Polar Capital Global Financials Trust – The tide has turned

The tide has turned

Having played a supporting role in the initial phase of the market’s recovery – breaking historical precedent in the process – financials, and banks in particular, have come back sharply since November. Polar Capital Global Financials Trust’s (PCFT’s) premium was recently at its highest level in more than five years, paving the way for share issuances. Banks were well-capitalised going into the pandemic, so the much-milder-than-expected impact on defaults to date, coupled with the prospect of economies gradually re-opening, is shifting the discussion forward to the potential impact of pandemic stimulus on inflation, and ultimately increases in interest rates. Meanwhile, distributions are returning and billions of dollars’ worth of loan reserves are being released.

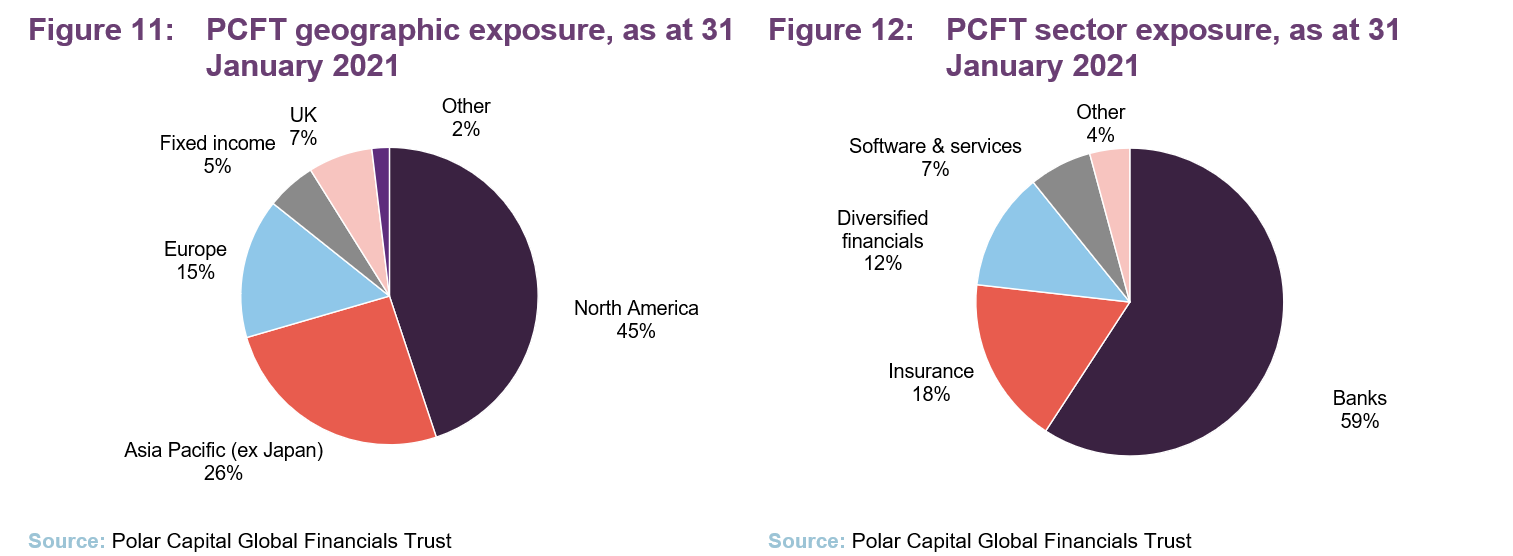

It is worth reiterating that PCFT has more strings to its bow than developed world banks. Asia ex Japan is now 26% of the fund and exposure to fintech payments companies like PayPal has been rewarded handsomely.

Growing income from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders, and fintech companies, as well as property and other related sub-sectors.

Market backdrop

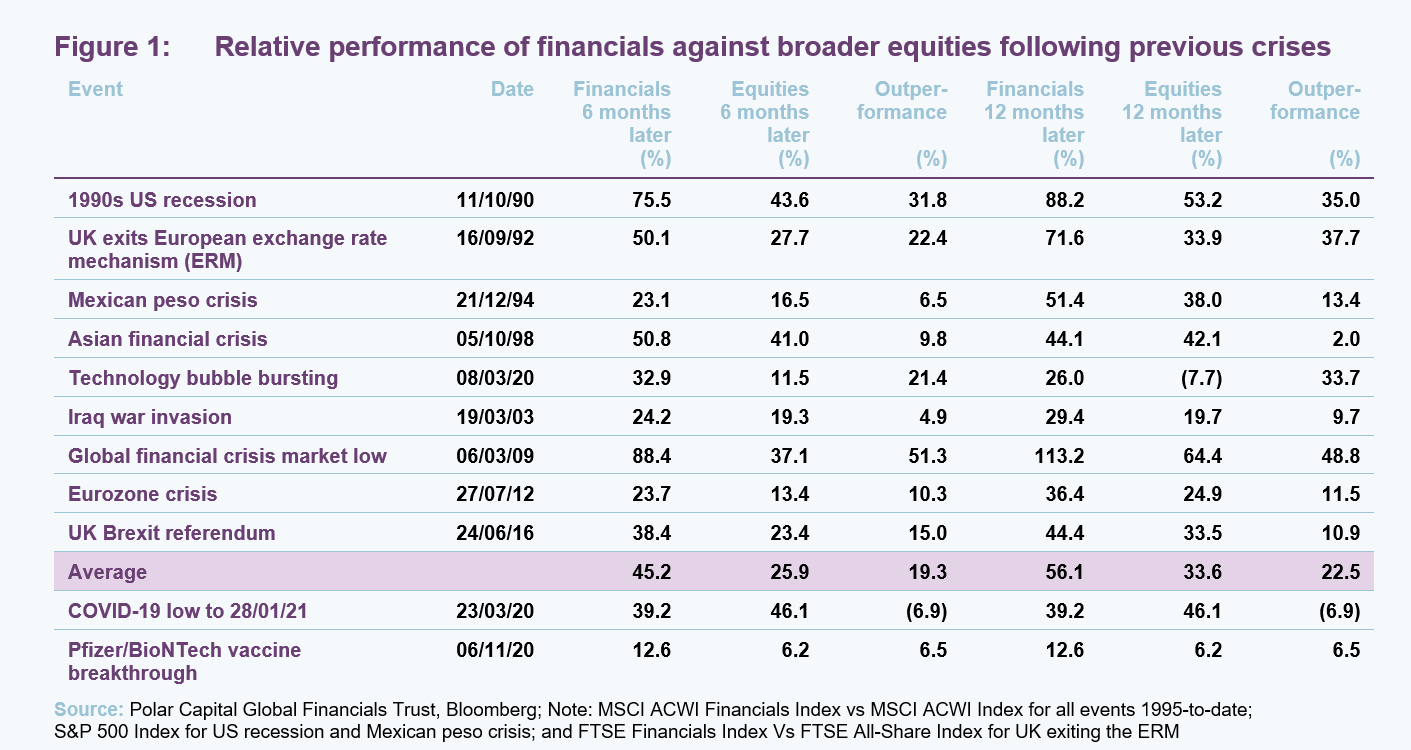

Underperformance of financials breaks historical precedent

The supporting cast role played by financials in shaping the market recovery over the latter half of 2020 broke precedent. In the wake of past crises, the sector has bounced back faster than the wider market. This is illustrated by Figure 1, which compares the performance of the sector against broader markets six months and one year after market lows that accompanied some of the most extreme market events of the last 30 years.

As we have discussed in previous notes, financials were already out of favour with investors before the pandemic struck. With the global financial crisis (GFC) of 2008–2009 still relatively fresh in the memory, the initial sell-off was disproportionately severe (banks were particularly hard hit). In effect, concerns over falling margins – as central banks slashed interest rates – and the potential for widespread loan losses, were judged to be more material than the considerable strides made in strengthening the US and wider global banking sector. Banks’ capital ratios were strong going into the pandemic, which – along with the de-risking brought about by much tighter regulation following the GFC – meant that any spill-over into another financial crisis was much less likely than might have otherwise been so. PCFT’s managers note that, unlike during the GFC, capital levels have continued to rise through the current downturn.

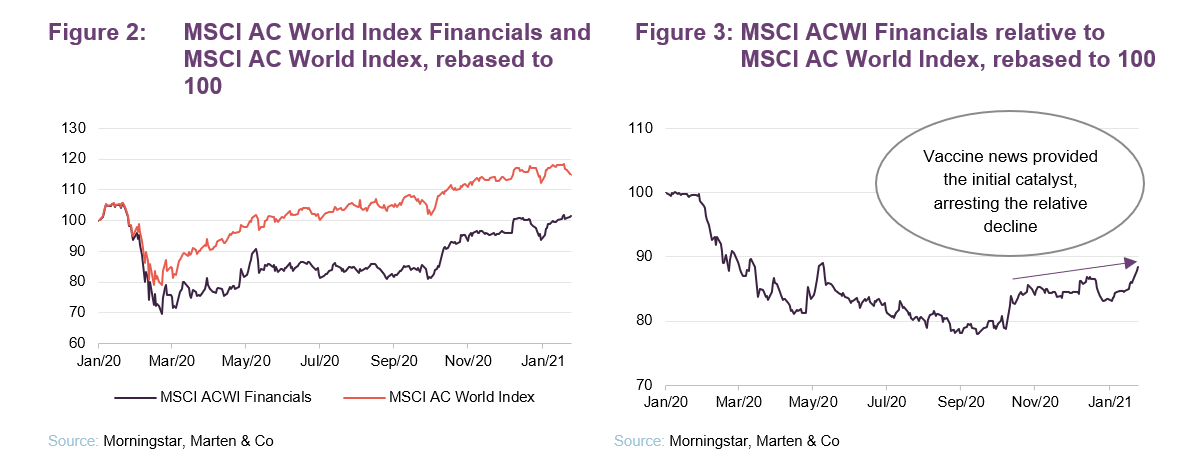

The tide began to turn in November 2020, as vaccine developments paved the way for a rotation back into sectors most aligned to the ‘economic reopening trade,’ like financials. The early improvement is captured by Figure 3.

On the valuation front, the fact that the global banking industry began 2021 by trading at around a 30% discount to book value, a level not seen since the GFC when the solvency of the entire financial system was in doubt, suggests that the rotation remains at an early stage.

Positive news in the period since our last note in October is paving the way for a steady resumption of capital distributions. The ECB has lifted its ban on dividends, though they must fall within 15% of earnings over the previous two years. A similar lifting of restrictions was announced in the UK, albeit at a 25% cumulative two-year earnings threshold.

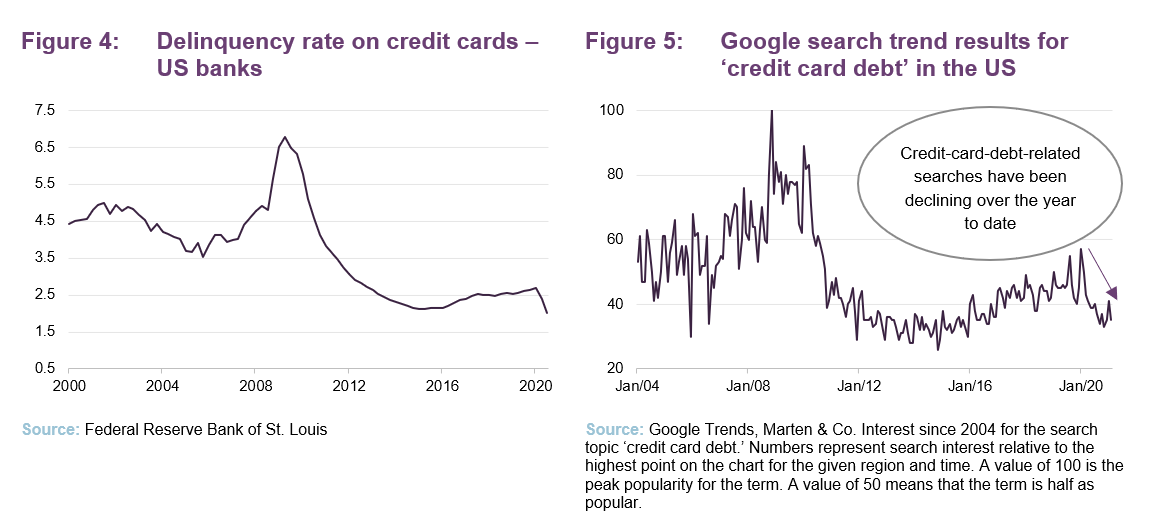

The bulk of the losses reported by banks in Europe and the US over the pandemic period stemmed from conservative provisions for bad loans. With credit performance having been considerably stronger than was widely anticipated, these provisions have been declining substantially. In January, it was announced that Citigroup, JPMorgan Chase, and Wells Fargo (the latter two are held by PCFT) had released more than $5bn in loan reserves. As we noted in our last note, if banks’ loss provisioning turns out to have been overly pessimistic, banks will have built up substantial excess capital that they could then return to shareholders.

We have updated Figures 4 and 6 from our last note. They show the delinquency rates on credit cards and commercial/industrial loans in the US. What seems clear from these charts is that, to date, despite the widespread disruption caused by the response to the pandemic, there has been no meaningful spike thus far. We have also used Google trends, in Figure 5, to show search results in the US for ‘credit card debt’ as a search topic to provide an alternative indicator with data up to February 2021.

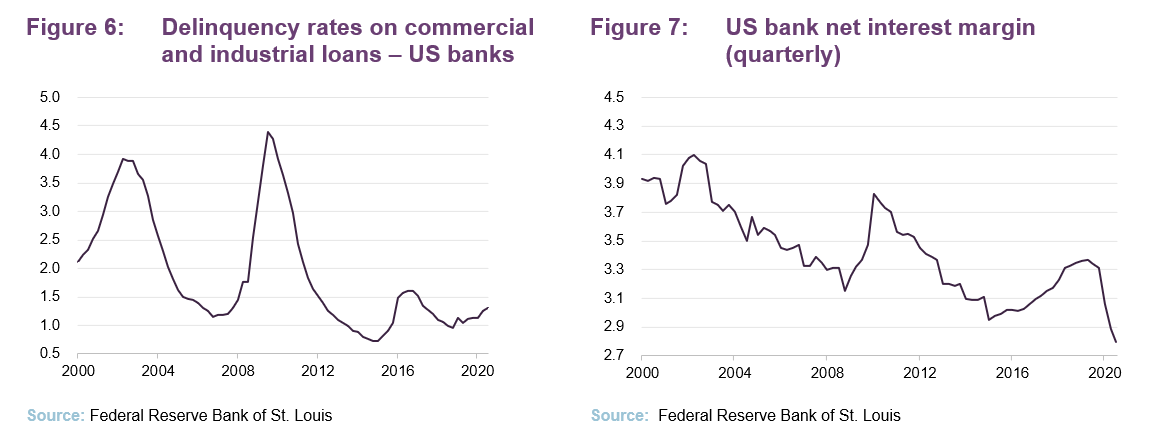

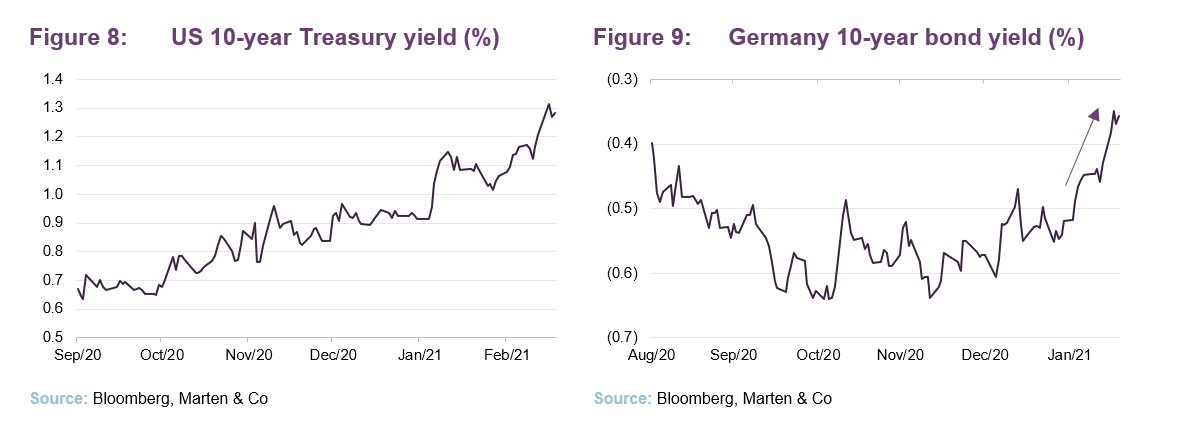

Bond market sell-off a good signal for banks

Perhaps the most significant catalyst for a sustained rally in bank shares began in February 2021. Recent developments in the bond market, which often foreruns trends in the stock market, have seen yields on 10-year government bonds (using the US and Germany as proxies) increasing apace. This is captured by Figures 8 and 9. The catalyst is the potential inflationary impact of government stimulus measures, especially in the US, where at the time of publication President Biden is awaiting approval from the Democrat-controlled Congress for a $1.9trn stimulus bill.

A rise in long rates provides scope for bank net interest margins to increase. Whilst the resilience of asset quality within the European and US banking sector will likely face greater tests over the next year or so, as governments gradually unwind support to corporates, the prospect of pent-up consumer demand being released could be supportive, as some of the companies in the sectors that have been worst affected by the pandemic start to recover.

Allocation to emerging markets grows to 28%

As we discuss in the following sections, PCFT provides a lot more beyond developed market banks. Exposure to Asia-Pacific (ex-Japan) has grown significantly over the past year and accounts for the vast majority of PCFT’s overall emerging markets (EMs) portfolio exposure level of 28%. Within Asia Pacific, disruption to economic activity has been far less pronounced. Supportive macro trends have benefitted financials, with the likes of China, South Korea and Taiwan exhibiting a strong recovery in exports.

The managers also see India as a compelling opportunity. Financials underperformed well before the pandemic, as a non-performing loans crisis squeezed credit growth. Valuations corrected accordingly and PCFT’s managers point to recent resilience and good loan growth. The announcement of India’s budget was also well received by markets. India’s HDFC Bank is the fund’s third-largest holding (see the asset allocation section).

The managers see EM banks providing an alternative to consumer stocks in EM as a play on middle-class spending. In several countries, including some of the fastest-growing such as Vietnam, more than half the population remains unbanked. Based on profitability metrics like return on assets (ROA), banks in EMs are often more profitable (HDFC’s ROA of 3.1% in 2019 was well ahead of Lloyds’s 0.4%), benefitting from more dominant market positions, which help to drive up margins.

M&A

Concerning M&A, the managers say that activity has been restarting. In the US, where there are still over 5,000 banks, deals are mainly taking the form of mergers with stronger banks absorbing weaker ones. More generous use of goodwill has been allowed, to help rubber-stamp deals.

Fintech investments aligned with COVID-19 shift

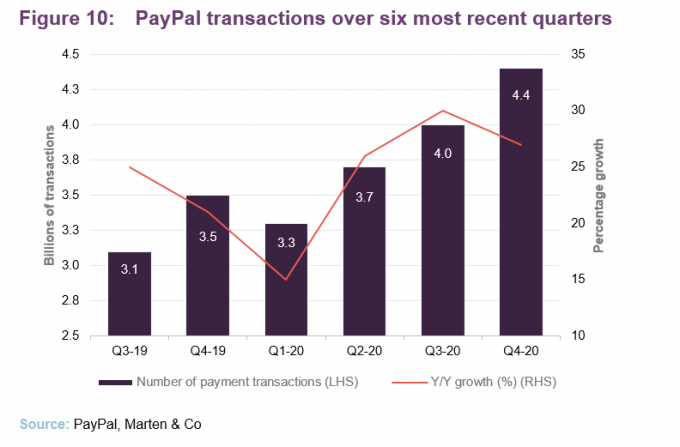

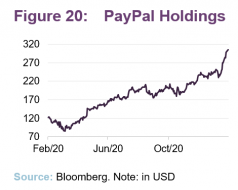

As at 31 January 2021, 59% of PCFT’s portfolio was allocated to banks. At about 10%, fintech now represents a significant part of the fund. The exponential growth in e-commerce globally has fuelled the growth of payments companies like PayPal. PayPal, which is discussed in more detail in the attribution section on page 12, saw its net new active accounts more than double between January and April 2020. Growth in the number of payment transactions it facilitated, shown in Figure 10, further demonstrates how transformative the pandemic has been.

Insurance

PCFT’s exposure to the insurance sector stood at 18% (14% non-life /4% life) at the end of January 2021, down from 20% when we last published (September 2020 figures). COVID-19 is expected to result in the largest insured loss in history. For example, in the UK, The Supreme Court ruled on 15 January that businesses were eligible to claim for COVID-related losses under their ‘business interruption’ policies. While such losses are material, PCFT’s managers say that the losses will transpire as an earnings event, not a balance sheet one, for the companies affected.

Following a period of severe insured losses, it is typical to see a significant increase in insurance premiums. Polar believes that COVID-19 has given fresh impetus to the insurance pricing cycle. It points to companies such as Marsh McLennan, the world’s leading insurance broker, which managed to deliver revenue growth and a higher dividend for 2020. Indeed, the non-life sector bell weather stock – Travelers – led a generally impressive reporting season from this area of financials.

Asset allocation

At the end of January 2021, there were 79 positions in PCFT’s portfolio (up from 75 at the end of September 2020 – the data we used in our last note) and the vast majority of these (more than 85%) had market caps greater than $5bn. The managers have increased the portfolio’s allocation to these larger cap holdings over recent months.

Shareholders approved an increase in the maximum level of gearing (from 15% to 20%) earlier this year. At the end of January 2021, gearing was 11.2%.

A clear trend in PCFT’s geographic asset allocation over the past 15 months has been the increase in the portion in Asia ex Japan, which as at 31 January 2021, had grown to more than a quarter of the portfolio. This represents a 10% increase on the allocation at the end of 2019, with most of this coming from the North America bucket.

At the sector level, exposure to banks is back up to 59%, from 48% at the end of September 2020. The managers trimmed some of the fintech-focused holdings, following strong performance, while the allocation to insurance is down slightly. Whilst not figuring in the top 10, the proportional weight of some of PCFT’s mid-cap bank holdings has increased on the back of the election result and vaccine news.

The fixed income element of the portfolio was 5.4% of the fund. It helps to bolster PCFT’s revenue account, which has been particularly useful over the past year.

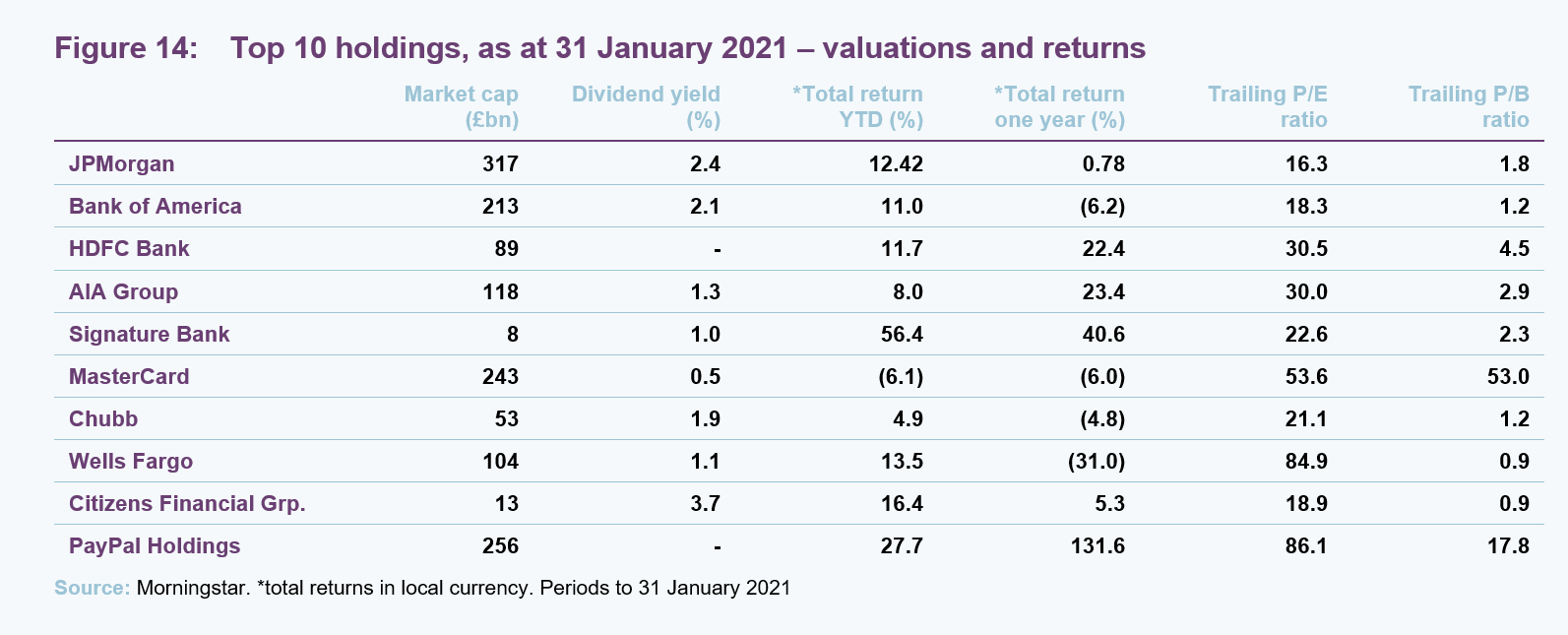

Top 10 holdings

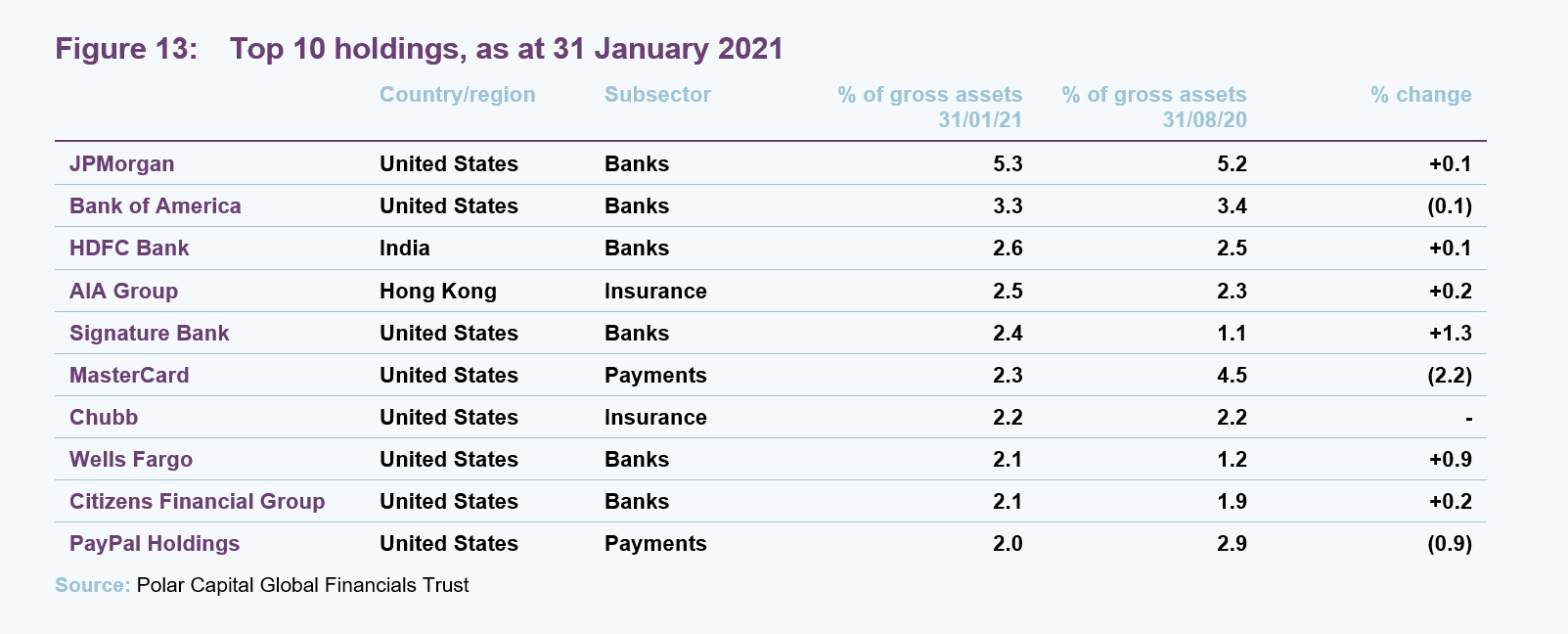

Three holdings – Signature Bank, Wells Fargo, and Citizens Financial Group – have moved into the list of the top 10 since we last published, replacing Marsh & McLennan, Toronto Dominion and PNC Financial Services.

Wells Fargo and Citizens Financial have been discussed in previous notes (see page 18 for a list of these).

The managers increased the holding in New York-focused Signature Bank, which has seen its shares nearly double over the past three months. They note that it is one of a number of their small and medium-sized US banks that has been reporting extremely high levels of loan growth.

Signature Bank reported record fourth quarter net income, growing deposits as well as its loan book. It also reported success in building its West Coast operations.

Some profit was taken on PayPal Holdings (discussed in the attribution section). MasterCard’s weight decreased by 2.2% – it faces a £14bn class-action lawsuit in the UK over ‘interchange fees’, which are levied on retailers and frequently passed on to end-consumers. A decline in total spending volumes and weak cross-border travel, which generate higher margin fees, has also weighed on the company.

Outside of the top 10, the managers have been able to source attractive yields from the Nordics. Switzerland has also been a relatively attractive market.

Performance

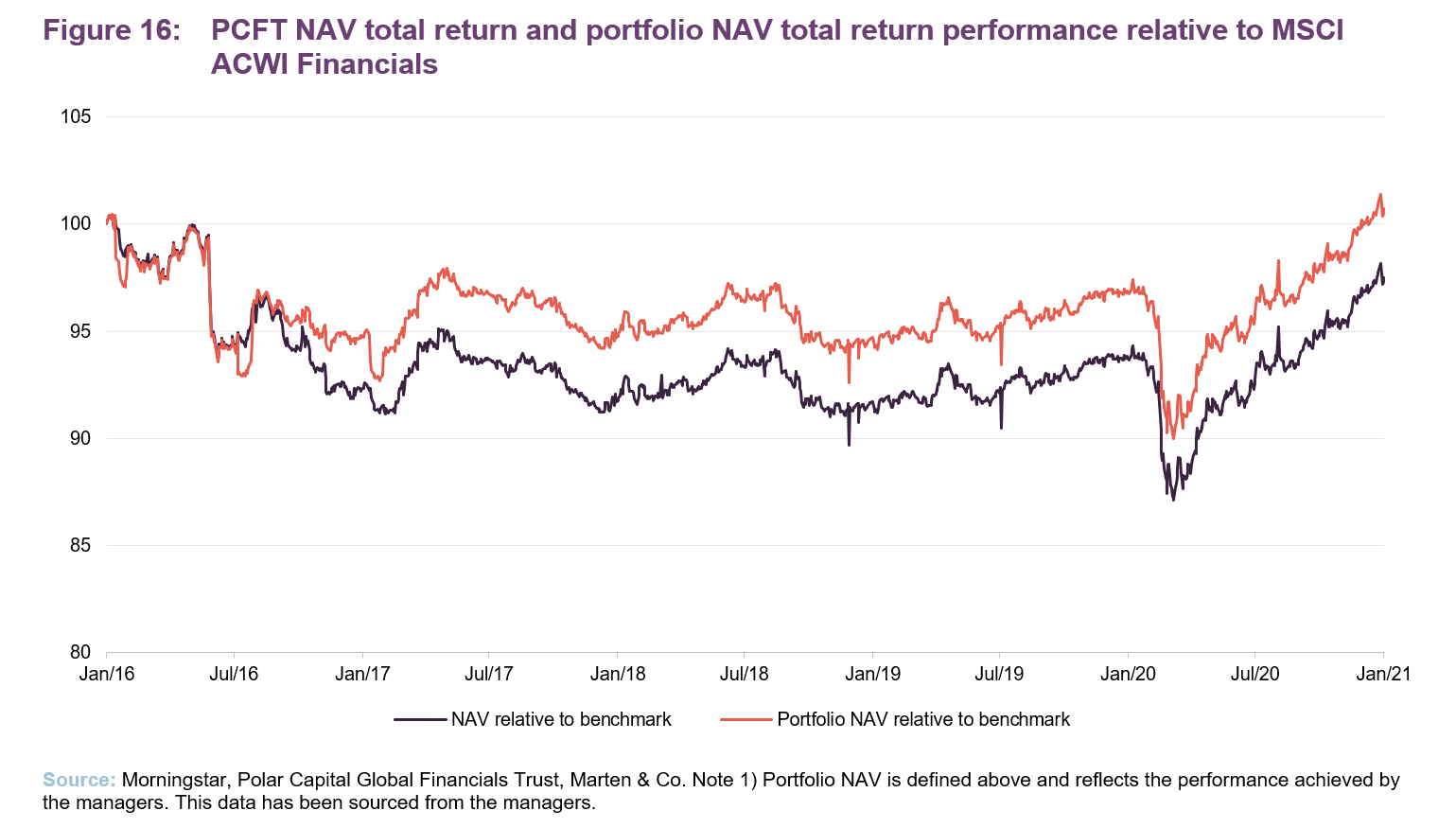

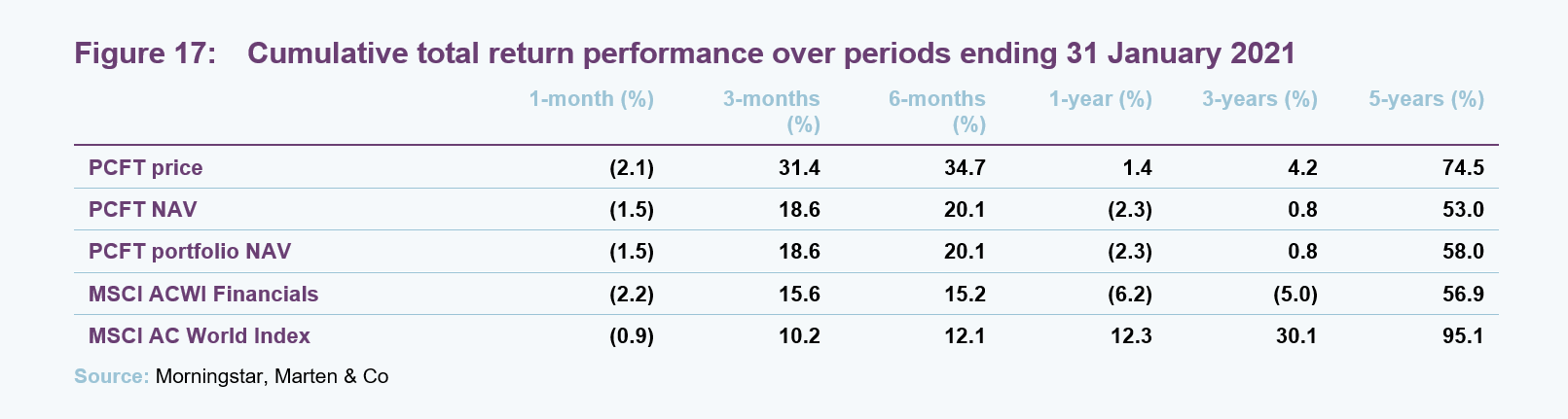

The chart in Figure 16 and the table in Figure 17 show returns both for PCFT’s IFRS NAV and also a ‘portfolio NAV’ which strips out the effects of the dilution attributable to PCFT’s subscription shares (which were exercised in 2017). The portfolio NAV gives a better indication of the returns achieved by the managers.

The trust’s gearing magnified the market’s fall in February/March, but performance has recovered since. Looking at the five-year chart, PCFT lagged MSCI ACWI Financials until the Spring of 2017 (held back largely by an underweight exposure to the US at that time) and its relative returns have been fairly stable since. The table in Figure 17 shows the relative outperformance of financials against global stocks over the six months to 31 January 2021.

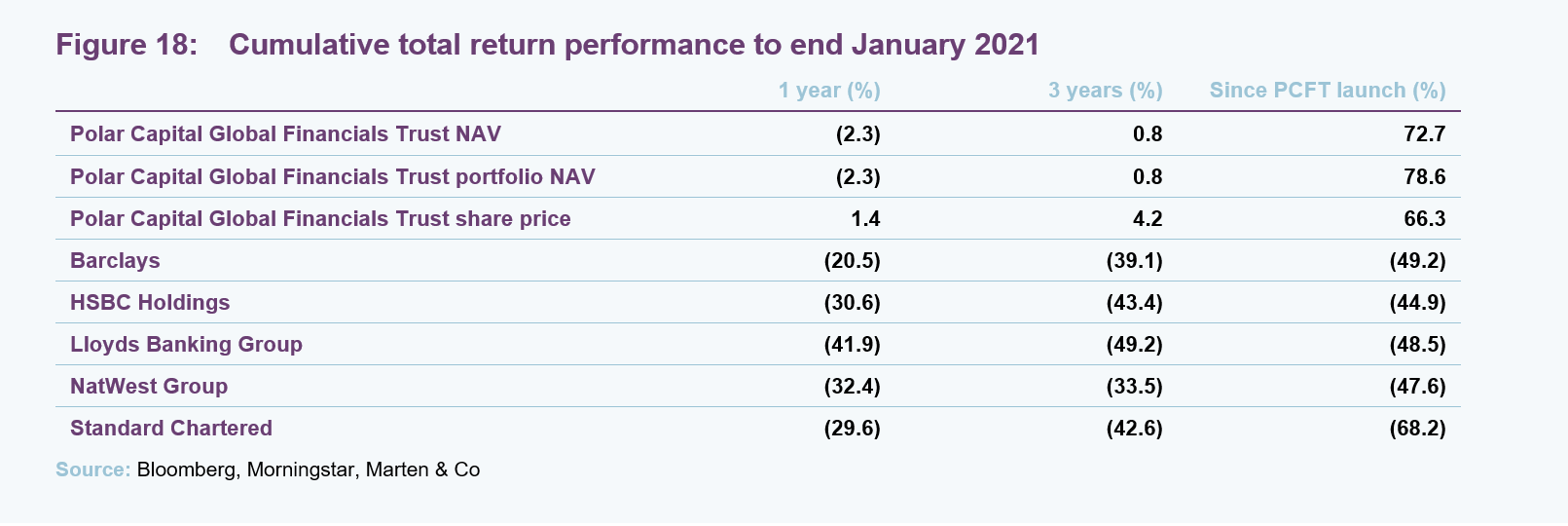

In our earlier notes, as well as the comparisons with indices, we have compared PCFT’s performance with that of the major UK banks, and we have updated this information in Figure 18. One of the drivers behind the launch of PCFT in 2013 was that it would provide UK-based investors with a relatively lower-risk exposure to the financial sector. Since then, PCFT has delivered returns well ahead of all of the major UK banks.

Performance attribution

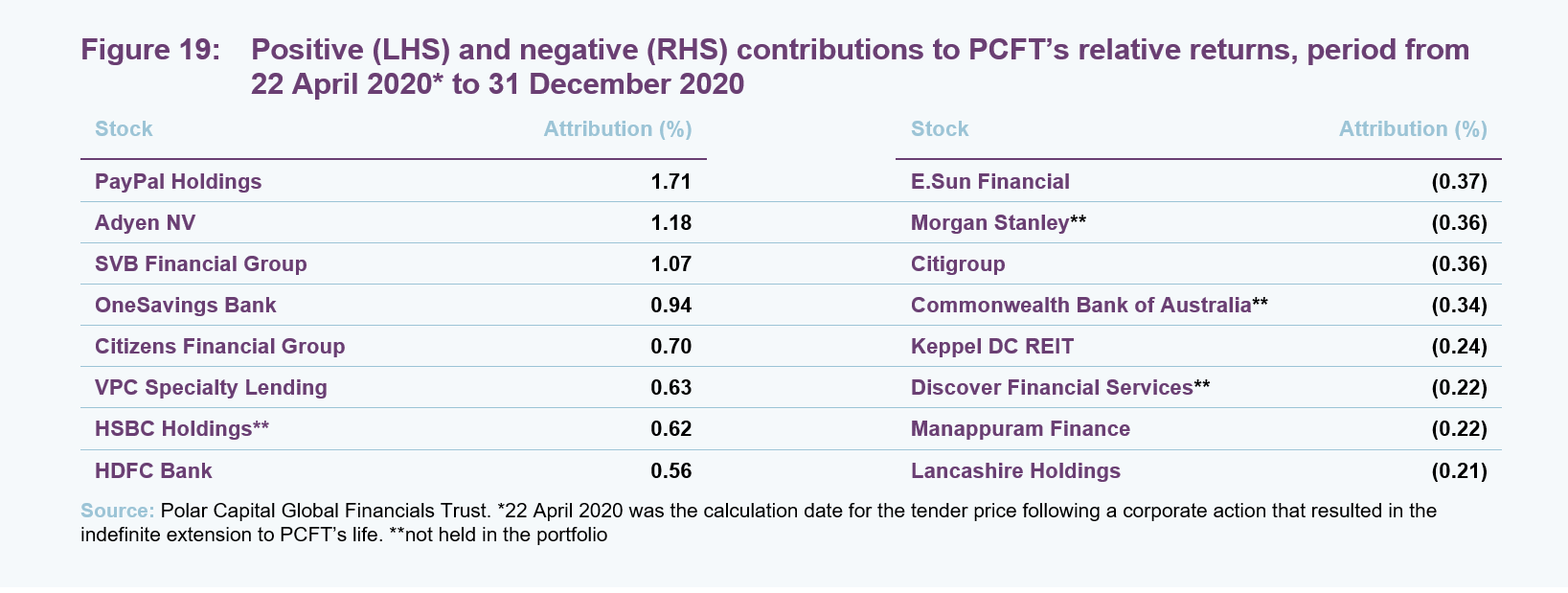

The manager supplied us with some performance attribution data that covers the period from 22 April 2020 to 31 December 2020. Performance has been broad-based and stock selection has positively contributed to performance.

PayPal Holdings

As Figure 10 on page 7 showed earlier, PayPal Holdings has been growing almost exponentially. In a presentation to investors over February, the company said it expected many of its key metrics, from the number of active accounts to

annual revenues (currently $26bn), to double over the coming five years. It has been bringing in new features such as ‘Buy Now Pay Later,’ an interest-free instalment option, and the integration of cryptocurrencies that can be held in its app (cryptos could ultimately be used to transact with merchants).

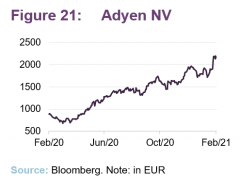

Adyen NV

Netherlands-based Adyen NV, also a payments-focused company, has similarly been a major beneficiary of the enforced en masse digitalisation. The company provides end-to-end infrastructure that connects directly to the likes of

Visa, MasterCard and a range of other payment methods. Reflecting the valuations ascribed to tech ‘winners’ currently, Adyen NV currently trades at a trailing P/E ratio of 281. As was the case with PayPal Holdings, PCFT’s managers reduced the holding in Adyen NV over recent months.

Elsewhere, as a tech-focused commercial bank, SVB Financial Group has also found conditions very suitable. We covered OneSavings Bank in our most recent annual overview note (see pages 5 and 10 of that note).

Detractors

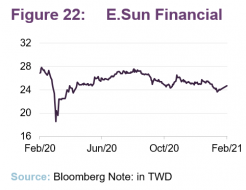

Not holding Morgan Stanley, Commonwealth Bank of Australia and Discover Financial Services was a drag on performance. Amongst stocks held, Taiwan-based

E.Sun Financial and Citigroup were the largest detractors.

Peer group

PCFT’s listed peer group is eclectic and provides a poor comparison. PCFT’s reports tend to compare the trust with the average of the Lipper Financial sector. Over the period from the date of the reconstruction of the portfolio on 22 April 2020, following the exit opportunity, to 6 January 2021, PCFT’s NAV total return was 9.2% ahead of the average of the 56 open-ended funds in the Lipper sector. PCFT’s outperformance extends to 25.8% when the comparison period is extended to cover the period from its launch in July 2013.

Dividend

PCFT pays dividends semi-annually on its ordinary shares in February and August. All dividends are paid as interim dividends. The payments are not necessarily of equal amounts. The company does not pay a final dividend.

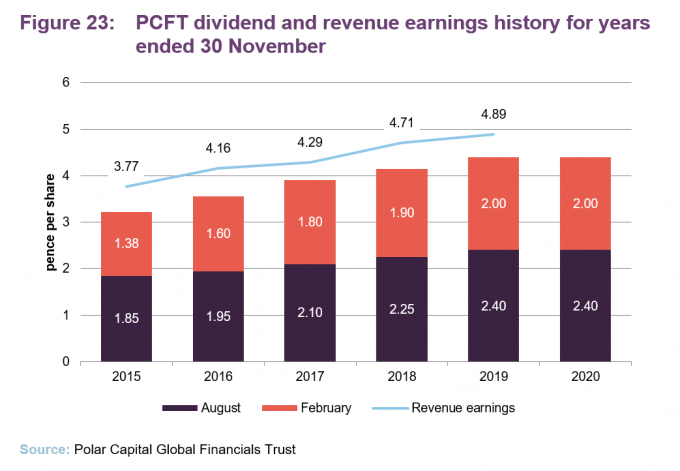

The chart in Figure 23 shows PCFT consistently paying dividends that were covered by revenue. This allowed it to build up a sizeable revenue reserve which stood it in good stead when COVID-19 triggered the suspension or cutting of many dividends. In addition, as an amount per share, the reserve grew significantly following the tender offer.

Over the first half of the company’s accounting year, the six months ended 31 May 2020, PCFT’s net revenue per share roughly halved (from 3.09p to 1.57p). Nevertheless, the board – comforted by the level of reserves – felt able to maintain the interim dividend and commit to at least maintaining the final dividend. More information on the revenue reserve and PCFT’s policy for dividend growth can be found on page 14 of our most recent annual overview note. On 23 February 2021, PCFT published its results for the year ended 30 November 2020.

Premium/(discount)

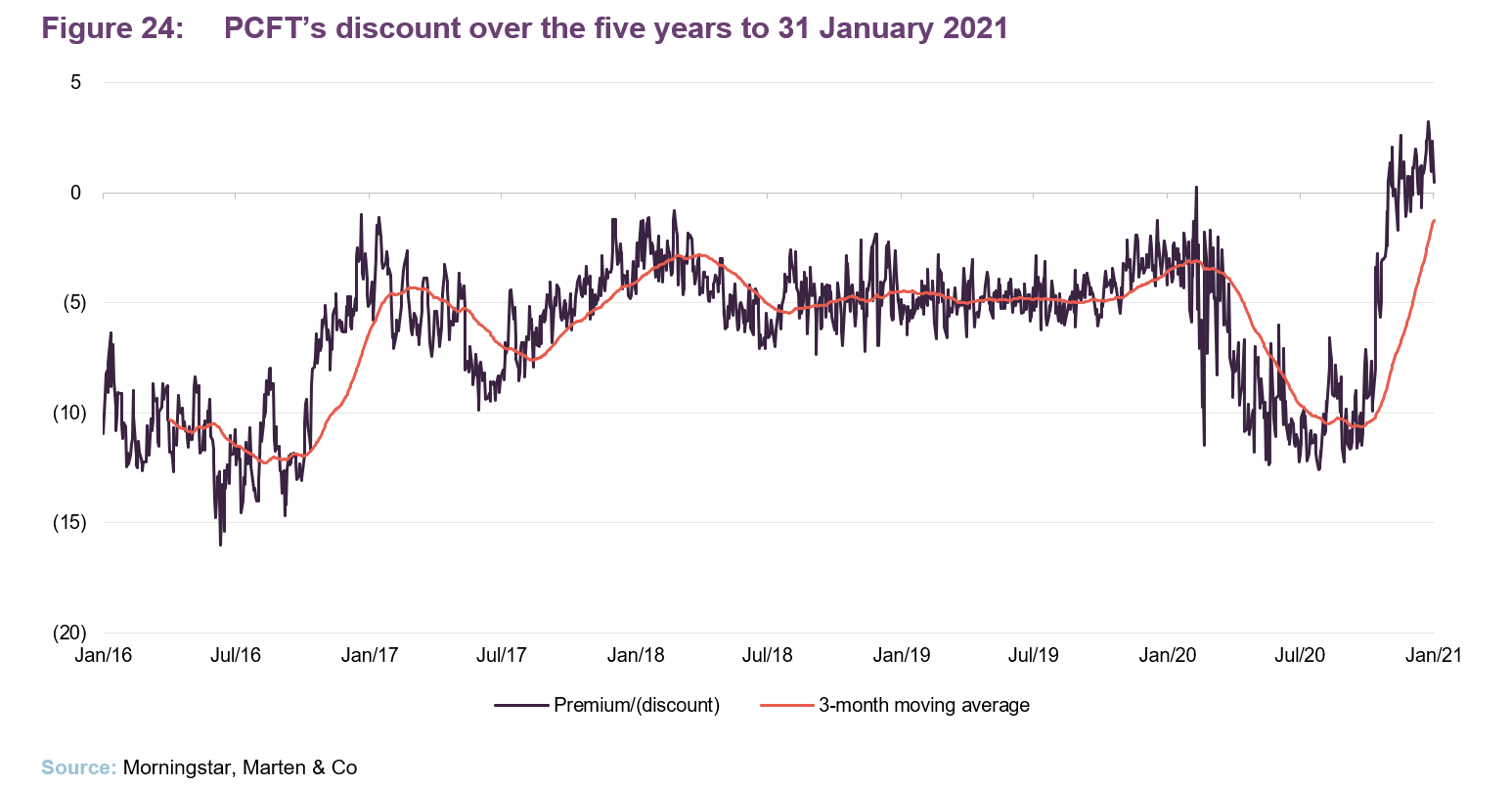

Over the year to the end of January 2021, PCFT’s share price has moved within a range of a 12.6% discount to a premium of 3.2% and has traded at an average discount of 6.4%.

Figure 24 perhaps illustrates the shift in sentiment towards financials and banks in particular, since the good news on vaccines in November 2020. As at 22 February 2021, PCFT’s shares were trading at a 0.7% premium to NAV. When we last published on PCFT, in October 2020, the discount was over 10%. We said then that investors might look back and realise that this was an attractive entry point.

For those who bought then, congratulations. If you missed out, having received permission from its shareholders to disapply pre-emption rights on the shares held in treasury, PCFT is issuing shares at a small premium to NAV. It is doing this on a regular basis to help moderate its premium. Such issuances enhance the NAV for existing investors, increase liquidity and help lower the trust’s ongoing charges ratio as fixed costs are spread over a wider base. By preventing the premium from becoming excessive, PCFT is helping to reduce the volatility of its share price.

Fund profile

Polar Capital Global Financials Trust (PCFT) launched on 1 July 2013. In April 2020, shareholders approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life but with five-yearly tender offers, the first of which is scheduled for 2025.

The trust’s twin objectives focus on growing investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

From April 2020 onwards, the trust’s performance benchmark is the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials). A history of earlier benchmarks is given in previous notes

(see page 18). We have used MSCI ACWI Financials for comparison purposes in this note.

PCFT’s AIFM is Polar Capital LLP and the lead managers are Nick Brind, John Yakas and George Barrow.

Management

The seven-strong financials team at Polar Capital LLC (four fund managers and three analysts) was managing approximately £1.7bn, as of January 2021. PCFT is one of five funds for which the team has direct responsibility.

Nick Brind

Nick joined Polar Capital following the acquisition of HIM Capital in September 2010, and is the manager of the Polar Capital Income Opportunities Fund and co-manager of PCFT. He has 25 years’ investment experience across a wide range of asset classes including UK equities, closed-end funds, fixed-income securities, global financials, private equity and derivatives. Before joining HIM Capital, Nick worked at New Star Asset Management. While there, he managed the New Star Financial Opportunities Fund, a high-income financials fund investing in the equity and fixed-income securities of European financials companies, which outperformed its benchmark index in all six years that Nick managed it. Previous to that, he worked at Exeter Asset Management and Capel-Cure Myers. At Exeter Asset Management, Nick managed the Exeter Capital Growth Fund from 1997 to 2003, which over this period was in the top decile of the IMA UK All Companies Sector. Nick has a Masters in Finance from London Business School.

John Yakas

John joined Polar Capital in September 2010 and is the manager of the Polar Capital Asian Opportunities Fund, Polar Capital Financial Opportunities Fund and co-manager of PCFT. John has 30 years’ experience in the financial services industry. Previously, he worked for HSBC as a banker, based in Hong Kong, and was the head of Asian research at Fox-Pitt, Kelton. In 2003 he joined Hiscox Investment Management, which later became HIM Capital. John won Lipper awards in the Equity Sector Banks and Other Financials Sector in 2010, 2011, 2012 and 2013 for the performance of the Asian Opportunities Fund. He has an MBA from London Business School and studied at the London School of Economics (BSc Econ).

George Barrow

George was appointed as joint fund manager of PCFT in December 2020, alongside Nick Brind and John Yakas. He joined Polar Capital in September 2010 and is the co-manager of the Polar Capital Financial Opportunities Fund. George has 12 years’ industry experience and works on the Polar Capital Financial Opportunities Fund, Polar Capital Asian Opportunities Fund and the Polar Capital Global Financials Trust Plc. He has built up a broad knowledge of the sector, expanding his initial European focus to also cover Asia and emerging markets. Before joining Polar Capital, from 2008 George was an analyst at HIM Capital, where he completed his IMC. He has a Master’s degree in International Studies from SOAS, where he graduated with merit.

Nabeel Siddiqui

Nabeel joined the Polar Capital Financials team as an analyst in August 2013 and works closely with John Yakas and Nick Brind, focusing on the global banking sector. Prior to this, he worked as an operations executive at Polar Capital. Nabeel began his career in August 2008 with Habib Bank, where he worked within a variety of functions. He has a Master’s degree in Money and Banking and has passed all three levels of the CFA.

Jack Deegan

Jack joined Polar Capital in October 2017 and works closely with Nick Brind on the Income Opportunities Fund. Prior to this, he worked at DBRS Ratings, covering the Swiss market as a lead analyst, as well as UK, Dutch, Japanese and Australian banks. Before DBRS, Jack worked in the Risk Management Division of the Bank of England for four years, assessing financial institutions with a view to determining access to the Bank’s Sterling Monetary Framework (SMF) facilities, and internal counterparty trading limits.

Nick Martin

Nick joined Polar Capital in September 2010 and is manager of the Polar Capital Global Insurance Fund (previously the Hiscox Insurance Portfolio Fund). He has 21 years’ experience in the financial services industry. The Fund was founded in 1998 by Alec Foster at Hiscox Plc and Nick has worked on it since 2001. He became co-manager in 2008 and subsequently the sole manager in 2016. Nick participated in the management buyout of Hiscox Investment Management in 2007 when the business was renamed HIM Capital Ltd. Polar Capital acquired HIM Capital Ltd in 2010. Nick has developed a broad knowledge of the insurance sector during this time, and from working for the chartered accountants, Mazars Neville Russell, where he specialised in audit and consultancy work for insurance companies and brokers. He is a qualified chartered accountant and obtained a first-class Honours degree in Econometrics and Mathematical Economics at the London School of Economics.

Dominic Evans

Dominic joined Polar Capital in October 2012 and is an investment analyst working with Nick Martin on the Polar Capital Global Insurance Fund. He has over 10 years’ insurance experience having previously worked as part of KPMG’s insurance segment, which he joined as a graduate trainee. At KPMG, Dominic obtained broad experience working on a range of global insurance companies through roles within transaction services, audit and markets. Prior to KPMG he worked for a year in corporate finance focusing on natural resource companies. Dominic is a chartered accountant and member of the ICAEW. He graduated in History with a first-class Honours degree with distinction from the University of Newcastle upon Tyne.

Previous publications

QuotedData has published four notes on PCFT. You can read these by clicking the links in the table below or by visiting the quoteddata.com website.

Don’t fear a slowing economy – Initiation – 30 April 2019

Banks too cheap to ignore – Update – 29 October 2019

New lease of life – Update – 22 February 2020

Too much pessimism – Annual overview – 22 October 2020

The legal bit

This marketing communication has been prepared for Polar Capital Global Financials Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.