Polar Capital Global Financials Trust – Too much pessimism?

Too much pessimism?

Whilst there are some bright spots, such as payments companies, which are beneficiaries of the shift to online shopping, fears about the potential impact of COVID-19 have hit valuations across much of the financial sector. The fall in Polar Capital Global Financials Trust’s (PCFT’s) NAV reflects this situation.

The managers are cautious, especially given the renewed lockdown measures being implemented in many economies, but think that in many cases markets are already pricing in worst-case scenarios. Banks’ provisioning appears to have peaked in the first half of 2020, as evidenced by US bank third quarter results which so far have come in substantially above expectations. This is in large part due to a sharp fall in loan loss provisions as the US economy has recovered far quicker than the banks were expecting only a few months ago.

Growing income from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI ACWI Financials TR (%) | MSCI AC World TR (%) |

|---|---|---|---|---|---|

| 1 | 30 Sep 2016 | 4.40 | 14.10 | 21.20 | 30.60 |

| 2 | 30 Sep 2017 | 37.30 | 24.10 | 27.10 | 14.90 |

| 3 | 30 Sep 2018 | 3.50 | 3.40 | 4.40 | 12.90 |

| 4 | 30 Sep 2019 | 5.30 | 5.30 | 5.50 | 7.30 |

| 5 | 30 Sep 2020 | -22.60 | -18.50 | -19.50 | 5.30 |

Fund profile

Polar Capital Global Financials Trust (PCFT) launched on 1 July 2013. In April 2020, shareholders approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life but with five-yearly tender offers, the first of which is scheduled for 2025.

The trust’s twin objectives focus on growing investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

From April 2020 onwards, the trust’s performance benchmark is the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials). A history of earlier benchmarks is given in previous notes (see page 20). We have used MSCI ACWI Financials for comparison purposes in this note.

PCFT’s AIFM is Polar Capital LLP and the lead managers are Nick Brind and John Yakas. More information on the management team is given on page 16.

Market backdrop

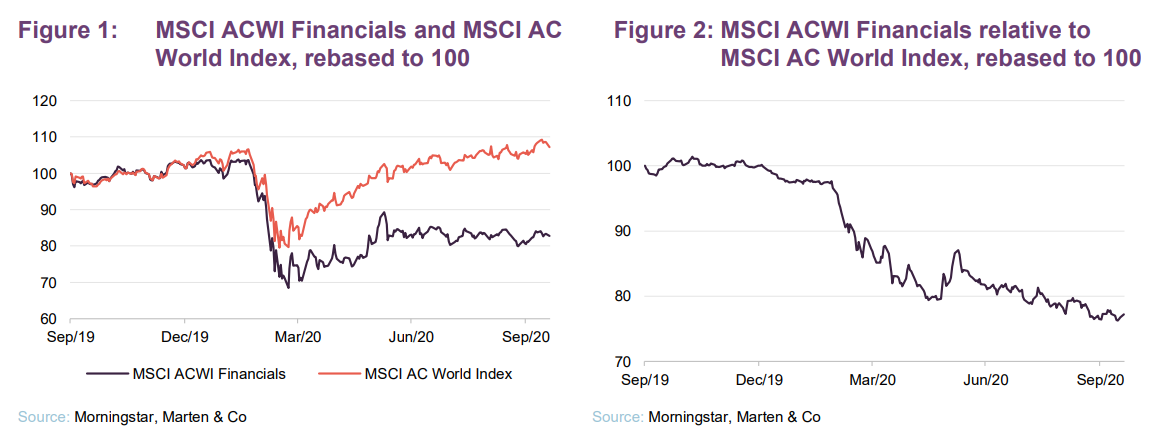

As we discussed in our last note, financials were already out of favour with investors before the pandemic struck. However, when panic set into markets in March 2020, financials stocks – and banks in particular – fell disproportionately and remain unloved. The managers believe that most investors are very underweight the sector, while being prepared to pay very high multiples for a narrow group of growth stocks.

The sector’s move suggests that investors expect falling margins and widespread loan losses in the sector.

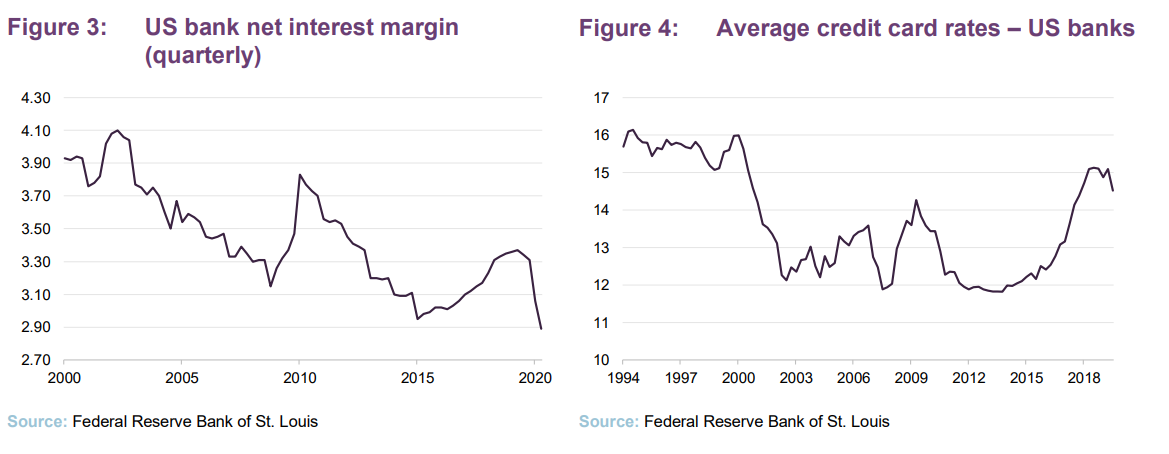

One part of the policy response to the pandemic was to slash interest rates. The US Federal Funds Effective Rate is back at historically low levels. The ECB’s deposit rate is -0.50%. The UK’s monetary policy committee is clearing the path to a shift to negative rates next year (UK base rates are 0.1%). All of this makes it hard for banks to earn money from the deposit side of their balance sheets.

It is true that net interest margins have contracted this year. We included earlier versions of Figures 3 and 4 in the note we published in October 2019, and have updated them here.

The reason we have included the chart on credit card rates is to emphasise the point that banks can still earn decent margins on their lending activities, even though the considerable liquidity that central banks have injected into the financial system is weighing on interest rates. However, the key question in relation to this is: what will happen to default rates?

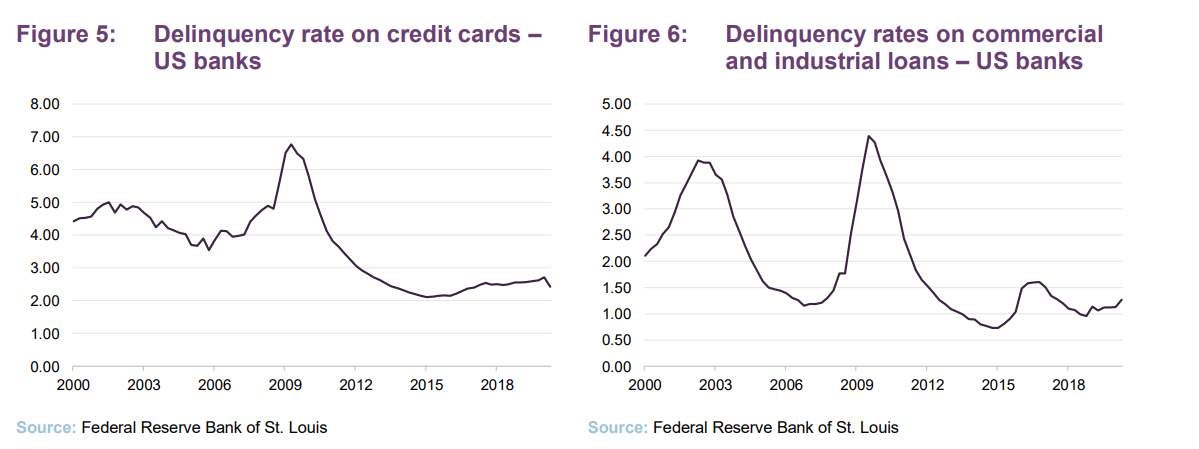

Figures 5 and 6 show the delinquency rates on credit cards and commercial/industrial loans in the US. What seems clear from these charts is that, to date, despite the widespread disruption caused by the response to the pandemic, there has been no meaningful spike in these figures.

The CARES Act, which was signed into law in March, provided a wide range of measures to support the US economy, including the right to request forbearance on mortgage payments and various income support measures. The UK’s bounce back loan and furlough schemes, the EU’s Support mitigating Unemployment Risks in Emergency (Sure) initiative, and similar measures introduced around the globe have all helped stave off problems with debt servicing.

PCFT’s managers say that the vast majority of borrowers appear to be servicing their debts. These schemes have end dates, however. The focus is now on which of these will be extended and what the terms of this will be. Discussions in the US on new stimulus bills are yet to come to fruition.

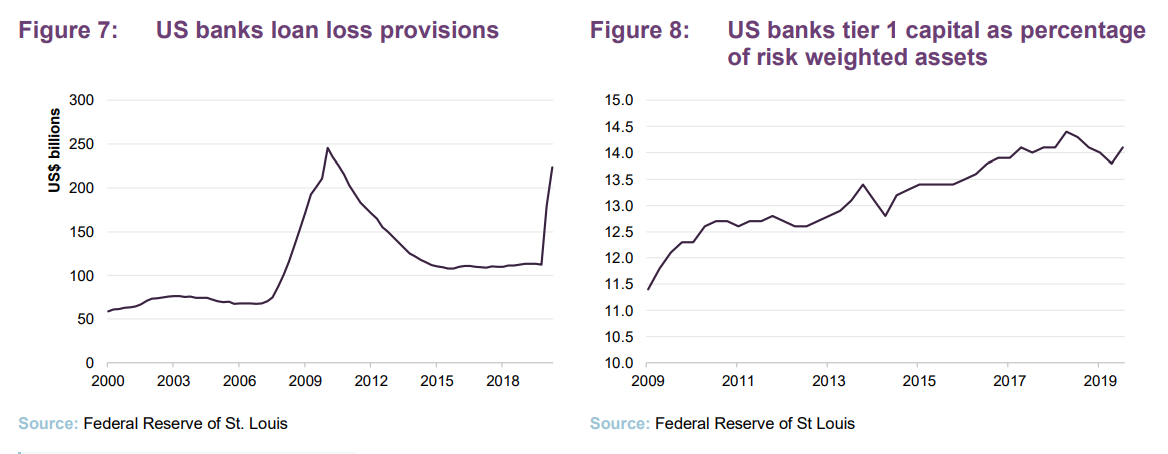

Banks made considerable loan loss provisions in the second quarter of 2020, but PCFT’s managers think these should now have peaked. Bank’s capital ratios were strong going into the pandemic. If bank’s loss provisioning turns out to have been overly pessimistic, banks will have built up substantial excess capital that they could then return to shareholders.

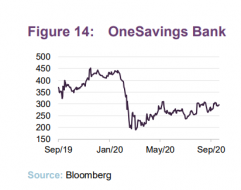

All these charts relate to the US market (which is the dominant part of PCFT’s portfolio), but a similar scenario could play out elsewhere. The managers cite the example of OneSavings Bank, which has a bias to UK buy-to-let debt. It upped its loan loss provision from 6bp to 60bp. However, it is operating on average LTVs of 68% for its buy-to-let and SME book and just 58% for its residential mortgage book.

The managers think that, generally, banks have been cautious in their lending to property companies, LTVs of around 30% on commercial property are commonplace. Equity stakeholders may face some pressure, however.

Subject to the seriousness of the second wave of the pandemic, the restraints that various regulators imposed on dividends could be lifted. There was no consensus among regulators in the EU on this issue. Banks in Germany were permitted to pay dividends, but France and Belgium said no. The managers say that there are signs that European regulators will permit the payment of dividends by the strongest banks in 2021. They note that Close Brothers felt able to announce a dividend in September and Banco Santander has announced, subject to agreement with the ECB, a dividend for May 2021.

Direct Line might offer a clue as to what might happen when dividends are reinstated on some of these stocks. It declared its normal interim dividend, together with a special dividend representing the dividend that it would have paid in May. The shares jumped by about 10% on the news. Even after the payment of these dividends, the company will have a solvency ratio of 192%, well ahead of its 140% to 180% target range.

One fear that the managers have is that the dividend suspensions might add to the cost of capital for financial companies in future.

Inflation and interest rates

Consensus thinking is that we are in for a prolonged period of low-to-no-growth, low inflation/deflation and low interest rates. This is reflected in the valuations of banks. The Fed has said that it does not expect to raise rates until 2023. However, there is increased talk about the possibility of inflation and, down the line, higher rates.

The Fed is now targeting inflation of 2% on average, to give itself the flexibility to keep rates on hold even if inflation starts to climb. The measures that governments and central banks have adopted to mitigate the effects of COVID-19 go far beyond the quantitative easing implemented in the wake of the financial crisis. The expansion in the money supply could be a trigger for inflation down the line. The managers think that, while there may be a reluctance to raise rates, this could allow inflation to overshoot targets and necessitate much higher rates in time.

Asia and emerging markets

Countries’ successes and failures in tackling the COVID-19 outbreak had a big influence on returns over H1 2020. Latin America has been one of the worst-hit regions, but PCFT’s exposure here is fairly light. The deteriorating political situation in Hong Kong impacted on many financial stocks there, although PCFT’s Hong Kong-listed holdings are more plays on Chinese growth. The managers did sell a position in Fortune REIT, which owns shopping malls in the city.

In India, PCFT retains its core holding in HDFC. Whilst much of India’s financial sector is struggling, HDFC has said that it expects its non-performing loans to peak well below levels of the financial crisis. It should be in a position to cherry-pick business that the State banks are forced to turn away. The Reserve Bank of India instituted a six-month-long moratorium on debt payments which expired at the end of August 2020. Debt that wasn’t being serviced during that period could not be classified as non-performing. This is no longer the case.

Insurance

The insurance industry is facing a record year for claims as COVID-19 related business interruption claims pile on top of high catastrophe claims and an ongoing problem with juries awarding ever-higher amounts to litigants. About 20% of the portfolio is invested in the sector. A poor year for claims this year should feed into stronger premiums over coming years as the industry tries to rebuild capital. Hiscox, which is held in PCFT’s portfolio, is one of a few companies that have been raising money from capital markets.

Investment process

PCFT’s managers are stock-pickers and geographic and sector allocations are driven by their stock selection decisions. However, the breadth of opportunity is highest in the US, which dominates the benchmark. The maturity of the industry in that country is coupled with a fragmentation of the banking market.

The managers are actively involved in researching opportunities. Proprietary research is a core part of the investment process. The managers feel that, while some of it is useful, external research is too often short-term in focus. They prefer to take a medium- to long-term view. Access to companies’ management is an important part of the process.

The approach seeks to identify stocks with the potential to create strong risk-adjusted returns. An analysis of balance sheet strength plays a part in this.

Short-term profitability and rapid top-line growth may mask underlying problems with asset quality. Most financials stocks are very highly geared, and consequently there is a real need to focus on limiting the downside.

The remit is global and includes emerging markets. The universe is about 500 stocks (typically, the smallest stock that the managers would consider for PCFT’s portfolio would have a market cap of around $500m). The managers say that this is a manageable number of stocks for the team to cover. The likes of Goldman Sachs and JPMorgan are complex beasts, but most banks have relatively simple business models. In many areas, pricing is commoditised and so the sector is quite generic, but research is essential to sort the good from the bad.

The managers use a scoring system to look at a range of variables around risk, growth and value. These include balance sheet strength; how the company is funded; the composition of the loan book; historical quality of the loan book; and trends in margins. This model is a framework for analysis rather than an engine to produce a buy list.

The team meets about 400 companies each year but a lot of this is double-checking their research findings. They talk to customers and competitors, for example.

For banks and similar companies, any assessment of value is based on a variation of CAPM – using returns on equity and price to book. The managers find that, for the reasons outlined above, P/E ratios and measures of growth do not work as well.

The sector is not just about balance sheet businesses, however, and it is evolving. The managers use a more earnings-driven, traditional approach to valuing other companies.

Asset allocation

At the end of September 2020, there were 75 positions in PCFT’s portfolio (up from 68 at the end of December 2019 – the data we used in our last note) and the vast majority of these (close to 80%) had market caps greater than $5bn.

Shareholders approved an increase in the maximum level of gearing (from 15% to 20%) earlier this year. The managers are relatively cautious, given the uncertainty created by a second wave of the coronavirus. At the end of September 2020, gearing was 10.1%.

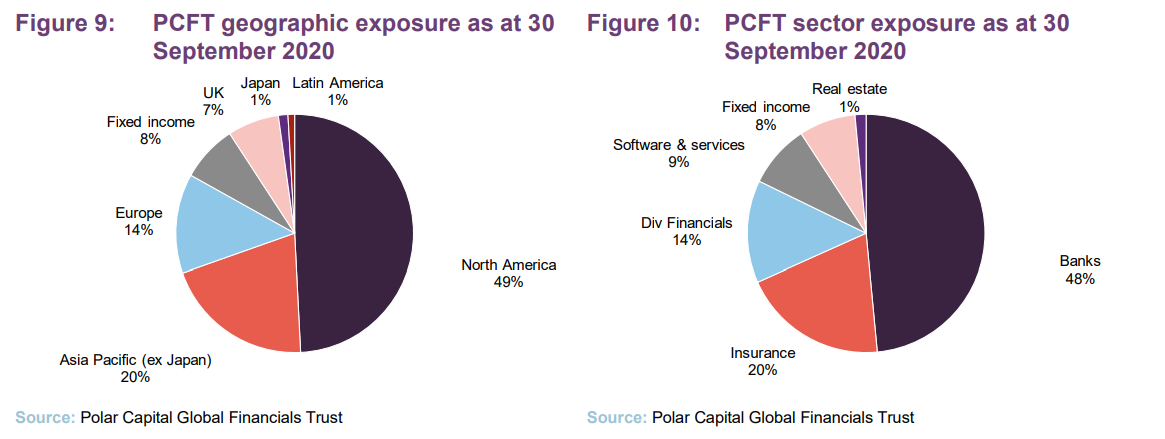

There is has been very little change in PCFT’s geographic asset allocation since the end of 2019 except that the portion invested in Asia ex Japan has risen (from 16% to 20%) at the expense of the allocation to Europe which has fallen from 16% to 14%. There has been quite a bit more movement within the sector breakdown in Figure 10, however. Exposure to banks has fallen from 63% to 48% and real estate from 4% to 1%. Exposure to all other sectors has risen.

Firmer pricing in the insurance market, soaring valuations of payment processing companies and relative weakness of banking stocks have all contributed to the allocation shift. The fixed income element of the portfolio helps to bolster PCFT’s revenue account, and this has been especially useful in the current environment of dividend suspensions.

Top 10 holdings

Two stocks, PayPal and PNC, have moved into the list of the 10 largest holdings over 2020. These are discussed below.

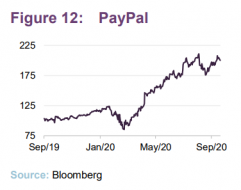

PayPal Holdings

At the end of February 2020, ahead of March’s market falls, PayPal Holdings was a 1.9% position in the trust. At that time its shares were priced at $108. The company was already seeing dramatic growth in its business, but a big jump in online spending helped propel the stock higher and, by the end of August, it had almost doubled over the previous six months.

Q2 was the strongest quarter in PayPal’s history, with 37% year on year growth in daily active accounts, 25% revenue growth and 49% EPS growth. PayPal processed $222bn of payments in Q2, the first time it had exceeded $200bn in a quarter. The company expects this momentum to continue into H2 2020. PayPal’s impressive growth was against a backdrop of falling payments volumes as COVID-19 hit the global economy. Mastercard recorded a 13.6% fall in the volume of payments that it processed (from $1.6trn to $1.38trn). The managers have taken some profits on the position.

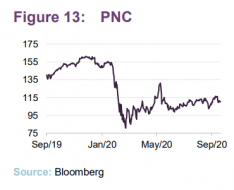

PNC Financial Services

PNC Financial Services is a US bank holding and financial services company headquartered in Pittsburgh, Pennsylvania. In Q2 2020 it sold its 22.4% stake in BlackRock Inc, freeing up $14.2bn. This strengthened the group’s balance sheet. At the end of June, it had a Tier 1 ratio of 11.3%, up from 9.4% at the end of March.

While COVID meant that the group had to increase its provisions in Q2, pushing PNC into a loss (pre booking the profit on the sale of BlackRock), in Q3 2020 the group managed to generate a 15% increase year-on-year in its diluted earnings per share. Provisions for credit losses were significantly lower than in Q2, tying up with the managers’ view that loan loss provisions have already peaked. The group’s net interest margin fell from 2.52% to 2.39% reflecting falling rates.

Other portfolio changes

One new holding in April was Ping An Insurance, the Chinese life assurance company. The managers have also been adding to some of the holdings in smaller banks such as OneSavings Bank, SpareBank 1 SMN and Webster Financial a small regional US bank, headquartered in Connecticut. They also highlighted the purchase of a stake in FinecoBank, an Italian digital wealth manager.

We mentioned OneSavings Bank’s prudent loan loss provisions on page 5, the managers also highlight the strength of its balance sheet, which has been helped by it voluntarily suspending dividend payments.

SpareBank 1 SMN is a Norwegian savings bank and part of a consortium of Norwegian savings banks. Norway fared relatively well with the COVID outbreak, although cases have been picking up recently. It has been growing its online business.

Although it has been a listed company since 2014, FinecoBank was spun out of the UniCredit Group in 2019. It has 1.36m clients in Italy and recently expanded into the UK. In common with other trading platforms, it saw an uptick in dealing volumes as markets gyrated in March and April. Its H1 2020 results show year on year revenue growth of 26% and a 30% increase in net profit.

Performance

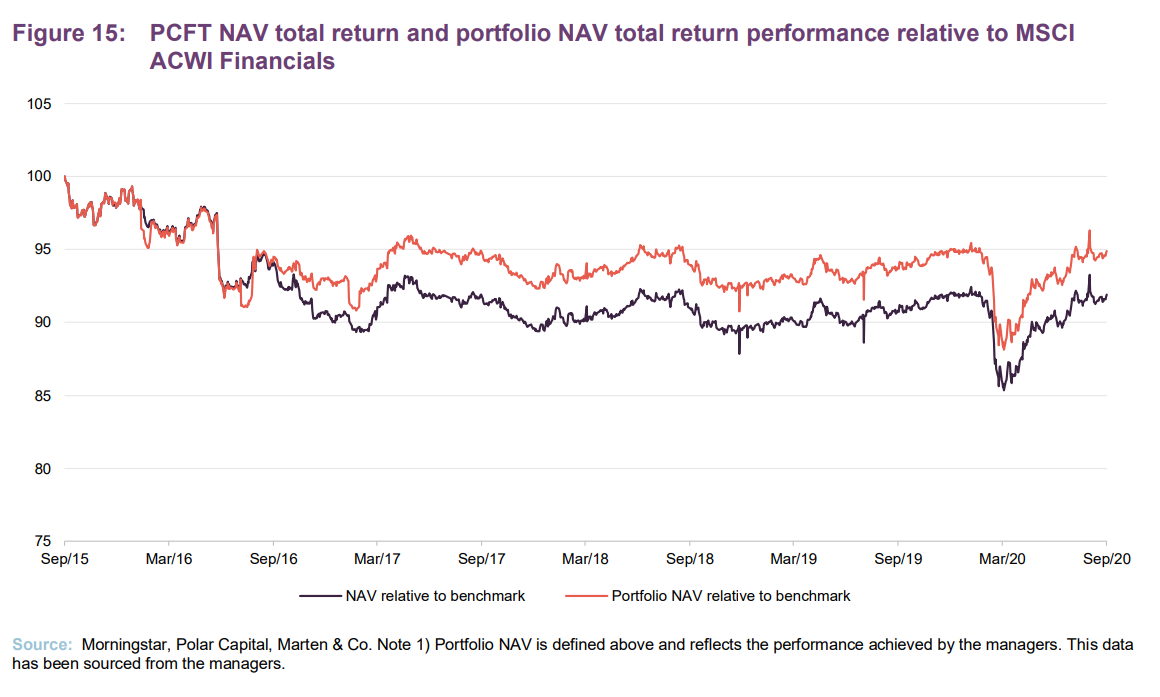

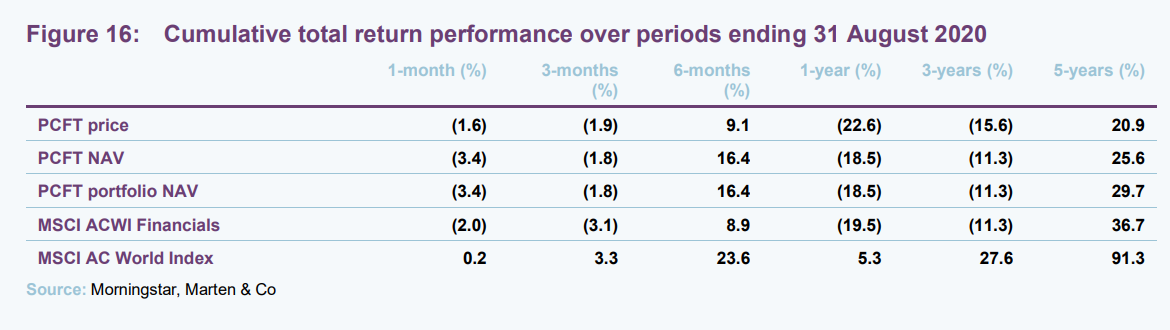

In the chart in Figure 15 and the table in Figure 16, we show returns both for PCFT’s IFRS NAV and also a ‘portfolio NAV’ which strips out the effects of the dilution attributable to PCFT’s subscription shares (which were exercised in 2017). The portfolio NAV gives a better indication of the returns achieved by the managers.

Looking at the five-year chart, PCFT lagged MSCI ACWI Financials until the Spring of 2017 (held back largely by an underweight exposure to the US at that time) and its relative returns have been fairly stable since.

The trust’s gearing magnified the market’s fall in February/March, but performance has recovered since.

One of the most striking things about the table in Figure 16 is the degree of the underperformance of financials stocks relative to the world index. Were financial stocks to recover some of this lost ground, PCFT’s gearing would work to its advantage.

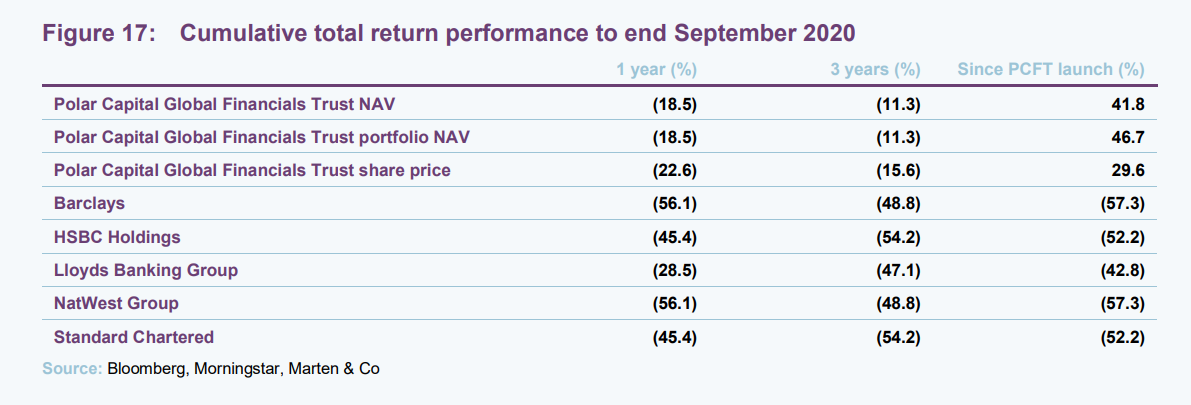

In our previous note, in addition to the comparisons with indices, we have compared PCFT’s performance with that of the major UK banks and we have updated this information in Figure 17. One of the drivers behind the launch of PCFT in 2013 was that it would provide UK-based investors with a relatively lower-risk exposure to the financial sector. Since then, PCFT has delivered returns well ahead of the major UK banks.

Performance attribution

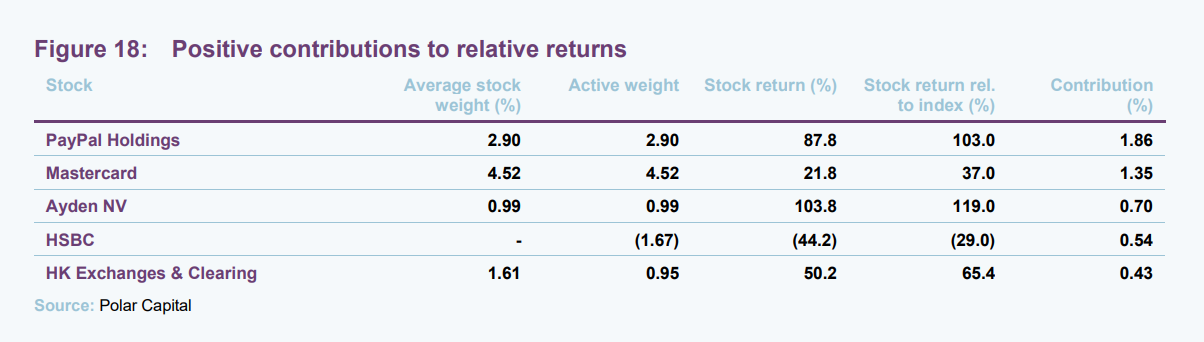

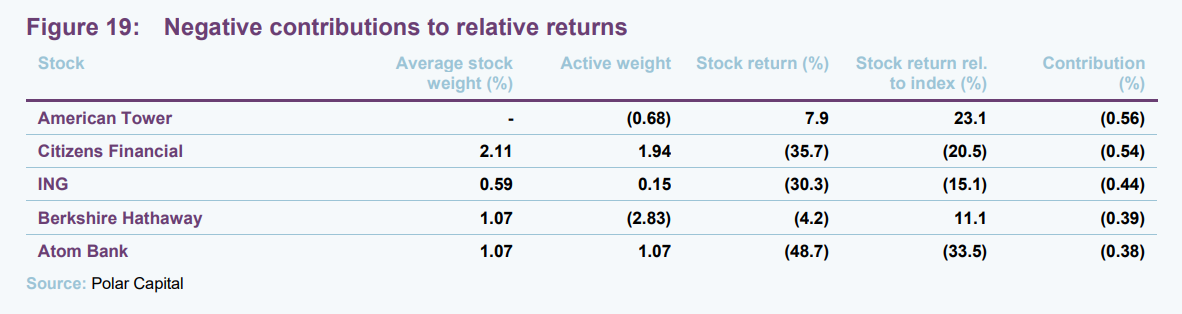

The manager supplied us with some performance attribution data that covers the period from 1 January 2020 to end August 2020. The trust’s net gearing is estimated to have taken 1.11% off the NAV. Geographic exposures were broadly neutral. North America did particularly well, but the trust had a small overweight exposure to this region.

We discussed PayPal’s performance on page 9; Mastercard’s strong share price reflects the enthusiasm for the payments sector that the growth in online shopping is generating. Ayden is a third payments company. It is based in the Netherlands. In its H1 numbers volumes were up 23% year-on-year and revenues up 27%. This was one of the stocks that the managers added to the portfolio in March. Its shares have more than doubled since.

Not holding HSBC has been a blessing. The managers note that the stock hit a 25-year share price low during September 2020. Exposure to Hong Kong’s problems didn’t help its cause, but the bank has also been caught up in various scandals.

HK Exchanges & Clearing appears to be a beneficiary of rising tension between the US and China. There is talk that Chinese companies listed in the US will opt to have their main listing in Hong Kong instead. A string of companies have IPO’d over the past few months (64 over the first half of 2020) and they will be joined shortly by Ant Group. Ant looks likely to become one of the largest stocks in PCFT’s benchmark (although its weight in the index may be restricted on liquidity grounds).

The list of negative contributors reflects the COVID-19-related fall in markets. American Tower, which PCFT didn’t hold, is a REIT which owns mobile phone masts across 20 countries. Its stable and predictable earnings have been prized highly by investors, given the current market turmoil. Another stock that did relatively well but in which PCFT had an underweight position relative to its benchmark was Berkshire Hathaway.

Citizens Financial and ING’s share price are still trading well below their levels of February 2020.

Peer group

PCFT’s listed peer group is eclectic and provides a poor comparison. PCFT’s reports tend to compare the trust with the average of the Lipper Financial sector. For the six-month period ended 31 May 2020, PCFT’s NAV total return was seven percentage points behind that of the average of the 56 open-ended funds in the Lipper sector, and 9.4% ahead since PCFT was launched in November 2013.

Dividend

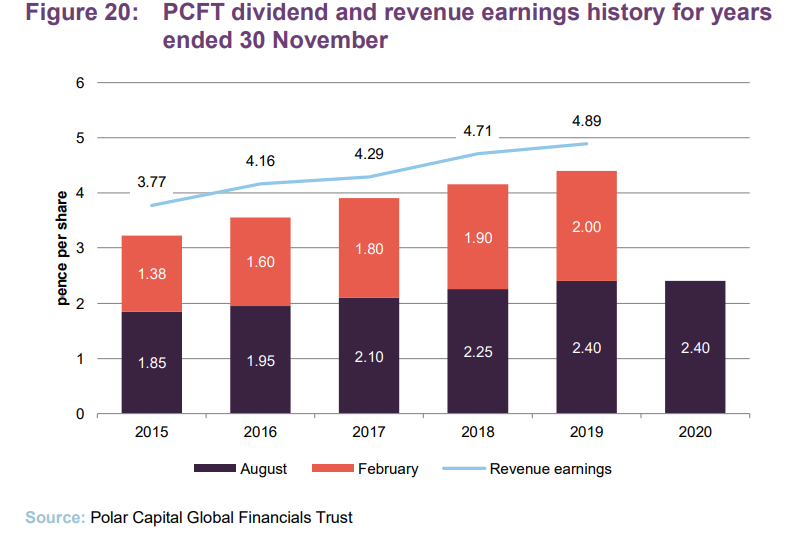

PCFT pays dividends semi-annually on its ordinary shares in February and August. All dividends are paid as interim dividends. The payments are not necessarily of equal amounts. The company does not pay a final dividend.

The chart in Figure 20 shows PCFT consistently paying dividends that were covered by revenue. This allowed it to build up a sizeable revenue reserve which stood it in good stead when COVID-19 triggered the suspension or cutting of many dividends. In addition, as an amount per share, the reserve grew significantly following the tender offer.

Over the first half of the company’s accounting year, the six months ended 31 May 2020, PCFT’s net revenue per share roughly halved (from 3.09p to 1.57p). Nevertheless, the board, comforted by the level of reserves, felt able to maintain the interim dividend and commit to at least maintaining the final dividend.

At the end of May 2020, the revenue reserve stood at £8.1m, adjusting this for August’s payment (equivalent to about £3.0m) would leave £5.1m or about 4.1 pence per share.

The board says that, in line with the dividend policy approved at the AGM held in May 2020, it continues to pursue a policy of dividend growth, although there is no guarantee that this can be achieved. Whilst significant uncertainty surrounds the outlook for dividend income, the board has available further income reserves to support dividend payments until the sustainable longer-term level can be determined.

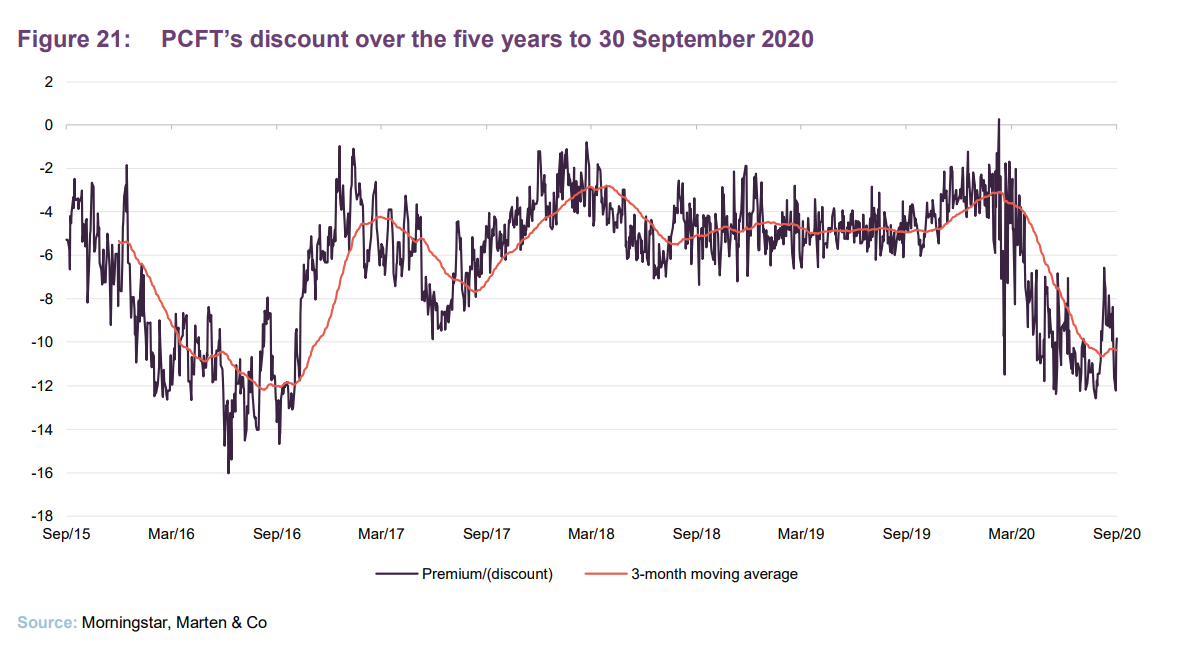

Discount

Ahead of the pandemic, PCFT’s discount had stabilised in low single digits but widened as the market panic set in and is yet to narrow. Sentiment is against the sector, as we have discussed elsewhere in this note. However, when this improves, it seems likely that PCFT’s absolute and performance will improve as well, and the discount will narrow. It may be that, in retrospect, investors will then consider that this was an attractive entry point.

Over the year to the end of September 2020, PCFT’s share price has moved within a range of a 12.6% discount to a premium of 0.3% and has traded at an average discount of 6.6%. At 19 October 2020, the discount was 10.1%.

Fees and costs

With effect from 7 April 2020, PCFT pays a base management fee of 0.70% per annum on NAV. This was reduced from 0.85% on the lower of market cap and NAV. The base management fee is charged 80% to revenue and 20% to income.

In addition, the manager has the opportunity to earn a performance fee. This will be calculated every five years (the first period runs from 7 April 2020 to 30 June 2025). The performance fee will be 10% of the total return generated by PCFT in excess of a hurdle. The hurdle is the benchmark (MSCI ACWI Financials) plus 1.5% per annum.

For the year ended 30 November 2019, the company’s ongoing charges ratio was 1.04%. All other things being equal, the fee cut should lower the ratio in this financial year and the next.

Capital structure and life

PCFT has a simple capital structure with a single class of ordinary shares in issue (subscription shares that were issued at launch were all exercised on 31 July 2017) and trades on the Main Market of the London Stock Exchange. At 20 October 2020, there were 122,970,765 ordinary shares in issue.

PCFT now has an unlimited life. With effect from 2025, the board intends to propose tender offers at five-yearly intervals. These would allow any shareholder who wishes to exit the company to do so at a price close to NAV.

Shares bought back as part of the tender offer process and any other shares bought back in the normal course of discount control may be held in treasury and reissued at a premium to asset value.

PCFT’s accounting year-end is 30 November and AGMs are usually held in April.

Gearing

As part of the package of measures approved by shareholders in April, PCFT may now borrow up to 20% of net assets at the time of drawdown. PCFT has a £22.5m unsecured facility with ING Bank NV (a £12.5m one-year revolving facility and a £10m one-year term loan).

At 31 August 2020, PCFT’s net gearing was 9.6% of NAV.

Management

The seven-strong financials team at Polar Capital LLC (four fund managers and three analysts) was managing approximately £1.54bn at 31 August 2020. PCFT is one of five funds for which the team has direct responsibility.

Two of the team focus on insurance companies. Nick Brind looks after the fixed-income element of portfolios. John Yakas specialises in emerging markets and Asian stocks. George Barrow covers Europe. There is considerable experience within the team, but they have quite diverse backgrounds.

Nick Brind

Nick joined Polar Capital following the acquisition of HIM Capital in September 2010, and is manager of the Polar Capital Income Opportunities Fund and co-manager of PCFT. He has 25 years’ investment experience across a wide range of asset classes including UK equities, closed-end funds, fixed-income securities, global financials, private equity and derivatives. Prior to joining HIM Capital, Nick worked at New Star Asset Management. While there, he managed the New Star Financial Opportunities Fund, a high-income financials fund investing in the equity and fixed-income securities of European financials companies, which outperformed its benchmark index in all six years that Nick managed it. Previous to that, he worked at Exeter Asset Management and Capel-Cure Myers. At Exeter Asset Management, Nick managed the Exeter Capital Growth Fund from 1997 to 2003, which over this period was in the top decile of the IMA UK All Companies Sector. Nick has a Masters in Finance from London Business School.

John Yakas

John Yakas joined Polar Capital in September 2010 and is the manager of the Polar Capital Asian Opportunities Fund, Polar Capital Financial Opportunities Fund and co-manager of PCFT. John has 30 years’ experience in the financial services industry. Previously, he worked for HSBC as a banker, based in Hong Kong, and was the head of Asian research at Fox-Pitt, Kelton. In 2003 he joined Hiscox Investment Management, which later became HIM Capital. John won Lipper awards in the Equity Sector Banks and Other Financials Sector in 2010, 2011, 2012 and 2013 for the performance of the Asian Opportunities Fund. He has an MBA from London Business School and studied at the London School of Economics (BSc Econ).

George Barrow

George Barrow joined Polar Capital in September 2010 and is the co-manager of the Polar Capital Financial Opportunities Fund. He has 12 years’ industry experience and works on the Polar Capital Financial Opportunities Fund, Polar Capital Asian Opportunities Fund and the Polar Capital Global Financials Trust Plc. George has built up a broad knowledge of the sector, expanding his initial European focus to also cover Asia and emerging markets. Prior to joining Polar Capital, from 2008 he was an analyst at HIM Capital, where he completed his IMC. George has a Master’s degree in International Studies from SOAS, where he graduated with merit.

Nabeel Siddiqui

Nabeel Siddiqui joined the Polar Capital Financials team as an analyst in August 2013 and works closely with John Yakas and Nick Brind, focusing on the global banking sector. Prior to this, he worked as an operations executive at Polar Capital. Nabeel began his career in August 2008 with Habib Bank, where he worked within a variety of functions. He has a Master’s degree in Money and Banking and has passed all three levels of the CFA.

Jack Deegan

Jack Deegan joined Polar Capital in October 2017 and works closely with Nick Brind on the Income Opportunities Fund. Prior to this, he worked at DBRS Ratings, covering the Swiss market as a lead analyst, as well as UK, Dutch, Japanese and Australian banks. Before DBRS, Jack worked in the Risk Management Division of the Bank of England for four years, assessing financial institutions with a view to determining access to the Bank’s Sterling Monetary Framework (SMF) facilities, and internal counterparty trading limits.

Nick Martin

Nick Martin joined Polar Capital in September 2010 and is manager of the Polar Capital Global Insurance Fund (previously the Hiscox Insurance Portfolio Fund). He has 21 years’ experience in the financial services industry. The Fund was founded in 1998 by Alec Foster at Hiscox Plc and Nick has worked on the Fund since 2001. He became co-manager in 2008 and subsequently the sole manager in 2016. Nick participated in the management buyout of Hiscox Investment Management in 2007 when the business was renamed HIM Capital Ltd. Polar Capital acquired HIM Capital Ltd in 2010. Nick has developed a broad knowledge of the insurance sector during this time, and from working for the chartered accountants, Mazars Neville Russell, where he specialised in audit and consultancy work for insurance companies and brokers. He is a qualified chartered accountant and obtained a first-class Honours degree in Econometrics and Mathematical Economics at the London School of Economics.

Dominic Evans

Dominic Evans joined Polar Capital in October 2012 and is an investment analyst working with Nick Martin on the Polar Capital Global Insurance Fund. He has over 10 years’ insurance experience having previously worked as part of KPMG’s insurance segment, which he joined as a graduate trainee. At KPMG Dominic obtained broad experience working on a range of global insurance companies through roles within transaction services, audit and markets. Prior to KPMG he worked for a year in corporate finance focusing on natural resource companies. Dominic is a chartered accountant and member of the ICAEW. He graduated in History with a first-class Honours degree with distinction from the University of Newcastle upon Tyne.

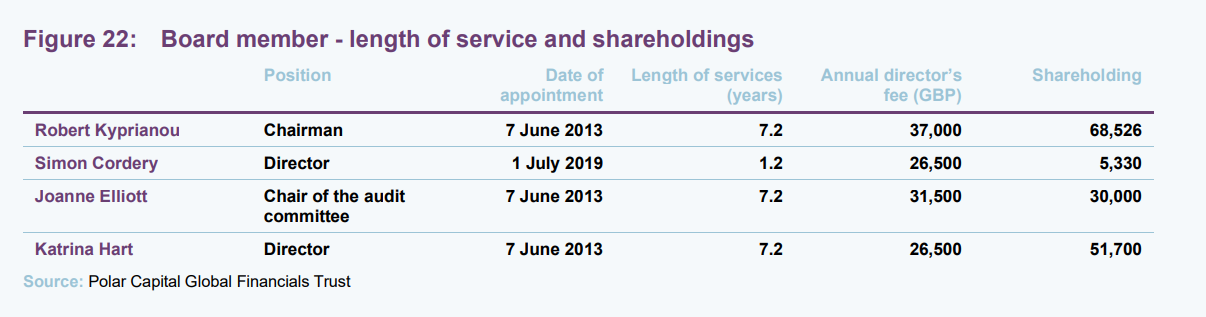

Board

The board comprises four non-executive directors, all of whom are independent of the investment manager and who do not sit together on other boards. All directors stand for re-election at three-yearly intervals and were last re-elected by shareholders at the AGM in 2020. The directors meet at least four times a year, and the audit committee meets at least twice a year.

Robert Kyprianou (non-executive chairman)

Robert was formerly the CEO of AXA Framlington until his retirement in September 2009. Previous appointments include: independent non-executive director of Gartmore Group Limited and Aviva Investors; global head of fixed income, and later deputy CEO and global head of securities at AXA Investment Managers SA; business head and global head of fixed income at ABN AMRO Asset Management Ltd and head of portfolio management at Salomon Brothers Asset Management Ltd. Robert is a director of Eurobank Cyprus Ltd and an independent non-executive director of Pimco Europe Limited.

Simon Cordery (non-executive director)

Simon has almost 40 years’ experience working within financial services, of which nearly 30 years have been focused on the wealth management industry. Most recently he was head of Investor Relations and Sales at BMO Global Asset Management, where he spent almost 25 years in senior roles, and previously he held roles with Invesco Fund Managers, Jefferies & Co, Kleinwort Benson Securities and Rea Bros Merchant Bank. Simon has considerable and detailed knowledge of the investment trust industry and is actively involved with the AIC.

Joanne Elliott ACA (non-executive director)

Joanne is currently CFO of the property team at Thames River Capital and has been the finance manager for TR Property Investment Trust Plc since 1995. Joanne previously held the position of director of property, finance and operations Europe at Henderson Global Investors. Previously she was corporate finance manager with London and Edinburgh Trust Plc, and prior to that she was an investment/treasury analyst with Heron Corporation plc. Whilst Joanne is a director of a number of private companies in connection with her role at Thames River Capital, she holds no other active external appointments.

Katrina Hart (non-executive director)

Katrina spent her executive career in investment banking, advising, analysing and commentating on a broad range of businesses. Initially working in corporate finance at ING Barings and Hawkpoint Partners, Katrina then moved into equities research at HSBC, covering the general financials sector. Latterly, she headed up the financials research teams at Bridgewell Group Plc and Canaccord Genuity, specialising in wealth and asset managers. Katrina is a non-executive director of Premier Miton Group Plc, an AIM-listed fund manager. She is also a non-executive director of Keystone Investment Trust Plc, Blackrock Frontiers Investment Trust Plc and AEW UK REIT Plc, each listed on the main market.

Previous publications

QuotedData has published three notes on PCFT. You can read these by clicking the links in the table below or by visiting the quoteddata.com website.

Don’t fear a slowing economy – Initiation – 30 April 2019

Banks too cheap to ignore – Update – 29 October 2019

New lease of life – Update – 22 February 2020

Legal

This marketing communication has been prepared for Polar Capital Global Financials Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.