Standard Life Investments Property Income Trust – Adding value in cautious times

Adding value in cautious times

Adding value in cautious times

Standard Life Investments Property Income Trust (SLI) has a long-term track record of market-beating returns achieved by investing in a diverse portfolio of commercial property in the UK. Minimal retail holdings and a bias to industrial property have proved beneficial to the fund. However, its active approach to asset management, aiming to keep voids low and rent flowing, has also been fundamental to its performance. Identifying and selling assets where the rental income may be at risk, and recycling the capital into property with strong rental growth prospects, has been the name of the game for SLI’s manager, Jason Baggaley, in recent months. A yield around 5% and returns ahead of listed peers help to justify SLI’s premium.

Commercial UK property exposure

Commercial UK property exposure

SLI aims to generate an attractive level of income, along with the prospect of both income and capital growth, by investing in a diversified portfolio of UK commercial property assets. It invests in three principal commercial property sectors: office, retail (including leisure) and industrial. SLI borrows money with the aim of enhancing returns; the board’s intention is that SLI’s loan-to-value ratio (LTV) will not exceed 45%. The current LTV is 24.6% and the manager says that the intended range at this point in the cycle is 25-30%.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Morning-star UK REIT total return (%) | Peer group NAV total return (%) | MSCI UK total return (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Dec 2015 | 15.50 | 17.80 | 9.50 | 11.90 | -2.20 |

| 2 | 31 Dec 2016 | 7.00 | 2.50 | -7.40 | 8.20 | 19.20 |

| 3 | 31 Dec 2017 | 13.70 | 14.60 | 12.70 | 9.90 | 11.80 |

| 4 | 31 Dec 2018 | -8.30 | 9.60 | -13.30 | 8.60 | -8.80 |

| 5 | 31 Dec 2019 | 18.00 | 4.10 | 33.10 | 2.90 | 16.50 |

A de-risked portfolio for future growth

A de-risked portfolio for future growth

The Conservative government’s landslide victory in the general election in early December 2019 appears to be a good outcome for the commercial property market. Political and economic uncertainty has somewhat blighted the market since the EU referendum in 2016, but in the weeks after the Tory majority was confirmed, several big-ticket investment deals were transacted across the UK. Listed real estate companies focusing on the UK experienced a bounce too, as investors’ confidence in the sector strengthened. More clarity on the implications of Brexit will likely result in further positive investor sentiment towards the commercial property sector.

SLI’s manager, Jason Baggaley, says that he expects to see a period of greater stability in the first half of 2020 at least, and with that the possibility of more overseas investment. That could lead to prices remaining stable or even increasing. Jason does, however, believe that transaction volumes will remain low, and later in the year, as the Brexit transition period comes towards an end, greater nervousness will return, resulting in reduced investment volumes. This is why SLI won’t be changing its cautious stance anytime soon.

The trust has focused on taking risk out of the portfolio during the past three years. Assets with a covenant risk have been sold and new purchases either benefit from long-term income from a strong covenant or rental growth potential.

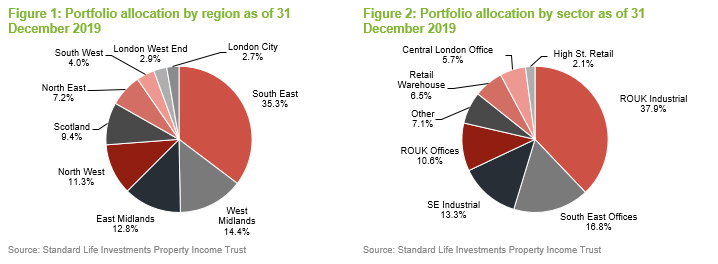

The industrial sector, which has been far and away the best-performing commercial property sector in recent years buoyed by a surge in online shopping, is set to be the stand-out performer again in 2020. On the flip side, the well-documented woes in retail have dragged on this sector. SLI’s portfolio is 51.2% weighted to industrial by value and just 8.6% retail.

Jason believes that the two sectors will continue their contrasting paths, but says he is increasingly mindful of being too general in that assumption. There has been some evidence that larger ‘big box’ industrial assets are taking longer to let, whilst investor demand for some industrial assets with shorter-term income has weakened. In other words, the days of making easy money are gone.

In the retail sector, values are likely to continue to be under pressure this year, with rents and estimated rental values predicted to fall further. However, some investors have started to see opportunities in the sector, believing values to have hit somewhere near the bottom. Jason says he is “open-minded” about investing in retail and will use an “asset-by-asset” approach when appraising potential retail investments.

The office sector, which makes up 33.1% of SLI’s portfolio, falls somewhere in between industrial and retail in terms of performance. In most cities in the UK – including central London – supply levels are low and the pipeline of new builds is small. Jason believes that the provision of amenity and services will remain a priority for office landlords as they seek to create an environment where people want to work. Despite the recent problems of WeWork, Jason thinks that the impact serviced offices have had on the office market will be lasting. Office tenants expect certain amenities such as communal break-out areas, showers and bike storage as the norm and are now increasingly wanting a ‘plug and play’ service – whereby the landlord provides the space already fitted out with furniture and communications infrastructure and the tenant can turn up and is ready to go. SLI, for example, has fibre internet in all of its buildings and makes sure that it is operational before the tenants re-locate.

SLI is looking to fit out most of its vacant office space and believes that giving prospective tenants an idea of what the space can look like (instead of the empty floorplate that is customary in the sector) will cut void times. In two recent examples, SLI fitted out the office space on suites that had been vacant for more than 12 months, and after four weeks they were let or under offer. The cost of fitting out the space is offset by shorter void times and, often, a slightly higher rent.

The trust’s approach to office space plays a big role in its Environmental, Social and Governance (ESG) commitment. The manager says that the Environmental aspect was introduced a long time ago and should be taken as read – things like providing LED lighting and efficient energy use. The interesting bit for SLI is the Social part. By creating a community within its multi-let offices and focusing on wellbeing, it can not only improve the Social aspect of ESG, but also help tenants increase productivity, thus making the space more attractive to corporate occupiers.

Portfolio update

Portfolio update

SLI has made several portfolio transactions in the six months since QuotedData published its initiation note on the company in July 2019. The biggest of these was the sale of its second-largest asset, Denby 242. The logistics property, which is located in Denby, Derbyshire, was acquired in August 2014 to support the trust’s expansion of its industrial portfolio in the Midlands but was sold in November 2019 for £19.1m.

The 242,766 square foot asset, which represented 4.4% of SLI’s annual income, had produced an annual return of 12.6% over the five-year period of ownership. However, the manager decided to realise profit from the asset after discussions with the occupier (TechnoCargo Logistics), on removing a break clause in the lease in 2020, revealed uncertainty on the tenant’s part over Brexit and their future logistics needs.

Due to the significant income that the asset represented in the portfolio, and the impact on earnings if the tenant did decide to execute its break option in 2020, the manager made a wise decision to sell.

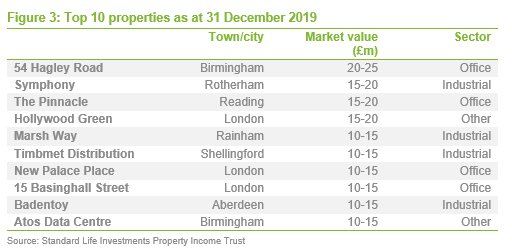

SLI quickly recycled the capital, buying an industrial unit in Badentoy North, Aberdeen, for £13.55m in December 2019, reflecting a net initial yield (the ratio of net rental income to the gross purchase price of a property) of 6.9%. The property is let to Schlumberger, the world’s largest oilfield services company, for a further eight years to break and 10 years to expiry. The asset also benefits from fixed rent increases in February 2020 and 2025, based on 2.75% per year compounded. Therefore, the purchase yield rises to 7.9% in February 2020 when the rental uplift comes into effect.

Buying commercial property in Aberdeen that is let to an oil company could be viewed as risky – however, the manager maintains that the fundamentals on this asset make it anything but. In Jason’s view, the risky segment of the Aberdeen real estate market is offices, which is often the area that oil companies scale back first in a market downturn. Industrial and storage warehouses, on the other hand, are usually retained. Then you have the tenant. Schlumberger is a huge global oil business, listed on the New York, Euronext, London and Swiss stock exchanges, and posted revenue of almost $33bn in 2018.

Furthermore, Jason highlights that Aberdeen itself has been reinvented to become a centre of excellence for not only oil and gas, but marine engineering and renewables, and boasts a huge off-shore wind farm. Supply of industrial space in Aberdeen is also at a relatively low level, having not witnessed the same scale of development as the office market, so supply/demand dynamics should be good. The property at Badentoy North has a site coverage of just 21%, giving SLI the option to develop a new industrial building of around 30,000 square foot on the site if and when market conditions were right.

Other significant portfolio transactions conducted in the past six months comprise the disposals of an industrial unit in Milton Keynes and an office in Staines and the acquisitions of an office in Edinburgh and industrial property in Trafford Park, Manchester.

The disposal in Milton Keynes is another example of the manager not wanting to take vacancy risk, citing the tenant as being one of the greatest income risks to the company. The tenant is an envelope-manufacturing company, which is operating in a market that is in decline. SLI sold the property for £9.3m – slightly below the June 2019 valuation.

The acquisition of the mixed-use office building Causewayside in Edinburgh is in the same mould as the fund’s largest asset 54 Hagley, in Birmingham, which it bought in late 2018. It is located just outside the core Edinburgh central business district in an area where rents are cheaper – at around the mid-teen per square foot mark, which is a significant discount to prime city centre rents. Like in Birmingham, if a congestion charge was introduced the building would probably sit outside of the congestion zone. The manager believes that if/when the congestion charge is enacted, some businesses would prefer to locate outside the zone, which will be supportive of rental growth. The property – which is let to Tesco and a pharmacy on the ground floor and has four floors of offices above, with one suite vacant on the fourth floor – was acquired for £8.7m, reflecting a yield of 3.2% which is expected to grow to 7.7% on expiry of rent-free periods and the letting of the vacant suite. SLI will undertake a small refurbishment of the vacant suite, upgrading the toilets, carpets and lighting. The manager says that the property has alternative use potential, including student accommodation and residential, providing further comfort.

The Trafford Park buy was at a yield and lot size that is usually too keen and too small for a normal SLI purchase, at 5.65% and £3.5m, but sits next door to an existing SLI holding and presents the company with significant long-term development potential. The asset, which is located in one of the best industrial estates in the UK, is let for a further nine years and at the next rent review in 2023 the yield is expected to grow to 6.9%.

Since the turn of the year, SLI has made a further sale, that of a single-let office building in Staines, west London. The 26,300 square foot building was sold for a net price of £10.7m after deducting the value of the outstanding rent free, reflecting an equivalent yield of 5.7%. The sale comes after SLI completed its asset management programme at the property. It negotiated a surrender of the previous tenant’s lease and re-let the whole building on a 10-year lease at a rent of £715,000 a year.

Performance

Performance

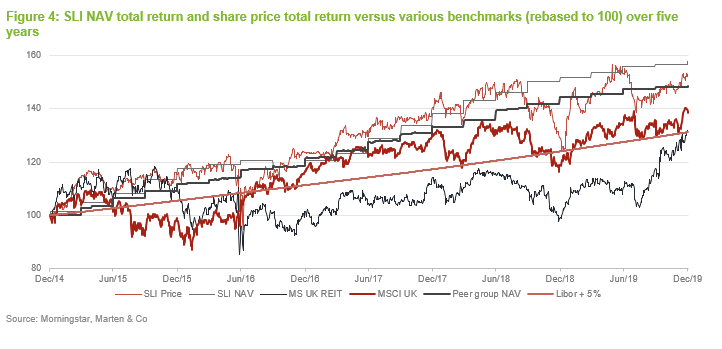

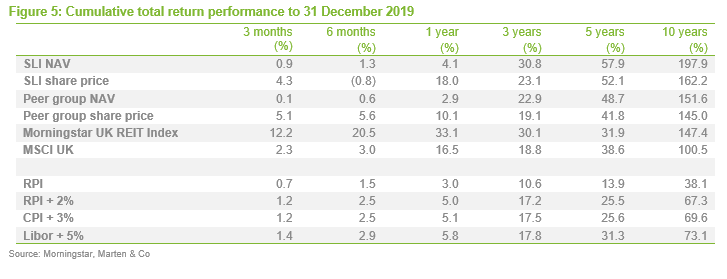

SLI’s NAV total return has, for all periods illustrated in Figure 5, beaten that of the peer group average. A similar pattern is witnessed for share price total return versus that of the peer group average, for all periods of one year and above. It is lower than the peer group share price total return average in the short-term comparatives.

For a strategy such as SLI’s, where assets tend to be held for the long term, longer-term periods are perhaps the most relevant when assessing the effectiveness of the strategy. In this regard, SLI has markedly outperformed the peer group averages, see Figure 5.

We have used the Morningstar UK REIT Index and the MSCI UK Index as comparators to SLI’s short and long-term performance and it has significantly outperformed both over a three-, five- and 10-year period.

From an inflation comparison, both SLI’s NAV total return and share price total return have been markedly ahead of inflation (as measured by both RPI and CPI) for all periods of three years and above. In Figure 5, we have used RPI, RPI + 2%, CPI + 3% and Libor + 5%. SLI’s superior long-term performance more than compensates for the variable returns in share price and NAV in the shorter term.

Premium/(discount)

Premium/(discount)

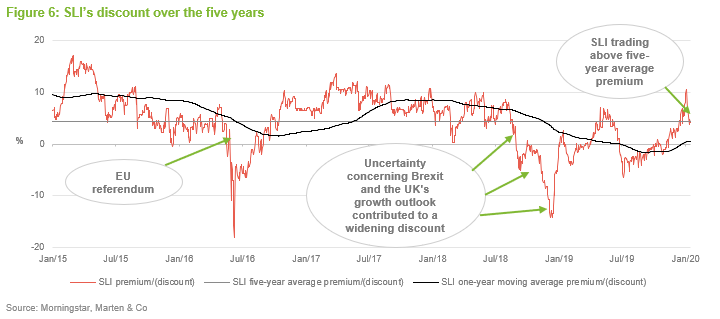

SLI has, for much of the last five years, traded at a premium to NAV (five-year average premium is 4.4%) and has only been interrupted on three occasions. First of all, SLI’s premium narrowed and then moved to a discount in the run-up to the UK’s referendum on EU membership in June 2016. Following the Brexit result, SLI’s discount reached a five-year high as the market became concerned about the outlook for commercial property values given the potential reduction in demand. However, SLI quickly returned to a premium as the market reassessed this outlook.

Then, as political tensions around Brexit escalated towards the end of 2018 (along with other market concerns) SLI once again moved from trading at a premium to a discount. This uncertainty continued into 2019. However, SLI’s discount began to narrow again as it became clear that parliamentary impasse would prevent the UK leaving on the 29 March 2019 as planned and was again trading at a premium by April 2019. SLI moved to a discount again in August 2019 as the likelihood of a no-deal Brexit heightened off the back of rhetoric from new prime minister Boris Johnson. The discount narrowed with no-deal Brexit seemingly off the table and returned to a premium following the Conservative party’s general election victory in December 2019. As at 12 February 2020, SLI was trading at a premium of 4.1%, which is in line with its five-year average. SLI’s premium is heavily driven by macro-economic sentiment. Therefore, with the terms and impact of Brexit still undetermined, it is quite possible that the premium could expand or even narrow and move to a discount in the months ahead.

Fund profile

Fund profile

SLI launched on 19 December 2003. It is domiciled in Guernsey, has a premium main market listing on the London Stock Exchange and, to maintain a tax-efficient structure, migrated its tax residence to the UK on 1 January 2015, when it also became a UK Real Estate Investment Trust (REIT).

SLI aims to provide investors with an attractive level of income, together with the prospect of income and capital growth. It aims to achieve this by investing in a diversified portfolio of UK commercial property. These are principally direct holdings within the three main commercial property sectors: office, industrial and retail although it can also hold assets in the ever-growing alternatives sector, with 7% of the portfolio currently in this sector.

The board and manager’s preference is towards properties that are in good, but not necessarily prime, locations, where it is perceived that there will be good continuing tenant demand. The manager also looks for properties where it can add value using asset management initiatives. There is also a focus on tenant quality but, as part of SLI’s strategy, tenants are treated as key stakeholders and the manager works closely to understand their needs. The aim is to achieve greater tenant satisfaction and retention and hence lower voids, higher rental values and stronger returns.

Previous publications

Previous publications

QuotedData published its initiation note on SLI, KYT (know your tenant), in July 2019. You can read this note by clicking on the link or by visiting QuotedData.com.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Standard Life Investments Property Income Trust plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.