Investment Companies Roundup

Kindly sponsored by Baillie Gifford

Table of contents

Table of contents

New research

New research

Here is a list of research we published over November:

An initiation note on Henderson High Income

“We have initiated coverage on Henderson High Income (HHI). Since its launch in 1989, total returns have been well ahead of the wider UK market; over 14x since launch, compared to 9.4x from the MSCI UK Index. Despite its performance record and high yield, the trust continues to trade at a discount.”

An annual overview note on The North American Income Trust

“The US market has been very highly driven by macroeconomic sentiment this year. Our annual overview note on The North American Income Trust (NAIT) includes commentary from manager Fran Radano, who says that increased market volatility creates opportunities for investors who are able to look through the noise. Over the last five years, NAIT’s NAV total return performance has exceeded that of the MSCI USA Value Index and the average of its peer group.”

An annual overview note on Henderson Diversified Income

“Henderson Diversified Income Trust (HDIV) is the top-performing fund in the debt – loans and bonds sector, but perversely, is trading at a smaller premium than some of its competitors. In our recently publish annual overview note, we explore the allocation decisions that have allowed HDIV to outperform its peers.”

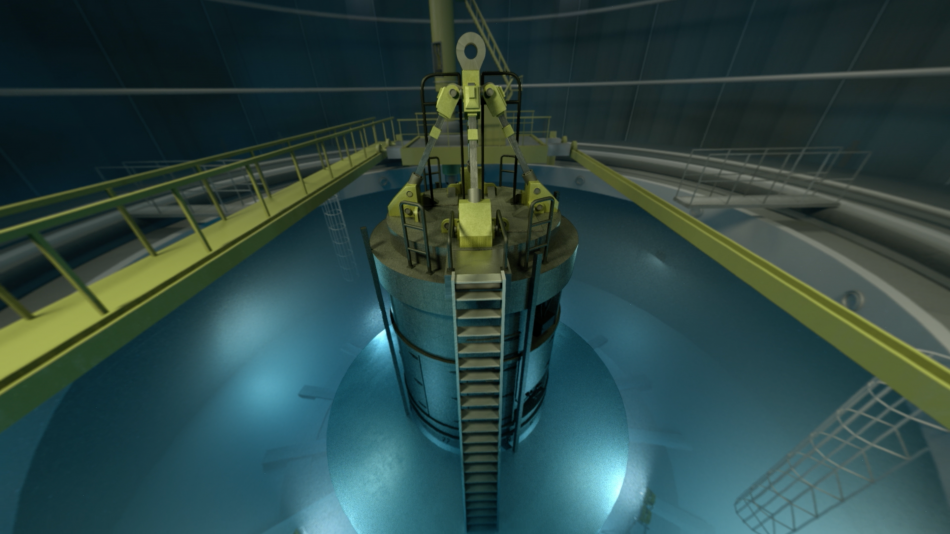

An update note on Geiger Counter

“Our update note on Geiger Counter (GCL) explores the potential for a resurgence in the uranium price, as more nuclear reactors come online (particularly in China and India), while major producers hold off from returning mothballed mines to production.”

An annual overview note on Aberdeen Frontier Markets

“Aberdeen Frontier Markets (AFMC)’s manager has been re-positioning the portfolio by reducing exposure to Sub-Saharan Africa, adding companies in new markets and looking to capture more of the momentum in markets. The trust exhibits a exhibits a low correlation with its benchmark as well as to emerging markets. We explore the potential for performance to turn around.”

In this issue

In this issue

- Following a lacklustre October, risk-appetite rose over November, reflected by both the level of the NAV and price returns as well as the prevalence of growth-focused funds in the tables. Sectorally, biotech strategies had a strong month, led by Biotech Growth and International Biotechnology. It was also a good month for UK equities with several UK smaller companies trusts, led by Montanaro UK Smaller Companies, JPMorgan Smaller Companies and Standard Life UK Smaller Companies, taking up positions in the outperformers table;

- Money in and out – After £1bn of new money entered the sector in October, November was likely to be much quieter. There were no new issues and net outflows totalled £171.m, skewed by Boussard & Gavaudan EUR. HICL Infrastructure hit its £100m target in a share placing;

- Discounts/premiums – The narrowing in the discounts of Montanaro UK Smaller Companies and JPMorgan Smaller Companies was price led, as the UK seemingly averted the threat of leaving the EU without a deal. There was leg-up in Hipgnosis Songs’s NAV over November following an independent semi-annual valuation of its song portfolio;

- Major news stories – LMS Capital voted to remove Gresham House as its manager and Scottish Mortgage discussed competitive pressures faced by China’s largest bellwether internet companies.

Performance data

Performance data

November’s biggest movers in price and NAV terms are shown in the charts below.

- Following a lacklustre October, risk-appetite rose over November, reflected by both the level of the NAV and price returns as well as the prevalence of growth-focused funds in the tables. A relatively subdued median NAV return +0.8% likely reflects a degree of momentum returning, lifting ‘winners’ higher and pushing ‘losers’ lower.

- Sectorally, biotech strategies had a strong month, led by Biotech Growth and International Biotechnology. Broader healthcare strategies did well too, benefitting BB Healthcare and Worldwide Healthcare. Investors appear to be warming to the idea that irrespective of who triumphs in the 2020 US election, the impact on Medicare for all will be less pronounced than initially feared.

- It was a good month for UK equities with several UK smaller companies trusts, led by Montanaro UK Smaller Companies, JPMorgan Smaller Companies and Standard Life UK Smaller Companies, taking up positions in the outperformers table.

- Oryx International Growth had some good news as its holding in waste company, Augean soared on a positive trading update.

On the negative side:

- After initially rallying in the aftermath of Schroders appointment as its new manager, Woodford Patient Capital, led price losses. It may be that the new manager is attempting to release as much of the ‘bad news’ it inherited as it can.

- Latin American strategies had poor months, led by Aberdeen Latin American Income and BlackRock Latin American, as regional political tensions and ongoing trade discontent affected sentiment.

- It was generally a poor month overall for emerging and frontier market funds, not helped by a strengthening in the dollar. Asia-focused Symphony International led NAV declines while shares in the Cuba-specialist, Ceiba, were pushed down.

- Carador Income USD, Marble Point Loan Financing and Fair Oaks Income were hit as investors became more nervous of credit ratings downgrades for low quality loans.

- Marwyn investors were disappointed when it ruled out any return of capital following the takeover of car auction site, BCA Marketplace.

Discounts and premiums

Discounts and premiums

The table below shows the top five movers in either direction (more or less expensive relative to NAV):

| wdt_ID | Fund | 29 Nov (%) | 31 Oct (%) |

|---|---|---|---|

| 1 | SQN Asset Finance Income | -12.30 | -22.40 |

| 2 | Montanaro UK Smaller Companies | -7.90 | -16.20 |

| 3 | UK Mortgages | -9.00 | -16.90 |

| 4 | Henderson Diversified Income | 3.20 | -4.40 |

| 5 | JPMorgan Smaller Companies | -8.80 | -15.00 |

| 6 | Hipgnosis Songs | 1.20 | 13.80 |

| 7 | Woodford Patient Capital | -47.90 | -35.50 |

| 8 | LMS Capital | -31.10 | -19.50 |

| 9 | Ceiba Investments | -36.30 | -24.80 |

| 10 | Crystal Amber | -20.10 | -10.90 |

More expensive relative to NAV:

- The narrowing in the discounts of Montanaro UK Smaller Companies and JPMorgan Smaller Companies was price led, as the UK seemingly averted the threat of leaving the EU without a deal.

- UK Mortgages’s shares recovered a little after a large block of shares was traded in October.

- Henderson Diversified Income has been the best performing fund in the debt sector over the past year, with its decision to keep the duration of its portfolio long paying off, given that the US central bank, the Federal Reserve, has been reducing rather than increasing interest rates this year.

Cheaper relative to NAV:

- There was leg-up in Hipgnosis Songs’s NAV over November following an independent semi-annual valuation of its song portfolio. Growing pressure from investors for more information on the underlying return profile of the portfolio, for what is a relatively new asset class, is thought to be responsible for the lower share premium to NAV valuation.

- Cuban investment fund, Ceiba remains unloved.

- LMS Capital has been reviewing its management contract for several months – it recently voted to remove Gresham House as manager and become self-managed. This didn’t go down well with all investors.

Money in and out

Money in and out

Money coming in:

- After £1bn of new money entered the sector in October, November was likely to be much quieter. There were no new issues and net outflows totalled £171.m, skewed by Boussard & Gavaudan EUR.

- HICL Infrastructure hit its £100m target in a share placing aimed at addressing its net funding requirement, thought to stand at about £90m, and providing additional resources in respect to an existing offshore transmission owner investment.

- The rest of the ‘top five’ comprised Smithson, Finsbury Growth & Income, AVI Japan Opportunity and City of London.

- Boussard & Gavaudan shrank as it enacted its proposals to roll over investors who wanted to into an open-ended fund.

- Scottish Mortgage bought back nearly £60m worth of shares, following £70m of repurchases over October.

- Edinburgh Investment features for a fourth successive month – its discount has been narrowing.

- CVC Credit Partners Euro Opportunities GBP and Bill Ackman’s Pershing Square complete the top-five.

Income

Income

The following funds announced their full year dividends over November (please refer to the attached document for a list of the notes around the numbers):

| wdt_ID | Fund | Year ended | Dividend (pence)* | Change over year (%) | Revenue / earnings (pence)* | Cover |

|---|---|---|---|---|---|---|

| 1 | Aberdeen Latin American Income | 31 Aug 2019 | 3.50 | - | 4.30 | 1.22x |

| 2 | Aberdeen Standard Equity Income | 20.50 | 6.8 | 21.70 | 1.06x | |

| 3 | Asia Dragon | 31 Aug 2019 | 4.80 | 20 | 4.90 | 1.02x |

| 4 | AVI Global | 16.50 | 26.9 | 19.10 | 1.16x | |

| 5 | Baillie Gifford Japan | 31 Aug 2019 | 3.50 | 337.5 | 3.50 | 1.00x |

| 6 | Henderson Far East Income | 31 Aug 2019 | 22.40 | 3.7 | 23.40 | 1.04x |

| 7 | Schroder Income Growth | 31 Aug 2019 | 12.40 | 5.1 | 14.20 | 1.15 |

| 8 | Schroder Oriental Income | 31 Aug 2019 | 10.10 | 4.1 | 10.60 | 1.05x |

| 9 | Troy Income & Growth | 2.80 | 3.2 | 2.70 | 0.96x | |

| 10 | Chelverton Growth | 31 Aug 2019 | 0.00 | N/A | -2.30 | N/A |

Events

Events

Here is a selection of upcoming events:

- ScotGems EGM 2019, 9 December 2019

- Aberdeen Frontier Markets AGM 2019, 10 December 2019

- International Biotechnology AGM 2019, 11 December 2019

- Aberdeen Latin American AGM 2019, 11 December 2019

- AXA Property Trust AGM 2019, 11 December 2019

- Amedeo Air Four AGM 2019, 11 December 2019

- International Biotechnology AGM 2019, 11 December 2019

- Asia Dragon AGM 2019, 12 December 2019

- Chelverton Growth AGM 2019, 12 December 2019

- Schroder Oriental Income AGM 2019, 23 December 2019

- Schroder Income Growth AGM 2019, 17 December 2019

- Scottish Oriental Smaller Companies AGM 2019, 18 December 2019

- AVI Global AGM 2019, 19 December 2019

- Henderson Far East Income AGM 2020, 23 January 2020

- European / Baillie Gifford European AGM 2020, 23 January 2020

- Aberdeen Standard Equity Income AGM 2020, 23 January 2020

- Keystone AGM 2020, 11 February 2020

- Fidelity Special Values AGM 2019, 12 December 2019

- CQS New City High Yield Fund AGM 2019, 13 December 2019

Master Investor – the UKs largest private investor show – 28 March 2020

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.