Seneca Global Income & Growth – On the rebound

On the rebound

On the rebound

Seneca Global Income & Growth Trust’s (SIGT’s) UK-biased value style and mid-cap exposure suffered heavily during the first quarter of 2020 as markets collapsed – its NAV fell by some 30.4%. However, the manager used the rout to take advantage of deep value opportunities (increasing exposure to UK equities, for example) and SIGT has benefitted as markets have rebounded – up 16.5% during Q2. The manager believes there is much more to come.

We cannot be sure how the pandemic will unfold from here. SIGT’s manager thinks that a v-shaped recovery is unlikely but envisages that multi-year global progress in economies and markets is possible. It has assessed SIGT’s portfolio and concluded that most of the stocks can survive a long lockdown. It believes that in five years’ time, most current valuations will look cheap when we are in a normalised economic environment and is therefore taking a long-term view.

Multi-asset, low volatility, with yield focus

Multi-asset, low volatility, with yield focus

Over a typical investment cycle, SIGT seeks to achieve a total return of at least the Consumer Price Index (CPI) plus 6% per annum, after costs, with low volatility and with the aim of growing aggregate annual dividends at least in line with inflation. To achieve this, SIGT invests in a multi-asset portfolio that includes both direct investments (mainly UK equities) and commitments to open- and closed-end funds (overseas equities, fixed income and specialist assets).

Note: SIGT’s benchmark became CPI + 6% with effect from 7 July 2017, having previously been Libor + 3% with effect from 18 January 2012

Once in a generation valuation opportunities

Once in a generation valuation opportunities

As we discussed in our April 2020 note (see page 2 of that note), the equity reduction strategy that Seneca Investment Managers (Seneca IM) had been following in anticipation of a recession has been vindicated, but the manager could not have anticipated the outbreak of covid-19 that triggered the recession and that all asset classes would become highly correlated as markets rolled over. SIGT’s portfolio was hit from a number of directions and did not offer the level of downside protection that the manager would have hoped for. However, as discussed on page 11, SIGT’s NAV has seen a marked recovery during the second quarter (the trust’s NAV gained 8.1% in April, 5.1% in May and 2.5% in June in total return terms) and the manager says that there is significant latent value in the portfolio and so there is still much more to go for. The manager also used the market lows to take advantage of what it considered to be ’once in a generation valuation opportunities‘, which has been a contributory factor in the recovery.

Where to next?

Where to next?

The manager says that until the virus is brought under control, there can be no certainty over the associated economic damage and what this will mean for companies and financial markets more generally. Whilst still below their pre-pandemic levels, markets have had a good run, aided by central bank and government policy measures as well as signs that many countries are getting to grips with controlling the spread of the virus.

Seneca IM highlights that this is not a normal crisis. It believes that there will be lots more volatility until the situation is resolved more permanently, and points out that during the 1918 flu pandemic, the second wave was stronger than the first. The manager notes that while the US Fed has indicated interest rates will be lower for longer, the impact of winter on the rate of transmission is still an unknown, cases have been rising in some parts of the US and the world may suffer bouts of on/off social distancing restrictions for the next two years.

SIGT’s manager sees three ways out of the current situation: herd immunity, vaccine or seasonality (warmer weather brings the r-ratio down and the virus burns itself out). None of these appear imminent and so the manager believes that a full v-shaped recovery is unlikely, but it thinks that we could see multi-year global progress in economies and markets and is therefore focusing on the longer term.

Equities on the rise again, funded by sales from fixed income

Equities on the rise again, funded by sales from fixed income

When we wrote on SIGT in April, we explained how the manager had been focusing on the trust’s UK holdings’ debt covenants and had been stress testing these for very extreme scenarios. At that time, it concluded that there was sufficient headroom for these to be unlikely to fail as businesses and, when the government started to provide support, the manager increased its purchases.

This confidence, coupled with the extreme valuation opportunities seen in both UK and overseas equities led the manager to increase exposure to equities and reduce exposure to other areas, primarily fixed income, booking profits. Over time, the manager plans to continue to reduce SIGT’s allocation to gold and redeploy this into better value opportunities as well. However, the manager continues to exercise caution and is not moving to reduce SIGT’s exposure to liquid and defensive assets too quickly, as it does not know how long the current situation will last. As noted above, it expects further bouts of volatility that will present additional buying opportunities.

Portfolio monitoring – two key questions

Portfolio monitoring – two key questions

SIGT’s manager say that in these uncertain times, it is important that it sticks to its small-mid-cap niche and focuses on the long-term value opportunity. In this regard, it is focusing on two key questions when assessing SIGT’s existing portfolio and potential new prospects:

- Is a company’s valuation attractive over the longer term?

- Can the company survive a long lockdown?

Having assessed SIGT’s portfolio, the manager has concluded that, yes, most of the stocks can survive a long lockdown. Furthermore, it believes that, in five years’ time, most current valuations will look cheap from the context of a normalised economic environment. In the meantime, the manager believes that markets are becoming more discerning but says it will need to continue to look through the short term noise as markets struggle to balance hope versus despair.

Asset allocation

Asset allocation

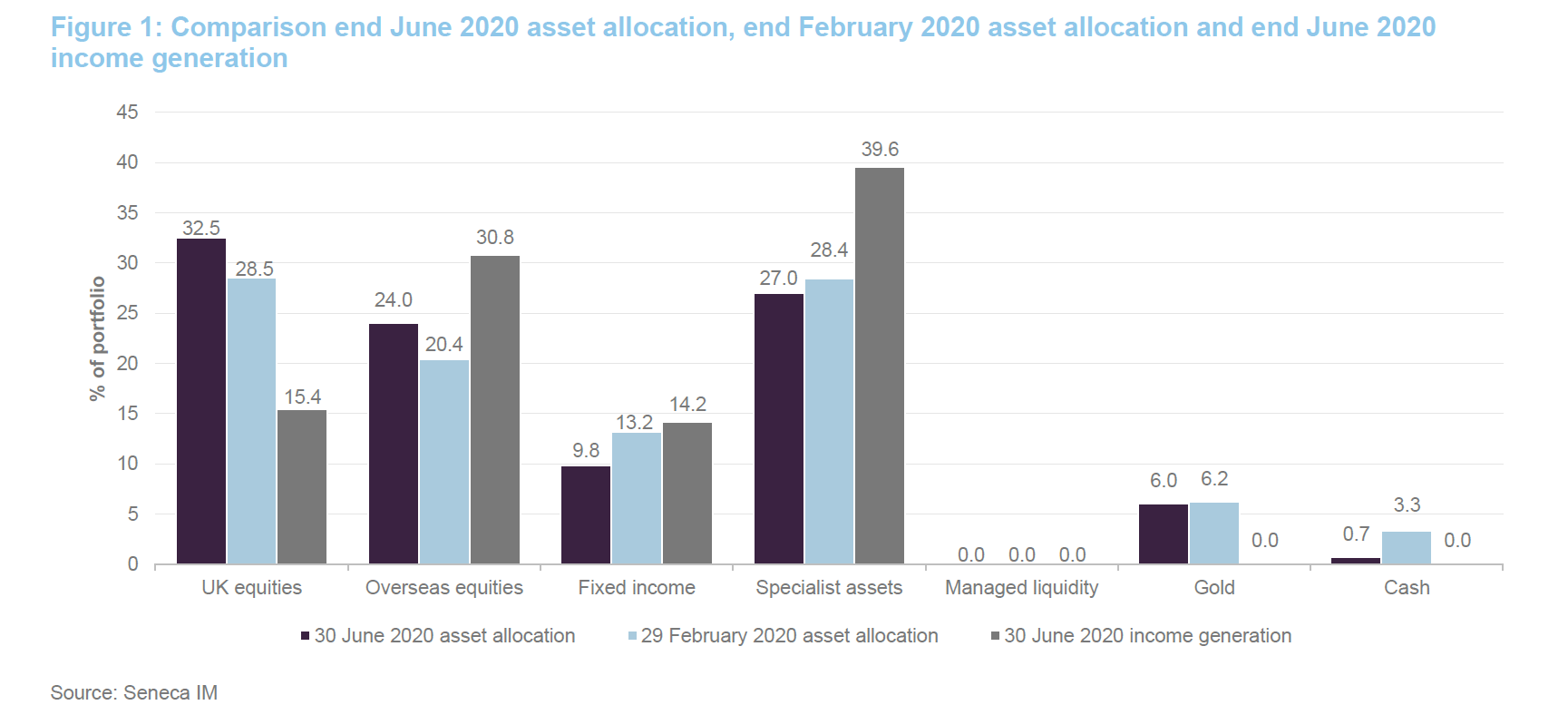

Figure 1 compares SIGT’s asset allocation as at the end of June 2020 and its asset allocation as at the end of February 2020 (the most recently available data when we last wrote on SIGT). The proportion of income generation, as at the end of June 2020, for each asset class is also included. Comparing the end of June asset allocation with the end of February asset allocation (see Figure 1), it is clear that the portfolio has been tilted more towards equities (both UK and overseas), which has been funded by reductions elsewhere (cash and fixed income in particular).

By way of illustration, the allocation to UK equities has increased by around four percentage points (key developments are discussed below), while the allocation to overseas equities has increased by 3.6 percentage points. The allocation to specialist assets has been reduced by 1.4 percentage points, gold has seen a modest reduction of 0.2 percentage points and cash has been reduced by 2.6 percentage points (the allocation to managed liquidity has been held at zero). Further explanation of these changes is provided in the following pages.

UK direct equities – key developments

UK direct equities – key developments

Since we last published, Seneca IM has now sold SIGT’s position in the iShares Core FTSE 100 ETF in its entirety. Seneca IM originally purchased the ETF to maintain SIGT’s exposure to UK equities rather than holding cash as it sold down the trust’s stake in AJ Bell (see page 10 of our November 2019 note for more discussion) but, following the market collapse, the manager began to switch the position into individual stocks where it saw ‘once in a lifetime’ valuation opportunities. The manager has added to SIGT’s holding in Clinigen, and initiated new positions in Origin Enterprises, M&G and Diversified Gas and Oil. All of these are discussed in further detail below.

Although not illustrated in Figure 1, the proportion of income generation that is being derived from UK equities has dropped significantly (from 29.2% as at the end of February 2020 to 15.4% as at 30 June 2020), despite an increased allocation to UK equities. This reflects the swathe of dividend cuts that have been made in response to the pandemic (see page 11 of our April 2020 note for further discussion of this). However, as highlighted on page 13, SIGT is maintaining its quarterly dividend at 1.68p per share for the time being and the board is willing to draw on the trust’s revenue reserves to achieve this.

Overseas equities – remains biased towards emerging markets and Asia, with zero exposure to the US

Overseas equities – remains biased towards emerging markets and Asia, with zero exposure to the US

Regular readers of our notes on SIGT will likely be aware that the manager reduced the trust’s exposure to the US to zero – as it considers this market to be expensive – and there is also limited exposure to both Europe and Japan. Instead, SIGT’s overseas equities exposure is tilted towards Asia and emerging markets (the manager likes the long-term structural growth that is available here and the less efficient nature of capital markets which creates more opportunities for managers who have the skills and resources to take advantage of pricing inefficiencies).

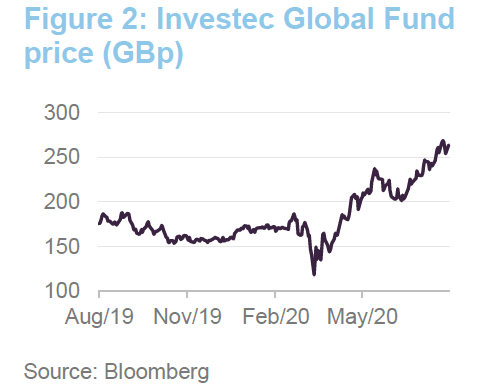

As noted above, the overall allocation to overseas equities has increased. However, within this, SIGT’s manager has reduced the size of the trust’s position in the Investec Global Gold Fund (see page 5 of July 2019 update note – Going for gold – for more details of this fund) as SIGT’s allocation to gold (through both the Investec fund and a physical gold ETF) has performed strongly as the pandemic has advanced. Reflecting the strength of its performance, the manager was keen to bring the allocation back to a more neutral level and rotate the proceeds into better value opportunities.

It should be noted that while the physical gold ETF is classified as a specialist asset, the Investec Global Gold Fund is classified as an overseas equities’ holding. This is because this fund invests in the equity shares of gold mining companies and so has equity risk that the physically-backed gold ETF does not.

Specialist assets – infrastructure reduced in favour of property

Specialist assets – infrastructure reduced in favour of property

As noted above, since we last published, there has been a small reduction in SIGT’s exposure to specialist assets. However, while the overall allocation has seen limited change, within this, the manager has reduced SIGT’s allocation to infrastructure, which has performed well, and has reallocated most of the proceeds into property, which now offers much better value, in the manager’s view.

Fixed income holdings – exposure now concentrated in three funds

Fixed income holdings – exposure now concentrated in three funds

In recent years, SIGT’s fixed income holdings have been very stable with the same funds continually occupying the top four positions. However, since we last published, the total number of fixed income holdings has been reduced by one, from four funds holdings to three. This has seen two long term positions sold in their entirety: the Templeton Emerging Markets Bond Fund and the Royal London Sterling Extra Yield Bond Fund, and the addition of one new holding: the Absalon Emerging Markets Corporate Debt Fund. The new fund is discussed in greater detail below.

Clinigen Group – position added to during market weakness

Clinigen Group – position added to during market weakness

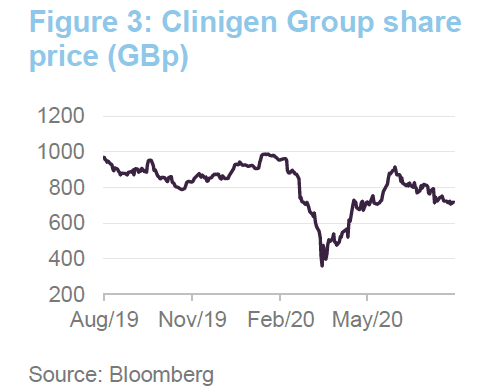

Seneca IM has added to SIGT’s holding in the Clinigen Group (www.clinigengroup.com), which describes itself as a global pharmaceutical and services business that is focussed on delivering the right drug to the right patient at the right time. Clinigen has a global network of businesses that provide services at each stage of a drug’s life cycle. It employs over 800 people globally, across 13 locations, with local knowledge in 130 countries, and operates in three areas of global medicine supply: clinical trials, unlicensed medicines and licensed medicines. Since its IPO in 2012, Clinigen has grown significantly, using a buy and build strategy; its share price has increased around 350% since it came to market.

Clinigen’s shares de-rated significantly during February and March 2020 (in addition to general market nervousness, there has also been concern over delays to clinical trials as a result of covid-19), to a point where SIGT’s manager felt that the share price was materially undervaluing the company’s growth prospects in its niche medical markets. The manager felt that this offered an attractive opportunity to build on the position, which was done close to the market low. SIGT has been rewarded, both as the stock has recovered and as Clinigen has signed two significant contracts for exclusive distribution.

In April, Clinigen signed an exclusive licensing and distribution agreement with Porton Biopharma Limited (PBL) to commercialise Erwinase, PBL’s treatment for patients with Acute Lymphoblastic Leukaemia in 19 countries, including the US, Europe and Japan. In May, Clinigen signed an exclusive agreement with Xeris Pharmaceuticals to manage the supply and distribution of its Gvoke (glucagon) injection. Gvoke is a treatment for diabetes, for which Clinigen will provide physicians and pharmacists with access on an unlicensed, on-demand basis for patients around the world (excluding the US).

In the middle of June, rumours began to circulate in the press that Clinigen was being considered for a possible takeover bid by the US private equity firm, Advent International. A report in the Mail on Sunday report cited City sources as saying that Advent had considered paying between 1,050p and 1,150p for each Clinigen share; a premium of up to 40% on the company’s previous closing price on Friday, valuing the firm in the £1.3-£1.5bn range. For now, this appears to have gone quiet, and the Mail on Sunday report did say that an initial indicative offer may already have been rejected by Clinigen. It is therefore not surprising that the share price has drifted back down, but this does nonetheless give some indication of the potential price uplift should Clinigen become an M&A target.

PRS REIT – added to position during market weakness

PRS REIT – added to position during market weakness

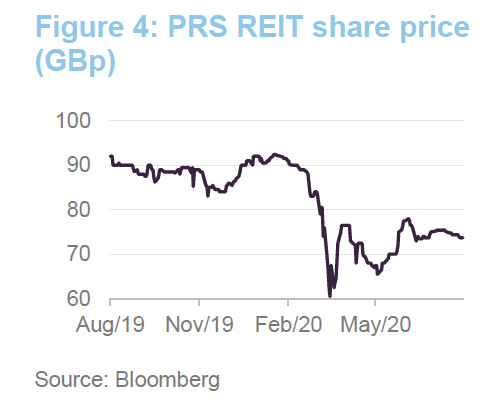

We last discussed PRS REIT (www.theprsreit.com) in detail in our September 2017 update note. At that time, we commented that SIGT had invested as part of PRS REIT’s £250m May 2017 IPO, alongside investors such as Aviva, BMO, Janus Henderson, AXA and the UK Government’s Homes and Communities Agency. PRS REIT invests in newly constructed private rental properties (mainly family homes) that are let on assured shorthold tenancies. Its manager, PRS Sigma Management, has two construction partners, Countryside Properties and Keepmoat Regeneration, as well as a longstanding relationship with the Homes and Communities Agency, which it says provides it with a strong source of greenfield and brownfield development opportunities.

PRS REIT invests early in the development process. This releases capital for the developer to allow it to progress the project; improves the developer’s working capital ratios; improves the developer’s economies of scale; and, because take-up of private rented properties is quicker than buy-to-own, the private rental segment provides the developer with a segment of the development that is established and can be used to market the buy-to-own properties. In return, PRS REIT gets a discount on the cost of the properties it purchases. Richard Parfect of Seneca IM says that, through economies of scale, PRS REIT is able to purchase its properties at around 88p per £1 of market value and so, on completion of the projects, PRS REIT can usually expect an uplift in its NAV. In its second-quarter trading update, PRS REIT reported a slow down in completions, due to covid-19 (135 homes in Q2 versus 330 in the previous quarter as construction was suspended/disrupted for eight weeks). However, the group collected 98% of rent for Q2 and said that it had the equivalent of just 0.49% of its annual rent were in lockdown-related rent arrears. Furthermore, rental demand has been strong with prices steady at pre-covid-19 levels.

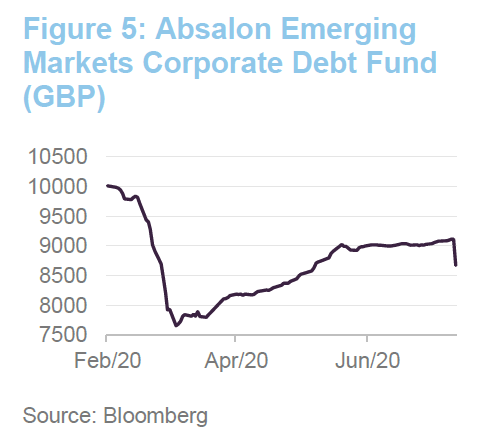

Absalon Emerging Markets Corporate Debt Fund – opting for a more niche offering

Absalon Emerging Markets Corporate Debt Fund – opting for a more niche offering

As noted above, Seneca IM has redeemed SIGT’s holding in the Templeton Emerging Markets Bond Fund and has made an allocation to the Absalon Emerging Markets Corporate Debt Fund instead. Although both provide exposure to emerging market debt, the new fund is significantly different to the one it has replaced and SIGT’s manager feels that it is a more niche offering that is a better fit with its own investment style (the Templeton fund is one of the largest in the emerging market debt space). By way of illustration, the new fund has a significantly higher yield to maturity of over 10% (the Templeton fund’s is 5.8%), a wider spread (958bps versus 533bps) and a shorter duration (three years versus 4.7 years).

The manager, Absalon Capital (absalon-capital.com), is a Danish credit manager that is part of Formuepleje A/S, the largest non-bank owned asset manager in Denmark. Absalon has a team of four portfolio managers who manage two dedicated credit strategies (global high yield and emerging markets corporate debt) for institutional investors with an AUM of €400m (the wider Formuepleje Group has 90 employees and has around €10bn in AUM). Absalon has been running its emerging markets corporate debt strategy since 2010, but this has been available through a Luxembourg incorporated SICAV since March 2015.

Absalon’s portfolios are managed bottom-up, using a stock picking approach. It aims to build its portfolios with an above average yield at below average prices focusing on out-of-favour areas of the market where it says that the risk of default is often overestimated, but where it considers that the issuer is on a stable/improving trend. For its emerging markets fund, it aims to outperform the JP Morgan CEMBI BD (Euro hedged) index over the cycle (three to five years).

Central to Absalon’s approach is the view that, where there are ratings downgraded, for both emerging market countries and sectors, all credits tend to be tarred with the same brush, which can lead to under-priced quality assets. Absalon searches for these mispriced opportunities. The emerging markets portfolio has between 75-125 positions and its construction is not constrained by an index; there will be zero weightings to sectors and geographies that the managers consider to be unattractive. It is focused on hard currency exposures and there are no limits on the weightings to investment grade of high yield credit. Reflecting this, credit selection is the primary driver of the portfolio’s returns.

SIGT’s manager describes the emerging markets fund as ’deep value, high risk and high reward’, but that it has a quality bias (the portfolio has a high quick ratio). It was hit heavily during the downturn, reflecting the fact that it had significant exposures to Latin America (as at 30 April 2200, the fund had 30% in the Americas) and 50% of the fund was in areas deemed to be cyclical or sensitive (it had significant exposures to energy, aviation and retail). As illustrated in Figure 5, it has since recovered a significant proportion of the lost ground, but SIGT’s manager believes that there is much more to go for.

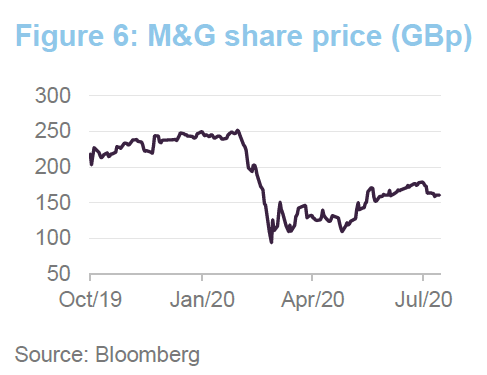

M&G – much more than asset management

M&G – much more than asset management

Seneca IM has established a position for SIGT’s portfolio in M&G (global.mandg.com), which was spun out of Prudential in October 2019. Insurance is an area that Seneca IM likes (the manager says that it is an area that pays good income but is often misunderstood and so is easier to find a mispriced asset) and SIGT also has positions in Phoenix Group and Legal & General, for example (it likes their large life insurance/annuity books as these have less volatile cash flows and pay attractive yields). The manager says that M&G suffers from a perception problem whereby many people think it is primarily an asset management business (this accounts for around 30% of revenues and 20% of profits) and underestimate the scale of M&G’s insurance related business.

M&G sold off heavily during the crisis (it lost around 60% of its value during the first three weeks of March – see Figure 6) allowing Seneca IM to build the position at an attractive valuation (it says that M&G is a decent long-term income generator and the yield was greater than 10% at the time of purchase). The manager acknowledges that the margins in M&G’s asset management are coming under pressure, but comments that M&G is seeing good growth from its annuity book, is launching new products and is growing internationally.

For example, M&G is looking to launch a European version of the PruFund with its European partners (M&G Plc Group fund managers are responsible for the management of the majority of underlying funds that these multi-asset funds invest in), which Seneca IM says offers the potential for massive growth (The PruFund had AUM of £1bn in 2008 and £54bn in 2019). Furthermore, its Prufolio product saw £1.9bn of inflows during 2019, and it is also moving into platforms (M&G bought the Royal London Digital Wealth Management platform in March 2020, which services some 1,500 advisory firms, with 90,000 customers, and is another new source of revenue and synergies).

SIGT’s manager says that the market has been taking a very short-term view of M&G. However, they highlight that its solvency ratio is strong (for FY 2019, it had £10.2bn of own funds, while it was required to have £5.2bn), it continued to pay a substantial dividend while others were cutting (17.9p, split 1/3 and 2/3 between the interim and final), and its dividend is covered 1.6x by earnings. They consider that, even with recent capital erosion, it is lowly valued relative to its capital, and is lower risk than the market appreciates.

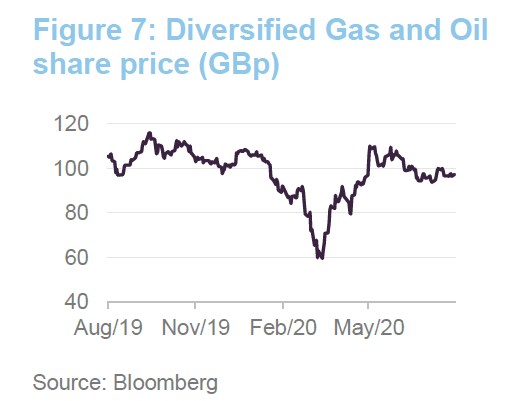

Diversified Gas & Oil – a value operator that should benefit from reduced gas output from US shale oil producers

Diversified Gas & Oil – a value operator that should benefit from reduced gas output from US shale oil producers

Diversified Gas & Oil (DGOC – www.dgoc.com) is an owner and operator of natural gas & oil wells that are primarily located in the Appalachian Basin in the United States. Its production operations are concentrated within Tennessee, Kentucky, Virginia, West Virginia, Ohio, and Pennsylvania, where it describes itself as being one of the largest independent conventional producers. Seneca IM describes DGOC as a value operator in the oil and gas space with cheap reliable flows. With a dividend yield in excess of 10%, it is therefore a good asset for an income hungry portfolio. The company transitioned to the main market of the LSE on 18 May 2020.

Rather than being a speculative exploration company, DGOC buys mature assets that have had their initial decay in output. Consequently, these are at a stage of lower volume production, but this is stable (it targets assets with decline rates of less than 5% per annum) and DGOC is able to buy these assets cheaply. DGOC issued new capital in early May to fund the purchase of two new assets and SIGT invested in the fundraising.

DGOC has grown its output in recent years, both through acquisition (it has been acquiring assets from industry players who have been refocusing their businesses on shale production) and by enhancing the efficiency of its existing operations. Seneca IM says that some of the assets that DGOC purchases have been mismanaged and, following acquisition, the DGOC team will do such things as repairing oil lines, reconnecting wells and repairing well linings, allowing them to boost production of these assets. It should be noted that its geographical focus not only affords it economies of scale, and by concentrating its efforts in resource rich locations that are well known to it, DGOC’s operations tend to be reasonably low-risk.

It should be noted that, in addition to having predictable production rates and relatively low rates of decline in output, the assets still have long lives (typically 40 to 50+ years). This allows DGOC to hedge the oil price two years out and provide itself with security of income as well. The company’s low cost of production also means that it is well positioned to weather the current low oil price environment, but it should also benefit from a reduction in the output of gas from shale production, as this is currently uneconomic for many producers. The company also says that, where the commodity pricing environment is favourable, it can activate a low-risk development program that ensures a quick return on its investment. This could offer significant potential upside should oil markets tighten.

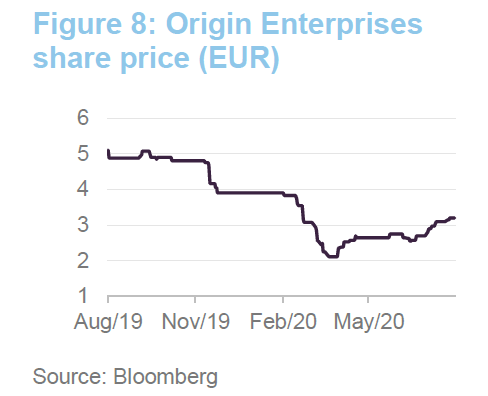

Origin Enterprises – new holding; purchased during market weakness

Origin Enterprises – new holding; purchased during market weakness

Origin Enterprises (originenterprises.com) describes itself as a focused agri-services group providing specialist on-farm agronomy services, digital agricultural services and the supply of crop technologies and inputs. Origin was established in 2006 by the IAWS Group (now ARYZYTA) as a spin-off to focus on its original agribusiness and food and nutrition businesses. However, since then Origin has expanded by acquiring agribusinesses so that it now has market-leading positions in its native Ireland, the United Kingdom, Poland, Romania and Ukraine. It also has operations in Belgium and Brazil. Origin employs over 2,500 people globally, including a sales force of 770, serving over 50,000 customers, through 112 distribution points that are spread over seven countries.

Origin’s shares de-rated significantly during February and March 2020. In addition to general market concerns about the spread of the virus, Origin’s share price suffered in the wake of announcement on 26 February 2020 that it was cutting its outlook for the full year (to 31 July) due to the impact of “prolonged and challenging weather conditions” in both Ireland and the UK.

In its November trading update, Origin had said that due to significant rainfall in the UK from September to November 2019, it expected that the total planted area for winter crops would be down 25% versus 2018. However, following further heavy rain between December and February (reportedly the wettest autumn winter planting season in 30 years), Origin’s announcement in February said that it expected the total area for winter crops to be down some 40% against the prior year. As a result, it expected that this planting area would be transferred to Spring crops, which require less spending by farmers on the agronomy services and crop inputs that Origin provides.

In a similar scenario to Clinigen that we discussed above, SIGT’s manager felt that the scale of Origin’s derating meant that its share price materially undervalued the company’s growth prospects, particularly as it is expanding into South America, which SIGT’s manager believes should help to diversify and smooth out the seasonality of its revenues. The manager felt that this offered an attractive opportunity establish a new position in this cash generative company at a very attractive yield. SIGT’s position was secured at prices close to the market low. On 17 June 2020, Origin issued its trading for the third quarter of its financial year in which it announced the suspension of its final dividend. Its share price had been moving down in advance of this announcement, but the market appears to have taken the news well as it has been trending upwards since.

Largest investments

Largest investments

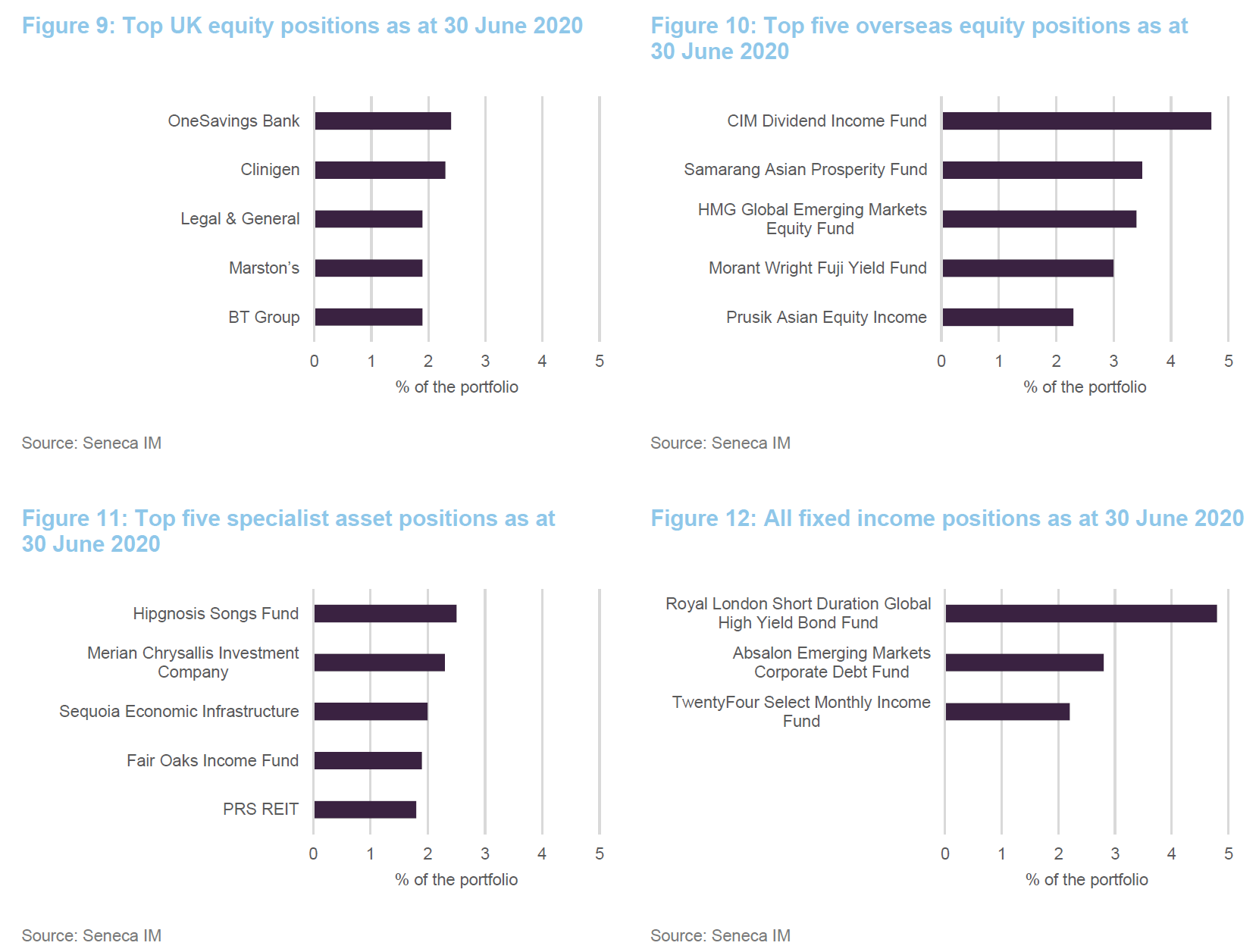

Figures 9 to 12 show the largest positions in each part of the portfolio as at 30 June 2020. Details of the rationale underlying some of these and other positions can be found in our previous notes (see page 16 of this note). For example, readers who would like more detail on Polypipe, Primary Health Properties, UK Mortgages, London Metric Property, Ediston Property and LXI REIT should see our April 2020 update note. Our November 2019 note has more detail on Hipgnosis Songs Fund, PurpleBricks and the Morant Wright Fuji fund, as well as updates on Schroder UK Public Private Trust (formerly Woodford Patient Capital) and AJ Bell. Some of the more recent changes are also discussed in detail above. The holdings in Figures 10 to 13 accounted for 47.6% of SIGT’s portfolio as at 30 June 2020.

Many of the names in Figures 9 to 12 will be familiar to readers of our previous notes on SIGT, particularly for the overseas equities, specialist asset and fixed income positions. Within SIGT’s top five UK direct equities, the iShares Core FTSE 100 ETF has been sold in its entirety to fund direct equity purchases, as noted above. This includes topping up existing holdings such as BT Group, Clinigen (the manager added to both of these positions at close to their lows), and Marston’s. Arrow Global (an investor in and manager of non-performing loans and non-core assets), has moved out of SIGT’s top five direct UK equity holdings on no real news. However, the manager says that this is a thinly traded mid-cap and its share price tends to be quite volatile as a result.

Looking at overseas equities, the manager has sold down SIGT’s holding in the Investec Global Gold Fund, reflecting its strong performance, which has pushed this down the rankings. With the Prusik Asian Equity Income Fund moving back up to the top five in its place.

Looking at specialist assets, International Public Partnerships has moved out of the top five, with PRS REIT moving up to take its place. This reflects the manager’s decision to reduce exposure to infrastructure and increase exposure to property on valuation grounds. Otherwise, the remaining holdings were top five specialist asset positions when we last published. Of these, Hipgnosis Songs Fund remains the largest position. SIGT participated in the C-share fundraising and this moved up the rankings when its C-shares merged with its ordinary shares. For more discussion on SIGT’s holding in Hipgnosis, see page 10 of our November 2019 annual overview note.

As was noted above, the number of fixed income holdings has fallen from four to three. Two long-term positions have been sold in their entirety, while the Absalon Emerging Markets Corporate Debt Fund (discussed above) is a new entrant. As was highlighted in our April 2020 update note, the manager has been trimming exposure to the Royal London Short Duration High Yield Bond Fund, although this long-term holding continues to be the largest fixed interest position.

Performance

Performance

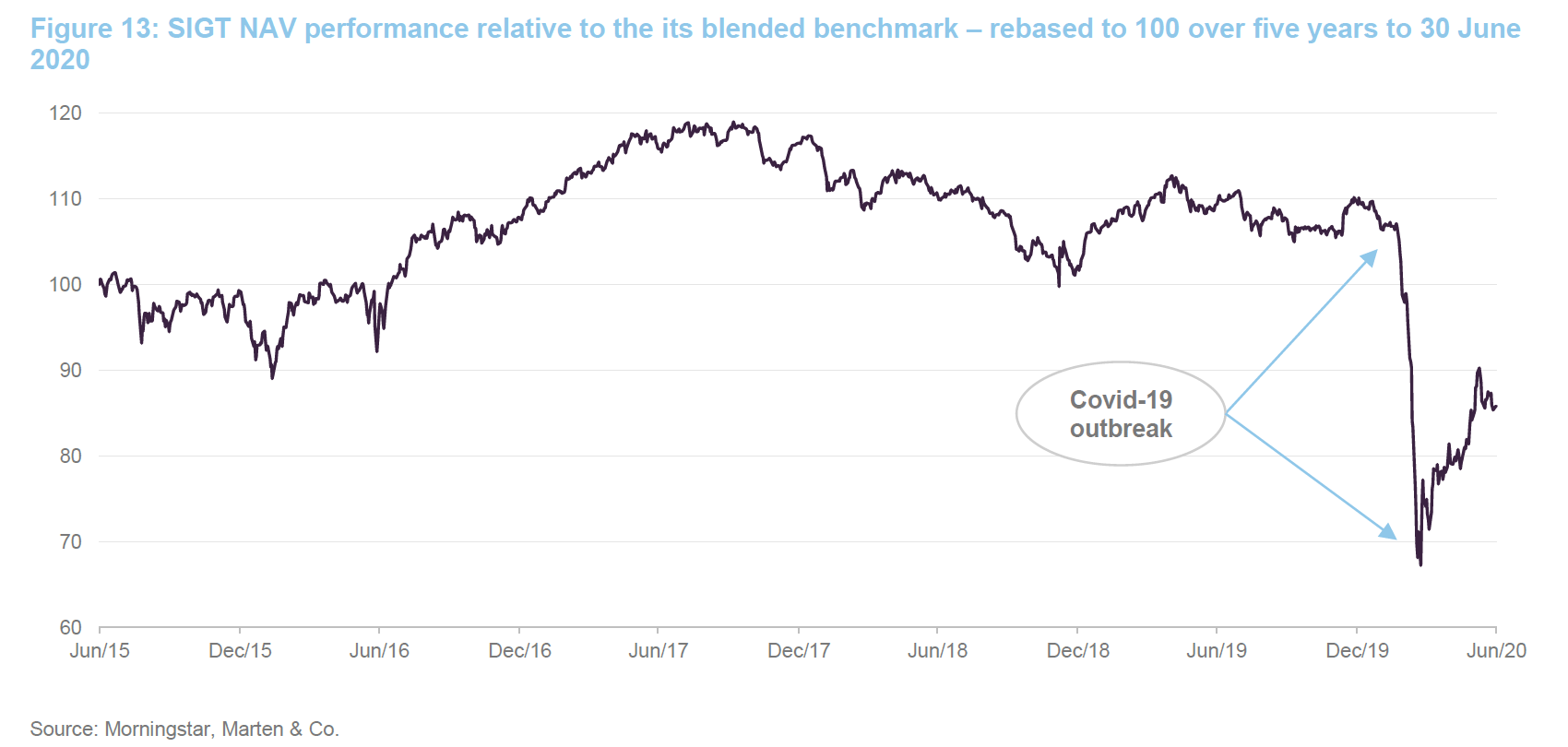

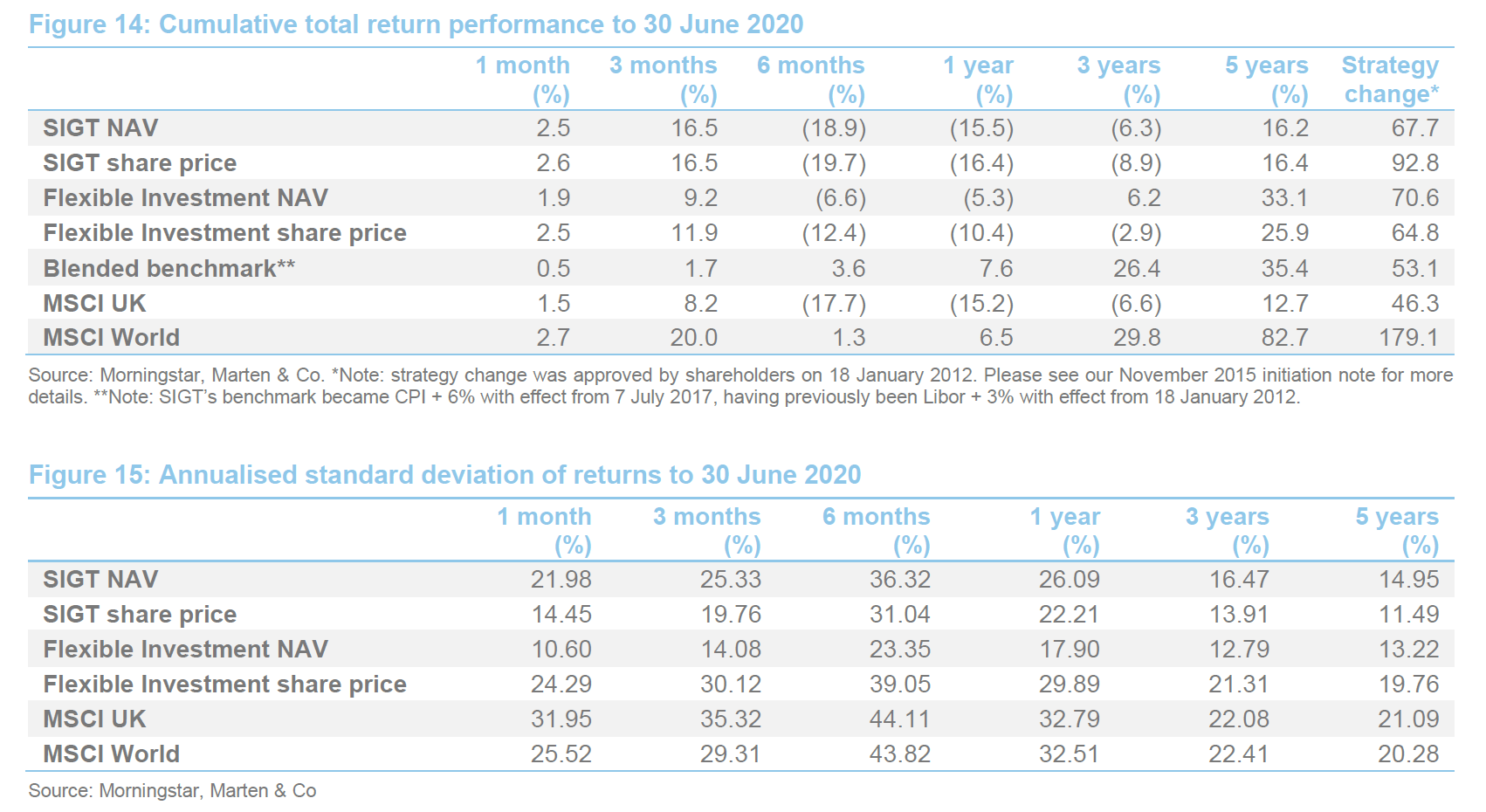

Figure 13 illustrates SIGT’s share price and NAV total return performances in comparison with those of its peer group, its blended benchmark, the MSCI UK and MSCI World indices. As we discussed in our April 2020 update note, SIGT has had a very difficult start to 2020. The outbreak of covid-19 has had a starkly negative effect on financial markets and SIGT’s NAV lost 30.4%, in total return terms, during the first quarter of 2020. Most of this has occurred in March, where the NAV was down 23.6% during that month alone.

However, the second quarter of 2020 has been much more positive for SIGT as markets recovered, with the trust’s NAV gaining 8.1% in April, 5.1% in May and 2.5% in June in total return terms (overall 16.5% in Q2).

A trio of headwinds, but leveraged into recovery

A trio of headwinds, but leveraged into recovery

As we discussed in our April 2020 update note, SIGT was hit by a trio of headwinds during the market rout that impacted both its absolute and relative performance.

When compared to its peers, we believe that SIGT’s higher weighting to equities (one of the highest in the peer group) and particularly UK small and mid-cap value stocks held it back.

SIGT’s peers are overwhelmingly capital growth focused and they have been able to make higher allocations to more defensive assets – such as gold and cash – that are not suitable for SIGT’s portfolio because of its income requirement.

Another consideration is that SIGT’s portfolio has a large allocation to stocks hurt by the effects of people social distancing (for example National Express, Marston’s and The Doric Nimrod Funds).

However, whilst SIGT found itself at the sharp edge of the market collapse, it was well positioned to benefit as markets recovered. This was been seen during the second quarter of 2020, as central bank intervention supported asset prices and lifted equity markets. During this period, the UK market outperformed global markets and SIGT has benefitted from its overweight position, although the US market has also been a good performer and SIGT has a zero allocation to this area (on valuation grounds). Within Europe, value has outperformed growth and SIGT’s manager says that its underlying managers have been outperforming as well.

SIGT’s manager says that, during the recovery so far, there has been hardly a stock that has had a negative return. Stand-out strong performances have come from a number of stocks, for example Marston’s, Halfords, Clinigen, PurpleBricks and the Investec Global Gold Fund. However, it still sees significant pent up value in SIGT’s portfolio and, as a long-term investor, it will wait for this to be released. In the meantime, the manager expects to see more volatility over the next few months as the extent of the damage done to the global economy over the longer term by the pandemic becomes clearer. Depending on the news flow, they expect to see markets move between risk-on/risk-off quite quickly, and so will continue to exercise caution.

Gold – strategy vindicated

Gold – strategy vindicated

As noted on page 10, SIGT’s allocation to gold has provided good downside protection. At the peak of the crisis, SIGT had around 7% of the portfolio in physical gold and gold miners. While the gold price was initially depressed (as a liquid asset, investors were selling physical gold at the height of the market distress to fund margin calls) it soon recovered strongly. The Investec Global Gold Fund (a fund of gold mining stocks) was also initially down some 30% (the market started to question whether these could continue to function), but this recovered strongly in the wake of the bounce in the gold price (see Figure 2 on page 4).

Specialist assets – discounts narrowed again

Specialist assets – discounts narrowed again

As all assets became highly correlated at the peak of the market rout, specialist assets did not initially provide the downside protection that had been hoped for – according to SIGT’s manager, discounts on these funds widened out to an average of around 20%. However, during the second quarter, these discounts have generally shown strong mean reversion and SIGT’s specialist assets allocation has performed well. Nevertheless, the manager says that there are still a number of holdings on significant discounts and so there remains considerable latent value here too.

As illustrated in Figure 15 and noted in our April 2020 update note, increased volatility in the wake of the market collapse, as well as high correlation between asset classes as markets rolled over has seen a marked uplift in the volatility of SIGT’s NAV. This is significantly above that of its flexible investment peers, but still below that of UK and global equities (as represented by the MSCI UK and MSCI World). However, the DCM has helped dampen share price volatility, which is markedly less than that of the NAV. Overall, we believe volatility should dampen down over time as markets regain their composure.

Quarterly dividend payments

Quarterly dividend payments

Challenging times, but SIGT’s is maintaining its quarterly dividend rate at 1.68p

Challenging times, but SIGT’s is maintaining its quarterly dividend rate at 1.68p

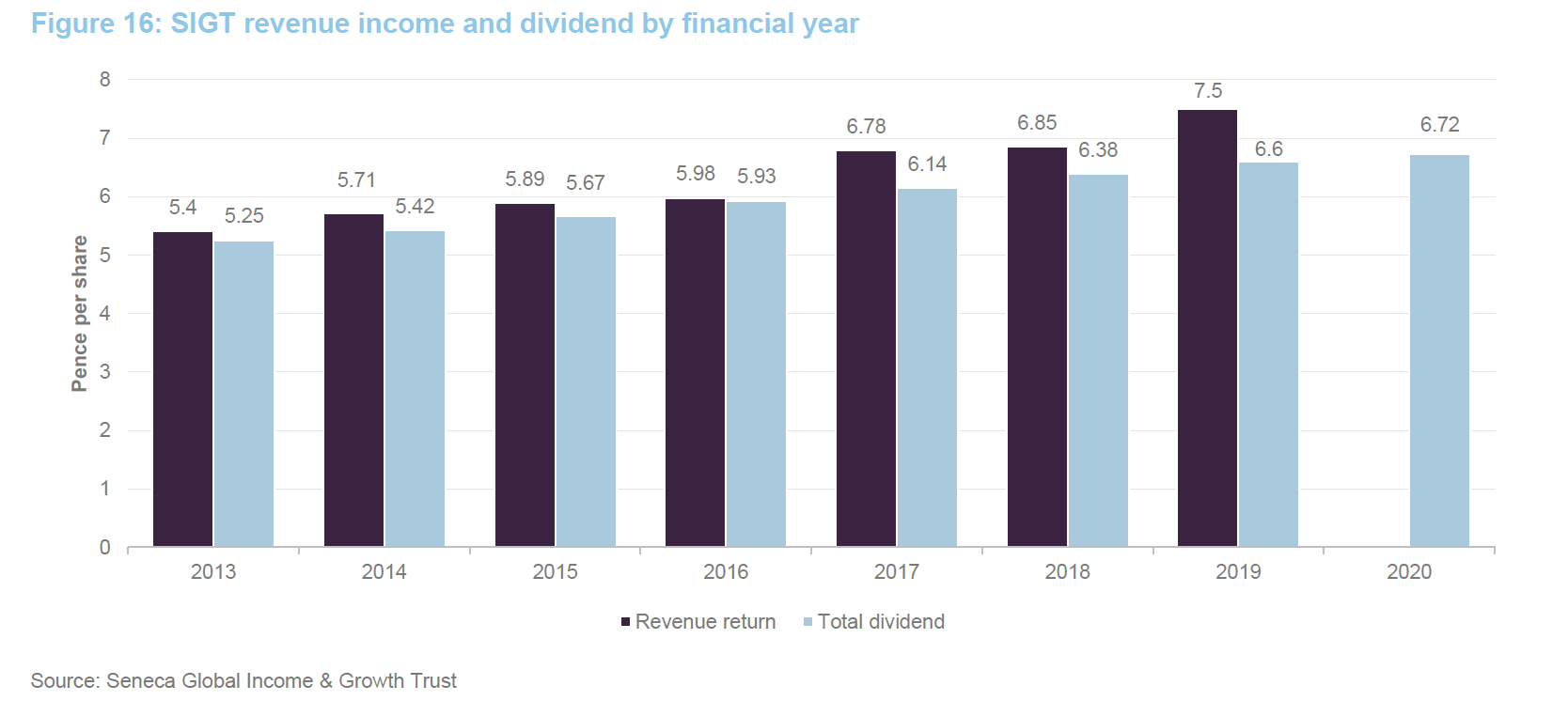

On 7 April 2020, SIGT declared its fourth interim dividend, for the year ending 30 April 2020, at 1.68p per share (in line with the first three quarterly dividends), bringing the total for the year to 6.72p per share (an increase of 1.8% over 2019). At the time, the board also said that, barring further unforeseen circumstances, it intends to maintain the quarterly dividend rate at 1.68p for the time being.

More detail of this was provided in our April 2020 update note (see pages 10 and 11 of that note), but to summarise, SIGT’s board said that it should do what it can to help shareholders through the current difficult period. The board’s view is that that SIGT is ‘well endowed with distributable reserves’ and that the trust is comfortably able to sustain the current dividend rate of 1.68p per share. However, this almost certainly means drawing on its revenue reserves and paying an uncovered dividend, which, as illustrated in Figure 16, would be a departure from its practice in recent years (SIGT has paid a covered dividend following its reorganisation in 2012 and has rebuilt its revenue reserves during the period since). As at 30 April 2020, SIGT’s revenue reserve stood at £2.005m or 4.20p per share. Prior to the strategy change in 2012, it stood at 0.3p per share.

SIGT’s DCM keeps it trading close to asset value

SIGT’s DCM keeps it trading close to asset value

Effectiveness of DCM is proven for volatile markets

Effectiveness of DCM is proven for volatile markets

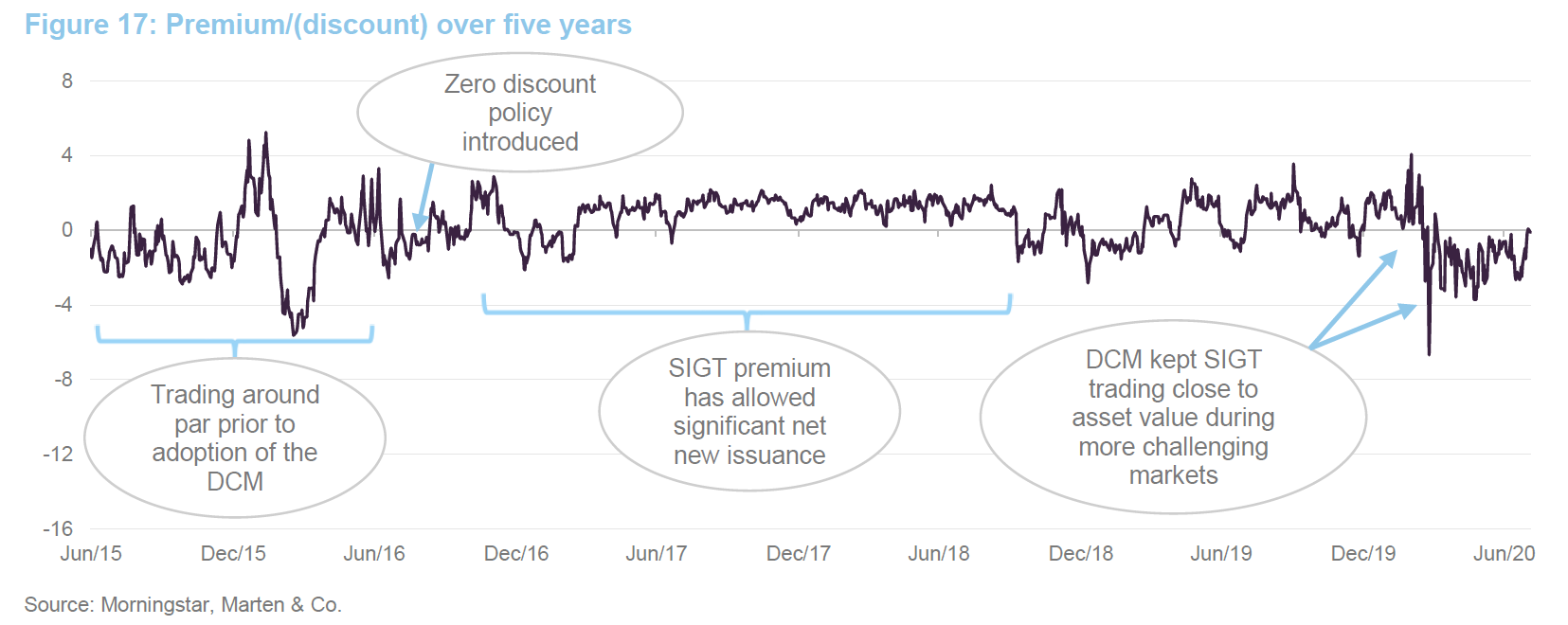

As illustrated in Figure 17, SIGT’s discount control mechanism (DCM), which went live on 1 August 2016, continues to keep the trust trading close to asset value (SIGT has traded at an average premium of 0.02% during the last 12 months). It is noteworthy that during more challenging market conditions, the certainty offered by the DCM kept SIGT trading close to asset value. For example, both towards the end of 2018 and so far this year (the widest discount during the recent market capitulation has been 6.7% on 25 March 2020). Furthermore, the DCM has been shown to keep SIGT trading around asset value during periods where the market has been rallying.

By giving investors confidence that they can enter and exit SIGT at close to NAV, the DCM is designed to allow SIGT to attract new shareholders and grow its asset base over time. The DCM has now been in place for approaching four years. As highlighted in our previous notes, the overwhelming trend has been one of share issuance since the DCM was introduced, prior to the pandemic. It should be noted that SIGT has, despite challenging market conditions, honoured this commitment and has recently been very active in repurchasing shares. YTD, SIGT has made net repurchases totalling 6.19m shares, equivalent to 12.6% of its issued share capital at the beginning of the year.

The significant net issuance that has taken place since the DCM was introduced illustrates that there is demand for SIGT’s strategy. We like the certainty that the DCM offers investors, and believe that the asset growth that it has facilitated is positive as, all things being equal, it serves to lower SIGT’s ongoing charges ratio and should support liquidity in SIGT’s shares. These should benefit all of SIGT’s shareholders.

Fund profile

Fund profile

Multi-asset portfolio with low-volatility returns and an income focus

Multi-asset portfolio with low-volatility returns and an income focus

SIGT’s aim is to grow both income and capital through investment in a multi-asset portfolio and to have low volatility of returns. Its portfolio includes allocations to UK equities, global equities, fixed income and specialist assets.

SIGT is designed for investors who are looking for income, want that income to grow, want the capital of the investment to grow, and are seeking consistency, or lower volatility, in returns. A pure bond fund could meet the first of those needs; a pure equity fund could meet the first three. SIGT invests across a number of different asset classes with the aim of achieving all four.

Over a typical investment cycle, SIGT seeks to achieve a total return of at least the Consumer Price Index (CPI) plus 6% per annum, after costs, with low volatility and with the aim of growing aggregate annual dividends at least in line with inflation. Seneca IM define a typical investment cycle as one which spans 5-10 years, and in which returns from various asset classes are generally in line with their very long-term averages.

Further information regarding SIGT can be found at Seneca IM’s website: senecaim.com

Seneca Investment Managers – a multi-asset value investor

Seneca Investment Managers – a multi-asset value investor

SIGT’s portfolio has been managed by Seneca Investment Managers (Seneca IM), and its forerunners, since 2005. Seneca IM describes itself as a multi-asset value investor. We think the combination of multi-asset investing with an explicit value-oriented approach may be unique to Seneca IM. The idea is that Seneca IM can allocate between different asset classes and investments, emphasising those that offer the most attractive opportunities and yields, making asset allocation, direct UK equity and fund selection (for access to other overseas equities and other asset classes) follow a value-based approach.

Seneca IM says that it saw significant inflows into its products from retail investors during 2019 (some £123m), and that 2020 has also started well. Flows of this size are very healthy for a management house of Seneca IM’s size.

Anne Gilding joined SIGT’s board on 15 June 2020

Anne Gilding joined SIGT’s board on 15 June 2020

As discussed in our April 2020 note, Anne Gilding joined SIGT’s board as a new non-executive director on 15 June 2020. Over the last 25 years Anne has led the development of global communications, branding and marketing solutions for a broad range of companies including Impax Asset Management Group Plc, BMO (formerly F&C), GAM, Vernalis Group Plc and UBS. She is currently a senior advisor to Peregrine Communications and a non-executive director of Aberdeen New Thai Investment Trust Plc.

Previous publications

Previous publications

Readers interested in further information about SIGT, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note Pausing on equity reductions, published on 4 November 2019, as well as our previous update notes and our initiation note (details are provided below). You can read the notes by clicking on the links below.

- Low volatility and growing income – 02-Nov-15

- On track for zero discount policy – 11-May-16

- In demand and no discount – 16-Sep-16

- Celebrating five years since strategy change – 10-Mar-17

- Changing tack – 13-Jun-17

- Steady reduction in equity exposure – 13-Sep-17

- Walking the walk – 16-Jan-18

- Cutting back on equities – 21-Jun-18

- Mind the (inflation) gap! – 18-Sep-18

- Holding steady as cycle turns – 24-Apr-19

- Pausing on equity reductions – 04-Nov-19

- Triple whammy but standing by the dividend – 24-Apr-20

The legal bit

This marketing communication has been prepared for Seneca Global Income & Growth Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.