QuotedData’s Real Estate Roundup – April 2020

Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

Performance data

March’s biggest movers in price terms are shown in the chart below.

Property stocks took a hammering in March as the covid19 pandemic took hold. The UK was put on lockdown to stop the spread of the coronavirus resulting in the enforced closure of many commercial real estate assets, including shops, restaurants, leisure facilities and hotels. The constituents of the top 10 best performing companies in price terms in March are all focused on real estate sectors that are less exposed to the impact of covid-19 and the lockdown. The top two, Assura and Primary Health Properties, both own portfolios of GP surgeries and their income is predominantly paid by the government.

That is the case for the two social housing companies, Civitas and Triple Point, whose rents are indirectly paid by the government. Supermarket Income REIT has seen its share price jump with its grocer tenants seeing a surge in demand as people stockpile goods. European logistics is set to be a net beneficiary of the pandemic, with a spike in demand for space from ecommerce companies and grocers, which have witnessed a surge in online orders. It is no surprise, then, to see ASLI and Tritax EuroBox in the top positions. Standard Life Investments Property Income Trust is also heavily focused on logistics.

Unsurprisingly, the worst performing property companies in March are all massively impacted by the lockdown. Estate agency group Countrywide has had a terrible run of bad news recently with an all-share takeover of the company falling out of bed. Now the housing market has all but stalled, the group lost 84.2% of its value during the month.

Companies that have a large exposure to retail also saw heavy falls in their share price as shops were shut and some of their tenants unable to pay rent. Intu Properties was the worst affected. Having announced it had received just 29% of its rent due in the first quarter of the year, its share price plummeted 63.4%. Fellow shopping centre owner Hammerson didn’t fare much better, losing almost 63% of its value in the month having faced similar troubles collecting rent. NewRiver REIT suffered heavy losses in the month, being one of the first property companies to announce it was suspending its dividend distribution. Although it does own a portfolio of pubs, its retail portfolio is less exposed as its peers, with 36% of its retail tenants by income still trading. Capital & Regional also owns a portfolio of shopping centres that have predominantly been closed and it expects to collect just 50% of rent for the quarter.

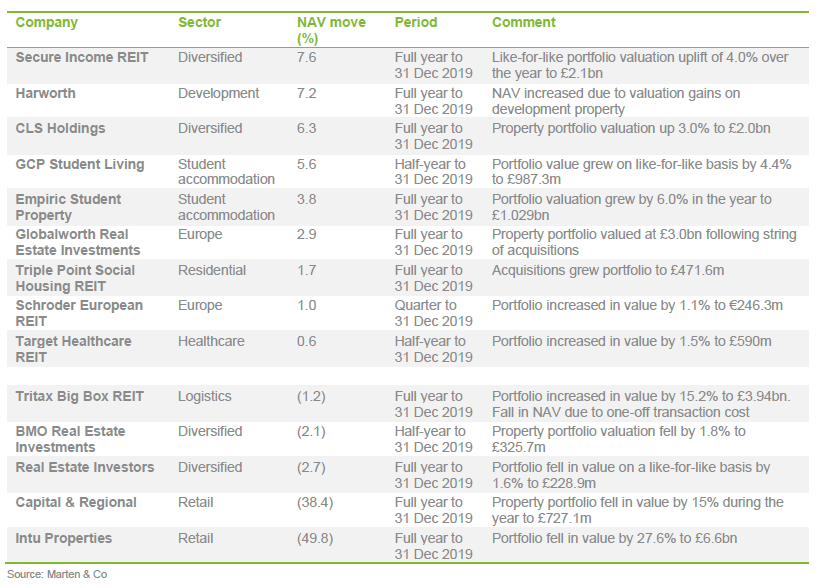

Valuation moves

Valuation moves

Corporate activity in March

Corporate activity in March

A host of property companies announced they would not be paying dividends as a result of the impact of the coronavirus pandemic. Companies included Empiric Student Property, NewRiver REIT, British Land, St Modwen, Hammerson and Shaftesbury.

Others, however, reaffirmed their commitment to pay their dividend. These companies included Supermarket Income REIT, Regional REIT and GCP Student Living.

Warehouse REIT called off plans for a £100m equity raise amid the market uncertainty caused by covid-19. Regional REIT also said it had shelved plans for an equity raise.

Gresham House bought the manager of Residential Secure Income REIT, TradeRisks Limited. Gresham paid £7m upfront and up to £4m more subject to the achievement of certain performance targets.

BMO Real Estate secured a new £20m five-year revolving credit facility from Barclays. Borrowings will be charged at 1.7% over LIBOR and unused facilities attract a commitment fee of 0.68% per year.

Empiric Student Property’s chief executive Tim Attlee will step down from the role in June 2020. Attlee co-founded and helped float Empiric in 2014 and was appointed as chief executive in November 2018.

Sirius Real Estate secured €50m funding through a Schuldschein loan offering a blended interest rate of 1.60%, with an average maturity of 3.7 years.

March’s major news stories – from our website

March’s major news stories – from our website

• Coronavirus – the long-term impact on property

QuotedData assessed the long-term impacts of the covid-19 pandemic on the property industry, including on the office sector, which could see the working from home trend accelerate and become a lasting thing following the enforced adoption by many businesses.

• Retailer landlords thrown a lifeline by Bank of England

The Prudential Regulation Authority (PRA), which is overseen by the Bank of England, urged banks to take a flexible approach to debt covenants. It said that normal accounting rules governing the treatment of credit losses should not be applied during the pandemic, stating banks should distinguish between normal covenant breaches and breaches arising as a result of the pandemic.

• Intu Properties collected just 29% of quarterly rent as covid-19 bites

Intu Properties said it would seek covenant waivers from its lenders as the impact of covid-19 hits its rental income. The group, which owns shopping centres in the UK and Spain, received just 29% of its rent for the quarter.

• Hammerson suspended dividend after receiving just 37% of quarterly rent

Retail landlord Hammerson collected just 37% of its rent in the latest quarter but vowed to help retailers through the covid19 pandemic through rent deferrals, waivers and offering monthly payments.

• British Land offers retail tenants rent holidays

British Land has suspended its dividend payments and said it was offering smaller shopping centre tenants a three-month rental holiday due to covid-19. The group said larger retailers and leisure tenants would be able to spread payments over the six quarters from September 2020.

• Merger talks between Countrywide and LSL Property Services called off

Estate agency group LSL Property Services pulled out of negotiations to buy fellow estate agent Countrywide. The tie-up would have brought together two of the UK’s biggest listed estate agents.

• U and I Group sold trio of retail assets for £22.4m

U and I Group sold three retail assets for a combined £22.4m. It disposed of Crown Glass Shopping Centre in Nailsea for £11.15m; two units at The Killingworth Centre in Newcastle for £7.5m; and 89-107 Queen Street in Cardiff for £3.75m. The deals were struck at marginally below book value as at September 2019.

• Civitas Social Housing acquired portfolio of homes for £19.6m

Civitas Social Housing acquired a portfolio of properties for £19.6m, which brought its run-rate dividend cover to 100%. It bought eight different properties across two separate deals.

• Impact Healthcare REIT landed a trio of deals worth £61.1m

Impact Healthcare REIT completed the acquisition of a portfolio of care homes, exchanged contracts to acquire a second portfolio and entered into a pre-let forward funding arrangement with an existing tenant. The deals will add 13 care homes comprising 925 beds to the group’s portfolio.

• Intu Properties warned it could go bust after posting a £2bn loss in 2019

Intu Properties said it could go under after reporting a £2bn loss in 2019 results. This was before the covid-19 pandemic. The shopping centre owner said a spate of retailer failings had resulted in the value of its properties falling almost £2bn (or 22.3%) to £6.6bn.

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Diversified

Martin Moore, chairman:

The relief rally following the decisive UK election result proved short-lived as the spread of the covid-19 virus has precipitated sharp stock market corrections across the globe. It is safe to make the judgement that eventually it will pass and economic activity should revert to normal levels. In the same way, we anticipate that the strong branded businesses making up our tenant base, together with the key operating assets that we lease to them, will prove just as attractive to investors once the virus has passed as they were before. Rental income should continue to rise along the path of inflation and therefore our earnings should not suffer the same interruption that operational businesses will face should events deteriorate.

In every reporting period since the company listed, the group’s net loan to value ratio has fallen and this trend continued in the year, with a reduction to 31.9% at 31 December 2019. If the correction in equity markets were to fuel a disruption in the market for long lease property we hold £234m of uncommitted cash, significantly more than our historic cash buffer of around £60m, which can be deployed to take advantage of any opportunities that arise. The current flight to safety by investors has driven bond yields around the world to historic lows. Safety has rarely, if ever, been as expensive in offering such meagre income returns, which seem unlikely to match the level of inflation. We believe that those investors willing to keep their nerve and focus on the medium term horizon have the potential to make significantly higher returns with only a modest amount of incremental risk by investing in secure, inflation-linked income streams such as those provided by SIR.

Vikram Lall, chairman:

Although sentiment improved at the start of 2020 following a conclusive general election result and Brexit being triggered, this went into sharp reverse soon afterwards in response to the spread of covid-19 both globally and within the UK. Monetary and fiscal policy have been eased substantially in an effort to combat the disruption caused by the pandemic. With economic growth forecasts being revised lower and concerns about a no deal Brexit re-surfacing, the outlook for property has become much more uncertain with share prices across the real estate sector falling sharply and remaining volatile. The duration and severity of the covid-19 outbreak is unknown, but it is likely to impact 2020 performance across the property industry, and the changes to working practices and lifestyles may have longer-term implications for the industry.

In such uncertain times the diversification of our asset base, the exposure to a wide range of sectors and occupiers, in particular industrial and offices which make up approximately three quarters of the asset base by value should provide relative resilience. The company has limited exposure to development, leisure and restaurants and no exposure to the other hospitality and healthcare sectors.

We anticipate that there will be some impact upon revenues for the coming year, but it is too early to quantify the levels. Against this uncertain background the company has a robust balance sheet and the cash position, including undrawn loan facilities, remains strong.

Paul Bassi, chief executive:

The unprecedented and fast changing circumstances surrounding covid-19 provide us with an uncertain landscape, however we have a strong, stable business platform and management have a proven track record of performing during periods of uncertainty, as demonstrated in the past.

We are alert to the potential impact of covid-19, an unforeseen human tragedy on a global scale. REI has a risk averse strategy, stable portfolio with high levels of occupancy and multi-sector diversification, together with controlled overheads. We remain vigilant and, in common with all businesses, we are closely monitoring the situation. To date, there has been no noticeable effect on the business, however it is too early to quantify what the impact may be in the future.

We have received assurance from all third-party providers and partners that they all have contingency measures in place to support REI. All necessary actions are being taken to safeguard our staff and ensure the continued progress and success of the business, through difficult and unprecedented global circumstances.

Stephen Hubbard, chairman:

Whilst it is too early to quantify the potential impacts of the covid-19 (coronavirus) pandemic, the company remains well placed to navigate effectively a prolonged period of uncertainty and to mitigate the risks presented by it. The company draws comfort from the group’s robust balance sheet and high-quality portfolio of defensive commercial property assets let or pre-let on very long term, index-linked leases to a wide range of strong tenant covenants highly diversified by tenant, sector and location.

The company’s debt is currently at 20% loan to value (LTV), with no short or medium term refinancing risk given the 12-year unexpired average duration of its long term debt facilities with Scottish Widows, which are fully fixed at an all-in average rate of 2.94% per annum. This provides significant headroom to the covenant of 50% and, similarly, the interest cover is c.600% versus the interest cover test of 300%. The company also has a committed £100m revolving credit facility with Lloyds Bank, which is completely undrawn.

The company’s portfolio is 100% let or pre-let to over 50 strong tenants, across nine sub-sectors. Further security is provided through the tenants and guarantors being the main trading or parent companies within the tenant groups. The company’s leases average 22 years to first break and each lease is drawn on a fully repairing and insuring basis – tenants are responsible for repair, maintenance and outgoings, so there is no cost leakage for the company. 96% of its income benefits from indexlinked or fixed uplifts.

A number of the company’s tenants, such as Aldi, Lidl and BUPA, are in sectors which are trading more robustly in the current climate. In the sectors which covid-19 has spot-lit, such as budget hotels, pubs and drive-thru coffee shops, the company’s tenants – Premier Inn, Travelodge, Greene King, Costa Coffee and Starbucks – are financially robust, with strong balance sheets and material cash holdings.

Industrial/logistics

Industrial/logistics

David Sleath, chief executive:

Whilst current global events are unprecedented, we anticipate that the structural trends that have been driving occupier demand for high-quality, well located warehouse space will remain intact and may even be strengthened by the crisis, as the importance of logistics supply chains has been thrown into sharp focus in recent weeks.

We have a very diversified customer base across a variety of sectors, many of whom are involved in the supply of critical goods and services, but we appreciate that current circumstances are placing pressure on the cash flows of some of our customers. Most of these businesses are fundamentally sound and we are working with them to provide appropriate assistance. While it is too early to fully assess the impact of this crisis, the high quality of our portfolio and the strength of our balance sheet means we are well placed to weather the storm caused by the covid-19 pandemic.

Healthcare

Healthcare

Malcolm Naish, chairman:

The current pandemic presents a significant challenge for the care home sector and potentially for some of our tenants. The safety and wellbeing of the residents in our homes, and the healthcare professionals who provide their care, is paramount. We derive some comfort from noting that infection control protocols many of us are now becoming familiar with, form a routine part of operations for care homes. The current enhancements to these, such as restricting access to essential visitors only, can only help. We would also note that the modern, purpose-built homes in our portfolio, via their en-suite wet-rooms, generous bedroom size, and wide corridors, will assist in effective implementation of the Government’s advice on isolation in residential care settings.

We are therefore confident that our tenants are well placed to provide the best quality care to their residents given the circumstances. The Manager is engaged with our tenants and is supporting their infection control processes by postponing scheduled home visits for the time being. Close asset monitoring will continue remotely, through established reporting channels for key metrics and regular discussions at both a senior management and individual home level. Anecdotally, we are already hearing from some tenants of requests for beds from local authorities seeking to move patients to care home settings rather than hospitals.

Residential

Residential

Steve Smith, chairman:

The coronavirus crisis is evolving and changing rapidly, and its full effect on the macro environment in the UK and globally is not easy to predict. We have taken both operational and financial measures to guide the company through this difficult period, and will continue to assess our plans as the situation changes. We believe that our business model is resilient and that we have the financial and operational capacity and capability to navigate challenges successfully while responding to opportunities. Our partners are well-established and supportive.

The company has a robust balance sheet, a diversified customer base and a housing delivery model that limits construction risk. The company’s cost base is covered by net rental income.

Currently, all construction activity has been suspended across all sites, a measure put in place by all major house builders in response to the coronavirus. At present, it is not known when activity will resume but there should be little adverse cash flow or balance sheet effect during this period of suspension, reflecting the company’s delivery model and our fixed price contracts.

Development

Development

Peter Williams, chairman:

Brexit, the related slowdown in decision-making and the only recently resolved political uncertainty in the UK have continued to impact upon timing of some of our projects. In particular this has led to delays in securing planning consents following the election purdah and a further slowdown in transaction timetables. This has recently been dramatically exacerbated by the impact of covid-19 on the decision-making process, business sentiment and economic activity. The rapidly accelerating impact of the covid-19 crisis on transactional activity and central and local government policy means that there is currently no reliable way to predict, with certainty, the timing or value of transactions.

Recent publications

Recent publications

Standard Life Investments Property Income Trust – Adding value in cautious times

An update note on Standard Life Investments Property Income Trust (SLI). The company has been focused on good portfolio management during an uncertain market by disposing of more risky assets and buying high yielding property with rental growth potential.

Industrial property market – The gift that keeps on giving

The second in our series of real estate sector notes, focusing on the industrial market. It looks at the future growth opportunities that exist and profiles all the industrial focused property companies.

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.