both exposed to transportation and have suffered from COVID-related travel restrictions. However, SIGT’s manager observes that as both were doing well before

COVID-19, it believes that both will survive and it considers that there is considerable upside for both over the longer term. Reflecting this, the manager has added to both positions since the market collapse. This has been done incrementally in small 5-15 basis point (0.05%-0.15%) chunks.

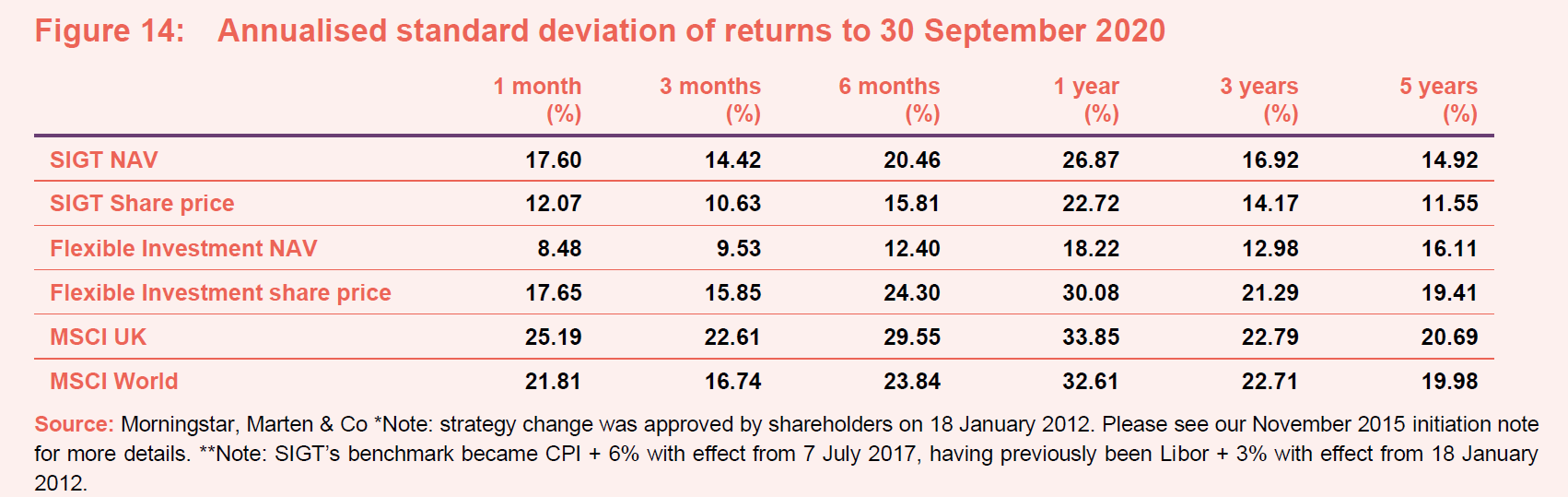

Volatility normalising

As illustrated in Figure 15 and noted in our April 2020 and August 2020 notes, increased volatility in the wake of the market collapse, as well as high correlation between asset classes as markets rolled over led to a marked uplift in the volatility of SIGT’s NAV, which is particularly visible in the six-month and one-year periods in Figure 14.

As noted in our August 2020 note, the discount control mechanism has helped dampen share price volatility, which is markedly less than that of SIGT’s NAV, in recent months. However, this trend is apparent in all of the time periods provided in Figure 14.

Overall, we continue to believe volatility should dampen down over time as markets regain their composure and comparing the six-month period with the more recent periods suggest that this is the case.

It should be noted that, historically, SIGT’s NAV volatility has tended to be below that of its flexible investment peer group and we expect that this will revert over time. However, the volatility of SIGT’s NAV remains below that of UK and global equities (as represented by the MSCI UK and MSCI World).

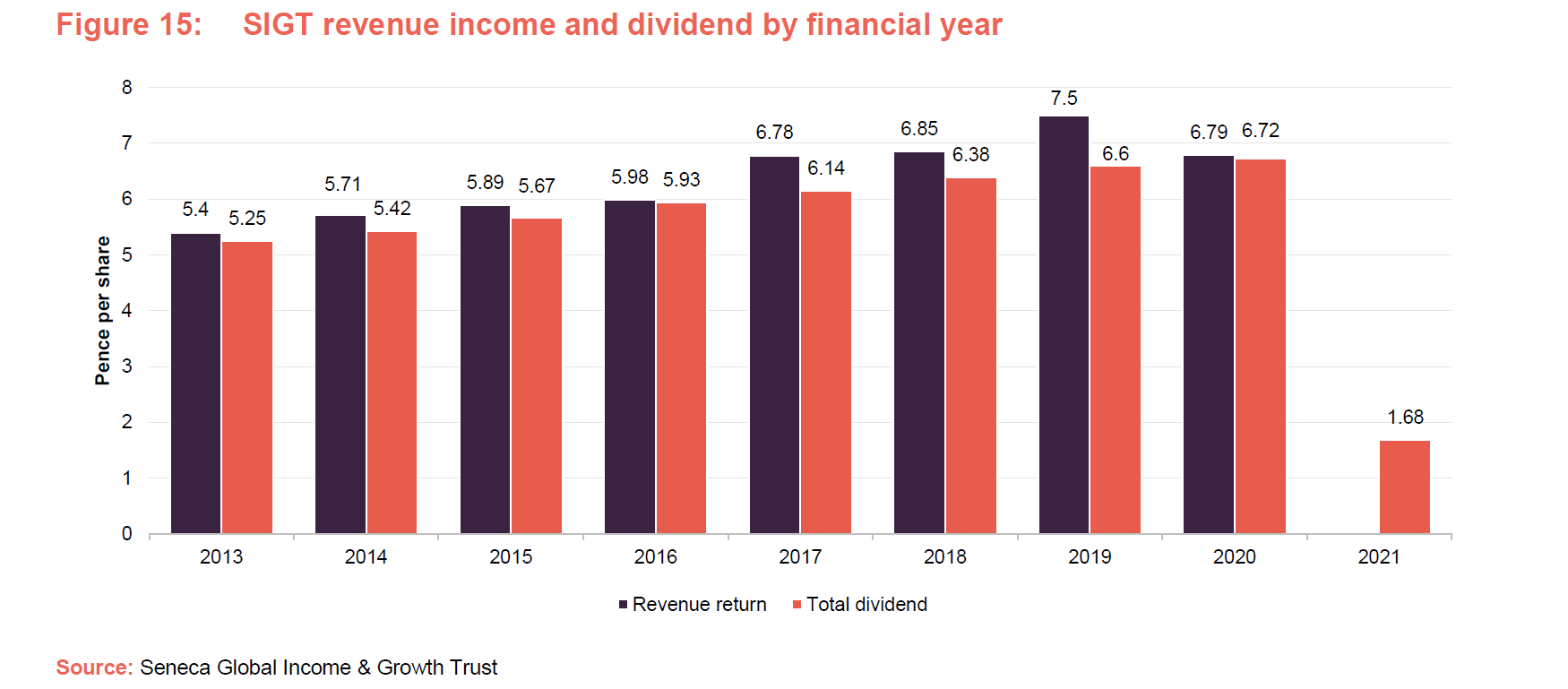

Quarterly dividend payments

SIGT’s is maintaining its quarterly dividend rate at 1.68p per share

As detailed in our August 2020 note, SIGT’s board has said that, barring unforeseen circumstances, it intends to maintain the quarterly dividend rate at 1.68p per share. This will be until such times as it can determine an appropriate level for the dividend.

On 19 August 2020, SIGT declared its first interim dividend in respect of the year ending 30 April 2021 at 1.68p per share, which is in line with the board’s previous commitment. This was paid to shareholders on 25 September 2020 to shareholders who were on the register on 4 September 2020, with an ex-dividend date of 3 September 2020. The 1.68p per quarter is equivalent to a total annual dividend of 6.72p per share, which is a yield of 4.6% on SIGT’s share price of 146.50p as at 14 October 2020.

The board recognises that there are many listed companies being forced – or deciding it is prudent – to cut, suspend or cancel their dividends. This includes companies that SIGT owns. At this point, it is difficult to see how long these cuts or policy changes will prevail, or what level of dividends these companies will be able to distribute in due course, but in the meantime, SIGT’s board considers that it should do what it can to help shareholders through the current difficult period. As noted on page 6, while revenue income from UK equities has declined significantly, SIGT’s specialist assets bucket has seen a good improvement. Overall, the manager expects SIGT’s dividend to remain uncovered for the time being, but that the shortfall should be relatively small.

As we have previously discussed, the board’s view is that that SIGT is ‘well-endowed with distributable reserves (both its revenue reserve and special reserve) and that the trust is comfortably able to sustain the current dividend rate of 1.68p per share. However, this almost certainly means drawing on its revenue reserves and paying an uncovered dividend, which is a departure from its practice in recent years (see Figure 15). It should be noted that SIGT has paid a covered dividend following its reorganisation in 2012 and has rebuilt its revenue reserves during the period since). As at 30 April 2020, SIGT’s revenue reserve stood at £2.005m or 4.20p per share. Prior to the strategy change in 2012, it stood at 0.3p per share.

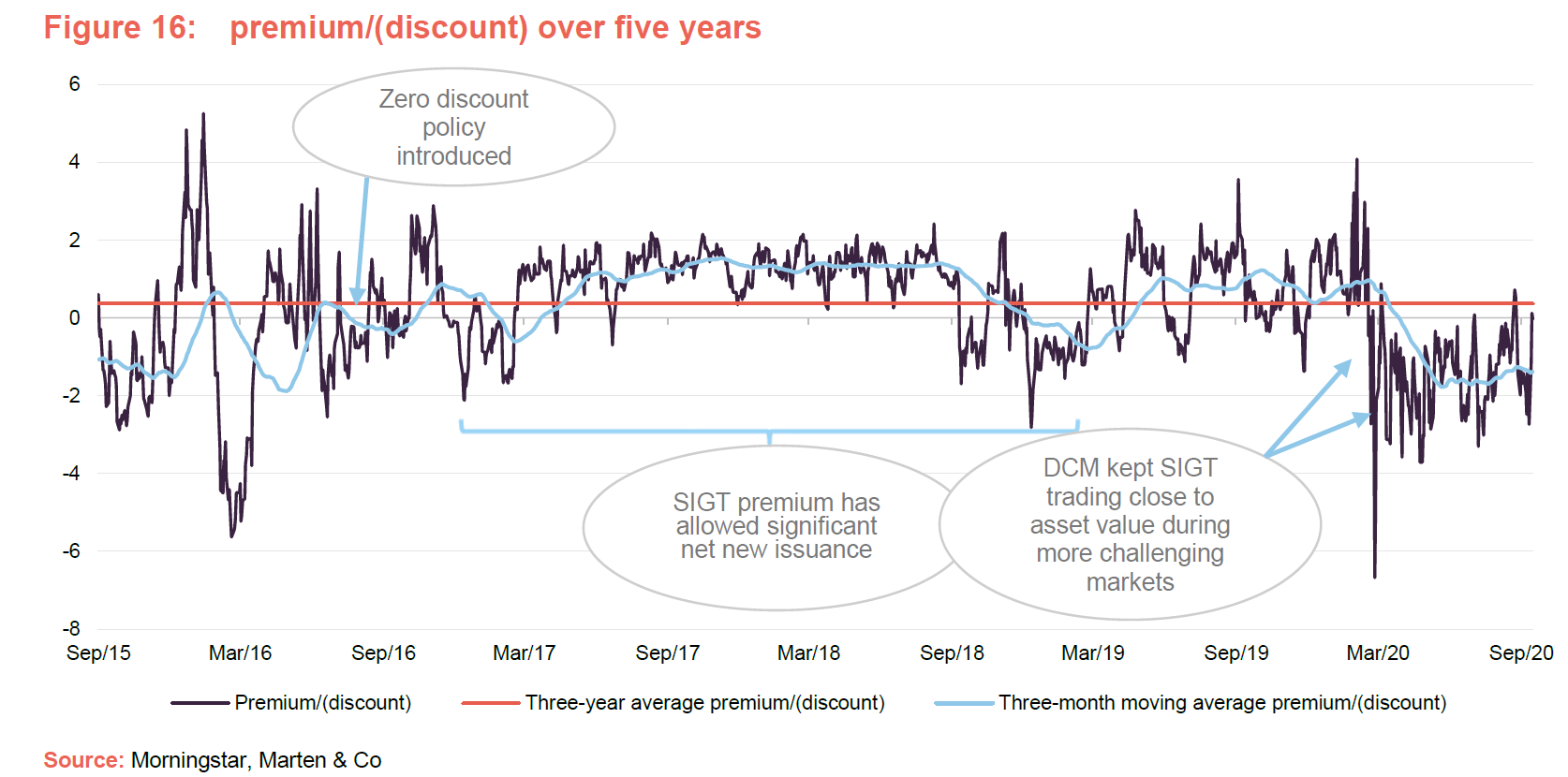

SIGT’s DCM has remained effective during more volatile markets

As illustrated in Figure 16, SIGT’s discount control mechanism (DCM), which went live on 1 August 2016, has continued to keep the trust trading close to asset value despite more challenging market conditions. It is noteworthy that SIGT has been active in the market for its own shares this year, repurchasing 8.65m shares, or 17.5% of its issued share capital year-to-date. The mechanism has, as designed, provided liquidity and some certainty to shareholders that they will be able to enter and exit the trust at close to asset value, although it should be noted that prior to the pandemic related market collapse in March, SIGT was frequently trading at a small premium. It has been trading at a small discount more recently (an average of 1.5% since 23 March 2020). The three-month moving average line in Figure 16 helps to illustrate this point.

We think that the board’s resolve to honour its commitment to the DCM, despite more challenging markets, has bolstered the trust’s credibility and should stand SIGT in good stead in the future. The DCM has now been in place for approaching four years and, as highlighted in our previous notes, the overwhelming trend has been one of share issuance since the DCM was introduced, prior to the pandemic.

If, as the managers assert, SIGT benefits from a strong uplift in its performance from a rotation back into value, small-mid caps. and in the UK this could once again trigger strong demand for SIGT’s strategy and, with the DCM in place, SIGT will be well positioned to grow again. We would welcome this as we believe that the previous asset growth that the DCM facilitated was positive for the trust as, all things being equal, it serves to lower SIGT’s ongoing charges ratio and should support liquidity in SIGT’s shares. With the significant repurchases made recently, these positive trends have been going in reverse this year.

Fund profile

Multi-asset portfolio with low-volatility returns and an income focus

SIGT’s aim is to grow both income and capital through investment in a multi-asset portfolio and to have low volatility of returns. Its portfolio includes allocations to UK equities, global equities, fixed income and specialist assets.

SIGT is designed for investors who are looking for income, want that income to grow, want the capital of the investment to grow, and are seeking consistency (or lower volatility) in returns. A pure bond fund could meet the first of those needs; a pure equity fund could meet the first three. SIGT invests across a number of different asset classes with the aim of achieving all four.

Over a typical investment cycle, SIGT seeks to achieve a total return of at least the Consumer Price Index (CPI) plus 6% per annum, after costs, with low volatility and with the aim of growing aggregate annual dividends at least in line with inflation. Seneca IM define a typical investment cycle as one which spans 5–10 years, and in which returns from various asset classes are generally in line with their very long-term averages.

Seneca Investment Managers – a multi-asset value investor

SIGT’s portfolio has been managed by Seneca Investment Managers (Seneca IM), and its forerunners, since 2005. Seneca IM describes itself as a multi-asset value investor. We think the combination of multi-asset investing with an explicit value-oriented approach may be unique to Seneca IM. The idea is that Seneca IM can allocate between different asset classes and investments, emphasising those that offer the most attractive opportunities and yields, making asset allocation, direct UK equity and fund selection (for access to other overseas equities and other asset classes) follow a value-based approach.

Seneca Investment Managers acquired by Momentum Global Investment Management

On 13 October 2020, it was announced that, subject to regulatory approval, Momentum Global Investment Management (MGIM) will acquire Seneca Investment Managers, SIGT’s manager. MGIM is the UK-based subsidiary of Momentum Metropolitan Holdings Limited, a large South African insurance and investment business, which is listed on the Johannesburg Stock Exchange.

Established in 1998, MGIM has around £4bn of assets under management (AUM) and provides specialist investment management services to institutional clients, financial intermediaries and their clients in the UK and Europe, Asia and the Middle East, South America and South Africa. Seneca IM has over £600m of AUM, giving the combined business an AUM in the region of £4.7bn.

SIGT’s board say that it is supportive of the transaction and has listed the following key takeaways:

- Both asset managers share a philosophy of outcome-based multi-asset value investing.

- Seneca IM’s current investment management team will retain its portfolio management responsibilities.

- The transaction will be structured to ensure that clients experience seamless continuity of service with the additional benefits of a stronger offering and broader capabilities.

- SIGT’s board anticipates there will be no change to SIGT following completion of the transaction, save for a change to the company’s name to reflect Seneca IM’s integration into MGIM and consequent re-branding.

- The Board understands there are no redundancies foreseen as a result of the transaction and that Seneca IM’s Liverpool office will supplement MGIM’s London office with the intention of growing the combined multi-asset business.

Previous publications

Readers interested in further information, may wish to read our annual overview note Pausing on equity reductions, published November 2019, as well as our previous notes. You can read these by clicking on the links below.

- On the rebound, published in August 2020, discussed SIGT’s post-covid recovery

- “Triple whammy but standing by the dividend”, published in April 2020, looked at the impact of covid of SIGT’s uk-biased small-md-cap value orientated portfolio.

- “Pausing on equity reductions”, published in November 2019, went through the most recent asset allocation decisions taken by the managers

- “Going for gold”, published in July 2019, looks at SIGT’s managers decision to reduce the trust’s equity weighting for new gold allocations

- “Holding steady as cycle turns”, published in April 2019, notes how SIGT’s portfolio is expected to outperform in an anticipated downturn

- “Mind the (inflation) gap!“, published in September 2018, talks about the warning signs of a recession nearing and how SIGT’s management looks to stay ahead of the turn

- “Cutting back on equities“, publsihed in June 2018, highlights the recent changes SIGT is making to reduce exposure and an overview of the trust

- “Walk the walk“, Published in January 2018, looks at the road map set by management to to reduce it’s weighting in equities as developing markets are reaching their peak

- “Steady reduction in equity exposure“, published in September 2017, states how SIGT’s management is sticking with their strategy of selling off equities, reflecting high levels of confidence

- “Changing tack“, published in June 2017, notes how SIGT is outperforming peers as well as growing its asset base with new discount control mechanism

- “Celebrating five years since strategy change“, published in March 2017, looks at SIGT five years after allowing its managers to have more flexibility with the portfolio

- “In demand and no discount“, published in September 2016, talks about the new discount policy to give investors more confidence which is already showing demand

- “On track for zero discount policy“, published in May 2016, notes how SIGT is on track to adopt a zero discount policy to increase comfort with investors

- “Low volatility and growing income“, published in November 2015, the first look at SIGT highlights their returns and increasing dividend

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Seneca Global Income & Growth Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.