Strategic Equity Capital – Focused on fundamentals

Focused on fundamentals

Focused on fundamentals

Just a couple of months ago, Strategic Equity Capital (SEC)’s NAV and share price were at an all-time high. However, since then the covid-19-related sell-off in markets has led to a flight to safety, to the detriment of smaller companies funds’ NAVs, and a widening of discounts. SEC has proved relatively resilient, however.

Jeff Harris and Adam Khanbhai, SEC’s managers, were confident in their portfolio ahead of the outbreak. The long-term economic effect of the measures being taken to stem the spread of the virus is hard to predict, but the effect on individual companies will vary greatly. For the bulk of SEC’s portfolio, we believe that SEC’s managers will see current market weakness as an opportunity to add to positions in companies that they know and like at attractive valuations. So, perhaps does the private equity industry. A bid for one portfolio company at the start of March might be the first of many.

The managers and the management contract are on the move. Jeff and Adam will boost the strategic public equity team at Gresham House and the AIFM will eventually be Aberdeen Standard Gresham House Investment Management Limited. Significantly increasing the resources available to support SEC.

Focused UK small companies portfolio

Focused UK small companies portfolio

SEC aims to achieve absolute returns over a medium-term period, principally through capital growth. SEC is managed with a focused portfolio of investments selected on the same basis that a private equity investor would use to appraise its investments.

A stronger asset management platform

A stronger asset management platform

On 27 March 2020, SEC’s board announced that the management contract for the trust had been awarded to Gresham House Asset Management Limited (Gresham House) and that the intention was to make Aberdeen Standard Gresham House Investment Management Limited, a proposed joint venture between Gresham House and Aberdeen Standard Investments, SEC’s AIFM in due course.

SEC had been managed by GVQ Investment Management (GVQIM or the managers) and its predecessors since launch (GVQIM was formerly GVO Investment Management and SVG Investment Managers). However, the board felt that SEC would benefit from greater resource than GVQIM could provide and decided to serve notice to GVQIM in the fourth quarter of 2019. The combination of Gresham House and Aberdeen Standard Investments increases the investment management and marketing resource available to the company.

Jeff Harris has been SEC’s co-lead manager since 7 February 2017 (having been assistant manager since 2014); alongside Adam Khanbhai, who became the co-manager at this point. Jeff and Adam are moving across to Gresham House as part of this deal and we think shareholders will be reassured that there will be no change to the portfolio or the investment approach as a consequence of the move.

The investment approach is summarised below and the process that the managers follow is more fully described on pages 8-11 of our July 2019 annual overview note.

Private equity style valuation techniques in public markets

Private equity style valuation techniques in public markets

The managers apply private equity techniques towards evaluating listed companies and seek to build a focused portfolio of predominantly UK listed stocks that they believe are undervalued and would benefit from strategic, operational or management initiatives.

This is an approach that has also been adopted by Richard Staveley, Laurence Hulse and Tony Dalwood, the managers of Gresham House Strategic, a £30m market cap investment company. Tony was part of SEC’s management team when it was launched in 2005. Gresham House Strategic is differentiated from SEC in that it is focused on micro-cap companies whereas SEC is focused on larger small caps, those that fall outside the mid-250 index (usually with a market cap below £300m). The implementation of MiFID II worsened the availability and quality of research on this part of the market and the managers believe that this contributes to some of these companies being mispriced.

Before making any investment, the managers carry out significant in-house research. At GVQIM they had the services of an Industry Advisory Panel available to them. A similar arrangement is in place at Gresham House where an Investment Committee will review the portfolio. The committee comprises Tony Dalwood, Richard Staveley, Ken Wotton (managing director of public equities at Gresham House) and, on completion of the joint venture, Peter McKellar (ASI’s global head of private markets), together with three external members: Tom Teichman, Bruce Carnegie-Brown and Graham Bird. More information on the committee is available on page 10.

Both Gresham House and Aberdeen Standard Investments have committed to trying to find buyers of ‘significant’ numbers of shares once the transition is complete and also, in Aberdeen’s case, once the joint venture is finalised.

There is no change to the management fee but the high watermark for the performance fee will be reset (which will still be payable only on benchmark outperformance over the next three years subject to a total fee cap of 1.4%). The new manager has agreed to waive all fees for the first six months of its appointment. This should cover all the costs associated with the change of manager, including any termination payment due to GVQIM. As a quid pro quo for the fee waiver, the board has agreed that notice cannot be served on the new manager until a year after its appointment and then for a notice period of six months.

We think that, given the continuity in the management team and investment management resource available to SEC, this is a good move. With the commitment to secure new buyers and, soon, the weight of the Aberdeen Standard Investments marketing machine behind the trust, the discount should narrow and, we would hope that the trust expands in time.

Brexit fears give way to covid-19 fears

Brexit fears give way to covid-19 fears

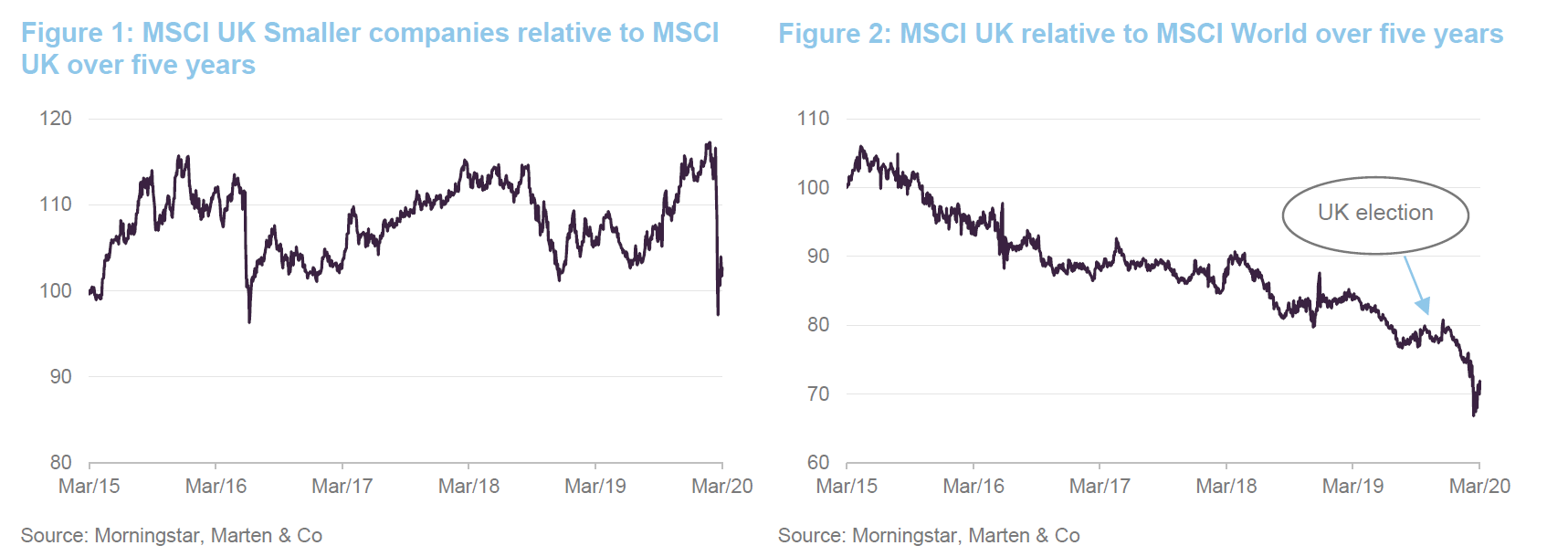

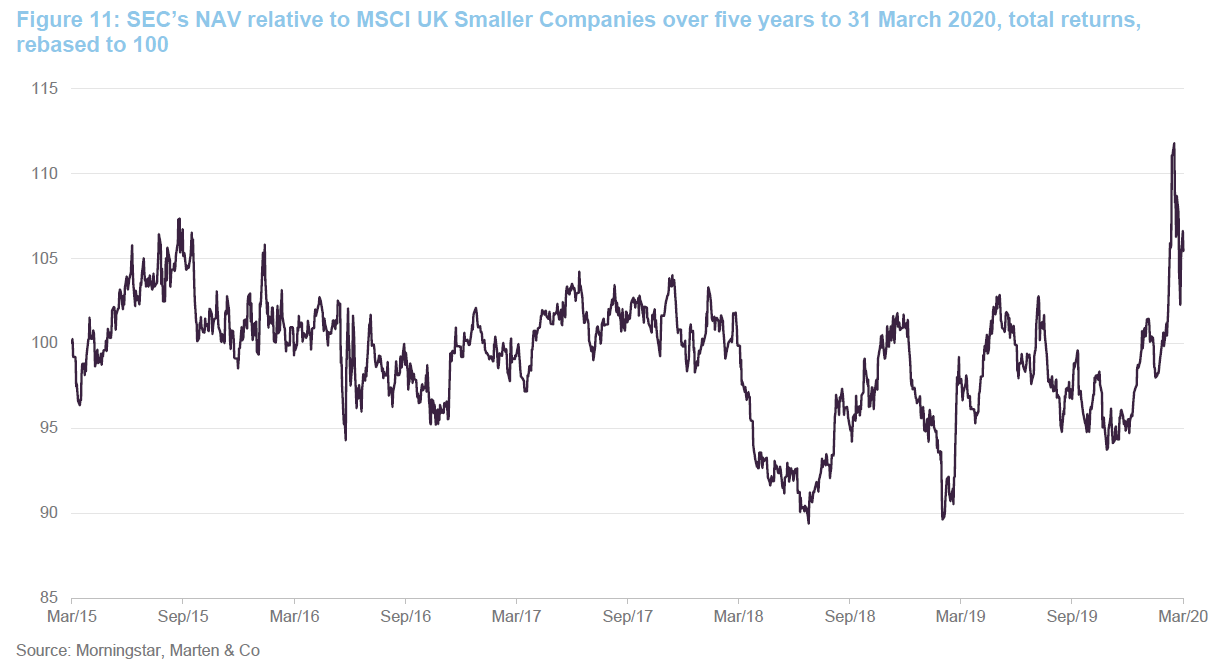

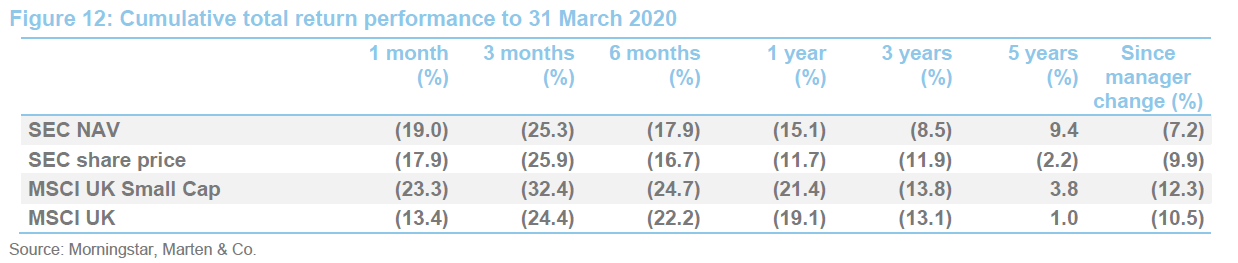

It has been an eventful three years since Jeff and Adam took the lead on managing SEC’s portfolio. Just a few weeks ago, SEC was riding high, but then covid-19 knocked markets. SEC has outperformed the MSCI UK Smaller Companies Index since the management change, but it has been a volatile ride for investors in UK companies, and smaller UK companies in particular.

UK equities remain firmly out of favour with global investors. The post-election ‘Boris bounce’ barely registers in Figure 2. The swift move to put a new fixed timetable on negotiations with the EU reintroduced the spectre of ‘no deal’, and this reduced the attractions of UK Plc to overseas investors. More recently, the pound has been very weak, especially against the dollar. Perhaps investors feel that the UK is relatively less-well-placed to weather the covid-19 storm.

The market’s focus on liquidity was sparked by the collapse of Woodford Investment Management (WIM). The managers note that many of WIM’s former positions were sold at distressed prices. They were able to take advantage of this to build stakes in some companies. The debacle illustrates the attractions of having a fixed pool of capital, as SEC does, versus an open-ended fund. This is being underlined in the current market environment.

Until panic set in around covid-19, UK small cap was outperforming large cap. However, within that, a growing aversion to illiquidity has depressed the valuation of smaller, small cap stocks relative to larger ones. Returns were influenced heavily by sentiment around Brexit. Small caps performed relatively well between summer 2019 and early March 2020, as hope rose that ‘no deal’ could be avoided and then the Conservatives won a landslide victory in the December election.

When we met the managers, ahead of the sell-off triggered by covid-19, they were already convinced that their stocks looked to be good value. The share price falls since should have deepened their conviction in the portfolio.

It is likely that many investors will sit on their hands for a while and see how things pan out, but it is perhaps worth pointing out that the private equity industry is sitting on record amounts of dry powder. The managers note a number of companies within the portfolio where they see a big discount between market value and the value indicated by their LBO valuation model. Evidence of this was provided on 3 March 2020 when Clayton Dubilier & Rice made an offer for Huntsworth (see page 6 in the attached pdf version).

Probably the most important thing to remember about SEC in the context of the current market turmoil is that this is very much a focused portfolio of stocks selected on their individual merits. Some of the attributes that the managers look for are a strong balance sheet and high cashflow generation. On this basis, whilst sentiment may be against it, the portfolio could be quite robust if the economy stalls for a while.

Asset allocation

Asset allocation

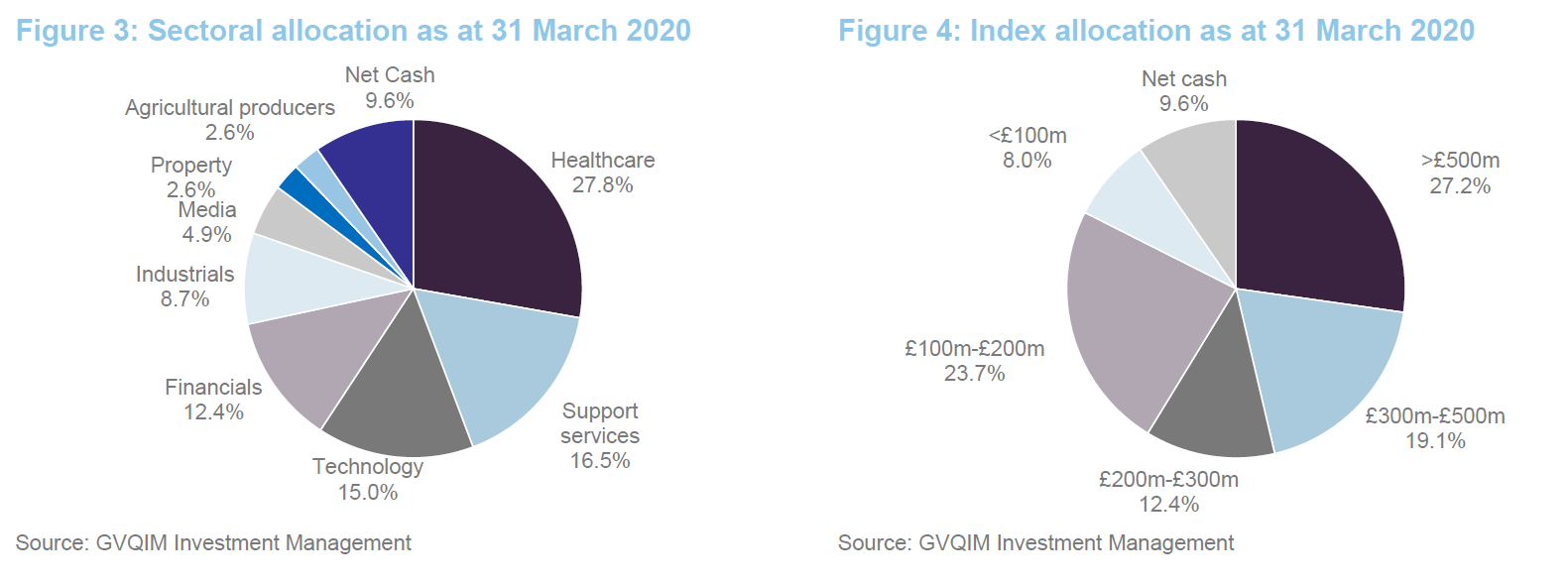

SEC held 21 stocks at the end of March 2020, up from 20 at the end of June 2019. The cash weighting has increased recently following a bid for Huntsworth and the sale of SEC’s position in Oxford Metrics Group.

The sector exposures are a product of stock selection, but it is interesting that the portfolio has a high allocation to healthcare (27.8% at the end of March versus an end February figure of 8.4% for the MSCI UK Small Cap Index – March data is not yet available).

Largest holdings

Largest holdings

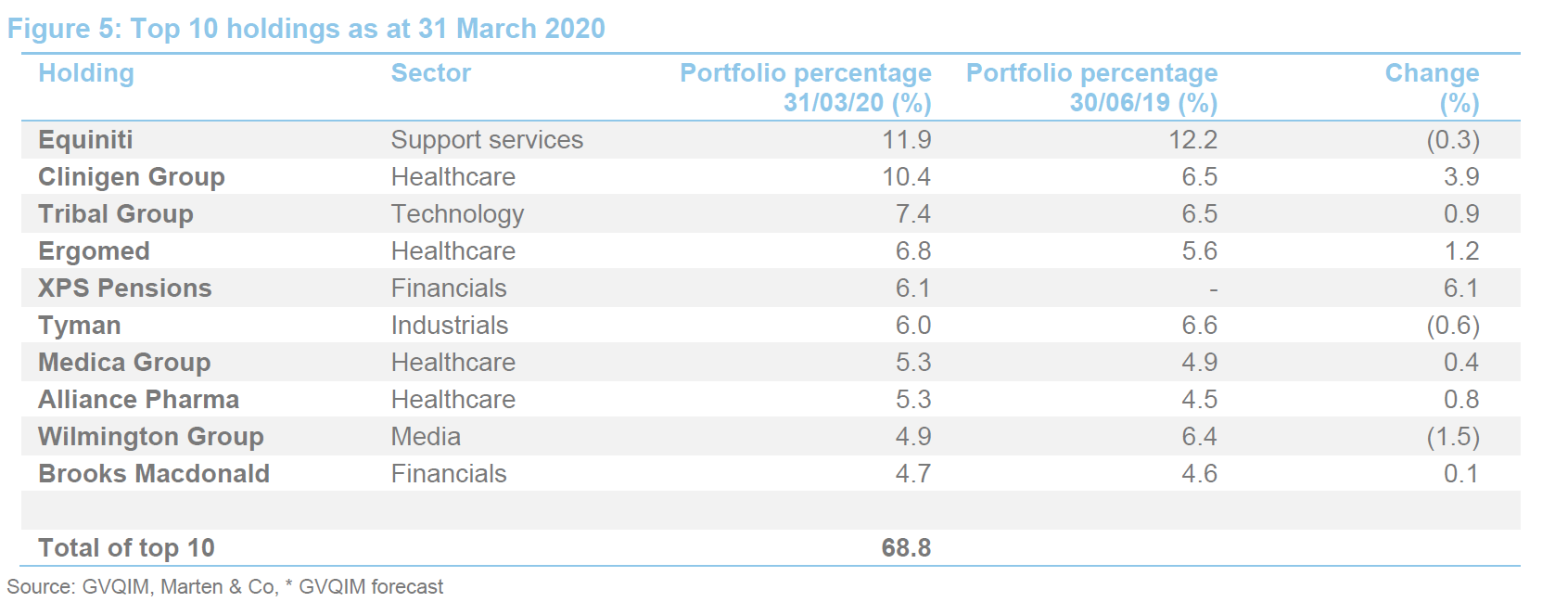

The Epiris bid for financial services firm IFG (formerly SEC’s largest holding), which was discussed in our last note, and profit-taking from former top 10 position 4imprint freed up capital to redeploy into six new investments in 2019.

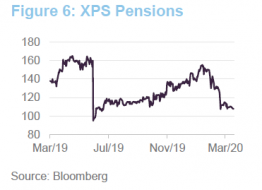

XPS Pensions

XPS Pensions

XPS Pensions (www.xpsgroup.com) was bought after it issued a profit warning in June 2019, triggering a 40% drop in its share price. Following 2017’s purchase of Punter Southall, the company is the UK’s largest pension consultancy. The managers say that it had been seen as safe and predictable investment. Guidance given to analysts about its earnings prospects by the then-CFO, turned out to be wrong. A new CFO was appointed with effect from 30 June 2019. The stock had been on the managers’ watchlist for a while. The share price recovery since SEC bought shares helped push the stock into the list of the 10-biggest holdings.

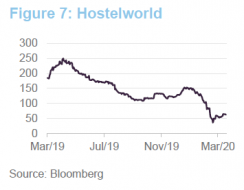

Hostelworld

Hostelworld

Hostelworld (www.hostelworldgroup.com) was an IPO in 2016. Its private equity backers had positioned the online booking platform as a growth stock. SEC did not participate in the IPO as the managers were uncomfortable with the stock’s valuation and the projected growth trajectory. After some initial disappointment, a new CEO and CFO were recruited and they reviewed the business. The conclusion was that Hostelworld needed to invest in its technology; this investment had a short-term negative effect on its results, however. The company was further compromised in investors eyes as it had been backed by Woodford Investment Management and Invesco, who ended up selling their stakes. In total, 60% of the register was turned over.

Hostelworld offered an attractive free cash flow yield of about 13%-14%. The managers had run a slide rule over it before the share overhang was placed and had already run the idea past SEC’s advisory panel. Looking long-term, it helps that SEC’s managers like the CEO, who came from Expedia. They think that it will take time to turn it around, but it is operating in a growing market and there is cash on the balance sheet.

In the short-term, all travel-related stocks have been impacted by the covid-19 outbreak. The managers are prepared to be patient. They say that SEC’s structure, as a closed-end vehicle, is a great help in this regard.

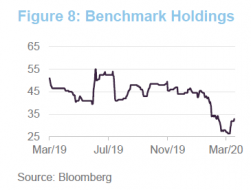

Benchmark Holdings

Benchmark Holdings

In the short-term, all travel-related stocks have been impacted by the covid-19 outbreak. The managers are prepared to be patient. They say that SEC’s structure, as a closed-end vehicle, is a great help in this regard.

Benchmark (www.benchmarkplc.com) was another Woodford holding. It is an aquaculture products business. Part of the business is based on salmon genetics i.e. selectively breeding high yielding fish with greater disease resistance. Benchmark is a leading player in this market. It also supplies nutrition products, including Artemia (a specialised live feed) predominantly for the shrimp farming industry.

These parts of the company are IP rich, cash generative, and generate good margins. However, its animal health division has consumed cash. A new sea-lice treatment could be launched this year or early next, which could be meaningfully positive, but the investment that it has put into developing vaccines for the aquaculture industry has not generated returns to date. It might be that it makes sense for Benchmark to exit this business and refocus on its core strengths. Peter George (Clinigen and Ergomed) is the new executive chairman, someone that the SEC team knows well and whom they trust to make difficult decisions.

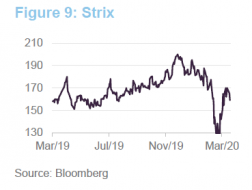

Strix

Strix

Strix (www.strix.com) makes heating elements for kettles. It is a cash generative business that IPO’d in the summer of 2017. Strix is a global leader in its niche, with a 38% global market share, and the SEC team think that there is room for it to improve its margins. A new manufacturing site in China is intended to help with this (the plant has been largely unaffected by the covid-19 outbreak). The business is cash generative, allowing for a 5% dividend yield and de-gearing. New products are in the pipeline. The company also has a water filtration brand, Aqua Optima.

Huntsworth

Huntsworth

Huntsworth (www.huntsworth.com) is a healthcare marketing and PR/public affairs business operating primarily in the US. The company has delivered reasonable organic growth and cash flow, and the managers thought that there could be an opportunity for consolidation within its sector. The stock had de-rated materially – it might be that investors felt that it was overly acquisitive and highly levered. The managers felt that the leverage was supported by the cash flow being generated by the company.

The managers were not alone in spotting the opportunity here. On 3 March, a company backed by Clayton, Dubilier & Rice made a recommended cash offer for the company at 108p per share. The managers sold stock following the bid, realising a 76% IRR on this investment.

The managers also sold SEC’s position in Oxford Metrics during the quarter, crystallising a 34% IRR on the position, equivalent to a 2.3x money multiple. The company develops and commercialises image processing and data location technologies. SEC first invested in December 2014 at 33p and made the last sale at 112p.

Performance

Performance

SEC has kept pace with the MSCI UK Small Cap Index over much of the last five years and, in the current sell-off, its portfolio is proving to be relatively resilient.

What is clear from Figure 12 is the effect of the widening of SEC’s discount on its share price returns and the relative strength of small cap versus large cap, until March at least.

Performance attribution

Performance attribution

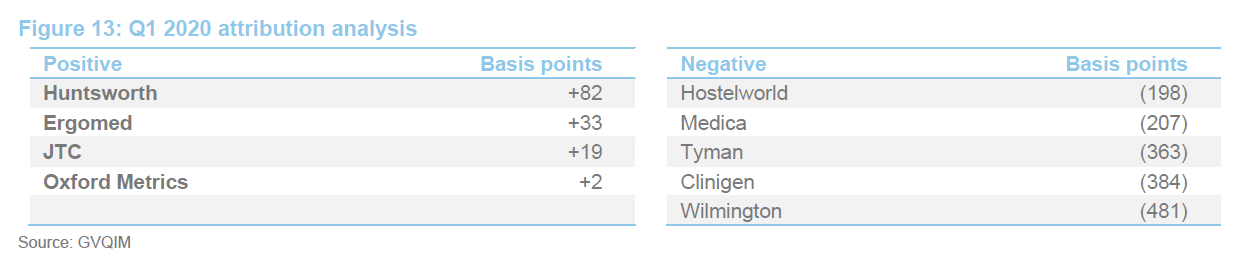

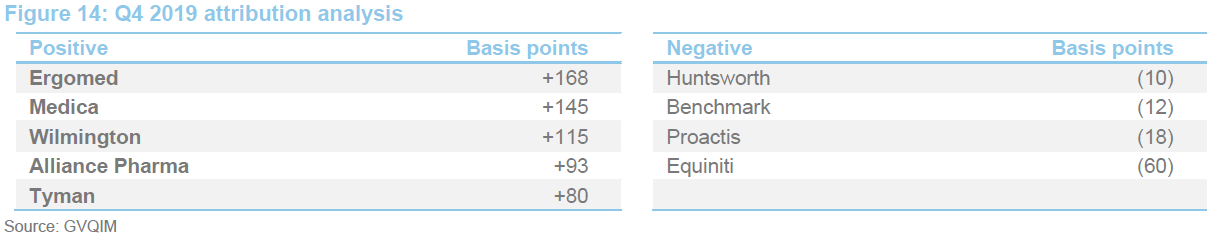

GVQIM produces quarterly performance attribution figures. We have reproduced three of these tables below, covering the nine months ended 31 March 2020.

Figure 13 is heavily influenced by the sell-off in markets, with only four stocks rising in value over the quarter. The bid for Huntsworth that we referred to on page 6 and, more importantly, the defensive characteristics of the portfolio have contributed to SEC’s outperformance of comparable indices over this period.

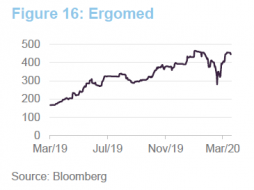

Ergomed is a clinical outsourcing business, helping drug companies develop and test new therapies. In a trading statement released in January it said that it expected a 26% increase in revenues for 2019 over 2018. More recently, it said it was supporting a study of siltuximab, an interleukin (IL)-6 targeted monoclonal antibody, for the treatment of patients with covid-19 who have developed serious respiratory complications. SEC initiated its investment in March 2018 at 190p in a founder placing. Ergomed has returned well over 100% and is one of the few listed companies to have a positive share price performance this year.

The managers note that Ergomed has strengthened its management team with new directors from a US company that was acquired. The position has been trimmed and sales that the managers have made to date have freed up all of the money that was originally invested.

Radiology analysis company, Medica also seems to be trading well, with a 19% increase in revenue for 2019. Wilmington said it is seeing improved organic growth. Its events business is likely to be impacted by covid-19, however.

It is worth highlighting the contribution from promotional products business, 4Imprint – the managers were taking profits on the position last year at prices above £30.

Clinigen’s share price recovered from the end of October but it has been hit hard in the current sell-off despite publishing strong figures for the second half of 2019. The managers believe there is a fundamental misunderstanding of the cash generation of Clinigen and have increased the holding significantly.

Peer group

Peer group

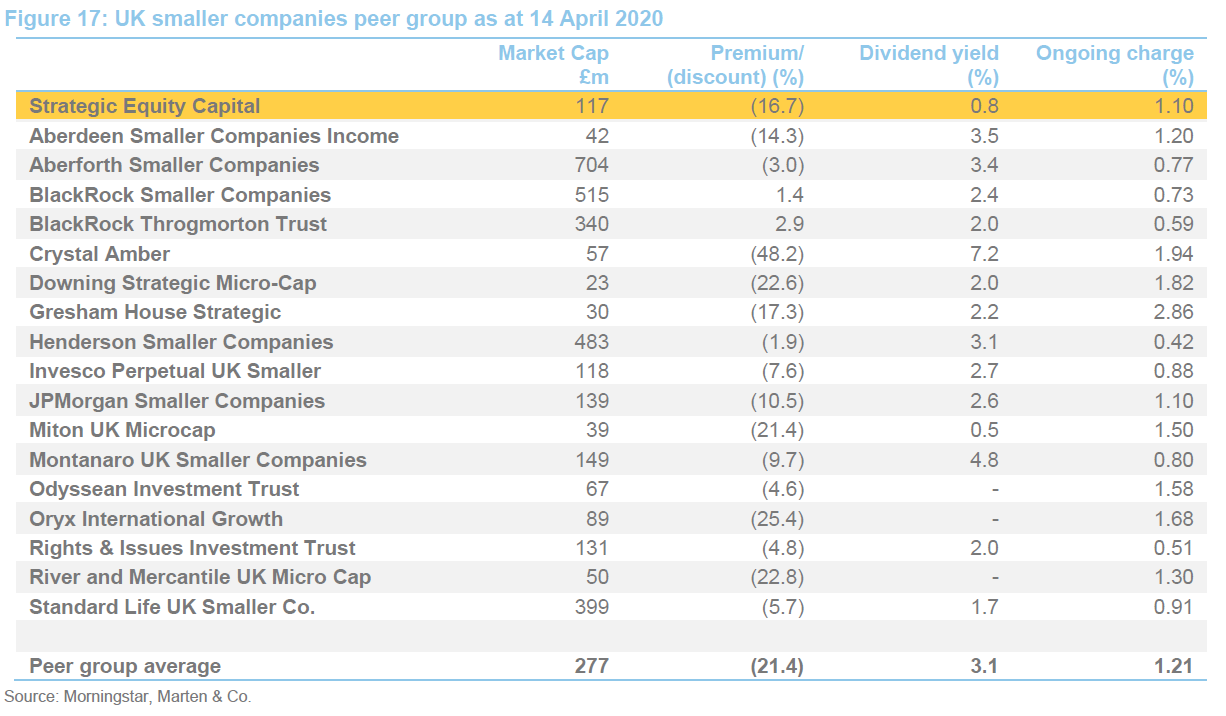

The AIC’s UK Smaller Companies sub-sector has 24 constituents. For the purposes of this note we have excluded split capital companies and those with a market cap less than £20m. We have also excluded Marwyn Value Investors, which has a very different investment approach to the rest of the peer group.

Discounts widened across the sector, but have narrowed from the worst levels. SEC’s discount is currently wider than the peer group average. SEC is not managed to deliver a high dividend yield. We would also note that SEC’s ongoing charges ratio is competitive, especially given its size.

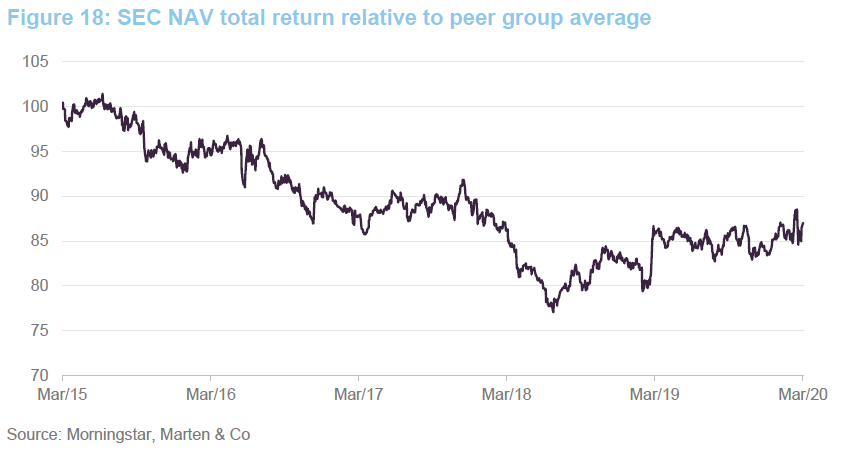

SEC’s performance has been improving relative to this peer group since the summer of 2018 as is evident in Figure 18.

Premium/discount

Premium/discount

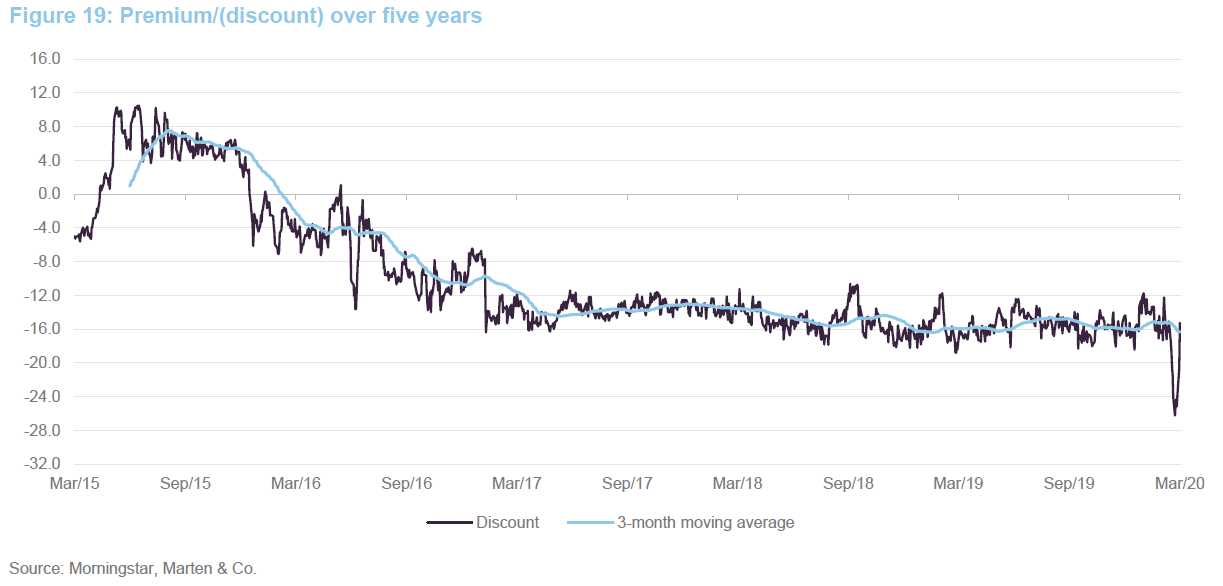

SEC’s discount has been very stable for a number of years, but spiked out briefly in the current market turmoil. Over the past 12 months, the discount has ranged between 26.2% and 11.8% and has averaged 15.7%.

Fund profile

Fund profile

Launched in 2005, Strategic Equity Capital (SEC) is a London listed investment trust that invests in a concentrated portfolio of predominantly UK-listed equities (typically 15–25 holdings), targeting an IRR of at least 15% per annum across the cycle.

SEC aims to achieve absolute returns over a medium-term period, principally through capital growth. SEC is managed with a focused portfolio of investments selected on the same basis that a private equity investor would use to appraise its investments.

SEC can invest in companies listed on other recognised exchanges, but this is limited to 20% of gross assets, at the time of investment, and the managers do not expect this to be a significant element of the portfolio. The approach is not constrained by any benchmark, has an absolute return focus and does not employ leverage at the investment trust level.

The new investment committee

The new investment committee

Thomas Teichman

Thomas Teichman

Thomas has 30 years’ VC & banking experience. He founded Spark in 1995 and was a former investment committee member at Brandt’s, Credit Suisse, Bank of Montreal and Mitsubishi Finance London. He was a start-up investor/director of lastminute.com, mergermarket.com, Kobalt Music (chairman), notonthehighstreet.com, ARC and MAID, amongst others.

Tony Dalwood

Tony Dalwood

Tony is CEO of Gresham House and an experienced investor with over 20 years in the industry. He has advised numerous public and private equity businesses. Since becoming CEO In December 2014, Tony has brought in a new management team that has transformed the company from an investment trust into an AIM listed specialist asset management group.

Tony started his career at Phillips & Drew Fund Management (later UBS Global Asset Management), one of the UK’s most prominent value investment firms with £60 billion in assets at its peak. He was a member of the UK Equity Investment Committee with responsibility for managing over £1.5bn of UK equities. Tony holds an MA in Management Studies from the University of Cambridge.

Richard Staveley

Richard Staveley

Richard entered fund management 20 years ago and is a Chartered Accountant. After initially starting at a hedge fund, he moved to Société Générale Asset Management where he was made head of UK Small Companies after becoming a CFA charter holder in 2002.

Richard then became a founding partner of River and Mercantile Asset Management in 2006, responsible for the top quartile performing UK Small company and UK Income Funds and helping grow the business to over £2bn AUM. In 2013 he joined Majedie Asset Management to initially co-manage and then solely run the small companies investments within the flagship UK Equity Service. These investments peaked at over £900m, while overall firm AUM doubled to £15bn during his tenure.

Ken Wotton

Ken Wotton

Ken is managing director, public equity at Gresham House and leads the investment team managing public equity investments. He is lead manager for LF Gresham House UK Micro Cap Fund, LF Gresham House UK Multi Cap Income Fund and manages AIM listed portfolios on behalf of the Baronsmead VCTs. Ken graduated from Brasenose College, Oxford, before qualifying as a Chartered Accountant with KPMG. He was an equity research analyst with Commerzbank and then Evolution Securities prior to spending the past 12 years as a fund manager at Livingbridge and now Gresham House specialising in smaller companies.

Bruce Carnegie-Brown

Bruce Carnegie-Brown

Bruce was appointed chairman of Lloyd’s of London, in June 2017 and is also chairman of Moneysupermarket Group and a vice chairman of Banco Santander. He was a non-executive director of JLT Group Plc from 2016 to 2017, prior to which he was non-executive chairman of Aon UK Ltd from 2012 to 2015, senior independent director of Catlin Group Ltd from 2010 to 2014 and chief executive for Marsh UK and Europe from 2003 to 2006.

Bruce was also senior independent director of Close Brothers Group Plc from 2006 to 2014. He previously worked at JP Morgan for 18 years in a number of senior roles and was managing partner of 3i Group Plc’s Quoted Private Equity Division from 2007 to 2009. He is president of the Chartered Management Institute.

Graham Bird

Graham Bird

Graham Bird was one of the founding employees of Gresham House Plc. He left GHAM in December 2019 but remains a member of the investment committee and is a consultant to the strategic public equity team. Graham joined Escape Hunt Group Ltd as its CFO on 6 January 2020 and became a non-executive director of SpaceandPeople Plc around the same time.

Graham is a chartered accountant, having qualified with Deloitte in London, and has worked in advisory, investment, commercial and financial roles. Prior to joining Gresham House, Graham spent six years in senior executive roles at PayPoint Plc, including director of strategic planning and corporate development and executive chairman and president of PayByPhone. Before joining PayPoint Plc, he was head of strategic investment at SVG Investment Managers, having previously been at JPMorgan Cazenove, where he served as a director in the corporate finance department. Graham holds an MA in Economics from the University of Cambridge.

Previous publications

Previous publications

Readers interested in further information about SEC, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note Discounted opportunity, published on 16 July 2019, as well as our previous update notes and our initiation note (details are provided below). You can read the notes by clicking on the links in Figure 20 or by visiting our website.

- Different, in a good way – Initiation – 27 January 2015

- Measured expansion on strong performance – Update – 16 July 2015

- Cashing up! – Update – 10 May 2016

- Business as usual – Update – 22 March 2017

- Quality small cap focus – Annual overview – 30 August 2017

- Confident, despite short-term setback – Update – 7 August 2018

- Discounted opportunity – Annual overview – 16 July 2019

The legal bit

The legal bit

This marketing communication has been prepared for Strategic Equity Capital Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.